Rick Mills – “White Gold Starts Drilling Flagship White Gold Project

White Gold Corp. (TSX-V:WGO) (OTCQX:WHGOF) (FRA:29W) this week started the second phase of its 2025 exploration program, building on the first phase announced on July 28th.

Phase 1 is a continuation of the company’s successful expanded exploration focus beyond gold, targeting critical metals including copper (Cu), molybdenum (Mo), tungsten (W), antimony (Sb) and bismuth (Bi), among others. Click here for the news release

Phase 2 aims to expand the current multi-million-ounce, high-grade gold resource, and enhance the project’s technical understanding for future development. Click here for the news release

White Gold Corp

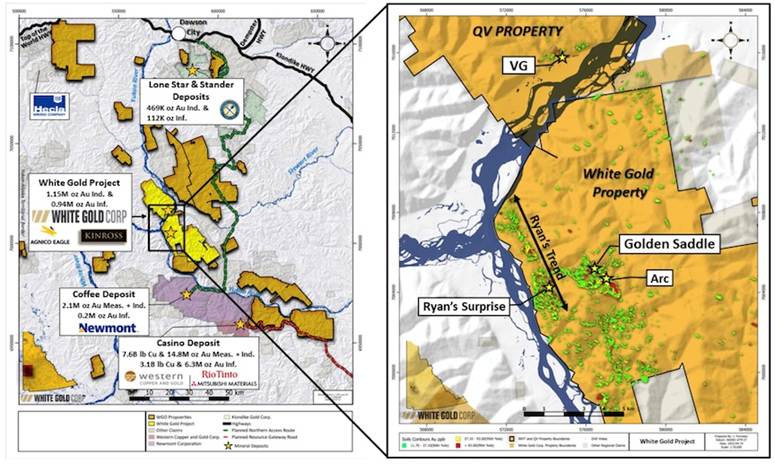

White Gold Corp is the largest landholder in the Klondike Gold District of Canada’s Yukon Territory, with a portfolio of 15,364 quartz claims across 21 properties, covering approximately 30,000 hectares or 3,000 square kilometers.

This represents about 40% of the Yukon’s White Gold District, which first came to the attention of resource investors during the White Gold area play of 2010, and is emerging as one of the most important new gold camps in Canada, rivaling those such as Val d’Or and the Abitibi.

The Toronto-based company was co-founded by acclaimed prospector Shawn Ryan, whose unique soil sampling technique earned him several awards, including the 1998 Yukon Chamber of Mines Prospector of the Year, and the 2011 PDAC Prospector of the Year.

Ryan started by researching geological maps and focused on areas with placer gold deposits (of which there were many; the Klondike Gold Rush of 1896-99 yielded over 20 million ounces from creek beds), then methodically sampled the soil, taking a “quality versus quantity” approach that involved collecting deeper samples than was the norm.

As reported by North of 60 Mining News at the time:

“In our business, one or two soil samples can be the clues for finding C$2 billion worth of gold, so we try our best at taking a quality soil sample every time.”

Ryan also discovered that the shallow “b-horizon” where soil samples are typically taken did not provide the best results in the unglaciated terrain of the Yukon. Instead of taking soil from the b-horizon depth of 10-15 centimeters that would yield 10-12 parts-per-billion gold, workers dug down 60-80 centimeters, or 2-2½ feet, to take samples that assayed 200 ppb.

“One has to dig a little deeper,” Ryan said. “We tested the technique in different terrains, and the results were consistent – the better samples were taken from the lower “b-” and upper “c-horizons.”

During this period of trial and error, Ryan also hit upon the perfect tool for taking samples – a soil auger, or tulip planter from Holland.

Ryan’s soil sampling technique led him to discover millions of gold ounces — including the Golden Saddle & Arc deposits — now part of White Gold’s flagship project of the same name.

Ryan now holds three titles with White Gold: co-founder, chief technical advisor and director. He also co-founded Ground Truth Exploration, inventor of the Drones to Drills technology allowing year-round exploration; and developer of the GT RAB Drill, a remotely controlled tracked platform that is pneumatically and hydraulically operated, drilling at 70% of the cost of diamond drilling. Ground Truth works closely with White Gold.

White Gold is led by CEO David D’Onofrio, a capital markets veteran with a focus on the natural resource sector. As an executive with the PowerOne Group, D’Onofrio has deep knowledge in representing, advising and assisting emerging companies in accessing capital, advising on mergers and acquisitions and managing their businesses.

New VP, Exploration Dylan Langille has a decade of experience in mineral exploration, with a proven track record in gold discovery and project advancement across Canada’s most prolific gold camps. Most recently, he was part of the core discovery team at the Great Bear Project in Red Lake, Ontario with Great Bear Resources. Following the acquisition of Great Bear by Kinross Gold, Langille led exploration efforts focused on growing the resource base ahead of a Preliminary Economic Assessment, contributing to one of Canada’s most significant recent gold discovery stories.

AOTH is going to meet with Dylan in 10 days or so and get into an in depth talk about White Golds various projects with our major focus on how they are going about trying to increase their already considerable gold ounce count. This is going to be a don’t miss, must read talk.

White Gold Project

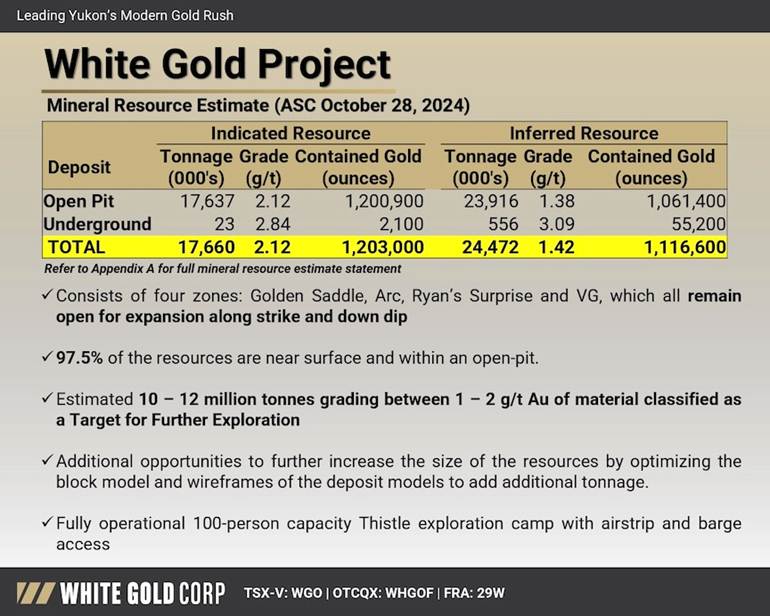

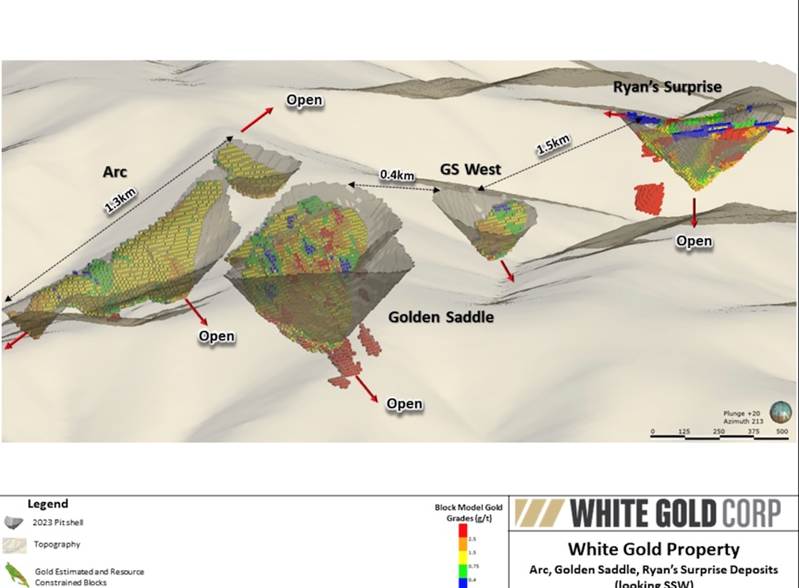

The White Gold Project hosts four near-surface gold deposits which collectively contain an estimated 1.203 million ounces of gold in the Indicated category (17.7 million tonnes averaging 2.12 g/t Au), and 1.116 million ounces in the Inferred category (24.5 million tonnes averaging 1.42 g/t Au) and remains open for further expansion. The four deposits are Golden Saddle, Arc, Ryan’s Surprise and VG.

An increase to the size of the resource may also be possible by incorporating mineralization hosted within the company’s Target for Further Exploration area that hosts an additional estimated 10-12 million tonnes grading between 1 and 2 g/t Au.

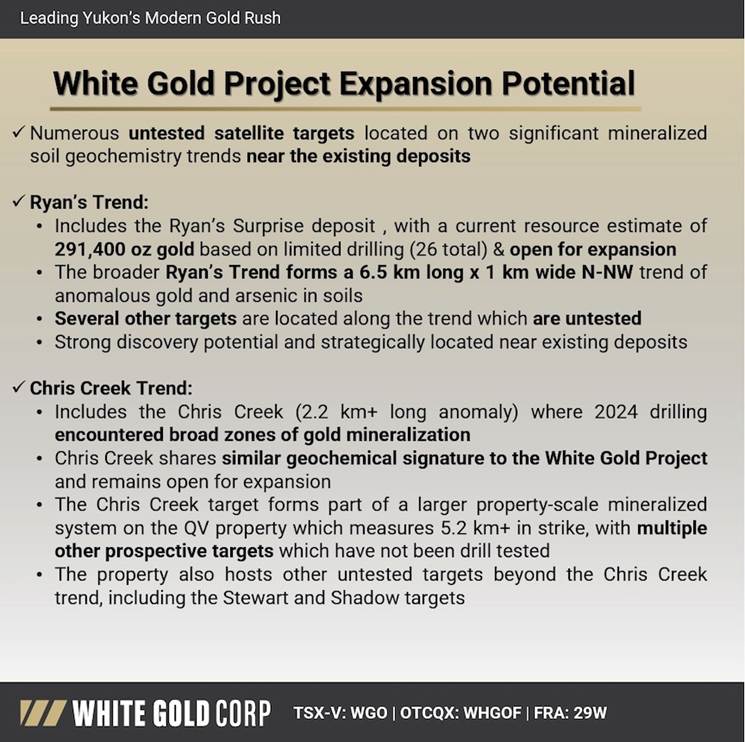

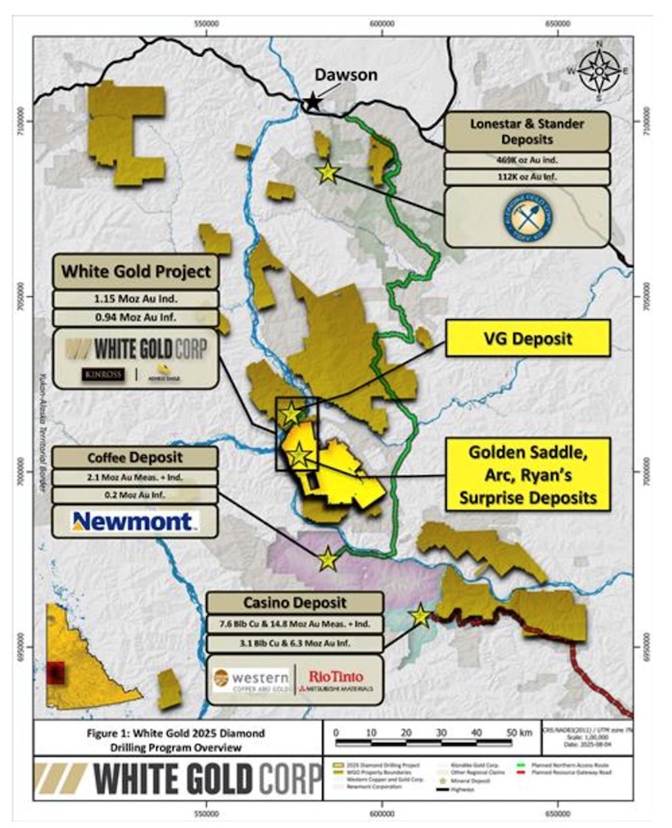

WGO’s claims package borders sizeable gold discoveries including the Coffee Project owned by Newmont, with Measured and Indicated resources of 50.2Mt grading 1.28 g/t Au for 2.17 million ounces of gold, and Inferred resources of 6.7Mt grading 1.14 g/t Au for 0.23Moz gold, and Western Copper and Gold’s Casino Project, which has Measured and Indicated resources of 2.490 billion tonnes grading 0.18 g/t Au, 0.14% Cu for 14.8Moz of gold and 7.6 billion pounds of copper, and Inferred resources of 1.4Mt grading 0.14 g/t Au, 0.14% Cu for 6.3Moz of gold and 3.1 billion pounds of copper.

The White Gold Project is located 95 km south of Dawson City and 350 km northwest of Whitehorse, the territorial capital.

Access is provided by fixed wing airplane from Dawson City and Whitehorse to the Thistle Creek airstrip, and by boat from Dawson City to a barge landing on the Yukon River. The company’s Thistle Camp is located at the southernmost part of the White Gold property and is the base of operations for all exploration. A gravel road that is used extensively by placer miners connects the camp with the airstrip and barge landing, which are located approximately 7.5 km east and 4.5 km northwest, respectively, of the camp.

Access to the Golden Saddle and Arc deposits to the north is provided by a 21-km-long exploration road located 600 meters west of camp. The Ryan’s Surprise and VG deposits are located 2 km west and 11 km north, respectively, of the Golden Saddle deposit and are accessible only by helicopter.

White Gold Project location

Phase 1 exploration

Most might not remember the White Gold Rush. But I certainly do, one of the reasons was because Shawn pulled off a genius move, all the property deals with so many juniors who wanted land included the clause that Ryan’s geological teams had to do all the work on the properties.

After the gold market collapse Ryan bought all the properties back, so not only does White Gold have all these properties back but Shawn has all this geological info compiled into likely the largest data base in the Yukon.

White Gold has been somewhat quiet the last few years, the sector was tough on all juniors, but WGO was fortunate to be able to finance from its long-time supporters and strategic partner Agnico Eagle also contributing. As such they were able to continue their systematic and extensive exploration in their part of the White Gold District over those years which has allowed the company to continue to increase its gold resources, make new gold discoveries and identify numerous new gold targets and other critical mineral opportunities.

But things are changing and it’s about to get very noisy in the White Gold District, the Yukon basically, and White Gold owns 40% of the WGD.

The Company is currently evaluating accretive strategies to advance these projects to unlock further value for all stakeholders. Additional information and exploration results on priority critical mineral targets are outlined below.

“Our entry into the critical metals space highlights the untapped multi-commodity potential of our vast Yukon portfolio,” Langille said. “Preliminary work has identified compelling targets with favorable geophysical and geochemical signatures for critical metals, and we are excited to advance these prospects with IP surveys to delineate drill targets.”

The geology underlying the company’s land package is prospective for several critical minerals, including copper, molybdenum, tungsten, antimony and bismuth. Middle to Late Cretaceous aged intrusions are favorable for porphyry deposits containing primary sources of copper, molybdenum and tungsten. The best example in the region is Western Copper and Gold’s Casino copper-gold-molybdenum porphyry deposit.

Yukon-Terrane Terrane mineral deposits

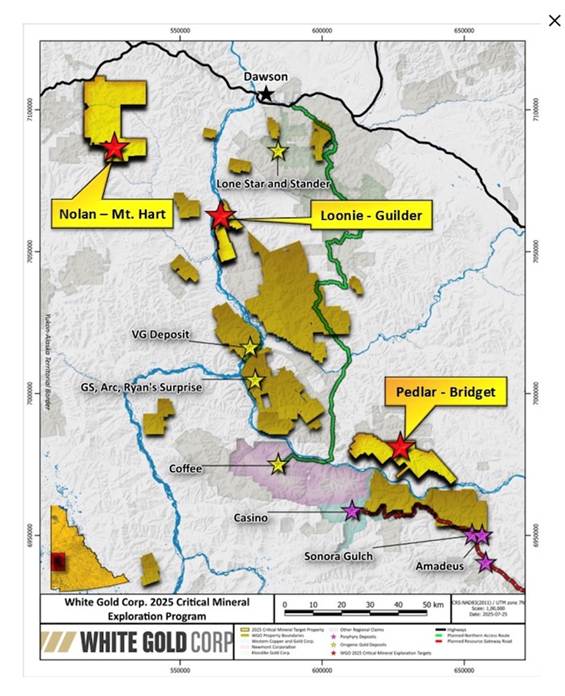

Initial 2025 activities have commenced on three critical mineral targets: Bridget on the Pedlar property, Guilder on the Loonie property, and the Mt. Hart target on the Nolan property. The program will include both gradient and dipole dipole induced polarization (IP) surveys designed to refine high-priority, porphyry-style targets for drill testing.

2025 critical mineral exploration program

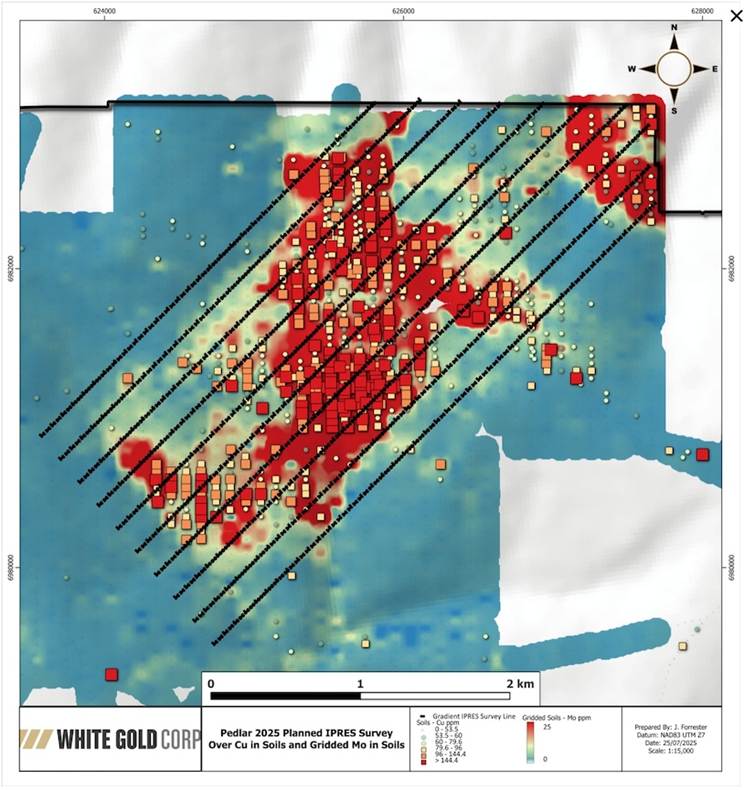

Pedlar property

Measuring 3 km NW-SE by 3.5 km NE-SW, the Bridget target represents a large, early-stage, geochemically zoned copper-molybdenum-tungsten target that has never been diamond drill-tested.

A 40 line-kilometer IP gradient survey and a dipole dipole survey will be conducted over the target to identify subsurface chargeability and resistivity anomalies indicative of critical metal mineralization.

Pedlar property

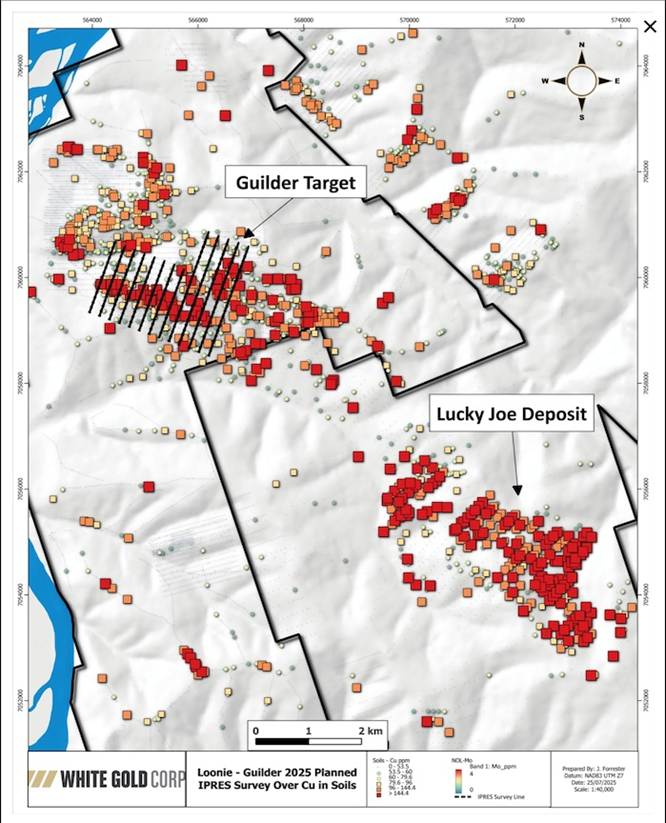

Loonie property

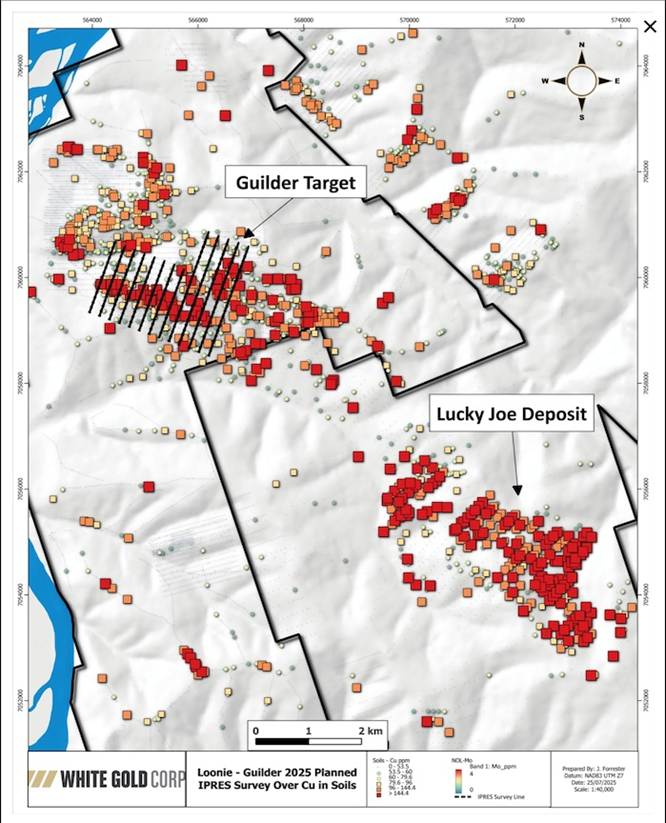

The Guilder target has identified an additional 3.0 by 0.5-km northwest-trending zone of anomalous Cu-in-soil results that is within a few kilometers and trending towards another target in the area.

Work will involve a 22 line-kilometer gradient IP survey and a dipole dipole survey on the Guilder target as follow-up to the high copper signature identified in soil sampling, and major structural trend identified in the interpretation of a 2024 VLF-EM and Lidar surveys.

Loonie property with Guilder target

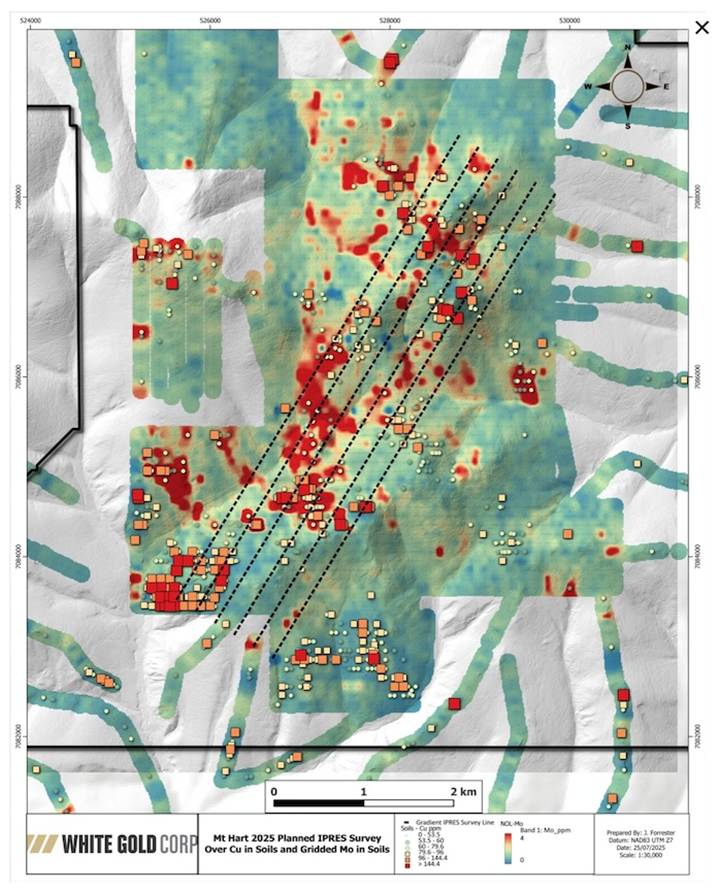

Nolan property

The Mt. Hart target is a large zoned multi-element soil geochemical anomaly hosting enrichment in Au, Ag, Cu, Mo, W, Pb, Bi, Sb, and Te. Previous mapping has concluded potential that a porphyry core is likely to exist at depth and that alteration seen at surface may represent epithermal-style alteration.

Work involves a 34 line-kilometer gradient IP survey, and a dipole dipole survey on the Mt. Hart target as follow-up to a high molybdenum anomaly identified in previous soil grids.

Nolan property with Mt. Hart target

All three properties present as moly-tungsten-tellurium-silver anomalies in soil, so White Gold decided to run broad-gradient IP surveys, to be followed up with dipole dipole surveys, a geophysical method used to map subsurface electrical resistivity.

The first target is Mt. Hart on the Nolan property. The way that it presents as a bullseye pattern tells WGO there may be a porphyry system at depth. The alteration at surface suggests the same thing, hence the 34 line-km gradient survey.

Another exciting target is Bridget on the Pedlar property. The large 3 x 3.5-km anomaly sits just 20 km northeast of Western Copper and Gold’s Casino Project. The soil geochemistry is characterized by tungsten values upwards of 101 ppm, with a lot of samples above 30 ppm. Molybdenum-in-soil values are commonly above 250 ppm, with a majority (400 samples) above 20 ppm. Copper-in-soil values are typically over 100 ppm.

The Guilder target on the Loonie property is also high in copper and moly in soils; it sits on strike to the Lucky Joe target and is structurally controlled.

The idea is for these three critical mineral targets along with others in the Company’s portfolio to be spun out into a separate company and placed into a pipeline for drilling.

The 40 line-km IP gradient survey on Mt. Hart is complete, with the geophysics program on the three targets about 50% complete, as of Aug. 7th.

Regional exploration work including geological mapping and prosecting, soil sampling, and LiDAR will also be carried out on several properties with the goal of identifying new targets.

Bob Moriarty of 321Gold.com and Quinton Hennigh Geological Consultant for Crescat Capital talk with Rick about White Gold in a recent Ahead of the Herd Under the Spotlight interview.

RM: Let’s talk about White Gold (TSX.V:WGO). Did you visit the White Gold Project, Quinton?

QH: Yeah, I got to see Shawn, we had several very long chats over the four or five days I was up there, and we went to White Gold, I’ve got to say that was the first time I made a site visit there and you know this is a very exciting project.

Back around 2010 I think, the last gold cycle, it’s kind of gone through an interesting history because it was what, bought by Kinross then spun out or whatever, like it’s been through the ringer so to speak. Anyway there was another project nearby called Coffee which was Kaminak, they’re not too far from one another, they’re actually part of the same belt in all respects, and this belt is south of Dawson, in fact if you look at the alluvial gold fields of Dawson, the belt goes all the way up to Dawson so in my view I have a much better understanding now of what’s going on there.

So, when I got to White Gold, I’m going to make a long story short, I was ready to see a typical orogenic gold deposit, meaning big, low grade, classic orogenic gold deposit. What does that mean? Ahh, don’t worry about it, geologist talk.

When I got there and I started looking at the geology, like the core and stuff, the light bulb went off. One of the great mysteries of the Dawson goldfields was where the heck did all this gold come from? What kind of a system could generate this much alluvial gold? And now I think I have a pretty good understanding ok.

The geology that I saw at White Gold resembles a couple of mines in the southwest US and northwest Mexico. One of them’s called Mesquite, that’s in Southern California, the second one is La Heradura, and it’s kind of northwest of Hermasillo. Those two deposits lie along the Mojave-Sonora megashear, so basically a giant shear zone, that’s kind of just torn the crust up through that region, and in doing so it’s also exposed a lot of deeper-level crustal rocks, they’re cooked-up rocks, hard crystalline rocks, high-ranked metamorphic rocks.

Well, when I got to White Gold and looked at the core, I’m like, “Holy smokes you could put a box of this core right next to core from La Heradura, which was a mine that we had at Newmont when I was there, and the suckers are a spitting image. They are the absolute replica of one another, so now I know what’s going on in the Yukon, ok. There’s a big megashear and you can see its structure.

I talked to Shawn Ryan about this too, there is at least one principal-like crustal-scale structured ripping right up through the Dawson camp, and these deposits, like White Gold’s various deposits and Coffee and stuff are more or less along this zone.

Now what does it mean? Well, look the mega shear in California hosts tens of millions of ounces of gold. What am I saying? Well, I’m saying that Dawson, the hard rock part of the Dawson camp, I’m not talking alluvial I’m talking the hard rock part of the Dawson camp, is way underexplored.

I think this is basically equivalent to, like you’re going to find some big deposits there, they’re going to be really big, like 10 million, 20 million ounces, and I think White Gold is quite frankly in the early stages of a discovery. Yet again this is a story where I didn’t have that high a view of it early on, but after seeing it now, I have a greater appreciation.

RM: I’ve got to ask, a decade and more ago this this whole area went through a major coming in and trying to consolidate it, it had many juniors working in the area, there was a whole area play built around this.

I said to my subscribers I’m buying Atac, I’m buying Underworld, I’m buying Kaminak this winter, that’s what I’m doing. So, Atac hit $8, Underworld was bought out, and the area’s back in play now.

I know project’s go through cycles, a property can be looked at 6 times before it’s figured out, you bring in new owners, different geo’s, new models, is that what this is?

QH: It’s a lot of it, look there’s a lot of cases where you see a discovery was made, usually for lack of capital or lack of priorities the thing kind of falls by the wayside, but then when the gold price picks up it becomes more interesting again. Part of that is geology, we have a greater understanding today of systems like Mezquite and La Heradura, like my brain cells are going holy cow this thing could be bigger than Ben Hur.

Here’s the key, they’ve got good geologists, there’s a young lad there Dylan Langille, Dylan is one smart cookie, he was with Great Bear and I was impressed ok, this kid is young, he can figure it out and that’s what you need ok, so the take away is these things languish, these deposits that we forget about, bring them off the shelf, you need somebody who’s going to really unwrap the thing properly and they’ve got it, so this young lad and his team are probably going to make White Gold a huge success.

RM: Interesting. Bob what do you think?

BM: Rick, I follow Crescat closely and when Crescat takes a position in a stock I’m quite happy to do that because Quinton’s done my homework for me, and that’s just as true of White Gold.

Kinross and Agnico Eagle have taken major positions in the stock, they each own about 12 or 13% of the shares and they’ve done their research into it, they believe it, and I think that Quinton’s analogy is excellent and White Gold is going to be one of the heroic stories of this particular cycle, but this cycle is going to go on for 5-10 years so it’s early days now and this is where you make all your money. (Kinross has since exited its position @ Cdn$0.29 with insiders, including Agnico, acquiring part of that position to increase their ownership to ~19.9%, which seemed to be well received by investors, as the stock closed today, August 8th @ Cdn$.495 – Rick)

RM: Yeah, Shawn Ryan’s got ‘street cred’, Quinton likes it, Bob’s a copycat, Crescat’s backing it and two majors are already in. What else?

BM: White Gold has a 2Moz resource already, which means they’ve got a mine effectively and at a $60 million market cap that gives them $30 Canadian per ounce which is cheap ok, so relative value is just as important as cheap value. White Gold is cheap at $30 an ounce or 30 cents a share.

Phase 2 exploration

Phase 2 of White Gold’s 2025 exploration program, starting in the coming weeks, will focus on high-priority gold projects including existing gold resources and discoveries of new gold occurrences.

As mentioned at the top, the aim is to expand the existing multi-million-ounce high grade gold resource and to enhance the project’s technical understanding for future development.

Phase 2 is focused on the company’s continued advancement of its significant gold assets. The planned work is in the immediate vicinity of the defined resources, with significant growth opportunities identified across multiple additional targets also located in close proximity to the existing resources.

White Gold drilling program overview

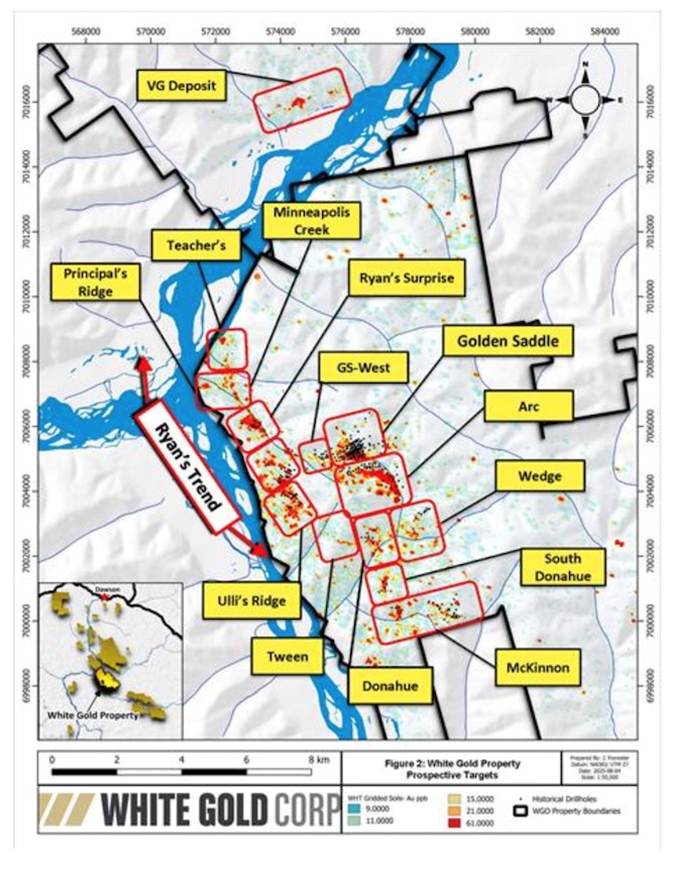

White Gold property prospective targets

Among the Phase 2 exploration highlights:

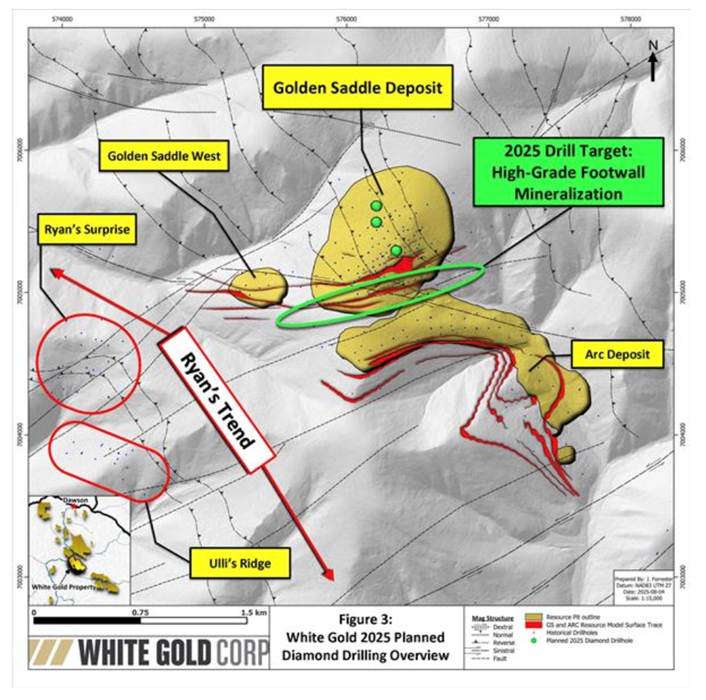

- Diamond drilling. Diamond drilling planned at the Golden Saddle Zone is set to target a high-grade footwall breccia identified in historic drilling. Previous drilling was extended far enough to discover this zone; however, it remains largely unexplored. This presents an exciting opportunity to increase known mineralization and expand the resource estimate as these areas are within or close to the existing pit shell and remain open in multiple directions.

2025 planned diamond drilling overview

Arc, Golden Saddle, Ryan’s Surprise deposits

- Relogging & resampling: Gold mineralization has recently been observed in unsampled core belonging to the footwall and hanging wall host rocks. These zones were not originally expected to host mineralization and were not assayed in historical drilling. To evaluate the presence of additional mineralization, a targeted program to relog and resample historic drill core will focus on delineating mineralization trends in the hanging wall and footwall of the Golden Saddle Zone, an area with strong potential for additional resource growth.

- Metallurgical & geotechnical sampling: Additional metallurgical and geotechnical test work across the Arc and Golden Saddle zones to advance technical understanding in support of a Preliminary Economic Assessment (PEA).

Significant expansion opportunity has been identified on the White Gold Project. The diamond drilling planned for Phase II is focused on the Golden Saddle Zone, which remains open in multiple directions and at depth, with drilling to date intersecting significant widths of high grade near-surface gold mineralization. Historic core relogging and resampling will further evaluate mineralization potential in areas adjacent to the main deposit envelope that were previously underexplored. These activities are designed to define and further expand the known resources and define new drill targets in support of future resource updates.

“Our Phase II program is focused on efficiently expanding the size and confidence of our flagship resource,” says Langille. “In addition to our diamond drilling, the relogging and resampling of historic core is an important step towards unlocking overlooked mineralization in the hanging wall, while the metallurgical and geotechnical test work will support future development pathways. These are just a few of the numerous opportunities that exist to continue to increase the size of the resources at the White Gold Project.”

Two holes drilled at depth are about 225 meters apart and they ran good grades, with one intersecting 2.7 grams over 3.6 meters and the other hole cutting 3.5 grams over 2 meters. However, the holes didn’t capture the plunge of the potential high-grade system. Langille says at the core of the system, drill holes are intersecting grades such as 3.7 grams over 66 meters, including 7 grams over 23 meters. “It’s really high-grade core and there’s also other intercepts that are 8 grams over 10 meters, so I think there’s a real opportunity to test the high-grade plunge of this system,” he said.

“With Phase II now underway, we are excited to build on our proven track record of discovery and resource growth in the White Gold District,” said David D’Onofrio, White Gold’s CEO. “We believe our flagship gold assets have the potential to become a Tier 1 project in Canada and provide a strong foundation for continued value creation. We are also optimistic that our systematic exploration methodology, which has been so successful to date, will deliver continued success with additional new discoveries in our underexplored, district-scale land package.”

Golden Saddle Deposit

The Golden Saddle deposit is located 95 km south of Dawson City on the White Gold property. The deposit consists of the GS Main, GS Footwall and GS West zones and together the zones define mineralization over a 1,500m strike length and up to 725m down dip. Currently, the GS Main is the most significant zone in terms of estimated ounces and overall grade, containing approximately 95% of the Indicated ounces within the deposit.

Gold mineralization at Golden Saddle is hosted in a meta-volcanic and meta-intrusive assemblage broadly consisting of felsic orthogneiss, amphibolite, and ultramafic units. Gold generally occurs as micron-scale blebs along fractures or encapsulated by pyrite, and as visible gold (less than 5mm in size) located as free grains in quartz. Mineralization is present in quartz veins and stockwork or breccia with disseminated pyrite.

Drill hole-intersected gold mineralization is spatially co-incident with structures, and structures or faults which are interpreted to be the primary conduits for hydrothermal fluids responsible for gold deposition. The thicknesses of the mineralization and breccia zones are variable from 5m to over 50m, and they pinch and swell along strike. A consistent higher-grade core (>3 g/t Au) occurs within the Main Zone at Golden Saddle. Gold mineralization at the Golden Saddle deposit remains open along strike and at depth and is known to extend beyond the limits of the current resource estimate; however, the mineralization in these areas does not currently meet the criteria to be classified as mineral resources.

Arc Deposit

The Arc deposit is located approximately 400 meters south of Golden Saddle and consists of two zones, the Arc Main and Arc Footwall zones, both trending E-NE and dipping to the north at approximately 50 degrees. Mineralization at Arc has been defined over 1,200m in strike length and up to 450m down dip, with mineralization open along strike and down dip. Gold mineralization at the Arc deposit is less well understood than at Golden Saddle, which is partially a function of drilling at the Arc deposit being more widely spaced. Gold mineralization is hosted within a meta-sedimentary sequence dominated by banded (graphitic) quartzite and interbedded pelitic biotite schist that is cross cut by numerous felsic to intermediate dikes and sills.

Gold mineralization appears to be focused within breccia and shear zones that have been affected by hydrothermal alteration and sulfide mineralization. Drilling has defined an upper main zone as well as a lower footwall zone of anomalous gold but of lesser tenure than the main upper zone. Mineralization remains open to the east, west and at depth. The occurrence of gold at Arc appears to be associated with disseminated and veined pyrite, arsenopyrite and graphite.

Ryan’s Surprise Deposit

Ryan’s Surprise is located 1.5 km west of the Golden Saddle deposit, along a 6.5 km long x 1 km wide north-northwest trend of anomalous gold and arsenic in soils (Ryan’s Trend), which also hosts several other prospective early-stage targets in close proximity with significant surface gold mineralization and represent further potential for expansion of this project. Gold mineralization at the Ryan’s Surprise deposit is primarily hosted within a meta-sedimentary sequence dominated by banded (graphitic) quartzite and interbedded pelitic biotite schist cross cut by numerous felsic-intermediate dikes and sills.

Gold mineralization appears to be focused within breccia and shear zones that have been affected by hydrothermal alteration and sulfide mineralization. Recent drilling has defined multiple subparallel zones that are host to gold-bearing sulfide mineralization including arsenopyrite and pyrite, and range in true width from <1 m to in some instances >10m. The mineralization footprint at the Ryan’s Surprise deposit measures approximately 550m north-south by 500m east-west to a vertical depth of 650m and remains open along strike and at depth. Metallurgical work and gold characterization and deportment studies are required to further determine accurate gold recoveries. However, host rocks, alteration and sulfide mineralization at Ryan’s Surprise display many similarities to the Arc deposit.

VG Deposit

The VG deposit is located approximately 85 km south of Dawson City and 11 km north of the Golden Saddle deposit. Gold mineralization at the VG deposit is hosted in quartz-carbonate veins, stockwork and breccia zones, and pyrite veinlets, including cubic pyrite and visible gold, associated with intense-quartz-carbonate-sericite alteration, pervasive K-spar and hematite emplaced along en-echelon faults or shear zones. Visually, the style of gold mineralization and alteration appears identical to the Golden Saddle deposit. To date, no metallurgical test work has been performed on the VG mineralization; however, given its close similarities to Golden Saddle, gold recoveries are assumed to be similar. Opportunities exist at the VG deposit to quickly upgrade a significant portion of Inferred resources to Indicated, as well as for expansion of gold mineralization at depth and along strike. There are also several other prospective targets, including the 5.2 km-long Chris Creek trend.

Conclusion

West-central Yukon is host to several highly prospective mineral districts, including the White Gold, Dawson Range, Klondike and Sixty-mile districts. The Klondike was the epicenter of the historic Klondike Gold Rush in 1896, with over 20 million ounces of placer gold production having occurred in the region since that time.

White Gold’s property portfolio, which covers large portions of the White Gold District, was assembled by renowned prospector Shawn Ryan, and represents the largest claim package in the region.

Two significant advanced-stage projects border the company’s claims to the south: the Coffee Project, owned by Newmont; and the Casino Project, owned by Western Copper and Gold.

The region has seen significant investment by major mining companies in recent years, and the Yukon is consistently ranked among the top 10 global mining jurisdictions on the Fraser Institute’s Investment Attractiveness Index.

All four of White Gold’s near-surface deposits, which form the White Gold Project, are interpreted to represent structurally controlled orogenic gold systems. These deposits collectively form the company’s gold resource base in the heart of its extensive land package and remain open for expansion.

The White Gold Project hosts four near-surface gold deposits which collectively contain an estimated 1.203 million ounces of gold in the Indicated category (17.7 million tonnes averaging 2.12 g/t Au), and 1.116 million ounces in the Inferred category (24.5 million tonnes averaging 1.42 g/t Au) The White Gold Project today is one of the highest-grade deposits in the Yukon; it’s the fifth highest-grade potentially open-pit deposit in Canada over 2Moz.

Golden Saddle is the best near-term opportunity for White Gold to add ounces to its resource base.

The message from White Gold management is they have three things they’re currently focused on: The White Gold deposit, which they think can get a lot bigger and move down the production path; several blue-sky opportunities on the gold side; and a number of interesting critical minerals projects they plan to spin out into a new company.

David D’Onofrio & Dylan Langille on White Gold Corp’s 2025 Exploration Update – 2025 08 07

Shawn Ryan and his team have collected over 600,000 soil samples that have highlighted a lot of gold targets but also many critical metals targets.

White Gold plans to break the gold and the critical minerals into two streams, hence the announcement of two separate programs: the critical minerals exploration program with the IP geophysics; and the drill program at the White Gold Project.

White Gold Corp in my view checks all the boxes. First, it has the potential for size and scalability. Statistically, these types of gold fields associated with hard-rock deposits are enormous. The White Gold Project remains open for further expansion. White Gold was able to acquire an enormous land mass — they own 40% of the White Gold District — 300,000 hectares or 3,000 square kilometers. The company has worked the ground and identified the most prospective targets.

Second, White Gold is in a jurisdiction that has been supportive of mining. The federal government, along with the British Columbia and Yukon governments, recently announced they will invest $60 million to support critical minerals development in northern BC and the Yukon.

The Yukon government is seeking to undertake prefeasibility activities to advance a 765-kilometer, high-voltage transmission line network that would connect the Yukon electrical grid to the grid in BC.

The Yukon Resource Gateway Project aims to upgrade transportation infrastructure in the Yukon to support resource development. At least one of the proposed new roads is likely to benefit White Gold.

Third is the geology, widely understood to be one of the greatest frontiers in Canada from a geological perspective that has not seen significant amounts of work. Mineral exploration is starting to bear fruit in the form of a high rate of discovery. In the White Gold District alone there’s been over 5 million ounces of gold discovered by Shawn Ryan and his team.

Success by juniors such as Snowline Gold are driving exploration activity in the region and investor excitement. The project borders sizeable gold discoveries including the Coffee Project owned by Newmont and Western Copper and Gold’s Casino Project.

With a dearth of exploration over the past decade, projects like White Gold are becoming few and far between. Producers need to find more ore to fund their operations and expansions, meaning companies like WGO, with the size and scalability to interest majors, are likely to be targets for acquisition or further funding to move down the development path to eventual production.

White Gold Corp.

TSXV:WGO, OTCQX:WHGOF, FRA:29W

2025.08.08 Share Price: Cdn$0.49

Shares Outstanding: 197.6m

Market Cap: Cdn$97.8m

WGO website

Subscribe to AOTH’s free newsletter

Richard owns shares of White Gold Corp. (TSX.V:WGO). WGO is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of WGO

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE