Signature Resources Announces Closing of Upsized Non-Brokered Private Placement

Signature Resources Ltd. (TSX-V: SGU) (OTCQB: SGGTF) (FSE: 3S30) is pleased to announce that it has closed its non-brokered private placement offering and is issuing 23,000,000 charity flow-through units, 10,458,401 flow-through units and 18,533,298 non-flow-through units for gross proceeds of to C$3,417,835 These totals exclude the issuance of NFT Units for the share-for-debt transaction that closed as an initial tranche of the Offering announced on October 22, 2025.

Each Charity FT Unit has been issued at $0.077 per unit, each FT Unit at $0.060 per unit, and each NFT Unit at $0.055 per unit. Each unit consists of one common share of the Company and one-half of one common-share purchase warrant. Each whole Warrant will entitle the holder to acquire one additional Common Share at a price of $0.10 per Warrant Share for a period of 12 months from the date of issuance.

The Common Shares and Warrants comprising the Charity FT Units and FT Units will qualify as “flow-through shares” within the meaning of subsection 66(15) of the Income Tax Act (Canada). The Warrant Shares will not qualify as flow-through shares. All securities issued pursuant to the Offering will be subject to a four-month hold period in accordance with applicable securities laws and TSX Venture Exchange (“TSXV”) policies.

On September 25, 2025, the Company announced a non-brokered private placement for gross proceeds of C$3,000,000 of FT Units and NFT Units. On October 22, 2025, the Company announced that it has amended the Offering to include Charity FT Units, in addition to the FT Units and NFT Units originally disclosed. In response to strong investor demand, the Company has also increased the targeted Offering size to C$3,700,000 inclusive of the share-for-debt transaction. The Company also announced the closing of the first tranche of the Offering with the issuance of 6,363,636 NFT Units for the settlement of $350,000 of outstanding indebtedness.

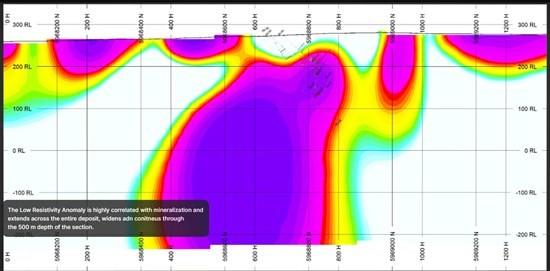

“We are very pleased to announce the closing of this financing as it allows us to commence our 2025 diamond drilling program of approximately 3,000 metres. The drill program will be targeting a large 3D IP/Mag anomaly that is down plunge from higher grade structures drilled to date (see Figure 1 below). We believe will demonstrate the ability to greatly expand the Lingman Lake deposit at depth and laterally to the West. We believe our drill targeting for these expansion opportunities have been enhanced by improved modeling from our initial resource and the incorporation of our geophysics. We are very excited to see the results of this next drilling campaign that will be exploring entirely new areas within the Lingman Lake project.”

– J. Dan Denbow, CFA – President, CEO and Director

Figure 1: Section 507780E Large Low Resistivity Anomaly Down Plunge from Existing Resource

As part of the entire Offering (including the shares for debt transaction) insiders of the Company purchased or acquired direction and control over 37% of the Offering by acquiring 6,250,067 FT Units and 15,200,000 NFT Units, constituting a “related party transaction” within the meaning of TSX Venture Exchange Policy 5.9 and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). With the entirety of the Offering closing, the company is issuing 58,358,095 Common Shares and 29,179,047 Warrants.

The Offering is subject to the acceptance of the TSX Venture Exchange. All securities issued pursuant to the Offering will be subject to a statutory hold period of four months and one day from the date of issuance, in accordance with applicable securities laws. Finders fees totalling $3,000 in cash and 50,000 broker warrants with an exercise price of $0.06 per share for a period of 24 months from the closing of the Offering will be paid as part of the transaction.

The net proceeds from the Offering will be used for exploration activities on the Company’s Lingman Lake Gold Project and for general working capital purposes. It is anticipated that approximately one-third of the net proceeds will be used for general working capital purposes and the remainder on exploration activities including the 2025 drill campaign, evaluation of the drill core and additional geologic studies including a metallurgical program. None of the proceeds will be used for investor relations service providers.

Qualified Person

The scientific and technical content of this press release have been reviewed and approved by Mr. Walter Hanych, P. Geo, consultant and Head Geologist, is a Qualified Persons under NI 43-101 regulations.

About Signature Resources Ltd.

The Company is a Canadian based advanced stage exploration company focused on expanding the 100% Lingman Lake gold deposit, located within the prolific Red Lake district in Northwestern Ontario, Canada. The Lingman Lake gold property (the “Property”) consists of 1,274 single-cell and 13 multi-cell staked claims, four freehold fully patented claims and 14 mineral rights patented claims totaling approximately 24,821 hectares. The Property includes what has historically been referred to as the Lingman Lake Gold Mine, an underground substructure consisting of a 126.5-metre shaft, and 3-levels at depths of 46-metres, 84-metres and 122-metres. There has been over 43,222 metres of drilling done on the Property and four 500-pound bulk samples that averaged 19 grams per tonne of gold. The Company’s initial mineral resource estimate contain an indicated 95,200 ounces with an average grade of 1.38 g/t Au and inferred 674,320 ounces at an average grade of 1.14 g/t Au at a cutoff grade of 0.30 g/t. The company is focused on rapidly expanding the known mineralized envelop with its 100% owned diamond drilling rigs. In November 2023, Wataynikaneyap Power energized a new 115kV high tension transmission line within 40 km of the historic Lingman Lake Mine (https://www.wataypower.ca/).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE