Rick Mills – “Precious Metals Bull Market Set to Continue, as Gold and Silver Shrug Off Gaza Peace Deal”

President Trump scored a major diplomatic win by brokering a ceasefire between Israel and Hamas in the two-year war in Gaza.

But was it a Pyrrhic victory and what lies ahead for the beleaguered enclave of Palestinians ruled by terrorist group Hamas?

At AOTH, we assert that the peace deal is unlikely to hold. Peace may have broken out in the Middle East but it’s unlikely to last for long, as the key stakeholders jostle for position.

Gold is a reliable indicator of geopolitical tensions, and one would think that the agreement would knock the gold price off its lofty perch. But it didn’t. Over the past five days, gold has risen from $3,943 on Oct. 9 to $4,160 as of this writing at 4 p.m. PST on Oct. 14. In fact, the precious metal hit a fresh record high on Tuesday of $4,170.48 earlier in the trading session before slipping back about $10 an ounce.

One-week spot gold. Source: Trading Economics

Trading Economics said investors increased safe-haven purchases amid escalating US-China trade tensions and growing expectations of US interest rate cuts. China threatens more retaliation after sanctioning five US units of South Korean shipbuilder Hanwha Ocean. This comes after US President Trump threatened to impose additional 100% tariffs on Chinese imports in response to Beijing’s move to tighten export controls on rare earths. Market anxiety also lingered over the prolonged US government shutdown, which Treasury Secretary Scott Bessent said is beginning to affect the economy.

Silver also climbed to a new record on Tuesday of $53 an ounce, as a historic short squeeze and tightening liquidity in London drove traders to scramble for physical supply globally, according to Trading Economics. Lease rates in London soared more than 30% on Friday, pushing rollover costs for short positions to unsustainable levels. At the same time, surging demand from India in recent weeks further strained supply, following earlier shipments of silver to New York amid fears the metal could face US tariffs.

One-week spot silver. Source: Trading Economics

(Gold and silver both kept climbing on Wednesday, Oct. 15, with gold trading at $4,218.10 as of 5:22 pm PST, and silver at $53.15)

The shaky peace accord is just one of several factors keeping gold and silver prices at record levels. Here we take a deep dive into them.

Hopes for peace exaggerated

On Monday, Oct. 13, Hamas returned all living Israeli hostages, while Israel freed almost 2,000 Palestinian prisoners and detainees.

At a summit in Egypt, Qatar, Turkey, Egypt and the US signed a declaration as guarantors of the ceasefire deal.

After being greeted by Israeli Prime Minister Benjamin Netanyahu, Trump visited the Knesset, where he conducted the first address by a US president since 2008. (BBC News)

While these are undeniably positive developments, the long-term success of the peace agreement lies in its minutia — in other words, “the devil is in the details.”

The next step after the hostage and prisoner exchange was for the Israeli Defense Forces to withdraw to an agreed-upon line within the Gaza Strip. But according to The Times of Israel, on Tuesday the IDF opened fire on Gazans who approached troops after crossing the so-called Yellow Line.

Also, the Hamas-controlled civil defense agency reported five people were killed in an Israeli drone strike with trying to return to their homes in Gaza City. Another Gazan was killed in a separate drone strike.

The second point is that, despite Trump’s 20-point peace plan, we have been here before. Hamas might of stopped fighting Israel but they certainly have not stopped killing to continue running Gaza.

Among the questions still to be answered, per The Conversation, are:

Will the IDF completely withdraw from Gaza and rule out annexation? Who will take on governance of the strip? Is Hamas going to be involved in this governance?

For peace to be successful, further hostilities must obviously cease, but that will be difficult because pressure will be on Israel to keep fighting, especially from the right-wing elements of Prime Minister Netanyahu’s government. On the other hand, if hostilities were to resume, Hamas loses any leverage for future negotiations now that it’s given up hostages. The Conversation asserts:

With Hamas relinquishing this leverage, it will be essential for the Israeli government to see these negotiations and the end of the war as fundamental to its long-term interests and security for peace to hold. There must be a sincere desire to return to dialogue and compromise, not the pre-October 7, 2023, complacency.

Other challenges that stand in the way include Hamas relinquishing its arms and any political power in Gaza; the blockade of Gaza by Israel and the resumption of humanitarian aid; Israeli settlement and annexation; the status of Jerusalem; and demilitarization.

The Israel-Hamas ceasefire may have cooled down tensions in one part of the Middle East, but in other areas they are ratcheting up.

Pakistan-Afghanistan clash

Reuters reported on Oct. 12 that dozens of fighters were killed in overnight border clashes between Pakistan and Afghanistan. Twenty-three Pakistani soldiers died, and nine Taliban lost their lives.

Tensions have risen after Islamabad demanded the Taliban take action against militants who have stepped up attacks in Pakistan, saying they operate from havens in Afghanistan. The Taliban, which came to power in 2021, denies that Pakistani militants are present on its soil…

On [Oct.9], Pakistan carried out airstrikes in Kabul and on a marketplace in eastern Afghanistan, according to Pakistani security officials and the Taliban, setting off retaliatory attacks by the Taliban. Pakistan has not officially acknowledged the airstrikes.

Afghan troops opened fire on Pakistani border posts late on [Oct. 11]. Pakistan said that it had responded with gun and artillery fire.

Pakistan closed crossings along the 2,600-km border with Afghanistan.

Another Reuters piece noted it was the worst fighting since the Taliban regained power in 2021. A temporary ceasefire was declared on Oct. 15. Will the cessation of hostilities, including airstrikes and ground-based attacks, lead to lasting peace between these two Islamic countries? Like the situation in Gaza, we at AOTH believe it’s unlikely.

India, meanwhile, has upgraded ties with the Taliban, announcing it would reopen its embassy in Kabul after closing it in 2021 following the withdrawal of US-led NATO forces from Afghanistan.

India and Afghanistan have historically had friendly ties, but New Delhi does not recognise the Taliban government.

India and the Taliban are now recalibrating their ties because of souring relations with their neighbor Pakistan as well as New Delhi’s concerns about major power rival China making inroads in Afghanistan, Reuters explained.

President Trump has previously said that “India is moving towards ‘deepest, darkest’ China orbit,” and labelled trade tensions between the US and India as a “totally one-sided disaster.”

The US trade deficit with India continues to grow, reaching $49 billion in 2024, a 5.9% increase over 2023, according to Eurasiaview.

Iran nuclear program very much alive

Iran’s nuclear program is back in the news, with the country’s top nuclear negotiator saying “Iran’s nuclear program can never be destroyed” in an interview with PBS Frontline correspondent Sebastian Walker.

Ali Larijanik, secretary of Iran’s Supreme National Security Council, told Walker:

“[I]n my opinion, Iran’s nuclear program can never be destroyed. Because once you have discovered a technology, that can’t take the discovery away. It’s as if you are the investor of some machine, and the machine is stolen from you.

“Well, you have the knowledge needed to make another one.”

Three of Iran’s main nuclear facilities — Fordow, Natanz and Isfahan — were targeted by US strikes on June 22 using 30,000-pound bunker-busting bombs. (Sky News).

The strikes were part of a 12-day war between Israel and Iran that involved the exchange of missile fire.

Sky News said satellite imagery showed major damage, but because some of the facilities are positioned deep under mountains, it’s hard to determine exactly how much damage the US bombs did. Iran just recently said that while willing to sign some sort of nuclear program deal it would never give up it’s uranium enrichment program. As of May 17, 2025, Iran’s total enriched uranium stockpile was approximately 9,247.6 kilograms. This includes a stockpile of 408.6 kilograms enriched to 60% purity, this 60% weapons grade uranium disappeared before Israel’s bombing started.

US-China trade tensions over shipping

Trade tensions are resurging after China’s Commerce Ministry said it was banning dealings by Chinese companies with five US units of South Korean shipbuilder Hanwha Ocean.

As reported by Associated Press,

The ministry also announced that it was investigating a probe by Washington into China’s growing dominance in world shipbuilding and threatened more retaliatory measures. It said the U.S. probe endangers China’s national security and its shipping industry and cited Hanwha’s involvement in the investigation.

The U.S. Trade Representative launched the Section 301 trade investigation in April 2024. It determined that China’s strength in the industry was a burden to U.S. businesses.

“China just weaponized shipbuilding,” said Kun Cao, deputy chief executive at consulting firm Reddal. “Beijing is signaling it will hit third-country firms that help Washington counter China’s maritime dominance.”

Both sides have already slapped special port fees on each other’s vessels.According to Aljazeera:

- Vessel operators must pay $50 per net ton for Chinese-owned or operated vessels arriving at a US port, to be increased to $140 by April 2028.

- Vessel operators of Chinese-built vessels arriving at a US port must pay $18 per net ton or $120 per container, which will be increased to $33 and $250, respectively, by 2028.

New rare earths export restrictions

China also announced new restrictions on rare earth exports. Overseas companies will be required to obtain Chinese government approval before exporting products containing rare earths that originated in China (Bloomberg).

Officials in the US and Europe are considering countermeasures.

As of Tuesday, new US tariffs on Canadian lumber and wood products announced last month are in effect. As reported by CBC News, They include a global tariff of 10 per cent on all softwood lumber and timber entering the U.S., on top of the 35 per cent duty already in place. Some finished wood products, like cabinets, vanities and upholstered furniture, are also being hit with a 25 per cent tariff with a further increase coming Jan. 1.

China Taiwan moving closer to war

Defense News says Russia is helping China prepare for an invasion of Taiwan saying Moscow’s assistance could advance China’s airborne program by 10 to 15 years. NATO issued a warning in June this year that there is a massive military buildup of Chinese forces and that the country could attack Taiwan.

On Sep 28, 2025, ABC NEWS Australia reported that a classified US report said “China is modifying its commercial ferry fleet in preparation for a potential invasion of Taiwan. Five Eyes observations have noted that more than 70 vessels are being fortified and strengthened to carry armoured vehicles. The report prepared for the Pentagon has identified these ferries as possible military targets in a conflict with China. ANU Security College’s David Andrews says the ferries would likely be used in the second phase of an operation to invade Taiwan.”

‘Frothy’ stock market

Some investors are buying precious metals because they fear a stock market crash.

Bloomberg reported on Tuesday that a volatile session on Wall Street saw stocks paring most of their earlier losses amid hopes that US and China trade negotiations are still on the table.

The S&P 500 fell up to 1.5% before recovering to -0.1%, after US Trade Representative Jamieson Greer told CNBC that President Donald Trump was still set to meet his Chinese counter part Xi Jinping.

According to Ulrike Hoffmann-Burchardi at UBS Global Wealth Management, more two-way volatility is likely in the near term for the global tech and chip sectors.

This is adding to anxiety among investors that the S&P 500, now in its fourth year of a bull market, is due for a correction.

According to Bloomberg, the index has gone 97 sessions without a 5% pullback compared with its long-term average of 59 days. A survey by Bank of America showed a record share of fund managers said AI stocks are in a bubble, while 54% of poll participants said tech stock were also looking too expensive.

“As investors shift their focus to third-quarter earnings, we believe they should not shy away from opportunities to buy pullbacks, as we suspect a multi-week consolidation phase has begun as we enter the fourth year of this bull market,” said Craig Johnson at Piper Sandler, a US investment bank.

A separate Bloomberg piece noted that Wall Street has learned to capitalize on the so-called “TACO” trade, which stands for Trump Always Chickens Out. A TACO trade is executed when a trader buys into the S&P when stocks tumble on the president’s threat to impose tariffs, then sells after Trump relents and markets recover.

AI bubble

The circular nature of the multitude of AI deals is causing concern.

Earlier this month, ChatGPT parent company OpenAI announced a deal with artificial intelligence chipmaker Advanced Micro Devices or AMD. Under the partnership’s terms, OpenAI will purchase AMD’s chips for an undisclosed sum in exchange for the right to take a stake of as much as 10% in the semiconductor giant.

The announcement came just weeks after Nvidia unveiled a deal under which it pledged to invest up to $100 billion in OpenAI.

OpenAI also has a $300 billion deal with Oracle to compute on Oracle’s cloud network space.

And there’s more.

Nvidia is buying $6.3B of cloud services from CoreWeave, another cloud services provider. OpenAI also has a deal with CoreWeave to pay as much as $22.4 billion for that compute space as well.

In speaking with technology reporter Emily Forgash, ‘Big Take’ host Sarah Holder asks whether the trillion-dollar AI market is being propped up by the industry itself? Forgash responds:

“This circular financing concern comes hand in hand with concerns over an AI bubble so when you’re putting that much money into an industry that hasn’t returned on those investments, @ this point in time, you could worry that it if never returns on those investments or if there’s never turning a profit then the whole thing will kind of combust.”

Another Bloomberg piece notes The AI boom that is revolutionizing how people live, and work has become increasingly fueled by just a handful of companies turning to one another for the vast amounts of capital and computing power needed to drive their breakneck growth.

Some of those partnerships are worth up to hundreds of billions of dollars. Taken together, they have enormously increased the companies’ values, helping send U.S. stock indexes to new highs.

But as AI investing grows more insular, there is also a risk that the money flowing between these companies is creating a mirage of growth…

To some investment advisers, the Nvidia-OpenAI deal is especially reminiscent of the ones announced in the lead-up to the 2000 dot-com bubble burst.

In March of that year, the tech-heavy Nasdaq Composite stock index fell by 77% and wiped-out billions of dollars in market value.

It would take 15 more years before the Nasdaq returned to its March 2000 highs.

“There’s a healthy part and an unhealthy part” to the AI ecosystem, said Gil Luria, a managing director at D.A. Davidson financial group who covers technology.

The unhealthy part has become marked by “related-party transactions” like the ones involving these companies, he said, which can artificially prop up the value of the firms involved.

If investors decide the ties among the AI giants are getting too close, he said, “there will be some deflating activity.” That’s Wall Street-speak for a bubble’s bursting.

One source points out that OpenAI now has an official valuation based on its secondary stock offering of $500 billion, and that despite “burning prodigious amounts of cash,” the company has announced deals totaling $1 trillion (which OpenAI doesn’t have) with a small number of tech companies.

“Each of these announcements causes the stocks of these companies to spike massively – the direct and immediate effects of hocus-pocus money,” states Wolf Street.

The financial news site also notes the “mind-boggling” though unrealistic power requirements to support OpenAI’s idea of building Nvidia GPUs (Graphics Processing Units). The 10 gigawatts of power required would dwarf the biggest nuclear power plant in the US, Vogtle in Georgia, which has a generating capacity of 4.5GW.

Richter draws a comparison between AI and the dot-com bubble which required expensive telecom infrastructure to be built out. “Progress was slow and revenues lagging, and then these overhyped stocks just imploded under that weight.”

“Whatever the narrative, it says risk in all-caps. Anything can prod these stock prices at their precarious levels to suddenly U-turn, and if the selloff goes on long enough, the investment bubble would come to a halt, and the hocus-pocus deals would be just that, and the whole construct would come apart.”

In a post titled ‘What Will Remain After the AI and Crypto Bubbles’, Project Syndicate maintains there are two bubbles currently: cryptocurrencies and artificial intelligence.

The crypto market, writes William Janeway, is a bubble by definition because there is no fundamental source of underlying value. He parallels it with the “Dutch tulip mania” of the 1630s.

The AI bubble is similar in that an innovative technology has emerged whose fundamental, long-term economic consequences cannot be known in advance. The bubble may have already peaked with [August’s] anti-climactic launch of OpenAI’s GPT-5 model, but only time will tell.

A common feature of both bubbles is the extent to which investors have been prepared to pay super-premium valuations for securities with minimal liquidity and no governance rights.

How does an investor know when the bubble will pop? Janeway identifies three signals: when the demand curve inverts, meaning that demand increases as prices rise; when the exponential increase in price calls forth new supplies as many others try to get in on the action; and in the terminal stages of a bubble, demand is increasingly fed by uninformed, amateur investors.

All three signals appear to be flashing red in the crypto and AI markets, says Janeway.

Unsustainable debt

The growing pile of debt across the US, Japan and Europe is boosting the appeal of alternative assets like precious metals.

The Financial Post notes the United States leads other mature economies in deficit spending, with the deficit equivalent to 6.4% of GDP in 2024. Compare this to 5.8% in France, 2.8% in Germany, 4.8% in the UK, and 2% in Canada.

AInvest notes the US deficit, currently around $1.1 trillion, is projected to expand by $3-5 trillion over the next decade, courting disaster. This puts the Federal Reserve in a bind: It can’t cut interest rates to ease borrowing costs because inflation remains sticky. Yes it is, and recent comments by Federal Reserve Chairman Powell says he sees no reason for them not to continue.

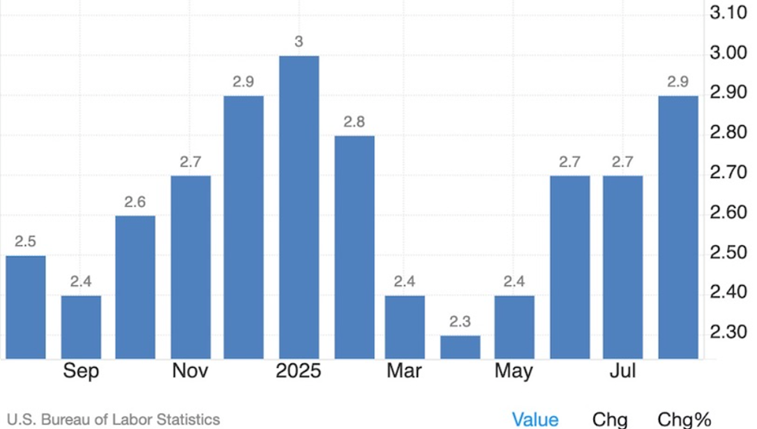

As the chart below shows, US inflation has risen from 2.3% in April to 2.9% in August.

US inflation % (CPI). Source: Trading Economics

The problem is global.

Bloomberg says Public debt has emerged as a serious risk after years of neglect, with government debt currently at 95% of global gross domestic product.

Five years ago, budget deficits soared because of pandemic-related stimulus spending. Deficits increased from 3.5% of global output in 2019 to 9.5% in 2020. The profligate spending should have been reduced after the pandemic subsided, but it wasn’t. “Even now, deficits are higher than they were in 2019,” Bloomberg states.

Yet policymakers seem oblivious to this fact:

Most US policymakers have simply stopped caring about ever-rising debt. Elsewhere, governments might pay lip service to the need for discipline — in some cases adopting budget rules or creating “fiscal councils” to address the problem — but their actions have fallen short. If long-term inflation-adjusted interest rates outpace economic growth and drift even higher, debt will keep trending upward and deficits will be ever harder to cut.

One manifestation of risky debt is the rise in auto sector bankruptcies.

Reuters reported this week that auto parts supplier First Brands and subprime lender and dealership Tricolor have both filed for bankruptcy. First Brands had more than $10 billion in liabilities, while Tricolor listed over $1 billion in liabilities, with more than 25,000 creditors.

Another part of the story is the slowdown in the credit rally, which got off to a robust start earlier in October, has hit a speed bump in recent days as investors reduced exposure to certain sectors over concerns around weakness in consumer and auto lending, experts said.

“We now seem to have a catalyst important enough to engender a shade of fear,” said Neha Khoda, head of U.S. credit strategy at Bank of America, in a note dated October 10.

JP Morgan boss Jamie Dimon has warned over further losses linked to the private credit sector, saying more “cockroaches” could emerge after the collapse of Tricolor and First Brands. Both firms had been backed by private credit within the so-called shadow banking sector. (The Guardian)

Ernest Hemingway has a great quote that can be referred to bankruptcies and country debt defaults. From ‘The Sun Also Rises’, “How did you go broke? “Gradually, then suddenly.”

J.P. Morgan’s David Kelly warned this week that while America is “going broke” it’s doing so slowly enough that markets aren’t panicking yet. With U.S. national debt now topping $37.8 trillion and interest payments exceeding $1.2 trillion, Kelly said the debt-to-GDP ratio—already at 99.9%—will likely keep rising even under moderate growth. Despite tariff revenues and temporary deficit relief, he cautioned that political choices or a slowdown could quickly worsen the fiscal picture, urging investors to diversify away from U.S. assets before “going broke slowly” turns fast.

The prospect of the US going broke gradually then suddenly is yet another reason to “diversify away from U.S. assets”, namely the dollar and US Treasuries, and channel capital into precious metals.

A startling number of US states — 22, to be exact — are effectively in a recession, according to Moody’s Chief Economist Mark Zandi, with many lower- and middle-income households “hanging on by their fingertips,” struggling with debt and slowing wage growth despite steady employment. Private data during the federal shutdown shows weakening consumer confidence, particularly among those earning under $35,000.”

Zandi also said, “California and New York, which together account for over a fifth of U.S. GDP, are holding their own, and their stability is crucial for the national economy to avoid a downturn.”

Is the US headed for civil war?

Ray Dalio told Fortune that the United States is headed for civil war, with either side exerting “tests of power” on their rivals. He warns that rising US debt and deepening political divisions could push the country towards crisis:

In an interview this week, the Bridgewater founder said America faces a choice between uniting around shared interests or descending into destructive conflict. He cautioned that the nation’s 125% debt-to-GDP ratio risks triggering a “debt bomb” if investors lose confidence, forcing higher borrowing costs or painful spending cuts.

US government shutdown enters third week

A glaring example of division is the US government shutdown, which started on Oct. 1 and has now entered its third week. According to Global News, Democratic lawmakers are demanding that any deal to reopen the federal government address their health care demands, while Republican House Speaker Mike Johnson said he won’t negotiate with Democrats until they hit pause on those demands.

On Wednesday a judge ordered Trump to stop firing federal workers during the impasse, saying that “It’s very much ready, fire, aim on most of these programs, and it has a human cost,” she said. It’s a human cost that cannot be tolerated.”

Gold

Factors causing gold to rise or fall include interest rates, real interest rates, inflation, the US dollar, geopolitical tensions, and economic events such as recessions, or the trade war currently being waged by US President Donald Trump.

The US Federal Reserve is widely expected to deliver another quarter-point rate cut later this month, following the same move in September, with another reduction anticipated in December.

Philadelphia Federal Reserve chief Anna Paulson said that rising risks to the labor market bolster the case for further US interest rate cuts.

AOTH says, Federal Reserve’s policy mistake is going to have grave consequences.

Kitco’s Jim Wyckoff writes that gold bulls’ next resistance level is $4,300 an ounce, while for silver bulls, it’s $55.

Gold has received a significant boost from President Trump 2.0, and it has kept climbing as his trade war continues.

The gold ‘fear trade is on’ — Richard Mills

We’ve already seen spectacular gains, but we believe that we are going to see a lot more before this precious metals and commodities bull market is over.

If the employment situation worsens and inflation keeps climbing, look for economic growth to sputter as the US enters stagflation — an unsavory mix of inflation, low growth and high unemployment.

Historically, gold outperforms other asset classes during times of economic stagnation and inflation. Of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities.

The World Gold Council (WGC) says gold is attracting more attention from central banks than at any time in the last decade.

Over the past three years, central banks have purchased over 3,000 tonnes of the precious metal. Analysts predict they could add another 1,000 tonnes to their reserves this year.

Demand is largely being driven by emerging market central banks, which are diversifying their holdings away from the US dollar, more so than developed market central banks.

Central banks worldwide are on track to buy 1,000 tonnes of gold in 2025, which would be their fourth year of massive purchases as they diversify reserves from dollar-denominated assets into bullion, consultancy Metals Focus said, via Reuters.

Central banks now own more gold than US Treasuries, a situation that hasn’t occurred in nearly three decades.

Gold’s share of central bank reserves reached 24% in the second quarter, its highest share since the 1990s, Deutsche Bank strategists reported on Oct. 9, via Cointelegraph.

Moreover, the de-dollarization trend continues, with foreign vendors from Latin America to Asia asking US importers to settle invoices in euros, pesos and yuan to avoid USD currency swings.

While some retail investors have sat out this gold bull due to how expensive the physical metal is (bars and coins), retail is getting in the game through gold-backed exchange traded funds.

Bloomberg reported that inflows into gold ETFs surged to a record $10.5 billion so far in September, with YTD inflows exceeding $50 billion, citing Citigroup data.

Economic Times of India said that the gold price is unstoppable, with the surge driven by safe-haven demand and expectations of further Fed interest rate cuts.

Renewed geopolitical tensions, including fresh 100% tariffs announced by the US on China, have escalated market uncertainty. This has pushed investors towards precious metals…

Fresh warnings of tariffs and trade restrictions between the United States and China have fueled risk aversion, pushing funds into traditional stores of value like gold and silver…

This sharp rise in gold and silver prices reflects growing fears over inflation, economic instability, and escalating geopolitical risks. The US government shutdown and a subdued dollar add to the bullish outlook for these metals. Expect continued market attention on gold and silver as they reach historic highs in 2025.

Silver

Goldmoney’s Alasdair Macleod notes the prospect of the gold-silver ratio declining from its current 79 to 50, pushed down by the falling dollar. “With gold at $4,000 and a ratio of 50, that makes silver $80. This is not a forecast, only an illustration of silver’s potential,” Macleod writes.

Precious metals analyst Hubert Moolman posted a Silver/ US Dollar chart dating from 1983. He says that based on the fractal in the chart (a fractal is a pattern of five consecutive price bars that signals a potential trend reversal or continuation), “it is expected that we are now likely in a sustained silver rally similar to 2010-2011, for example.” Silver hit a then-high of $49.51 in April 2011, broken on Tuesday by a fresh record-high $53.

Further, Moolman showed in a previous article that significant silver peaks occurred within 8.5 years after the Dow/gold ratio peak, with the Great Depression silver peak occurring the soonest (6 to 7 years after).

“Given that silver actually rallied on a sustained basis for at least 2 years before each of these peaks, we are likely to see silver rally for most of the coming 20 months,” he wrote.

Silver’s time to shine — Richard Mills

Source: Trading View

FX Empire wrote Silver’s fundamentals are screaming higher. The market is on course to register its fifth consecutive annual supply deficit with mine output unable to keep pace with industrial demand. Consumption is exploding across growth sectors. Solar panels and renewable technologies continue to absorb increasing volumes of Silver thanks to its unmatched conductivity. The expansion of electric vehicles and electrification infrastructure is also fuelling demand, while AI data centres and semi-conductors are adding an entirely new dimension of structural consumption.

Economic Times reports Emkay Wealth Management anticipates silver prices could grow 20%, potentially reaching $60 in the next year. Morgan Stanley, UBS and Bank of America also project solid gains due to the metal’s tight supply and its industrial uses.

Because silver is such a small market, prices could swing 1.7 times faster than gold in either direction, the publication states.

On Oct. 11 the Jerusalem Post ran the following headline: ‘Silver Supply Crisis Deepens as London Inventories Plunge 33%’

The article summarizes:

A historic silver squeeze is unfolding across global markets – one that analysts say could reshape the precious metals landscape for years to come. Prices have surged past $50 per ounce, vaulting silver into territory reached only once before in history. This is not a speculative anomaly but a convergence of structural factors that together point to a profound, global shortage.

Among the key points made:

- Persistent supply deficits: For several consecutive years, global silver demand – exceeding 1.16 billion ounces annually – has outstripped mine production and recycling, leaving a cumulative deficit nearing 800 million ounces since 2020.

- Reduced mine output: Around 70% of silver is mined as a byproduct of base metals like copper and zinc, limiting production flexibility.

- Depleted inventories: London’s silver vaults — the world’s largest repository — have seen available stockpiles plunge 33% since mid-2021, leaving an estimated 200 million ounces of “free float” silver, down from 850 million in 2019.

- Explosive investment demand: Investors worldwide are turning to silver as confidence in fiat currencies wanes and inflation expectations rise.

- Indian buying surge: India’s silver imports have spiked dramatically as buyers shift away from Hong Kong suppliers, further tightening global availability.

- Geopolitical fears: Uncertainty surrounding potential U.S. tariffs on silver imports following a Section 232 investigation is adding volatility to an already strained market.

- The crisis is most visible in London, the historic center of global precious metals trade. Traders are now air-freighting silver bars across the Atlantic to exploit massive premiums — an extraordinary step typically reserved for gold.

Market insiders are also warning that China could escalate the silver squeeze by stopping silver bullion exports. As reported by Silver Academy:

Any sign that Chinese authorities are freezing or even severely slowing general silver exports—diverting all domestic refined production to meet local solar, electronics, and industrial demand—could render the London short squeeze catastrophic for global shorts.

Current reports already show smelters favoring China’s internal industry over overseas contracts, with tighter restrictions on new export licenses and greater scrutiny to prevent silver smuggling. The logistical bottlenecks, combined with negative inventory in London and tight Asian markets, mean that if “China ceases silver bullion exports” becomes policy—even unofficially—Western banks and traders would find themselves scrambling to deliver into futures and ETF obligations with no meaningful relief in sight. In that event, the structural arbitrate that’s so far alleviated London’s critical shortage simply vanishes, making the short position nearly indefensible and sending the market into genuine panic mode.

If this isn’t enough to send silver prices through the roof, it was recently reported that Australia’s Perth Mint has suspended all sales of silver products, and that silver dealers in India, who sell via Amazon, are defaulting on deliveries.

Conclusion

We started this article talking about geopolitical tensions such as the Gaza war, the clash between Afghanistan and Pakistan, and the revival of Iran’s nuclear program. The US-brokered peace agreement between Israel and Hamas is certainly positive news, and let’s all be thankful for the return of the remaining living hostages but arguably, the devil is in the details, and it is too early to say whether the ceasefire will hold.

At AOTH, we are not optimistic.

A clue as to how investors are feeling about the events in the Middle East was revealed by the prices of both gold and silver reaching new record highs on Tuesday, Oct. 14, amid the cessation of hostilities and the withdrawal of the IDF to the so-called Yellow Line.

Gold is normally purchased as a safe-haven alternative to stocks and bonds. We see this in continued strong gold buying by central banks, especially developing-country CBs. Central banks now hold more gold than Treasuries for the first time in nearly three decades.

We also see it through the surge in purchases of gold-backed ETFs.

Investors are buying gold for various reasons, including: the ongoing trade war instigated by the Trump administration; the fear of a stock market crash; cryptocurrency and AI bubbles that look ready to pop; sticky inflation; rising US unemployment; the threat of a recession evidenced by a slowing of US manufacturing due to high tariffs; ballooning deficits and debt that politicians no longer seem to care about; and the prospect of further interest rate cuts.

For silver, it’s the combination of monetary and industrial demand, combined with tight supply conditions, that is driving the metal to fresh heights. A dramatic “silver squeeze” is resulting from reduced mine output, depleted warehouse inventories, fears of US tariffs on silver imports, and that China could stop bullion exports altogether. The country is the world’s second-largest silver producer behind Mexico, according to the US Geological Survey.

The silver squeeze is manifesting in the suspension of sales of silver products by the Perth Mint, possibly the first among other to follow, and silver dealers in India who are defaulting on deliveries.

We forecast higher prices in the coming months, and more records broken, as geopolitical and trade war tensions continue to roil markets and investors flock to the safety of precious metals.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE