SILVER TIGER REPORTS ON CURRENT AND PROPOSED EXPLORATION ON VEINS NORTH AND SOUTH OF THE HISTORIC EL TIGRE MINE

“As we get nearer to making a construction decision for the open pit portion of the El Tigre Project and with our technical team nearing completion of the underground PEA in coming weeks, we are advancing our summer exploration program. We are currently exploring the prospective area north of the historic El Tigre Mine through focused mapping and sampling of both historic core and underground workings. We will soon begin similar exploration on the Southern Veins.”

– Glenn Jessome, President & CEO, Silver Tiger Metals

Silver Tiger Metals Inc. (TSX-V:SLVR) (OTCQX:SLVTF) is pleased to announce preliminary results from its 2025 Summer Exploration Program on the prospective Northern Veins, located 2 kilometers North of the historic El Tigre Mine and outlines initial exploration plans to test several undrilled greenfield areas on the Southern Veins on its 100% owned, silver-gold El Tigre Project located in Sonora, Mexico. Current exploration work consists of mapping and sampling both surface and historic underground workings to define drill ready targets for Q4-2025.

Glenn Jessome, President & CEO stated “As we get nearer to making a construction decision for the open pit portion of the El Tigre Project and with our technical team nearing completion of the underground PEA in coming weeks, we are advancing our summer exploration program. We are currently exploring the prospective area north of the historic El Tigre Mine through focused mapping and sampling of both historic core and underground workings. We will soon begin similar exploration on the Southern Veins.”

Mr. Jessome further stated, “The Northern Veins, a faulted offset of the veins at the historic El Tigre Mine, show the same structure, mineralogy, grades and orientations as the well-defined veins around the historic El Tigre Mine on which our PFS and pending underground PEA are based. With the initial 10 kilometers of mapped vein strike length we have to the North and recent assay results we are disclosing today, we see the potential to drill these Northern Veins in our Winter 2025 program.”

Exploration Objectives 2025

• Begin drilling on Northern Veins in Q4-2025

• Generate drill targets in the Southern Veins at Lluvia de Oro, La Mancha and El Toro through analysis of old mining works

• With 25 kilometers of mapped vein strike complete, which is 50% of the project area, the Corporation intends to increase mapping coverage to 70%

Overview – Veins

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas. The high-grade epithermal veins dip steeply to the west, and are typically 0.5 metres wide, and locally can be up to 5 metres in width. Over 25 kilometers of these veins at El Tigre have been mapped along strike on surface. Based on the extensive historic workings, the veins are inferred to extend to more than 450 metres depth with many veins reaching strike length of 3 kilometers or more. At the El Tigre property there are both brownfields and greenfields targets defined by extensive Silver Tiger drilling. Silver Tiger has found over 60 small-scale workings in addition to the historic El Tigre Mine.

The El Tigre Mine Veins contain over 90% of the Corporation’s Measured and Indicated Resource and is the focus area of the PFS and pending PEA. The El Tigre Vein, the Seitz Kelly Vein and the Sooy Vein (the “El Tigre Mine Veins”) have over 10 kilometers of combined vein strike length of which only 50% is drill tested. Gold was first discovered in 1896 with mining beginning soon after on the El Tigre Mine Veins (Figure 1). Significant underground mining took place with over 32 kilometers of development completed before mine closure with a reported 353,000 ounces of gold and 67.4 million ounces of silver extracted at an average grade of over 2 kilograms silver equivalent per ton. The Corporation’s Drill Hole ET-21-264, returned assays up to 82,827.3 g/t silver equivalent over 0.5 metres proximal to historically mining stopes, showing high-grade vein mineralization continues at depth and along strike (see the Corporation’s press release dated Nov 9, 2021).

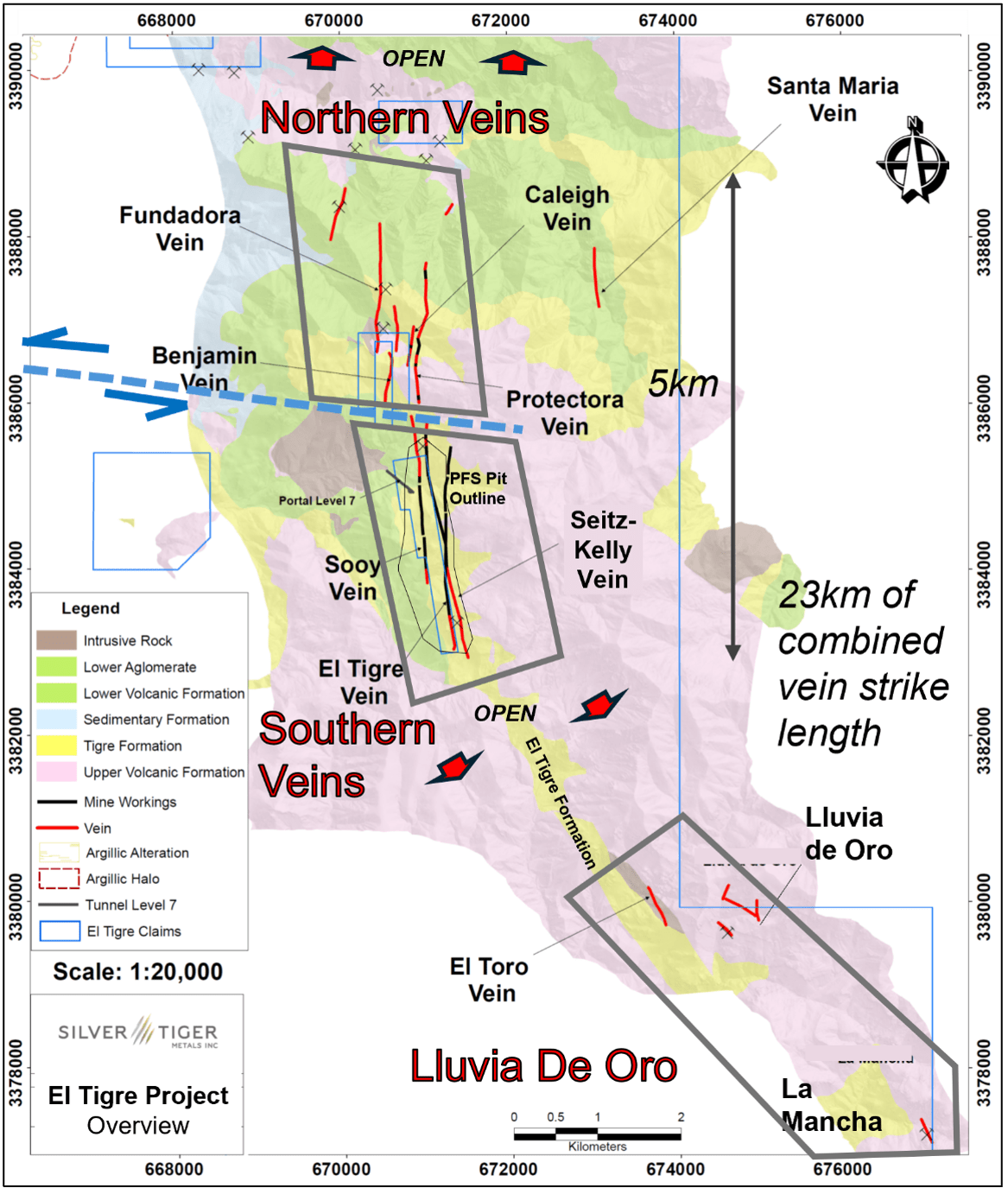

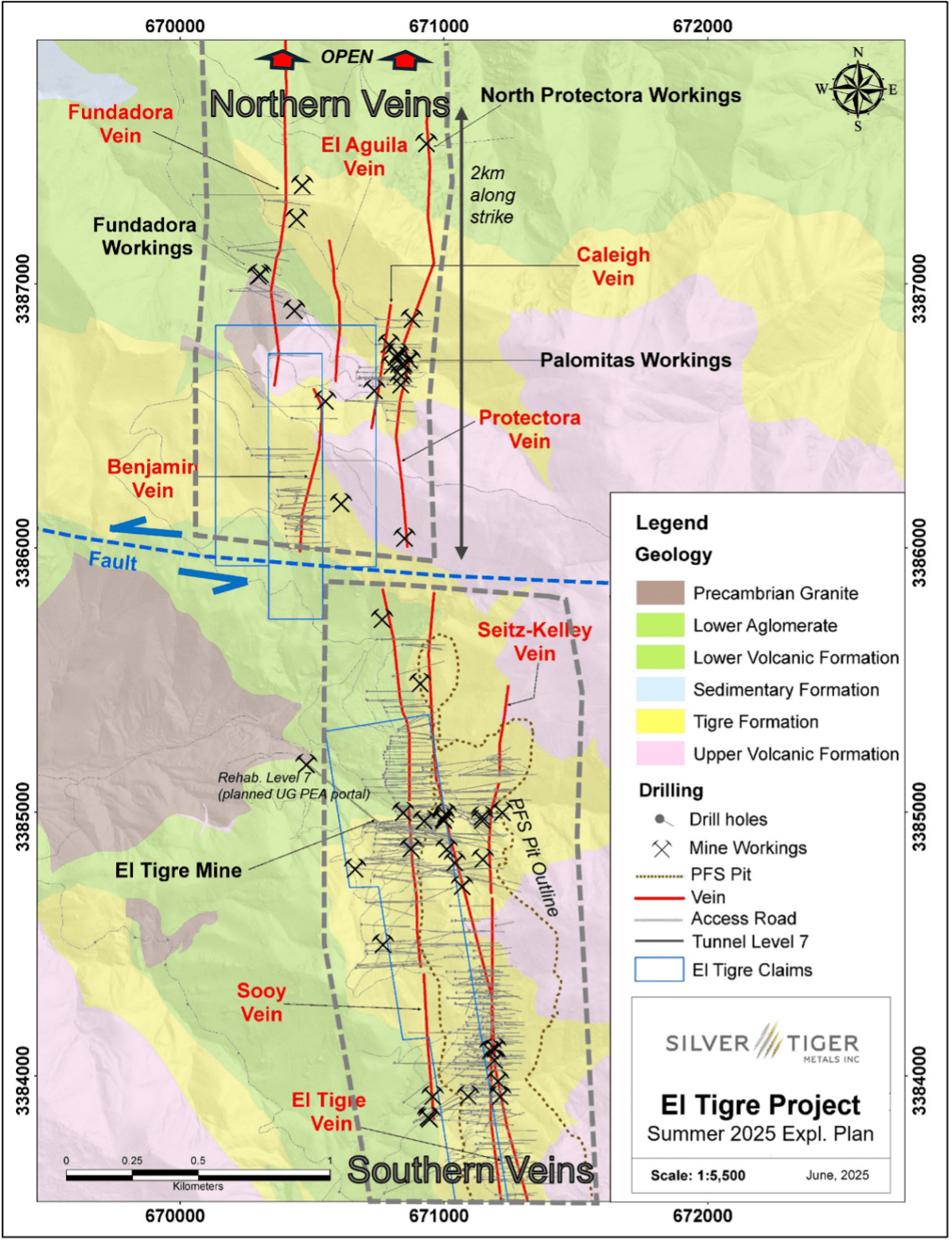

Figure 1: El Tigre Project – Northern and Southern Exploration Targets

The Northern Vein Area has over 10 kilometers of combined strike length confirmed by surface mapping and sampling, drilling and the presence of underground workings mainly on the Fundadora, Protectora and Caleigh Veins. This area is considered brownfields with 15% of the mapped strike of veins being drilled. These veins are the faulted offset of the El Tigre Mine Veins and exhibit the same structure, mineralogy, grades, orientations, strike length and width (1-2 metres) as the well-defined El Tigre Mine Veins that account for bulk of the Corporation’s Mineral Resource Estimate.

The Southern Veins which includes Lluvia de Oro, La Mancha and El Toro is considered greenfields with veins striking for over 10 kilometers and no drilling ever conducted on this area. This prospective area is evidenced by historic workings and high-grade channel sampling. The El Toro, Lluvia de Oro and La Mancha Veins are hosted in the El Tigre Formation, a permissive formation that is the host for the Stockwork Zone, which is the basis of the Company’s PFS (see the Corporation’s Press Release dated October 22, 2024).

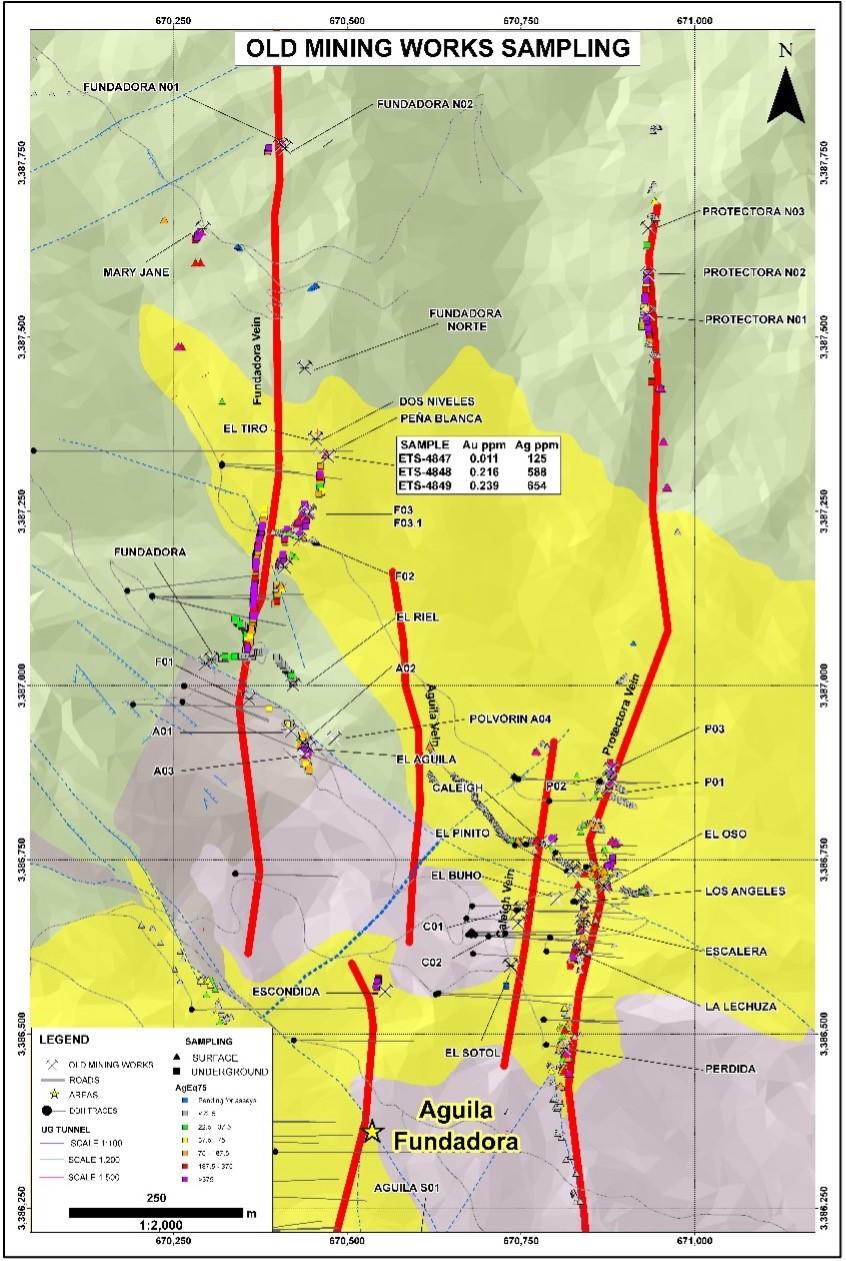

Figure 2: Current Sampling of Historic Workings – Northern Veins

Northern Veins – 2025 Summer Exploration Plan – Brownfields Targets

Exploration crews have begun to locate, catalog, map and sample historic adits and drifts in the Northern Veins (Figure 2). This work is aimed at confirming the geological similarities of the Northern Vein mineralized systems to the well-established El Tigre, Seitz-Kelly and Sooy Veins. Once assessment of the historic workings is complete all adits and drifts will be scanned with a LiDAR-capable drone. For the remainder of the summer, Silver Tiger will continue to define targets to drill in Q4-2025.

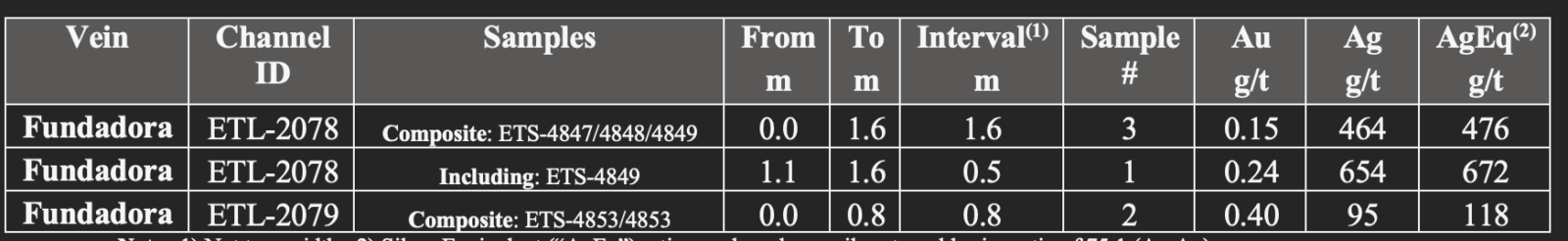

After surveying the tunnels, the geologists mapped the veins and then collected chip samples across the veins at intervals between 3 to 5 metres along the length of the tunnel. The samples were chipped with a rock hammer across the face of the vein exposed in the tunnel. The minimum length of the samples was 0.50 metres, and the samples weighed approximately 3 to 5 kg. Sampling was stopped at either the end of the tunnel or when access was restricted due to ground conditions. Of the 110 chip samples collected, the chip sample assay results received to date are set out in the table below (see Table 1 and Figure 2 for Sample Location).

As work progresses on the Northern Veins, exploration crews will begin analysing Lluvia de Oro, La Mancha and El Toro on the Southern Veins.

Table 1: Significant Channel Samples on Northern Veins

Notes:1) Not true width.; 2) Silver Equivalent (“AgEq”) ratios are based on a silver to gold price ratio of 75:1 (Au:Ag).

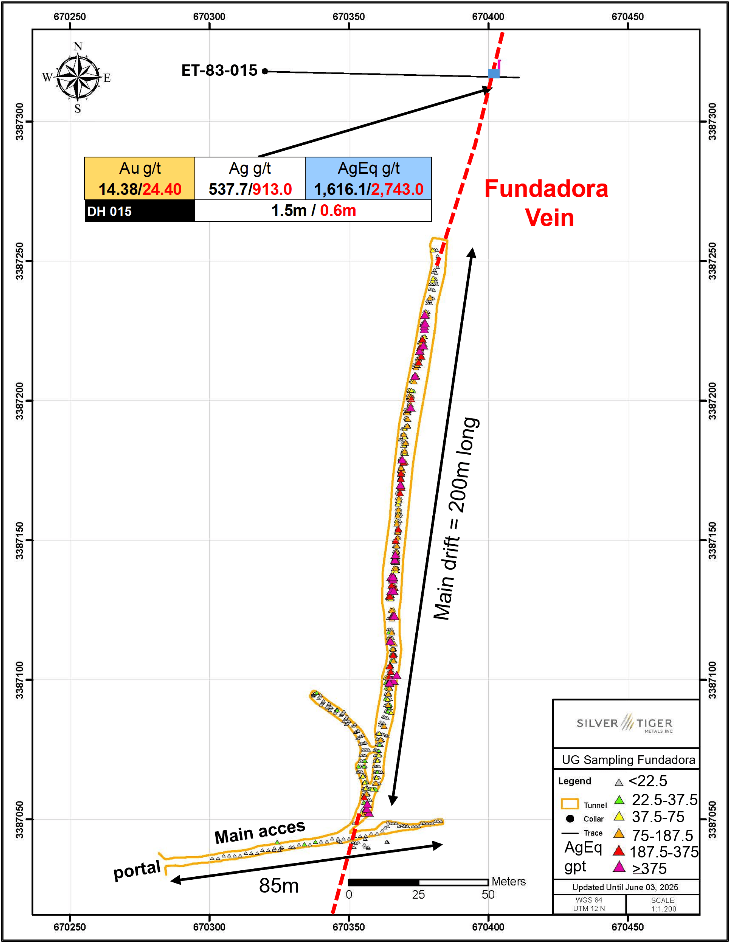

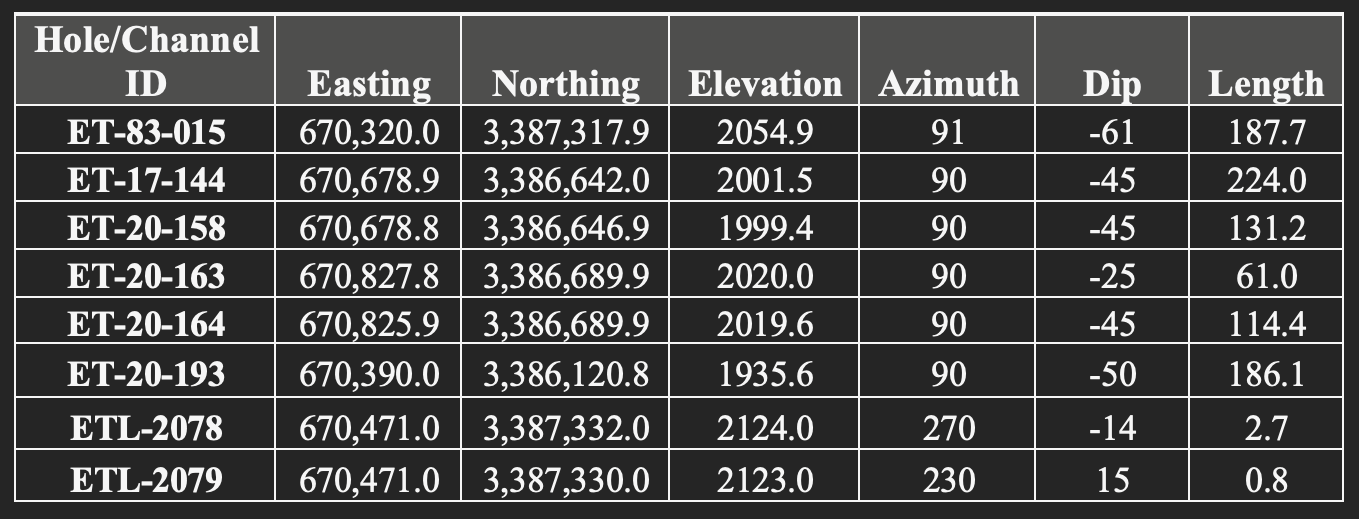

Reconnaissance drilling was conducted on the Northern veins by the Company in 2017 and 2020, before shifting focus to the development of the El Tigre Mine Veins. Significant veins were consistently intercepted in the North (Table 2) proving the continuity and grade seen in the underground historic workings. Anaconda (c. 1982-83) completed a 250 metre exploration drift on the Northern Veins (Figure 4).

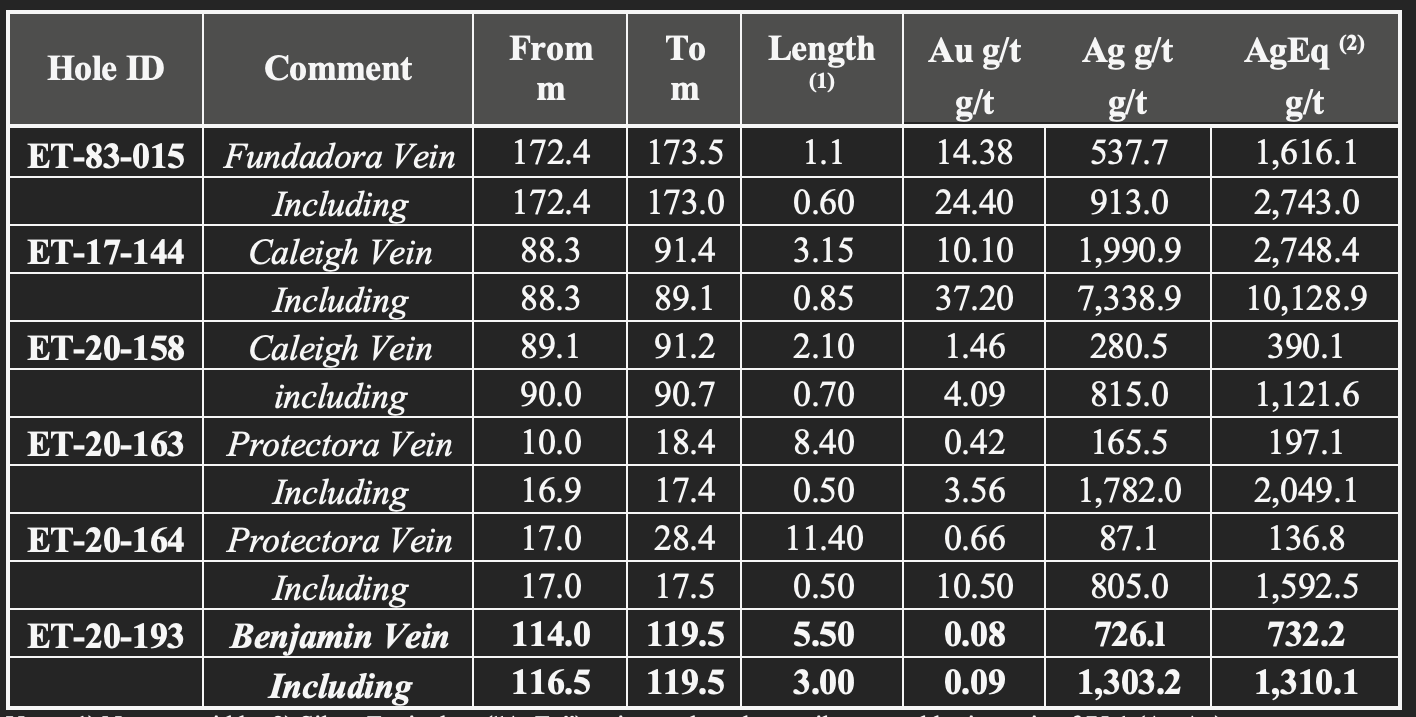

Table 2: Historic Significant Intercepts in Northern Veins

Notes:1) Not true width.; 2) Silver Equivalent (“AgEq”) ratios are based on a silver to gold price ratio of 75:1 (Au:Ag).

The Northern Veins consist of both historically mined veins including the Protectora and Fundadora (Figure 3); and veins discovered by the Corporation including the Benjamin and Caleigh (see the Corporation’s Press Releases dated Sept 10, 2020 and Nov 17, 2020).

Figure 3 : Plan View El Tigre Project– Northern Veins

Caleigh Vein

Discovered in 2020 by the Corporation, the Caleigh Vein is the highest grade of the Northern Veins with, for example, DDH ET-17-144 returning assays at 10,129 g/t silver equivalent over 0.85 metres (Table 2). The Caleigh Vein is mapped on surface for 1.2 kilometers with only 25% of the vein drill tested.

Caleigh Vein

Caleigh Vein is mapped on surface for 1.2 kilometers with only 25% of the vein drill tested.

Benjamin Vein and Black Shale

The newly discovery Benjamin Vein has been mapped on surface for 1 kilometer, with only 25% drill tested. Drill hole DDH ET-20-193 returned assays at 1,310 g/t silver equivalent over 3.0 metres (Table 2). The Benjamin Vein also hosts significant Black Shale style mineralization that is seen in the El Tigre Mine Veins.

Fundadora Vein – Northern Veins

This vein was intermittently mined during the time of the El Tigre Mine (c. 1892-1930) and therefore hosts many small workings including a 250+ metre exploration drift constructed by Anaconda Mining in 1982 (Figure 4). Drilling assays confirm the high grade seen in channel sampling in a 2020 program, with DDH ET-83-015 returning assays at 2,743 g/t silver equivalent over 0.6 metres (Table 2). The Fundadora Vein has been mapped over 2 kilometers on surface with only 15% of the vein drill tested.

Figure 4: Plan View –Historic UG Sampling and Mapping Fundadora Workings

Protectora Vein – Northern Veins

The Protectora Vein extends along strike for 2 kilometers and from its position, dip. and strike it can be considered the north extension of the Sooy Vein. This vein has only been drill tested for 15% of the mapped strike length. Like the Fundadora vein, this vein was mined historically as The Palomita Mine and the North Tigre Mine. Drilling assays confirm the high grade seen in channel sampling in a 2020 program, with DDH ET-20-163 returning assays at 2,049 g/t silver equivalent over 0.5 metres (Table 2).

Figure 5: Historic Workings Exploration – Protectora Vein

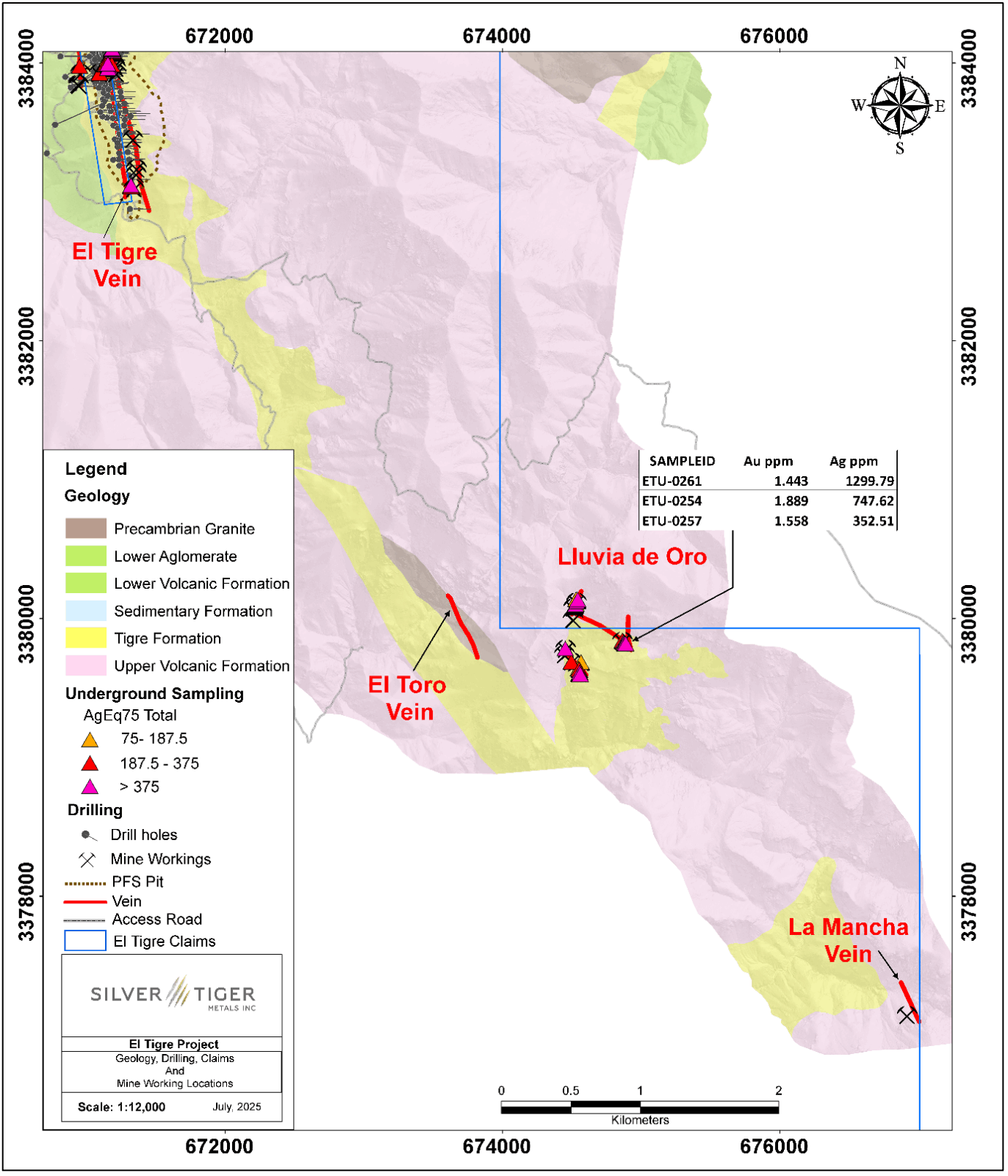

Southern Veins – Lluvia De Oro, La Mancha and El Toro – Greenfields Target

Reconnaissance mapping and sampling was conducted in the Lluvia de Oro Area by the Company in 2016 and 2020. The El Toro and La Mancha Veins, while mapped, remain unsampled.

Significant historic underground workings (greater than 500 metres in length) were found in Lluvia de Oro with grab sampling completed in a 2020 program returning assays up to 1.90 g/t gold and 1,300 g/t silver (Figure 5). Importantly, the Lluvia de Oro vein system is contained within the El Tigre formation, the host to the Stockwork Zone of which the Corporation’s 2024 PFS is centered. There is potential to extend open pit mineralization from the far south of the proprosed open pit south towards Lluvia de Oro.

Figure 6: Plan View El Tigre Project– Lluvia de Oro – Southern Veins

Table 3: Drillhole Locations for Significant Intercepts – Northern Veins

Underground Preliminary Economic Assessment Update

The Company’s Technical Team and lead consultants (P&E Mining), are near completion of underground PEA with expected release in Q3-2025. The underground PEA is centered on the high-grade Vein, Sulfide and Shale Zones. Final process flow diagram design and costing are in process with initial cost (CAPEX) and operational expenditures (OPEX) established, and metallurgical and geotechnical studies complete.

Open Pit Update

The Company is preparing for a construction decision of the Open Pit portion of the El Tigre Project. Kappes, Cassiday & Associates (KCA) of Reno, experts in heap leach design, have been retained for a Detailed Engineering to Process Study. WSP has completed the preliminary Engineering to Heap Leach and Ponds.

“The Northern Veins, a faulted offset of the veins at the historic El Tigre Mine, show the same structure, mineralogy, grades and orientations as the well-defined veins around the historic El Tigre Mine on which our PFS and pending underground PEA are based. With the initial 10 kilometers of mapped vein strike length we have to the North and recent assay results we are disclosing today, we see the potential to drill these Northern Veins in our Winter 2025 program.”

– Glenn Jessome, President & CEO, Silver Tiger Metals

Procedure, Quality Assurance / Quality Control and Data Verification

The diamond drill core (HQ size) is geologically logged, photographed and marked for sampling. When the sample lengths are determined, the full core is sawn with a diamond blade core saw with one half of the core being bagged and tagged for assay. The remaining half portion is returned to the core trays for storage and/or for metallurgical test work.

The sealed and tagged sample bags are transported to the Bureau Veritas facility in Hermosillo, Mexico. Bureau Veritas crushes the samples (Code PRP70-250) and prepares 200-300 gram pulp samples with ninety percent passing Tyler 200 mesh (Code PUL85). The pulps are assayed for gold using a 30-gram charge by fire assay (Code FA430) and over limits greater than 10 grams per tonne are re-assayed using a gravimetric finish (Code FA530). Silver and multi-element analysis is completed using total digestion (Code MA200 Total Digestion ICP). Over limits greater than 100 grams per tonne silver are re-assayed using a gravimetric finish (Code FA530).

Quality assurance and quality control (“QA/QC”) procedures monitor the chain-of-custody of the samples and includes the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch are tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Silver Tiger’s QA/QC protocols.

Qualified Persons

David R. Duncan, P. Geo., V.P. Exploration of the Corporation, is the Qualified Person for Silver Tiger as defined under National Instrument 43-101. Mr. Duncan has reviewed and approved the scientific and technical information in this press release.

About the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 27 years’ experience discovering, financing, and building large hydrothermal gold and silver mines in Mexico. Silver Tiger’s 100% owned 28,414 hectare Historic El Tigre Mining District is located in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

Silver Tiger commenced work on its El Tigre Project in 2017. Silver Tiger has drilled over 150,000 metres at the El Tigre Project, with 119,000 metres completed since 2020. Silver Tiger has completed a maiden MRE in 2017 and MRE updates in 2023 and 2024. The PEA for the El Tigre open pit was released in November 2023.

The 2024 PFS for the El Tigre open pit delivered robust economics. The PFS projects an After-Tax NPV of US$222 million at a 5% discount rate, an After-Tax IRR of 40.0%, and a payback period of 2.0 years. This open pit operation is expected to have a 10-year mine life. The El Tigre project delivers a life of mine undiscounted After-Tax Cash Flow of US$318 million, with initial capital costs of $86.8 million (including $9.3 million in contingency). Operating cash costs are projected at $973/oz AuEq and $12/oz AgEq, with AISC at $1,214/oz AuEq and $14/oz AgEq. The economics of the Project have been evaluated based on a discounted $26/oz silver price and gold price of $2,150/oz.

A PEA for the permitted underground mineral resource is expected to be released in Q3-2025.

VRIFY Slide Deck and 3D Presentation – Silver Tiger’s El Tigre Project

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

Access the Silver Tiger Metals Inc. Company Profile on VRIFY at: https://vrify.com

The VRIFY Slide Deck and 3D Presentation for Silver Tiger Metals Inc. can be viewed at: https://vrify.com/decks/17174 and on the Company’s website at: www.silvertigermetals.com

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE