Rick Mills – “Silver North to Drill Haldane in Historic Keno Hill Silver District”

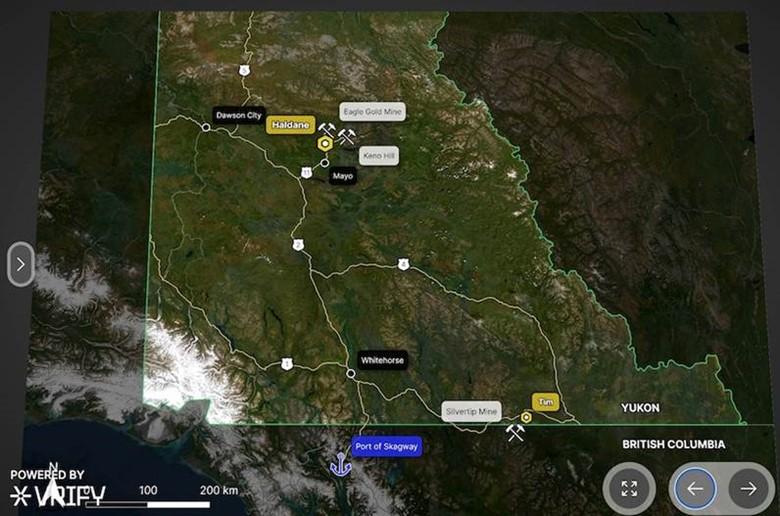

Silver North Resources (TSX-V:SNAG) (OTCQB:TARSF) offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

The company is planning a much larger drill campaign than last year, 2,500 meters compared to 750m, with drilling focused on the Main Fault where Silver North had success last year.

Keno Hill

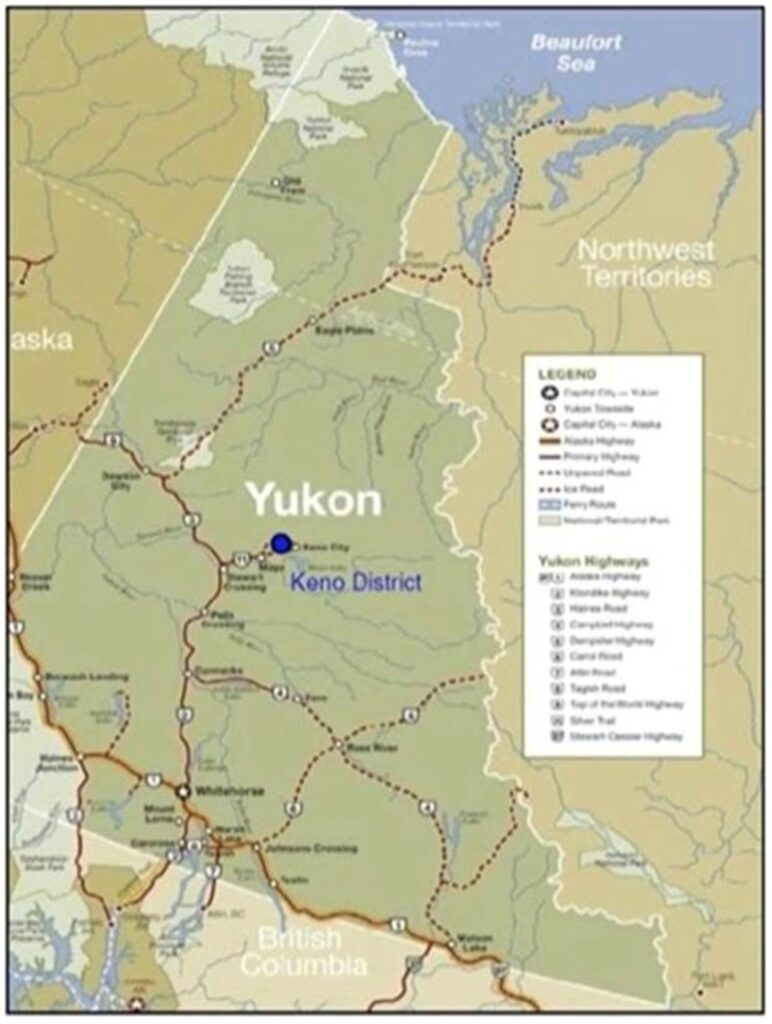

Keno Hill was not only Canada’s second largest primary silver producer and one of the richest silver-lead-zinc deposits ever mined, but it was also a mainstay of the Yukon economy, keeping the territory flush from the 1920s to the early ‘60s following the decline of the Klondike Goldfield.

At its peak, Keno Hill supported about 15% of the territory’s population and produced more wealth than the Klondike, one of the richest placer gold districts in the world.

Source: Mineralogical Association of Canada

According to the Yukon government, from 1913 to 1989, 4.87 million tonnes were mined at an average grade of 1,389 grams per tonne silver, 5.62% lead and 3.14% zinc. Over 65 deposits and prospects have been identified in the district. Most occur within the Keno Hill quartzite as structurally controlled veins close to the Robert Service Thrust Fault.

The district is about 450 km north of the Yukon capital, Whitehorse.

Although staked for its silver mineralization, the Keno Hill property is located within the Tintina gold belt, a zone of gold deposits associated with Cretaceous Tombstone suite granitic intrusions.

Significant deposits hosted within the Tintina gold belt include Banyan Gold’s AurMac, Snowline’s Valley, Victoria Gold’s nearby Eagle gold mine, Golden Predator’s Brewery Creek, Rockhaven’s Klaza project, in addition to numerous prospects including Gold Dome, Clear Creek, Red Mountain and other deposits in Alaska including Donlin Creek, Pogo and Fort Knox.

Three discoveries

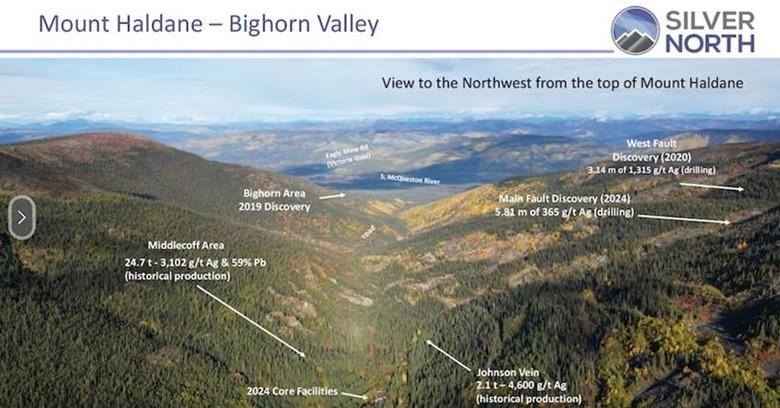

Silver North in November announced the Main Fault discovery at its Haldane silver project within the historic Keno Hill Silver District in the Canada’s Yukon Territory.

Drilling confirmed that the Main Fault, marked by a series of silver-bearing surface showings, is a productive structure hosting multiple high-grade silver-bearing veins and breccias. 732 meters of drilling was completed in three holes testing the West Fault and Main Fault targets.

The 8,579-hectare Haldane property is located 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine, and hosts numerous occurrences of silver-lead-zinc-bearing quartz-siderite veins as seen elsewhere in the district.

Main Fault is the third discovery Silver North has made since acquiring the Haldane property.

Thought to be a parallel structure to the West Fault, Main Fault was targeted in the 2024 drill program based on surface sampling of the fault at the Main and Main South showings where oxidized vein samples on surface average 151 g/t silver over 7.6m and 223 g/t silver over 3.6m. Two holes tested this target, successfully intersecting a wide structural zone consisting of three siderite-sulfide vein faults and breccias with an interstitial stockwork of siderite-bearing veinlets and brecciated host rocks that forms the overall structural zone.

The company also found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

Two takeaways from Silver North’s progress to date jump out at me.

First, discovery after discovery from first-time drilling makes Haldane a very prospective project. Rarely is a discovery made after completing just three drill holes.

“Our success rate in drilling new targets has been pretty good,” CEO Jason Weber commented with understatement. “We drilled Bighorn, where drilling had never been attempted and with the very first hole we hit silver veins, then at West Fault we made a new discovery a few years later, and now here at Main Fault, so I think it just speaks to the prospectivity of the Haldane property.”

In fact, in just eight drill holes Silver North made three discoveries, out of the 16 holes Silver North has drilled at Haldane (The remaining eight holes were drilled following up the West Fault discovery). A phenomenal success rate for an early-stage junior.

My second takeaway is the fact that the holes at Main Fault were drilled shallower than at West Fault, and SNAG is intersecting multiple veins with each hole.

2025 drilling

In a recent talk with AOTH, Weber said 90% of the 2025 drilling will be at Main Fault. “Exploring on strike and down dip, because we’ve only hit it on one section in two holes. So the idea is stepping out on that, testing it down dip along strike, and then hopefully moving the rig down the road and completing one hole at Bighorn.”

The $2 million program comes on the heels of two major financings, one for $1.3 million at the end of April, and an ongoing private placement wherein the company hopes to raise another $2.1M.

“At Haldane, a 10-hole (2,500 m) diamond drilling program will target expansion of Keno-style silver lead-zinc mineralization at the newly identified Main Fault target, a wide zone with at least three high grade silver veins identified to date. Drilling will aim to expand both along strike and to depth of the two discovery holes completed in 2024, one of which returned 1,088 g/t silver, 3.90 g/t gold, 1.89% lead and 0.63% zinc over 1.83 metres,” states the July 2 news release.

Drilling is expected to start at the end of July.

Silver North is using 300 grams per tonne as the cut-off grade, which isn’t be accident.

“I look at what Hecla’s reserves grades are, they’re closer to the 680 grams range, , so I think if you’re putting together anything 500 grams plus you’re good, 700-750 you’re off to the races,” says Weber. “I think Hecla’s cut-off grade is about 300 g/t silver so 300 as a good metric. If you’re getting 3, 4, 5 meters at 300 grams silver you’re in the ballpark. if you’re getting 500 and higher you’re in really good shape.”

He notes 3,000 to 4,600 grams silver was recovered from the Johnson and Middlecoff veins at Haldane from small scale hand mining in the early 1900s.

“Those kind of grades that make these things work, because you get these extremely high-grade pods where you can get 3,000 and 4,000 [g/t], and Hecla’s even hit a few >5,000-gram intersections where it adds silver ounces to the reserves extremely quickly. What it means is that with these exceptional grades these intersections can add ounces quickly and in a very small footprint.”

Indeed, with those high grades, it doesn’t take a lot of acreage to build a 30-million-ounce silver resource.

“In our case at Main Fault, within 300 meters of strike length, knowing the grades that Keno veins can produce, you could have that 30 million oz resource, so these things are not big at all, their footprint’s tiny because they’re so high grade,” says Weber.

A good neighbor

Alexco Resources had been working Keno Hill since 2006, but it struggled under a royalty agreement with Silver Wheaton that even after it was re-negotiated was still a millstone around its neck, impeding progress.

When Alexco closed the mill in 2022 Hecla saw an opportunity and acquired all of Alexco’s shares for about $72 million. The silver major restarted Keno Hill in mid-2023 and it’s been “rocking it” ever since.

Hecla Mining is now the biggest player in the district with a 440 tonne-per-day mill. Hecla commenced production at Keno Hill in mid-2023.

The mine produced 2.8 million ounces in 2024, while increasing silver reserves by 17% to 64.3Moz. Five deposits are present at Keno Hill: Bellekeno, Flame & Moth, Lucky Queen, Bermingham and Onek.

Hecla’s Yukon mine hosts enough high-grade reserves for 11 years of mining; drilling shows promise for near-future growth.

Hecla is a good model for Silver North Resources to follow as it develops its Haldane silver project, which is 25 kilometers west of the Keno Hill deposits; Hecla’s Keno Hill butts up against Silver North’s Haldane at the latter’s northeast corner.

Silver North says the same rocks as Hecla’s high-grade Keno Hill silver mines continue onto the Haldane property. It hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins as seen elsewhere in the district.

Conclusion

It’s remarkable that, even after 100 years of mining, the Keno Hill Silver District is still unearthing new discoveries.

Silver North Resources has been working its Haldane project making discovery after discovery — three in five years — Bighorn, West Fault and Main Fault — with very few holes drilled.

CEO Jason Weber and his team are extremely skilled, lucky and elated in having acquired a project with an environment so highly mineralized.

SNAG made three discoveries with three small drill programs and they’re not hitting single, narrow veins but multiple high-grade structures. Weber modestly noted they achieved some good grades but they’re probably not the best in the district — suggesting plenty of exploration upside. This year’s 2,500m drill program should yield steady news flow, the lifeblood of any junior explorer.

There is also room for movement in the stock price. Trading at just 15 cents per share with a paltry $9.1 million market cap, Silver North is, imo, still undervalued, despite recent doubling from $0.08 to $0.16.

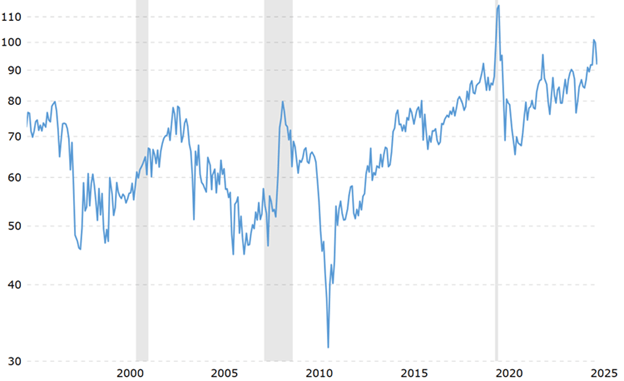

Silver is up 26% year to date and at 92:1, the silver-gold ratio is higher than the 50-60:1 historical average, suggesting a further rise in the price to reach the natural ratio is likely.

Silver Trading Economics

Gold Trading Economics

Gold Silver Ratio Macro Trends

Weber noted that when silver moves, it moves fast, causing silver equities to whipsaw. This makes timing an entry point difficult. The better strategy is to buy early when there’s a lull, like currently, and patiently wait for the upward price correction.

“We are just taking a little breather here, we had a good run and are setting up for the next one, I firmly believe that” he said.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.155 2025.07.02

Shares Outstanding 61.2m

Market cap Cdn$7.3m

SNAG website

Subscribe to AOTH’s free newsletter

Richard does not own shares of Silver North Resource (TSX-V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE