Rick Mills – “What, and Who, Caused the Inflation the Fed is Currently Fighting?

The weaker labor market and rising unemployment rate, which hit 4.1% in June, is fodder for the US Federal Reserve to slash interest rates, possibly once in September and a second time in December.

In remarks to Congress, Fed Chair Jerome Powell said the US is “no longer an overheated economy” with a job market that has “cooled considerably” and is back where it was before the pandemic, suggesting the potential for rate cuts is becoming stronger. (Reuters, July 9, 2024)

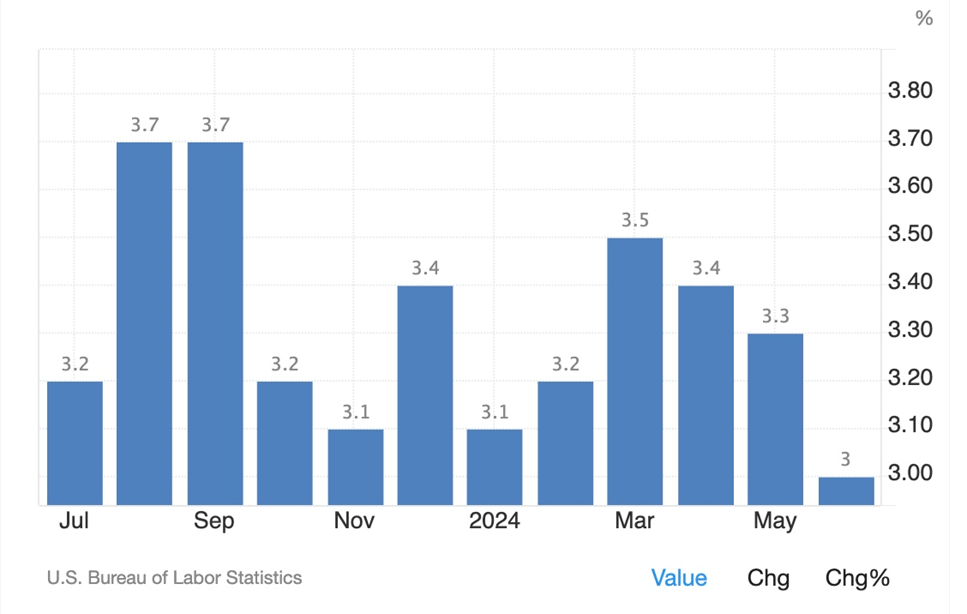

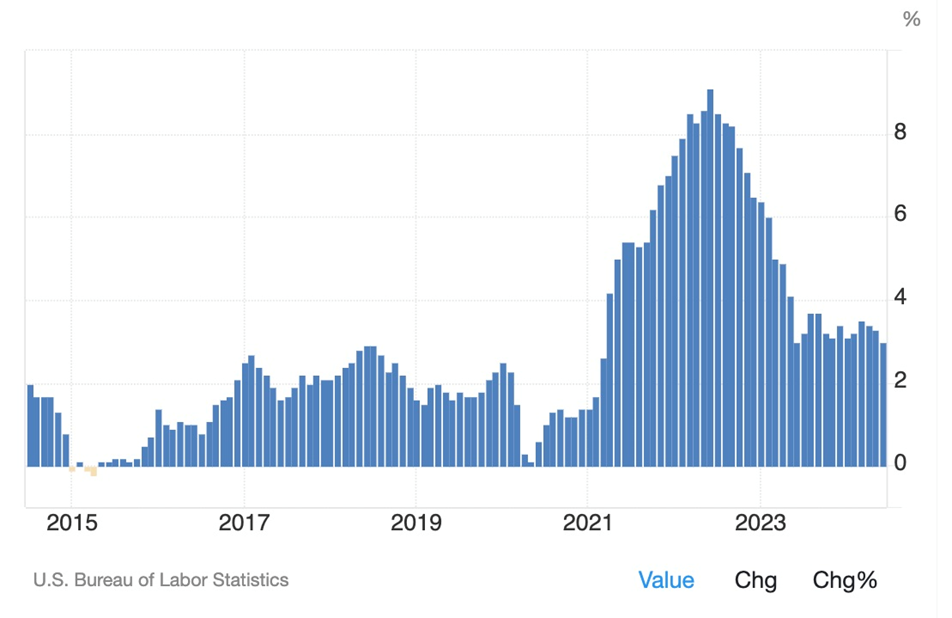

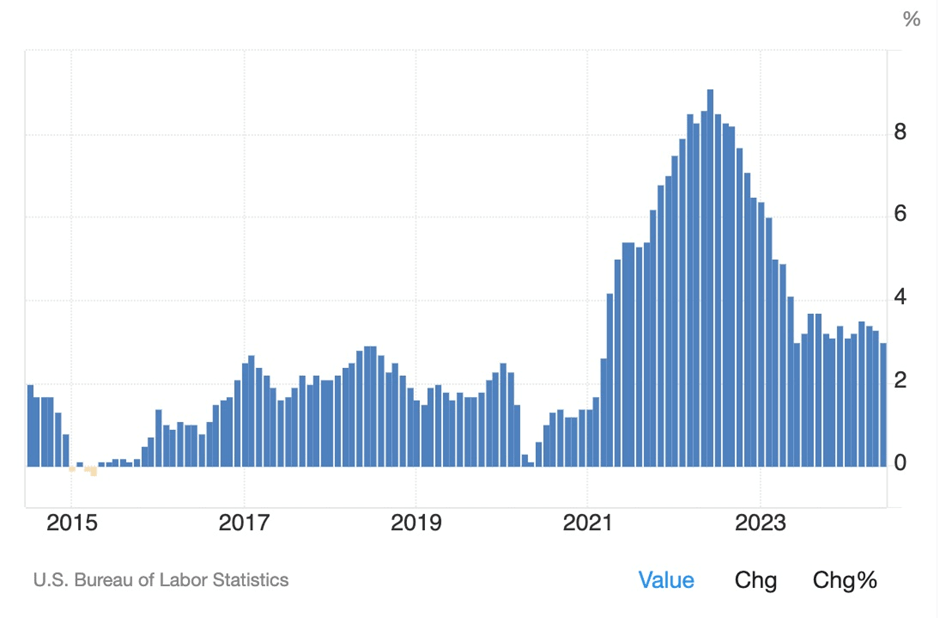

Powell told senators that inflation has been improving in recent months. The chart below shows the annual inflation rate slowed to 3.0% in June, compared to 3.3% in May and 3.4% in April.

US inflation (CPI). Source: Trading Economics

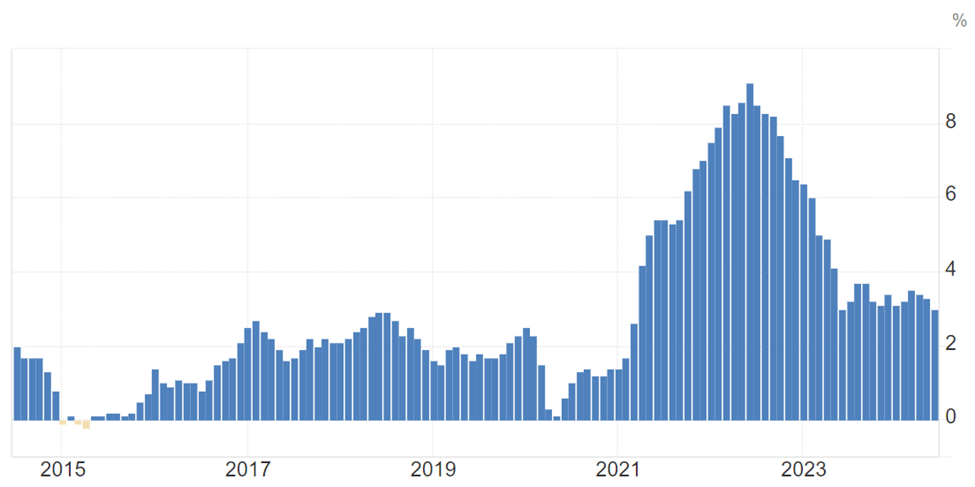

The Fed deserves credit for taming the inflation dragon, which was roaring at 9.1%, the highest in 41 years, in June 2022. Its target rate is 2%, the Goldilocks zone of “not too hot, not too cold,” when the economy is growing, but not by enough to cause widespread price increases, i.e. inflation.

A 10-year chart shows inflation stayed within 2-3% for five years before the pandemic began in March 2020. The economic slowdown as a result of the global health crisis pushed inflation down to 0.1% in May 2020, before slowing starting to climb following the lifting of lockdown measures. Between June 2020 and June 2022, inflation went from 0.6% to 9%, a 15-fold increase.

To fight it, the Federal Reserve raised interest rates 11 times, a cumulative 5% increase in the federal funds rate. The last time the Fed hiked interest rates was July 2023; since then, the rate increases have been on hold as inflation continues to fall.

So there you have inflation’s pattern, the way it has behaved over the past decade. Most of us have felt it in one way or another: prices of gas, groceries, restaurant meals, car insurance, rent, etc., are all way up.

But what causes inflation? Most economists say a combination of factors, but a little research by us at AOTH reveals that inflation is more about one factor than any other: government spending.

It’s not the explanation you’ll hear from the central banks, which arguably, are in cahoots with governments when it comes to fiscal discipline — despite their alleged independence.

Take this, from the Central Bank of Canada:

How global forces sparked high inflation

At the beginning of the COVID‑19 pandemic, prices for commodities like oil, natural gas and lumber plummeted. Because the economy was shut down, people had fewer opportunities to eat out or travel, so demand shifted suddenly from services to goods. But pandemic shutdowns also affected important pieces of the global supply chain, such as factories and ports. This meant that supply couldn’t keep up with all the extra demand for goods. As a result, prices surged.

When economies reopened, prices for these commodities spiked suddenly. And because these commodities feed into so many other products and services, the ripple effect on other prices was widespread. Then Russia’s invasion of Ukraine made prices surge even more.

In a nutshell, the following global forces combined to create a perfect storm:

- a spike in commodity prices

- a surge in the global demand for goods

- impaired supply chains

Undoubtedly, supply chain disruptions were part of the great post-pandemic price increases; we can’t deny it.

But they aren’t as important as people think. The real culprit is government spending, and we can prove it in three charts.

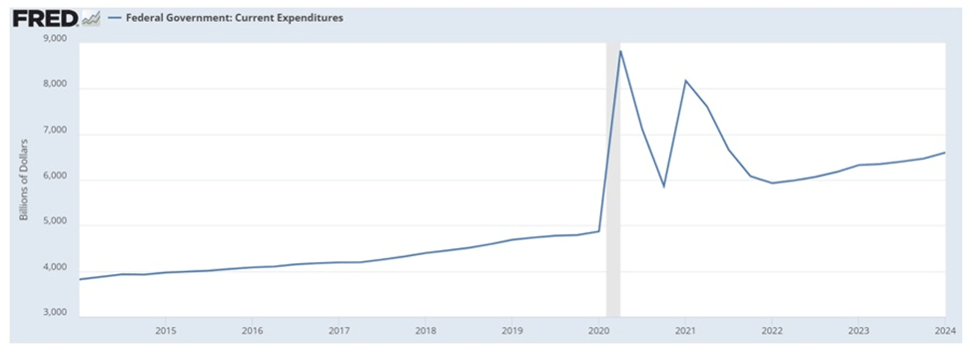

Government Expenditures

10-year US inflation. Source: Trading Economics

It gets very interesting when we look at the above charts, one thing becomes immediately obvious and that’s which administration, Trump’s or Biden’s, is responsible for the current bout of inflation. Which president, Trump or Biden, was the bigger spender? Spoiler alert: it’s not the guy who just dropped out of the race.

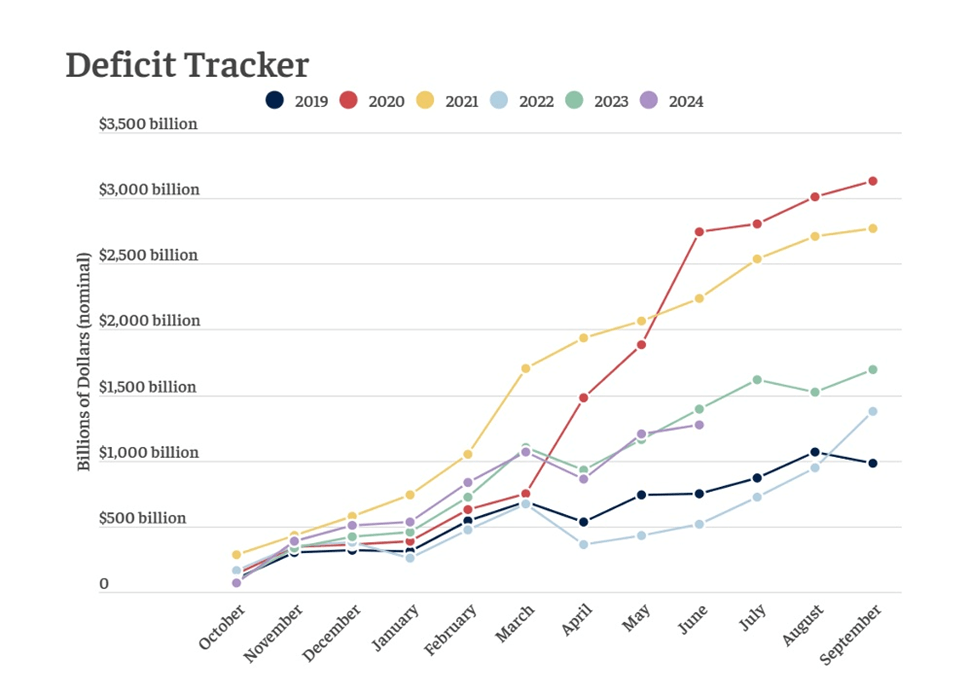

The charts track Government expenditures, deficits and inflation.

We are most interested in the last year of Donald Trump’s presidency, and the first year of Joe Biden’s presidency. Donald Trump’s tenure as the 45th president of the United States began with his inauguration on Jan. 20, 2017, and ended on Jan. 19, 2021. Number 46, President Biden, was inaugurated on Jan. 20, 2021.

As Investopedia notes, “Budgets and deficits stand for the first year (of a new President’s administration – Rick) because the federal fiscal year runs from Oct. 1 to Sept. 30. This makes it impossible for the incoming president to influence whether the budget has a deficit from January, when they take office, through the remainder of the fiscal year.”

Notice when the US Government expenditures start to climb, notice when US inflation rate jumps, look at the Budget Deficits, look at 2020 and 2021 on all three charts.

That’s President Trump’s responsibility.

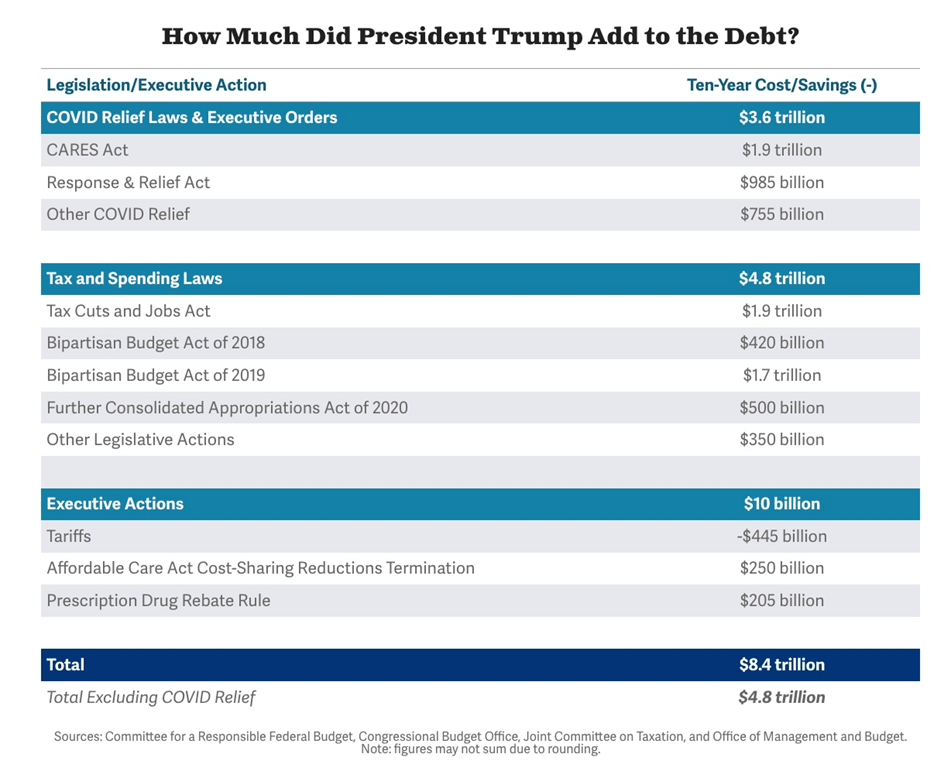

According to the Committee for a Responsible Federal Budget (CRFB), Trump added over $8 trillion of new 10-year borrowing, much of it in the last year of his admin, and the first of Biden’s.

Throughout Trump’s four years in office, the debt rose from $19.95 trillion to $27.75T — an increase of 39%. (Biden continued what Trump started — a rapid escalation of the debt, currently sitting at $34.5T)

Which US presidential candidate does gold prefer?

The CRFB evaluated the 10-year debt impact of the laws and executive orders Trump signed. It found that $3.6T came from covid relief laws and executive orders, $2.5T came from tax cut laws, and $2.3T from spending increases, leaving a total of $8.4 trillion.

Source: CRFB

An article by ProPublica notes that Trump’s addition to the national debt amounts to ~$23,000 in new federal debt for every American.

It goes on to say that the growth in the annual deficit under Trump ranks as the third-biggest increase of any US presidential administration. The only presidents that ran bigger deficits were George W. Bush and Abraham Lincoln. And while Trump had covid to deal with, he didn’t launch two foreign wars as GWB did, or have to pay for a civil war like Lincoln.

The huge expansion of government spending ,debt, deficits and inflation under Trump happened despite the real estate tycoon saying that he would do the opposite.

In a March 31, 2016 interview with Bob Woodward and Robert Costa of The Washington Post, Trump said he could pay down the national debt, then about $19T, in eight years by renegotiating trade deals and spurring economic growth. On July 27, 2018, he told Sean Hannity of Fox News, “We have $21 trillion in debt. When this [2017 tax cut] really kicks in, we’ll start paying off the debt like it’s water.”

But that’s not how it played out. As ProPublica reports, when Trump took office in January 2017, the non-partisan Congressional Budget Office (CBO) projected that federal budget deficits would be 2-3% of GDP during Trump’s term. Instead, the deficit reached nearly 4% of GDP in 2018 and 4.6% in 2019.

The sharp reduction in the corporate tax rate to 21% from 35% eliminated a large chunk of federal revenue. The CBO in 2018 estimated that the tax cuts would increase deficits by about $1.9T over 11 years.

Trump’s claim that this would be offset by tariff increases also didn’t pan out. ProPublica reports that tariffs in fiscal 2019 netted about $71 billion. The $36 billion increase from Obama’s last year in office amounted to less than 1/750th of the national debt.

And now the rubber meets the road. Who is responsible for inflation, Trump or Biden?

Remember that “Budgets and deficits stand for the first year because the federal fiscal year runs from Oct. 1 to Sept. 30. This makes it impossible for the incoming president to influence whether the budget has a deficit from January, when they take office, through the remainder of the fiscal year.”

This means Trump was responsible for 2020 and 2021 spending and budget deficits. In October 2020, inflation was at 1.2%. A year later, inflation was at 6.2%. Trump’s fiscal policies more than quintupled prices in one year.

If we take October 2021 as the start of the first fiscal year he was responsible for, Biden is only to blame for a 2.9% rise in inflation (9.1% minus 6.2%).

Inflation has fallen significantly since the Federal Reserve started hiking interest rates. The first hike was in March 2022. It took a few months to take effect, but by July 2022 inflation was down to 8.5%. Ten more rate increases brought inflation down to around 3% where it currently sits.

The inflation reduction has happened despite the rise in federal spending since 2022.

Conclusion

There are many reasons given for inflation — the Canadian central bank names three, a spike in commodity prices, a surge in the global demand for goods, and impaired supply chains — but the one that matters most is, by far, government spending.

Here we have proven that Trump’s heightened spending before and during the pandemic, in combination with tax cuts, led to a substantial increase in spending, annual deficits, the national debt AND a huge jump in inflation.

Trump’s first three years in office weren’t too bad for inflation — it stayed under 3% until covid. Pandemic-related spending plus tax cuts pushed government expenditures from about $5 trillion to $9 trillion. Inflation rose from 1.2% at the end of fiscal 2020, to 6.2% with four months to go in Trump’s presidency.

Donald Trump’s tenure as the 45th president of the United States began with his inauguration on Jan. 20, 2017, and ended on Jan. 19, 2021. Number 46, President Biden, was inaugurated on Jan. 20, 2021.

As Investopedia notes, “Budgets and deficits stand for the first year (of a new President’s administration – Rick) because the federal fiscal year runs from Oct. 1 to Sept. 30. This makes it impossible for the incoming president to influence whether the budget has a deficit from January, when they take office, through the remainder of the fiscal year.”

Truth is, and the charts prove it, Former President Trump, despite his and the GOP’s ceaseless attacks on the Biden admin, is responsible for most of the inflation the Biden/Harris admin can now claim to have beaten.

LEGAL NOTICE / DISCLAIMER

AHEAD OF THE HERD NEWSLETTER, AHEADOFTHEHERD.COM, HEREAFTER KNOWN AS AOTH.

PLEASE READ THE ENTIRE DISCLAIMER CAREFULLY BEFORE YOU USE THIS WEBSITE OR READ THE NEWSLETTER. IF YOU DO NOT AGREE TO ALL THE AOTH/RICHARD MILLS DISCLAIMER, DO NOT ACCESS/READ THIS WEBSITE/NEWSLETTER/ARTICLE, OR ANY OF ITS PAGES. BY READING/USING THIS AOTH/RICHARD MILLS WEBSITE/NEWSLETTER/ARTICLE, AND WHETHER YOU ACTUALLY READ THIS DISCLAIMER, YOU ARE DEEMED TO HAVE ACCEPTED IT.

MORE or "UNCATEGORIZED"

SAGA Metals Reports Assay Intercepts Including 52.05% Fe₂O₃, 7.21% TiO₂, 0.375% V₂O₅ from 2026 Drilling at Trapper South, Radar Critical Minerals Project in Labrador

SAGA Metals Corp. (TSX-V: SAGA) (OTCQB: SAGMF) (FSE: 20H), a North American exploration company focu... READ MORE

Vior Gold Corporation Announces District Scale Projects Acquisition

VIOR GOLD CORPORATION INC. (TSX-V: VIO) (OTCQB: VIORF) (FRA: VL5) is pleased to announce that, on Ma... READ MORE

USA Rare Earth to Acquire Texas Mineral Resources Corporation

USA Rare Earth, Inc. (Nasdaq: USAR) and Texas Mineral Resources Corp. (OTCQB: TMRC) today an... READ MORE

Endeavour Reports Strong FY-2025 Results

Endeavour Mining plc (LSE:EDV) (TSX:EDV) (OTCQX:EDVMF) is pleased to announce its operating and fin... READ MORE

Bunker Hill Announces Closing of C$33,752,300 Brokered Life Offering, Concurrent Non-Brokered Private Placement and Warrant Exercise

Bunker Hill Mining Corp. (TSX-V: BNKR) (OTCQB: BHLL), is pleased to announce that it has closed its ... READ MORE