Rick Mills – “US Manufacturing Might is Being Replaced by China”

As the old Chinese saying goes, “When the winds of change blow, some build walls while others build windmills.”

The nation building walls is of course the United States under Trump’s radically protectionist tariff policy. China is doing everything that the US isn’t right now — expanding its manufacturing base while inviting foreign investment into the country.

The end result is that China is ascending and the United States is descending. It’s a trend that could continue for years, if not decades.

Trump slump

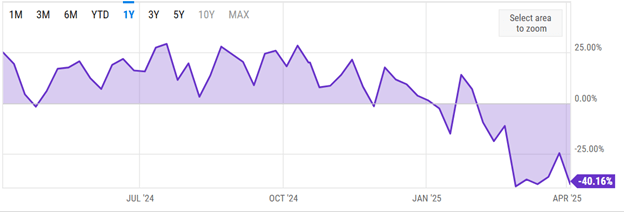

Donald Trump’s erratic, aggressive economic policies have created uncertainty in the markets. The “Trump bump” that occurred following his election in November has been replaced by a “Trump slump”, with many predicting a recession within the first half of the year.

As investors know, the stock market hates uncertainty. Trump immediately started his second term by threatening tariffs on both friends (Canada, Mexico, Europe) and foes (China). A lot of traders didn’t take the threats seriously and the S&P 500 continued to perform at high levels, reaching a one-year peak of 6,144 on Feb. 19.

The once-booming S&P 500 has erased all its gains and is now trading at levels before Trump was re-elected. On April 3rd the S&P 500 finished at 5,372 compared to 5,823 on Oct. 28. The DXY is falling out of bed and yields look to be heading into the threes. (the election was on Nov. 5)

Source: tradingeconomics.com

US dollar Index DXY

US 10-year Treasury yield

The Trump administration announced on Feb. 1 it would levy 25% tariffs on all imports from Canada and Mexico and 10% on imports from China. Two days later Trump delayed the Canada-Mexico tariffs by a month. After a month they were delayed for another 30 days. On April 2nd, Liberation Day for the US, Trump tariffed the world.

The full list of Trump’s ‘reciprocal’ tariffs

The new country ranging tariff measures, along with Trump’s aggressive posturing towards Greenland, his threats to Canadian sovereignty, and the litany of Elon Musk-driven government cuts have united with a suddenly weakening economy to undermine investor sentiment.

Investor Sentiment Ycharts.com

Bloomberg goes a gigantic step further, noting the US is no longer seen as the dominant player in financial markets, with investors now considering other options.

As evidence, the article presents the following:

- The S&P 500 Index has underperformed relative to the rest of the world, and the US share of world market capitalization has slipped, while European stocks, currency, and government bond yields have risen.

- The dollar has weakened, and US Treasury yields have tumbled, with investors increasingly looking to invest elsewhere, such as in European markets, due to a shift away from US economic and market exceptionalism. The world’s reserve currency as of mid-March was 4% below the post-election peak it reached in January. The Bloomberg Dollar Spot Index reached its lowest since early November.

- The moves in European markets were a big driver. As German benchmark yields rose to the highest since 2023, the euro gained nearly 5% for its best run since 2009.

- Accelerating the shift away from US assets: Germany’s plan to massively increase spending is being lauded as a sea change in European policymaking, lifting the region’s stocks, currency and government bond yields. Meanwhile, the emergence of AI startup DeepSeek in China is raising questions about America’s supremacy in the tech sector.

- Add it all up, and the aura of US economic and market exceptionalism, which dominated for more than a decade, is looking shaky.

- The once-unstoppable S&P 500 Index in March logged one of its worst weeks of underperformance relative to the rest of the world this century. The US share of world market capitalization has also slipped since peaking above 50% early this year. The S&P 500 is now trailing European benchmarks and the Hang Seng Index.

“For the first time you are getting compelling arguments to invest elsewhere,” says Peter Tchir, head of macro strategy at Academy Securities. “That’s been a shift. America was the only game in town and capital flows came here without much thought, and that might be reversing or at least changing.”

Regarding the US economy, more bad news is emerging.

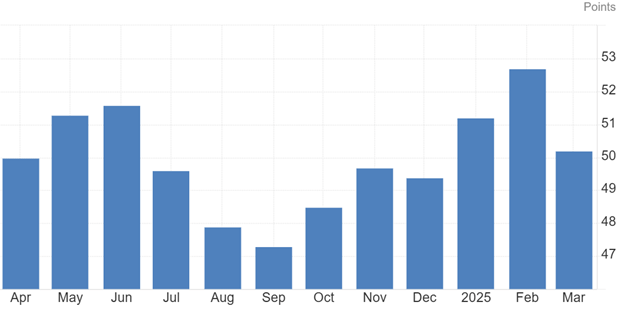

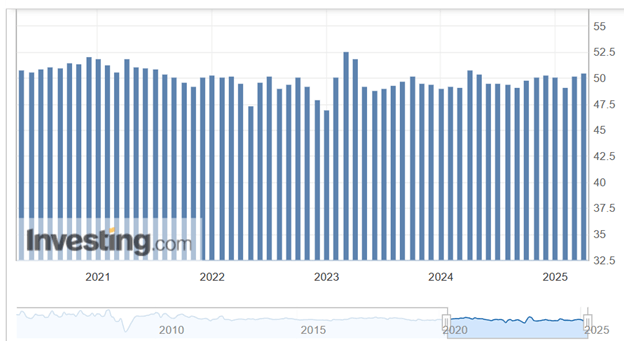

A piece in the Globe and Mail draws attention to softening economic indicators especially manufacturing. On the same day that Trump introduced tariffs, March 4, the Institute for Supply Management (ISM) released its monthly index of manufacturing activity showing that orders were dropping so rapidly the sector will soon be contracting. Managers expect to pay much higher prices, suggesting that inflation could further constrain sales and output.

The Manufacturing PMI in the United States decreased to 50.20 points in March from 52.70 points in February. The PMI averaged 53.11 points from 2012 until 2025. (Trading Economics)

United States Manufacturing PMI trading economics.com

According to a recent survey conducted by YouGov on behalf of The Economist, 61% of US adults think that raising tariffs will hurt the average American, while only 14% of respondents think that it will have a positive effect on them. That’s because Americans — still wary about inflation after three years of rising prices — broadly expect tariffs to further increase prices and thus inflict further financial pain on already inflation-stricken US households.(Statista)

Unsurprisingly, US consumers are pulling back on spending amid tariff fear. According to Statista, After years of seemingly defying inflation and driving U.S. GDP growth, U.S. consumer spending showed signs of weakness in the first two months of 2025. After dropping more than 0.6 percent in January, real personal consumption expenditure barely bounced back in February, edging up just 0.1 percent or $16 billion on a seasonally adjusted, annualized basis.

The weaker-than-expected spending increase was driven by a decline in service spending – the first since January 2022 and a warning sign that consumers may be starting to cut back on discretionary spending. At the same time, consumers increased spending on durable goods, possibly making purchases earlier than planned to avoid higher prices widely expected as a consequence of new tariffs.

Remember, consumer spending makes up 70% of US GDP.

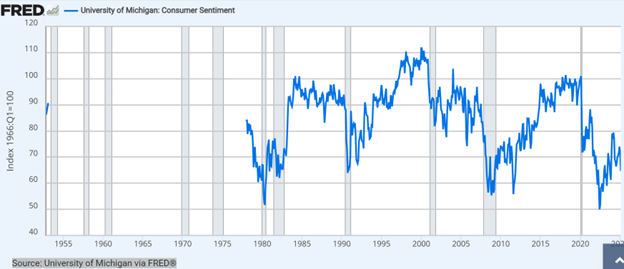

The University of Michigan’s monthly Index of Consumer Sentiment fell to the lowest level in more than two years in March. The index dropped for the third consecutive month.

The Atlanta Fed’s “nowcast” on the state of US economy estimates that US manufacturing is shrinking at an annual rate of nearly 3% “which could translate into a very serious recession.”

JP Morgan Chase & Co. said they see a 40% chance of recession this year “owing to extreme US policies.”

The most agreed-upon definition of a recession is negative economic growth for two consecutive quarters. According to Barron’s, The subdued rise in real spending suggests first-quarter gross domestic product growth will be significantly weaker than the fourth quarter’s 2.4% increase.

The first-quarter GDP numbers aren’t out yet but we will be watching for them closely. If Q2 shows negative growth too, and that is likely considering the damage that tariffs are doing, the US could be in an official recession by the end of June.

In an op-ed, The Economist writes that Trump’s “American Dream” of tariffs preserving jobs and making America richer is clashing with reality, as “investors, consumers and companies show the first signs of souring on the Trump vision.”

The S&P 500 rose 4% in the week after the vote in November, on anticipation of Trump slashing red tape and implementing generous tax cuts like he did in 2017. But the budget blueprint passed in Congress in February only keeps the tax cuts from 2017, it doesn’t expand them, though it does add trillions to the national debt, the op-ed states.

No wonder that the markets are flashing red, measures of consumer sentiment and small business confidence have slipped, and inflation expectations are rising.

Trump unsurprisingly is downplaying the negative impacts of his economic policies. “There’ll be a little disturbance,” he warned blithely in his address to Congress on March 4. “But we’re okay with that.”

The death of US manufacturing

Trump clearly doesn’t read history, for if he did, he would realize that US manufacturing has been severely hollowed out over the years, and a tariff war isn’t going to bring the jobs back.

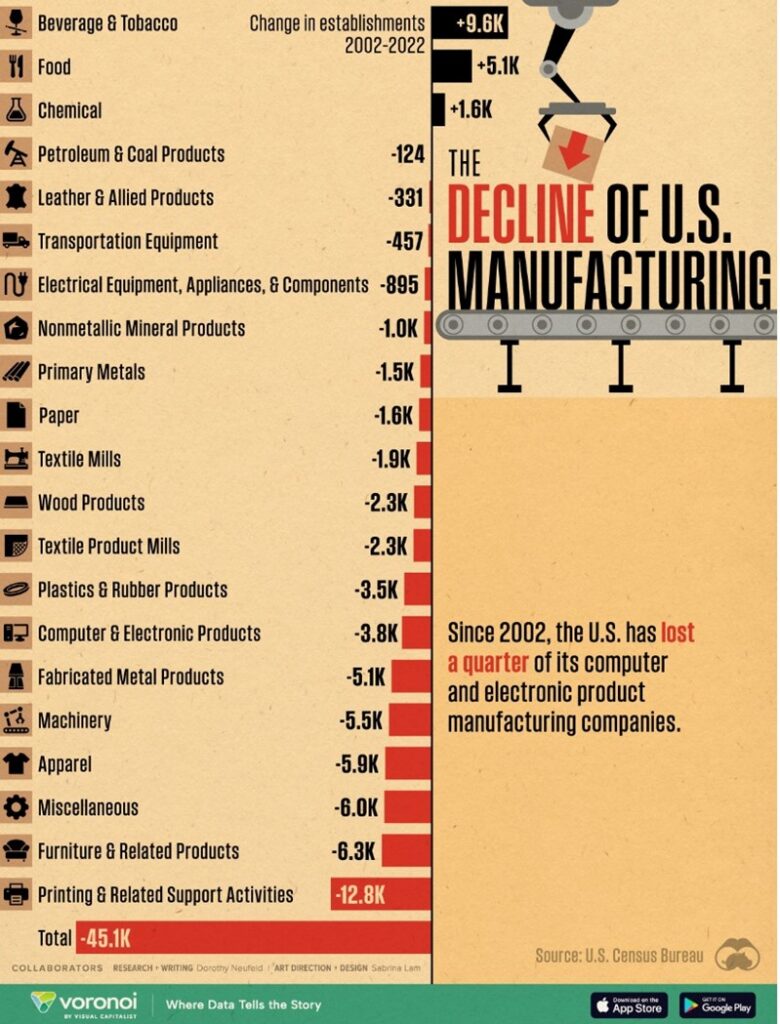

According to Visual Capitalist,

Between 2002 and 2022, the U.S. lost more than 45,000 manufacturing firms amid evolving global trade dynamics.

While the U.S. was the world’s leading manufacturer up to 2010, production has fallen $2.4 trillion behind China as of 2022. Factors such as trade liberalization, including the North American Free Trade Agreement, and China’s accession to the World Trade Organization in 2001, have contributed to a significant shift in the U.S. industrial base over the past few decades.

According to data from the US Census Bureau, from which the below infographic from Visual Capitalist was created,

Overall, the number of U.S. manufacturing firms has shrunk by 14% over 20 years, with 50% or higher drops in the apparel and textile mills sectors.

Amid factory closures across nearly all manufacturing sectors, employment has dropped to 13 million workers as of January 2023, down from its 1979 peak of 19.5 million workers. Today, manufacturing jobs make up roughly 10% of the U.S. private sector workforce.

While manufacturing productivity growth excelled during the 1990s and 2000s, it has lagged over the last decade. Over a third of this slowdown was due to the computer and electronics sector, which was a major driver of productivity growth in previous decades, particularly in semiconductor chips. Since 2002, the number of computer and electronic manufacturing firms has decreased by a quarter.

Similarly, other durable manufacturing sectors like machinery and primary metals (such as steel and aluminum), saw double-digit declines in the number of firms.

Source: Visual Capitalist

But won’t the tariffs Trump has imposed, with more announced on Wednesday, April 2, serve to lure manufacturing jobs back to the US?

Not according to a post on The Street Wednesday, which states that some industries, like semiconductors, could benefit from reshoring, while others such as the paper and apparel industries may never recover lost jobs.

It also notes that much of US manufacturing capacity has long ago been offshored, and those previously shuttered businesses would require significant modernization. It could very well be that for many companies, it’s cheaper to force concessions from overseas suppliers than try to refurbish long-shuttered capacity here in America.

America is now the problem

Economist Stephen Roach goes further on the negative impacts of tariffs, writing in Project Syndicate that The world’s major growth engines are about to run in reverse.

The policies and uncertainties of US President Donald Trump’s second administration have hit a sluggish global economy with a transformational exogenous shock. Risks are especially worrisome in both the United States and China, which have collectively accounted for a little more than 40% of cumulative global GDP growth since 2010.

America is now the problem, not the solution. Long the anchor of the rules-based international order, the US has turned protectionist, posing major risks to an already fragile global trade cycle. At the same time, Trump’s MAGA (“Make America Great Again”) movement has driven a powerful wedge between the US and Europe and divided North America, with Canada’s very independence in Trump’s crosshairs. The central role of the US in sustaining post-World War II geostrategic stability has been shattered…

The Trump shock, in short, is the functional equivalent of a full-blown crisis. It is likely to have a lasting impact on the US and Chinese economies, and the contagion is almost certain to spread throughout the world through cross-border trade and capital flows. Perhaps most importantly, this is a geostrategic crisis, reflecting a reversal of America’s global leadership role. In the space of little more than two months, Trump has turned the world inside out.

China rising

Arguably, the effects of the tariffs on China are likely to be more muted than Roach indicates, because China has over the years “eaten America’s lunch” when it comes to two-way trade between nations.

East eats West’s copper breakfast, lunch and supper

Moreover, according to a Bloomberg article, Trump has given China’s President Xi a rare opening to deepen relationships across the board, including with key US allies in Asia and beyond.

Chinese officials moved quickly on Thursday to align with other nations after Trump unveiled America’s steepest tariffs in a century, saying the US had been “looted, pillaged, raped, and plundered by nations near and far, both friend and foe alike.” While Beijing faced its third round of US levies, this time longstanding American allies such as Japan, Australia and the United Kingdom were also hit with tariffs as high as 24%.

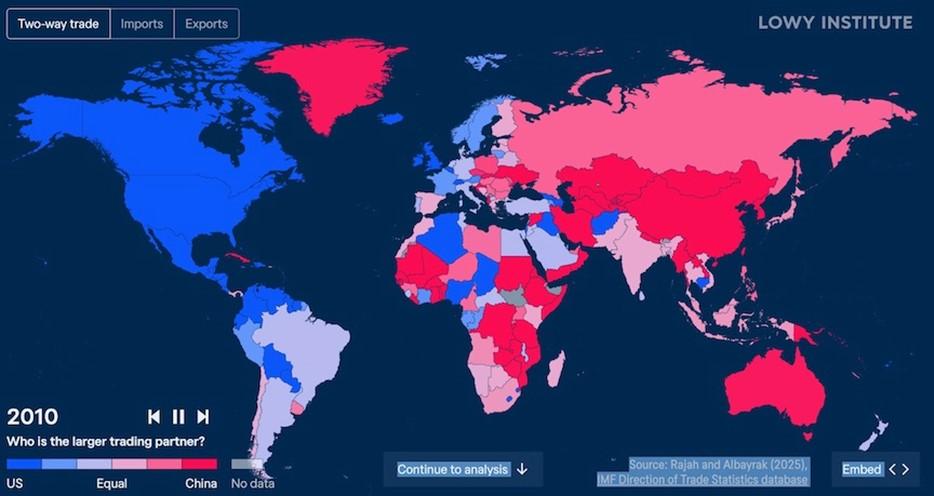

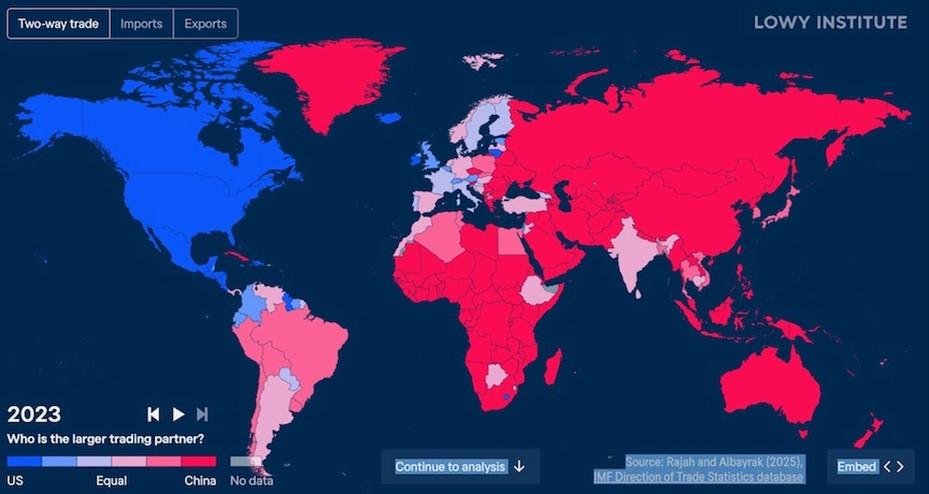

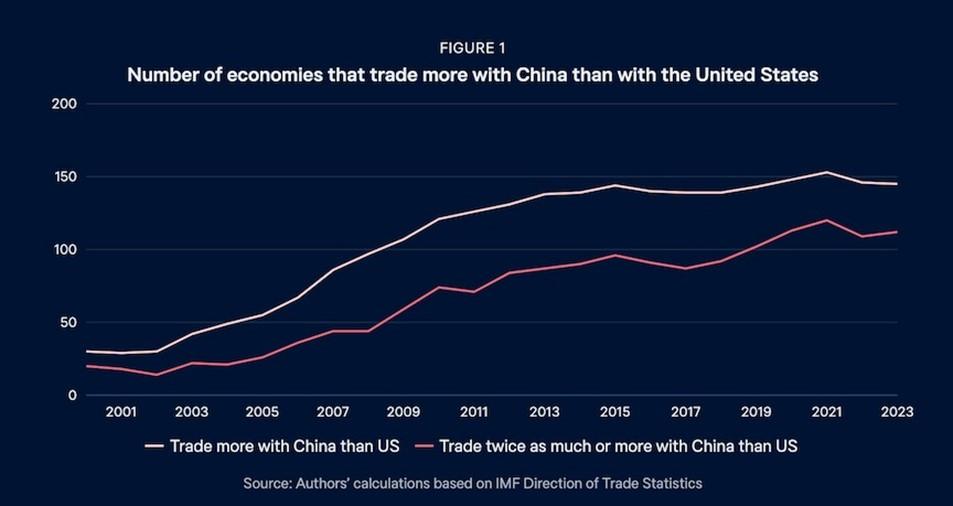

The maps below by the Lowy Institute shows changing patterns of global trade between the two largest economies, the US and China, from 2001 to 2023. Economies trading more intensely with either country are shown in darker red (for China) or blue (for the United States). The time-lapse graphic focuses on two-way trade flows (i.e. exports plus imports) as the principal measure of trade integration between two economies.

Two-way trade between the US and China in 2010. Source: Lowy Institute

Two-way trade between the US and China in 2023. Source: Lowy Institute

Among the key findings:

- China’s lead over the United States in international trade relationships has only widened since the last US-China trade war of 2018-19.

- Around 70% of economies trade more with China than they do with America, and more than half of all economies now trade twice as much with China compared to the United States.

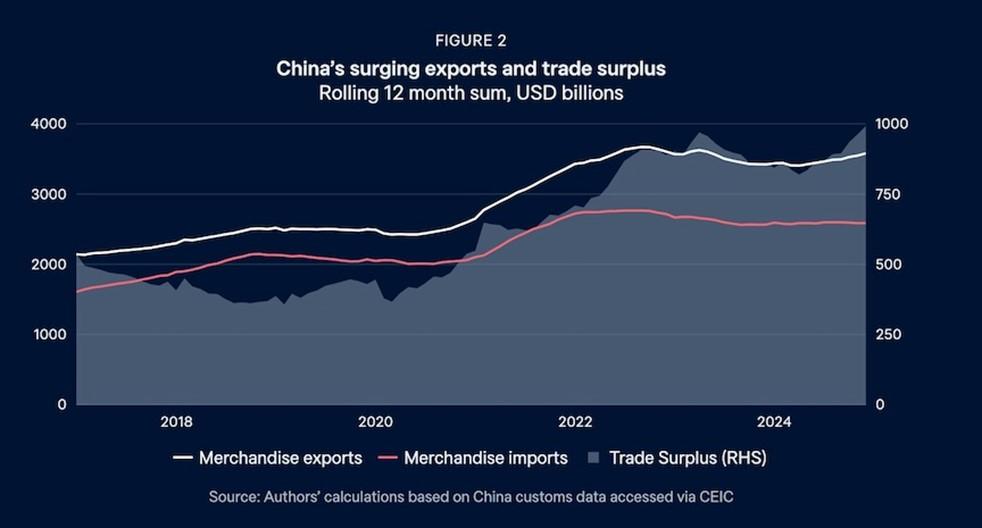

- China’s global trade relationships remain deeply unbalanced, with a trillion-dollar surge in China’s merchandise exports since the pandemic, while its imports have not kept pace.

- By 2018, 139 out of 202 economies with available data traded more with China than with the United States. That pattern has held with the latest data, which covers the full year for 2023 for 205 economies. About 70% of the world, or 145 economies, now trade more with China than with America.

- China was the largest bilateral trading partner for 60 economies in 2023, almost twice as many as for the United States.

- China has deepened its global trade relationships compared to America. In recent years, the much more notable increase has been in the intensity of China’s trade relationships. In 2023, 112 economies traded more than twice as much with China as they did with America, up from 92 in 2018.

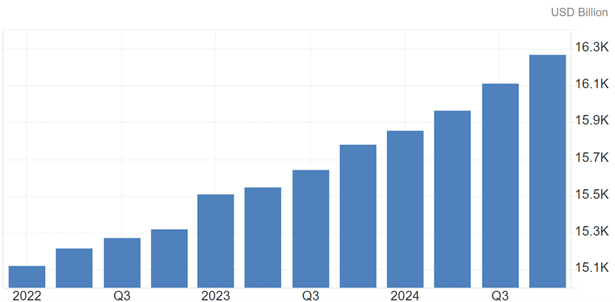

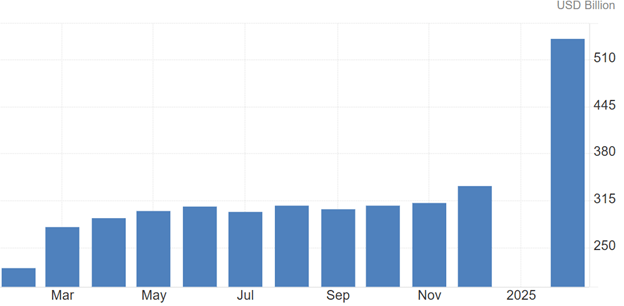

- It is no secret what’s behind China’s increasingly deep trade relationships: a big jump in exports (Figure 2). China’s total exports plateaued at about USD$2.5 trillion in 2019, reflecting sharp US tariff hikes imposed over 2018-19 by the first Trump administration as well as softening global demand. Since the pandemic, China’s exports have surged, reaching around $3.5 trillion since early 2022 and with little sign of abating. With its imports not keeping up, China’s trade surplus has more than doubled, from around $430 billion in 2019 to an almost $1 trillion surplus in 2024.

Source: Lowy Institute

Source: Lowy Institute

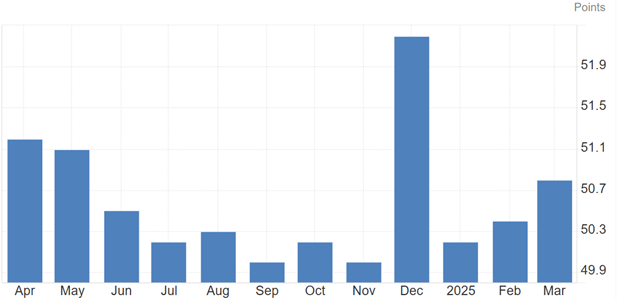

China’s surging exports and trade surplus is reflected in its stellar manufacturing data.

Reuters reported on March 31 that China’s manufacturing hit a 12-month high, driven by new orders according to a factory survey.

Its $18 trillion economy is also benefiting from foreign buyers frontloading purchases, in anticipation of further US tariffs.

In contrast to the United States’ declining PMI, China’s official PMI rose to 50.5 in March compared to 50.2 in February. That’s the highest reading since March 2024.

China Manufacturing Purchasing Managers Index (PMI)

The non-manufacturing PMI including services and construction accelerated to 50.8 from 50.4.

China Non Manufacturing PMI tradingeconomics.com

“The official PMIs suggest that infrastructure spending is ramping up again and that exports have so far remained resilient in the face of U.S. tariffs,” Reuters quoted Julian Evans-Pritchard, head of China economics at Capital Economics.

China’s independence from the United States is not only reflected in trade and manufacturing statistics, but in government policy.

Recently, according to Asia Times, Beijing held its annual China Development Forum, sending the message that as the US pursues protectionist “America First” policies, the world’s second largest economy is open for business.

The country is taking concrete measures to attract foreign investment. According to the Chinese Ministry of Commerce, So far, China has allowed 13 foreign-invested companies to access value-added telecommunications services. Additionally, more than 40 foreign-funded biotechnology projects have been launched and three new hospitals entirely owned by foreign entities have won approval to operate.

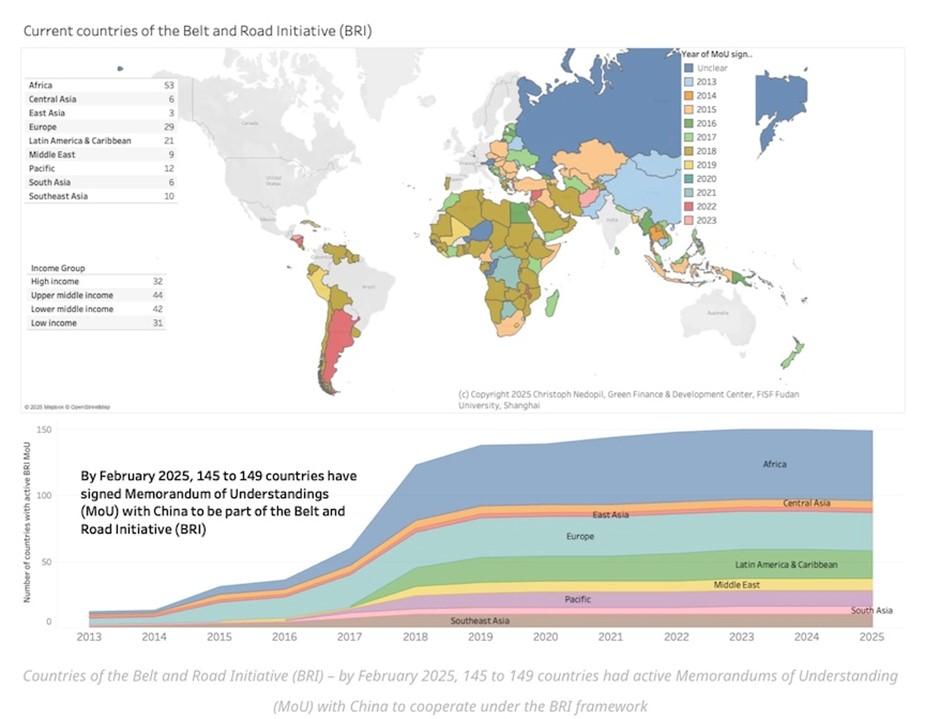

For the past 12 years China has been actively cultivating trade ties with Central Asian, Southeast Asian, Middle Eastern, Latin American and African countries through its Belt and Road Initiative (BRI).

Launched in 2013, the BRI is a global infrastructure development strategy to boost Chinese trade, economic growth and regional influence.

Source: Green Finance & Development Center (GFDC)

According to a recent report by Australia’s Griffith Asia Institute (GAI) in collaboration with the Green Finance & Development Center (GFDC) of China, China’s overseas mining investment under BRI hit a 2024 peak of $21.4 billion. The report via Mining.com says the government continues to place heavy emphasis on raw materials for the energy transition.

Among the key points:

- To date, China’s BRI spending has crossed $1.1 trillion, with the funds going towards key sectors such as mining, energy and transportation in partnership with 149 countries.

- In 2024, mining maintained its status as a major area of focus under the initiative, accounting for 17.6% of last year’s total BRI-related investments, behind only energy’s 32.5%, GAI’s report shows.

- According to GAI, China already holds significant shares of global mining sources (over 80% of global graphite resources), and even more control in material processing (where across lithium, nickel, cobalt and graphite, China owns more than 50% of global capacity).

- Like mining, China’s clean energy (solar, wind, hydropower) investments under the BRI also reached a record high of $11.8 billion.

- Looking ahead, GAI expects a further expansion of BRI investments and construction contracts in 2025, given the “clear need” to support the green energy transition in both China and in BRI countries. This, as it points out, provides continued opportunities for mining and minerals processing deals, technology deals and green energy — which China now refers to as the “New Three”.

As for where the mining concentration is, a recent Eurasianet article indicates Central Asia is an important focus. Published via Oilprice.com, the article states that the US and European Union are increasingly trying to access Central Asia’s rich critical minerals reserves. However, at the same time, Russia and China are actively working to maintain and expand their influence in the region.

For example, Russian officials voiced readiness to help Tajikistan develop its mining sector during Tajik leader Emomali Rahmon’s recent visit to Moscow, the Russian outlet Nezavisimaya Gazeta reported.

In addition, Alexei Likhachev, the head of the Russian nuclear energy agency Rosatom, said in a March 17 television interview that Russia and Tajikistan “are building new technological chains in a number of other areas related to energy, instrument making, and possibly rare earth metal mining. Tajikistan is rich in rare earth metals.”

Likhachev also revealed Rosatom was in the “initial stage of negotiations” with Tajik leaders on the construction of a small nuclear power plant in Tajikistan, a country that has already invested vast sums in building the Rogun Dam to meet the country’s electricity needs.

China, which already has a strong position in Central Asia’s mining sector, is also looking to get a piece of the nuclear energy action. Shen Yanfeng, the head of China’s National Nuclear Corporation, paid a visit earlier in March to Kazakhstan, which recently announced an intention to build three nuclear power reactors…

Elsewhere, Azim Akhmedkhadzhayev, the director of Uzbekistan’s nuclear energy agency Uzatom, said in an interview with the French daily Le Figaro that Tashkent will engage French companies in the construction and operation of a nuclear plant on Uzbek soil for “political, financial and technological reasons.” Uzbekistan already has a deal with Rosatom to help develop the country’s nuclear energy potential.

It’s worth pointing out that the Trump trade war is making enemies out of friends in Canada and Europe — US allies that have fought alongside American troops in previous wars and enjoyed free trade and cordial relations with the US of A for the past several decades.

Buy Canadian

In the face of punishing trade tariffs the country did nothing to provoke, Canada is becoming more patriotic through government-sponsored “Buy Canadian” programs, and a strong social movement to avoiding travel to the US.

‘Made in Canada’ labels are being pressed onto grocery store items. The federal government created a guide how to buy, sell and support Canadian, including defining each type of label. (Global News)

Trump has unwittingly inserted himself into the current Canadian federal election, with the three main political parties taking positions on Trump’s tariffs and his threats — benign or serious — about annexing Canada.

CBC wrote that Trump’s rhetoric is motivating Canadians to cast a ballot on April 28.

Protests have broken out at Tesla dealerships and there have been reports of vandalism to dealerships and Teslas over Elon Musk’s close association with Trump. The Canadian government has barred Teslas from being eligible for the country’s EV rebate because of the tariffs.

Canadians that would normally travel to the United States by car or by plane are canceling trips and heading elsewhere. In 2024, Canadian tourists spent $20.5 billion on travel to the United States, supporting 140,000 American jobs, according to the U.S. Travel Association.

Data from the Whatcom Council of Governments — a regional government agency that is centered along the northwest Washington state border — shows a nearly 43% drop in vehicles with BC licence plates heading south via Lower Mainland border crossings this March compared to March 2024. (CBC News)

Low travel interest to the US led WestJet to cancel flights to Seattle from Kelowna for the month of April. WestJet also ended the Las Vegas service that it had to the US earlier than expected.

Claire Newell, a travel expert quoted by Global News, said all four major Canadian airlines — Air Canada, WestJet, Porter and Flair — have changed their schedules, at least for the summer. “They’re still going to most US destinations, but with less capacity,” said Newell.

A spokesman for Kelowna Airport said domestic travel is up considerably as well as seat capacity.

A recent Abacus Data poll revealed that 66% of Canadians feel the current situation has made the US a less attractive travel destination. (Global News)

MEGA

Canada’s anti-American vibe is catching on in Europe.

In Sweden, The Guardian said more than 70,000 users have joined a Facebook group calling for a boycott of US companies, while in Denmark, there has been widespread anger over Trump’s threats to bring the autonomous territory of Greenland under US control. Vice President Vance’s trip to Greenland uninvited has fanned the flames.

The largest grocery company in Denmark is tagging European-made goods with a black star to differentiate them from American products. Danish shoppers are boycotting American goods and services such as Tesla, Netflix and Coca-Cola, NBC News said.

In Norway the largest oil bunkering operation, privately owned Haltbakk, has stopped supplying fuel to US Navy ships.

Investors, too, are sending a message to the US government through decisions about how funds are placed.

US investors poured a record $10.6 billion into ETFs focused on European stocks in the first quarter, which is seven times the inflows from a year earlier, according to data from BlackRock via Reuters.

“It’s a really massive swing,” Reuters quoted a spokesperson from BlackRock who noted that since Russia’s invasion of Ukraine in early 2022, the funds had seen net outflows of $6.4 billion.

Some have dubbed the trending interest in European stocks “Make Europe Great Again (MEGA)”.

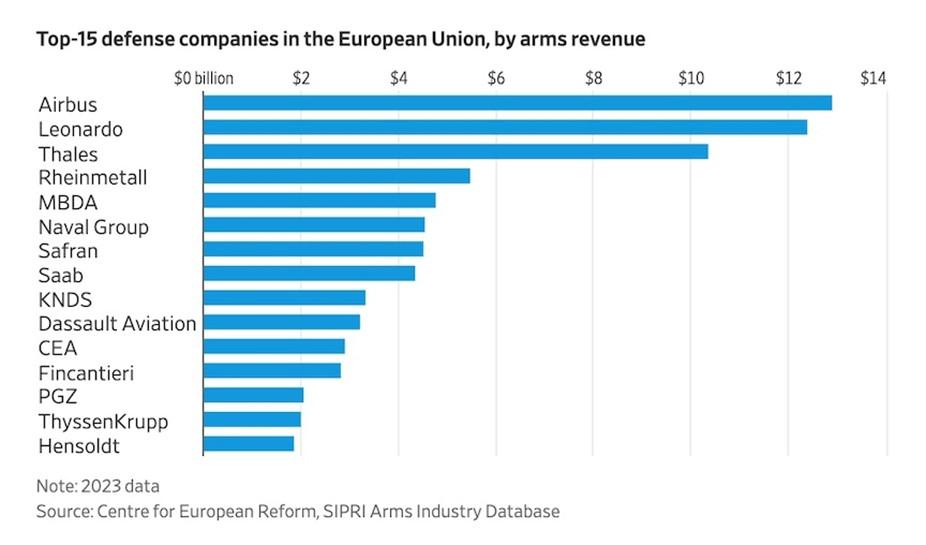

European nations have realized they can’t rely on the United States anymore for continental defense and are re-arming themselves.

“Readiness 2030”, prioritises the supply of strategic equipment, like air and missile defence, artillery systems, missiles, ammunition and drone and anti drone systems. Military expenses would be excluded from strict European fiscal constraints.

If each member state was to spend 1.5% of its GDP on defense, on average, the combined amount would be €650 billion. In addition, the plan provides for €150 billion in loans to buy defence capabilities mostly made in Europe.

Additional funding sources for defence are under study, including the mobilization of private financing. The EU is also studying the harmonisation of requirements and joint procurements to ensure a more efficient market, reduce costs, guarantee the cross-border access to supply chains and to increase the competitiveness of the defence sector as a whole.

Conclusion

The Trump-inspired movement against the United States in Canada and Europe to me is further proof of America’s decline.

Back in 2021, President Biden famously said that China will “eat our lunch” if America doesn’t step up its infrastructure spending.

He was right. But China’s lead over the United States goes much further than spending on public works. As this article has demonstrated, China is kicking US butt when it comes to two-way trade.

Around 70% of economies trade more with China than they do with America, and more than half of all economies now trade twice as much with China compared to the United States.

China’s strength is clearly on the export side.

Since the pandemic, China’s exports have surged, reaching around $3.5 trillion since early 2022 and with little sign of abating, despite tariffs. With its imports not keeping up, China’s trade surplus has more than doubled, from around $430 billion in 2019 to an almost $1 trillion surplus in 2024.

China Exports

We see China’s export strength reflected in its manufacturing data. At the end of March, China’s manufacturing hit a 12-month high driven by new orders, according to a factory survey.

In contrast to the United States’ declining PMI, China’s official PMI rose to 50.5 in March compared to 50.2 in February. That’s the highest reading since March 2024.

The non-manufacturing PMI including services and construction accelerated to 50.8 from 50.4.

The offshoring of American jobs combined with other factors like automation has hollowed out the US manufacturing sector.

According to data from the US Census Bureau, the number of US manufacturing firms has shrunk by 14% over 20 years, with 50% or higher drops in the apparel and textile mills sectors.

Amid factory closures across nearly all manufacturing sectors, employment has dropped to 13 million workers as of January 2023, down from its 1979 peak of 19.5 million workers. Today, manufacturing jobs make up just 10% of the US private sector workforce.

So not only is China eating the US’s lunch when it comes to infrastructure build-outs, it is killing the US on two-way trade and manufacturing.

Remember too, that China is the undisputed champion when it comes to mining and mineral processing.

China’s metal dominance — Richard Mills

For decades, China has dominated critical minerals, with Canada and the US, among other nations, all too willing to let Beijing do the mining and/ or processing and sell the end-products.

For key battery materials essential in green technologies, China refines 73% of the world’s cobalt, 59% lithium, and 68% of nickel. It also leads gallium and germanium production — two minerals critical for chipmaking. (Asia Pacific Foundation of Canada)

China has the minerals, the processing expertise, the manufacturing, future-looking industries (like electrical vehicles, wind, solar), and the markets to lead the world. It doesn’t need the United States.

Indeed China is building its own trading eco-system.

To date, China’s Belt and Road Initiative spending has crossed $1.1 trillion, with the funds going towards key sectors such as mining, energy and transportation in partnership with 149 countries.

Russia and China are actively working to maintain and expand their influence in minerals-rich Central Asia.

Consider also, as countries look to avoid US tariffs, the population advantage that Europe has over the United States.

The United States has 340 million people, with a per capital purchasing power of $82,000. The European Union has a population of 450,000 and a purchasing power of $62,000.

Now one might think that a country like Canada, with a population of only 40 million, would be forced to trade with the United States, because the US has over eight times the population of Canada and a purchasing power greater than Europe.

But when you take into account Europe’s larger population, the purchasing power of the US and Europe works out to be the same.

The key point is that Canada, Mexico and other US trade partners have options. They can trade with each other. They don’t have to trade with America, which is no longer exceptional, no longer enjoys the “exhorbitant privilege” it used to; in fact it’s an empire in decline.

The US manufacturing data proves it. Trump can huff and puff all he wants and erect massive tariff walls against friends and foes. The reality is the rest of the world could, with global co-operation between friends and allies, afford to lose the United States as a trading partner but the US can’t afford to lose the world. Not anymore.

Somebody should tell Trump that.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE