Rick Mills – “Silver Market”

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

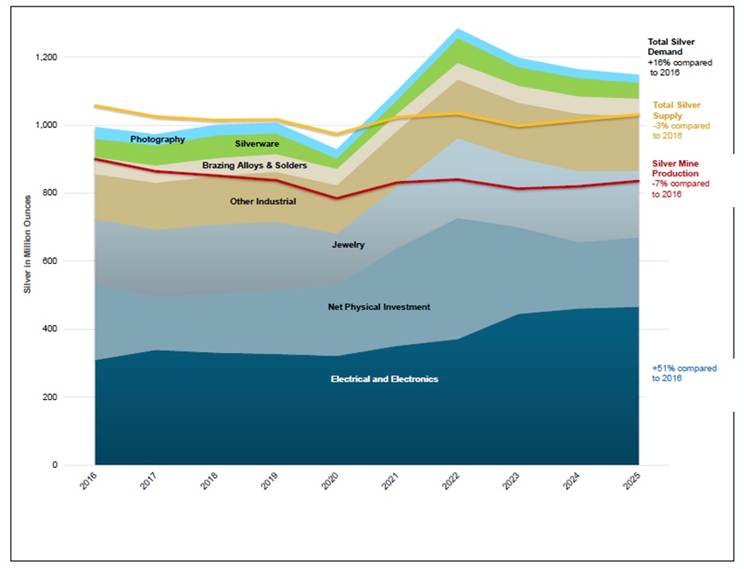

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

A report commissioned by the Silver Institute found that demand for industrial applications, jewelry production and silverware fabrication is forecast to increase by 42% between 2023 and 2033.

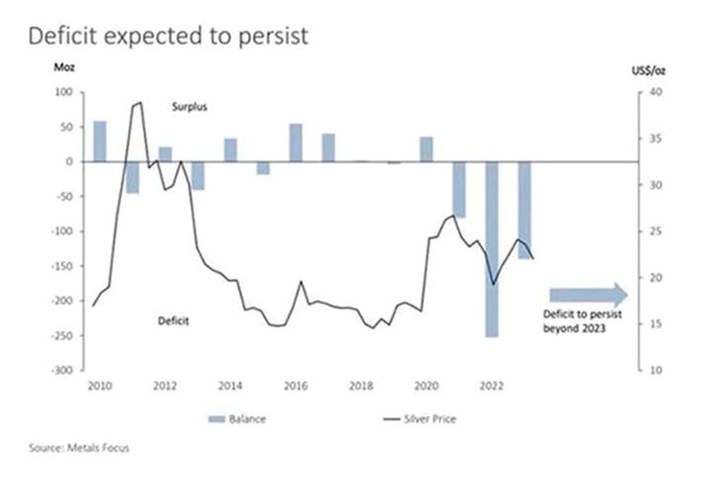

The Silver Institute reported the global market for silver experienced a deficit in 2024 of 148.9 million ounces, the fourth year in a row that supply failed to meet demand, fueled by technologies like solar panels, electric vehicles and AI-related electronics.

In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

The cumulative shortfall from 2021-25 is almost 800 million ounces.

Undervalued silver poised for explosive move higher – Richard Mills

In fact, the silver shortage is only expected to get worse, accompanied by higher prices.

A breakdown of the silver market by commodities analyst Marin Katusa, via John Rubino, explains how silver’s declining usage in photography — as film cameras were replaced by digital SLRs and smart phones — has been replaced by silver needed for solar, solid-state batteries and new applications like AI data center chips, advanced electrical relays, smart grid infrastructure upgrades, and every US manufacturing facility.

“Which is why the global industrial silver demand is soaking up nearly all of the silver on the planet,” Rubino writes.

A few facts to accompany the charts below:

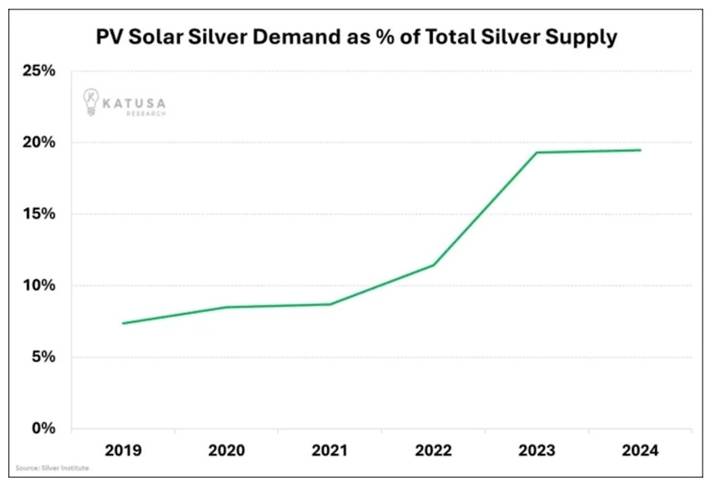

- Silver is the most conductive metal on planet earth, making it the most efficient metal for photovoltaic cells’ solar power.

- BloombergNEF expects solar to have a record-breaking year in 2025, with 698GW of new capacity installed. Then 753GW in 2026, and 780GW in 2027. That would put solar silver demand at around 20% of total silver supply.

- Although the silver intensity of solar panels has been dropping in a process known as “thrifting”, standard solar cells are being replaced by “TOPCon” cells, which use more than twice as much silver as PERC cells. If TOPCon’s market share climbs to 84% in the next four years (as projected) and global solar capacity additions hit BloombergNEF’s forecast of 827GW, silver’s annual solar demand could reach 557Moz, 54% of annual supply.

- Silver is lightweight and highly conductive, helping EVs achieve better mileage. Samsung’s next-gen solid-state EV battery has twice the energy density of its competitors and gets 600 miles on a single 9-minute charge. Samsung already has an agreement to begin production and when it does, every car manufacturer will have to play catch-up. If that battery were used in just 20% of global car production, it could take an additional 514Moz of silver.

Of course, we can’t forget that silver, like gold, is a monetary metal too. With the market entering its fifth straight year of structural deficits, investors and even central banks are beginning to accumulate silver at historic rates.

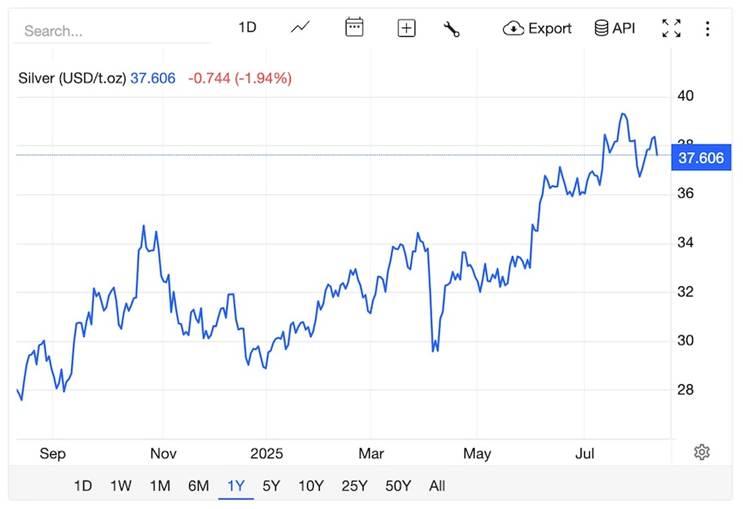

In June 2025 alone, Rubino writes, silver ETFs saw $1.6B in net inflows, more than all of 2024. So far this year, silver has appreciated by 30%, as of this writing, to $37.60/oz. Silver’s performance in July was the best in 14 years.

Source: Trading Economics

While that is an impressive gain, even better than gold’s 27% YTD, some analysts predict the rally is just getting started.

In its mid-year outlook for silver, Sprott highlighted the years-long structural deficit and intensifying industrial demand as major factors to propel prices even higher.

Citigroup recently upgraded its near-term silver price forecast to beyond $40 an ounce, citing tightening supply and strengthening demand. (Mining.com)

Sprott explains what by now is a familiar story. Dwindling supply isn’t keeping up with demand, especially from three sectors— solar power, EVs and electronics. Solar alone accounted for 17% of last year’s silver demand, triple the 5.6% from a decade ago. Mine supply has shrunk 7% since 2016.

Source: Sprott

Surging lease rates are another indication of a tightening silver market.

An AI Overview tells us that silver lease rates are the interest rates that borrowers pay to lease or borrow physical silver. Elevated lease rates often indicate a tightening physical market, where it’s more difficult or expensive to obtain physical silver.

According to the Jerusalem Post,

“Rising lease rates are a clear warning sign that the physical market is tightening,” said Nicky Shiels, head of metals strategy at MKS PAMP SA, in a recent client note. “It’s a supportive backdrop for higher prices if this trend continues.”

The sharp moves have drawn the attention of both hedge funds and retail investors, who are looking for signs of another squeeze in precious metals.

Sprott notes a wildcard for the silver market is investment demand. Because silver ETFs are backed by physical silver stored in vaults, this silver is unavailable for industrial users. In the first half of 2025, silver ETFs saw significant inflows, reaching 95Moz.

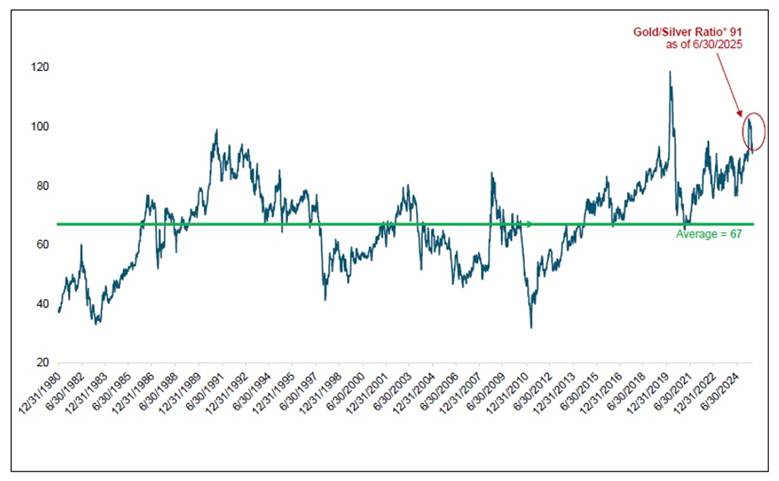

Another factor is the gold-silver ratio. To find the ratio, simply divide the gold price by the silver price. If the ratio is above the historical average of 67, silver is undervalued compared to gold. The current gold-silver ratio, as of this writing, is 88. For the ratio to correct towards the mean value of 67, either silver has to go up or gold must go down. I put my money on silver increasing

Source: Sprott

Sprott analyst Maria Smirnova says that silver is primarily influenced by retail investment demand, while gold is controlled by central banks and sovereign entities.

“The available inventory of freely traded silver has been heavily diminished, making the metal more sensitive to incremental buying. Small increases in demand could now lead to disproportionately large increases in price,” she wrote.

Indeed, in past precious metals bull markets, silver’s rally has been, on average, about twice as large as gold, Sprott’s report said.

Silver is also more volatile than gold, which is why it is sometimes called “the devil’s metal”. While gold’s monthly historical volatility is around 13.28%, silver’s is 23.57%.

What do the charts say?

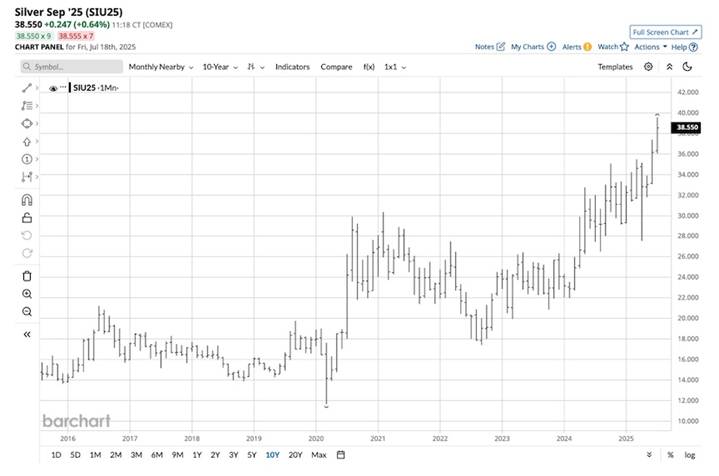

You might be aware that silver has done well this year, but did you know how well silver has performed since the pandemic year, 2020? According to the 10-year monthly COMEX silver futures chart below, since a 2020 low of $11.64/oz, silver has more than tripled in value.

Source: Barchart

Barchart says the next technical price target is around $50.

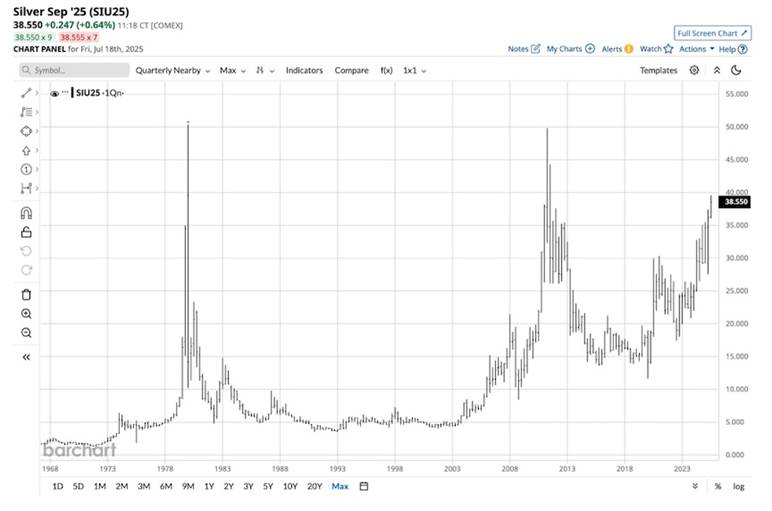

The question technical analysts really want to know the answer to, is could silver breach the all-time high reached in 1980 of $50.32?

For a long-term chart see the quarterly continuous contract chart below. The next-biggest spike after 1980 was 2011, when silver hit $49.82. Barchart notes that silver’s fundamentals have aligned with the price action, pointing out the Silver Institute’s forecasted 150Moz deficit this year.

Source: Barchart

But this does not account for “the potential of skyrocketing investment and speculative demand.” Another potential catalyst for silver is if the Trump administration slaps a tariff on the metal, like the 50% levy it has imposed on semi-finished copper imports.

“The bottom line is that tariffs and silver’s bullish trend could attract a herd of speculative buying, causing silver prices to rise, perhaps substantially, past the 1980 peak,” Barchart writes.

Morris Hubbartt, chief market analyst and trading risk specialist with Super Gold Signals, published a selection of charts showing bullish signals for silver and silver stocks. The four I chose below are spot silver, the Global X Silver Miners ETF (NYSE:SIL), ProShares Ultra Silver (NYSE:AGQ), and Amplify Junior Silver Miners ETF (NYSEArca:SILJ).

Source: StockCharts

A good indication we are in a silver bull market is when high-profile investors are buying.

India-based Economic Times asked Jim Rogers soon after silver hit a 14-year high whether he was buying the metal. Rogers’ reaction? Yes, because it’s still inexpensive.

“Well, I bought more silver last week. If silver continues cheap, I hope I am smart enough to buy more. I own gold. I am not buying gold. I am buying silver because silver is down. Gold is not,” said the financial commentator and chairman of Beeland Interests, Inc.

Rogers also gave his opinion on the US dollar. He said because America is the largest debtor nation in the history of the world, and the debt gets worse by the day, he plans to sell it “when the dollar goes up in a big spurt.” This is despite Rogers stating that he doesn’t know of another currency that can compete with the greenback.

Precious metal investors closely watch two things: the US dollar and interest rates. The dollar usually moves in an opposite direction to gold and silver. Lower interest rates are generally good for precious metals while higher rates stifle PM demand. The reason, of course, is that investors can get a yield off investments like government bonds and when interest rates rise, bond yields typically follow.

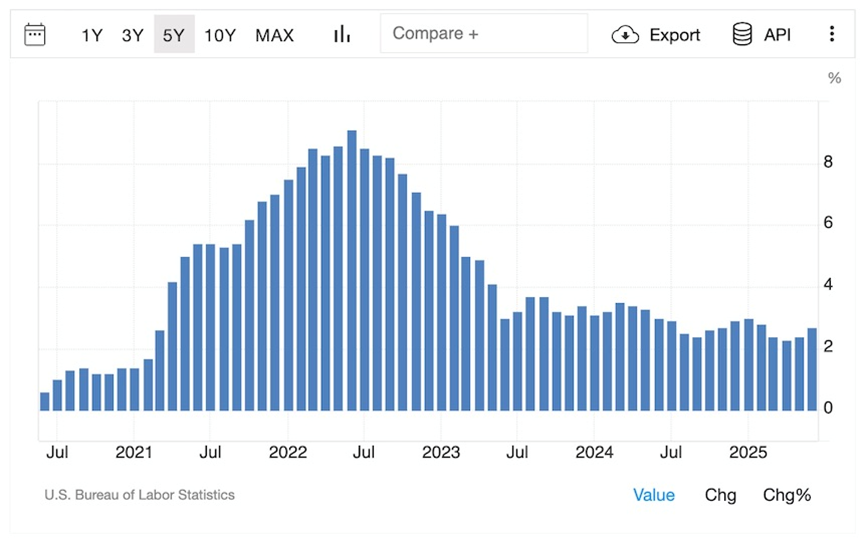

Will the Federal Reserve raise or lower interest rates? PM investors need to know. While the Fed raised rates to quell high inflation that started rising in 2021 following the pandemic, it stopped raising them when inflation came close to its 2% target. At its last meeting at the end of July, the Federal Open Market Committee held rates steady at a range of 4.25-4.50%. The Fed hasn’t cut rates since the second half of 2024, when it lowered them by a total of 1%.

But weak economic data — including a disappointing jobs report, a soft ISM Services PMI, and elevated jobless claims — have reinforced market bets on a rate cut next month.

Adding to the speculation, President Trump nominated Stephen Miran, chair of the Council of Economic Advisors, to replace Adriana Kugler on the Federal Reserve Board of Governors. The move has fueled concerns that the Fed could become more politicized and risk losing some of its independence. Markets also weighed reports that Fed Governor Christopher Waller, viewed as more dovish, could be Trump’s pick to lead the central bank, reinforcing expectations of easier policy.

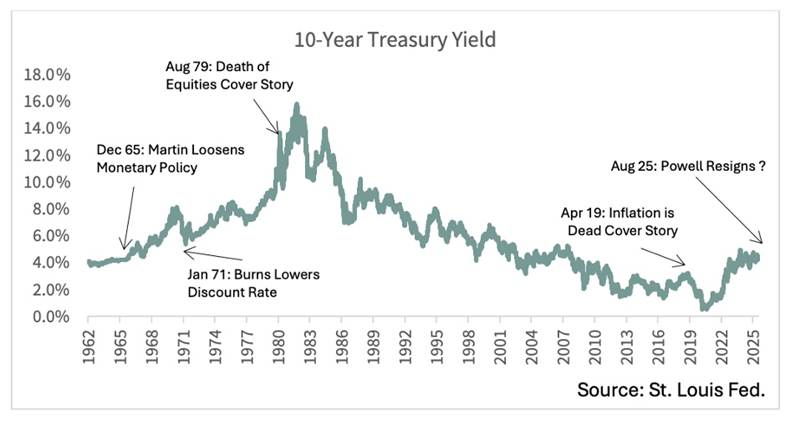

Wall Street commodities investment firm Goehring & Rozencwajg just put out a column making the point that Trump isn’t the first US president to interfere in the workings of the supposedly apolitical US Federal Reserve; former Fed chairs William McChesney Martin and Arthur Burns both caved to the wishes of their sitting presidents.

Entertainingly, G&R recalled the last time a Fed Chairman found himself in similar crosshairs, it ended with a shove against the stone wall of a Texas ranch house, courtesy of President Lyndon B. Johnson himself. That chairman was William McChesney Martin…

Just as Martin and Burns, despite their reputations and resolve, eventually bowed to the pressure from their respective Commanders-in-Chief, we believe Jerome Powell will—sooner or later—do the same. Whether by reluctantly guiding interest rates downward himself or by exiting stage left to make room for a more compliant successor, the outcome is likely to be identical. One way or another, monetary policy will loosen. We are confident that Trump’s new appointee will arrive in his office; sleeves rolled up and rate cuts ready.

If or when that happens, Goehring & Rozencwajg again lean on history to predict the likely outcome: inflation. They say that in both 1966 and 1971, when the Fed chairmen turned monetary policy towards accommodation (lower rates) to please their political masters, “Inflation took off like a shot… the road ahead leads not to price stability but to another inflationary surge, just as potent as those that came before.”

In fact, they believe higher inflation to be a long-term trend.

US inflation rate. Source: Trading Economics

We are firmly in the camp that believes the great disinflationary arc, which began in the stern days of Paul Volcker’s Fed, has run its course. The era of falling yields and fading price pressures is over. In its place, a new cycle has begun—an inflationary one, with the potential to stretch across decades.

Conclusion

Silver is breaking out, up around 30% year to date, surpassing even gold. In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

Could silver breach the all-time high in 1980 of $50.32? The technical analysis from Morris Hubbartt above looks promising.

The bullish factors for silver include the ongoing supply deficits, as silver miners fail to keep up with demand from the solar power sector and electric vehicles, specifically. Solid-state batteries and new applications like AI data center chips, advanced electrical relays, smart grid infrastructure upgrades, and every US manufacturing facility, will pile on more demand for silver. Mine supply has shrunk 7% since 2016.

The investment case for silver is also strong, and getting stronger, as market participants price in at least once rate cut in September, and possibly another in December, despite the threat of inflation posed by the Trump tariffs, as imported goods get more expensive. In the first half of 2025, silver ETFs saw significant inflows, reaching 95Moz.

Trump is actively trying to manipulate the Fed’s Board of Governors, to replace Powell with personnel more on board with interest rate cuts. A rate cut in September would certainly be a tailwind for precious metals.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE