Rick Mills – “Silver North Intersects 13.15 Meters Averaging 818 g/t Silver and 1.39 g/t Gold

Assay results have been received for the first three holes of Silver North Resources’ (TSX-V: SNAG) (OTCQB:TARSF) summer drill program at its Haldane Project, located within the historic Keno Hill Silver District of Canada’s Yukon Territory.

The program, which started in mid-August and was recently completed, saw eight holes drilled totaling 1,759.5 meters. The assay results from five additional holes are pending.

“The focus of the 2025 program is to expand upon the discovery made at the Main Fault last year,” Silver North’s President and CEO Jason Weber said in the Aug. 15 news release. “The Main Zone has shown strong potential in both its high grades and large widths of mineralization. The current program will aim to build upon last year’s results and expand beyond the discovery section.”

All eight holes in the 2025 program were drilled into the Main Fault target.

The first hole extended mineralization 90 meters down dip from 2024 discovery intersections and 50 metres to the northeast.

Highlighted results include 3.2 meters averaging 2,014 g/t silver, 1.72 g/t gold, 4.73% lead and 1.1% zinc within a larger 13.15-meter intersection of 818 g/t silver, 1.39 g/t gold, 2.54% lead and 0.98% zinc from 249.9 meters down hole.

Another sub-interval starting at 256.1m averaged 1,112 g/t silver, 4.61 g/t gold, 7.11% lead and 1.51% zinc over 1.25m.

The road-accessible, 8,579-hectare Haldane property is sited 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine. Haldane hosts several occurrences of silver-lead-zinc-bearing quartz siderite veins resembling the ore-bearing veins being mined at Keno Hill.

“We are extremely pleased with the results of the 2025 program so far, highlighted by the 90m down dip step-out from last year’s discovery holes at the Main Fault,” Weber said in the Nov. 17 news release. “The width and grades of the mineralized portion of the structure at the Main Fault continue to impress; HLD25-31 is the best hole drilled on the property to date. We saw some indication of higher gold grades with some portions of the mineralized structure in 2024. With this down dip hole, we are seeing consistent high-grade silver with significantly higher gold concentrations than seen at other targets on the property.”

HLD25-31 was drilled from the same pad as the 2024 discovery holes at the Main Fault. The hole intersected the Main Fault approximately 90m down dip from hole HLD24-30.

According to SNAG, the HLD25-31 intersection appears to indicate a steepening of the structure versus the apparent dip in holes HLD24-29 and 30.

Additionally, the elevated gold grades observed in the hanging wall intersection of HLD24-30 are observed throughout the entire 13.15m interval. As with other intersections at the Main Fault and elsewhere on the Haldane property, mineralization consists of siderite +/- quartz, galena and sphalerite veins and breccias, as well as strongly faulted and ground-up vein and vein breccia material.

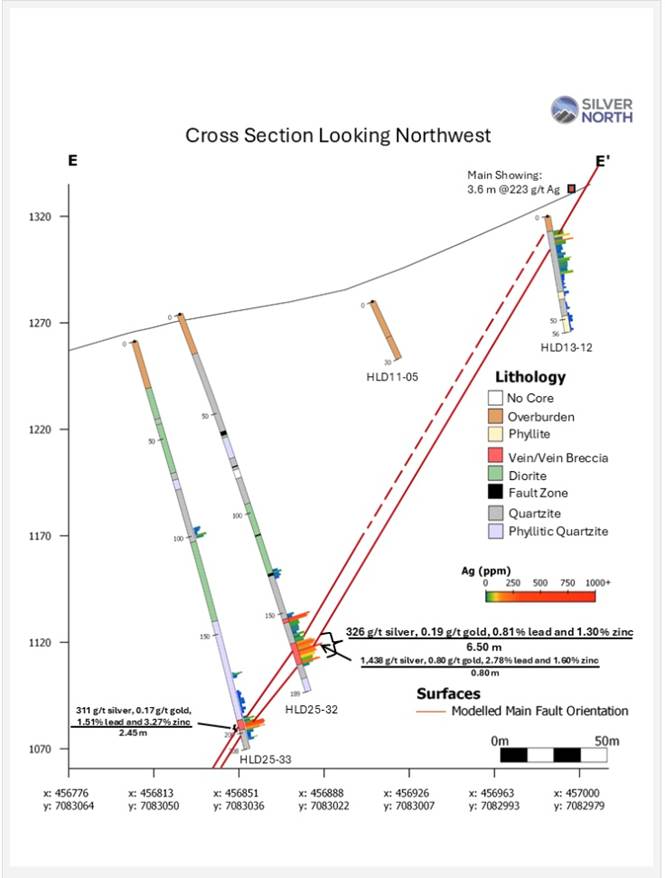

As for the other two holes, HLD25-32 and 33 were drilled to test the Main Fault on a section 50 meters to the northeast of HLD24-29 and 30, and HLD25-31 section. These holes successfully extended the breadth of silver-lead-zinc mineralization.

HLD25-32 intersected 6.5 meters averaging 326 g/t silver, 0.19 g/t gold, 0.81% lead and 1.3% zinc from 165.1 meters including 0.80m averaging 1,438 g/t silver, 0.51 g/t gold, 2.78% lead and 1.6% zinc. This is hosted within a broad 22.65-meter-wide mineralized zone averaging 160 g/t silver, 0.23 g/t gold, 0.75% lead and 0.80% zinc from 153.0 meters down hole.

HLD25-33 intersected the Main Fault approximately 45m down dip of HLD25-33, yielding 2.45m of 311 g/t silver, 0.17 g/t gold, 1.51% lead and 3.27% zinc, within a 5.56m interval of 176 g/t silver, 0.11 g/t gold, 1.33% lead and 1.96% zinc from 193.49m down hole.

Drill hole plan map

Silver North offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Under the Spotlight – Jason Weber CEO, Silver North

Silver North a year ago announced the Main Fault discovery —the third Silver North has made since acquiring the Haldane property.

Although staked for its silver mineralization, Hecla’s Keno Hill property is located within the Tintina gold belt, a zone of gold deposits associated with Cretaceous Tombstone suite granitic intrusions.

Significant deposits hosted within the Tintina gold belt include Banyan Gold’s AurMac, Snowline’s Valley, Victoria Gold’s nearby Eagle gold mine, Golden Predator’s Brewery Creek, Rockhaven’s Klaza project, in addition to numerous prospects including Gold Dome, Clear Creek, Red Mountain and other deposits in Alaska including Donlin Creek, Pogo and Fort Knox.

There have been 200 million ounces of silver mined so far out of the district; the mines are primary silver mines with by-products zinc and lead.

The average silver mine in the Keno Hill District is 30 million ounces, and the historical production grade sits at around 1,100 g/t silver.

Silver North achieved nearly double that in the sub-interval of its first hole of the 2025 drill program (3.2 meters averaging 2,014 g/t silver, and 1.72 g/t gold). The full interval, a 13.15m intersection, returned 818 g/t silver and 1.39 g/t gold — still remarkable.

Silver North raised $1.35 million earlier this year, the hard-dollar precursor to a $2.1 million financing which closed on Aug. 12.

Silver North has done three small drill programs and each of the programs has made discoveries, but Main Fault is special, it’s a large chunk of mineralization and with at least 200 meters of surface expression and significant down-dip potential. SNAG thinks drilling this year is going to, at the very least, achieve better visibility towards attaining a 30-million-oz regular Keno deposit.

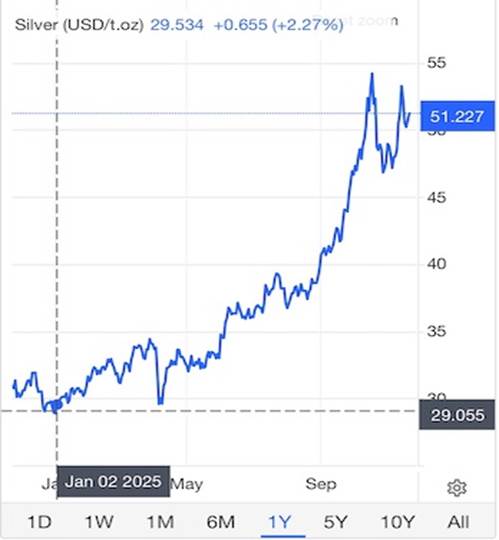

Silver market

Silver has had a phenomenal 2025, gaining 76% year to date, bettering even gold’s 57% historic run.

Source: Trading Economics

According to Trading Economics, on Wednesday Silver steadied around $51 as markets digested the Fed’s October minutes which revealed a divided committee. Many officials still expect cuts at some point but a large group signalled that a December move is not certain, and that pullback in near term easing expectations strengthened the dollar and removed some momentum from the metals rally. At the same time lingering macro and geopolitical risks preserved safe haven demand. Physical fundamentals remained supportive with technical momentum from last month’s break above $52 keeping buyers engaged and steady Asian physical purchases propping up demand even as spot liquidity has shown signs of improvement. With attention fixed on the delayed US jobs report and further Fed commentary, silver’s next leg will hinge on whether incoming data restores stronger cut odds or confirms a more cautious Fed path.

While the Federal Open Market Committee approved a 25-basis-points cut at their Oct. 28-29 meeting — the benchmark rate is now 3.75%-4% — the path forward looks less certain.

At the post-meeting news conference, Fed Chair Jerome Powell said a December rate cut was “not a foregone conclusion.”

According to CNBC, traders had been pricing in a near certainty of another move at the Dec. 9-10 session. As of Wednesday afternoon, that had been reduced to about a 1 in 3 chance, according to the CME Group’s FedWatch measure of futures pricing. Odds for a January cut are around 66%.

The minutes from that meeting, released Wednesday, showed Federal Reserve officials expressing skepticism about the need for an additional rate reduction before the end of the year. The officials are divided over whether a stalling labor market or stubborn inflation are bigger economic threats.

Meanwhile, silver’s combination of monetary and industrial demand, combined with tight supply conditions, is driving the metal to fresh heights. Silver reached a record USD$54.47 on Oct. 17.

While silver hasn’t been able to hold gains above $54 an ounce, selling pressure has been limited. A slowing world economy has weighed on the precious metal’s industrial demand, but strong investment demand has more than made up for the drop, states the Silver Institute.

In its outlook, the institute re-iterated that the silver market will see its fifth annual deficit this year of 95 million ounces. Inflows into silver-backed ETFs have increased by 187Moz so far this year, said Philip Newman, managing director at Metals Focus, the British research firm behind the annual Silver Survey.

“This reflects investor concerns over stagflation, the Federal Reserve’s independence, government debt sustainability, the US dollar’s role as a safe haven, and geopolitical risks. Silver’s exceptional price performance and its favorable supply-demand backdrop have further reinforced investor confidence,” Newman said in his note.

Kitco News said the silver market has seen significant supply chain disruptions:

At the start of the year, significant amounts of silver flowed into the US as bullion banks and other market players built a stockpile to avoid potential tariffs.

Although the US government has said that precious metals, including silver, are exempt from tariffs, the metal has remained in New York due to concerns it could still face import taxes, as it has also been declared a critical metal.

New York vaults are overflowing with silver, and refiners are at capacity when it comes to recycling the metal. Buyback premiums for scrap silver are significantly lower in North America because of the glut.

Meanwhile, in London, growing demand from India and rising investment demand in ETFs have created significant tightness in the local marketplace, driving lease rates to record highs.

In an interview with Kitco News, Metals Focus Director of Gold and Silver Matthew Piggott said there are expectations for silver to experience annual supply deficits for the foreseeable future.

The company forecasts silver will rise to $60/oz in 2026.

It’s a great time to be exploring for silver, with by-products gold, lead and zinc, in the Yukon’s historic Keno Hill Silver District, right next door to Keno Hill, an active silver mine being run by Hecla Mining, the largest silver miner in the United States and Canada.

Silver North Resources

TSX-V:SNAG, OTCQB:TARSF

Cdn$0.28 2025.11.19

Shares Outstanding 61.2m

Market Cap Cdn$17.8m

SNAG website

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver North Resource (TSX.V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE