SILVER ONE ANNOUNCES IN-GROUND MINERAL RESOURCE ESTIMATE PREPARED IN ACCORDANCE WITH NI 43-101 ON ITS CANDELARIA PROJECT, NEVADA

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1) is pleased to announce the completion of a NI 43-101 mineral resource estimate for its Candelaria Project, located in Nevada, USA. The mineral resource estimate, prepared by James A. McCrea, P. Geo, includes the in-ground mineralization and stockpiles adjacent to the historic Mount Diablo and Northern Belle pits (Table 1). The MRE was prepared in accordance with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards and Canadian National Instrument.

Highlights:

- Mount Diablo and Northern Belle pit-constrained resources:

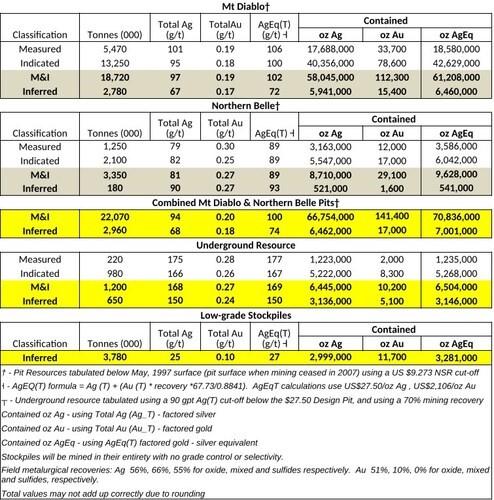

– Measured and Indicated (M&I) resource of 22,070,000 tonnes averaging 94 g/t Ag and 0.20 g/t Au, for 66.754 million ounces of silver and 141,400 ounces of gold, or 70.836 million ounces of silver equivalent (see note ˧ in table 1).

– Inferred resource of 2,960,000 tonnes averaging 68 g/t Ag and 0.18 g/t Au, for 6.462 million ounces of silver and 17,000 ounces of gold (7.00 million oz AgEq). - Underground Measured and Indicated resource of 1,200,000 tonnes averaging 168 g/t Ag and 0.27 g/t Au, for 6.45 million ounces of silver and 10,200 ounces of gold (7.150 million oz AgEq).

- Underground Inferred resource of 650,000 tonnes averaging 150 g/t Ag and 0.24 g/t Au, for 3.136 million ounces of silver and 5,100 ounces of gold (3.490 million oz AgEq).

- Candelaria’s project resources (from open-pit, underground, stockpiles and leach pads) now total 108.82 million ounces of silver equivalent in the Measured and Indicated categories, and 29.81 million ounces of silver equivalent Inferred.

Greg Crowe, President and CEO commented: “This updated mineral resource is based on results from extensive reverse circulation and core drilling programs and metallurgical studies completed by Silver One. It also includes historic drill hole information from previous operators. We are very pleased with the results. At this phase, the majority of the resource has been upgraded to a Measured and Indicated category. The current resource estimate exceeds the historic resource, which is encouraging as the current resource is pit-constrained and of higher confidence than historic estimates, plus the mineralization remains open in all directions. Additionally, the company’s efforts of testing a novel non-cyanide recovery process have yielded excellent results and have demonstrated the capacity to increase silver and gold recoveries, while potentially lowering process costs. The Company plans to resume drilling late in the year to continue expanding the in-ground mineralization, both in the near-surface mineralization and the higher-grade underground targets. Metallurgical testing of the new non-cyanide technology will continue to further examine the optimization of silver and gold recoveries. Silver One is undertaking a PEA study to compare the recoveries and costs of using cyanide versus these new non-cyanide solutions. It is also examining a pilot heap-leach test to investigate field silver and gold recoveries.”

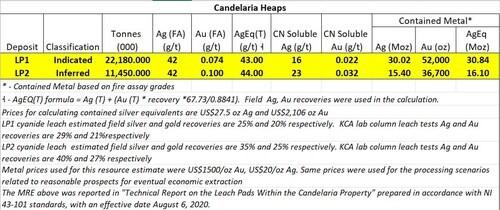

Silver One previously announced a NI 43-101 mineral resource for mineralization in leach pads on August 18, 2020. The leach pad resources include 22.18 million tonnes for 30.02 million ounces of silver and 52,000 ounces of gold (at a grade of 42.1 g/t Ag and 0.074 g/t Au respectively) in the Indicated category, and 11.45 million tonnes for 15.4 million ounces of silver and 36,700 ounces of gold (at grade of 41.8 g/t Ag and 0.10 g/t Au respectively) in the Inferred category. Indicated and Inferred silver equivalent ounces (AgEq) total 30.8 and 16.1 million ounces respectively (Table 2).

Table 1. Candelaria in-ground, underground, and stockpiles mineral resource estimates.

Totals above include pit Constrained Mineral Resources (Mt. Diablo and Northern Belle) at a US$9.273 NSR cut-off, within a US$27.50/oz Ag optimized pit shell (see footnotes and Resource Estimate Details section below).

| 1. | A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. |

|

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. |

|

|

An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

|

|

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. |

|

| An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. | |

| 2. | Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources has no known issues and does not appear materially affected by any known environmental, permitting, legal, title, socio-political, marketing, or other relevant issues. There is no guarantee that Silver One will be successful in obtaining any or all of the requisite consents, permits or approvals, regulatory or otherwise for the project or that the project will be placed into production. |

| 3. | The mineral resources in this study were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (‘CIM’), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the Standing Committee on Reserve Definitions and adopted by the CIM Council on May 10, 2014. |

| 4. | This Mineral Resource Estimate for the near-surface material is based on material within an optimized open pit shell that results from a US$27.50/oz silver price revenue factor. Tonnes and grade reported at $27.50/oz Ag and U$2,106/oz Au. |

| 5. | The Mineral Resource Estimate for underground material was calculated using a 90 g/t Ag(T) cut-off below the $27.50 Pit and using a 70% mining recovery. |

| 6. | Total Ag (AgT) and Au (AuT) mean total silver and gold assays (FA/Gravity) reported by the lab. It also means Calculated silver and gold values for historic samples collected by previous operators that were assayed for cyanide soluble silver or gold only, but not assayed for total gold and silver. Average total silver and gold for Mt. Diablo, Northern Belle and Underground resources in this table are derived from silver and gold assays in a database that consists of up to 80% of cyanide soluble silver and gold assays only. Approximately 20% of the assays in the database have both FA and or gravity total silver and gold values. The latter constitutes the basis for the generation of the Calculated silver and gold values using regression formulas developed by qualified Silver One professionals. |

Table 2. Candelaria Leach Pad mineral resources. As reported on August 18, 2020 company’s news release.

Candelaria’s project resources now total 108.822 million ounces of silver equivalent in the Measured and Indicated categories, and 29.808 million ounces of silver equivalent including in-ground, leach pad and stockpiles material. Higher grade material such as the underground resource, contains a significant amount of zinc. However, owing to the scarcity of base metal assays in most of the database, base metals are not included in this resource estimate at this time.

This report brings to current, upgrades and expands the historic resource of the Mount Diablo, Northern Belle and Stockpiles reported by SSR in a Technical Report filed on SEDAR in 2002, and complements the resource estimate of the leach pads reported by the company in 2020 (See the Company’s news release of August 18, 2020).

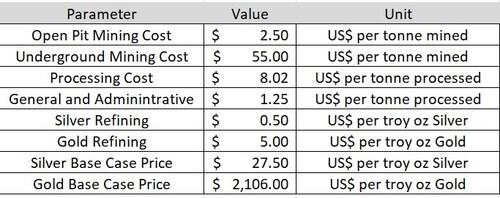

Metal prices used for this resource estimate are US $27.50 per ounce of silver and US $2,106 per ounce of gold. These prices are used for the exploitation scenarios related to reasonable prospects for eventual economic extraction. The 3-year trailing average metal prices are US $2,146 per ounce of gold and US $25.11 per ounce of silver. Spot prices for April 30, 2025 were US 3,328 per ounce of gold and US $33.19 per ounce of silver.

To fulfill the requirement of reasonable prospects for economic extraction (“RPEEE”), a conceptual crushing and leaching scenario using the Merrill-Crowe process was developed based on the results of the High-Pressure Grinding Rolls (“HPGR”) and column cyanide leach tests. These metallurgical tests were completed by McClelland Laboratories Inc. and Kappes Cassiday & Associates in Reno, Nevada (see Company’s news release May 21, 2019).

The scenarios evaluated were developed based on an operational throughput of 10,000 per day (tpd). The base case was using a silver recovery of 56%, 66% and 55% for oxide, mixed and sulfide material respectively, and gold recoveries of 51%, 10% and 0% for oxide, mixed and sulfide, respectively. These metal recoveries are estimated field recoveries which are discounted by a factor of 9% from laboratory column test recoveries, as normally done in practice by KCA for feasibility study purposes. The mining and heap-leach processing assumptions for RPEEE are shown in Table 3.

Table 3. Mining and Heap Leach Processing assumptions for RPEEE.

The above assumptions use an open-pit mining internal cut-off NSR value of US$9.27/tonne (equivalent to a cut-off grade between 14.81 g/t AgEq to $17.78 g/t AgEq depending on the rock and mineralization type). Cut-off for underground mining is 90 g/t Ag.

Resource Estimate Details

- The constraining pit for RPEEE was designed using 6m and 3m block size and the Lerch-Grossman “LG” algorithm. The optimal pit resulted from a US$27.50 g/t Ag and US$2,106 g/t Au price revenue factor and was used as a pit shell for the near-surface resource estimate. Tonnage and grade reported was tabulated at US$27.50/oz Ag and US$2,106/oz Au.

- Specific gravities were calculated from 78 laboratory measurements of all types of mineralized materials. Averages are 2.52 g/cm3 for oxide and mixed mineralization, 2.66 g/cm3 for sulfides, and 2.37 g/cm3 for all other rock materials.

- Historical mine workings at Northern Belle were digitized in mine grid from various maps, vertical and longitudinal sections and solid wireframes were built and converted to UTM coordinates. Volume of workings were calculated and deducted from the respective block affected.

- Measured, Indicated and Inferred Mineral Resources were determined from respective classification search ranges for Mt Diablo:

| Range | composites | classification | |

| 0 to 5.81m | >5 | Measured, | |

| 5.81to9.62m | >10 | Measured | |

| 9.62to11.53m | >10 | Indicated | |

| 11.53-27.1m | 10-30 | Indicated | |

| >27.1m | all | Inferred |

- Classification search ranges for Northern Belle:

| 0 to 6.26m | >5 | Measured | |

| 6.26 to 12.65m | >10 | Measured | |

| 6.26t o 12.65m | Indicated | ||

| 12.65 to 37.18m | 10-30 | Indicated | |

| >37.18m | all | Inferred |

- Underground resources were tabulated using a 90 g/t Ag(T) cut-off below the $27.50 Pit and using a 70% mining recovery.

- The Mineral Resource Estimate is based on a drill hole database containing 938 surface RC, percussion and diamond drill holes totaling 143,389 metres of drilling and 76,796 assays. Historic drilling (90% of the drillholes with only cyanide soluble assays) was converted from mine grid to UTM by surveying mine grid points in UTM and doing a grid conversion.

- Verification of the interpolation of the resource model included visual inspections of the block grades versus composite values and geologic model, block model swash plots for soluble silver, and a ‘one out’ cross-validation.

A Technical report in support of the MRE, dated effective April 30, 2025 titled “Technical Report on the Candelaria Property, Mineral and Esmeralda Counties, Nevada, USA” was prepared by James A. McCrea, P. Geo., in accordance with the requirements of NI 43-101, and will be filed on SEDAR+ within 45 days of this press release.

Candelaria Project Background

Candelaria was historically the highest-grade silver producer in the state of Nevada, averaging over 1,200 g/T AgEq (40 oz/t AgEq) from high-grade vein mining between the mid-1800s and the mid-1900s. Open pit mining operations mined silver and base metals from stockwork and manto-style mineralized bodies with accessory gold values hosted in rocks of the Candelaria and Pickhandle Gulch formations. The majority of the mineralization is associated with the Lower Candelaria shear and Pickhandle thrusts. Open-pit mining was undertaken in the 1970s through 1998 by several companies, including Nerco, Inc. and Kinross. Kinross closed the open pit and leach operation in 1998 due to low silver prices. Leaching of the historic pads was not completed leaving a substantial amount of silver unprocessed. It is estimated that the property has produced over 68 million ounces of silver. Historical information was obtained from “Geology of the Candelaria Mining District, Mineral County, Nevada, 1959, Nevada Bureau of Mines, Bulletin 56”, and the SSR Mining Inc. technical report titled “Candelaria Project Technical Report” dated May 24, 2001 (filed on SEDAR June 20, 2002), prepared by Pincock Allen & Holt.

Qualified Persons

The mineral resource estimate was prepared by James A. McCrea, P. Geo, an independent Qualified Person as defined by National Instrument 43-101 who has reviewed and approved the content of the news release relating to the mineral resource estimate.

The technical content of this news release, not related to the mineral resource estimate, has been reviewed and approved by Robert M. Cann, P. Geo, a Qualified Person as defined by National Instrument 43-101 and an independent consultant to the Company.

About Silver One

Silver One is focused on the exploration and development of quality silver projects. The Company holds 100% interest in its flagship project, the past-producing Candelaria Mine located in Nevada. Potential reprocessing of silver from the historic leach pads at Candelaria provides an opportunity for possible near-term production. Additional opportunities lie in previously identified high-grade silver intercepts down-dip and potentially increasing the substantive silver mineralization along-strike from the two past-producing open pits.

The Company owns 636 lode claims and five patented claims on its Cherokee project located in Lincoln County, Nevada, host to multiple silver-copper-gold vein systems, traced to date for over 11 km along-strike.

Silver One also owns a 100% interest in the Silver Phoenix Project. The Silver Phoenix Project is a very high-grade native silver prospect that lies within the “Arizona Silver Belt,” immediately adjacent to the prolific copper producing area of Globe, Arizona.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE