Scorpio Gold Drills 25.02 Metres Grading 0.76 G/T Gold, From 138.35 Metres Along The Reliance Trend At The Manhattan District, Nevada

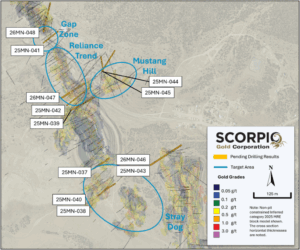

Scorpio Gold Corp. (TSX-V: SGN) (OTCQB: SRCRF) (FSE: RY9) is pleased to announce results from three holes from its 2025 drilling program at the Manhattan District Project, Nevada, USA: from the Phase Two program (25MN-034 through 25MN-036). The results are tabulated in Table 1 and discussed below. Scorpio Gold has drilled 38 drill holes to date from its Phase Two diamond drilling program, 25MN-011 through 25MN-045 and 26MN-046 through 26MN-048, for a grand total of 11,906 m. With the results herein, Scorpio Gold has reported assays on 26 of these (25MN-011 through 25MN-036), totalling 8,584 m, and assays are pending from 12 holes (25MN-037 through 25MN-045 and 26MN-046 through 26MN-048), totalling 3,322 m. The pending results will be reported as they come available and the holes are discussed briefly below.

“We have started the year with strong operational momentum, with drilling progressing steadily across the Manhattan District and twelve completed holes currently in the lab awaiting results. Our focus in 2026 is on delivering results to the market in a consistent and disciplined manner while working towards adding inventory to our resource and continuing to advance our geological understanding of the district. In parallel with drilling within the current resource area, we are positioning one of our three active rigs to test targets outside the core resource footprint, beginning with a two-hole program at Black Mammoth commencing the last week of January. This work is designed to evaluate the broader district-scale potential of Manhattan and to identify new zones of mineralization that could support future resource growth,” commented Zayn Kalyan, CEO and Director of Scorpio Gold.

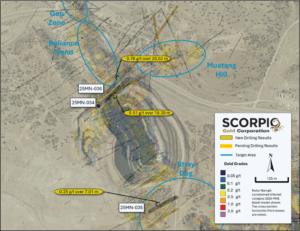

Two holes were drilled along the Reliance Trend (25MN-034 and 25MN-036), one hole was drilled at the southern end of the West Pit (25MN-035), see Figure 1. These holes tested laterally and below the Inferred Resource Constraining Pit, modelled at a gold price of US$2,500 with a 0.3 g/t gold only cutoff grade, along with other inputs including: mill recovery of 90%, 50 degree pit slope angle for in-situ rock, mining costs of $3.00 per tonne for both ore and waste, milling costs of $15.00 per tonne processed, general administration cost of $3.50 per tonne processed and 2% royalty costs, and ore loss and dilution not applied. For further details see “Mineral Resource Estimate and NI 43-101 Technical Report, Manhattan Property, Nye County, Nevada” with an effective date of June 4, 2025 on Scorpio Gold’s website, here.

The mineralization noted in previous and current reported drill holes is consistent with the Company’s existing geological model. The mineralization controls and geometries are closely related to district scale structural features and preferred host lithologies. The Company started collecting oriented core since mid-2025, and continues to do so on all drilling, which has increased confidence in structural features. Dilatational structures and structural intersections continue to be the primary focus of the mineralizing fluids, with many of the recognized structures hosting low sulphidation epithermal gold vein assemblages in their hanging walls.

Figure 1. Surface Plan Map of Drill results over 2025 MRE Block Model.

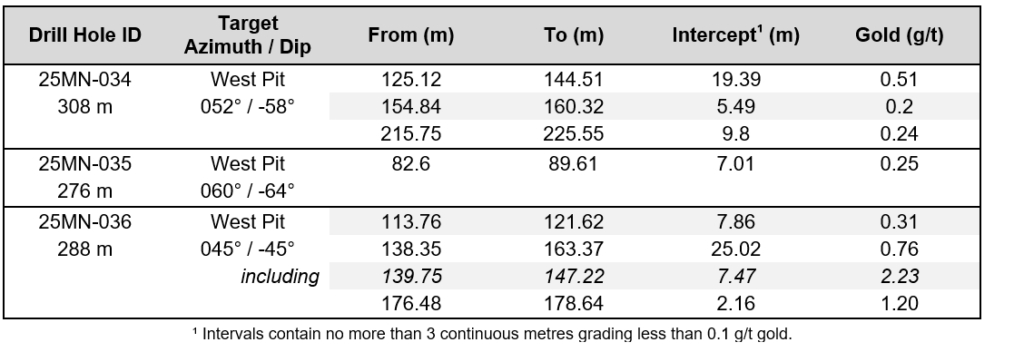

Table 1. Results from the latest batch of drill holes. Note: There is insufficient geological information to estimate a true width for the drill intercepts reported.

Completed hole summaries, reported results, see Figure 1:

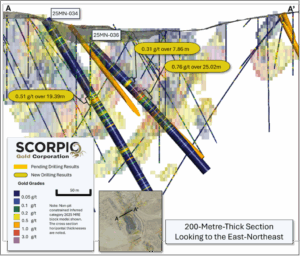

Hole 25MN-034, contained three intervals, all hosted in fine grained clastic units, of 19.39 m, 5.49 m and 9.8 m grading 0.51 g/t gold, 0.20 g/t gold and 0.24 g/t gold respectively. The first two intervals fall within the IRCP and the last intercept is located approximately 47 m below the IRCP. See Figure 2, section A to A’.

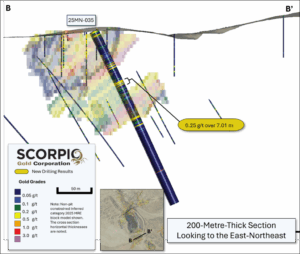

Hole 25MN-035, contained one significant interval, hosted in fine grained clastic units, of 7.01 m grading 0.25 g/t gold, within the IRCP. See Figure 3, section B to B’.

Hole 25MN-036, contains three intervals, all hosted in fine grained clastic units, of 7.86 m, 25.02 m and 2.16 m grading 0.31 g/t gold, 0.76 g/t gold and 1.20 g/t gold respectively. All these intervals fall within the IRCP. See Figure 2, section A to A’.

Figure 2. Section A-A, along trace of holes 25MN-034 and 25MN-036, showing gold grades with reported intervals highlighted.

Figure 3. Section B-B’, along trace of holes 25MN-035, showing gold grades with reported intervals highlighted.

Completed hole summaries, assays pending, see Figure 4:

25MN-037: drilled at the southern end of the historic West Pit, 100 m to the north of 25MN-035.

25MN-038: drilled at the southern end of the historic West Pit, within a structurally complex zone.

25MN-039: drilled as a 50 m step out to drill hole 25MN-036, to the north-northwest, on the Reliance Trend.

25MN-040: drilled as a 50 m step out on hole 25MN-038, to the east-northeast, in a structurally complex area to the south of the historic West Pit.

25MN-041: drilled within the Gap Zone to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

25MN-042: drilled as a 50 m step out on drill hole 25MN-039 to the north northwest, on the Reliance Trend.

25MN-043: drilled directly north of the historic East pit, to test for a northerly extension of a westerly mineralised fault splay.

25MN-044: drilled near Mustang Hill, to the north, to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

25MN-045: drilled near Mustang Hill, to the north-northeast to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

26MN-046: drilled directly north of the historic East pit, to test for a northerly extension of a westerly mineralised fault splay. A 50 m step-out from drill hole 25MN-043.

26MN-047: drilled as a 50 m step out on drill hole 25MN-042 to the north northwest, on the Reliance Trend.

26MN-048: drilled at Goldwedge to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

About the Manhattan District

Manhattan, located in the Walker Lane Trend of Nevada, USA, is road accessible and lies approximately 20 kilometers south of the operating Round Mountain Gold Mine, which has produced more than 15 million ounces of gold. For the first time, the Company has consolidated Manhattan’s past-producing mines under a single entity that holds valuable permitting and water rights. Historically, Manhattan has produced approximately 700,000 ounces of gold from high-grade placer and lode operations dating from the late 1890s through to the mid-2000s.¹ The maiden mineral resource estimate covering the Goldwedge and Manhattan Pit areas of Manhattan is comprised of 18,343,000 tonnes grading 1.26 g/t gold for a total of 740,000 oz contained gold in the inferred category.²

A historical mineral resource estimate covers the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas of Manhattan and comprises 1,652,325 tonnes grading 5.89 g/t gold for a total of 303,949 oz contained gold.³ The deposit is interpreted as a low-sulfidation, epithermal, gold-rich system situated adjacent to the Tertiary-aged Manhattan caldera in the Southern Toquima Range of Nevada. A “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

Notes

- Adjacent Properties: The Company has no interest in, or rights to, any of the adjacent properties mentioned, including the Round Mountain Gold Mine, and exploration results on adjacent properties are not necessarily indicative of mineralization on the Company’s properties. Any references to exploration results on adjacent properties are provided for information only and do not imply any certainty of achieving similar results on the Company’s properties.

- Historical Data: This news release includes historical information that has been reviewed by the Company’s qualified person. The Company’s review of the historical records and information reasonably substantiate the validity of the information presented in this presentation. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Third-Party Mineral Projects: These deposits are cited solely for geological context. The Company cautions that these properties are not necessarily adjacent to, nor does the Company or have any interest in or control over them. Although certain geological features may be similar, there is no assurance that mineralization comparable to these deposits will be discovered on any of the Company’s properties. Information regarding the aforementioned deposits is taken from publicly available sources and technical reports believed to be reliable, but has not been independently verified by the Company. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Mineral Resource Estimate:All scientific and technical information relating to Manhattan pertaining to Maiden MRE contained in this news release is derived from the Technical Report dated October 23, 2025 (with an effective date of June 4, 2025) titled “Mineral Resource Estimate and NI 43-101 Technical Report” prepared by Matthew R. Dumala, P.Eng (BC) of Archer Cathro Geological (US) Ltd., Patrick Loury, M.Sc., CPG (AIPG) of Daniel Kunz & Associates, Annaliese Miller, LG (WA) of Geosyntec Consultants, Inc. and Art Ibrado, PhD, PE (AZ) of Fort Lowell Consulting PPLC. The information contained herein in respect of the Maiden MRE is subject to all of the assumptions, qualifications and procedures set out in the Technical Report and reference should be made to the full text of the Technical Report, a copy of which has been filed with the applicable securities regulators and is available under the Company’s profile on www.sedarplus.ca.

- Historical MRE: A Qualified Person has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

The Company considers the Historical MRE relevant as it demonstrates the presence of significant gold mineralization across multiple zones within Manhattan; however, its reliability is uncertain because it was prepared prior to the adoption of the current CIM Definition Standards and current QA/QC practices. The Historical MRE provides limited disclosure of assumptions, parameters, estimation methods, cutoff grades, and QA/QC protocols, and therefore these cannot be fully verified by the Company. The categories used in the historical estimate predate, and are not directly comparable to, current CIM Definition Standards, and the Company is not treating the Historical MRE as a current Mineral Resource Estimate. To upgrade and verify the Historical MRE in order to make it a current Mineral Resource Estimate, the Company would be required to undertake confirmatory drilling, modern QA/QC sampling, validation and digitization of historical datasets and updated geological modeling followed by the preparation of a new Mineral Resource Estimate in accordance with CIM Definition Standards and NI 43-101. The Company encourages readers to exercise appropriate caution when evaluating the Historical MRE.

All scientific and technical information relating to Manhattan pertaining to the Historical MRE contained in this news release is derived from the Technical Report dated May 1997 titled “Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County” prepared by New Concept Mining, Inc.. The information contained herein in respect of the Historical MRE is subject to all of the assumptions, qualifications and procedures set out in the Historical Technical Report and reference should be made to the full text of the Historical Technical Report.

- References: (1) Strachan, D. G., and Master, T. D., 2005: Update and Revision of the Gold Wedge Project Development, Nye County. Report prepared for Nevada; Royal Standard Minerals, Inc. and dated March 31, 2005; (2) Dumlala, M. R., and Lowry, P., 2025:Mineral Resource Estimate and NI 43-101 Technical Report, Manhattan Property, Nye County, Nevada. Report prepared for Scorpio Gold Corporation and dated October 23, 2025 (with an effective date of June 4, 2025); and (3) Berry, A., and Willard, P., 1997: “Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County”. Report prepared for New Concept Mining, Inc. and dated May 1997.

About Scorpio Gold Corp.

Scorpio Gold holds a 100% interest in the Manhattan District located in the Walker Lane Trend of Nevada, USA. Scorpio Gold’s Manhattan District is ~4,780-hectares and comprises the advanced exploration-stage Goldwedge Mine, with a 400 ton per day maximum capacity gravity mill, and four past-producing pits that were acquired from Kinross in 2021 (see news release dated March 25, 2021). The consolidated Manhattan District presents an exciting late-stage exploration opportunity, with over 140,000 metres of historical drilling, significant resource potential, and valuable permitting and water rights.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

ON BEHALF OF THE BOARD OF SCORPIO GOLD CORPORATION

Zayn Kalyan, Chief Executive Officer and Director

Tel: (604)-252-2672

Email: zayn@scorpiogold.com

Investor Relations Contact:

Kin Communications Inc.

Tel: (604) 684-6730

Email: SGN@kincommunications.com

Connect with Scorpio Gold:

Email | Website | Facebook | LinkedIn | X | YouTube

To register for investor updates please visit: scorpiogold.com

TSXV: SGN | OTC: SRCRF | FSE: RY9

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE