Santacruz Silver Produces 4,710,013 Silver Equivalent Ounces in Q4 2024

Including 1,761,686 ounces of silver and 23,357 tonnes of zinc

Santacruz Silver Mining Ltd. (TSX-V: SCZ) (OTCQB: SCZMF) (FSE: 1SZ) reports its Q4 2024 production results from its Bolivar mine, Porco mine, Caballo Blanco Group of mines and the San Lucas ore sourcing business, all located in Bolivia, and the Zimapan mine located in Mexico.

Q4 2024 Production Highlights:

Silver Equivalent Production: 4,710,013 silver equivalent ounces

Silver Production: 1,761,686 ounces

Zinc Production: 23,357 tonnes

Lead Production: 2,932 tonnes

Copper Production: 248 tonnes

Underground Development: 11,168 meters

Arturo Préstamo, Executive Chairman and CEO of Santacruz, commented, “During the fourth quarter of 2024, Santacruz continued to deliver steady operational performance, processing 493,141 tonnes of ore and producing 4,710,013 silver equivalent ounces. Silver production rose by 3% compared to the previous quarter, reaching 1,761,686 ounces. This growth in silver output and favorable market dynamics in silver prices have significantly strengthened our revenue-generating ability. These results underscore Santacruz’s unwavering focus on optimizing our processes and mining operations across all our producing assets, a testament to our commitment to operational excellence.” Mr. Préstamo continued; “Looking ahead, we believe that these solid production levels will provide a strong platform for continued value creation as we move into 2025”.

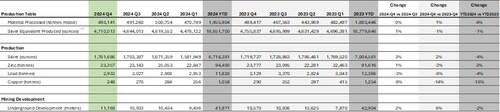

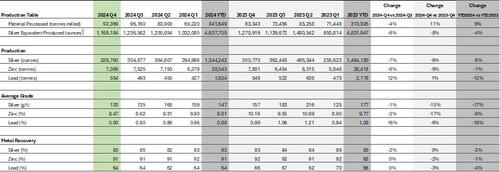

Production Summary – Total

| (1) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

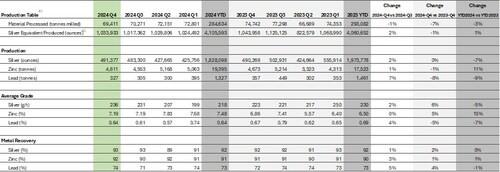

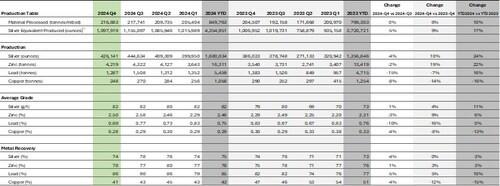

Bolivar Mine

| (1) | Bolivar is presented at 100% whereas the Company records 45% of revenues and expenses in its consolidated financial statements. |

| (2) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

In Q4 2024, Bolivar processed 69,411 tonnes of ore, yielding 1,033,933 silver equivalent ounces, comprised of 491,377 ounces of silver and 4,611 tonnes of zinc. Compared to Q3 2024, the ore processed decreased marginally by 1%, while silver production increased by 2%, driven by improved silver head grades and slightly higher recovery rates at the mill. This improvement is particularly notable considering strong silver prices and favorable market conditions. Zinc production also increased by 1%, contributing to an overall 2% increase in silver equivalent production compared to the previous quarter.

When comparing Q4 2024 to Q4 2023, ore processed decreased by 7%, primarily due to fewer working days caused by specific logistical challenges. These issues were addressed effectively, ensuring a positive operational outcome despite the reduced processing volume.

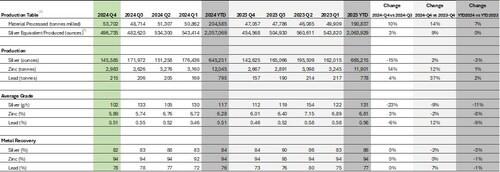

Porco Mine

| (1) | Porco is presented at 100% whereas the Company records 45% of revenues and expenses in its consolidated financial statements. |

| (2) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

In Q4 2024, Porco processed 53,702 tonnes of ore, yielding 496,735 silver equivalent ounces, which included 145,585 ounces of silver and 2,983 tonnes of zinc. Compared to Q3 2024, the volume of ore processed increased significantly by 10%, driving a 3% increase in silver-equivalent production. However, this quarter’s silver output decreased by 15% due to lower silver head grades. Despite this decline, the overall increase in processed material highlights Porco’s ability to sustain strong operational performance and adapt to changing ore characteristics.

When comparing Q4 2024 to Q4 2023, ore processed increased by 14%, demonstrating operational improvements. Silver production increased by 2%. With current silver prices, this increase in silver production positions Porco to leverage on today’s favorable market conditions.

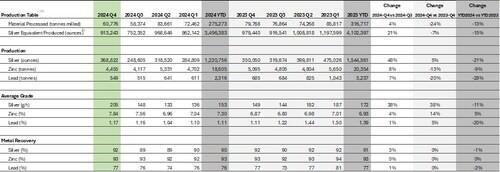

Caballo Blanco Group

| (1) | The Caballo Blanco Group consists of the Colquechaquita and Tres Amigos mines. |

| (2) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

In Q4 2024, the Caballo Blanco Group processed 60,776 tonnes of ore, achieving a production of 913,243 silver equivalent ounces, comprised of 368,822 ounces of silver and 4,455 tonnes of zinc. Compared to Q3 2024, ore processing increased by 3%, while silver production significantly increased by 48%, driven by higher silver head grades and improved recovery rates at the mill. Zinc production also grew by 8%, resulting in an overall 21% increase in silver equivalent production compared to the previous quarter. These results highlight the substantial impact of the operational enhancements implemented during Q3 2024. These improvements in production metrics underscore Santacruz’s ability to optimize quality processes across its mines and milling facilities. This progress reflects our commitment to continuous improvement initiatives implemented across all our assets.

When comparing Q4 2024 to Q4 2023, ore processed at Caballo Blanco decreased by 24%. However, this reduction is not directly comparable, as Caballo Blanco processed ore from three mines in Q4 2023, whereas in Q4 2024, it only processed ore from two mines (Colquechaquita and Tres Amigos). Reserva now supplies its ore to San Lucas’s ore source business. This operational adjustment has proven to be a positive strategic decision, improving mill performance and overall operational efficiency.

San Lucas Feed Sourcing

| (1) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

In Q4 2024, San Lucas experienced a 4% decrease in ore processed volume compared to Q3 2024. This reduction is attributed to the increased ore processing activities from the Porco and Caballo Blanco mines, which utilized more capacity at the milling facilities. Consequently, less processing capacity was allocated to San Lucas. This highlights the effectiveness of San Lucas’s role in ensuring that milling facilities operate at full capacity and adapt to the specific needs of the Bolivian assets. By prioritizing the processing of ore from other operations, San Lucas has demonstrated its flexibility and alignment with the Company’s broader commercial strategies, which include supporting the optimization of resources.

When comparing Q4 2024 to Q4 2023, the ore processed as San Lucas increased by 11%. This increase is primarily attributed to including ore from the Reserva mine into San Lucas, starting in Q3 2024, as part of the ongoing optimization initiatives.

Zimapan Mine

| (1) | Silver Equivalent Produced (ounces) have been calculated using prices of $23.85/oz, $1.21/lb, $0.94/lb and $3.91/lb for silver, zinc, lead and copper respectively applied to the metal production divided by the silver price as stated here. |

In Q4 2024, Zimapán processed 216,883 tonnes of mineralized material, producing 1,097,919 silver equivalent ounces. This included 426,141 ounces of silver and 4,219 tonnes of zinc. Compared to Q3 2024, the volume of processed material remained consistent; however, silver equivalent production decreased by 5%. This decline was primarily driven by a 4% reduction in silver production, attributed to lower recovery rates, and a 2% decrease in zinc production, resulting from lower head grades. Zimapán continues with steady processing levels, underscoring its operational reliability and ability to maintain consistent performance.

When comparing Q4 2024 to Q4 2023, mineralized material and silver production increased by 6% and 10%, respectively. With current silver prices, this increase in silver production positions Zimapán to leverage on today’s favorable market conditions.

Qualified Person

Garth Kirkham P.Geo. an independent consultant to the Company, is a qualified person under NI 43-101 and has approved the scientific and technical information contained within this news release.

About Santacruz Silver Mining Ltd.

Santacruz Silver is engaged in the operation, acquisition, exploration, and development of mineral properties in Latin America. The Bolivian operations are comprised of the Bolivar, Porco and the Caballo Blanco Group, which consists of the Tres Amigos, Reserva and Colquechaquita mines. The Soracaya exploration project and San Lucas ore sourcing and trading business are also in Bolivia. The Zimapan mine is in Mexico.

Production Summary – Total (CNW Group/Santacruz Silver Mining Ltd.)

Bolivar Mine (CNW Group/Santacruz Silver Mining Ltd.)

Porco Mine (CNW Group/Santacruz Silver Mining Ltd.)

Caballo Blanco Group (CNW Group/Santacruz Silver Mining Ltd.)

San Lucas Feed Sourcing (CNW Group/Santacruz Silver Mining Ltd.)

Zimapan Mine (CNW Group/Santacruz Silver Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE