SILVERCORP REPORTS Q3 FISCAL 2023 ADJUSTED NET INCOME OF $11.8 MILLION, $0.07 PER SHARE, AND ISSUES FISCAL 2024 PRODUCTION, CASH COSTS, AND CAPITAL EXPENDITURE GUIDANCE

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reported its financial and operating results for the three months ended December 31, 2022. All amounts are expressed in US dollars, and figures may not add due to rounding.

HIGHLIGHTS FOR Q3 FISCAL 2023

- Mined 296,050 tonnes of ore, milled 303,442 tonnes of ore, and produced approximately 1.9 million ounces of silver, 1,100 ounces of gold, 20.1 million pounds of lead, and 7.0 million pounds of zinc;

- Sold approximately 1.9 million ounces of silver, 1,100 ounces of gold, 19.3 million pounds of lead, and 7.1 million pounds of zinc, for revenue of $58.7 million;

- Realized adjusted earnings attributable to equity holders of $11.8 million, or $0.07 per share. The adjustments were made to remove impacts from impairment charges, share-based compensation, foreign exchange, mark-to-market equity investments, and the share of associates’ operating results;

- Reported net income attributable to equity holders of $11.9 million, or $0.07 per share;

- Generated cash flow from operating activities of $25.7 million;

- Cash costs per ounce of silver, net of by-product credits, of negative $1.15;

- All-in sustaining costs per ounce of silver, net of by-product credits, of $9.28;

- Spent and capitalized $1.4 million on exploration drilling, $9.0 million on underground development, and $2.8 million on construction of the new mill and tailings storage facility;

- Strong balance sheet with $210.3 million in cash and cash equivalents and short-term investments. The Company holds a further portfolio of equity investments in associates and other companies with a total market value of $121.8 million as at December 31, 2022.

FISCAL 2024 PRODUCTION GUIDANCE

- To mine and process 1,100,000 to 1,170,000 tonnes of ores, yielding approximately 4,400 to 5,500 ounces of gold, 6.8 to 7.2 million ounces of silver, 70.5 to 73.8 million pounds of lead, and 27.7 to 29.7 million pounds of zinc.

- The guidance represents a production increase of approximately 3% to 8% in ores, 1% to 26% in gold, 3% to 8% in silver, 3% to 8% in lead, and 14% to 23% in zinc compared to the expected production results in Fiscal 2023.

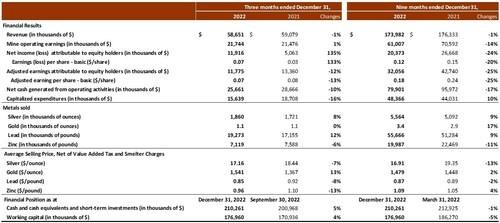

CONSOLIDATED FINANCIAL RESULTS

Net income attributable to equity holders of the Company in Q3 Fiscal 2023 was $11.9 million or $0.07 per share, compared to net income of $5.1 million or $0.03 per share in the three months ended December 31, 2021 (“Q3 Fiscal 2022”).

In Q3 Fiscal 2023, the Company’s consolidated financial results were mainly impacted by i) increases of 8% and 12%, respectively, in silver and lead sold, and a decrease of 6% in zinc sold; ii) decreases of 7%, 8%, and 13%, respectively, in the realized selling prices for silver, lead and zinc, and an increase of 13% in the realized selling price for gold; iii) a foreign exchange loss of $0.8 million arising from the depreciation of the US dollar against the Company’s functional currencies, mainly the Chinese yuan and Canadian dollar; and iv) a gain of $3.0 million on equity investments.

Revenue in Q3 Fiscal 2023 was $58.7 million, down 1% compared to $59.1 million in Q3 Fiscal 2022. The decrease is mainly due to a decrease of $4.6 million arising from the decrease in the net realized selling prices for silver, lead and zinc, offset by an increase of $4.2 million arising from the increase in silver and lead sold.

Income from mine operations in Q3 Fiscal 2023 was $21.7 million, up 1% compared to $21.5 million in Q3 Fiscal 2022. Income from mine operations at the Ying Mining District was $19.0 million, compared to $17.6 million in Q3 Fiscal 2022. Income from mine operations at the GC Mine was $2.9 million, compared to $4.0 million in Q3 Fiscal 2022.

Cash flow provided by operating activities in Q3 Fiscal 2023 was $25.7 million, down $3.0 million compared to $28.7 million in Q3 Fiscal 2022.

The Company ended Q3 Fiscal 2023 with $210.3 million in cash, cash equivalents and short-term investments, up 5% or $9.3 million compared to $201.0 million as at September 30, 2022.

Working capital as at December 31, 2022 was $177.0 million, up 4% or $6.0 million compared to $170.9 million as at September 30, 2022.

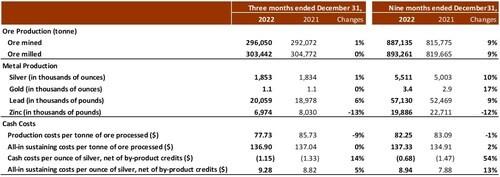

CONSOLIDATED OPERATIONAL RESULTS

In Q3 Fiscal 2023, the Company mined 296,050 tonnes of ore, up 1% compared to 292,072 tonnes in Q3 Fiscal 2022. Ore milled in Q3 Fiscal 2023 was 303,442 tonnes, effectively the same compared to 304,772 tonnes in Q3 Fiscal 2022.

In Q3 Fiscal 2023, the Company produced approximately 1.9 million ounces of silver, 1,100 ounces of gold, 20.1 million pounds of lead, and 7.0 million pounds of zinc, representing increases of 1%, 0%, and 6%, respectively, in silver, gold and lead production, and a decrease of 13% in zinc production over Q3 Fiscal 2022.

In Q3 Fiscal 2023, the consolidated production costs were $77.73 per tonne, down 9% compared to $85.73 per tonne in Q3 Fiscal 2022. The all-in sustaining production costs per tonne of ore processed in Q3 Fiscal 2023 were $136.90, essentially the same compared to $137.04 in Q3 Fiscal 2022.

In Q3 Fiscal 2023, the consolidated cash costs per ounce of silver, net of by-product credits, were negative $1.15, compared to negative $1.33 in the prior year quarter. The increase was mainly due to a decrease of $0.6 million in by-product credits offset by a decrease of $0.5 million in expensed production costs.

The consolidated all-in sustaining costs per ounce of silver, net of by-product credits, were $9.28 compared to $8.82 in Q3 Fiscal 2022. The increase was mainly due to an increase of $3.1 million in sustaining capital expenditures offset by a decrease of $1.1 million in administrative expenses and mineral resources tax.

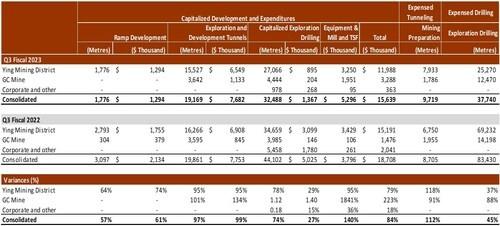

In Q3 Fiscal 2023, on a consolidated basis, a total of 70,228 metres or $2.5 million worth of diamond drilling were completed (Q3 Fiscal 2022 – 127,532 metres or $7.3 million), of which approximately 37,740 metres or $1.1 million worth of diamond drilling were expensed as part of mining costs (Q3 Fiscal 2022 – 83,430 metres or $2.3 million) and approximately 32,448 metres or $1.4 million worth of diamond drilling were capitalized (Q3 Fiscal 2022 – 44,102 metres or $5.0 million). In addition, approximately 9,719 metres or $3.8 million worth of preparation tunnelling were completed and expensed as part of mining costs (Q3 Fiscal 2022 – 8,705 metres or $3.3 million), and approximately 20,945 metres or $9.0 million worth of tunnels, raises, ramps and declines were completed and capitalized (Q3 Fiscal 2022 – 22,958 metres or $9.9 million).

In December 2022, the Company’s Kuanping Silver-Lead-Zinc-Gold Project received a mining license from the Department of Natural Resources, Henan Province, China. The Kuanping Mining License covers 6.97 square kilometres and is good until March 13, 2029.

As of December 31, 2022, a total of $4.0 million in expenditures have been incurred on the construction of the new 3,000 tonnes per day flotation mill (the “New Mill”) and the new tailings storage facility. A total of 2,147 metres of drainage tunnels were completed, and the site preparation for the New Mill was also substantially completed. The first batch of $4.1 million (RMB¥29.3 million) of milling equipment was ordered. The environmental assessment study report was revised and is pending government approval.

The Company spent approximately $1.8 million to upgrade most roads to concrete and upgrade certain environmental protection facilities at the Ying Mining District as part of our continued commitment to build and operate green mines. The Company also spent approximately $1.0 million to construct an X-Ray Transmission Ore Sorting System (“XRT Ore Sorting System”) to optimize mine planning and improve processing head grades at the GC Mine. The XRT Ore Sorting System is expected to be completed in the fourth quarter of Fiscal 2023.

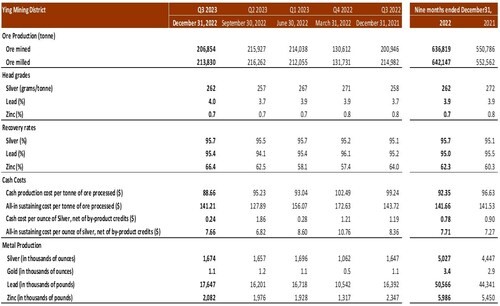

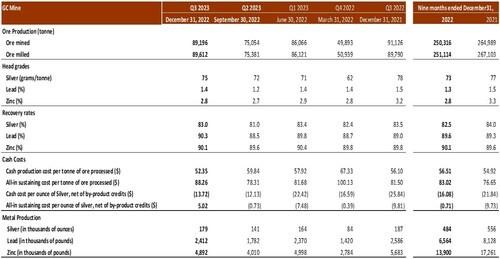

INDIVIDUAL MINE OPERATING PERFORMANCE

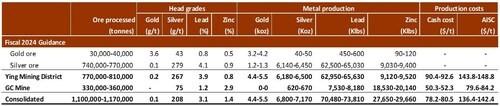

FISCAL 2024 PRODUCTION, CASH COSTS, AND CAPITAL EXPENDITURES GUIDANCE

In Fiscal 2024, the Company expects to mine and process 1,100,000 to 1,170,000 tonnes ore, yielding approximately 4,400 to 5,500 ounces of gold, 6.8 to 7.2 million ounces of silver, 70.5 to 73.8 million pounds of lead, and 27.7 to 29.7 million pounds of zinc. Fiscal 2024 production guidance represents production increases of approximately 3% to 8% in ores, 1% to 26% in gold, 3% to 8% in silver, 3% to 8% in lead, and 14% to 23% in zinc compared to the expected production result in Fiscal 2023.

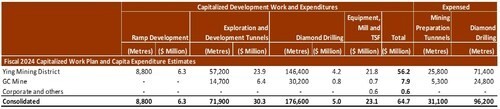

The table below summarizes the work plan and estimated capital expenditures in Fiscal 2024.

In Fiscal 2024, the Company plans to: i) complete 8,800 metres of tunnels as major access and transportation ramps at estimated capitalized expenditures of $6.3 million, representing a 26% increase in meterage and a 19% increase in cost compared to the expected results in Fiscal 2023; ii) complete 71,900 metres of exploration and mining development tunnels at estimated capitalized expenditures of $30.3 million, representing a decrease of 4% in meterage and an increase of 1% in cost compared to the expected results in Fiscal 2023; iii) complete and capitalize 176,600 metres of diamond drilling to upgrade and explore mineral resources for future production at an estimated cost of $5.0 million, representing an increase of 11% in meterage and a decrease of 38% in cost compared to the expected results in Fiscal 2023; and iv) spend $23.1 million on equipment, the XRT Ore Sorting System, a paste backfill plant, the mill and TSF (tailing storage facility).

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 31,100 metres of mining preparation tunnels and 96,200 metres of diamond drilling.

(a) Ying Mining District

In Fiscal 2024, the Company plans to mine and process 770,000 to 810,000 tonnes of ore at the Ying Mining District, including 30,000 – 40,000 tonnes of gold ore with an expected head grade of 3.6 g/t gold, to produce approximately 4,400 to 5,500 ounces of gold, 6.2 to 6.5 million ounces of silver, 62.9 to 65.6 million pounds of lead, and 9.1 to 9.5 million pounds of zinc. Fiscal 2024 production guidance at the Ying Mining District represents production increases of approximately 0% to 5% in ore, 1% to 26% in gold, 3% to 8% in silver, 4% to 8% in lead, and 21% to 26% in zinc compared to the expected production results in Fiscal 2023.

The cash production cost is expected to be $90.4 to $92.6 per tonne of ore, and the all-in sustaining production cost is estimated at $143.8 to $148.8 per tonne of ore processed, representing a 2% to 3% decrease in cash production cost and a 1% to 2% increase in all-in sustaining production cost compared to the expected results in Fiscal 2023.

In Fiscal 2024, the Ying Mining District plans to: i) complete 8,800 metres of metre tunnels as major access and transportation ramps at estimated capitalized expenditures of $6.3 million, representing an increase of 26% in meterage and an increase of 19% in cost compared to the expected results in Fiscal 2023; ii) complete 57,200 metres of exploration and mining development tunnels at estimated capitalized expenditures of $23.9 million, representing a decrease of 8% in meterage and a decrease of 6% in cost compared to the expected results in Fiscal 2023; iii) complete and capitalize 146,400 metres of diamond drilling to upgrade and explore mineral resources for future production at an estimated cost of $4.2 million, representing an increase of 13% in meterage and a decrease of 24% in cost compared to the expected results in Fiscal 2023; and iv) spend $21.8 million on equipment and facilities, including $12.9 million on the construction of the TSF, $3.0 million to build a paste backfill plant and a XRT Ore Sorting system to optimize the mine plan and improve ore processing head grades, and $1.2 million to improve certain power facilities and to replace some electrical cables. The Company still plans to complete the TSF in 2024 and is currently delaying construction of the new 3,000 TPD mill by one year.

In addition to the capitalized tunneling and drilling work, the Ying Mining District also plans to complete and expense 25,800 metres of mining preparation tunnels and 71,400 metres of diamond drilling, representing decreases of 18% and 44%, respectively, compared to the expected results in Fiscal 2023.

(b) GC Mine

In Fiscal 2024, the Company plans to mine and process 330,000 to 360,000 tonnes of ore at the GC Mine to produce 620 to 670 thousand ounces of silver, 7.5 to 8.2 million pounds of lead, and 18.5 to 20.1 million pounds of zinc. Fiscal 2024 production guidance at the GC Mine represents production increases of approximately 11% to 21% in ore, 4% to 14% in silver, -2% to 6% in lead, and 12% to 21% in zinc production compared to the expected results in Fiscal 2023.

The cash production cost is expected to be $50.3 to $52.3 per tonne of ore, and the all-in sustaining production cost is estimated at $79.6 to $84.2 per tonne of ore processed, representing a 10% to 11% decrease in cash production cost and a 4% to 5% decrease in all-in sustaining production cost compared to the expected results in Fiscal 2023.

In Fiscal 2024, the GC Mine plans to: i) complete and capitalize 14,700 metres of exploration and development tunnels at estimated capital expenditures of $6.4 million, an increase of 12% in meterage and an increase of 42% in cost mainly due to increased tunnel dimension to allow small scale mechanized equipment access, compared to the expected results in Fiscal 2023; ii) complete and capitalize 30,200 metres of diamond drilling at an estimated cost of $0.8 million, representing a 100% increase in meterage and cost to prepare for future production, compared to the expected results in Fiscal 2023; and iii) spend $0.7 million on equipment and facilities. The total capital expenditures at the GC Mine are budgeted at $7.9 million in Fiscal 2024, down $0.5 million compared to the expected results in Fiscal 2023.

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 5,300 metres of tunnels and 24,800 metres of underground drilling at the GC Mine, representing decreases of 28% and 43%, respectively, compared to the expected results in Fiscal 2023.

(c) Kuanping Project

The Company plans to carry out studies to complete the environmental assessment report, water and soil protection assessment report, and preliminary safety facilities and mine design report as required for the Kuanping Project in Fiscal 2024. Further updates on the mine construction plan and cost estimates will be provided upon completion of these reports.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG.

CONSOLIDATED FINANCIAL RESULTS (CNW Group/Silvercorp Metals Inc)

CONSOLIDATED OPERATIONAL RESULTS (CNW Group/Silvercorp Metals Inc)

EXPLORATION AND DEVELOPMENT (CNW Group/Silvercorp Metals Inc)

INDIVIDUAL MINE OPERATING PERFORMANCE – Ying Mining District (CNW Group/Silvercorp Metals Inc)

INDIVIDUAL MINE OPERATING PERFORMANCE – GC Mine (CNW Group/Silvercorp Metals Inc)

FISCAL 2024 PRODUCTION, CASH COSTS, AND CAPITAL EXPENDITURES GUIDANCE (CNW Group/Silvercorp Metals Inc)

FISCAL 2024 PRODUCTION, CASH COSTS, AND CAPITAL EXPENDITURES GUIDANCE (CNW Group/Silvercorp Metals Inc)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE