SILVER TIGER ANNOUNCES PFS WITH NPV OF US$222M FOR THE STOCKWORK ZONE OF THE EL TIGRE SILVER-GOLD PROJECT, SONORA, MEXICO

“We are very pleased with the work completed by our consultants and our technical team on the PFS for the open pit at El Tigre. The open pit delivers robust economics with an NPV of US$222 million, an initial capital expenditure of US$87 million, and a payback of 2 years with 3 years of production in the Proven category in the ‘Starter Pit using metal prices greatly discounted to the spot price.”

– Glenn Jessome, President & CEO, Silver Tiger Metals

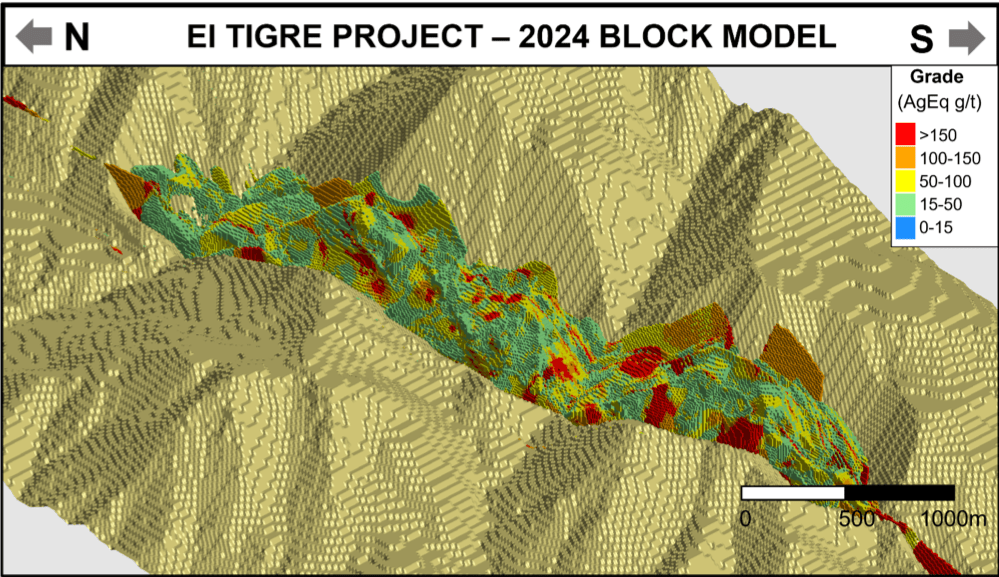

Silver Tiger Metals Inc. (TSX-V:SLVR) (OTCQX:SLVTF) is pleased to a Preliminary Feasibility Study for its 100% owned, silver-gold El Tigre Project located in Sonora, Mexico. The PFS is focused on the conventional open pit mining economics of the Stockwork Mineralization Zone defined in the updated Mineral Resource Estimate (Figure 1). The updated MRE also contains an Out-of-Pit Mineral Resource that Silver Tiger plans to study in a Preliminary Economic Assessment in H1-2025.

Highlights of the PFS are as follows (all figures in US dollars unless otherwise stated):

- After-Tax net present value (using a discount rate of 5%) of US$222 million with an After-Tax IRR of 40.0% and Payback Period of 2.0 years (Base Case);

- 10-year mine life recovering a total of 43 million payable silver equivalent ounces or 510 thousand payable gold equivalent ounces, consisting of 9 million silver ounces and 408 thousand gold ounces;

- Total Project undiscounted after-tax cash flow of US$318 million;

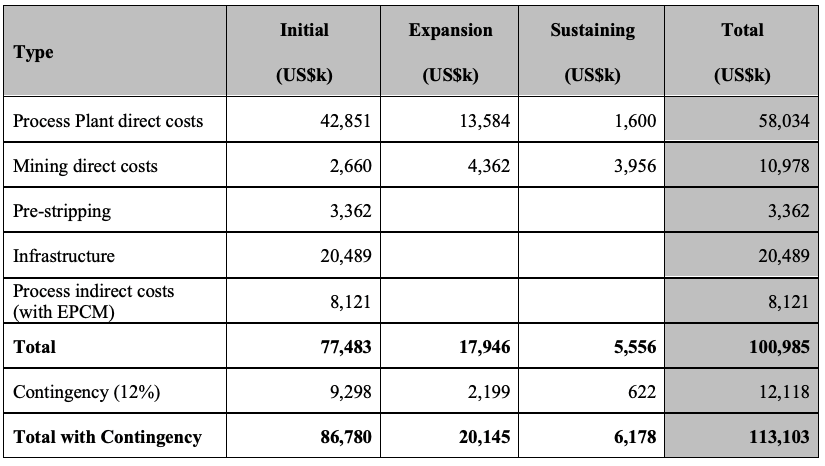

- Initial capital costs of $86.8 million, which includes $9.3 million of contingency costs, over an expected 18-month build, expansion capital of $20.1 million in year 3 and sustaining capital costs of $6.2 million over the life of mine;

- Average LOM operating cash costs of $973/oz AuEq, and all in sustaining costs of $1,214/oz AuEq

- Average annual production of approximately 4.8 million AgEq oz or 56.7 thousand AuEq oz; and

- Three (3) years of production in the Proven category in the Phase 1 Starter Pit.

Glenn Jessome, President & CEO stated “We are very pleased with the work completed by our consultants and our technical team on the PFS for the open pit at El Tigre. The open pit delivers robust economics with an NPV of US$222 million, an initial capital expenditure of US$87 million, and a payback of 2 years with 3 years of production in the Proven category in the ‘Starter Pit using metal prices greatly discounted to the spot price.” Mr. Jessome continued “This is a pivotal point for our Company as we now have a clear path forward to making a construction decision for the open pit. The open pit has good grade (48 g/t AgEq), low strip ratio (1.7:1), and wide benches (~150 m) with mineralization at surface. With such positive parameters and with our VP of Operations Francisco Albelais, a career expert in the construction of large heap leach mines in Mexico, we are confident we will be able to advance the Project very quickly.” Mr. Jessome concluded “The open pit is only one component of El Tigre as we have also today delivered over 113 Mozs AgEq in the underground Mineral Resource Estimate and disclosed an Exploration Target establishing 10 to 12 million tonnes at 225 to 265 g/t AgEq for 73 to 100 Moz AgEq. This disclosed ‘near-mine’ Mineral Resource and potential, when coupled with the fact that only 30% of this prolific Property has been explored, shows the value of the El Tigre Project. The Company will also continue to work on this substantial underground Mineral Resource by starting underground drilling immediately, and plan to release an underground PEA in H1-2025.”

Highlights of the updated Mineral Resource

- Increased confidence in MRE, with increase of 132% in Total Measured & Indicated Silver Equivalent (“AgEq”) Ounces from September 2023 MRE, with 59% increase in Measured & Indicated AgEq grade;

- Total Measured & Indicated Mineral Resource of 200 Moz AgEq grading 92 g/t AgEq contained in 68.0 million tonnes (“Mt”);

- Inferred Mineral Resource of 84 Moz AgEq grading 180 g/t AgEq contained in 14.5 Mt; and

- Inclusion of Out-of-Pit Mineral Resource of 5.3 Mt Measured & Indicated Mineral Resource at grade of 255 g/t AgEq and 10.1 Mt Inferred Mineral Resource grading 216 g/t AgEq.

Figure 1: El Tigre Block Model Visualization, Showing Pit- Constrained Mineral Resources.

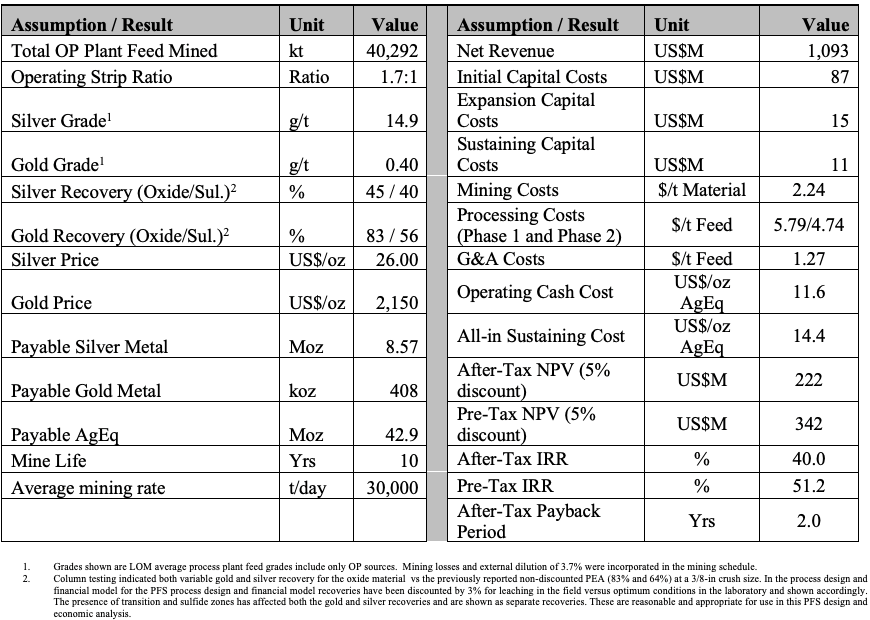

Preliminary Feasibility Summary

The PFS was prepared by independent consultants P&E Mining Consultants Inc. (“P&E”), with metallurgical test work completed by McClelland Laboratories, Inc. – Sparks, Nevada, process plant design and costing by D.E.N.M. Engineering Ltd., and environmental and permitting led by CIMA Mexico. Following are tables and figures showing key assumptions, results, and sensitivities.

Table 1: El Tigre PFS Key Economic Assumptions and Results(1-2)

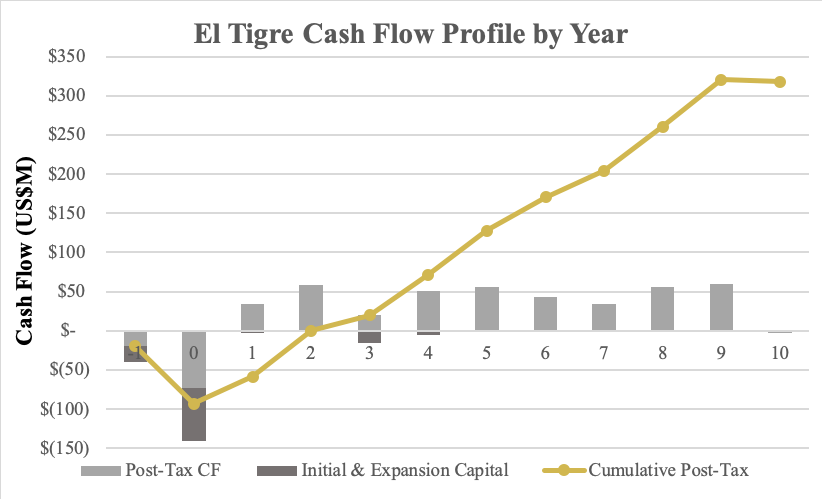

Figure 2: El Tigre Cash Flow Profile by Year

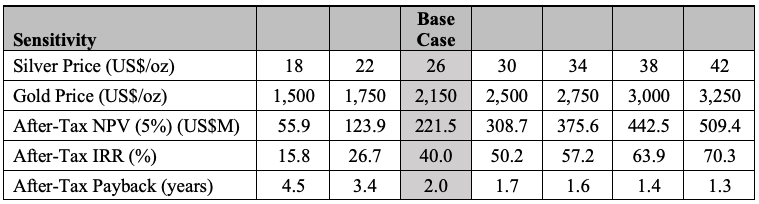

Figure 2 above highlights the post-tax cash flows of US$318 million associated with the El Tigre Project. The economics of the Project have been evaluated based on the base case scenario $26/oz silver price and gold price of $2,150/oz. As illustrated in the following sensitivity tables, the Project remains robust even at lower commodity prices or with higher costs (Tables 2 and 3).

Table 2 – El Tigre PFS Gold and Silver Price Sensitivities

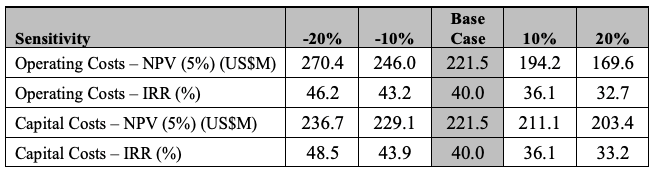

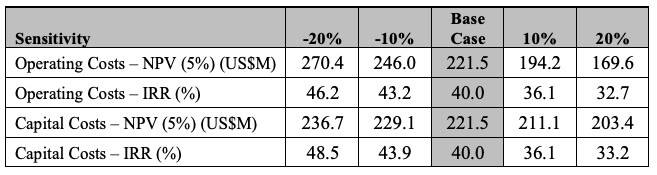

Table 3 – El Tigre PFS Operating Cost and Capital Cost Sensitivities

Capital and Operating Costs

The El Tigre Project has been envisioned as an open pit mining operation starting at a processing rate of 7,500 tonnes per day for years 1-3 and then ramping up to 15,000 tonnes per day by year 4 after 1 year construction for ramp up in year 3.

The process plant is comprised of conventional three (3) stage crushing to an optimum -3/8 inch (10 mm) crush size. The crushed material will be conveyed and loaded on the lined pad areas. A series of pumping and piping will allow irrigation of the stacked heap material and subsequent production of pregnant solution to flow to the respective impoundment pond. The pregnant solution will be pumped to the recovery facility consisting of the Merrill – Crowe process (zinc precipitation) and refinery to produce the gold and silver dore for marketing. The process barren solution will be recycled (with NaCN addition) and pumped back to the heap for further leaching. The process plant location will be adjacent to the pad and pond infrastructure area.

Water supply to the process plant is provided by pumping from nearby Bavispe River to the process area water distribution system and high voltage grid power will be installed by the local utility to supply process and infrastructure electrical requirements. Expansion capital includes the cost to increase the process plant capacity from 7,500 tonnes per day to 15,000 tonnes per day as noted in Year 4 of operation.

Table 4 – LOM Capital Cost Estimate

Mining

Open pit mining will be contracted and carried out by drill and blast followed by conventional loading and truck haulage to the waste rock storage facilities and the process plant.

Metallurgy

A detailed metallurgical test program was carried out by McClelland Laboratories, Inc., Sparks, Nevada on six El Tigre starter pit samples. The program included crushing, coarse bottle rolls, and column testing at both 80% passing 3/8 inch and 1/2 inch (10 and 12 mm) crush size for five (5) of the six samples. One low grade sample was only crushed to 80% passing 1-1/2 inch (38 mm) as an indication of low grade leachability. The leach samples comprised of drill core sample representing the starter pit and during the testing process it became apparent that the presence of transition and sulfide zones are in the starter pit thus affecting the base design recoveries. This variable test program (column and coarse bottle roll) estimated oxide average gold and silver respective metallurgical recoveries of 86% Au and 48% Ag at the 3/8 inch (10 mm) crush. The transition and sulfide zones had estimated recoveries of 59% Au and 43% Ag. Further percolation testing also confirmed no requirement for agglomeration of the crushed material is required prior to loading on the leach pad.

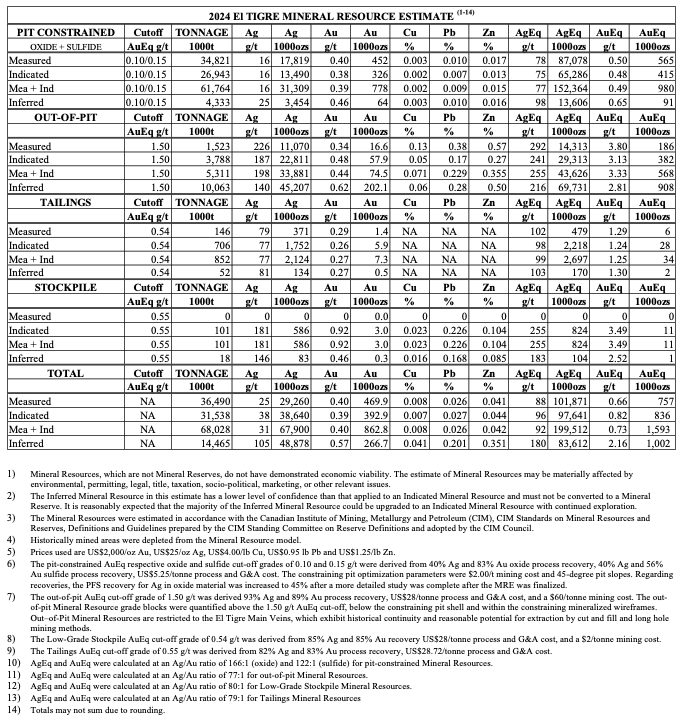

Mineral Resource Estimate

The basis for the PFS is the Mineral Resource Estimate completed by P&E for the El Tigre Project located in Sonora State, Mexico, which has an effective date of October 22, 2024, with an NI 43-101 Technical Report to be filed within 45 days of this news release. A summary of the Mineral Resource Estimate is provided in Table 5.

Table 5 – Updated Mineral Resource Estimate October 2024

Mineral Resource Estimate Methodology – El Tigre Project

The El Tigre Project includes the El Tigre Veins, El Tigre Tailings and the El Tigre Low-Grade Stockpile.

The databases used for this Mineral Resource update contain a total of 20,149 collar records that contribute directly to the Mineral Resource Estimate and includes collar, survey, assay, lithology and bulk density data. Assay data includes Au g/t, Ag g/t, Cu %, Pb % and Zn % grades. The drilling extends approximately five km along strike.

P&E Mining Consultants Inc. collaborated with Silver Tiger personnel to develop the mineralization models, grade estimates, and reporting criteria for the Mineral Resources at El Tigre. Mineralized domains were initially developed by Silver Tiger and were reviewed and modified by P&E. A total of twenty-seven individual mineralized domains have been identified through drilling and surface sampling. Interpreted mineralization wireframes were developed by Silver Tiger geologists for the El Tigre Veins based on logged drill hole lithology, assay grades and historical records. Silver Tiger identified continuous zones of mineralization from assay grades equal to or greater than 0.30 g/t AuEq with observed continuity along strike and down-dip, using a calculated Ag:Au equivalent factor of 75:1. The selected intervals include lower grade material where necessary to maintain wireframe continuity between drill holes.

P&E developed mineralized domains for the El Tigre Low-Grade Stockpile and the El Tigre Tailings based on lithological logging and LiDAR surface topography.

Assay samples were composited to either 1.00 m or 1.50 m for the vein domains. No compositing was used for the Low-Grade Stockpiles and Tailings models. Composites were capped prior to grade estimation based on the analysis of individual composite log-probability distributions.

A total of 5,542 bulk density values were taken by Silver Tiger from drill hole core. Mineralized bulk density values were assigned for each of the El Tigre Main Veins based on the median vein measurement. For the El Tigre North Veins, a bulk density of 2.65 t/m3 was assigned for the veins and a value of 2.42 t/m3 was assigned for the Protectora Halo. For the Low-Grade Stockpile a value of 1.60 t/m3 was assigned, and for the Tailings a value of 1.39 t/m3 was used based on 37 nuclear density measurements.

Vein block grades for gold and silver were estimated by Inverse Distance Cubed (“ID3”) interpolation of capped composites using a minimum of four and a maximum of twelve composites. Vein block grades for copper, lead and zinc were estimated by Inverse Distance Squared interpolation of capped composites using a minimum of four and a maximum of twelve composites.

Nearest-Neighbour grade interpolation was used for the Low-Grade Stockpiles, and for the Tailings, block grades were estimated by ID2 estimation of capped assays using a minimum of four and a maximum of twelve samples.

For the El Tigre Main Veins, blocks within 30 m of three or more drill holes/channels were classified as Measured Mineral Resources, and blocks within 60 m of three or more drill holes/channels were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

For the North Veins, blocks interpolated by at least two drill holes within 50 m were classified as Indicated Mineral Resources. Blocks interpolated by at least one drill hole within a maximum distance of 200 m were classified as Inferred Mineral Resources.

For the Low-Grade Stockpiles, blocks within 15 m of two or more drill holes were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

For the Tailings, blocks within 30 m of three or more auger or core drill holes were classified as Measured Mineral Resources. Blocks within 60 m of two or more auger/drill holes/pits or trenches were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

P&E considers that the block model Mineral Resource Estimates and Mineral Resource classification represent a reasonable estimation of the global mineral resources for the El Tigre Project with regard to compliance with generally accepted industry standards and guidelines, the methodology used for estimation, the classification criteria used and the actual implementation of the methodology in terms of Mineral Resource estimation and reporting. The Mineral Resources have been estimated in conformity with the requirements of the CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines as required by the Canadian Securities Administrators’ National Instrument 43-101. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

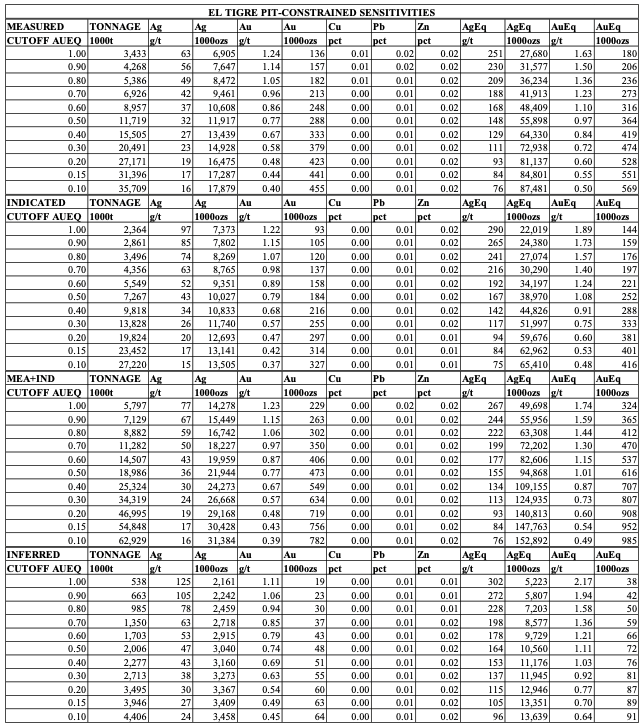

Table 6: AuEq Cut-off Sensitivities – ET Pit-Constrained Mineral Resource

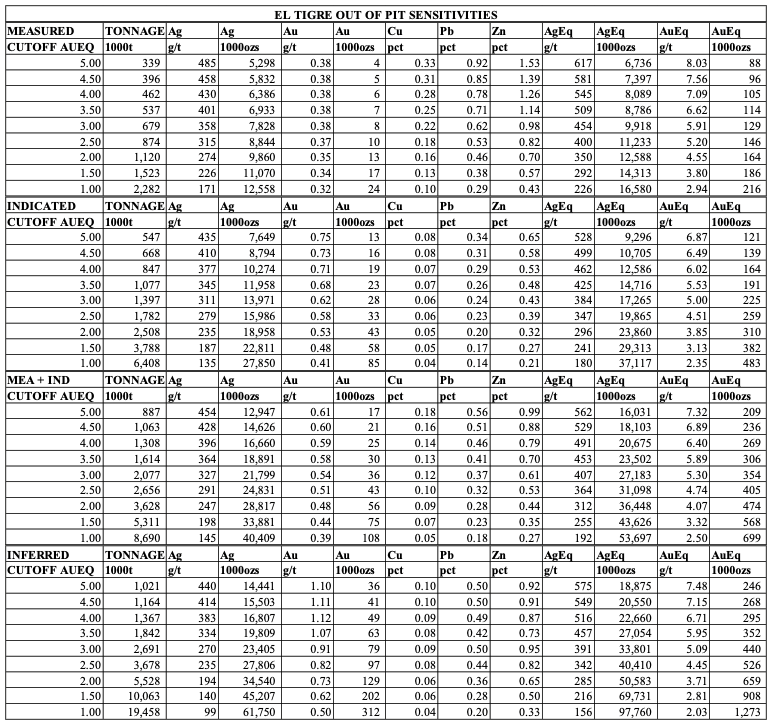

Table 7: AuEq Cut-off Sensitivities – ET Out-of-Pit Mineral Resource

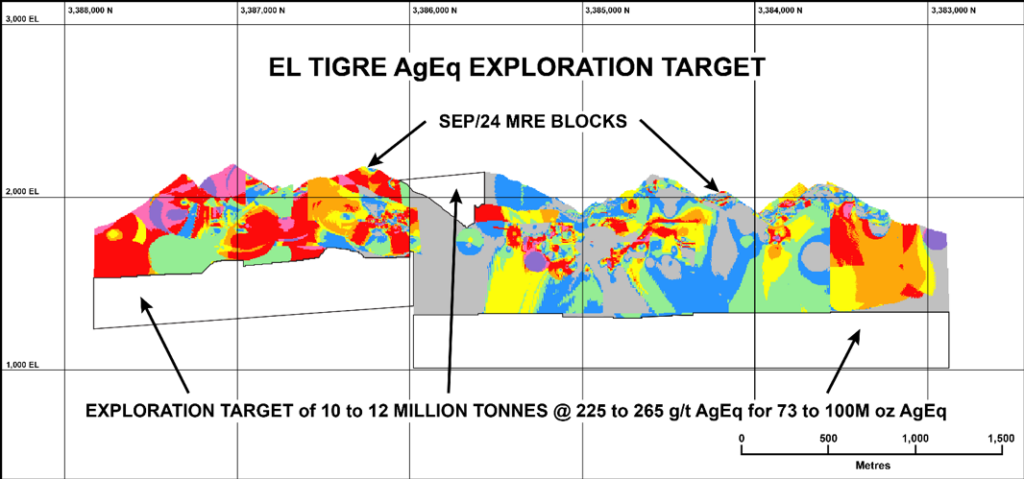

Exploration Potential

Exploration potential at the El Tigre Project is substantial with prospective areas for exploration both down dip and along strike with the disclosed Exploration Target establishing 10 to 12 million tonnes at 225 to 265 g/t AgEq for 73 to 100 Moz AgEq.

Figure 3—Exploration Potential released October 2024

Surface Rights Agreement

The Company owns royalty-free, 100% of the 6,238 hectares land-package encompassing the footprint of proposed mining operation with no Ejido presence. In addition, the Company controls 28,414 hectares of Concessions to conduct exploration along a 25 km strike length of the Sierra Madres.

Underground Preliminary Economic Assessment

The Company will also continue to work on this substantial, permitted underground Mineral Resource Estimate and advance this towards a Preliminary Economic Assessment by H1-2025. The Measured and Indicated Out-of-Pit Mineral Resource at El Tigre is 44 Moz AgEq grading 255 g/t AgEq contained in 5.3 Mt and the Inferred Mineral Resource is 70 Moz AgEq grading 216 g/t AgEq contained in 10.1 Mt.

“This is a pivotal point for our Company as we now have a clear path forward to making a construction decision for the open pit. The open pit has good grade (48 g/t AgEq), low strip ratio (1.7:1), and wide benches (~150 m) with mineralization at surface. With such positive parameters and with our VP of Operations Francisco Albelais, a career expert in the construction of large heap leach mines in Mexico, we are confident we will be able to advance the Project very quickly”

– Glenn Jessome, President & CEO, Silver Tiger Metals

Qualified Persons

Mineral Resource Estimate: Dave Duncan P. Geo. VP Exploration of Silver Tiger, Charles Spath P.Geo., VP of Technical Services of Silver Tiger, and Fred Brown, P.Geo RM-SME Senior Associate Geologist of P&E Mining Consultants, and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

Preliminary Feasibility Study: Andrew Bradfield P. Eng of P&E Mining Consultants, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants and David J. Salari, P. Eng. of D.E.N.M. Engineering Ltd are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

A Technical Report is being prepared on the Preliminary Feasibility Study in accordance with National Instrument 43-101 (“NI-43-101”), and will be available on the Company’s website and SEDAR within 45 days of the date of this news release. The effective date of this Preliminary Feasibility Study is October 22, 2024.

About the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 25 years’ experience discovering, financing and building large epithermal silver projects in Mexico. Silver Tiger’s 100% owned 28,414 hectare Historic El Tigre Mining District is located in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas at the northern end. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with production coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the middle El Tigre Vein extended 1,450 metres along strike and was mined on 14 levels to a depth of approximately 450 metres. The Seitz Kelley Vein was mined along strike for 1 kilometre to a depth of approximately 200 metres. The Sooy Vein was only mined along strike for 250 metres to a depth of approximately 150 metres. Mining abruptly stopped on all 3 of these veins when the price of silver collapsed to less than 20¢ per ounce with the onset of the Great Depression. By the time the mine closed in 1930, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The average grade mined during this period was over 2 kilograms silver equivalent per ton.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE