Rick Mills – “NV Gold Identifies Large, Structural Target for August Drilling”

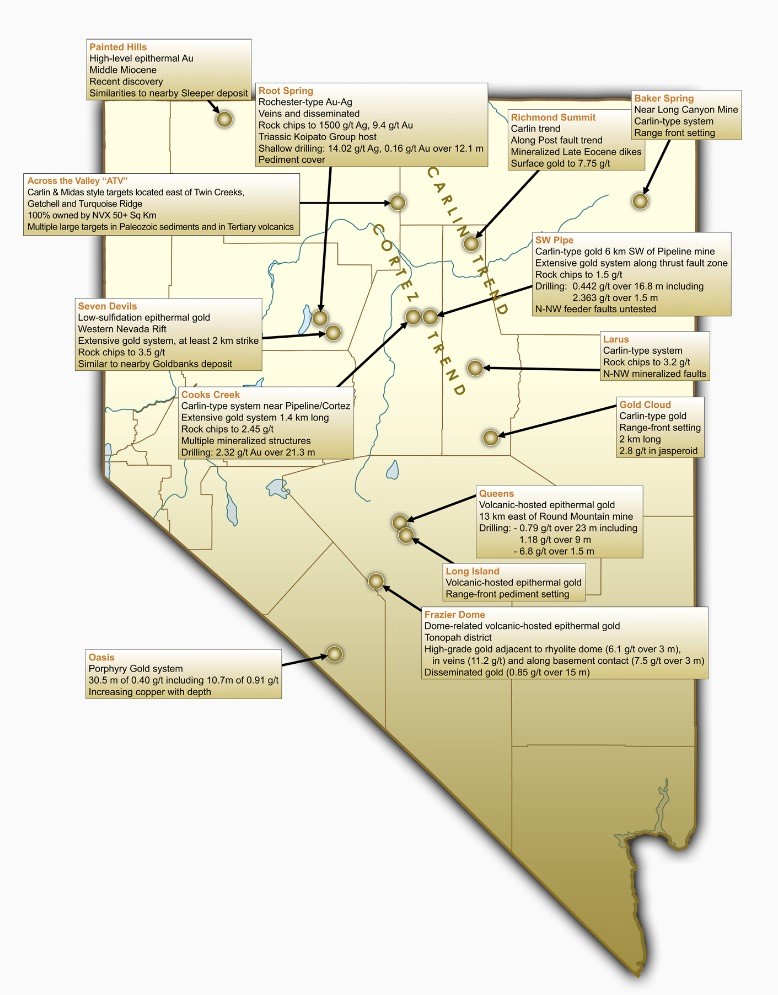

NV Gold (TSX-V:NVX) (US:NVGLF) has determined where it will plant the first drill rig this summer, among a thick portfolio of over a dozen gold projects in Nevada.

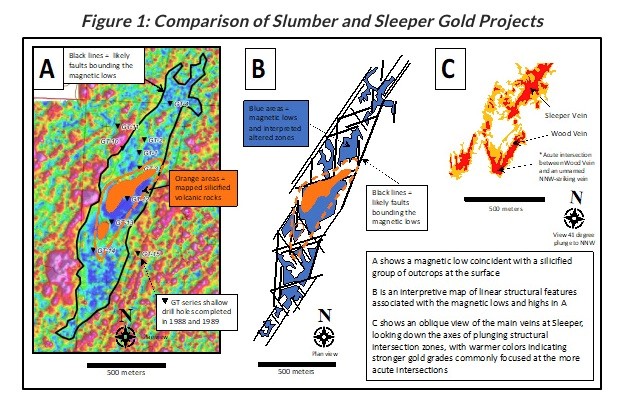

The Slumber property in the Jackson Mountains, located about 50 miles northwest of Winnemucca, Humboldt County, is approximately 21 miles west of the Sleeper bonanza epithermal vein gold deposit. The Sleeper mine (operated by AMAX Gold) produced 1.6 million ounces of gold and 2.3 Moz of silver, between 1986 and 1996.

Slumber

Slumber is one of several high-level epithermal gold systems on a trend that starts in the Jackson Mountains, runs through the Bilk Creek Mountains and continues north into Oregon. These deposits, along with the Sleeper, Sulphur-Hycroft, Goldbanks, Blue Mountain, Sandman, and other precious metals deposits located along fault-fracture zones of the Northern Nevada Rift, define an important epithermal province in northwestern Nevada.

The target at Slumber is volcanic-rock-hosted epithermal gold and silver mineralization. The hope is to find a bonanza-type vein gold deposit.

Epithermal veins can stretch hundreds of meters deep and are usually narrow and high-grade. In conjunction with these veins, are large alteration “haloes” of mineralization made by circulating hydrothermal fluids.

While usually high-grade and close to surface, epithermal gold deposits are generally low tonnage, unlike Nevada’s three northwest trending belts: the Carlin, Cortez and Walker Lane trends, which are three of the world’s top mining districts.

NV Gold picked up Slumber at the end of May through a letter of intent with the vendors. Of interest to the management team were a number of observed geological features, including:

- Hydrothermal alteration, principally in the form of silicification (imbued with the mineral silica), associated with widespread gold mineralization.

- Mineralized pieces of quartz vein float occurring in an alluvial-filled valley.

- Two or more gold-bearing zones exhibiting cross-cutting quartz veining, hydrothermal brecciation, and oxidized pyrite exposed through and surrounded by alluvium (gravel creek-bed).

Previous exploration at Slumber consisted of 15 shallow, reverse-circulation holes, drilled on and near silicified outcrops. Seven of the holes returned anomalous gold intercepts over thicknesses ranging from 1.5 to 32m. Rock chip samples collected from the outcrops held gold values up to a gram per tonne, plus elevated concentrations of silver, antimony and other gold pathfinder elements.

Seeing the potential for a drill program, NV Gold set about gravity and ground magnetics to assess structure and alteration that is obscured by widespread alluvial cover up to 100 meters thick.

The upshot of those surveys, released on Thursday, is the discovery of a large, hidden gold structure that will be the target of NV Gold’s first drill program of 2019.

Two ground-based geophysical surveys covering a 4 sq. kilometer area “paint complementary images of the structure and nature of bedrock geology hidden at depth beneath the Slumber project area,” NV Gold states in its news release.

The results of a gravity survey indicate the presence of a broad, north-northeast-trending trough, crossed by two deeper NE-trending fault-bounded basins. A magnetic survey found “a distinct area of greatly reduced magnetic susceptibility” thought to indicate a zone of hydrothermal alteration. Moreover, the magnetic low, measuring about 2 km long by 300m wide, stretches out in a north-northeast direction, coinciding with the results of the gravity survey.

According to NV Gold, the geophysical surveys identified a lens-shaped zone at the center of the target – further investigation will help to pinpoint areas likely to contain high-grade gold or silver mineralization. Also of interest are “hidden structural continuities, possible conduits for hydrothermal fluids, and a significant area of interpreted hydrothermal alteration,” that will be drilled in August.

Frazier Dome

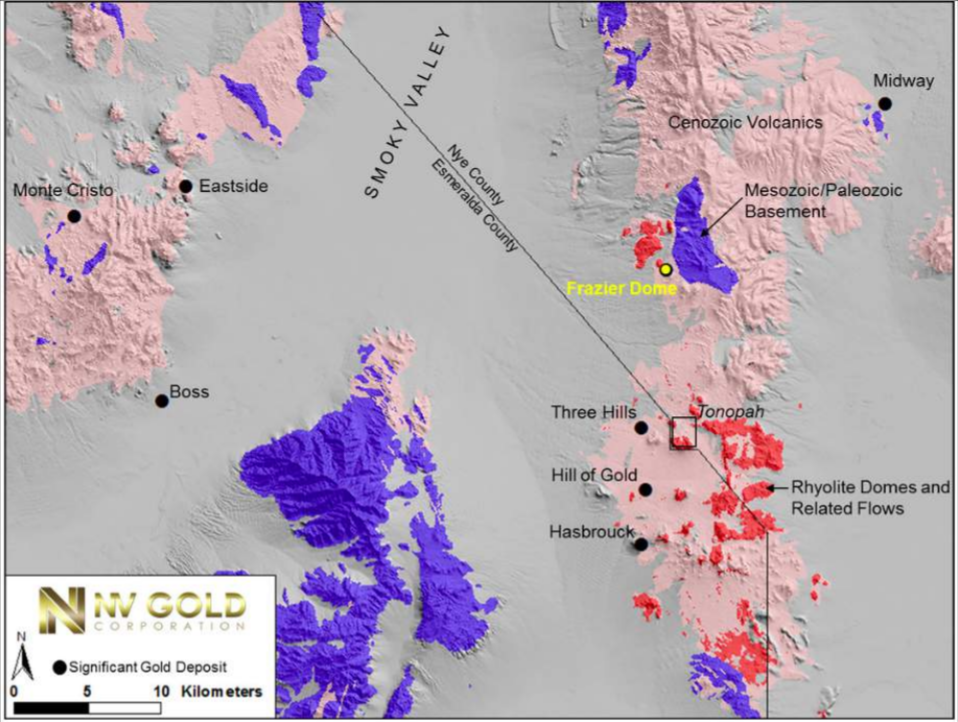

Once NV Gold completes drilling at Slumber, hopefully waking it up to a major discovery, the company will pivot to its flagship Frazier Dome project, located near Tonopah, NV.

The second drill program of the summer will target a potentially mineralized gold system at depth – something relatively unusual for Nevada, which has built a gold-mining reputation on a foundation of low-grade, high-tonnage mines.

Frazier Dome is characterized as “a low-to intermediate-sulfidation, volcanic-hosted epithermal gold system with high-grade mineralization.”

That’s in line with two types of mineralization often seen around the Tonopah gold district:

- High-grade, intermediate-sulfidation silver-rich veins and

- Younger, low-sulfidation, gold-rich mineralization related to intrusive rhyolite domes, which have been the focus of West Kirkland Mining’s Hasbrouck, Hill of Gold and Three Hills mines to the south (total combined production of 1,063,000 ounces gold and 16,345,000 oz silver; and Allegiant Gold’s Eastside project 32 km to the west, which has shored up an inferred resource estimate of 654,000 ounces gold and 3.9 million ounces silver.

A rhyolite dome is a mound of rock containing rhyolite, a type of igneous rock formed when lava exudes from a volcano, creating a dome-like structure around the vent. The presence of a rhyolite dome at Frazier Dome is significant, because all of the other domes around it have unearthed significant gold mineralization. Frazier is one of the last unexplored rhyolite domes in Tonopah.

In its 2019 exploration program, NV Gold plans to chase the anomalous gold found at surface, to depth. The idea is to try and find the source of the high-grade surface mineralization. The company will set up reverse-circulation drills and test the four targets it drilled last year, to a depth greater than 150 meters.

For more on Frazier Dome, read NV Gold chasing high-grade Au in Nevada

Drill to thrill

All of that is pretty technical, but the important take-away for AOTH subscribers and NVX investors, is further evidence of a “drill to thrill” strategy meant to preserve cash and reward shareholders.

At Ahead of the Herd, we love junior gold explorers and especially gold juniors that have a focused exploration strategy in place. A lot of exploration companies hone in on a prospect and then spend the summer poking holes in the ground. Then the wait starts for results. Not NV Gold – they are going to conduct their summer activities a little different. The objective is to drill two or three projects per year – they are focused on drilling the best targets, on each project, one after the other…bang bang bang.

We like the fact that NV Gold is being smart with how it sinks exploration dollars into the ground, by hitting the best targets with drill holes that will, at the very least, act as a kind of sniff test for going further. And might perhaps lead to a major discovery hole. And just a note to investors here – there will be, according to the company, a third project drilled this year. We’ll hear news shortly.

We also love the exploration team that Ball and other NVX management have put in place. These guys have 125 years of combined experience in Nevada, and they have an incredible data set to help guide their claim-staking and exploration efforts.

Compiled in the 1970s and 80s by USMX, which explored Nevada and built a wealth of information, and AngloGold in the 1990s and 2000s, the databases facilitate a “Nevada 2.0” thinking about the multiple layers of opportunity that remain buried in Nevada. The goal is to systematically evaluate and execute focused exploration programs.

Rock hounds trio

The trio of rock hounds includes Quinton Hennigh, a PhD in geology, and CEO of Novo Resources (CNS:NVO), which is developing a conglomerate gold play in Western Australia. Many remember Hennigh as the chief geologist at Evolving Gold where he is credited with discovering the Rattlesnake Hills deposit and a gold find three miles north of ATV – one of NVX’s 14 projects.

Odin Christensen, PhD, is another long-time geologist with over 35 years industry experience under his belt. He was with Newmont Mining for 21 years. Between 1985 and 89, Christensen was exploration manager for Newmont and Carlin Gold Mining in northeastern Nevada until he retired as their head geo.

Marcus Johnston, a PhD in economic geology, joined the company in January as VP Exploration. Dr. Johnston brings more than 20 years of experience in exploration and mining, with an emphasis on mineral systems in Nevada. He also revitalized the entire McCoy mining district, now owned by Premier Gold Mines.

We feel very confident in this group and its upcoming Nevada three drill programs.

Tightly held

And we like NV Gold’s low share count – 46 million outstanding shares – of which management and insiders own >45%. NVX has quality shareholders like Eric Sprott, US Global Investors and Redstar Gold.

“Our goal is to manage our capital so that at the end of summer, we still have a strong cash balance in our treasury, but we’ve created enough opportunity for our shareholders to have a potential win,” explained President Peter Ball, in an earlier interview with Ahead of the Herd.

“It also giving us the strength to head into the fall with some capital to continue on,” Ball added. The company’s treasury is currently sitting at ~ Cdn$1.5 million. A $1 million plus oversubscribed private placement was completed at the end of March, whereby the board of directors and management purchased 27% of the shares.

Projects pipeline

A number of properties within NV Gold’s portfolio are either drill-ready or continue to become more interesting as they are reviewed. They include ATV, SW Pipe, Seven Devils, Painted Hills and Richmond Summit, to name a few. Additional properties such as Queens, Long Island and Larus/Gold Cloud are also on the radar with information. NVX continues to discover with its high-caliber team digging deep into their geological database to unearth quality exploration targets.

Gold price surging

Their timing is good. NVX and other gold juniors are sinking drill bits into the ground as the gold price is maintaining its lofty heights.

A bunch of events have heaped together to produce a major upswing for gold, which closed Thursday at $1,441.90, a $15 gain on the day. That includes dovish signals from the US Federal Reserve ie. an interest rate cut, record central bank buying, a torrent of gold inflows into ETFs, and most recently, weakness in the US dollar and dampened expectations of a resolution to the US-China trade feud.

Silver was on a tear too on Thursday, with the spot price nearly hitting a four-month high, before settling at $16.30 an ounce in New York trading.

Technical analyst Jim Wyckoff of Kitco says a seven-week-old uptrend for gold is in place, with the next resistance level for August futures at June’s $1,442.90 high.

Conclusion

Of course gold prices don’t affect gold juniors directly, since they are not yet producing, but a sustained upturn turns investors’ eyeballs towards the sector, thus attracting capital to gold stocks. As resource investors, we know the best leverage to a rising gold price, such as we see today, is quality juniors with quality projects.

I’m looking forward to a great summer/fall of news flow from NV Gold Corp..

NV Gold Corp

TSX-V:NVX, US:NVGLF

Cdn$0.16 July 19th

Shares Outstanding 46.4m

Market cap Cdn$7.4m

NV Gold website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

NV Gold Corp (TSX.V:NVX), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of NVX

MORE or "UNCATEGORIZED"

Red Pine Provides Further Update On Assay Results for Wawa Gold Project

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) further to... READ MORE

Getty Copper Intersects High-grade Copper Mineralization in the First Drill Holes, Glossie Occurrence, Highland Valley Area, Southern B.C.

Getty Copper Inc. is pleased to report drill results from the fir... READ MORE

Guanajuato Silver Announces Closing of C$11.35 Million Brokered Financing

Guanajuato Silver Company Ltd. (TSX-V:GSVR) is pleased to announc... READ MORE

Hot Chili Closes A$24.9 Million Private Placement and Announces Full Underwriting of A$5 Million Share Purchase Plan

Positioning for Near-Term, Meaningful, Copper Production H... READ MORE

Barksdale Announces San Javier Preliminary Economic Assessment

Barksdale Resources Corp. (TSX-V: BRO) (OTCQX: BRKCF) is pleased ... READ MORE