Rick Mills – White Gold drills 6.9 g/t gold over 50.2m

White Gold (TSX-V:WGO) (OTCQX:WHGOF) (FRA:29W) this week reported assays from the first drill hole of the 2025 drill program at its Golden Saddle deposit, part of the company’s flagship White Gold Project located in Canada’s Yukon Territory.

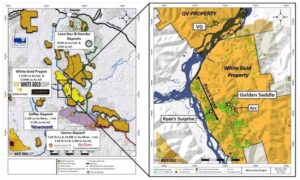

White Gold Project location

According to the Nov. 4 news release,

Hole WHTGS25D0218A successfully intersected the high-grade footwall breccia target, returning 6.89 g/t Au over 2.8 meters, infilling 150-meter gap up-dip and confirming continuity of this mineralized zone parallel and footwall to the Main Zone. The same hole also returned 6.89 g/t Au over 50.2 meters through the main Golden Saddle zone, representing one of the best intervals ever drilled on the property, expanding high grade mineralization within the Main Zone. The hole also intercepted mineralization in the hanging wall returning 0.75 g/t over 3.00 meters, further supporting recent 3D modeling refinements that capture mineralization in the hanging wall more consistently…

WHTGS25D0218A is just the first of five drill hole assays to be returned to WGO as part of the 2025 program. Two additional holes on Golden Saddle and two holes on the Arc deposit are pending assays.

“These high-grade results exceeded our expectations and further demonstrate the exceptional potential of our Flagship Project which already ranks as one of the highest-grade undeveloped open pittable gold deposits in Canada,” said White Gold’s CEO David D’Onofrio. “Intersecting one of the best intervals ever reported from the property, while confirming additional mineralized zones in the hanging wall and footwall, underscores the robust nature of this deposit and is just one example of the significant opportunity to further expand and enhance our resource base.”

Dylan Langille, vice president, exploration, commented:

“This hole represents an important technical milestone for our team. We set out this year with a shift in strategy to focus on our flagship deposits for the first time in several years. We identified opportunities for resource growth which included testing extent and continuity of parallel zones of mineralization (hanging wall and foot wall), down-dip and strike extensions at both Golden Saddle and Arc, and interpreted high-grade ore shoots at the core of Golden Saddle. These first results are quite encouraging and act as the first step in increasing confidence in the continuity of the footwall breccia, confirming more high-grade Golden Saddle core further increasing the grade of the block model, and demonstrating presence of mineralization in the hanging wall. We are eagerly anticipating the results from the additional drilling and other exploration performed this year.”

If your author was asked for a quote, I would have to say x218A is awesome, incredible, a barnburner of a hole and a hell of a first result. It is a hugely positive first step and really starts to validate both management for bringing Dylan on board and his model and thinking on how to increase White Gold’s gold ounce count. We are going to do a very deep dive on this model, hole, what it adds to the WGO story and the other 4 holes yet to come but first a bit, for our new to the story followers, about the company itself.

White Gold Project

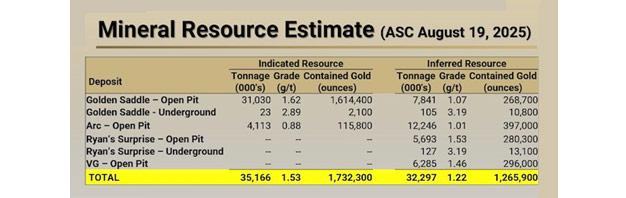

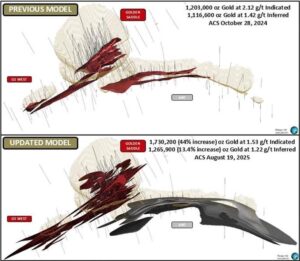

The White Gold project hosts four near-surface gold deposits, which collectively contain an estimated 1,732,300 gold ounces in the indicated categeory (35.2 million tonnes grading 1.53 grams per tonne gold) and 1,265,900 ounces of gold inferred (32.2 million tonnes grading 1.22 g/t Au). based on open pit and underground resource estimates.

The four deposits are Golden Saddle, Arc, Ryan’s Surprise and VG. All four are interpreted to represent structurally controlled orogenic gold systems. Golden Saddle is the best near-term opportunity for White Gold to add ounces to its resource base.

White Gold Corp is the largest landholder in the Klondike Gold District of Canada’s Yukon Territory, with a portfolio of 15,364 quartz claims across 21 properties, covering approximately 30,000 hectares or 3,000 square kilometers.

This represents about 40% of the Yukon’s White Gold District, which first came to the attention of resource investors during the White Gold area play of 2010, and is emerging as one of the most important new gold camps in Canada, rivaling those such as Val d’Or and the Abitibi.

The Toronto-based company was co-founded by acclaimed prospector Shawn Ryan, whose unique soil sampling technique earned him several awards, including the 1998 Yukon Chamber of Mines Prospector of the Year, and the 2011 PDAC Prospector of the Year.

Phase 2 exploration

White Gold in August started the second phase of its 2025 exploration program, building on the first phase announced on July 28 targeting critical minerals.

According to WGO,

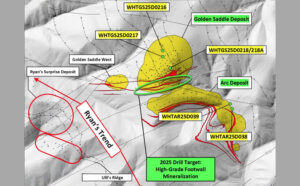

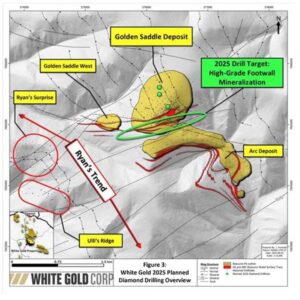

The 2025 drill program on the Golden Saddle deposit was designed to target a high-grade footwall breccia identified in historic drilling which resides immediately below and parallel to the Main Zone. Very limited previous drilling was extended far enough to discover this zone and therefore it remains largely unexplored. This year, three drill holes were designed and drilled to refine this complex structural-lithological domain, testing continuity and extent of the high-grade mineralization in the footwall, as well as mineralization in the hanging wall and main zone.

Drilling highlights:

- Intersected gold mineralization in footwall breccia target, returning 6.89 g/t Au over 2.80 meters, infilling a 150-meter gap up dip, and confirming continuity of high-grade mineralization parallel and footwall to the Golden Saddle Main Zone.

- Hole x218A fills 70m spacing in high-grade gold mineralization of the Golden Saddle Main Zone, returning 6.89 g/t Au over 50.2 meters 60 meters east of WD-031, which returned 3.4 g/t Au over 104m. These higher-than-anticipated results will have a positive influence on further increasing the grade of the mineral resource estimate.

- Hole x218A intersects and confirms confidence of hanging wall mineralization recently captured in the new geological model and updated mineral resource estimate. The hanging wall mineralization will be further supported by the relogging and sampling program for significant amounts of un-assayed core in the vicinity of previously encountered hanging will mineralization as well as for future exploration of these domains at depth.

The plan

When I talked to CEO David D’Onofrio in mid-October, he confirmed one focus of the diamond drill program was to drill into the footwall that runs parallel to the Golden Saddle Main Zone. Historical drilling had encountered two pierce points in the footwall, but they were 300 meters apart. None of that material could be incorporated into the existing resource estimate.

VP Exploration Dylan Langille felt that if they could stitch the Footwall Zone together through infill drilling, the zone could be pulled into the resource, potentially adding significantly more gold ounces to the existing resource — and putting White Gold on track to publishing a PEA in the first half of next year.

Potentially, that’s more 4-gram-plus material for a starter pit.

In fact, the plan was to test three targets with each of three holes: the Golden Saddle Main Zone, the Footwall Zone underneath it, and the Hanging Wall Zone above the Main Zone.

The Hanging Wall Zone had been previously identified but it was sparsely included in White Gold’s historical (2024) resource estimate. That’s because there is a lot of unassayed drilling in the hanging wall. In Langille’s review, he discovered about 7,000 meters of historical drilling through the hanging wall was never assayed — opening up another route to adding more ounces.

I should mention the high-grade core of the Golden Saddle deposit. The core is estimated at over 1.1 million ounces, grading almost 3 grams per tonne, which in an open pit is quite a spectacular grade. Raising the cut-off grade to 3 g/t yields over 700,000 ounces at 5 g/t — extraordinary.

There is nothing like it in the Yukon or even across Canada in an open pit. And it remains open to expansion.

When I first talked to VP-Ex Dylan Langille about the Phase 2 drill program he said, i.e., that the low-hanging fruit to adding ounces is to assay the previously drilled holes in the Hanging Wall Zone. Relatively recent drilling in 2018-19 saw select intervals sampled, and they ran good grades. Stringing together back-to-back samples of 2 g/t, 5 g/t and 1 g/5 makes a nice composite.

“We’re talking about a shallow open pit, so effectively that’s going to change a lot of your waste rock into ore, so it’s going to improve your economics and your strip ratio, and it’s just going to make this deposit a lot bigger and a lot more attractive,” Langille told me.

There is also the potential for expansion at depth.

“If you look at the deposit and the broad mineralization envelope, it plunges to the north at about 55° and I think internal to that mineralization envelope there might be a high-grade plunge that plunges about 50° towards the west. If you look at some of the long sections that we’ve put out I show that as a target. There’s 200 meters between drill holes at depth that just skirted the highest-grade portion of the deposit I believe, so I think there’s some serious potential to expand that high-grade zone at depth,” said Langille.

2025 planned diamond drilling overview

Execution

It’s one thing to draw up a plan, and another to execute it. Langille and the technical team at WGO have done precisely what they set out to do.

First, let’s talk about the first drill hole reported in the Nov. 4 news release, that went through all three zones: Golden Saddle Main, the footwall and the hanging wall.

Beginning at roughly 100 meters down hole, WHTGS25D0218A intersected 6.89 g/t over a width of 50.2 meters in the Main Zone, with multiple assays over 10 g/t.

The footwall breccia zone previously identified in historical drilling, but which remained underexplored, was intersected at a down-hole depth of 409 meters. The interval returned 6.89 g/t over 2.80 meters.

In the Hanging Wall Zone, hole x218A returned 0.75 g/t over 3 meters, with a highlight of 1.05 g/t Au over 2m.

In sum, the first hole drilled into the Golden Saddle deposit cut through all three zones for a total distance of roughly 56 meters — a huge intercept — with an average grade of 4.84 g/t. Again, extraordinary.

To be clear, previous drill holes have pierced all three zones, but none has been as good as this hole.

According to the news release,

The program’s first drill hole at the Golden Saddle deposit successfully intersected the targeted high-grade footwall breccia, returning 6.89 g/t Au over 2.8 meters, alongside a very strong interval of 6.89 g/t Au over 50.2 meters within the Main Zone — representing one of the best intercepts ever reported from the property. Mineralization was also confirmed in the hanging wall, underscoring the potential for additional ounces in domains historically not recognized for their accretive resource potential.

These early results validate the technical strategy implemented this year, which targeted the footwall breccia and hanging wall extensions, as well as high-grade core continuity at Golden Saddle. Drilling, relogging, and assaying unsampled core initiatives seek to further demonstrate the presence of multiple parallel mineralized zones that remain open along strike and at depth, supporting the ongoing potential for the significant resource growth of the uniquely high-grade Golden Saddle Deposit.

Of significance is the fact that the footwall and the Main Zone are the same grade. The drill was targeting the high-grade footwall breccia that sits below the Main Zone about 100 meters away. The drill hole successfully infilled pierce points separated by a few hundred meters of spacing, and it did so at a relatively shallow depth.

The results from the Main Zone — 6.89 g/t over 50.2m — will effectively increase the grade of a future updated resource estimate. It stretches what is already a high-grade zone even wider.

The results from the Footwall Zone — 6.89 g/t over 2.8m — will also increase the grade and add ounces to the open-pit resource.

As for the hanging wall, the results support the theory that White Gold needs to go back and sample/ assay the historical drill holes. Doing so will likely reconfigure the pit shells and increase the grade. Material now classified as low-grade or waste rock may be converted into ore, this improving the economics of the pit.

We are waiting for two more holes from Golden Saddle and two from the Arc Zone. At Golden Saddle, the holes will infill two previously drilled holes spaced 300 meters apart. The footwall breccias seem to be a bit wider, which could translate into a bigger composite.

At Arc, the holes are testing the down-dip plunge of the existing mineralization. The geology at Arc between all three drill holes looks consistent, which is encouraging.

Right now, the zone runs for 1.5 kilometers, but it hasn’t been tested below 100 meters depth. The first two drill holes are the first step to take a step down and test if the gold mineralization continues along plunge. If that’s the case, then you have 1.5 kilometers of trend that need more of those same step-down holes. According to Langille, that would potentially double Arc’s resource from the current 350,000 ounces, if the estimated 7,000 meters of drilling required is carried out next year.

A very do-able goal considering that White Gold just completed a $23 million private placement.

Conclusion

It’s not very often that a junior resource company builds a new release around just one hole, but in White Gold’s case it makes perfect sense, because the company has executed its plan to a T.

White Gold’s technical team is led by VP Exploration Dylan Langille. Langille has a decade of experience in mineral exploration, with a proven track record in gold discovery and project advancement across Canada’s most prolific gold camps. Most recently, he was part of the core discovery team at the Great Bear Project in Red Lake, Ontario with Great Bear Resources.

Langille says he got excited by the White Gold Project when he realized that the foundational 2.3 million ounces had a lot of expansion potential. Over the years WGO had been marketing the deposit as being open along strike and at depth, but not much expansion drilling had been done.

“That became my strategy along with CEO David D’Onofrio and the team, to say, ‘We really need to get back to drilling Golden Saddle, we need to take this thing off the shelf, we need to dust it off, we need to show its potential,’” Langille told me.

The plan was to test three targets with each of three holes: the Golden Saddle Main Zone, the Footwall Zone underneath it, and the Hanging Wall Zone above the Main Zone.

Hole WHTGS25D0218A not only returned high-grade gold mineralization of 6.89 grams per tonne, but it did so consistently over 53 of 56 meters, traveling through all three zones. An outstanding hole in my judgment and one that confirms the model Langille is working from.

He thinks there could be multiple high-grade zones within the known mineralized footprint.

“There’s 200 meters between drill holes at depth that just skirted the highest-grade portion of the deposit I believe, so I think there’s some serious potential to expand that high-grade zone at depth.”

Indeed, Golden Saddle offers multiple opportunities to add ounces: sampling the un-assayed drill holes from the Hanging Wall Zone; stitching the Footwall Zone together through infill drilling; and expanding the deposit at depth.

There is also some really good potential at the Arc deposit.

While it currently has about 350,000 oz, Arc has only been drilled down to about 100 meters; only ~7,000 meters of drilling has been done with holes broadly spaced 125m apart. Another 7,000 meters could double the ounce count through infill drilling along strike, and drilling down plunge to a depth of at least 200 meters.

The first two drill holes are the first step to test if the gold mineralization continues beyond 100m.

Five drill holes into two of the four deposits isn’t going to double or triple the resource, but the results — if the remaining four holes deliver assays as successful as the first hole — are setting White Gold up for a larger and very important drill program next year. And they have a considerable treasury at Cdn$23,000,000.00.

Also realize that the other two deposits, Ryan’s Surprise and VG, while they already have ~300,000 ounces each, are limited because of a lack of drilling.

So far, the drilling has shown that these deposits are open, so there’s plenty of targets and room for expansion, giving White Gold yet more opportunities to increase the ounce count in a new resource, along with publication of the upcoming PEA in 2026.

White Gold Corp.

TSX-V:WGO, OTCQX:WHGOF, FRA:29W

2025.11.05 Share Price: Cdn$0.89

Shares Outstanding: 197.6m

Market Cap: Cdn$196.3m

WGO website

Richard (Rick) Mills

aheadoftheherd.com

Richard does not own shares of White Gold Corp. (TSX-V:WGO). WGO is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of WGO

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE