SILVERCORP TO ACQUIRE ORECORP, CREATING A DIVERSIFIED, HIGH GROWTH PRECIOUS METALS COMPANY

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) and OreCorp Limited (ASX: ORR) are pleased to announce the signing of a binding scheme implementation deed whereby Silvercorp will acquire all fully-paid ordinary shares of OreCorp not held by Silvercorp or its associates, pursuant to an Australian scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Cth), subject to the satisfaction of various conditions.

Transaction Highlights

- OreCorp shareholders to receive A$0.15 in cash and 0.0967 of a Silvercorp common share (valued at A$0.45) for each OreCorp Share held, representing total consideration with an implied value of A$0.60 per OreCorp Share.1

- OreCorp’s Board unanimously recommends OreCorp shareholders vote in favour of the Scheme, subject to no Superior Proposal2 emerging for OreCorp and an independent expert concluding, and continuing to conclude, that the Scheme is in the best interests of OreCorp shareholders.

- Silvercorp to provide OreCorp with approximately A$28 million in funding via an equity placement (more fully described below) to immediately advance development of its Nyanzaga Gold Project in Tanzania, including progressing resettlement activities and early project works.

- The Agreement aims to:

- Create a diversified, highly profitable precious metals company with a pro forma market cap of US$630 million3, a robust growth pipeline and exposure to a highly prospective emerging mining jurisdiction;

- Provide a re-rating opportunity on the successful development of Nyanzaga, which is expected to commence commercial gold production in H2 2025; and

- Enable OreCorp and Silvercorp shareholders to participate in a larger company with greater access to capital, higher liquidity, increased scale and enhanced capital markets relevance.

- Silvercorp has the balance sheet strength to fund construction and aggressive exploration of Nyanzaga, as well as pursue regional M&A opportunities.

- Silvercorp’s best-in-class technical team has the track record and expertise to build Nyanzaga and pursue opportunities for optimization.

- Consideration mix preserves Silvercorp’s strong balance sheet, allowing funds to be deployed for development of Nyanzaga, managing risk and optimizing future opportunities.

- Existing OreCorp shareholders will own 17.8% of Silvercorp’s common shares outstanding on a fully-diluted in-the-money basis following implementation of the Scheme.

- The Scheme is subject to various customary closing conditions, including OreCorp shareholder approval and Court approval.

- Silvercorp has agreed to use reasonable endeavours to apply for admission of Silvercorp to the official list of the Australian Securities Exchange.

- Proposed development of Nyanzaga by Silvercorp supported by Tanzania Government Authorities.

| ____________________________ |

| 1 Value attributed to Silvercorp share and implied value attributed to OreCorp Share calculated based on the 20-day volume weighted average price of Silvercorp’s common shares on the NYSE American for the period ending August 3, 2023, converted to Australian dollars using a U.S. dollar to Australian dollar foreign exchange rate of 1.526. |

| 2 As defined in the Agreement. |

| 3 The pro forma financial information is for illustrative purposes only and is not intended to represent the future financial position of the combined entity. |

Nyanzaga Highlights

OreCorp holds an 84% interest in the Nyanzaga Gold Project located in the Mwanza region, Tanzania, in partnership with the Government of Tanzania. Key permits are in place to develop Nyanzaga for first gold in H2 2025. A definitive feasibility study, announced in August 2022, estimated that Nyanzaga could deliver 2.5 million ounces of gold over a 10.7 year life.4 As reported in OreCorp’s June 2023 Quarterly Activities Report released on July 21, 2023, Nyanzaga’s post-tax net present value at a 5% discount rate is US$905 million and the internal rate of return is 32%, using a recent spot gold price of US$2,000/oz.5

Nyanzaga is located approximately 40 km north east of the Bulyanhulu mine, one of Barrick Gold Corporation’s two gold mines in the Lake Victoria Goldfields, which together with the North Mara mine produced approximately 547,000 ounces of gold in 2022.6 The Geita Gold Mine, one of AngloGold Ashanti Limited’s flagship mines, located 80 km west of Nyanzaga, produced 521,000 ounces of gold in 2022.7

Silvercorp Chairman and CEO, Dr. Rui Feng, said:

“This transaction will create a new globally diversified precious metals producer. We believe this is a rare opportunity to leverage our technical expertise and strong balance sheet to unlock value for all shareholders by bringing Nyanzaga into commercial production by H2 2025. Under the leadership of Her Excellency, President Samia Suluhu Hassan, Tanzania is becoming an attractive place for foreign investment. We look forward to partnering with the Government of Tanzania and leveraging OreCorp’s existing team and relationships to ensure a successful development that benefits all stakeholders.”

OreCorp Managing Director and CEO, Henk Diederichs, said:

“This transaction provides our shareholders with an immediate and significant upfront premium and exposure to a geographically diverse mid-tier precious metals company. With a strong operating history, solid balance sheet and significant mine building and operational experience, Silvercorp’s management team is well-positioned to fund and advance Nyanzaga into commercial production.”

Honorable Minister of Minerals, Dr. Doto Mashaka Biteko, said:

“The Tanzanian Government is supportive of the proposed partnership between OreCorp and Silvercorp and looks forward to working together to develop Nyanzaga as a robust project delivering beneficial outcomes to the people of Tanzania and other stakeholders.”

| ____________________________ |

| 4 Cautionary Statement – based on a gold price of US$1,750/oz. Refer OreCorp ASX announcement dated 22 August 2022 (“Nyanzaga DFS Delivers Robust Results“). The production target referred to in the DFS and this announcement comprises 92% Probable Ore Reserves and 8% Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources, and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised. |

| 5 Refer OreCorp ASX announcement dated 21 July 2023 (“June 2023 Quarterly Activities Report“). |

| 6 Barrick Gold Corporation (2022) Annual Report 2022. |

| 7 AngloGold Ashanti Limited (2022) Mineral Resource and Mineral Reserve Report as at 31 December 2022. |

Benefits for OreCorp Shareholders

- Total implied consideration of A$0.60 per OreCorp Share (being A$0.15 in cash and 0.0967 of a Silvercorp common share valued at A$0.45),8 representing:

- a 41.7% premium to the 20-day volume weighted average price of OreCorp’s shares on the ASX for the period ending August 4, 2023;9 and

- a 31.5% premium to OreCorp’s closing share price of A$0.435 on the ASX on August 4, 202310.

- Share consideration provides enhanced trading liquidity, re-rating potential and opportunity to participate in further upside from Nyanzaga and Silvercorp’s existing portfolio;

- Significantly reduces development and operational risk at Nyanzaga by leveraging Silvercorp’s technical expertise and ESG track record;

- Strong pro forma balance sheet removes immediate funding uncertainty and mitigates risk of significant dilution; and

- Enhanced capital markets profile with a pro forma market cap of US$630 million11 and listings on the TSX, NYSE and, subject to successful admission and quotation, the ASX.

Benefits for Silvercorp Shareholders

- Accretive transaction on a net asset value basis;

- Provides immediate geographic and metal diversification;

- Addition of a largely de-risked, low-cost gold project that has key permits in place and is on track for first gold in H2 2025;

- Re-rating opportunity due to enhanced scale, asset diversification, production and exploration upside as well as a foothold in an emerging, mining-friendly jurisdiction; and

- Meaningfully grows Silvercorp’s mineral reserves and resources profile.

| ____________________________ |

| 8 Based on the 20-day volume weighted average price of Silvercorp’s common shares on the NYSE American for the period ending August 3, 2023, converted to Australian dollars using a U.S. dollar to Australian dollar foreign exchange rate of 1.526. |

| 9 Based on the 20-day volume weighted average price of Silvercorp’s common shares on the NYSE and OreCorp’s ordinary shares on the ASX for the period ending August 4, 2023. |

| 10 Based on the closing price of Silvercorp’s common shares on the NYSE and OreCorp’s ordinary shares on the ASX as of August 4, 2023. |

| 11 The pro forma financial information is for illustrative purposes only and is not intended to represent the future financial position of the combined entity. |

Transaction Summary

Under the terms of the Agreement, Silvercorp or a wholly owned subsidiary will, subject to the satisfaction of various conditions, acquire the OreCorp Shares by means of a court-sanctioned scheme of arrangement under Part 5.1 of the Corporations Act 2001 (Cth), whereby each holder of OreCorp Shares will receive, for each OreCorp Share held, A$0.15 in cash and 0.0967 of a Silvercorp common share valued at A$0.45 for a total implied consideration of A$0.60 per OreCorp Share.12

The implied consideration of A$0.60 per OreCorp share represents a 41.7% premium to the 20-day VWAP of OreCorp’s shares on the ASX for the period ending August 4, 2023 and values OreCorp at approximately A$242 million on a fully-diluted-in-the-money basis. Existing OreCorp shareholders will own 17.8% of Silvercorp’s common shares outstanding on a fully-diluted in-the-money basis following implementation of the Scheme.

Concurrent with entering into the Agreement, Silvercorp and OreCorp have also entered into a placement agreement, whereby 70,411,334 new fully-paid ordinary shares of OreCorp will be issued to Silvercorp at a price of A$0.40 per OreCorp Share for aggregate proceeds of approximately A$28 million. The Placement will occur in two tranches, with the first tranche (for aggregate proceeds of A$18 million) to complete on the third business day after execution of the Agreement and the second tranche (for aggregate proceeds of approximately A$10 million) to complete 10 business days thereafter. Upon completion of the Placement, Silvercorp will hold approximately 15% of the total outstanding ordinary shares of OreCorp. Proceeds from the Placement will be used to immediately commence resettlement activities as contemplated in the Relocation Action Plan, facilitating the prompt development of Nyanzaga.

Boards Approvals and Recommendations

The OreCorp Board has unanimously approved the transaction and recommends that all OreCorp shareholders vote in favour of the Scheme at the meeting of the shareholders of OreCorp, in the absence of a Superior Proposal and subject to the independent expert to be appointed by OreCorp concluding (and continuing to conclude) that the Scheme is in the best interests of OreCorp shareholders. Subject to those same qualifications, each director of OreCorp intends to vote, or cause to be voted, all OreCorp Shares held or controlled by them (representing 4.6% of OreCorp’s issued shares as at the date of this announcement) in favour of the Scheme at the Scheme Meeting.13

The Silvercorp Board has also unanimously approved the transaction.

| ____________________________ |

| 12 Based on the 20-day volume weighted average price of Silvercorp’s common shares on the NYSE American for the period ending August 3, 2023, converted to Australian dollars using a U.S. dollar to Australian dollar foreign exchange rate of 1.526. |

| 13 OreCorp Directors hold an aggregate of 18,487,960 OreCorp Shares, representing 4.6% of shares on issue as at the date of this announcement which, together with 1,864,482 Performance Rights held by OreCorp Directors, represent 5.1% on a fully diluted basis as at the date of the announcement (calculations exclude options which will be cancelled if the Scheme proceeds). |

Key Shareholder Support

Rollason Pty Ltd, which controls 49,136,589 OreCorp Shares (representing approximately 12.3% of the OreCorp Shares as at the date of this announcement), has provided a signed voting intention statement to OreCorp indicating that Rollason intends to vote, or cause to be voted, all OreCorp Shares held or controlled by it or its associates at the time of the Scheme meeting in favour of the Scheme, in the absence of a Superior Proposal and subject to the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of OreCorp shareholders. Rollason has consented to OreCorp publicly announcing its voting intention.

Tanzanian Government Support

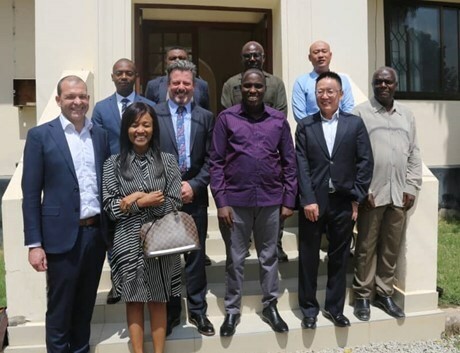

OreCorp and Silvercorp met with key Tanzanian Government stakeholders including the Treasury Registrar and the Minister of Minerals. The Government is supportive of the transaction, underpinning Her Excellency Samia Suluhu Hassan’s mantra that Tanzania is open for international investment. The companies are looking forward to the continued support from key Government stakeholders.

Honorable Minister of Minerals, Dr. Doto Mashaka Biteko with Chairman of OreCorp, Matthew Yates (left) and Chairman and CEO of Silvercorp, Rui Feng (right)

Transaction Structure and Certain Terms of the Agreement

The Scheme is subject to customary closing conditions for a transaction of this nature, including:

- OreCorp shareholders approving the Scheme at the Scheme Meeting;

- Approval of the Federal Court of Australia;

- Completion of the Placement;

- The Independent Expert issuing an Independent Expert’s Report which concludes (and continues to conclude) that the Scheme is in the best interests of OreCorp shareholders;

- Tanzanian Fair Competition Commission and any other applicable approvals;

- Foreign Investment Review Board approval in Australia, if required;

- OreCorp performance rights and OreCorp options being dealt with such that none will remain in existence on completion of the Scheme;

- No material adverse change and no prescribed occurrence in relation to either Silvercorp or OreCorp;

- Approval for quotation on TSX and NYSE of the Silvercorp common shares to be issued to OreCorp shareholders as the scrip component of the consideration; and

- Other customary conditions.

Under the Agreement, Silvercorp has agreed to use reasonable endeavours to apply for admission of Silvercorp to the official list of Australian Securities Exchange. If ASX has provided Silvercorp with conditional approval for admission to the official list of ASX by the business day before the date of the second court hearing, OreCorp shareholders (other than ineligible shareholders) may elect to receive the scrip component of the consideration in the form of CHESS Depositary Interests (which may be traded on ASX) instead of in the form of Silvercorp common shares. If conditional approval is not provided by ASX by the business day before the date of the second court hearing, all OreCorp shareholders (other than ineligible shareholders) would receive the scrip component of the consideration in the form of Silvercorp shares, tradable on the TSX and NYSE.

The Agreement also contains customary deal protection mechanisms, including no talk and no due diligence provisions, (subject to a fiduciary out exception) and no shop, as well as notification and matching rights for Silvercorp in the event of a Competing Proposal14. The transaction may incur a capital gains tax payable under Tanzanian legislation. A break fee of approximately A$2.8 million shall be payable by OreCorp to Silvercorp if the Agreement is terminated as a result of certain specified circumstances.

A copy of the Agreement, which sets out the terms and conditions of the Scheme and associated matters, will be filed on Silvercorp’s profile on SEDAR+ at www.sedarplus.com.

Timetable and Next Steps

OreCorp shareholders do not need to take any action in relation to the Scheme at this stage.

A Scheme booklet setting out the key terms of the transaction, including the Scheme, Independent Expert’s Report, Investigating Accountant’s Report and the reasons for the recommendation of the OreCorp Board will be sent to all OreCorp shareholders in due course. The Scheme Meeting to consider the Scheme is expected to be held in November 2023 and the Scheme is expected to be implemented before the end of 2023 subject to satisfaction of all conditions and receipt of all necessary approvals. The Scheme is conditional on, among other things, approval by a majority in number of OreCorp shareholders who vote at the Scheme Meeting and at least 75% of all votes cast at the Scheme Meeting. Silvercorp is excluded from voting at the Scheme Meeting.

| ____________________________ |

| 14 As defined in the Agreement. |

An indicative timetable is set out below:

| Action | Estimated Date |

| First Court Date | Early-mid October 2023 |

| Dispatch scheme booklet to OreCorp shareholders | Early-mid October 2023 |

| Scheme Meeting | Mid November 2023 |

| Second Court Date | Mid November 2023 |

| Effective Date | End of November/early December 2023 |

| Record Date | End of November/early December 2023 |

| Implementation Date | End of November/early December 2023 |

Advisors and Counsel

Canaccord Genuity Corp. is acting as financial advisor to Silvercorp. King & Wood Mallesons, Australia and A&K Tanzania are acting as Silvercorp’s Australian and Tanzanian legal advisors, respectively.

CIBC Capital Markets is acting as financial advisor to OreCorp. Allen & Overy and REX Attorneys are acting as OreCorp’s Australian and Tanzanian legal advisors, respectively.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. Silvercorp’s strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG.

About OreCorp

OreCorp is a Western Australian based mining exploration company listed on the Australian Securities Exchange (ASX) under the code ORR. OreCorp’s key project is the Nyanzaga Gold Project in northwest Tanzania

Honorable Minister of Minerals, Dr. Doto Mashaka Biteko with Chairman of OreCorp, Matthew Yates (left) and Chairman and CEO of Silvercorp, Rui Feng (right) (CNW Group/Silvercorp Metals Inc)

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE