SOMA GOLD CORP. EXTENDS THE STRIKE LENGTH OF LEVEL 1 BY 68M WITH HIGH-GRADE DRILL INTERCEPTS AT THE CORDERO MINE, EL BAGRE, ANTIOQUIA, COLOMBIA

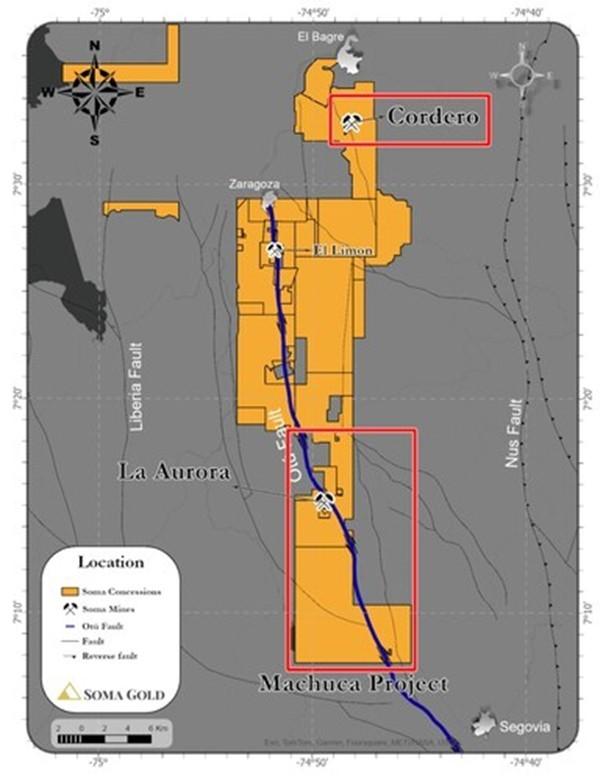

Soma Gold Corp. (TSX-V: SOMA) (WKN: A2P4DU) (OTC: SMAGF) is pleased to announce updated results from its 2024 diamond drill program at the Cordero Mine on the Bagre Project in central Colombia (Figure 1). Results from the first nineteen diamond drill holes in this program were previously reported (press release July 16, 2024), with geochemical analysis pending for the remaining seven holes. This release includes the results from those seven holes, along with twelve additional drill holes.

Cordero Level 1 Diamond Drilling

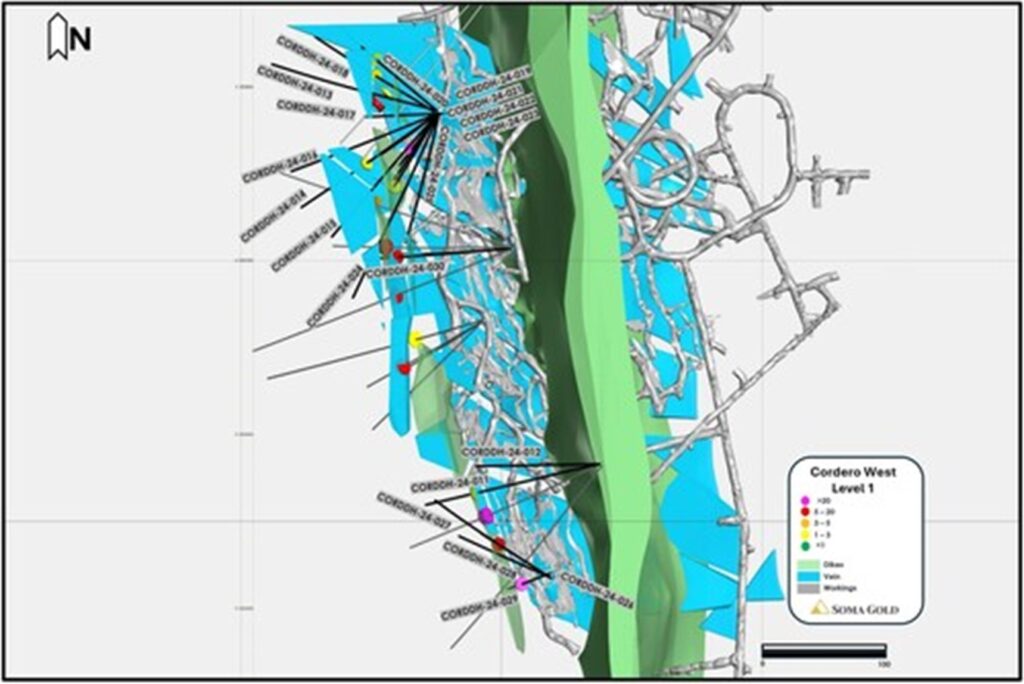

The Q2/Q3 2024 drilling to date continues to target the up-dip extension of the gold-bearing “Cordero Vein,” focusing on delineating the southern extent of Level 1 (Figure 2). The Cordero Vein has been successfully mined from Level 2 to Level 6. Earlier attempts to develop above Level 2 were hindered by a cross-cutting mafic dyke. The Q2/Q3 drill program aimed to evaluate the western side of the dyke for a continuation of the Cordero Vein, a previously untested target.

Drilling Highlights

- CORDDH-24-014 1.4m at 2.3 g/t Au incl. 0.4m at 7.9 g/t Au

- CORDDH-24-019 1.6m at 9.1 g/t Au incl. 1.0m at 14.3 g/t Au

- CORDDH-24-023 1.2m at 22.3 g/t Au incl. 0.4m at 66.2 g/t Au

- CORDDH-24-027 1.6m at 5.2 g/t Au incl. 0.55m at 9.2 g/t Au

- CORDDH-24-029 1.7m at 25.0 g/t Au incl. 0.65m at 35.4 g/t Au and 0.4m at 41.6 g/t Au

- CORDDH-24-030 1.15m at 8.7 g/t Au incl. 0.5m at 18.2 g/t Au

The Cordero Deposit is hosted in the El Carmen Stock, a polyphase intrusion comprised of coarse-grained tonalite, diorite, and gabbroic phases. Laminated fault-fill quartz veins crosscut the intrusion, forming right-stepping en echelon vein arrays. The veins are interpreted to be conjugate shear zones that developed within a regional scale, north-striking, sinistral brittle-ductile shear zone. The controlling shear zone also hosts the Los Mangos Deposit 2.8 km to the north. Mineralized veins exhibit three distinct phases of development: early barren quartz veins, sphalerite–galena–pyrite–gold mineralization controlled by microfractures, and a final phase of brittle fracturing and cataclasis along the margins of the veins filled with quartz–pyrite–tellurides–gold. The final stage of brittle fracturing, micro-breccia, and cataclasis is commonly associated with bonanza gold grades. The veins are subsequently crosscut by aphanitic mafic dykes and numerous, late brittle faults. The late brittle faults typically display dextral strike-slip displacement and offset the quartz veins from <1.0 m to 10’s of metres. The late brittle faults commonly dismember the mineralized veins into short strike-length segments, the continuity of which is difficult to discern from drill data.

Chris Buchanan, Soma’s Vice President of Exploration, stated, “We are pleased to be able to extend the strike length of the Level 1 quartz veins at Cordero Mine by 68 m to the south. This trend remains open to the south and will continue to be the focus for further development of the deposit.”

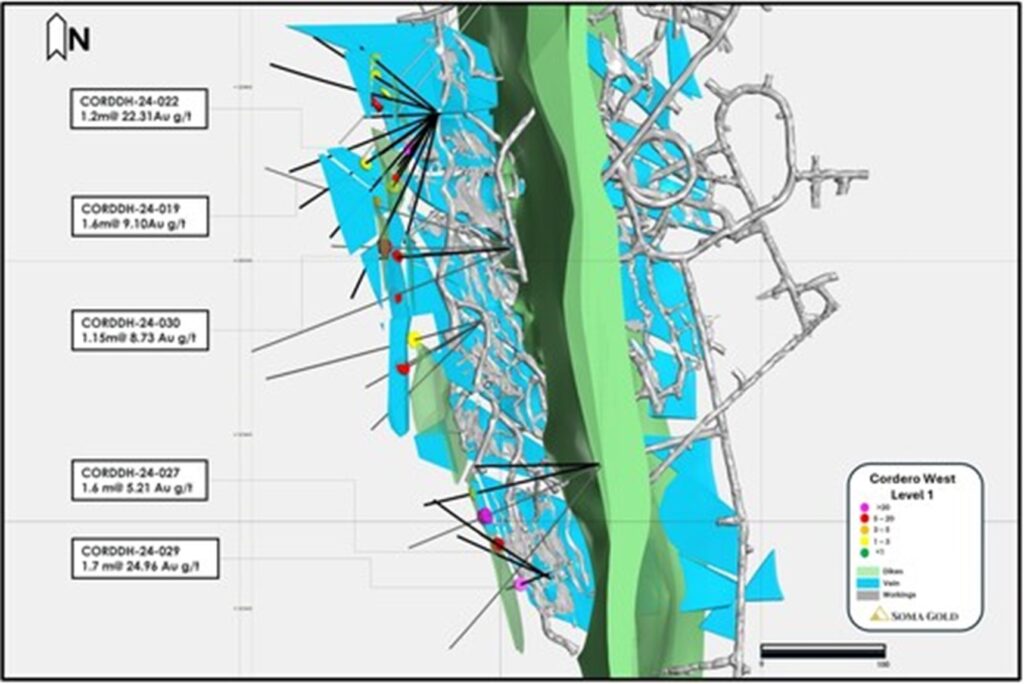

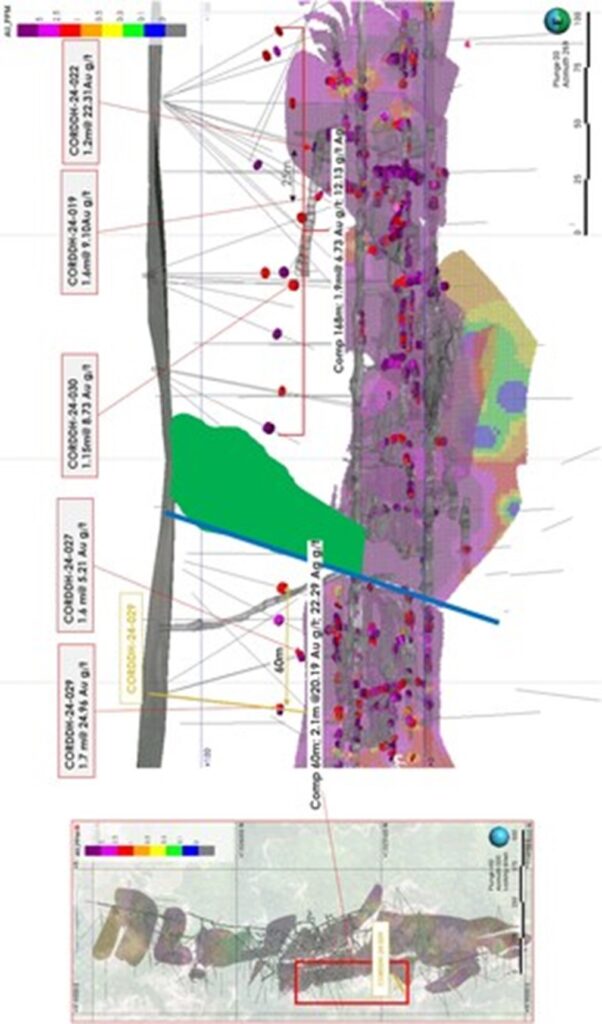

Composited assay results from nineteen drill holes are presented in Table 1. Four of these drill holes intersected mineralized quartz veins containing high-grade gold concentrations, while an additional four drill holes intersected quartz veins with moderate to low gold assay values. The inhomogeneous distribution of gold grades is attributed to the nuggety nature of the Cordero Deposit. Drill holes that did not intersect the main quartz vein typically intersected either younger mafic dykes or fault gaps between the vein segments. Notably, drill hole CORDDH-24-029, located at the southernmost end of the Level 1 zone, intersected a quartz vein structure with the highest-grade composite intercept in the Q3 drill program (Figures 3 and 4). The Level 1 vein remains open for further expansion to the south in future infill drill programs.

The Q2/Q3 drill program extended the strike length of high-grade quartz veins that delineate Level 1 on the western side of the dyke system, resulting in a total strike length of 305m. Figure 3 shows the geological interpretation of the western, up-dip continuation of the mineralized veins, cross-cutting dykes, and late brittle faults. The younger dykes and faults dismember the quartz vein into approximately eight segments with dextral offset or missing section within the dykes. The locations of high-grade composite assays are highlighted with representative disks and labels.

A long section of the drill intercepts is presented in Figure 4. While the high-grade intercepts are at approximately the same elevation, they occur within different segments of the quartz veins. Additional surface drilling is planned to determine the up-dip extent of each interpreted vein segment and to better evaluate the distribution of gold grades within these segments. Soma’s exploration team is currently developing an internal resource model based on this geological interpretation. The updated resource model will guide the development work required to start mining operations on Level 1 in late Q3 2024.

Table 1: Composited Au assays from Cordero Level 1 Q2/Q3 drill holes

| Hole ID | From (m) |

To (m) |

Length (m) |

Composite Assays (g/t Au) |

| CORDDH-24-011 | 93.1 | 94.5 | 1.4 | 1.4m@2.0 g/t Au |

| CORDDH-24-012 | no sample has more than 1 g/t Au | |||

| CORDDH-24-013 | no sample has more than 1 g/t Au | |||

| CORDDH-24-014 | 64.6 | 66 | 1.4 | 1.4m@2.3 g/t Au |

| incl. | 0.4m@7.9 g/t Au | |||

| CORDDH-24-015 | no sample has more than 1 g/t Au | |||

| CORDDH-24-016 | no sample has more than 1 g/t Au | |||

| CORDDH-24-017 | no sample has more than 1 g/t Au | |||

| CORDDH-24-018 | 63.8 | 65.15 | 1.35 | 1.35m@1.3 g/t Au |

| incl. | 0.5m@4.7 g/t Au | |||

| CORDDH-24-019 | 86.7 | 88.3 | 1.6 | 1.6m@9.1 g/t Au |

| incl. | 1.0m@14.3 g/t Au | |||

| CORDDH-24-020 | no sample has more than 1 g/t Au | |||

| CORDDH-24-021 | no sample has more than 1 g/t Au | |||

| CORDDH-24-022 | 71.9 | 73.1 | 1.2 | 1.2m@22.3 g/t Au |

| incl. | 0.4m@66.2 g/t Au | |||

| CORDDH-24-023 | 85 | 86.5 | 1.5 | 1.5m@1.7 g/t Au |

| CORDDH-24-024 | no sample has more than 1 g/t Au | |||

| CORDDH-24-025 | no sample has more than 1 g/t Au | |||

| CORDDH-24-026 | no sample has more than 1 g/t Au | |||

| CORDDH-24-027 | 79.25 | 80.85 | 1.6 | 1.6m@5.2 g/t Au |

| incl. | 0.55m@9.2 g/t Au | |||

| CORDDH-24-028 | no sample has more than 1 g/t Au | |||

| CORDDH-24-029 | 63.7 | 65.4 | 1.7 | 1.7m@25.0 g/t Au |

| incl. | 0.65m@35.4 g/t Au | |||

| incl. | 0.4m@41.6 g/t Au | |||

| CORDDH-24-030 | 93.6 | 94.25 | 0.65 | 1.15m@8.7 g/t Au |

| incl. | 0.5m@18.2 g/t Au | |||

Regional Exploration Targets

Soma has been actively prospecting, mapping, and evaluating informal mines on the Machuca Property. In early September a diamond drill rig was mobilized to the La Aurora Mine and is currently testing the vein system at depth and along strike. This drilling program continues drill program that began in December 2023 (see press release dated March 5, 2024). Soil sampling has been completed at two target areas on the Machuca Project: Pysche 1 and Orus targets. Sampling at the Pysche 2 target is ongoing and is expected to be completed by early October 2024.

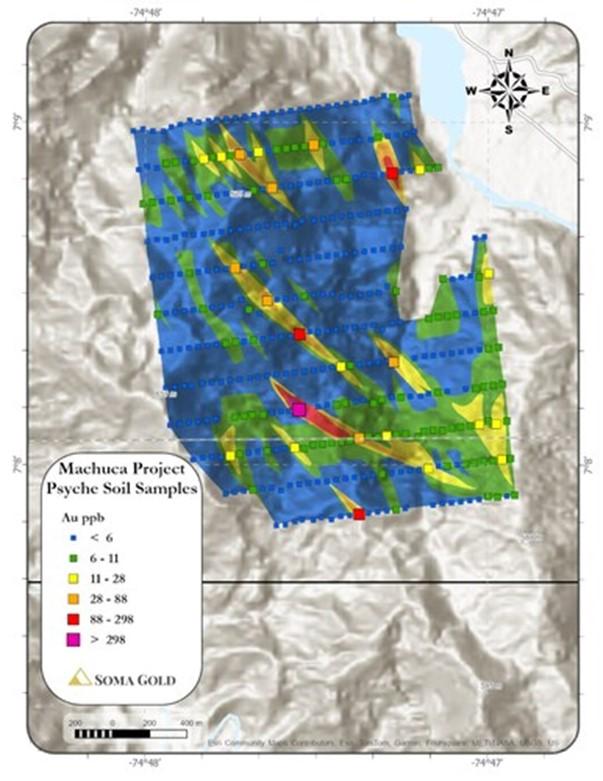

Pysche 1 Target

Figure 5 presents the results of the soil sampling program on the Pysche 1 target area. The soil grid consists of 200m-spaced lines with 50 m sample spacing. Strongly anomalous samples (>28 ppb Au) outline five northwest-trending anomalies. These anomalies align with faults and quartz veins mapped during the prospecting program. The largest Pysche 1 anomaly extends over a strike length of 900 m and is up to 100 m wide. Quartz veins were commonly observed in numerous small, informal mines within the delineated soil anomalies. The Pysche 1 target is considered a high priority for initial drill testing in Q4 2024.

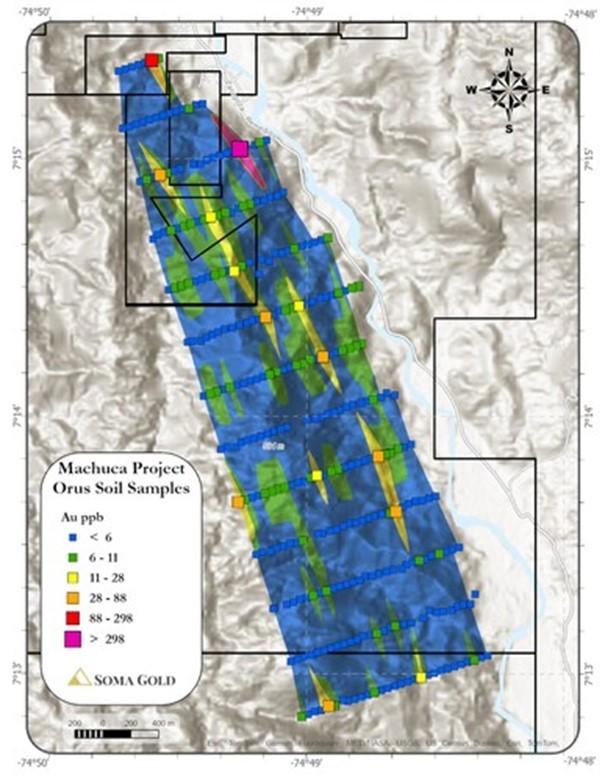

Orus Target

Figure 6 presents the results of a soil sample grid along the strike of the Otu Fault. The grid features 200 m line spacing and 50 m sample spacing. Strongly anomalous soil samples (>28 ppb Au) delineate a series of anomalies with a prominent north-northwest trend. The anomalies have strike lengths ranging from 250 m to 700 m and are generally 50 to 125 m wide. The “en echelon” nature of the soil anomalies is consistent with known quartz vein systems in the area. particularly at the La Aurora Mine. Notably, three strongly anomalous soil samples occur along the western and southern edge of the grid, indicating the grid remains open to the west and south. Additional soil sampling is planned to extend and infill the grid to better delineate potential vein structures. A diamond drill program for the Orus Project is scheduled for Q1 2025.

Pysche 2 Target

Geological mapping and prospecting work on the Pysche 2 target area began in late August. A large soil survey is currently being conducted, using 200 m line spacing and 50 m sample spacing. The grid is oriented to test for northeast-striking structures and quartz veins that have been identified in the target area. Since evaluation work began, several previously unknown informal mines have been identified at Pysche 2. These mines are comprised of northeast-striking, moderately southeast-dipping quartz veins that occur along strike from each other. Collectively, these informal mines delineate a 1.8 km-long trend of quartz vein occurrences with high-grade gold mineralization.

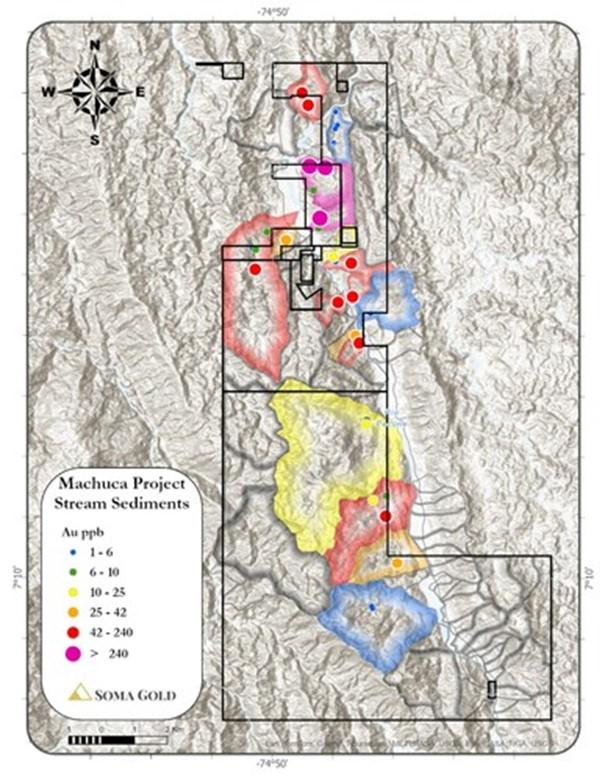

In addition to the soil sampling program, the exploration team has been collecting stream sediment samples from all identified drainage basins on the Machuca Project (Figure 7). Assays from these stream sediment samples have identified several anomalous drainage basins with gold concentrations greater than 42 ppb. The most anomalous samples were collected from the Pysche 2 target area, with a maximum gold concentration of 1,520 ppb (1.5 g/t Au). The presence of significant gold concentrations in these stream sediment samples emphasizes the importance of further exploration in the Pysche 2 target area.

The Otú fault system has a strike length of over 100 km, from Aris’s Segovia-Remedios mines (TSX:ARIS) in the south to Nechi in the north, where it is buried beneath younger sedimentary overlap sequences. Soma’s property holdings now cover more than 56 km of this strike length. High-grade gold mineralization occurs along the entire strike length of the Otú Fault, within brittle-ductile to brittle quartz veins that formed during later stages of deformation along the fault. Across the district, quartz veins display orientation patterns suggesting they formed in conjugate faults associated with brittle faulting along the Otú Fault. Notable mines along the Otú trend include Segovia-Remedios, La Aurora, El Limon, Le Ye, Los Mangos, and Cordero. The Machuca Property is located along a critical segment of this regional fault structure and contains numerous indicators of high-grade gold mineralization.

QA/QC Statement

Soma follows a comprehensive QA/QC program to ensure the reliability of assay data collected from its exploration programs. All samples are sawn or split in half, with one half being returned to the core box for storage. The second half-core is placed in a labelled plastic bag with a tag, document, and sealed for shipment. Batches of samples are shipped to Actlabs Colombia SAS (Actlabs) in Rio Negro with security tags and documented chain of custody.

Pulps of each sample are prepared in Rio Negro. Pulp samples are then shipped to Actlabs Canada for multi-element analysis. All samples are analyzed using package 1E3, an ICP-MS analysis that provides the concentration of 51 elements. Fire assay analysis for gold and Silver is completed by Actlabs in Rio Negro. Thirty-gram aliquots of each sample are analyzed for gold using a standard fire assay with an atomic absorption finish, package 1A2. Overlimit samples are subjected to an additional fire assay with a gravimetric finish, package 1A3-30, to determine the gold concentration.

A comprehensive QA/QC program has been implemented to monitor the reliability of assay data collected during exploration programs. The program includes the regular insertion of certified blanks, duplicates, and certified OREAS standards. Assays of the QA/QC samples are automatically compared to the certified value and standard deviations in the database.

Qualified Person Statement

Mr. Chris Buchanan, P.Geo, is Soma’s Vice-President of Exploration and a Qualified Person as defined by National Instrument 43-101. Mr. Buchanan has reviewed the technical information disclosed in this press release.

ABOUT SOMA GOLD

Soma Gold Corp. is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (Permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

Figure 1: Location of the Cordero Mine and Machuca Project, El Bagre, Antioquia, Colombia (CNW Group/Soma Gold Corp.)

Figure 2: Location of Q2/Q3 drillholes targeting the Cordero Level 1 Zone (CNW Group/Soma Gold Corp.)

Figure 3: Location of Q2/Q3 high-grade gold composites along the strike of Cordero Level 1 Zone (CNW Group/Soma Gold Corp.)

Figure 4: Long section view of high-grade drill intercepts in the Cordero Level 1 Zone (CNW Group/Soma Gold Corp.)

Figure 5: Reconnaissance soil grid on the Pysche 1 Target, Machuca Project (CNW Group/Soma Gold Corp.)

Figure 6: Reconnaissance soil grid on the Orus Target, Machuca Project (CNW Group/Soma Gold Corp.)

Figure 7: Stream sediment samples on the Machuca Project (CNW Group/Soma Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE