Rick Mills – “Silver North Drilling Flagship Haldane”

Silver North Resources (TSX-V: SNAG) (OTCQB: TARSF) in mid-August started drilling its flagship Haldane silver project, located within the historic Keno Hill Silver District in Canada’s Yukon Territory.

According to the company, initial plans outline 10 holes from four drill sites, totaling approximately 2,500 meters of drilling.

“The focus of the 2025 program is to expand upon the discovery made at the Main Fault last year,” Silver North’s President and CEO Jason Weber said in the Aug. 15 news release. “The Main Zone has shown strong potential in both its high grades and large widths of mineralization. The current program will aim to build upon last year’s results and expand beyond the discovery section.”

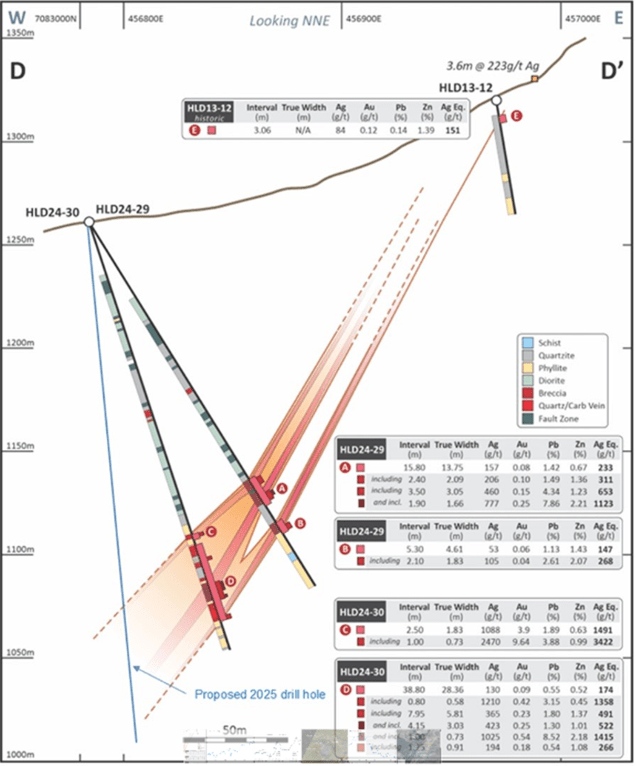

The first hole is testing down-dip of the 2024 Main Zone discovery, where three stacked high-grade silver-bearing veins were intersected within a structural zone that returned 28.36m (true width) of 130 g/t silver, 0.09 g/t gold, 0.55 % lead and 0.52% zinc.

Further details on the drill program are as follows:

The ten hole (~2,500 metres) diamond drilling program will target expansion of Keno-style silver lead-zinc mineralization at the newly identified Main Fault target, a wide zone with at least three high grade silver veins identified to date. Holes HLD24-29 and -30 intersected high grade mineralization such as 1.83m (true width) of 1,088 g/t silver, 3.90 g/t gold, 1.89% lead and 0.63% zinc as well as wider zones of silver mineralization including 5.8m (true width) 365 g/t silver, 0.23 g/t gold, 1.80% lead and 1.3 % zinc (refer to Silver North’s news release dated November 14th, 2024).

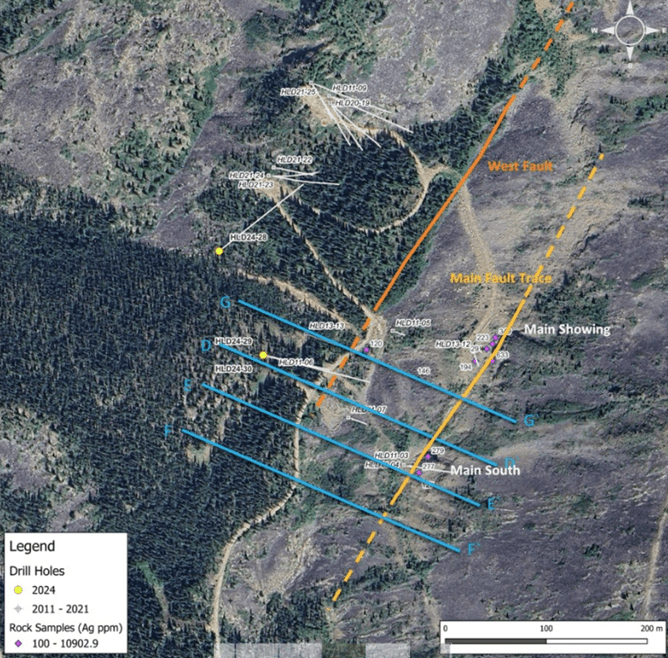

The first hole of the program (HLD25-31) will test the continuity of mineralization approximately 60m further down dip of the 2024 intersections. The remaining holes, subject to in-field adjustments due to logistical consideration or visual results, will consist of fans of 3 holes on sections approximately 50 and 100 metres southwest and 50 metres northeast of the discovery section to test the strike and depth continuity of mineralization (Figures 1, 2). Time and budget permitting, one hole may also be completed at the Bighorn target, following up on silver-bearing quartz-siderite-galena veins intersected in the only drillhole at Bighorn.

The program is expected to be completed by the end of October.

Figure 1 – Main Zone plan with proposed drill sections

Figure 2 – Cross Section D-D’ – Main Fault drilling

Haldane project

Silver North offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

The company’s drill campaign is much larger than last year, 2,500 meters compared to 750m, with drilling focused on the Main Fault where Silver North had success last year.

Although staked for its silver mineralization, the Keno Hill property is located within the Tintina gold belt, a zone of gold deposits associated with Cretaceous Tombstone suite granitic intrusions.

Significant deposits hosted within the Tintina gold belt include Banyan Gold’s AurMac, Snowline’s Valley, Victoria Gold’s nearby Eagle gold mine, Golden Predator’s Brewery Creek, Rockhaven’s Klaza project, in addition to numerous prospects including Gold Dome, Clear Creek, Red Mountain and other deposits in Alaska including Donlin Creek, Pogo and Fort Knox.

Silver North last November announced the Main Fault discovery at its Haldane silver project within the historic Keno Hill Silver District in Canada’s Yukon Territory.

Drilling confirmed that the Main Fault, marked by a series of silver-bearing surface showings, is a productive structure hosting multiple high-grade silver-bearing veins and breccias. 732 meters of drilling was completed in three holes testing the West Fault and Main Fault targets.

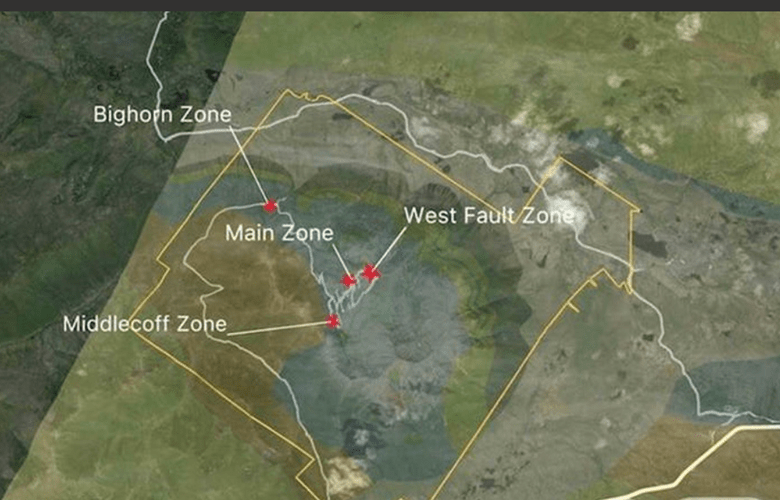

The 8,579-hectare Haldane property is located 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine, and hosts numerous occurrences of silver-lead-zinc-bearing quartz-siderite veins as seen elsewhere in the district.

Main Fault is the third discovery Silver North has made since acquiring the Haldane property.

Thought to be a parallel structure to the West Fault, Main Fault was targeted in the 2024 drill program based on surface sampling of the fault at the Main and Main South showings where oxidized vein samples on surface average 151 g/t silver over 7.6m and 223 g/t silver over 3.6m. Two holes tested this target, successfully intersecting a wide structural zone consisting of three siderite-sulfide vein faults and breccias with an interstitial stockwork of siderite-bearing veinlets and brecciated host rocks that forms the overall structural zone.

The company also found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at the Bighorn target with high lead concentrations.

Two takeaways from Silver North’s progress jump out at me.

First, discovery after discovery from first-time drilling makes Haldane a very prospective project. Rarely is a discovery made after completing just three drill holes.

Exciting for investors, Haldane is one of only a few pure-play silver deposits in the world, and even rarer, it is being drilled.

In just eight drill holes Silver North made three discoveries, out of the 16 holes Silver North has drilled at Haldane — a phenomenal success rate for an early-stage junior.

Silver North Rides the Silver Rocketship

My second takeaway is the fact that the holes at Main Fault were drilled shallower than at West Fault, and SNAG is intersecting multiple veins with each hole.

The Main Fault hosts multiple high-grade, silver-bearing veins and breccias. You can have a 30-million-ounce silver deposit within 300 meters at those grades, and they’ve got a lot of veins left to explore in a lot of areas.

The project is in the Yukon’s Keno Silver District, one of the highest-grade silver districts in the world. In fact, it’s right next to the silver veins being mined at Keno Hill by Hecla.

There’s been 200 million ounces of silver mined so far out of the district and the mines are primary silver mines with by-products zinc and lead.

Hecla started mining Keno Hill in 2023 with proven and probable reserves of close to 50 million ounces @ 700 grams per tonne. And the mineralization in their project, what they’re mining, is similar to the Haldane project.

The average silver mine in the Keno Hill District is 30 million ounces, and the historical production grade sits right around 1,100 grams per tonne silver.

Silver North has a plan, a focus, and they’re executing. They raised $1.35 million earlier this year, the hard-dollar precursor to the current $2.1 million financing, which closed on Aug. 12.

Silver North has done three small drill programs and each of the programs has made discoveries, but Main Fault is special, it’s a large chunk of mineralization and there are three layers to it. SNAG thinks drilling this year is going to, at the very least, achieve clear visibility towards attaining a 30-million-oz regular Keno deposit.

Silver market

If you like silver, you’ve got to like the leverage offered by a pure silver play like Haldane.

Silver is breaking out, up around 48% year to date, surpassing even gold. In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

Washington last month categorized silver as critical to US national security, meaning that any new silver mines in the United States will be highly valued.

(Among its update draft list of 54 critical minerals, the US Geological Survey added silver, copper, potash, silicon, rhenium and lead.)

Silver’s time to shine — Richard Mills

The bullish factors for silver include the ongoing supply deficits, as silver miners fail to keep up with demand from the solar power sector and electric vehicles, specifically. Solid-state batteries and new applications like AI data center chips, advanced electrical relays, smart grid infrastructure upgrades, and every US manufacturing facility, will pile on more demand for silver. Mine supply has shrunk 7% since 2016.

The investment case for silver is also strong, and getting stronger, as market participants price in a 25-basis-points cut in September, and possibly a 50-bp reduction, despite the threat of inflation posed by the Trump tariffs, as imported goods get more expensive. In the first half of 2025, silver ETFs saw significant inflows, reaching 95Moz.

Trump is actively trying to manipulate the Federal Reserve’s Board of Governors, to replace current Fed Chair Jerome Powell with personnel more on board with interest rate cuts. A rate cut in September would certainly be a tailwind for precious metals.

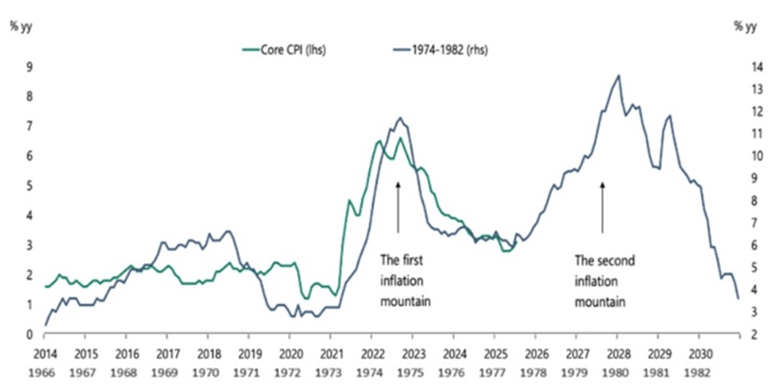

The Fed is arguably bumbling into a similar policy mistake that they made in the 1970s, that of cutting rates too soon after an initial inflation spike in July.

Will the Fed cause an inflation mountain by lowering rates too soon? — Richard Mills

US producer prices increased by the most in three years in July amid a surge in the costs of goods and services.

Companies are starting to pass on higher input costs to their customers after months of “eating them”. The higher costs are weighing on corporate earnings, putting shareholder pressure on firms to maintain profit margins and “pass through” the tariffs.

The Producer Price Index (PPI) in July rose 0.9% from June, the largest advance since consumer inflation peaked in June 2022, said a report by the Bureau of Labor Statistics (BLS). It climbed 3.3% from a year ago.

The Personal Consumption Expenditures (PCE) price index was +2.6% in July, and the core PCE (goods and services minus food and fuel, and the Fed’s preferred measure of inflation) was +2.9%, up from 2.8% in June and the highest since February.

Economist Torsten Slok warned about this at the Jackson Hole Symposium in August, where he said the Fed see structural distortions from tariffs and immigration policy.

(Tariffs are inflationary because they force importers to pay an extra “tax” on imports, that are eventually passed onto consumers. Immigration restrictions are inflationary because they pull workers out of the economy. The removal of workers is pushing up wages in industries like agriculture, construction and hospitality.)

If those forces keep inflation sticky and Powell cuts rates, as he’s under pressure from the White House to do, Slok wrote that he could be vulnerable to a 1970s-style “stop-go” policy mistake — the backdrop for the second inflation mountain.

In such a scenario, reminiscent of the ‘70s, if the Fed loosens policy prematurely, inflation could spike, leading to the painful corrective measures seen under Powell’s predecessor Paul Volcker, who hiked rates aggressively and weathered severe, double-dip recessions. — Fortune

Source: Apollo Global Management

Trump is highly motivated to get the Fed to cut interest rates so that he doesn’t have to finance the national debt at higher rates when US Treasury bonds roll over. It looks like Trump will get his wish.

He nominated Stephen Miran, chair of the Council of Economic Advisors, to replace Adriana Kugler on the Federal Reserve Board of Governors. Fed Governor Christopher Waller, viewed as more dovish, could be Trump’s pick to lead the central bank, reinforcing expectations of easier policy. Trump could either fire Powell or wait until his term ends next May before appointing a successor more to his liking.

Gold’s real secular move has yet to even begin – Richard Mills

Interest rate cuts are a tailwind for precious metals. Gold is up over a third year to date, hitting $3,500 an ounce for the first time earlier this month. Silver had done even better, rising 48%.

One-year silver chart. Source: Trading Economics

The dollar, meanwhile, suffered its worst first-half performance in 50 years. A low dollar is generally good news for gold/silver and gold/silver stocks.

A top economist says the US is at the ‘Edge of the cliff’ and in a full-blown labor recession that risks spilling into the rest of the economy.

One-year DXY. Source: Trading Economics

Conclusion

There are 12 kilometers of vein potential on the property; other discoveries include the high-grade West Fault.

I like this project because it’s got standalone potential, or it could be plug into Hecla’s existing operation. Hecla has 55 million ounces of proven and probable silver reserves, SNAG is literally next door, just 2 kilometers away from Hecla’s mill. If Silver North can show they have 30, 40, 50 million ounces of silver, I’m thinking they will be looked at pretty hard by Hecla.

At a market capitalization of just $24.2 million, as of Monday’s close, Silver North is cheap, with a great story and money in the bank.

What’s more, the share price is up 375% year to date.

Silver North Resources

TSX-V:SNAG, OTCQB:TARSF

Cdn$0.38 2025.09.15

Shares Outstanding 61.2m

Market Cap Cdn$24.2m

SNAG website

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver North Resource (TSX-:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE