Silvercorp Announces Updated Mineral Resource Estimate for its Condor Project, located in the Zamora Chinchipe Province of Ecuador

Silvercorp Metals Inc. (TSX: SVM) (NYSE: SVM) is pleased to report an updated independent mineral resource estimate prepared in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects for its Condor gold project in the Zamora-Chinchipe Province of Ecuador.

A preliminary economic assessment was completed on the Project in 2021 by a previous operator1, which outlined a high tonnage, low-grade, open pit gold project. As discussed in its December 4, 2024 press release, that after publishing an updated MRE the Project, the Company will then publish an updated Preliminary Economic Assessment study for the Project.

The MRE update was completed by SRK Consulting (Canada) Inc. with an effective date of February 28, 2025, focused on the higher-grade material that would be accessible through underground mining, whereas the Camp and Los Cuyes deposits are reported as underground resources, based on cutoff grades of 2.2 g/t (Base Case) , 1.5 g/t (Case 2), and 1 g/t (Case 3) of gold equivalent (Table 1). For the smaller satellite deposits of Enma and Soledad, mineral resources are reported using conceptual pit constraints (Table 2).

Highlights of MRE for Underground Operation

- Total indicated underground mineral resources of 3.17 million tonnes at Camp and Los Cuyes deposits, containing 0.34 million ounces of gold, 2.0 Moz of silver and 49.4 million pounds of zinc, or collectively 0.37 Moz gold equivalent at a cutoff grade of 2.2 g/t AuEq.

- Total inferred underground mineral resources of 12.1 Mt at Camp and Los Cuyes deposits, containing 1.38 Mozs of Au, 8.56 Mozs of Ag, and 204.2 Mlbs of Zn, or collectively 1.50 Mozs AuEq at a cutoff grade of 2.2 g/t AuEq.

- Favorable initial metallurgical test work indicates laboratory-based gold recoveries of up to 96% at Camp and 88% at Los Cuyes based on cyanide leaching.

Resource Estimation Details

The mineralized bodies have been modeled as a combination of sub-vertical to steeply dipping planar structures, and a disseminated system of mineralization in four distinct deposits, each with individual mineralization characteristics. The exploration database contains exploration results from previous operators of the Project from 1993 to 2018. Silvercorp has undertaken relogging of the drill holes and a re-interpretation of the controls on mineralization. The mineral resources have been estimated using a combination of ordinary kriging and Inverse Distance squared weightings depending on the quantity and density of data available in each mineralized domain. The mineral resources have been classified and reported in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards and NI 43-101.

A full NI 43-101 technical report covering all the details of mineral resource estimation processes will be posted under the Company’s SEDAR+ profile at www.sedarplus.ca within 45 days from the date of this news release.

| ________________________________ |

| 1 Condor Project NI 43-101 Report on Preliminary Economic Assessment Zamora-Chinchipe, Ecuador, July 28, 2021, filed under Luminex Resources on Sedar+ |

Resource Statement Table

A Base Case underground mineral resource estimate for the Camp and Los Cuyes deposits was made based on a cutoff grade of 2.2g/t AuEq which is calculated from assumptions of specified metal prices and estimated costs of mining, processing and G&A. Cutoff sensitivity tables for Case 2 (cutoff grade of 1.5 g/t AuEq) and Case 3 (cutoff grade of 1.0 g/t AuEq) are also provided. These cases are based on lower cutoff grades derived from higher metals prices and lower costs of mining, processing and G&A, to accommodate optimistic perspective of future market conditions.

Table 1: Condor Project – Underground Mineral Resource as of Feb 28, 2025

Base Case – Cutoff Grade AuEq 2.2 g/t

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | ( %) | ( %) | (Moz) | (Moz) | (Moz) | (Mlb) | (Mlb) | |

| Indicated | |||||||||||

| Camp | 2.45 | 3.44 | 3.17 | 18.68 | 0.08 | 0.73 | 0.27 | 0.25 | 1.47 | 4.36 | 39.45 |

| Los Cuyes | 0.72 | 4.04 | 3.82 | 22.9 | 0.09 | 0.63 | 0.09 | 0.09 | 0.53 | 1.37 | 9.97 |

| Total | 3.17 | 3.58 | 3.32 | 19.63 | 0.08 | 0.71 | 0.37 | 0.34 | 2.00 | 5.72 | 49.42 |

| Inferred | |||||||||||

| Camp | 7.9 | 3.38 | 3.07 | 20.59 | 0.08 | 0.89 | 0.86 | 0.78 | 5.23 | 13.27 | 154.94 |

| Los Cuyes | 4.2 | 4.71 | 4.47 | 24.64 | 0.12 | 0.53 | 0.64 | 0.60 | 3.33 | 10.74 | 49.28 |

| Total | 12.1 | 3.84 | 3.55 | 22 | 0.09 | 0.77 | 1.50 | 1.38 | 8.56 | 24.01 | 204.22 |

| Cutoff grade calculation= (Mining cost + Processing cost + G&A) / (Au price * Au payable * Au recovery * (1-royalty)/31.1035): | |||||||||||

| -Camp = (US$80/t + US$40/t+ US$22/t)/(US$2,200 * 99.5% * 96% * (1-3%)/ 31.1035. | |||||||||||

| -Los Cuyes = (US$80/t + US$35/t+ US$18/t)/(US$2,200 * 99.2% * 88% * (1-3%)/ 31.1035. | |||||||||||

Sensitivity Case 2 – Cutoff Grade AuEq 1.5 g/t

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | ( %) | ( %) | (Moz) | (Moz) | (Moz) | (Mlb) | (Mlb) | |

| Indicated | |||||||||||

| Camp | 4.37 | 2.72 | 2.47 | 17.17 | 0.07 | 0.69 | 0.38 | 0.35 | 2.41 | 6.85 | 66.70 |

| Los Cuyes | 1.25 | 3.11 | 2.93 | 18.80 | 0.08 | 0.63 | 0.12 | 0.12 | 0.75 | 2.23 | 17.30 |

| Total | 5.62 | 2.81 | 2.57 | 17.53 | 0.07 | 0.68 | 0.51 | 0.46 | 3.17 | 9.08 | 83.99 |

| Inferred | |||||||||||

| Camp | 16.25 | 2.58 | 2.31 | 17.45 | 0.06 | 0.77 | 1.35 | 1.21 | 9.11 | 22.67 | 276.04 |

| Los Cuyes | 5.29 | 4.12 | 3.90 | 21.79 | 0.11 | 0.52 | 0.70 | 0.66 | 3.70 | 12.41 | 60.95 |

| Total | 21.53 | 2.96 | 2.70 | 18.51 | 0.07 | 0.71 | 2.05 | 1.87 | 12.82 | 35.07 | 337.00 |

| Cutoff grade calculation= (Mining cost + Processing cost + G&A) / (Au price * Au payable * Au recovery * (1-royalty)/31.1035): | |||||||||||

| -Camp = (US$60/t + US$30/t+ US$22/t)/(US$2,500 * 99.5% * 96% * (1-3%)/ 31.1035. | |||||||||||

| -Los Cuyes = (US$60/t + US$30/t+ US$15/t)/(US$2,500 * 99.2% * 88% * (1-3%)/ 31.1035. | |||||||||||

Sensitivity Case 3 – Cutoff Grade AuEq 1 g/t

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | ( %) | ( %) | (Moz) | (Moz) | (Moz) | (Mlb) | (Mlb) | |

| Indicated | |||||||||||

| Camp | 6.44 | 2.25 | 2.02 | 15.77 | 0.06 | 0.62 | 0.47 | 0.42 | 3.27 | 8.90 | 87.91 |

| Los Cuyes | 1.45 | 2.86 | 2.69 | 17.60 | 0.08 | 0.63 | 0.13 | 0.13 | 0.82 | 2.55 | 20.07 |

| Total | 7.89 | 2.36 | 2.14 | 16.11 | 0.07 | 0.62 | 0.60 | 0.54 | 4.08 | 11.45 | 107.98 |

| Inferred | |||||||||||

| Camp | 23.78 | 2.16 | 1.92 | 15.43 | 0.06 | 0.68 | 1.65 | 1.47 | 11.80 | 29.05 | 356.32 |

| Los Cuyes | 6.01 | 3.78 | 3.58 | 20.20 | 0.10 | 0.53 | 0.73 | 0.69 | 3.90 | 13.71 | 70.66 |

| Total | 29.79 | 2.49 | 2.26 | 16.39 | 0.07 | 0.65 | 2.38 | 2.16 | 15.70 | 42.76 | 426.98 |

| Cutoff grade calculation= (Mining cost + Processing cost + G&A) / (Au price * Au payable * Au recovery * (1-royalty)/31.1035): | |||||||||||

| -Camp = (US$55/t + US$20/t+ US$15/t)/(US$3,000 * 99.5% * 96% * (1-3%)/ 31.1035. | |||||||||||

| -Los Cuyes = (US$55/t + US$20/t+ US$10/t)/(US$3,000 * 99.2% * 88% * (1-3%)/ 31.1035. | |||||||||||

In addition to the underground MRE at Camp and Los Cuyes, conceptual open pit shell constrained MRE were reported for Soledad and Enma with cut-off grades of 0.5 g/t AuEq for Soledad and 0.6 g/t AuEq for Enma (Table 2):

- Total indicated open pit mineral resources of 4.06 Mt at the Soledad and Enma deposits, containing 0.14 Moz of Au, 9.27 Moz of Ag, and 50.1 Mlbs of Zn, or collectively 0.15 Mozs AuEq.

- Total inferred open pit mineral resources of 14.17 Mt at the Soldedad and Enma deposits, containing 0.35 Mozs of Au, 2,676 Kozs of Ag, and 158.1 Mlbs of Zn, or collectively 0.38 Mozs AuEq.

Table 2: Condor Project – Conceptual Open Pit Constrained Mineral Resource as of Feb 28, 2025

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | ( %) | ( %) | (Moz) | (Moz) | (Moz) | (Mlb) | (Mlb) | |

| Indicated | |||||||||||

| Soledad | 4.03 | 1.14 | 1.06 | 7.05 | 0.05 | 0.56 | 0.15 | 0.14 | 0.91 | 4.37 | 49.88 |

| Enma | 0.03 | 1.05 | 0.97 | 7.11 | 0.07 | 0.3 | 0.00 | 0.00 | 0.01 | 0.05 | 0.21 |

| Total | 4.06 | 1.14 | 1.06 | 7.05 | 0.05 | 0.56 | 0.15 | 0.14 | 0.92 | 4.41 | 50.10 |

| Inferred | |||||||||||

| Soledad | 14.15 | 0.83 | 0.76 | 5.86 | 0.04 | 0.51 | 0.38 | 0.35 | 2.66 | 12.82 | 158.01 |

| Enma | 0.02 | 0.74 | 0.56 | 16.07 | 0.06 | 0.2 | 0.00 | 0.00 | 0.01 | 0.03 | 0.10 |

| Total | 14.17 | 0.82 | 0.76 | 5.87 | 0.04 | 0.51 | 0.38 | 0.35 | 2.68 | 12.85 | 158.11 |

| Cutoff grade within pit shell = (Processing cost + G&A)/ (Au price * Au payable * Au recovery * (1-royalty)/31.1035): | |||||||||||

| -Soledad = (US$20/t+ US$12/t)/(US$2,200 * 99.5% * 90% * (1-3%)/ 31.1035. | |||||||||||

| -Enma = (US$20/t+ US$12/t)/(US$2,200 * 99.5% * 75% * (1-3%)/ 31.1035. | |||||||||||

Notes:

- Mineral resources are reported in relation to a conceptual pit shell for Soledad and Enma, and above an underground extraction economic cut off value for Camp and Los Cuyes. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate.

- AuEq equivalent formulas by deposits using a gold price of US$2,200/oz, silver price of US$27/oz, zinc price of US$2,650/t and lead price of US$1,950/t.

– Camp = Au g/t + Ag g/t * 0.0076 + Zn %* 0.1643 + Pb% * 0.0976.

– Los Cuyes = Au g/t + Ag g/t * 0.0092 + Pb% * 0.1515.

– Soledad = Au g/t + Ag g/t * 0.0109.

– Enma = Au g/t + Ag g/t * 0.0111. - Numbers may not compute exactly due to rounding.

Deposit Descriptions

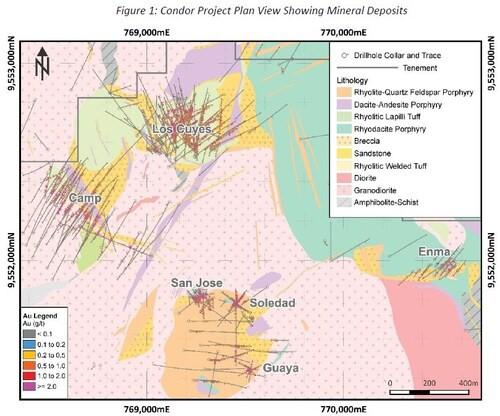

The Condor deposits are hosted in a Cretaceous volcanic complex of diatremes and rhyolite/dacite intrusives crosscutting the Zamora batholith granodiorite of Jurassic age. The Project consists of the following known deposits in the northern area (Figure 1):

Figure 1: Condor Project Plan View Showing Mineral Deposits

- Los Cuyes: Gold is hosted in a volcanic diatreme which crosscuts a granodiorite batholith. The diatreme, with a dimension of 450m in NE-SW x 300m in NW-SE x 350m depth comprises phreatomagmatic breccias, tuff and sediments, all of which are cross-cut by NW and NE striking dykes of rhyolite and dacite. Gold mineralization mostly occurs in subvertical vein structures containing pyrite and sphalerite with minor amounts of galena and chalcopyrite. The vein-like mineralisation primarily occurs along the contact zones of intrusive dykes with the surrounding volcanics and Granodiorite batholith. In addition, gold is also associated with sulfide dissemination occurring in rhyolitic tuff units, resulting in wide sub-horizontal zones of gold mineralization.

- Camp: Gold mineralization occurs within veins of pyrite/sphalerite and is controlled by NW striking rhyolite dykes at shallow levels, as well as crypto intrusive domes of rhyolite at depth. Gold mineralization remains open beyond a depth of 700 metres based on existing drill data.

- Soledad: Gold mineralization is associated with pyrite/sphalerite replacement of feldspar grains (patchy) or veins hosted in a rhyodacite porphyry. At San Jose, gold mineralization consists of sphalerite-rich veins hosted in phreatomagmatic breccia.

- Guaya: Gold mineralization is associated with pyrite-sphalerite veins hosted in a rhyo-dacite porphyry.

- Enma: Gold mineralization occurs within veins of pyrite/sphalerite hosted in the rhyolitic breccia along the contact between dacitic tuff and granodiorite batholith.

Next Steps

The Company will undertake a 3,500-metre surface drilling program over 10 holes at Los Cuyes and Camp commencing in May 2025 to test several areas where the Company sees exploration potential:

- Broad zones of sub-horizontal disseminated gold mineralization which occur within the rhyolitic tuffs at Los Cuyes.

- Contact zone of crypto rhyolite domes with batholith granodiorite for wide mineralization at Camp.

- Region between the Camp and Los Cuyes deposits.

- Gap area between Camp and Soledad, testing for potential connection of NW trending mineralized structures across the two deposits and for potential strike extension of NW trending mineralized structures.

- Gap between the Los Cuyes and Enma deposits for potential strike extension of NW trending mineralized structures.

With the MRE complete, the Company plans to publish a PEA by the end of 2025 for an underground operation. In addition, the Company will continue to advance necessary permits and community agreements required to develop exploration tunnels into the higher grade zones, which will inform a possible feasibility study which would follow the PEA.

Qualified Person

The MRE and data verification were completed by SRK. Mr. Mark Wanless, Pr.Sci.Nat, Principal Geologist with SRK, is the qualified person (as defined in NI 43-101) for the purposes of the MRE. The scientific and technical information contained in this news release has been reviewed and approved by the qualified person. The qualified person has verified the information disclosed herein using standard verification processes, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties or any limitations on the verification process that could be expected to affect reliability or confidence in the information discussed herein.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by 1) focusing on generating free cash flow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE