Rick Mills – “We Need China’s Critical Minerals Technology, Not Their Metals”

North America relies heavily on foreign supplies of critical minerals — the raw materials it needs to become a leader in high technology, transportation, energy, and defense. Materials like lithium, graphite and rare earths.

For years, the United States and Canada did not bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, or the DRC. Let whoever has an inexpensive means of production become a source for the West.

China heard opportunity knocking and answered the door, seizing control of almost all rare earth element processing and magnet manufacturing, in the space of about 10 years.

How the US lost the plot on rare earths

In 2010, an international incident sent rare earth oxide prices into the stratosphere. A Japanese naval vessel interdicted a Chinese fishing boat near the Senkaku Islands, of which Japan and China both claim ownership, and detained the captain. In response, the Chinese decided to ban all rare earth exports to Japan, then China’s largest REE customer. The rare earths market panicked, and within months, all the rare earth oxides gained in price.

In 2019, it nearly happened again. As part of its trade war strategy, China raised the prospect of cutting exports of the commodities that are critical to America’s defense, energy electronics and auto sectors.

Suddenly, the once-remote possibility of using critical metals as pawns in the trade war became more likely. But it is more than rare earths. The US is dependent on foreign countries for critical metals used in cell phones, electric vehicles, renewable energies and semiconductors.

On August 1st, China’s commerce department imposed new restrictions requiring exporters to seek a license to ship gallium and germanium compounds. Germanium is used in solar power and fiberoptics, along with military night-vision goggles. Gallium is used make radio frequency chips for mobile phones, satellite communications and semiconductors.

CNBC reports China shipped zero germanium and gallium in August compared to 13 tonnes total in July. The USGS says China was a leading global producer and exporter of germanium in 2022. Last year 98% of the world’s gallium was mined in China.

China cites national security concerns for the restrictions. The more likely explanation is retaliation for the US launching rules last October aimed at cutting off exports of chips and semiconductor tools to China.

It can’t be coincidence that President Biden in August signed a bipartisan bill that, according to CNBC, aims to strengthen U.S. competitiveness with China by investing billions of dollars in domestic semiconductor manufacturing and science research.

The bill, dubbed the Chips and Science Act, includes more than $52 billion for U.S. companies producing computer chips, as well as billions more in tax credits to encourage investment in semiconductor manufacturing.

Once again, China showed the ease with which it can undercut US security of supply, in industries of national importance.

Insecurity of supply

As I’ve stated many times, without a reliable supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over the United States. There is always the possibility of slowed flows or bans on strategic materials, due to politics, acts of aggression/war or trade disputes.

According to the International Energy Agency, the concentration of supply intensified for some critical minerals in 2022 despite US and Europe’s efforts to diversify and reduce reliance on China.

The minerals in question — highlighted by the IEA’s 2023 edition of the Critical Minerals Market Review — include nickel and cobalt, key ingredients in EV batteries whose supply sources are heavily concentrated.

Nearly 70% of the world’s cobalt comes from the Democratic Republic of the Congo, while about a third of nickel production is from Indonesia. China controls most of the processing, establishing itself as the dominant force in the battery metals supply chain.

One way to meet the threat of foreign countries restricting, or embargoing, critical minerals, is to encourage the exploration and mining of these metals in the United States or Canada.

Here at AOTH we have been advocating for the creation of a “mine to magnet” electric vehicle supply chain in North America for years.

We have also recognized the vulnerability of major economies like Canada and the United States to shortages of certain metals that are going to be heavily demanded in the coming decades, far beyond their traditional uses, as nations shift their economies from fossil fuels to renewable energy sources and strive to meet more stringent emissions regulations pertaining to vehicles and industry.

China’s dominance

Included on the US Geological Survey’s list of 35 critical minerals are the building blocks of the new electrified economy, including lithium and graphite. China has a stranglehold on both metals, meaning it can use them as a cudgel in trade talks with the United States, or it could freeze shipments of them during a war.

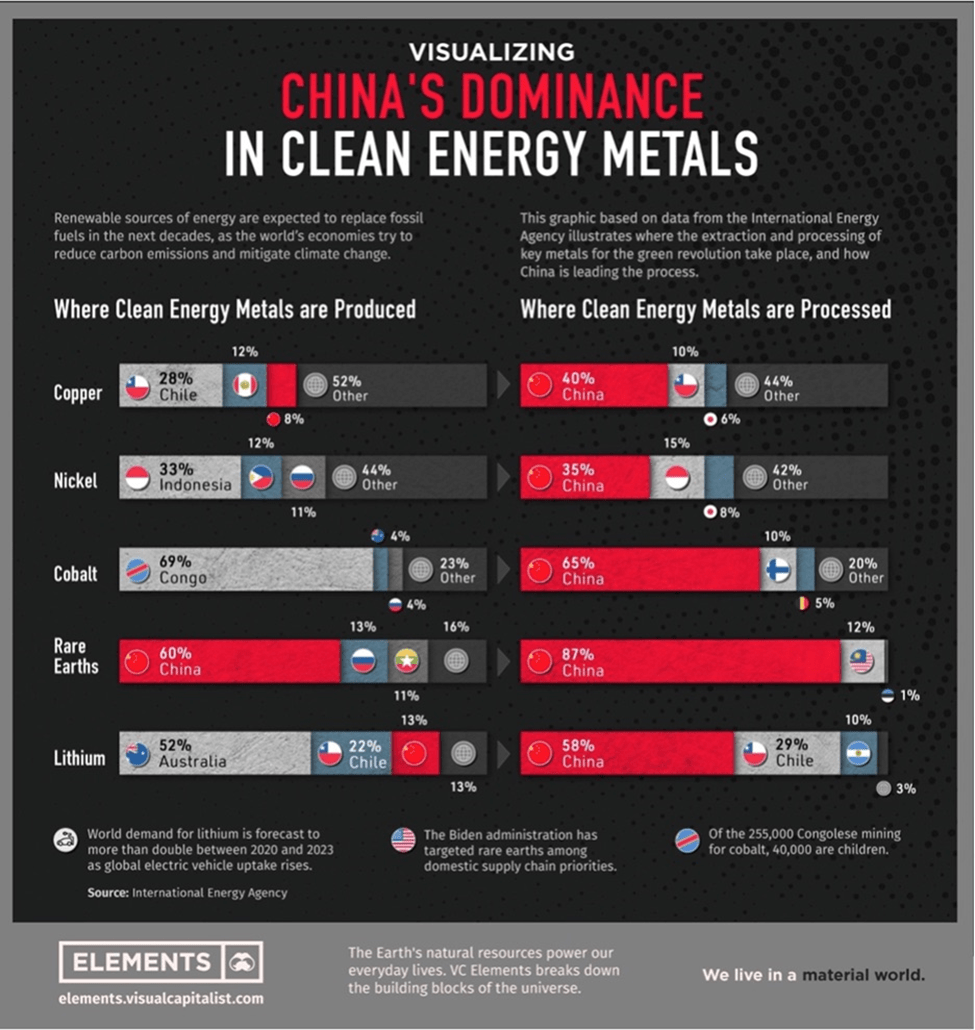

Indeed, when it comes to raw materials for the electric vehicle industry, China is undisputedly the most dominant force on the planet.

Almost every metal used in EV batteries today likely comes from there, either mined or processed. Thanks to its technological prowess in refining, China has established itself as the across-the-board leader in the battery metals processing business (see below).

Source: Visual Capitalist

According to the International Energy Agency, the country accounted for roughly 60% of the world’s lithium chemical supply in 2022, as well as producing three-quarters of all lithium-ion batteries.

It also has a tight grip over the world’s supply of cobalt through its mining operations in the

Democratic Republic of the Congo. Over the next two years, China’s share of cobalt production is expected to reach half of global output, up from 44% at present, according to UK-based cobalt trader Darton Commodities.

The IEA estimates China’s share of refining is around 50-70% for lithium and cobalt, 35% for nickel, and 95% for manganese, despite being directly involved in a small fraction of the mine production.

The nation is also responsible for nearly 90% of rare earth elements, which are essential raw materials for permanent magnets used in wind turbines and EV motors, as well as 100% of graphite, the anode material in EV batteries.

Shedding reliance

In a February 2022 fact sheet, the White House conceded that: “The US is increasingly dependent on foreign sources for many of the processed versions of these minerals. Globally, China controls most of the market for processing and refining cobalt, lithium, rare earths and other critical minerals.”

Speaking to CNBC earlier this year, Special Presidential Coordinator Amos Hochstein called this “a major concern for the US” and for the rest of the world.

“We can’t have a supply chain that is concentrated in any country, doesn’t matter which country that is,” he said. “We have to make sure from the mining and refining process to the building of the batteries and wind turbines that we have a diversified system that we can be well supplied for.”

Mining executives in the US critical minerals space are aware of the market dissonance. “China is leading the way when it comes to lithium — and the rest of the world has not been quick enough to respond to its dominance,” American Lithium CEO Simon Clarke told CNBC back in November.

“For decades, they’ve been locking up some of the best assets across the world and quietly going about their business and developing knowledge on building lithium-ion technology, soup to nuts, and we’ve been very slow to react to that,” he stressed.

One positive development is the Inflation Reduction Act, a landmark piece of climate legislation enacted by the US Congress last year to jumpstart clean energy production.

The IRA represents the single largest investment in climate and energy in American history. The act, which aims to cut 2005 emissions levels in half by 2030, would provide US consumers tax credits of up to $7,500 per electric vehicle, provided the parts and materials are sourced from countries with which Washington has a free trade agreement. This includes Canada and Mexico.

Another recent trend is “friend-shoring”. The idea is for a group of countries with shared values, and at a similar stage of development, to source raw materials and to manufacture goods. The goal is to prevent less like-minded nations from exploiting their comparative advantage, or in some cases, their monopolies, in key raw materials, technologies or products.

First mentioned publicly by Janet Yellen, the US Treasury Secretary, in 2020, the target is clearly China and Russia. The US wants to reduce dependence on authoritarian regimes like China that supply most the world’s rare earths and magnets, and dominate the production of several battery/ electrification metals including copper, zinc, tin, lithium and graphite; and diversify away from Russian suppliers of critical commodities such as energy, food and fertilizer. In some cases, like semiconductors, the goal is to divvy up supply between friendly nations. For example the US has begun engaging with South Korea to diversify chip production away from Taiwan, which is its no. 1 supplier but faces a security threat from China.

Friend-shoring isn’t just theoretical; the term made its way into a 250-page report released by the Biden administration in 2022, titled ‘Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth’.

Friend-shoring sounds good, but how beneficial would it be? An AOTH analysis found that friend-shoring’s negatives outnumber its positives.

‘Friend-shoring’ threatens Western metal supplies

Economists argue that picking trade partners for geopolitical reasons could create a world of antagonistic blocks, similar to George Orwell’s imaginary world in ‘1984’, or the Cold War. As the Wall Street Journal maintains, the global economy could split into two hostile camps, the United States and China, thus hurting growth and accelerating inflation.

The down sides haven’t stopped Western nations from taking steps to synchronize trade practices on critical minerals.

Earlier this year, the United States signed a cooperation agreement with Japan covering various minerals for electric car batteries. The US and its Asian ally will refrain from imposing export duties on lithium, cobalt, manganese, nickel and graphite.

Washington is also close to striking a similar deal with the European Union, according to reports. A draft of the agreement currently lists five minerals — cobalt, graphite, lithium, manganese and nickel, mirroring that of the US-Japan deal.

The motive behind the United States trade strategy is well-documented — to shed its dependence on China while loosening the grip its main rival has on the global supply chain of critical minerals.

Minerals Security Partnership

An example of friend-shoring put into practice is the Minerals Security Partnership (MSP), formed last year a sort of “metallic NATO”. Members include the United States, Canada, Australia, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom and the European Commission.

Theoretically open to all countries that are committed to “responsible critical mineral supply chains to support economic prosperity and climate objectives,” the MSP aims to help “catalyze investment from governments and the private sector for strategic opportunities … that adhere to the highest environmental, social, and governance standards,” reads a statement from the US State Department.

(Curiously, when the MSP was first convened in September, 2022, additional countries in attendance included Argentina, Brazil, the Democratic Republic of the Congo, Mongolia, Mozambique, Namibia, Tanzania, and Zambia.

The DRC? The Congo’s staggering economic potential — it contains 5% of the world’s copper and 50% of its cobalt — is matched only by its poverty and corrupt mismanagement.

The country ranks near the bottom of the UN Human Development Index (HDI), an annual assessment of human well-being. Countries at the bottom of the list suffer from inadequate incomes, limited schooling opportunities and low life expectancy rates due to preventable diseases such as malaria and AIDS.

Another example of friend-shoring is the section of the Inflation Reduction Act relating to electric vehicles. A system of tax credits applies to vehicles made in North America. The act also requires that a vehicle’s battery include a percentage of critical minerals procured from countries the US has a trade agreement with, such as Canada.

Working at cross-purposes

Despite friend-shoring, “on-shoring” (the idea of bringing production home to reduce supply chain disruptions and to repatriate US jobs), bilateral trade agreements, and other measures (e.g., the IRA) to shed US reliance on foreign metal supplies, some politicians are advocating precisely the opposite.

I was shocked to read an article on Bloomberg titled ‘US Says It Can’t Cut China Out of Critical-Minerals Supply Chain’. Jose Fernandez, the US under-secretary for economic growth and the environment, is heavily quoted in the Sept. 22 piece, saying that the United States won’t be able to cut China out of the critical minerals supply chain, even as Washington seeks to diversify its sources.

“This is not about China,” Fernandez, who (ironically) leads the Minerals Security Partnership, told a briefing in New York. “We are perfectly happy to work with them on this and right now we purchase many of the minerals from Chinese companies. It’s about diversifying.”

He went even further, stating that, “The world needs them to be involved — the broader picture is climate change, and we’re not going to solve the climate crisis without the involvement of the PRC.”

So let me get this straight. A top Biden official heads up the initiative to work closer with US allies to reduce their dependency on China for critical minerals, yet the same official believes that the United States needs China to solve climate change and is “happy to work with them.”

There are so many things wrong with this view, it’s hard to know where to begin. Let’s start with the fact that the United States doesn’t buy many minerals from Chinese companies; rather, it purchases the metal end products that China processes, such as magnets made from rare earth oxides, graphite anodes, lithium carbonate or hydroxide batteries, and nickel-sulfate batteries.

China, as mentioned, has established itself as the across-the-board leader in the battery metals processing business. Graphite is a good example. In 2022, 96% of the world’s anodes were made in China because the United States doesn’t have the technology and has yet to open a graphite mine.

Next is the idea that the United States needs China and can’t go it alone in developing an electric vehicle supply chain. In fact, the US has plenty of minerals needed to make batteries used in EVs and energy storage. For example, the country has a million tonnes of lithium and 69,000 tonnes of cobalt, in reserves, according to the USGS. The country’s largest undeveloped graphite deposit is located near Nome, Alaska.

It was recently reported that a group of US geologists found what they believe to be the world’s largest lithium reservoir, inside an ancient volcano located along the Nevada-Oregon border. A study in the journal ‘Science Advances’ estimates the McDermitt Caldera hosts claystones containing 20-40 million tonnes of lithium — more than Bolivia’s salt flats, the world’s largest untapped lithium resource.

Surely, additional minerals could be found if the current residents of the White House were more open to mining. The Biden administration started off appearing to support the extractive industry, as it developed policies around climate action, but their position changed. There are no plans to prioritize exploration and the streamlining/ fast-tracking of permits to expedite mine-building. Instead, the focus is on manufacturing plants.

Rather than allowing more mines, Biden’s team wants to create jobs that process minerals domestically into electric vehicle battery parts. Such a plan would help cut US reliance on China for EV materials while also enticing unions with manufacturing work — even though the US does not (yet) possess such technology.

‘Not hard to dig a hole’, anti-mining Democrats say

Meanwhile the government has rejected or slowed large new mining projects, including Antofagasta’s proposed Twin Metals copper-nickel mine in Minnesota, Northern Dynasty’s Pebble copper-gold project in Alaska, and Rio Tinto’s Resolution copper mine in Arizona.

Notwithstanding the latter’s ability to supply the United States with 25% of its copper needs, the federal government in 2021 rescinded the approved environmental impact statement and ordered a review of an already approved deal by Congress allowing Rio Tinto ownership of the land, Australian Financial Review reported.

My third criticism of Mr. Fernandez is how dangerous it is to rely on others. For clarity on this, just ask the US military.

US rockets launched into space are powered by Russian engines. Yes, you read that right. Our Cold War enemy, which ironically started the space race with the 1957 launch of Sputnik, all use RD-180 engines made by NPO Energomash, a Russian state-owned company.

Magnets made from Chinese rare earths are used in the Joint Strike Fighter, the Pentagon’s answer to a one-size-fits-all warplane.

According to the US Army, Rare-earth elements have become the new oil, playing a major role in the technological advancements made in the last 50 years. Everything from GPS navigation capability, cell phones, fiber optics, computers, automobiles and missiles relies heavily on rare-earth elements for development and production. For example, according to a 2013 report from the Congressional Research Service, each F-35 Lightning II aircraft requires 920 pounds of rare-earth materials. Rare earths, including yttrium and terbium, are used for laser targeting and weapons in combat vehicles…

According to the U.S. Government Accountability Office, it would take 15 years to overhaul the defense supply chain, meaning that any changes to it need considerable lead time.

Yet rather than taking steps to increase domestic mining of critical minerals, those in power seem intent on perpetuating dependence, even if it means switching allegiance to countries other than China.

For example Vietnam, which has the world’s second-largest REE deposits, is planning on re-starting its largest rare earths mine, Dong Pao. Reuters recently reported that Australia’s Blackstone is eyeing a $100 million investment in the mine and that Blackstone’s partner VTRE is planning a factory with South Korea’s Setopia.

The article says VTRE hopes to win a concession allowing it to extract about 10,000 tonnes a year of rare-earth oxides, which is around a third of its expected output. This puts Dong Pao’s production just below California’s Mountain Pass mine, which in 2022 produced 22,000 tonnes of REO equivalent.

While it is unclear whether the restart involves US investors, it seems likely. As Reuters states, The U.S. agreed during Biden’s visit to help Vietnam better map its rare-earth resources and “attract quality investment”, according to a White House fact sheet, a move that could encourage U.S. investors to bid for Vietnam’s new concessions.

Is getting its processed rare earths in Vietnam any better than having them shipped from China? Let’s not forget this is a country the United States fought a war over and lost. Can Vietnam’s government be trusted as a reliable supplier? I have my doubts.

As a miner in a foreign country, you never know if you’re going to wake up to the mine being expropriated, or you’ve been tapped for 51% ownership, or your taxes on profits suddenly went up to 22%.

As for the US government, look no further than these next two examples of hypocrisy — touting so-called green technologies, yet at the same time working with foreign governments who care little for the environment, labor laws, or reducing inequality.

In late 2022, during the US-Africa Leaders Summit in Washington, the United States signed a memorandum of understanding with the Democratic Republic of the Congo and Zambia for developing “an integrated value chain for the production of EV batteries.” According to the Carnegie Endowment for International Peace, This MOU is in line with the African Green Minerals strategy put forward by the African Development Bank.

Does anyone really believe that the DRC, which has been described as “the rape capital of the world,” and is a known source of “conflict gold”, will adhere to such a strategy, beyond lip service?

Mozambique was the world’s second-largest producer of graphite in 2022, accounting for 14% of production. Australia’s Syrah Resources opened its Balama mine there in 2018.

Most of the country’s graphite is in Cabo Delgado, a northern province that has been wracked by political violence. According to S&P Global, militia attacks in the region forced mine shut-downs at Balama, with only 72,000 tonnes of production achieved in 2021, compared to 100,000t in 2018 and 153,000t in 2019.

African sources of graphite, uranium tainted by conflict

Despite the instability, Mozambique was one of five African countries invited by the United States last year to the new Minerals Security Partnership. As mentioned, the MSP was formed to try and reduce China’s influence on US imports of critical minerals, including graphite, a component used in electric vehicle battery anodes.

In fact the US Department of Energy went further, providing Syrah Resources with a USD$107 million loan to build a graphite processing facility in Vidalia, Louisiana, and then later, a $220 million grant enabling it to expand the facility four-fold.

Again, look at the hypocrisy. Here’s the US government throwing its support behind everything clean and green, ESG and all that, yet it’s okay working with some of the worst nations in the world when it comes to human rights, poverty and the environment.

Ford-CATL template

Fortunately, there is a way for the US to reduce critical minerals dependency on China, or other countries, while remaining open to receiving their technologies. The template is the recent agreement between Ford and CATL, the world’s manufacturer of lithium-ion batteries.

In February of this year, Ford Motor Company announced a plan to work with Contemporary Amperex Technology Co. Ltd. to build an EV battery factory in Michigan.

Unlike a typical joint venture, Ford will retain 100% ownership in the plan and license the lithium ferrous phosphate (LFP) battery technology from CATL. According to the Council on Foreign Relations, This unconventional equity structure could make Ford eligible to receive benefits from the Biden administration’s Inflation Reduction Act, which promises U.S. automakers federal subsidies in exchange for domestic production of EV batteries.

The deal is a win-win for Ford. The automaker gets to license the technology it needs to make LFP batteries, a cheaper alternative to nickel-manganese-cobalt (NMC) batteries, and it retains full control over the $3.5 billion manufacturing plant. The deal also stands to catapult Ford’s EV ambitions — as Bloomberg notes, it is second only to non-unionized Tesla by EV sales in the US.

The batteries would be installed in the F-150 Lightning pickup truck and the Mustang Mach-E.

Despite the advantages for Ford and CATL — the state-owned company would collect fees and other royalties — the agreement is a lightning rod for criticism, particularly among Republicans.

It was recently reported that Ford announced a pause in building the factory, as Congressional Republicans investigate Ford’s connections with CATL.

“We’re pausing work, and we’re going to limit spending on construction at Marshall until we’re confident about our ability to competitively run the plant,” Ford spokesman T.R. Reid told The Detroit News, Monday.

The reasons for the interruption are unclear (one could be the ongoing UAW strike), however to us at AOTH, it’s just political theater. The Ford-CATL deal is another example of US partisan politics. If the Democrats like something, the Republicans must oppose it. Many GOP members are anti-EV and anti climate change.

Former US Ambassadors Peter Hoekstra and Joseph Cella, co-founders of the Michigan-China Economic and Security Review Group, were quoted by Fox News as saying:

“We applaud that the construction of this reckless deal has been halted.

“From the outset, Ford Motor Company, the State of Michigan, the Michigan Economic Development Corporation and all other parties to it have been irresponsible in advancing this deal.”

They continued:

“There was zero strict scrutiny or due diligence, concerns of our intelligence and national security agencies were ignored and mocked.

“The halting of the construction is the natural result of the consent of the governed being ruptured by government and business elites. With citizen activists, we are not relenting or letting our guard down. We will keep fighting against the Ford-CATL and Gotion deals until they are no more.”

While the deal raises eyebrows among some quarters, arguably it should be supported and replicated. Why? Because the United States needs Chinese battery technology. This isn’t another Huawei; they’re not stealing our technology, we’re licensing theirs.

In this way it’s no different from Tesla installing Panasonic battery packs in their electric vehicles. Is anyone surprised that the Japanese company employs 200 technicians at Tesla’s Nevada gigafactory and 3,000 American workers? Unlike most companies, Tesla views production as more important than R&D because they don’t know how to make their products without Japanese technology! It’s the same with CATL and Ford.

Speaking of Tesla, it should be pointed out that CATL also supplies batteries to the top-selling US EV brand. The two companies have agreed to produce lithium-ion batteries together at Tesla’s Shanghai battery factory. CATL has also unveiled an EV battery it claims has a range of over 1,000 kilometers from a single charge.

The 18650-type Tesla battery which powers the Model S and the Model X, and the 2170-type that runs the Model 3 and the Model Y, are both supplied by Panasonic. Tesla’s prismatic battery, which has lithium-iron-phosphate chemistry, is being supplied by CATL and is slated for all future Model 3s and Model Ys.

For an understanding of why CATL’s new batteries for Tesla will “kill the competition”, watch this 18-minute video.

Conclusion

In inking a battery deal with CATL, Ford’s timing is excellent.

Billions of dollars are being poured into domestic auto manufacturing, with almost $40 billion committed to new-car factories last year.

Yet some fear there will be a shortage of powerpacks in the US and that has some companies, like Tesla and Ford, turning to China. Bloomberg states, as money is being poured in, manufacturing is becoming more expensive because raw material prices are up and a scarcity of metals key to batteries, like cobalt and lithium, looms. Barriers to entry are rising.

It isn’t just about rising costs and prices. The growing financial burden of this transition needs hefty policy support. The IRA, for instance, is focused on easing some of these issues, providing subsidies to manufacturers and buyers to accelerate production and EV adoption. However, it also comes with caveats directed toward cutting out China-sourced or processed materials over the next five years, even though analysts have said this will raise costs. It has complicated companies’ plans and added layers of complexity.

What’s more, US lawmakers aren’t making partnerships like CATL’s with Ford — necessary for mass EV adoption, commercially viable manufacturing and the energy transition — any easier. Last month, a ranking member of the House Science, Space and Technology Committee hit out at the US Energy Department over a $20 million award to Texas-based Microvast Holdings Inc. to build factories in the US because it has a significant chunk of assets and revenue in China.

The more recent example is Ford announcing a pause in building its Michigan factory, as Congressional Republicans investigate Ford’s connections with CATL.

Working with Chinese companies may be uncomfortable to some, but the way I see it, we can’t cut China out completely.

Consider: China has spent the last 20 years building their EV supply chain and the technology to support it. One of the results was China manufactured 96% of all electric vehicle battery anodes in 2022. The US has zero commercial production of anodes as the technology used to do it lies in China.

The world’s greatest R&D country in the world has been sidelined by China in the technology of mineral processing. It’s high time we acknowledged this fact and did something about it.

The answer is not to close the door on China but to work with them on the mineral processing side. Not the mining — as I’ve stressed, we or our allies have the minerals, all we need to do is have the government make mining them a priority.

Processing them is different. For two decades we were asleep at the switch. We didn’t notice when the United States ceded its permanent magnet technology to the Chinese, we could care less when China gobbled up cobalt mines in the DRC and created a monopoly on processing the rare mineral. Ditto for lithium, graphite, rare earths, copper, the list goes on.

We’re so far behind, we have little choice but to cooperate with China through deals like Ford-CATL. Remember, China is not coming to steal our technology, we’re reverse-engineering it — licensing the technology so we can carry out the mineral processing ourselves. There’s a huge difference.

Some concluding remarks are providing by Bloomberg, which frames the Ford-CATL as an economic necessity:

The coming together of these industrial giants to make the EV dream a reality stands in sharp contrast to the prevailing political rhetoric and the goals of the Inflation Reduction Act that seek to cut dependence on China as the US builds out domestic supply chains. So much for the much-hyped economic decoupling: Globally interdependent supply chains, technology and investments cannot just be severed to find greener pasture elsewhere. Firms like CATL and Ford will have to team up to leverage areas of expertise that are also of crucial industrial importance to make their profits a reality.

At AOTH we care more about finding a way to get batteries built in the US than politics. I’m seeing the Ford-CATL deal as a promising path forward and a template that could be used elsewhere.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

Bonterra Announces Closing of Upsized Brokered Private Placement for Proceeds of $10.5M

Bonterra Resources Inc. (TSX-V: BTR) (OTCQX: BONXF) (FSE: 9BR2) i... READ MORE

ESGold Expands Montauban Mine Building to 4,000 sq. ft. Ahead of Key Operational Milestones

Increased facility footprint reflects advanced construction progr... READ MORE

ARIS MINING COMPLETES INSTALLATION AND COMMISSIONING OF SECOND MILL AT SEGOVIA, ON TIME AND ON BUDGET

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces the... READ MORE

Zodiac Gold Expands Arthington Discovery with Broad Gold Intercepts

Zodiac Gold Inc. (TSXV: ZAU) a West-African gold exploration co... READ MORE

Appia Announces Final Closing of Its Non-Brokered Private Placement

Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQB: APAAF) (... READ MORE