SOMA GOLD REPORTS FIRST-QUARTER FINANCIAL RESULTS AND OPERATING HIGHLIGHTS

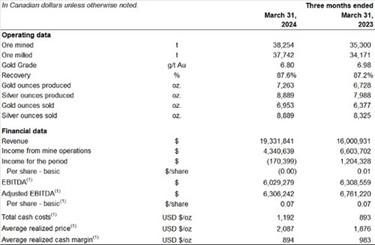

- Soma produced 7,335 AuEq ounces in Q1-2024 – an 8% increase over the 6,796 AuEq ounces produced in Q1-2023.

- Revenue for the quarter was up 21% to $19.3 million.

- Adjusted EBITDA(1) was $6.3 million for the quarter, which was largely consistent with $6.8 million in Adjusted EBITDA(1) recorded in Q1-2023.

- Transition to new Mining Method progressed in Q1 resulting in the expected, temporarily higher production costs, which are expected to fall in Q2 and for the balance of the year

- Total cash costs per ounce of gold sold(1) was US$1,192, and the average realized cash margin(1) was US$894, compared to US$983 in Q1-2023.

Soma Gold Corp. (TSX-V: SOMA) (WKN: A2P4DU) (OTC: SMAGF) is pleased to announce that the Company’s Financial Statements and MD&A for the Three Months Ended March 31, 2024 and 2023 have been filed on SEDAR and are available at the following link: https://bit.ly/Q1FS2024Soma or on the Company’s website.

Operations Review – Three Months Ended March 31, 2024

- Total AuEq production of 7,335 ounces from the Cordero Mine and the el Bagre Milling Operations.

- Codero Operations reported attributable cash costs per ounce of gold sold(1) of US$1,192 and an AISC(1) of US$1,760 per ounce.

- Income from mining operations of $4.3 million.

- EBITDA(1) of $6.0 million and adjusted EBITDA(1) reaching $6.3 million.

- Net loss of $0.1 million or $0.00 per share.

- Adjusted EBITDA(1) per share of $0.07.

Outlook for the balance of 2024

- Continue exploration of the expanded property package along the Otu fault to build total resources and identify the next mine on the Company’s Antioquia properties.

- Bring the permitted Machuca mine into production and complete the permit application process for the Nechi mine to increase minable resources to feed the el Limon and El Bagre mills.

- Advance the formalization process of small miners working on the Company’s concessions, aiming for 10% of the ounces produced to be from these small miners.

- Continue discussions with local permitted small miners to facilitate contract processing at the El Limon mill.

- Review additional strategic additions to the Company’s concession package, focusing on trends identified by the exploration program.

- Drill the Cordero deposit at depth using the new underground drill purchased by the Company to confirm the deposit’s extension, increasing the Cordero resource.

Geoff Hampson, Soma’s President and CEO, states, “The transition to a conventional mining method continued in Q1, increasing costs per ounce. This transition will largely be completed by the end of Q2, coinciding with the opening of higher-grade zones. The combination of higher grades, reduced development and waste rock, and an increase in the number of stopes will all contribute to a strong second half of the year. We are very pleased with the progress made in understanding and interpreting the structural geology, which we believe will lead to additional resources, even in some of the mines on our property that were thought to be depleted.”

Three Months Ended December 31, 2023 and 2022 – Financial and Operating Highlights

ABOUT SOMA GOLD

Soma Gold Corp. is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (Permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

Three Months Ended December 31, 2023 and 2022 – Financial and Operating Highlights (CNW Group/Soma Gold Corp.)

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE