SILVERCORP REPORTS OPERATIONAL RESULTS AND THE FINANCIAL RESULTS RELEASE DATE FOR THE SECOND QUARTER OF FISCAL 2023

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reports production and sales figures for the second quarter of fiscal year 2023 ended September 30, 2022. The Company expects to release its Q2 Fiscal 2023 unaudited financial results on Thursday, November 3, 2022 after market close.

In Q2 Fiscal 2023, the Company produced approximately 1.8 million ounces of silver, 1,200 ounces of gold, 18.0 million pounds of lead and 6.0 million pounds of zinc, representing increases of 6%, 50%, and 2%, respectively in silver, gold and lead, and a decrease of 20% in zinc compared to the second quarter ended September 30, 2021.

For the first six months of Fiscal 2023, the Company produced approximately 3.7 million ounces of silver, 2,300 ounces of gold, 37.1 million pounds of lead, and 12.9 million pounds of zinc, representing increases of 15%, 28%, and 11%, respectively in silver, gold and lead, and a decrease of 12% in zinc compared to the same prior year period.

Q2 FISCAL 2023 OPERATING HIGHLIGHTS

- On a consolidated basis, 290,981 tonnes of ore were mined, down 1% over Q2 Fiscal 2022, but 291,643 tonnes of ore were milled, up 7% over Q2 Fiscal 2022.

- On a consolidated basis, the Company sold approximately 1.8 million ounces of silver, 1,200 ounces of gold, 17.3 million pounds of lead, and 5.9 million pounds of zinc, compared to approximately 1.7 million ounces of silver, 800 ounces of gold, 17.3 million pounds of lead and 7.6 million pounds of zinc sold in Q2 Fiscal 2022.

- At the Ying Mining District, 215,927 tonnes of ore were mined and 216,262 tonnes of ore were milled, up 4% and 19%, respectively, compared to Q2 Fiscal 2022. Approximately 1.7 million ounces of silver, 1,200 ounces of gold, 16.2 million pounds of lead, and 2.0 million pounds of zinc were produced, representing increases of 9%, 50%, 10%, and 25%, respectively, in silver, gold, lead, and zinc over Q2 Fiscal 2022.

- At the GC Mine, 75,054 tonnes of ore were mined and 75,381 tonnes of ore were milled, down 12% and 16% compared to Q2 Fiscal 2022. Approximately 141 thousand ounces of silver, 1.8 million pounds of lead, and 4.0 million pounds of zinc were produced, representing decreases of 21%, 39% and 32%, respectively, in silver, lead and zinc compared to Q2 Fiscal 2022. Mining operations at the GC Mine were partially affected in August and September 2022 as the Company worked on improving ventilation and electric power facilities to comply with several new safety production regulations issued by the National Mine Safety Administration of China (e.g., underground workface temperature shall not be over 30 degrees centigrade), which became effective September 1, 2022. The Company will continue to work on some improvements in October to fully comply with these new regulations.

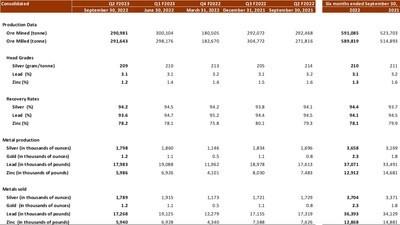

The consolidated operational results for the past five quarters and for the six months ended September 30, 2022 and 2021 are summarized as follows:

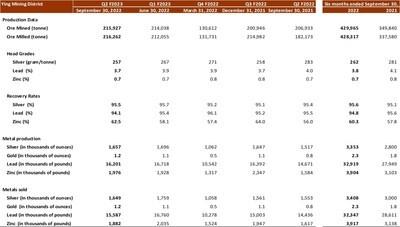

The operational results at the Ying Mining District for the past five quarters and for the six months ended September 30, 2022 and 2021 are summarized as follows:

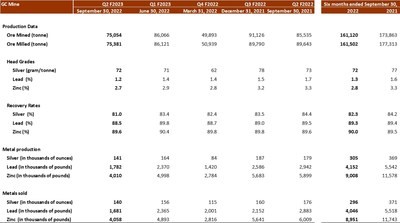

The operational results at the GC Mine for the past five quarters and for the six months ended September 30, 2022 and 2021 are summarized as follows:

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE