Scorpio Gold Drills 24.67 Metres Grading 1.85 g/t Gold, from 98.76 Metres, in New Zone of Mineralization at the Manhattan District, Nevada

Highlights

- Hole 26MN-026 returned 1.85 g/t gold over 24.67 metres from 98.76 m

- Hole 25MN-021 returned 1.52 g/t gold over 18.14 metres from 176.78 m

- Hole 25MN-020 returned 0.94 g/t gold over 36.97 metres from 162.95 m

- Hole 25MN-022 returned 21.82 g/t gold over 3.23 metres from 168.86 m incl. 0.43 m grading 159.94 g/t gold reduced to 9.95 g/t gold applying a 70 g/t gold top cut

Scorpio Gold Corporation (TSX-V: SGN) (OTCQB: SRCRF) (FSE: RY9) is pleased to announce results from seven holes from its 2025 drilling program at the Manhattan District Project located in Nevada, USA, namely,: (i) the final three holes from the Phase One program (25MN-020, 25MN-021 and 25MN-022) and (ii) the initial four holes from the Phase Two program (25MN-023, 25MN-024, 25MN-025 and 25MN-026). The results from holes 25MN-020 through 25MN-026 are tabulated in Table 1 and discussed below. Scorpio Gold has reported assays on 16 drillholes totalling 5,341 m in 2025.

“The results from this latest set of drill holes continue to reinforce what our team has believed from the outset: Manhattan is a district-scale opportunity with multi-million ounce potential, that already stands apart from its peers based on grade-something the market has yet to fully appreciate. Encountering new zones of mineralization both near surface and at depth speaks to the true scale of the system, as well as the continuity we are rapidly defining across multiple target areas.

“Several of these holes step out meaningfully from the existing resource model, and with multiple intercepts ending in mineralization, our confidence in a significantly expanded resource envelope continues to grow. Intervals such as 18.14 metres grading 1.52 g/t gold in hole 25MN-021, and 3.23 metres grading 9.95 g/t gold in hole 25MN-022, represent a previously unrecognized splay off the main Reliance Trend-one that may ‘blow out’ into thicker zones where it intersects favourable host horizons like the limestones and sandstones that dominate the caldera margin. This is a strong demonstration of near-resource prospectivity and the potential to materially expand the mineralized footprint at Mustang Hill and beyond.

“With our 50,000-metre program now well underway, this batch of results is just the beginning of what we expect to be a steady cadence of updates that highlight the growing value of Manhattan, our high-grade, low-risk Nevada gold asset,” commented Zayn Kalyan, CEO and Director of Scorpio Gold.

Results from holes MN25-021 and MN25-022 at Mustang Hill indicate the presence of a previously unidentified structural trend that hosts gold mineralization at grades similar to the existing Mineral Resource along the margin of the Manhattan Caldera. These results present the opportunity to add a new, near-surface target zone to Manhattan that is proximal to the existing Mineral Resource. Future work will include reviewing historic drillholes and underground workings in the area to define the size and shape of this new target area to prepare for testing with diamond drilling.

Implications for Resource Growth

Collectively, the results from Mustang Hill, the Gap Zone, and the Reliance Trend support Scorpio Gold’s exploration model of significant near-resource expansion. Multiple high-grade intercepts, thick mineralized intervals, and step-outs of 25-100 metres are consistent with the Company’s objective to materially grow the resource base in upcoming updates.

| Hole | Area | Highlight Result | Geological Significance |

| 25MN-021 | Mustang Hill | 39.01 m @ 1.03 g/t | New structural splay; 100 m from resource |

| 25MN-022 | Mustang Hill | 3.23 m @ 21.82 g/t | High-grade feeder zone |

| 25MN-020 | Gap Zone | 36.97 m @ 0.94 g/t | Resource continuity |

| 25MN-026 | Reliance Trend | 24.67 m @ 1.85 g/t | Step-out expansion |

| 25MN-025 | Reliance Trend | 3.47 m @ 6.69 g/t | Complex boundary modeling |

| 25MN-024 | Reliance Trend | 8.99 m @ 1.93 g/t | 25 m step-out |

| 25MN-023 | Stray Dog | 4.88 m @ 2.59 g/t | 100 m step-out; limits extent |

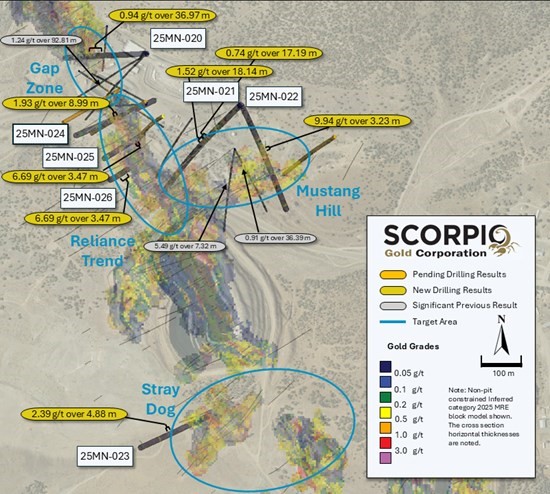

Figure 1. Plan map showing surface background with Inferred Mineral Resource block model and highlighting intercepts in reported batch of drill hole results.

| Drill Hole ID |

Target Azimuth / Dip |

From (m) |

To (m) |

Intercept¹ (m) |

Gold (g/t) |

| 25MN-020 | Reliance Trend | 162.95 | 199.92 | 36.97 | 0.94 |

| 25MN-021 | Mustang Hill | 76.69 | 93.57 | 16.89 | 0.48 |

| 225° / -45° | 103.17 | 125.67 | 22.49 | 0.26 | |

| 155.63 | 172.82 | 17.19 | 0.74 | ||

| 176.78 | 194.92 | 18.14 | 1.52 | ||

| including | 181.48 | 190.21 | 8.73 | 2.90 | |

| 25MN-022 | Mustang Hill | 119.66 | 135.38 | 15.71 | 0.46 |

| 155° / -45° | 168.86 | 172.09 | 3.23 | 9.94 | |

| including | 168.86 | 169.29 | 0.43 | 159.94 | |

| 177.39 | 180.11 | 2.71 | 10.18 | ||

| including | 177.39 | 178.26 | 0.87 | 11.77 | |

| including | 178.26 | 178.69 | 0.43 | 39.80 | |

| 183.64 | 187.73 | 4.08 | 1.12 | ||

| 25MN-023 | Stray Dog | 121.92 | 126.8 | 4.88 | 2.39 |

| 070° / -45° | |||||

| 25MN-024 | Reliance Trend | 177.39 | 186.39 | 8.99 | 1.93 |

| 070° / -55° | |||||

| 25MN-025 | Reliance Trend | 71.35 | 74.28 | 2.93 | 0.92 |

| 60° / -60° | 87.78 | 104.55 | 16.76 | 0.26 | |

| 150.82 | 164.74 | 13.93 | 0.88 | ||

| 170.54 | 173.98 | 3.44 | 0.29 | ||

| 182.54 | 186.02 | 3.47 | 6.69 | ||

| including | 184.89 | 186.02 | 1.13 | 17.72 | |

| 196.78 | 201.32 | 4.54 | 0.34 | ||

| 25MN-026 | Reliance Trend | 98.76 | 123.43 | 24.67 | 1.85 |

| including | 65° / -80° | 98.76 | 101.35 | 2.59 | 4.58 |

| including | 113.75 | 115.23 | 1.48 | 12.52 | |

| including | 113.75 | 122.22 | 8.47 | 3.56 | |

| 132.28 | 145.39 | 13.11 | 0.21 | ||

| 156.36 | 159.14 | 2.77 | 3.11 | ||

| 166.73 | 169.77 | 3.05 | 1.11 | ||

| 180.81 | 189.52 | 8.72 | 2.07 | ||

| 249.02 | 250.12 | 1.1 | 10.49 | ||

| ¹ Intervals contain no more than 3 continuous metres grading less than 0.1 g/t gold. | |||||

Table 1. Drill intervals from reported batch of drill hole results. There is insufficient geological information to estimate a true width for the drill intercepts reported.

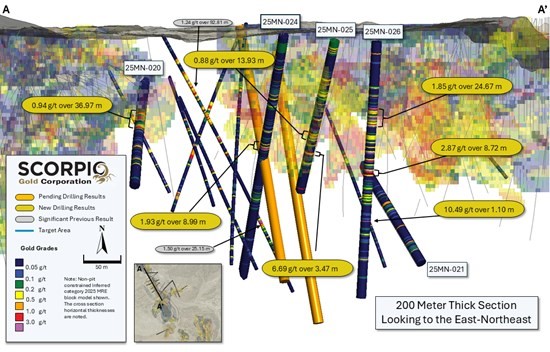

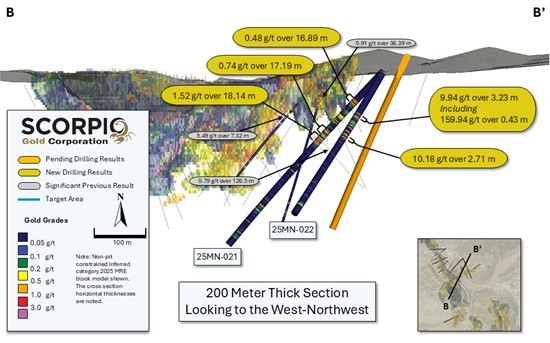

- Mustang Hill – New Structural Splay Confirmed

Hole 25MN-021, drilled at Mustang Hill, intersected 18.14 m grading 1.52 g/t gold from 176.78 m and this was separated by 3.96m from an overlying interval of 17.19 m grading 0.74 g/t gold from 155.63 m. Combining these two intervals results in an intersection of 39.01 m grading 1.03 g/t gold from 155.63 m. This intersect represents a new zone of mineralization, located approximately 100 m from the nearest Inferred resource blocks, located laterally to the southwest. The hole also intersected 16.89 m grading 0.48 g/t gold from 76.69 m that represents a new zone of near surface mineralization.

Hole 25MN-022, drilled at Mustang Hill, intersected 3.23 m grading 21.82 g/t gold from 168.86 m that included a single 1.40 m sample grading 159.94 g/t gold. When a 70 g/t gold top cut is applied, this interval is reported as 3.23 m grading 9.95 g/t gold. Below this, intervals of 2.71 m grading 10.18 g/t gold from 177.39 m and 4.88 m grading 1.12 g/t gold were intersected. These three intervals are all situated approximately 50 m from the nearest Inferred resource blocks and may represent a newly recognised splay of the main Reliance Fault.

Figure 2. Section A-A’ with background with Inferred Mineral Resource block model and highlighting intercepts in reported batch of drill hole results.

- Gap Zone – Continuity Confirmed

Hole 25MN-20, drilled in the Gap Zone, intersected 36.97 m, grading 0.94 g/t gold from 162.95 m and confirmed the continuity of mineralization and this confidence is expected to add tonnes to the existing Inferred resource in this area, located between the West Pit and the Goldwedge underground mine.

Figure 3. Section B-B’ with background with Inferred Mineral Resource block model and highlighting intercepts in drill holes 25MN-021 and 25MN-022.

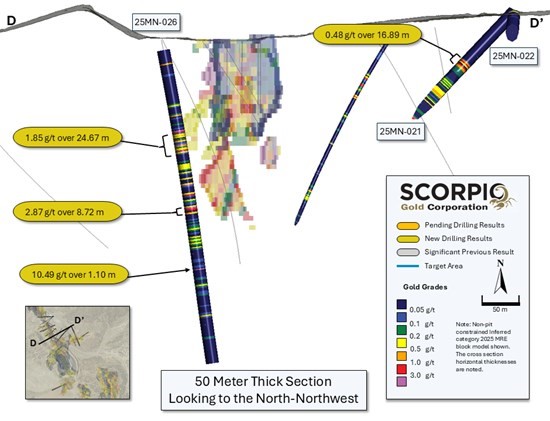

- Reliance Trend – Step-outs Demonstrate Scale

Hole 25MN-25, drilled to the northwest, intersected four intercepts: 9.88 m grading 0.35 g/t gold from 82.78 m, 13.93 m grading 0.88 g/t gold from 150.82 m, 3.47 m grading 6.69 g/t gold and 4.54 m grading 0.34 g/t gold from 196.78 m. The boundary of the Inferred resource is complex in this area, but these holes are expected to convert additional tonnes into a more coherent volume.

Hole 25MN-26, drilled to the northwest, intersected five intercepts that step out on the Inferred resource: 7.28m grading 0.29 g/t gold from 138.10 m, 2.77m grading 3.11 g/t gold from 156.36 m, 3.05 m grading 1.11 g/t gold from 166.73 m, 8.72 m grading 2.07 g/t gold from 180.81 m and 1.10 m grading 10.49 g/t gold from 249.02 m. The approximate distance from the nearest resource block for each interval is, respectively, 35 m, 20 m, 20 m, 25 m and 60 m.

Figure 4. Section C-C’ with background with Inferred Mineral Resource block model and highlighting intercepts in drill holes 25MN-026 and 25MN-022.

Hole 25MN-24, drilled to the northwest, intersected 9.00 m grading 1.93 g/t gold from 177.39 m, and was a 25m step-out hole on the existing Inferred resource along the trace of the Reliance fault zone.

Hole 25MN-23, drilled to the northwest, intersected 4.88 m grading 2.59 g/t gold from 121.92 m, and was a 100m step-out hole on the existing Inferred resource, indicating it pinching out in this direction.

Quality Assurance/Quality Control and Sampling Procedures

HQ sized diamond drill core samples were cut in halves, then bagged and secured with security tags to ensure integrity during transportation to the Reno, NV, Paragon Geochemical facility for preparation. For quality assurance, unmarked coarse blanks, unmarked certified reference materials, and requested laboratory duplicates were inserted into the sampling sequence. QA samples were systematically inserted into each batch of samples, amounting to approximately 8% of the run of samples. Samples were analyzed for gold using method PA-AU02 (~500 g), a two-cycle PhotonAssayTM analysis of crushed material (70% passing 2 mm). All Paragon Geochemical facilities comply with ISO 17025:2017.

About the Manhattan District

Manhattan, located in the Walker Lane Trend of Nevada, USA, is road accessible and lies approximately 20 kilometers south of the operating Round Mountain Gold Mine, which has produced more than 15 million ounces of gold. For the first time, the Company has consolidated Manhattan’s past-producing mines under a single entity that holds valuable permitting and water rights. Historically, Manhattan has produced approximately 700,000 ounces of gold from high-grade placer and lode operations dating from the late 1890s through to the mid-2000s.¹ The maiden mineral resource estimate (the “Maiden MRE“) covering the Goldwedge and Manhattan Pit areas of Manhattan is comprised of 18,343,000 tonnes grading 1.26 g/t gold for a total of 740,000 oz contained gold in the inferred category.²

A historical mineral resource estimate covers the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas of Manhattan and comprises 1,652,325 tonnes grading 5.89 g/t gold for a total of 303,949 oz contained gold.³ The deposit is interpreted as a low-sulfidation, epithermal, gold-rich system situated adjacent to the Tertiary-aged Manhattan caldera in the Southern Toquima Range of Nevada. A “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101“) has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

Notes

- Adjacent Properties: The Company has no interest in, or rights to, any of the adjacent properties mentioned, including the Round Mountain Gold Mine, and exploration results on adjacent properties are not necessarily indicative of mineralization on the Company’s properties. Any references to exploration results on adjacent properties are provided for information only and do not imply any certainty of achieving similar results on the Company’s properties.

- Historical Data: This news release includes historical information that has been reviewed by the Company’s qualified person. The Company’s review of the historical records and information reasonably substantiate the validity of the information presented in this presentation. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Third-Party Mineral Projects: These deposits are cited solely for geological context. The Company cautions that these properties are not necessarily adjacent to, nor does the Company or have any interest in or control over them. Although certain geological features may be similar, there is no assurance that mineralization comparable to these deposits will be discovered on any of the Company’s properties. Information regarding the aforementioned deposits is taken from publicly available sources and technical reports believed to be reliable, but has not been independently verified by the Company. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Mineral Resource Estimate (MRE): All scientific and technical information relating to Manhattan pertaining to Maiden MRE contained in this news release is derived from the Technical Report dated October 23, 2025 (with an effective date of June 4, 2025) titled “Mineral Resource Estimate and NI 43-101 Technical Report” (the “Technical Report“) prepared by Matthew R. Dumala, P.Eng (BC) of Archer Cathro Geological (US) Ltd., Patrick Loury, M.Sc., CPG (AIPG) of Daniel Kunz & Associates, Annaliese Miller, LG (WA) of Geosyntec Consultants, Inc. and Art Ibrado, PhD, PE (AZ) of Fort Lowell Consulting PPLC. The information contained herein in respect of the Maiden MRE is subject to all of the assumptions, qualifications and procedures set out in the Technical Report and reference should be made to the full text of the Technical Report, a copy of which has been filed with the applicable securities regulators and is available under the Company’s profile on www.sedarplus.ca.

- Historical MRE: A Qualified Person has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

The Company considers the Historical MRE relevant as it demonstrates the presence of significant gold mineralization across multiple zones within Manhattan; however, its reliability is uncertain because it was prepared prior to the adoption of the current CIM Definition Standards and current QA/QC practices. The Historical MRE provides limited disclosure of assumptions, parameters, estimation methods, cutoff grades, and QA/QC protocols, and therefore these cannot be fully verified by the Company. The categories used in the historical estimate predate, and are not directly comparable to, current CIM Definition Standards, and the Company is not treating the Historical MRE as a current Mineral Resource Estimate. To upgrade and verify the Historical MRE in order to make it a current Mineral Resource Estimate, the Company would be required to undertake confirmatory drilling, modern QA/QC sampling, validation and digitization of historical datasets and updated geological modeling followed by the preparation of a new Mineral Resource Estimate in accordance with CIM Definition Standards and NI 43-101. The Company encourages readers to exercise appropriate caution when evaluating the Historical MRE.

All scientific and technical information relating to Manhattan pertaining to the Historical MRE contained in this news release is derived from the Technical Report dated May 1997 titled “Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County” prepared by New Concept Mining, Inc. The information contained herein in respect of the Historical MRE is subject to all of the assumptions, qualifications and procedures set out in the Historical Technical Report and reference should be made to the full text of the Historical Technical Report.

- References: (1) Strachan, D. G., and Master, T. D., 2005: Update and Revision of the Gold Wedge Project Development, Nye County. Report prepared for Nevada; Royal Standard Minerals, Inc. and dated March 31, 2005; (2) Dumlala, M. R., and Lowry, P., 2025: Mineral Resource Estimate and NI 43-101 Technical Report, Manhattan Property, Nye County, Nevada. Report prepared for Scorpio Gold Corporation and dated October 23, 2025 (with an effective date of June 4, 2025); and (3) Berry, A., and Willard, P., 1997: “Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County”. Report prepared for New Concept Mining, Inc. and dated May 1997.

Qualified Person

The scientific and technical information in this news release has been reviewed, verified and approved by Leo Hathaway, P. Geo., Chief Geologist of Scorpio Gold, a “Qualified Person” as defined in NI 43-101. Mr. Hathaway is not independent of the Company. Mr. Hathaway reviewed and verified the sampling, analytical and QA/QC data underlying the technical information disclosed herein.

About Scorpio Gold Corporation

Scorpio Gold holds a 100% interest in the Manhattan District Project located in the Walker Lane Trend of Nevada, USA. The Manhattan District comprises ~4,780-hectares, including the advanced exploration-stage Goldwedge Mine, with a 400 ton per day maximum capacity gravity mill, and four past-producing pits that were acquired from Kinross in 2021 (see news release dated March 25, 2021). The Manhattan District presents an exciting late-stage exploration opportunity, with over 140,000 metres of historical drilling, significant resource potential, and valuable permitting and water rights.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE