Sirios Announces Significant Increase in Cheechoo Open-Pit Gold Resources and Introduces Underground Resources

Sirios Resources Inc. (TSX-V: SOI) (OTCQB: SIREF) is pleased to report an updated Mineral Resource Estimate for its 100%-owned Cheechoo Gold Project, located in Eeyou Istchee James Bay, Québec, less than 15 km from Dhilmar Ltd.’s Éléonore gold mine.

Highlights of the 2025 MRE include:

- 1.3 million ounces at 1.12 g/t Au (Indicated Resources);

- 1.7 million ounces at 1.23 g/t Au (Inferred Resources);

- including 446,000 ounces in underground resources at 3.09 g/t Au

- Significant gold grade increase over the 2022 MRE:

- 19% increase of the open-pit indicated grade (from 0.94 g/t Au to 1.12 g/t Au);

- 38% increase of the open-pit inferred grade (from 0.73 g/t Au to 1.01 g/t Au);

- Low strip ratio of 2.9:1;

- Conceptual Exploration Target of 31 to 40 million tonnes of mineralization grading between 1.27 to 1.45 g/t Au.

Dominique Doucet, President and CEO of Sirios Resources, commented: “The substantial increase in gold resources at Cheechoo reflects the dedicated efforts of our team since the last mineral resource estimate. The total resources now position the project as a highly compelling opportunity for mining development-just a few kilometers from a producing gold mine. Furthermore, we are especially enthusiastic about the growth potential represented by our consultants’ conceptual Exploration Target, which includes targets for underground resources-an exciting prospect given that drilling to date has largely focused on near-surface zones. With this new MRE in hand, Sirios is now outlining a strategy to fast-track additional resource growth and advance the project toward the development stage.”

Cheechoo Project Mineral Resource Estimate

The updated Mineral Resource Estimate is based on 345 drill holes, totalling 82,717 meters, including 8,660 meters since 2022. This MRE introduces a new underground component and is based on a new geological model that has revealed previously underestimated, higher-grade zones within the deposit. An interactive 3D viewer of the new model is now available at sirios.com/en/cheechoo.

Table 1: Indicated and Inferred Mineral Resources Estimate (MRE)

| Pit constrained | 0.3 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Indicated | 34,993,000 | 1.12 | 1,262 | |

| Inferred | 38,222,000 | 1.01 | 1,242 | |

| Stope constrained | 1.5 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Inferred | 4,493,000 | 3.09 | 446 | |

| TOTAL | 0.3 & 1.5 g/t Au Cut-off grade | Tonnes (t) | Au (g/t) | Au (koz) |

| Total Indicated | 34,993,000 | 1.12 | 1,262 | |

| Total Inferred | 42,715,000 | 1.23 | 1,688 |

- The independent qualified person for the MRE, as defined by National Instrument (“NI”) 43-101 guidelines, is Pierre Luc Richard, P.Geo., of PLR Resources Inc. with contributions from Alexandre Burelle, P.Eng., of Evomine for cut-off values, open pit optimization solids and underground optimization solids, and Christian Laroche, P.Eng., from Synectiq, for metallurgical parameters. The effective date of the MRE is July 01, 2025.

- These Mineral Resources are not mineral reserves as they have no demonstrated economic viability. No economic evaluation of these Mineral Resource has been produced. The quantity and grade of reported Inferred Resources in this MRE are uncertain in nature and there has been insufficient drilling to define these Inferred Resources as Indicated. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated category with continued drilling.

- The Qualified Persons are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the Mineral Resource Estimate.

- Calculations used metric units (metres (m), tonnes (t), and g/t). Metal contents in the above table are presented in troy ounces (metric tonne x grade / 31.103475). Values were rounded, and any discrepancies in total amounts are due to rounding errors.

- The Cheechoo Mineral Resource estimate follows the November 29, 2019, CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

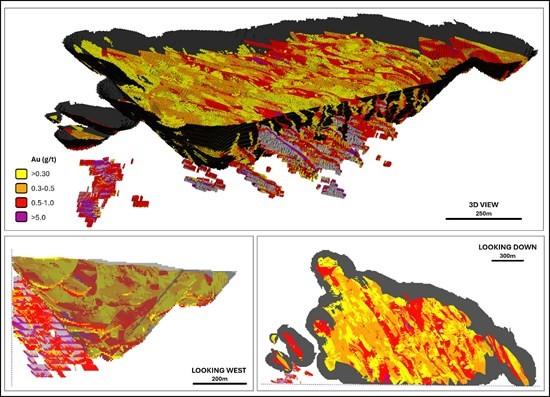

Figure 1: 2025 MRE Pit Shell and Block Model

Conceptual Exploration Target

A significant Exploration Target-with both open-pit and underground potential-was identified by our consultant PLR Resources during the preparation of the MRE.

Highlights of the Exploration Target:

- Estimated total of 31 to 40 million tonnes of mineralization grading between 1.27 to 1.45 g/t Au, including:

- Open-pit component:

25 to 32 million tonnes of mineralization grading between 0.90 to 1.05 g/t Au; - Underground component:

6 to 8 million tonnes of mineralization grading between 2.80 to 3.05 g/t Au.

- Open-pit component:

This conceptual Exploration Target is integrated into the litho-structural model used for the MRE, with the aim of facilitating future targeting and drill hole planning. PLR Resources proposed a 20,000 m drill hole program to provide infill drilling aiming at converting part of the Exploration Target into Inferred Resources, test structural features and potentially increase the size of the Exploration Target.

Disclosure warnings in respect to an exploration target review

- An Exploration Target is not a National Instrument 43-101 compliant resource or reserve.

- The Exploration Target is confirmed only as a target for further exploration.

- Potential quantity and grades are conceptual in nature only.

- There has not been sufficient drilling to define any mineral resource on this Exploration Target; drilling intercepts crosscut the Exploration Target but drill spacing is too scarce to classify these blocks as Inferred Mineral Resources.

- There is no certainty that further drilling will result in the target being delineated as a mineral resource.

- The assessment of the target for further exploration was completed by PLR Resources, a consultant independent of the company. The estimation of the potential quantity and grade of the exploration target was based on the same drill hole database used for the Mineral Resource Estimate. With the available drilling information, PLR developed conceptual gold mineralization volumes, constrained by interpreted lithological and structural models. The original core samples were composited, and the composited gold assays were capped (similarly to the Mineral Resource Estimate) after evaluating the statistical distributions on probability plots. The gold values were interpolated into a three-dimensional block model using Ordinary Kriging. To estimate a tonnage, PLR used the same specific gravity values used for the Mineral Resource Estimate.

- An open-pit scenario limited by the Project’s boundary as well as DSO stopes were run to constrain the Exploration Target.

Parameters and criteria used for the Mineral Resource Estimate (MRE)

Table 2: General pit and stope parameters used for the Mineral Resource Estimate

| PARAMETER | UNIT | OPEN PIT | UNDERGROUND |

| Revenue | |||

| Gold price | USD/oz | 2,500 | 2,500 |

| Exchange rate | CAD/USD | 1.35 | 1.35 |

| Operating costs | |||

| Mining cost | CAD/t mined | 4 | 75 |

| Incremental bench cost | CAD/t mined/10m bench | 0.05 | N/A |

| Processing cost | CAD/t milled | 17.5 | 17.5 |

| General and administration cost | CAD/t milled | 5.5 | 5.5 |

| Mineralized material based costs | CAD/t milled | 23 | 98 |

| Mining | |||

| Selective mining unit | m | 5 x 5 x 5 | N/A |

| Minimum mining width | m | N/A | 2.5 |

| Stope height | m | N/A | 25 |

| Minimum slope angle – overburden | deg | 25 | N/A |

| Minimum slope angle – rock | deg | 50 | N/A |

| Cut-off grade | |||

| Cut-off grade applied | g/t milled | 0.25 | 1.5 |

- Resources are presented as undiluted and in situ for the open-pit scenario and include internal dilution for the underground scenario and are considered to have reasonable prospects for economic extraction. The constraining pit shell was developed using overall pit slopes of 50 degrees in bedrock and 25 degrees in overburden. The pit optimization to develop the mineral resource-constraining pit shells was done using the pseudoflow algorithm in Deswik software. The stope optimization to develop the underground mineral resource was done using Deswik.SO software.

- The MRE wireframe was prepared using Leapfrog Edge v.2024.1.3 and is based on 345 drill holes, totalling 82,717 meters drilled and 56,337 assays. The cut-off date for the drill hole database was May 13, 2025.

- Composites of 1.5 metres were created inside the mineralization domains. High-grade capping was done on the composited assay data. Based on individual statistical study for each zone, composites were capped at 25.0 g/t Au for the HG zones, 2.0 g/t Au for the corridors and 1.0 g/t for the tonalite intrusion. A three-pass capping strategy defined by capping values decreasing as interpolation search distances increase was used in the grade estimation for the HG zones.

- Pit constrained Mineral Resources for the base case are reported at a cut-off grade of 0.3 g/t Au; DSO-constrained Mineral Resources for the base case are reported at a cut-off grade of 1.5 g/t Au and include internal dilution (must-take). The cut-off grades will be re-evaluated in light of future prevailing market conditions and costs.

- Specific gravity values were estimated using data available in the drill hole database. Density values between 2.64 and 2.76 were applied to the host rocks.

- Grade model resource estimation was calculated from drill hole data using an Ordinary Kriging interpolation method in a sub-blocked model using blocks measuring 5 m x 5 m x 5 m in size and sub-blocks down to 0.625m x 0.625m x 0.625m. Both ordinary kriging (OK) and inverse square distance (ID2) interpolation methods were tested, resulting in no material difference in the Mineral Resource Estimates.

- The Indicated and Inferred Mineral Resource categories are constrained to areas where drill spacing is less than 50m and 100 metres respectively and show reasonable geological and grade continuity.

Cautionary Statement Regarding Mineral Resources

The mineral resources disclosed in this press release conform to NI43-101 standards and guidelines and were prepared by independent qualified persons. The above-mentioned mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological grade and/or quality of continuity. An Inferred Mineral Resource has a lower level of confidence relative to a Measured or Indicated Mineral Resource and constitutes an insufficient level of confidence to allow conversion to a Mineral Reserve. It is reasonably expected, but not guaranteed, that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resources with additional drilling. The National Instrument 43-101 Technical Report, including the mineral resources for the Cheechoo Project contained in this news release, will be delivered and filed on SEDAR by Sirios Resources Inc. within 45 days of the date of this news release.

Qualified persons

The Mineral Resource Estimate and other scientific and technical information in this news release has been prepared and approved by independent qualified persons for purposes of NI 43-101: Pierre Luc Richard, P.Geo., of PLR Resources Inc. with contributions from Alexandre Burelle, P.Eng., of Evomine for cut-off values, open pit optimization solids and underground optimization solids, and Christian Laroche, P.Eng., from Synectiq, for metallurgical parameters.

About the Cheechoo Gold Project

The Cheechoo Gold Project is a flagship asset of Sirios Resources Inc., located in the Eeyou Istchee James Bay territory of Québec, less than 15 km from the Éléonore gold mine. The project is 100% owned by Sirios and is recognized for its significant expansion and development potential, targeting both large-scale open-pit and higher-grade underground mining scenarios. Learn more at sirios.com/en/cheechoo.

About the Éléonore Gold Mine

The Éléonore Mine is an underground gold operation located in the Eeyou Istchee James Bay region of Québec, directly adjacent to Sirios’ Cheechoo Property. Commercial production at Éléonore began in April 2015. In 2024, Dhilmar Ltd. acquired the mine from Newmont Corporation in a $795 million USD transaction and is now the current operator.

About PLR Resources

PLR Resources specializes in mineral resource estimates and project evaluations and offers a wide variety of services, from grassroots exploration planning to feasibility studies and mining operation optimization, serving clients that include juniors, major operators as well as financial experts seeking reliable and realistic advice.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE