Ridgeline Minerals Provides Assay Results and Drill Program Updates for the Big Blue and Atlas Projects

Big Blue highlights: 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and 2.6% W (or 35.3% CuEq)

To view a summary of today’s press release by Ridgeline CEO Chad Peters, click HERE

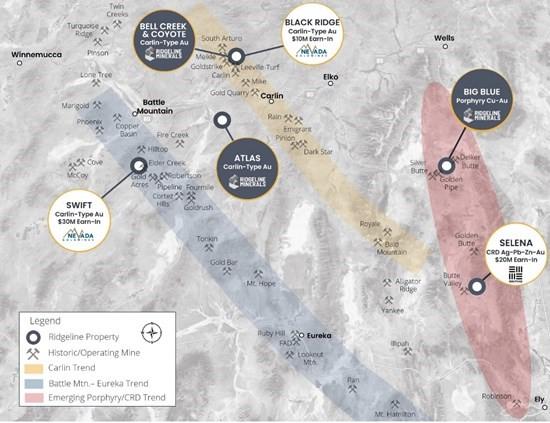

Ridgeline Minerals Corp. (TSX-V: RDG) (OTCQB: RDGMF) (FSE: 0GC0) is pleased to provide assay results and drilling updates for the maiden drill programs at the Company’s Big Blue and Atlas exploration projects (Figure 1). Both projects are 100%-owned by the Company with no underlying work commitments or royalties. Details on each drill program are highlighted below.

Chad Peters, Ridgeline’s President & CEO commented, “We were excited to test the conceptual IP targets at Big Blue and are encouraged that we intercepted an exceptionally high-grade Cu-Ag-W intercept in our maiden program. While the program did not meet all of our objectives, it did confirm that the northeast trending Delker Mine corridor continues to carry high-grade mineralization from surface to over 500 meters beneath the historic Delker Mine. This high-grade corridor remains open at depth and along strike for 1.5 kilometers between the Delker and Skarn Hill mines before dipping under alluvial cover.”

Mr. Peters continues, “Initial results suggest mineralization may be vectoring south along the Delker corridor towards the Skarn Hill mine, highlighting the potential to discover copper-rich skarn and CRD mineralization in the same rock formation that hosts the Chinchilla CRD discovery at our nearby Selena project. We will continue to revise our geologic model and assess the next steps for the project. Meanwhile, we will complete drill programs this summer across our four other projects — Atlas, Selena, Swift and Black Ridge, with the latter three projects fully funded by our partners.”

Big Blue

The Company completed three core holes totaling 2,072 meters to test induced polarization geophysical targets that suggested the potential for both high-grade copper – gold skarn and porphyry Cu-Au targets beneath and adjacent to the historical Delker Mine.

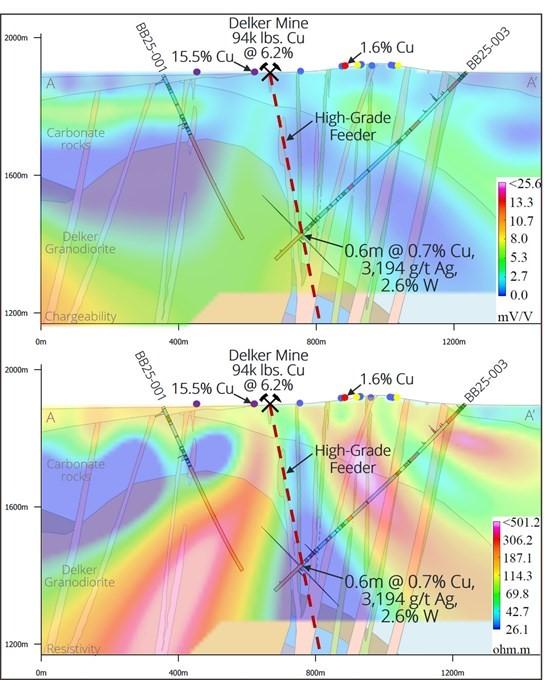

Delker Skarn Target

The Company drilled one hole from each side of the Delker Mine trend, which crosscuts an IP chargeability high down-dip and to the west of the Delker Mine in hole BB25-001 and a resistivity high down-dip and to the east of the Delker Mine in hole BB25-003 (Figure 2)

- BB25-003 returned a high-grade copper— silver— tungsten intercept over 0.6 meters grading 0.7% Cu, 3,194 g/t Ag and 2.6% W (or 35.3% copper equivalent) starting at 675.7m downhole (Figure 2)

- True thickness of the drilled intercept is unknown

- Mineralization was hosted at the strongly altered fault contact between the Ely formation carbonates and the Delker granodiorite (a barren, pre-mineral intrusion)

- Compared to BB25-001, hole BB25-003 exhibits increased skarn alteration and widespread zones of anomalous copper (and narrow high-grade) within porphyry dikes and the surrounding carbonate host rocks

- Suggests the northeast trending fault zone underpinning the Delker Mine is dipping steeply east vs the originally interpreted west dip

- Results from these two holes indicate a potential vector to the south towards the Skarn Hill mine

- The granodiorite is interpreted as a potential “cap rock” to fluid flow, which may help to concentrate high-grade mineralization along the granodiorite contact (Figure 2)

***Copper Equivalent is calculated using a copper price of US$4.50/lb, a silver price of US$32/Oz. and a tungsten price of US $450/Metric Ton Units with 80% metallurgical recoveries assumed for all metals

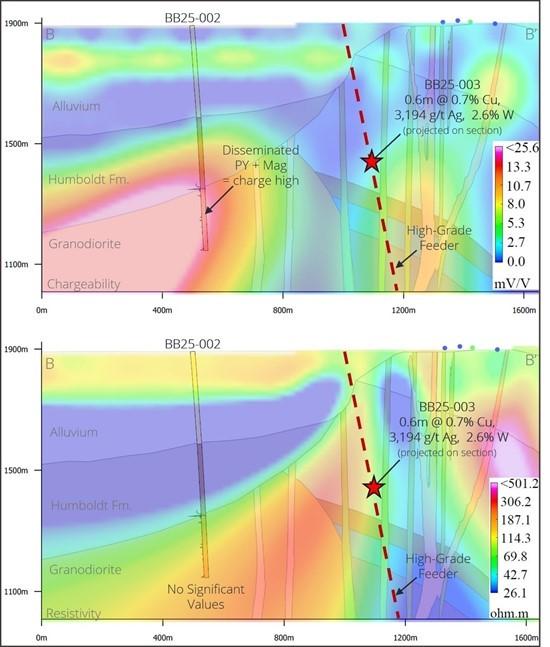

Delker Porphyry Target

Core hole BB25-002 was drilled into the Delker porphyry target to test a kilometer-scale IP chargeability high ranging from 20-25 Mv/V (Figure 3)

- BB25-002 intersected what is interpreted as the continuation of the Delker granodiorite at a depth of 544m downhole, which is consistent with the start of the modeled chargeability high (Figure 3)

- The granodiorite did not exhibit any elevated copper values or porphyry style alteration and is interpreted as a pre-mineral intrusion of Jurassic age

- The granodiorite exhibited elevated pyrite and magnetite, which is interpreted as the likely source to the strong chargeability response in the Company’s IP survey

- The granodiorite did not exhibit any elevated copper values or porphyry style alteration and is interpreted as a pre-mineral intrusion of Jurassic age

- No further exploration will be conducted by Ridgeline on the Delker porphyry target

Ohio Porphyry Target

The Ohio target was not tested in the maiden drill program but exhibits some of the highest-grade rock chip samples collected at Big Blue (up to 3.9% Cu and 16.3 g/t Au) to-date. Ohio is located roughly 2.0 kilometers west of the Delker Mine corridor and the Ridgeline team will utilize the new drill data to refine its geology and IP models accordingly as it assesses future exploration targets across the property.

See X-Section 72000N showing high-grade rock chips over IP geophysics at the Ohio Target HERE

Atlas

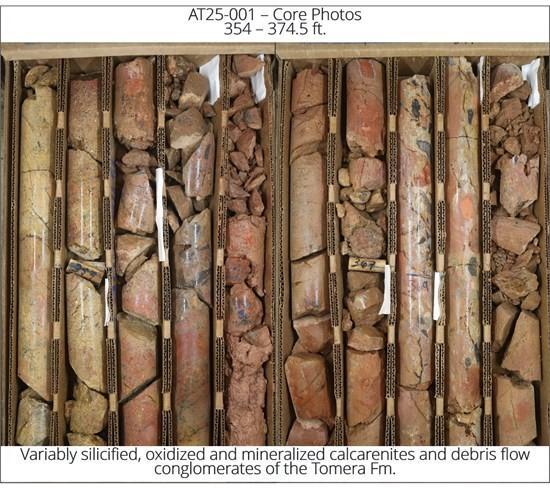

The Company completed two wide spaced core holes totaling 551 meters to test for oxide gold mineralization hosted within the same Pennsylvanian to Permian age limestones and conglomerates that host the multi-million-ounce Dark Star deposit that is owned and operated by Orla Mining on the nearby Carlin Trend

- The team intersected the anticipated section of Penn/Perm host rocks in both holes with the Ridgeline team observing weak to strong intervals of Carlin-Type alteration and oxide mineralization throughout the entire column of target host rock units down to depths of approximately 200m vertical (Picture 1)

- The company extended both holes 100-150m deeper than originally anticipated to transect the full host rock section

- As a result, only two initial holes were completed on the maiden program to ensure the program remained on schedule and budget

- All samples have been submitted for assay as of June 17th with results for both holes to be released together when available

Figure 1: Ridgeline’s 200-kilometer² exploration portfolio in Nevada. The 100%-owned Big Blue and Atlas projects both saw maiden drill programs completed in Q2, 2025

Figure 1: Ridgeline’s 200-kilometer² exploration portfolio in Nevada. The 100%-owned Big Blue and Atlas projects both saw maiden drill programs completed in Q2, 2025

QA/QC Procedures

Drill core is HQ size and split by diamond core saw into ½ core samples and submitted to American Assay Laboratories of Sparks, Nevada, which is a certified and accredited laboratory, independent of the Company. Independent check samples are sent to Paragon Geochemical Labs of Sparks, Nevada. Samples are prepared using industry-standard prep methods and analysed using FA-PB30-ICP (Au; 30g fire assay) and ICP-5AM48 (48 element Suite; 0.5g 5-acid digestion/ICP-MS) methods. AAL also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration. Ridgeline’s QA/QC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results completed by the Company’s Qualified Person, Michael T. Harp, Vice President, Exploration.

The technical information contained in this news release has been prepared under the supervision of, and approved by Michael T. Harp, CPG, the Company’s Vice President, Exploration. Mr. Harp is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Project.

Figure 2: X-Section showing chargeability and resistivity over geology with Ridgeline core holes BB25-001 and BB25-003 targeting high-grade Cu-skarn beneath and along strike of the historical Delker Mine

Figure 2: X-Section showing chargeability and resistivity over geology with Ridgeline core holes BB25-001 and BB25-003 targeting high-grade Cu-skarn beneath and along strike of the historical Delker Mine

Figure 3: Big Blue hole BB25-002 targeting the Delker Porphyry target intersected a barren phase of the Delker granodiorite with elevated levels of disseminated pyrite and magnetite interpreted as the source to the kilometer-scale chargeability high

Picture 1: Core photos of Atlas drill hole AT25-001 showing oxidized and variably silicified debris flow conglomerates of the Penn/Perm Tomera Fm. A prominent host rock at Orla Mining’s Dark Star deposit

Picture 1: Core photos of Atlas drill hole AT25-001 showing oxidized and variably silicified debris flow conglomerates of the Penn/Perm Tomera Fm. A prominent host rock at Orla Mining’s Dark Star deposit

Big Blue Project

Big Blue is located in Elko County, Nevada, approximately seventy-five kilometers southeast of the city of Elko, NV. The Project includes the past producing Delker Mine, which historically produced 94,434 pounds of copper at an average grade of 6.2% between 1916-191714 from structurally controlled skarn deposits outcropping between the Delker and Skarn Hill mines. The property shares its southern boundary with the Medicine Springs Ag-Pb-Zn Carbonate Replacement project (owned by Torex Gold Resources) and had seen limited modern exploration in over a century until Ridgeline staked the property in 2023. The primary target at Big Blue is porphyry-skarn Cu-Au ± Ag-Mo mineralization, with potential to discover polymetallic, carbonate replacement deposit (CRD) style mineralization as the system zones outward over 6+ kms of untested strike towards the Medicine Springs project. Big Blue is 100% owned by the Company and is comprised of a total of fifty square kilometers of highly prospective exploration ground.

Atlas Project

Atlas is located in Eureka County, Nevada, approximately 30 kilometers southwest of the town of Carlin, NV. The property exhibits classic Carlin-Type alteration and gold mineralization within outcropping Pennsylvanian to Permian age carbonate to siliciclastic host rocks. The primary target at Atlas is a bulk tonnage, oxide, Carlin-Type gold system, which is analogous to the nearby Dark Star gold deposit (part of the greater Railroad Mining District), which is currently owned by Orla Mining and advancing towards mine development. The 100% owned Project is comprised of a total of six square kilometers of highly prospective exploration ground that has never been drill tested and will benefit from the Ridgeline teams’ systematic approach to discovery.

About Ridgeline Minerals Corp.

Ridgeline Minerals is a discovery focused precious and base metal explorer with a proven management team and a 200 km2 exploration portfolio across seven projects in Nevada, USA. The Company is a hybrid explorer with a mix of 100%-owned exploration assets (Big Blue, Atlas, Bell Creek & Coyote) as well as two earn-in exploration agreements with Nevada Gold Mines at its Swift and Black Ridge projects and a third earn-in with South32 at its Selena project.

MORE or "UNCATEGORIZED"

Labrador Gold Announces Closing of Change of Business and Acquisition of Units of Northern Shield

Labrador Gold Corp. (TSX-V: LAB) (FNR: 2N6) is pleased to announc... READ MORE

La Mancha Exercises Right to Subscribe for Additional Shares of G Mining Ventures

G Mining Ventures Corp. (TSX:GMIN) (OTCQX:GMINF) announces that t... READ MORE

Osisko Development Announces Proceeds of $24.9 Million From Warrant Exercise

Osisko Development Corp. (NYSE: ODV, TSX-V: ODV) announces that i... READ MORE

LIFT Closes Acquisition with SOQUEM for an Additional 25% Interest in the Galinée Property, Quebec

Li-FT Power Ltd. (TSX-V: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) i... READ MORE

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE