Rick Mills – “Miners Down Tools at Two Chilean Copper Mines, as Majors Struggle to Maintain Production Levels”

The copper market continues to be challenged by supply issues, with two large mines in Chile hit by strikes.

On Monday, Lundin Mining (TSX:LUN) said it will gradually cut down activities at the Caserones copper mine after a small part of its workforce in Chile took action over a failed collective bargaining agreement.

The Canadian miner had tried to reach an agreement with one of three unions representing approximately 30% of Caserones employees, or 5% of the total workforce at the Caserones, prior to the strike…

The company recently upped its stake in Caserones to 70% after exercising an option with Japan’s JX Nippon Mining & Metals. The mine represents one of Lundin’s trio of key assets in or around northern Chile, the other two being the 80%-owned Candelaria mine in the Atacama region and the Josemaría project in Argentina. (via Mining.com)

No word yet on how the strike could impact production.

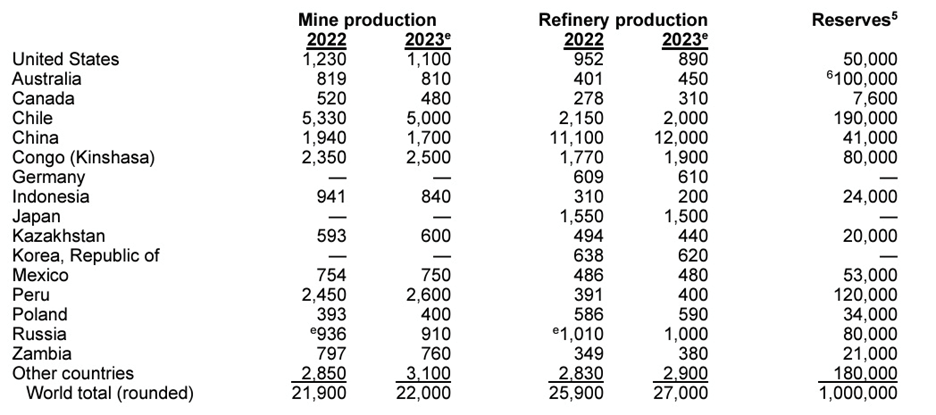

Chile is the largest producer of mined copper in the world, followed by the Democratic Republic of Congo and Peru.

Source: US Geological Survey

Labor strife is also evident at BHP’s huge Escondida mine, with a strike starting on Tuesday. Reuters reported “a powerful workers union… is looking to snarl production at the site as it pushes for a bigger share of profits.”

Readers may recall a 44-day strike at Escondida in 2017 which caused copper prices to spike when the mega-miner declared “force majeure”.

The same thing happened in 2016 after a 26-day strike, and in 2011 the union halted operations for two weeks.

In Africa, the export of copper has been interrupted for a different reason. On Aug. 11, Zambia temporarily sealed its border with Congo after the DRC government banned certain beverage imports, including beer, from Zambia, local media said.

Landlocked Congo only has one way to access ports, and that is through Zambia. The latter resumed trade with the DRC on Tuesday.

Copper market

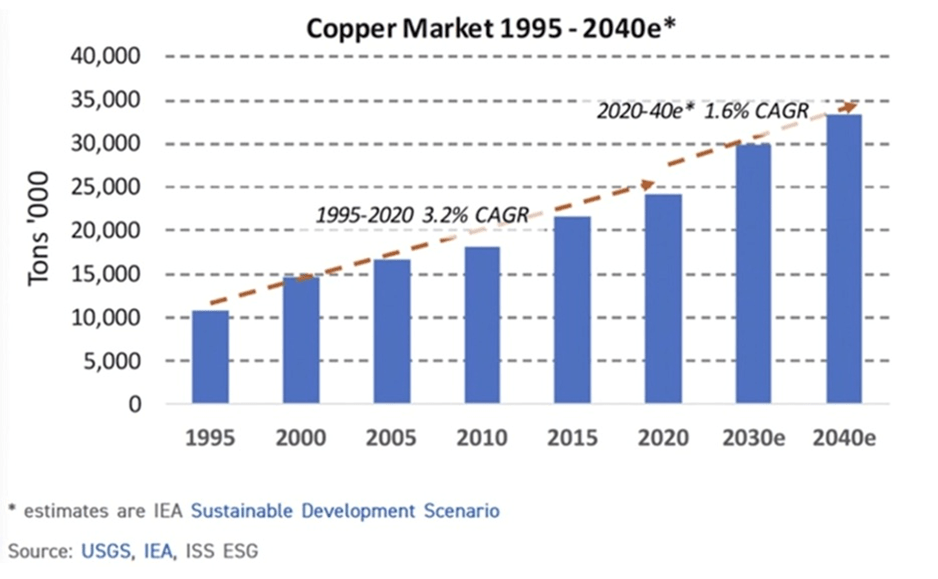

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes. If the copper supply doesn’t grow this year, we are possibly looking at a 6Mt deficit.

Gold, silver and copper had a banner first half — Richard Mills

Copper: Humanity’s first and most important future metal — Richard Mills

Mining companies are seeing their reserves dwindle as they run out of ore. Commodities investment firm Goehring & Rozencwajg says the industry is “approaching the lower limits of cut-off grades and brownfield expansions are no longer a viable solution. If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all.”

Effectively, lower grades mean millions of tonnes more rock needs to be moved and processed to get the same amount of copper.

In July, the vice president of US investment bank Stifel Financial Cole McGill presented data that corroborates Goehring & Rozencwajg, stating “If you look at grades at the top 20 copper mines since 2000, they’ve trended down about 15-20%, and if you take out some of the higher-grade African projects, that’s even lower.”

Sprott agrees that, Chile and Peru, the top copper-producing countries, are grappling with labor strikes and protests, compounded by declining ore grades. Russia, ranked seventh in copper production, faces an expected decline due to the ongoing war in Ukraine. Despite efforts by miners to ramp up production, many analysts anticipate a widening supply imbalance.

Major copper miners aren’t doing much to alleviate the problem. High-quality projects are increasingly rare and major new discoveries are lacking. The global time from discovery to production averages 16.5 years.

To meet the increase in copper demand, copper majors are focused on extending the life spans and productivity of existing mines rather than carrying out more expensive, and risky, exploration and development of new (greenfield) projects.

E&MJ Engineering stated in its outlook for copper production to 2050, “The trend toward declining orebody grades and continued development of the pursuit of existing operations to exploit lower grade deposits is likely to continue, in the absence of high-grade project discovery.

“A decline in ore grade results in higher operating costs due primarily to the amount and depth of material required to be mined and processed to produce the same amount of copper product. It is no surprise that both GHG emission intensity and energy intensity increase as ore grade decreases. There is a point of inflection, where below an ore grade of around 0.5% copper, the intensity of both metrics rises sharply.”

Given that many mines are fast approaching, if not already tackling, similar grades, this is a pressing problem. In its fiscal year 2020 commodity outlook, BHP, the world’s third largest copper producer, estimated that grade decline could remove about 2 million metric tons per year (mt/y) of refined copper supply by 2030, with resource depletion potentially removing an additional 1.5 million to 2.25 million mt/y by this date.”

Grade decline, deteriorating ore quality and supply pressure from growing resource nationalism highlights the importance of funding exploration.

Unfortunately, according to Sprott, capital for the exploration and development of copper mines peaked at $26.13 billion in 2013. Since then, it has almost halved and remains low, with only $14.42 billion spent in 2022.

McGill told Bloomberg that between 2009 and 2016, copper supply grew at a CAGR of 3.5-4%. Since 2016, when copper priced bottomed at around $2-2.20/lb, the CAGR is around 1%.

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mine production will drop to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Last year, the government of Panama ordered First Quantum Minerals (TSX:FM) to shut down its Cobre Panama operation, removing nearly 350,000 tonnes from global supply.

A strike at another large copper mine, Las Bambas in Peru, temporarily halted shipments.

Copper specialist Anglo American (LSE:AAL) says it is scaling back output by about 200,000 tons, owing to head grade declines and logistical issues at its Los Bronces mine. Los Bronces production is expected to fall by nearly a third from historical levels next year as the miner pauses a processing plant for maintenance, Reuters said.

Copper mined from Anglo American’s Chile and Peru operations was 6% lower in the second quarter compared Q2 2023, and 1% lower than Q1 2024. The decrease was “driven by lower throughput at Los Bronces and El Soldado, and planned lower grades at Quellaveco, partially offset by higher throughput at Collahuasi driven by the fifth ball mill,” the company stated in a quarterly production report.

Chile’s copper output has been dented by a long-running drought in the country’s arid north. State miner Codelco’s 2023 production was the lowest in 25 years.

All four of Codelco’s megaprojects have been delayed by years, faced cost overruns totaling billions, and suffered accidents and operational problems while failing to deliver the promised boost in production, according to the company’s own projections.

A July 11 Reuters story said Codelco is behind target for production in 2024, with H1 production lower than last year’s first half. Output has been hit by a fatal accident at it’s Radomiro Tomic mine, and delays to the startup of its Rajo Inca project. Chairman Maximo Pacheco said longer-term issues have affected Chuquicamata and El Teniente, without elaborating.

Glencore’s (LSE:GLEN) first-half production of 462,600 tonnes was 2% below 2023’s 488,000 tonnes, which the firm attributed to the sale of its Cobar mine in Australia.

Freeport McMoran (NYSE:FCX) saw lower second-quarter output of 1.037 billion pounds compared to the year-ago quarter of 1.067Blbs, but higher first-half production of 2.122Blbs compared to H1 2023’s 2.031Blbs. Quarterly copper production from Freeport’s North American mines was down for both time periods.

In Zambia, Africa’s second largest copper producer drought conditions have lowered dam levels, creating a power crisis that threatens the country’s planned copper expansion.

Indeed First Quantum mentions “additional power supply restrictions by Zambian Electricity Supply Corporation Limited.” While the company highlights 2% higher second-quarter production compared to Q1, with 10,034 more tonnes mined at Kansanshi, its quarterly production was down y/y, from 187,175 tonnes in Q2 2023 to 102,709t in Q2 2024.

Ivanhoe Mines (TSX:IVN) reported a 6.5% Q1 drop in production at the world’s newest major copper mine, Kamoa-Kakula in the DRC.

The forecasted copper supply gap — more than 15Mt by 2034 — was front and center at the Rule Symposium in Florida earlier this year. Mining magnate and Ivanhoe Mines’ founder Robert Friedland said current copper prices “fall woefully short” of supporting the development of new projects.

“We see a crisis coming in physical markets and a requirement for much higher prices to enable most of the copper projects that are in development to have a prayer coming in,” Friedland said via The Northern Miner. The incentive price to build new mines is $11,000/t.

Source: Trading Economics

Higher prices are needed to counteract soaring cost inflation in building new mines, even in cheaper jurisdictions like Chile and Peru.

Friedland produced a surprising statistic, that humanity must mine more copper in the next 20 years than we have in human history to meet surging global demand on the back of the energy transition.

He estimated the global economy needs to find five or six new Kamoa-Kakula-sized projects yearly to maintain a 3% gross domestic product growth rate over the next two decades.

Over the past 10 years, greenfield additions to copper reserves have slowed dramatically. S&P Global estimates that new discoveries averaged nearly 50Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80% to only 8Mt per year.

There are really only three ways for the industry to get this additional metal. First, they can increase production from existing mines; this often involves “going underground”, digging beneath the existing open pit to access more ore. An expansion to the existing concentrator or building a new one, is sometimes needed.

Second, they can expand their mines laterally, going after resources that weren’t part of the initial mine plan because they were less accessible, or un-economic.

Third, they can explore for new mineral deposits, either internally, or working with junior mining companies, which have the exploration expertise to bring a deposit forward to the point when it can be sold to a major.

Obviously option three, known as greenfield exploration, is more difficult, costly, and carries higher risk than options one and two, called brownfield exploration.

Crux Investor noted that majors like BHP are acquiring copper assets through M&A rather than building new mines. Examples include BHP’s purchase of Oz Minerals and Newmont’s acquisition of Newcrest.

Despite the market’s recognition of copper’s role in the future economy and increasing supply tightness, Crux Investor says analysis shows copper prices still remain below their long-term inflation-adjusted average, suggesting room for further appreciation.

While BMO Capital Markets and Citigroup analysts believe current copper prices may rise past $4.54/lb due to a Chinese smelter supply shortage, and grid investments in China, they say a sustained price gain is needed by copper miners to make investment decisions.

Copper mining is an extremely capital-intensive business for two reasons.

First, mining has a large up-front layout of construction capital called capex — the costs associated with the development and construction of open-pit and underground mines. There is often other company-built infrastructure like roads, railways, bridges, power-generating stations and seaports to facilitate extraction and shipping of ore and concentrate. Second, there is a continuously rising opex, or operational expenditures. These are the day-to-day costs of operation: rubber tires, wages, fuel, camp costs for employees, etc.

The average capital intensity for a new copper mine in 2000 was between US$4,000-5,000 to build the capacity, the infrastructure, to produce a tonne of copper. In 2012 capital intensity was $10,000/t, on average, for new projects. Today, building a new copper mine can cost up to $44,000 per tonne of production.

Capex costs are escalating because:

- Declining copper ore grades means a much larger relative scale of required mining and milling operations.

- A growing proportion of mining projects are in remote areas of developing economies where there’s little to no existing infrastructure.

- Many inputs necessary for mine-building are getting more expensive, as cross-the-board inflation, the highest in 40 years, infiltrates the industry. This includes two of the largest costs, wages and diesel fuel, used to run mining equipment.

The bottom line? It is becoming increasingly costly to bring new copper mines online and run them.

Investors are also demanding a higher return on investment than previously, when there was a greater appetite for risk.

Citigroup is bullish on copper, with the bank’s analysts predicting that prices could surpass $10,000 a tonne ($4.53/lb) this year due to policy support in China.

Mining.com reports Beijing is expected to introduce further stimulus to upgrade its renewable energy infrastructure at the Third Plenum meeting in mid-July:

These additional measures, specifically targeting domestic property and grid investments, are expected to support copper prices in the near term, Citi analysts said in a note.

Why Kodiak Copper (TSX-V:KDK) (OTCQB:KDKCF) (Frankfurt:5DD1)

Kodiak Copper’s MPD project is located along the southern-most portion of the Quesnel Trough, an extremely prospective for discovery mineral belt extending over 1,000 kilometers from Washington State to the Yukon border. It is the longest mineral belt in Canada and British Columbia’s main copper-producing belt.

Copper-gold porphyries include Copper Mountain, New Afton, Mount Milligan, Woodjam, Kwanika and Kemess. Teck’s Highland Valley is the biggest open-pit mine in Canada.

The chances of successfully finding a deposit and building a mine are substantially higher when a skilled team is in charge. Kodiak’s management team, and the Discovery Group, have a successful, an envious, track record of shareholder return.

Copper market fundamentals are currently strong with analysts predicting increasing demand facing the headwinds of structural supply deficits.

KDK has a large, fully funded exploration/drilling program underway, and investors can expect news well into 2025.

Kodiak Copper, through a unique combination of advanced modern technology (AI) and old fashioned ‘boots on the ground’ exploration and prospecting offers significant exposure to copper and gold.

Exploration has already shown plenty of size potential as KDK has now drilled several kilometer-scale zones of mineralization over almost the entire length of the property of 20km. Drilling to date at Kodiak’s MPD deposit has proved extensive and high-grade mineralization at several porphyry centers, with multiple targets yet to be tested. The 2024 drill program is set to test multiple targets, building critical mass.

And we know that the project shares geological similarities to Copper Mountain and New Gold. All three are alkalic copper porphyries, meaning the mineralization is copper-gold.

“We are fully funded for a substantial drill program as we continue to systematically prove that our district-scale MPD project has the potential to become a world-class mine. For our 2024 program we have prioritized high-confidence targets near existing zones to expand mineralization, and new targets that present fresh discovery potential. We will continue to build critical mass and focus particularly on adding and expanding near-surface mineralization and higher-grade zones.” Claudia Tornquist, Kodiak President and CEO

Junior Resource Company valuations are low and Kodiak Copper MPD Project has all the hallmarks of a major copper/gold porphyry system with the potential to become a world class mine.

Kodiak’s MPD Project lies in a low cost, low risk area. Infrastructure includes supplies, roads, railway, highly trained skilled local workforce and cheap hydro power.

Strong capital structure and shareholders with Cdn$7m in treasury.

With a strong capital structure, cash in hand, a fully funded exploration/ drilling program underway, and Teck Resources as their largest shareholder (holding 9.1%), it seems Kodiak Copper is well-positioned for growth.

Why Max Resource Corp (TSX-V:MAX) (OTC:MXROF) (Frankfurt:M1D2)

MAX is taking a fresh approach to exploring its Sierra Azul Copper-Silver Project in Colombia, following a recently signed earn-in agreement with Freeport-McMoRan Exploration Corporation a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE:FCX).

Under the terms of the EIA , announced on May 13, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Sierra Azul Project by funding cumulative expenditures of CAD$50 million and making cash payments to Max of CAD$1.55 million.

This week, Max announced the 2024 exploration program at Sierra Azul, funded by USD$4.2 million (CAD$5.8 million) of approved expenditures by Freeport-McMoRan Exploration Corporation, as per the May 13 earn-in agreement.

“We are leveraging Freeport’s global exploration team and expertise to unlock Sierra Azul’s potential, which we believe is host to one of the world’s largest underexplored sedimentary and volcanic copper-silver systems,” Max’s CEO Brett Matich said in the July 29 news release.

“The USD$4.2 million exploration budget to be implemented in the second half of 2024 is the largest annual exploration budget to date. We look forward to working with Freeport, one of the world’s largest copper producers, to advance our Sierra Azul Copper-Silver Project.”

The program has two main objectives:

Conduct systematic regional exploration over the entire Sierra Azul project area of greater than 1,300 km;

Define priority targets for drilling.

In terms of drill targets, the program will focus exploration on 28 targets that span 90 km over all three districts of the Sierra Azul Project: AM, Conejo and URU. The two priority districts are AM and Conejo. AM is more advanced and prospective with 14 targets and potential deep-seated surface structures. Conejo is earlier-stage but thought to be at least as prospective as AM.

Conclusion

At AOTH we believe copper presents a compelling opportunity for investors. The Sprott report notes that copper prices and miners are likely to benefit from the growing supply-demand gap. It also says that copper’s strategic importance drove significant M&A in 2023, with BHP and Rio Tinto acquiring copper producers at significant premiums. Automakers concerned about securing future supplies are investing directly in mining companies.

But copper miners buying other copper miners does nothing to alleviate the supply shortage. It only transfers one copper reserve to another. Majors have underinvested in copper exploration and development, preferring M&A to the expense and risk of finding new copper deposits.

Junior copper explorers provide investors exposure to potential new discoveries that could help narrow the supply gap. These discoveries offer the chance for outsized returns, though obviously with higher risk.

Juniors resource companies are sensitive to commodity prices, meaning their share prices rise, or fall, directly in line with the commodity with which they are associated. Historically junior resource companies have offered the best leverage to rising commodity prices.

Richard owns shares of Max Resources (TSXV:MAX)

Richard does not own shares of Kodiak Copper (TSX.V:KDK).

KDK and MAX are paid advertisers on his site aheadoftheherd.com

This article is issued on behalf of MAX and KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE