SENDERO RESOURCES INTERSECTS 256M OF 0.53 G/T GOLD EQUIVALENT IN MAIDEN DRILL PROGRAM AT THE PEÑAS NEGRAS PROJECT IN THE VICUÑA DISTRICT

Sendero Resources Corp (TSX: SEND) is pleased to announce results of the first three diamond drillholes from the ongoing maiden drilling program at its 100% owned Peñas Negras Project in the Vicuña District in La Rioja, Argentina.

Highlights

- PNDH003 (La Ollita) intersected 256m of 0.53 g/t Gold Equivalent “AuEq” from 84m.

- including 70m of 0.66 g/t AuEq from 84m

- including 20m of 0.76 g/t AuEq from 92m

- including 94m of 0.58 ag/t AuEq from 246m

- including 8m of 1.09 g/t AuEq from 254m

- including 70m of 0.66 g/t AuEq from 84m

Ongoing drilling at La Ollita (holes PNDH004-PNDH006) is confirming the presence of a large mineralized advanced argillic epithermal lithocap telescoped on a porphyry gold – copper system.

Sendero Executive Chairman, Michael Wood, commented:

“We are delighted with the initial results from La Ollita in our maiden drilling program which confirms our thesis that La Ollita is a telescoped high-sulfidation epithermal/ porphyry system, like other major deposits in the Vicuña District, such as Filo del Sol, and with comparable grade to the resource grade at Josemaria. Such telescoped systems create large, diverse mineral systems and La Ollita will be the sole focus for the rest of the current drill program as we seek to gain a better understanding of the deposit geometry, grade distribution and mineralogy.”

Click HERE for a summary of today’s news from Michael Wood

Figure 1. Peñas Negras Project and Exploration Targets

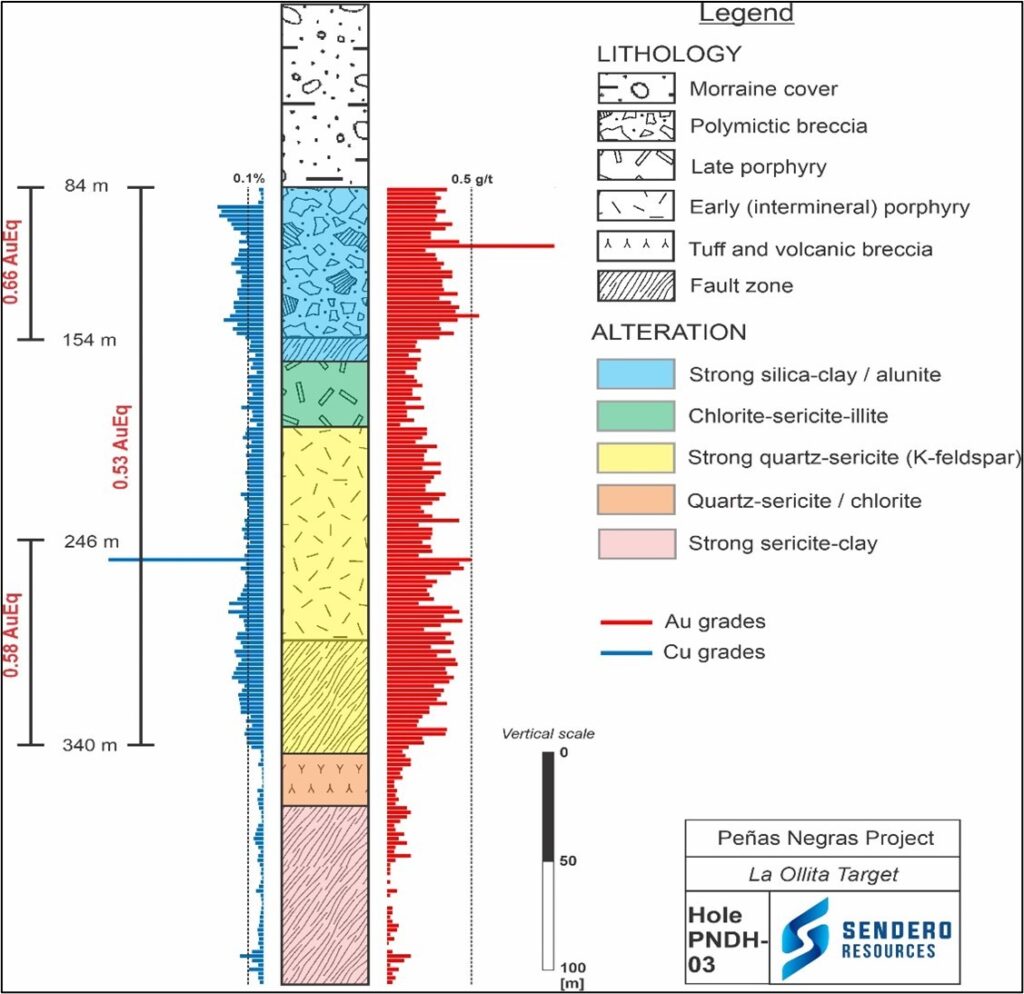

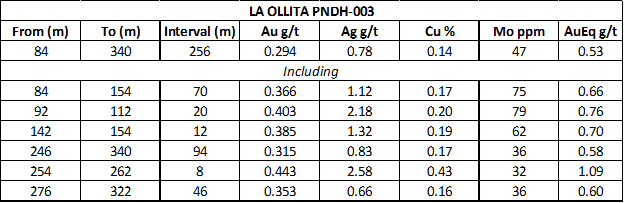

Discovery Hole PNDH003

After initial drilling at La Peña and Tamberías, attention was shifted to the La Ollita target where previous drilling in the 1990’s by Eldorado Gold had intersected gold (Au) – copper (Cu) mineralisation at relatively shallow depths (≤150m). PNDH003, a vertical hole drilled to 450m depth, intersected an advanced argillic lithocap below 84m of moraine cover to a depth of 159m. Below this depth the hole intersected several phases of dacite porphyry, an early mineralized phase, and a late-mineralized phase, before ending in a post-mineral fault zone (Figure 2).

The upper part of the hole intersected a phreatomagmatic breccia with intense pervasive residual vuggy silica and clays with alunite and returned 70m of 0.66 g/t AuEq from 84m (Table 1 and Figure 2). In this advanced argillic style alteration were pyrite-enargite-chalcocite and black sulfide veins with metal values up to Au (1.1g/t), Ag (7.3g/t), Mo (200ppm) and Cu (0.3%). In addition, late intermediate sulfidation epithermal style Zn-Pb-Ag-Cu veins overprint the porphyry Au-Cu mineralization.

Below 159m the hole intersected high sulfidation mineralization and advanced argillic alteration overprinting porphyry-style sericite and potassic (K-feldspar-biotite) alteration with A-type quartz veinlets. The early porphyry phase returned 94m of 0.58 g/t AuEq from 246m (Table 1 and Figure 2). Note that Au-Cu grades dropped off considerably when entering extensive post-mineral faults below 340m, with the reduction in grade due to displacements by the faults rather than a reduction in Au-Cu grades of the system itself. Despite extension drilling into this post-mineral fault zone, we were unable to pass and stopped the hole on advice of the drill contractor.

Figure 2: PND003 La Ollita – Grade Distribution, Lithology and Alteration

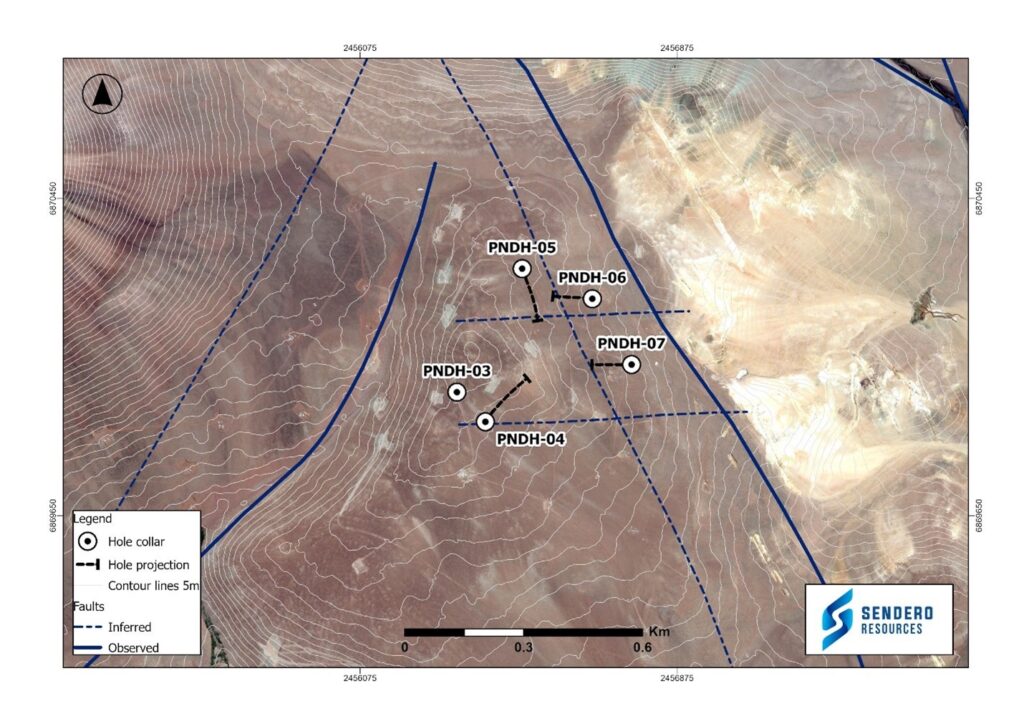

The Company’s initial exploration drilling at La Ollita is focused within a triangle-shaped structural zone formed by the intersection of NE-NW-EW faults (Figure 3), which coincides with magnetic and IP chargeability anomalies. The Company’s thesis is that this triangular zone represents a zone of weakness and provided a feeder for magmatic-hydrothermal fluids forming the advanced argillic lithocap measuring at least 600 x 600m. The Company believes the advanced argillic lithocap could be far more extensive than this and exploring extensions will be a focus for future drilling.

Figure 3: La Ollita Diamond Drill Hole Locations on Satellite Image

The results of PNDH003 and the ongoing drilling at La Ollita are demonstrating the existence of an extensive well preserved telescoped Au-Cu-Ag mineral system concealed beneath the moraine cover. This finding is comparable to other deposits in the Vicuña District like Filo del Sol which show alteration and mineralization telescoping on large systems of both high-sulfidation Cu-Au-Ag and porphyry Cu-Au.

The mineralization in PNDH003 is richer in gold than copper with average grades of 0.294 g/t Au to 0.142% Cu across the 256m interval, with the highest metal grades of 1.11 g/t Au (110-112m), 1.35% Cu (254-256m), 9.4 g/t Ag (254-256m) and 200pm of Mo (86-88m). Copper could become dominant in some zones of the system but for now the Company is reporting in gold equivalent (AuEq) as gold has been observed to be the dominant metal in the system to date. If PNDH003 was being reported in Copper Equivalent it would be comparable in grade to the resource grade at the nearby Josemaria deposit.

The remainder of the current drill program will be completed at La Ollita with holes PNDH004, PNDH005 and PNDH006 now completed and PNDH007 currently being drilled (Figure 3). Drilling will continue to mid to late April, with approximately 3,100m drilled so far.

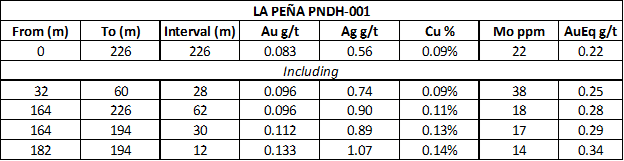

La Peña (PNDH001) and Tamberías (PNDH002)

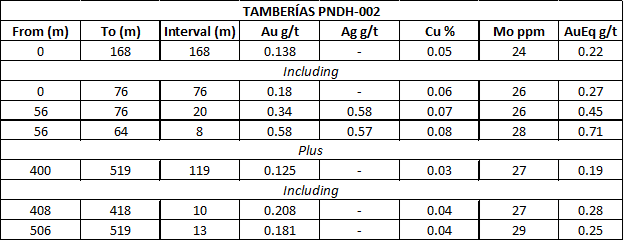

Drilling started at the two targets, La Peña (PNDH001) and Tamberías (PNDH002), with the most compelling exposed geology, surface soil and rock geochemistry, and magnetic and IP signatures (Figure 1, Tables 2 & 3). In both PNDH001 & PNDH002, Au-Cu and intermediate sulfidation epithermal style mineralization was encountered associated with quartz-diorite porphyry cut by various breccia facies including both magmatic-hydrothermal and late phreatomagmatic breccias. The early magmatic-hydrothermal breccia is mainly polymictic containing clasts of country rock, including porphyritic and fragmental rhyolite, granite, microdiorite, andesite, and volcaniclastic rocks, as well as porphyry Cu clasts with A-style veins.

Assay results confirm low tenor but consistent Au-Cu-Mo grades & Ag at La Peña (see Tables 2 & 3). This is reminiscent of the periphery of Maricunga style gold-rich porphyry systems, and the Company is evaluating future drill hole locations to test different parts of these systems.

Additional Lithocap Targets – Ritzuko, Punta Negra and Vicuñita

Following the positive findings at La Ollita, the Company has been conducting initial field investigations on other lithocap targets on the property known to host gold mineralization from historic geochemistry: two at Ritzuko and two on the new joint venture ground at Punta Negra and Vicuñita (Figure 1). In all four locations there is a similar structural setting to La Ollita with the intersection of NE-NW faults and all four targets show visible advanced argillic alternation (alunite-pyrophyllite-dickite-kaolinite) on ASTER images.

Table 1: PNDH003 La Ollita Drill Highlights

Table 2: PNDH001 La Peña Drill Results

Table 3: PNDH002 Tamberias Drill Results

Note: Gold Equivalent Values are based on metals prices of $2000/oz Au $4/lb Cu, $25/oz Ag, $20/lb Mo and recovery is assumed to be 100% as no metallurgical data is available.

About Sendero Resources Corp.

The Company is focused on copper-gold exploration at its 100% owned Peñas Negras Project in the Vicuña Belt in Argentina. The Peñas Negras Project has similar geological characteristics to other deposits in the Vicuña Belt and a cluster of porphyry and epithermal targets have been identified on the project. The Company, through its wholly owned subsidiary, Barton SAS, is the holder of ten granted mining concessions covering 120 km2 in the province of La Rioja, Argentina. The company also has an option agreement to earn 80% interest on eight granted mining concessions covering 91.7 km2 adjacent to the East of the Peñas Negras Project. The Company has an experienced management and exploration team who will use their expertise and operational knowledge to advance the multiple targets across the project.

MORE or "UNCATEGORIZED"

Antimony Resources Corp. (ATMY) (K8J0) Reports Massive Antimony Bearing Stibnite - Drills 4.17% Sb over 7.40 meters Including Three Zones of Massive Antimony Bearing Stibnite which returned 28.8% Sb, 21.9% Sb, and 17.9% Sb Respectively

Highlights Assays received High-grade assays returned for Drill H... READ MORE

Kenorland Minerals and Auranova Resources Report Drill Results at the South Uchi Project, Ontario; Auranova Completes Initial Earn-in

Kenorland Minerals Ltd. (TSX-V: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) a... READ MORE

Wallbridge Exploration Drilling Continues to Intercept High-Grade Gold Mineralization at Martiniere

Wallbridge Mining Company Limited (TSX: WM) (OTCQB:WLBMF) announc... READ MORE

ValOre Reports Results from Successful 87 Hole Trado® Auger Drilling Campaign at Pedra Branca, Including 10.0 m at 12.95 g/t 2PGE+Au from Surface

Provides Update on Pedra Branca PGE Project and Strategic Growth ... READ MORE

Pasinex Announces 2024 Annual and 2025, Q1 Financial Results

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) announced financi... READ MORE