Rick Mills – “SURG finds more breccia icing to put on its porphyry cake”

It could be the icing on the cake that gives Surge Copper (TSX-V:SURG) the tonnage it needs to interest a suitor in its Ootsa copper-gold play, situated about 90 minutes drive from Smithers, BC.

SURG released new assays Wednesday from Holes S-18 212 and 214, which are the first results from a high-grade breccia zone the company discovered earlier this summer as part of its 2018 drill program.

Exploration was halted due to a large wildfire burning in the area that has caused road closures and evacuations, but Surge’s CEO Shane Ebert said the situation is improving. The 100,000-hectare Nadina Lake fire has been contained so the drill crew and geologists could be back working within the week.

The icing

The highlight was a 22m intersection on Hole 214, which hit 1.5% copper-equivalent (Cu Eq), within a larger interval containing 48m at 0.7% Cu Eq.

Meanwhile Hole 212, from which assays were published Aug. 9, returned more promising results, with a 22m intersection grading 0.5% copper equivalent including 6m of 1.2% Cu Eq. Holes 212 and 214 are in the high-grade breccia zone we introduced, along with a new porphyry target, in our Aug. 18 update on SURG, which also described our recent site visit.

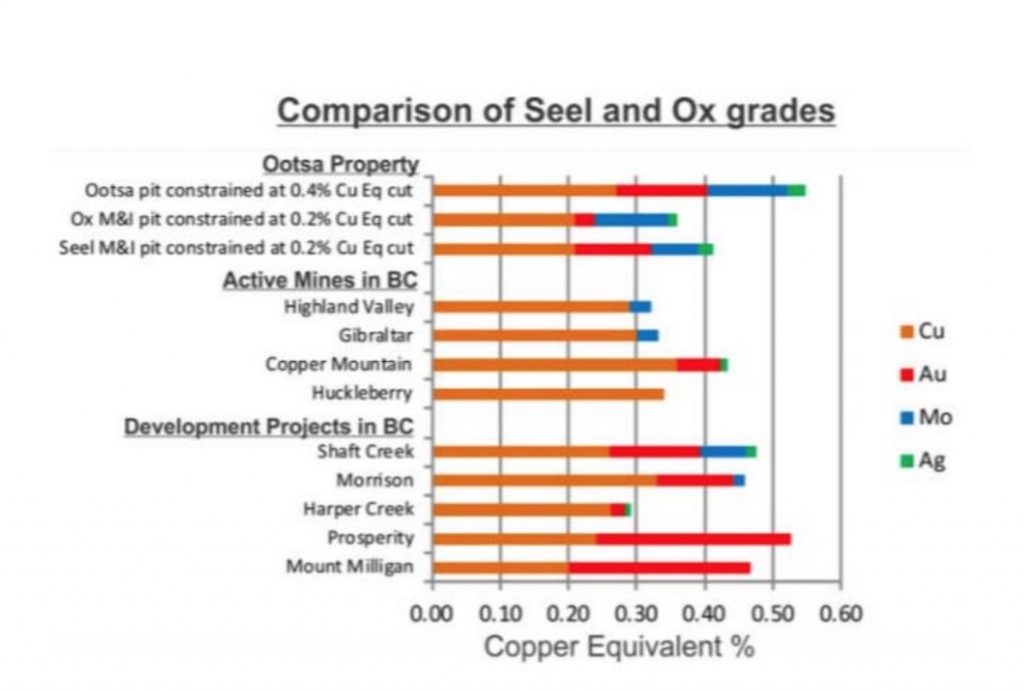

For perspective, most copper mines in BC are under 0.4% copper, so the grades are above-average. See the chart below that shows how Surge Copper stands up against some of the biggest copper mines in BC in terms of copper grades.

Both holes intersected long intervals of intense alteration, containing elevated zinc and silver. These included 98m of 0.61% zinc and 5.1 grams per tonne (g/t) silver, including 14 m of 1.12% zinc and 6.27 g/t silver in Hole 214, and 71m of 0.57% zinc, 0.11% lead and 6.7 g/t silver in Hole 212.

In a phone call with Ahead of the Herd, CEO Shane Ebert said he was surprised at the high zinc numbers. “I don’t know if that’s going to be anything we can use down the road but it sure shows there’s a big strong hydrothermal system going through,” said Ebert, who is also the chief geologist on site.

The nearby Huckleberry Mine isn’t set up to process lead and zinc (it runs a copper/ precious metals flotation circuit and a molybdenum circuit) but Ebert said similar mineralization found on site showed good recoveries of copper, gold and silver.

The current PEA has the potential for a 12-year mine that would produce 324 million pounds of copper, 185,000 ounces of gold, 15.8 million pounds molybdenum and 3 million ounces of silver. The report specifies a contract mining and toll milling scenario using Imperial Metals’ mill – where the Ootsa operation would produce at 20,000 tonnes a day, around the same as Huckleberry before it shut down. Historical exploration at Ootsa has seen 144,000 meters drilled, with over 350 holes punched into the low-lying topography. Three deposits – Ox, East Seel and West Seel – have been discovered.

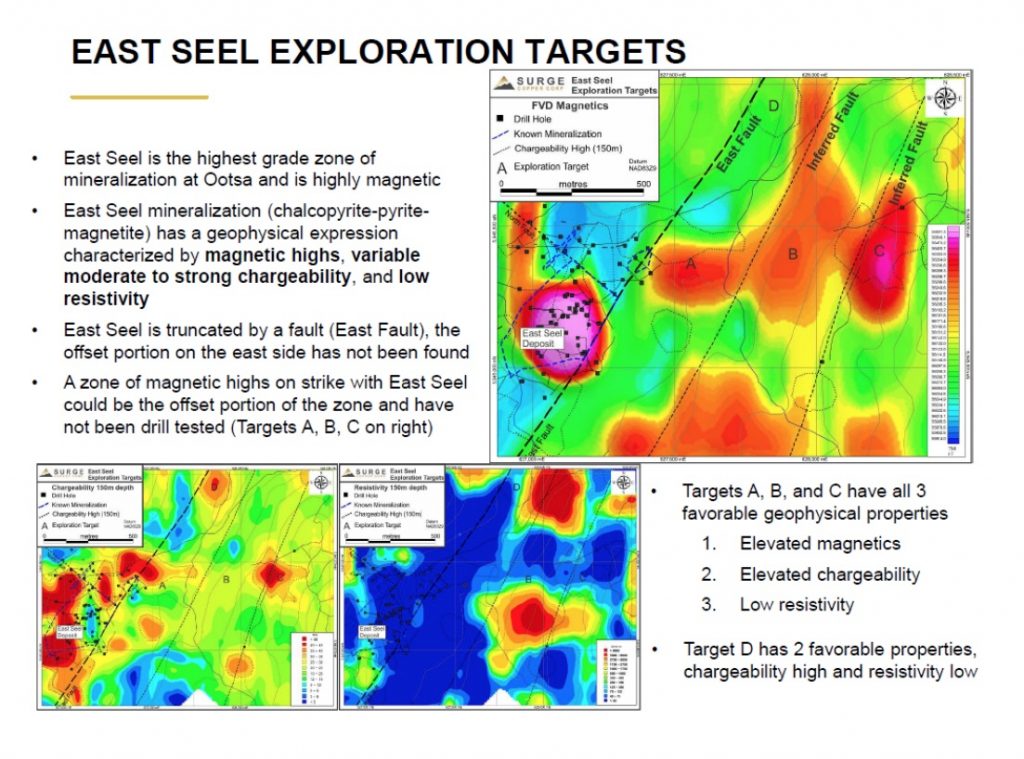

Surge Copper’s 2018 exploration plan involves exploring around the edges of the East Seel deposit which has the highest grades among the three Ootsa deposits.

The goal is to add another 20 to 24 million tonnes to the current 224 million tonnes of measured and indicated resources in the ground, which would enable Surge to comfortably run a stand-alone operation ie. a mine that could function without any involvement from neighboring Huckleberry Mine, owned by Imperial Metals but currently on care and maintenance.

Read our Surge Copper: 3 great scenarios for an explanation of the company’s options: partnering with Imperial Metals in operating a new mine; going it alone by growing the resource to a point where it doesn’t need Imperial, likely with third-party backing; or getting bought out by a major or mid-tier mining company.

Ebert said the results so far from the 3,000m program are encouraging:

“The first hole tells us we can expand things and that’s what we wanted to show. We’ve got good knowledge of the area through drill holes, a good idea of what things are open. So we can definitely expand the existing resource which is great because a little bit more will get us over the economic hurdle we’re trying to achieve. This new [breccia] zone, we maybe need a bit more work to figure out how it’s going to hold together size-wise and along strike but it’s pretty encouraging to be hitting these kind of numbers on a new discovery, it’s completely covered [with overburden]. There’s very little to go on apart from geophysics and drilling holes.”

He wants to drill another six to eight holes to see if “the zone has legs.”

“Almost every large undeveloped copper body comes with very specific issues, from jurisdiction, being privately owned or already held by a major.” Mining.com

The cake

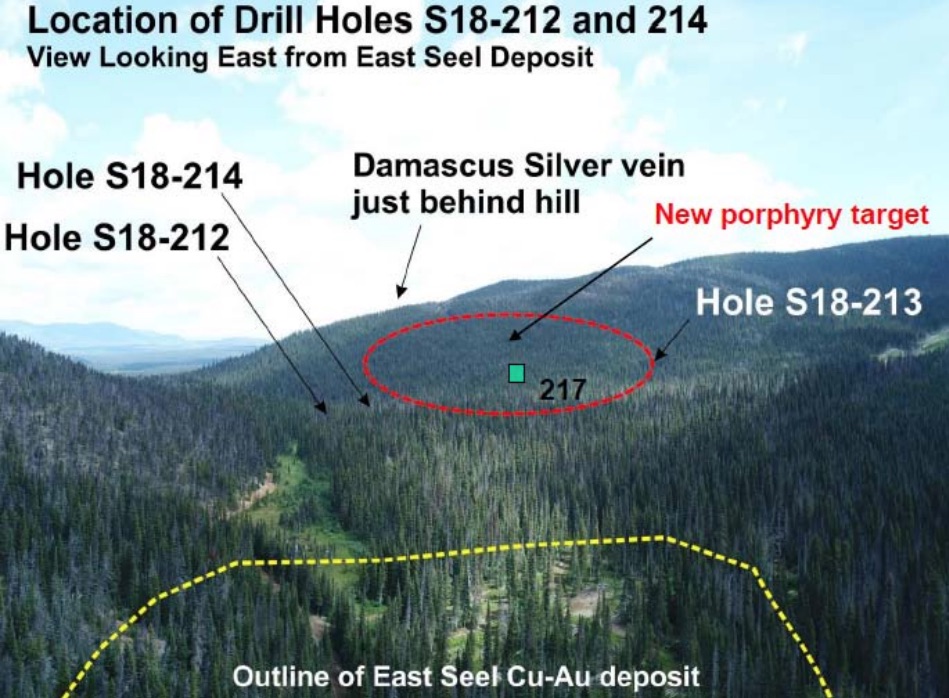

While the assays from Holes 212 and 214 show some good copper-equivalent grades, what is really exciting for Surge Copper is Holes 216 and 217, both of which are targeting a new porphyry – which typically host large sources of copper ore. Yet-to-be-assayed core samples are “showing potential for porphyry style quartzchalcopyrite-molybdenite mineralization located between the East Seel deposit and the historic Damascus high grade silver vein,” reads the Aug. 9 press release. A new porphyry would be significant for Surge Copper because it would aid in its plan to add another 20 to 24 million tonnes of mineralization at Ootsa, thus improving the economics of the project outlined in the PEA.

Ebert said SURG’s drilling priority in what’s left of the season will be focused on the porphyry potential of Holes 216 and 217. “The reason for that is a porphyry is a much bigger, easier to define tonnage zone, than a breccia target. The breccia has potential for grade, you add the higher grade breccias ore to the porphyry ore to level out the grade, like icing on a cake, but the porphyry really would be an easy thing to build the tonnage we need quite quickly.”

While the drills haven’t hit the porphyry yet, Ebert believes they’re close – judging from the indications of copper-moly veinlets and the geophysics showing elevated magnetics, chargeability and low resistivity.

“We’ve hit little bits of the intrusion but we haven’t drilled into the main intrusive body yet,” he said. “We have a nice magnetic target and coincident chargeability target that’s untested in proximity to these holes. That would probably be the first area we’d want to go in and test.” Assays on Holes 216 and 217 are pending.

Ebert’s next call after talking to us was to discuss the grades and volumes of mineralization found so far at Ootsa with Randall Thompson, who in July was named VP Operations at Imperial Metals. Thompson, the former President of Imperial Metals, is also on SURG’s board of directors – Randall held various roles of increasing responsibility at Huckleberry Mines Ltd., and was instrumental in implementation of the Huckleberry Main Zone Optimization plan which extended the mine life, and the permitting and construction of TMF3 (the second tailings storage facility on the site). This is significant, since the relationship between the two companies could be key in whether Imperial decides to partner with SURG or even take them over.

Ebert noted there are other examples of smaller operations adding to a larger mine’s mill feed, naming Imperial’s Mount Polley Mine as an example. Copper grades around 1% are good as far as BC goes, so there is a good possibility Imperial would be interested, especially if the breccia zone can be extended to 40-50m.

“If we could find a few million tonnes of 1 %-plus material that would be of extreme interest to them,” said Ebert.

The value of the rocks look good. To make an underground mine work, you need ore valued at $250 to $350 a tonne and by our calculation SURG’s rock today even with low copper prices would generate $360 a tonne. So mining is certainly feasible.

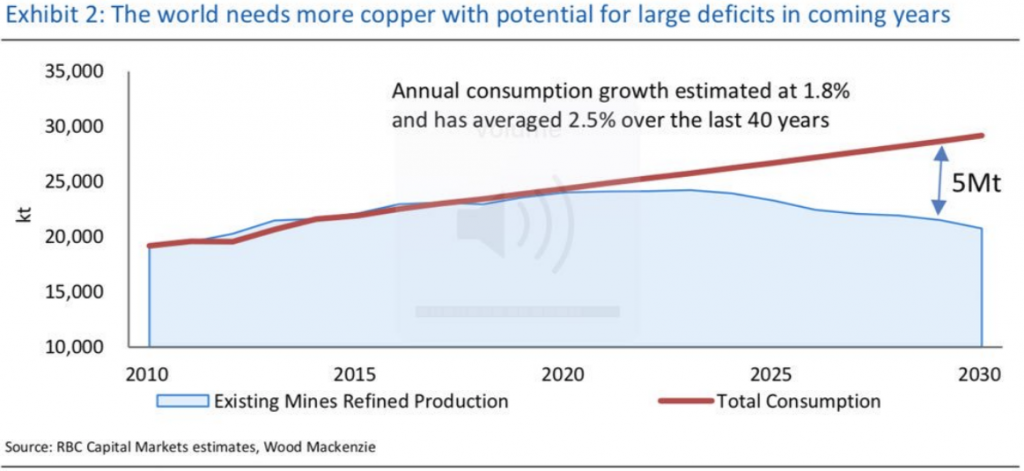

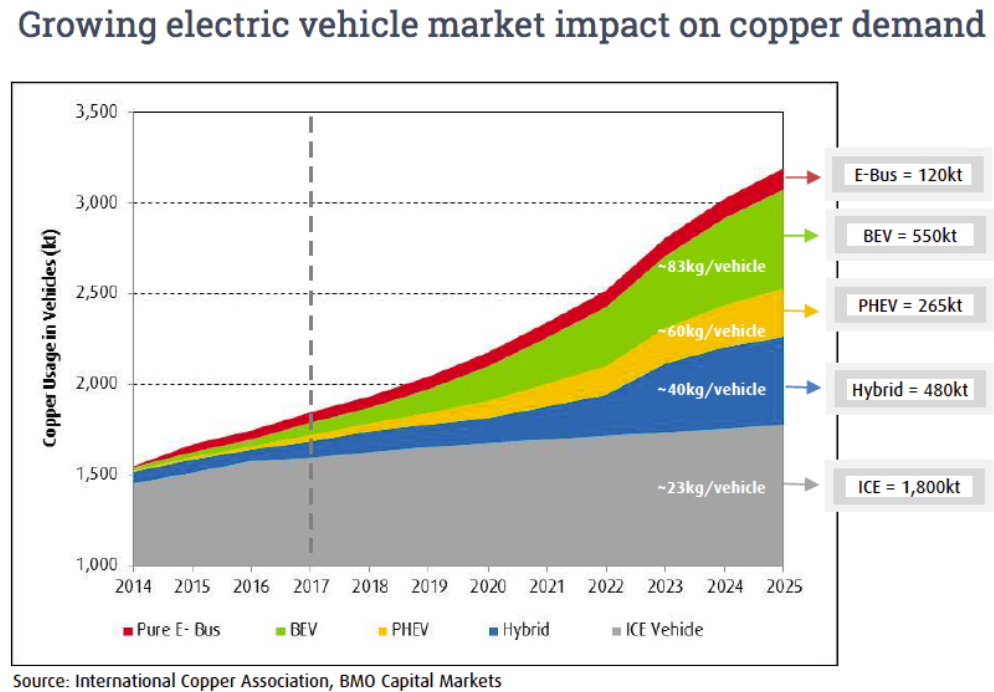

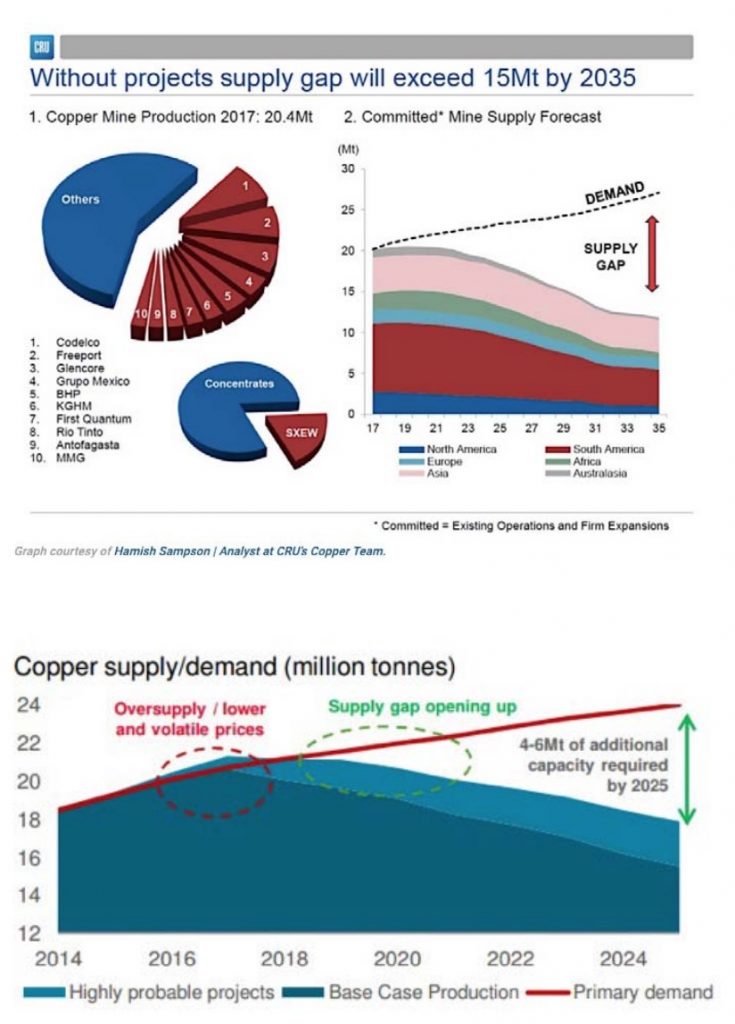

SURG’s news comes amid some furious deal-making in the copper sector, as the major miners scramble to acquire copper reserves. Commodities analysts are forecasting that demand for the red metal – used in construction (plumbing), telecommunications (copper wire) and the burgeoning electrical vehicle market – will outstrip supply by 2020.

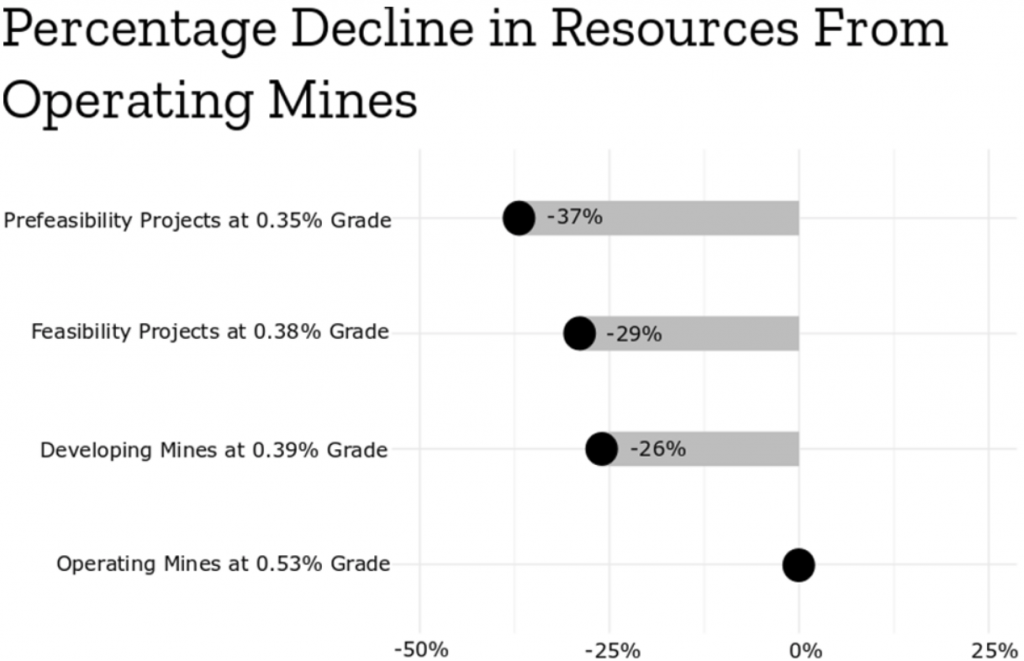

According to CRU analyst Hamish Sampson, unless new investments arise, existing mine production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes. (see chart below). That’s because over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

For more on the copper market read our extensive article, The coming copper crunch.

On Wednesday China’s Zijin Mining offered $1.4 billion for Nevsun Resources, whose flagship copper mine is Bisha in Eritrea; it’s also developing the Timok copper and gold project in Serbia. Zijin’s $6 per share deal bettered an earlier offer from Lundin Mining, which only valued the company at $4.75/sh. Lundin had repeatedly tried to buy the company but Nevsun rejected its bids for being too low.

The offer for Nevsun is the second recent copper deal by Zijin, which last week bought a major stake in Serbia’s largest copper mine, RTB Bor. The largest gold miner in China and one of the country’s top copper producers paid $1.26 billion for a 63% stake in the heavily indebted mine.

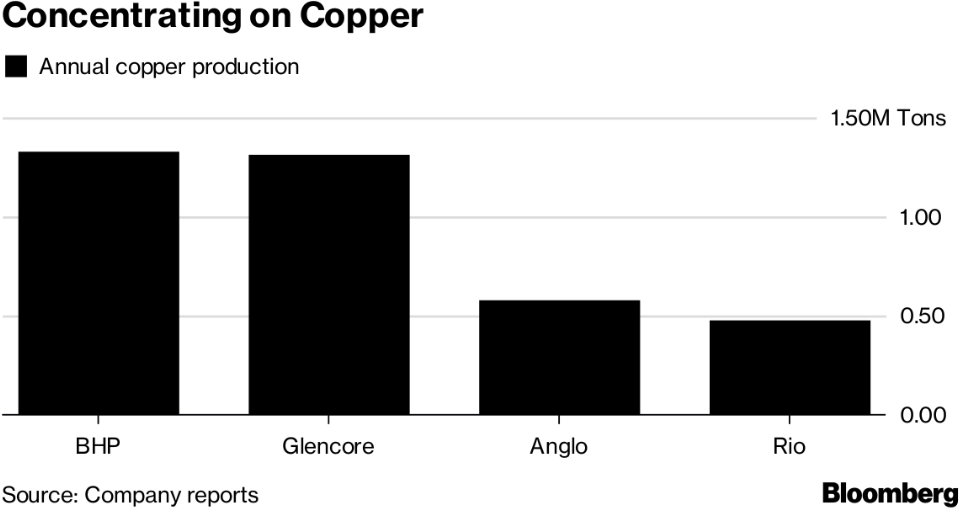

Meanwhile the world’s biggest mining company, BHP (formerly BHP Billiton) bought a 6.1% stake in SolGold, an Ecuador-focused explore-co, which is developing a large copper asset named Casabel.

“Consistent with our positive long-term outlook, copper is a key exploration focus for BHP as we seek to replenish our resource base and grow this important business,” BHP’s chief executive Andrew Mackenzie said in a press release announcing the deal.

MINING.com quotes BMO Capital Markets saying the copper pipeline is the lowest it’s been in a century, and that after the Cobre Panama mine gets started next year, there will be a gap until the next batch of 200,000-plus tonnes annual production projects in 2022-23.

Surge Copper could also be in the mix – not as a major producer but as providing either a close source of mill feed for a re-started Huckleberry Mine, or a stand-alone underground operation.

Conclusion

With 2018’s drilling season still in full swing, Surge Copper has come up with two discoveries: a high-grade breccia zone and a potential new copper porphyry, both of which could add to the resource estimate at Ootsa and the economics of the PEA. We don’t yet have the “fire” of a porphyry, but we have lots of “smoke”. Another couple of drill holes could pierce the porphyritic intrusion and SURG could be off to the races delineating bulk tonnage.

The second point to make is that things are happening at the Huckleberry Mine. Vehicles have been spotted coming and going from the mine, likely doing exploration. This can’t be confirmed but it looks as though Imperial may be working on a drill program. If that is the case, the timing for SURG couldn’t be better in trying to make an arrangement with Imperial to re-start Huckleberry possibly using mill feed from Ootsa. According to Imperial, exploration in 2016 was conducted at its Whiting Creek prospect. Three drill holes intersected copper and moly mineralization, with two holes near surface and one at a depth of about 185 meters.

A technical report from Imperial Metals on the Huckleberry Mine’s Main Zone shows an M&I resource of 180.7 million tonnes with grades of 0.315% copper. The mine has approximately five more years of reserves. That’s not a lot. Does Imperial keep exploring Whiting Creek, or make a deal with Surge Copper to extend the mine life? Of course it’s too early to say, but the possibility is intriguing.

Add to that, the amount of deal-making going on as major and mid-tier miners keep their eyes peeled for copper reserves, and things are looking bright for SURG. Unlike places like Ecuador and Serbia, British Columbia is a stable jurisdiction with a long, successful history of copper-gold mining.

I’m anticipating the results from the next two drill holes that can tell us the grades from the prospective porphyry, and I am also keeping an ear to the ground as to what Imperial is planning on doing with Huckleberry.

For all these reasons I have SURG on my radar and own shares.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Surge Copper (TSX.V:SURG). SURG is an advertiser on his site aheadoftheherd.com

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE