Rick Mills – Kodiak Copper: Drilling to Expand Their Resource

Previously I gave four reasons for liking Kodiak Copper (TSX-V:KDK) (OTCQB:KDKCF) (Frankfurt:5DD1).

They are worth re-visiting:

- Management

Kodiak Copper’s management team and the Discovery Group have a successful, enviable track record of shareholder returns.

Kodiak was established by Chairman Chris Taylor of Great Bear fame. The founder and CEO of Great Bear Resources presided over its acquisition by Kinross Gold in 2022 for $1.8 billion.

The Discovery Group company is led by Claudia Tornquist, previously a general manager at Rio Tinto working with Rio’s copper operations. She was also the former director of Kennady Diamonds, leading the $176M sale of the company to Mountain Province Diamonds.

On March 12, 2025 KDK announced the promotion of Dave Skelton to VP Exploration and the appointment of Baykan Aksu as Senior Geologist. Skelton will succeed current VP Exploration Jeff Ward who is retiring from day-to-day operations and assuming an advisory role.

On March 26 Peter Holbek was appointed as a technical advisor. Holbek is a former senior executive at Copper Mountain, whose namesake mine is near Kodiak’s MPD project in southern British Columbia, with many similarities in geology and structural setting.

Holbek has 45 years of experience in geology, base and precious-metal exploration, resource estimation and mine development. He was most recently Vice President, Exploration at Copper Mountain Mining Corp., a post he held from 2007 to 2022, where he directed exploration efforts, initially to define sufficient mineral reserves to advance the Copper Mountain project into production, and subsequently to grow the resources of this major mine.

Working with metallurgy, engineering, grade control and environmental professionals, he led the incorporation of geo-metallurgical data into resource models which facilitated the prediction of mine throughput, metal recoveries and tailings characteristics. In 2013, he was awarded the E.A. Scholz medal for excellence in mine development by the Association for Mineral Exploration (AME) of BC.

Kodiak Copper recently added to its team by bringing on board Mike

Westendorf as Metallurgical Advisor and Alan O’Connor as Senior Exploration Manager.

Westendorf is a professional engineer with over 18 years of diversified mining experience. He has a strong background in metallurgy and process engineering, having worked at the Copper Mountain mine where he held senior positions and helped guide the project from the feasibility stage through to construction, operation, expansion, and ultimately M&A with Hudbay Minerals.

O’Connor is a registered professional geologist with over 35 years of mineral exploration experience across North and South America. He has a proven track record in managing exploration programs for base metals, gold, silver, and diamonds, from grassroots through to resource definition stages.

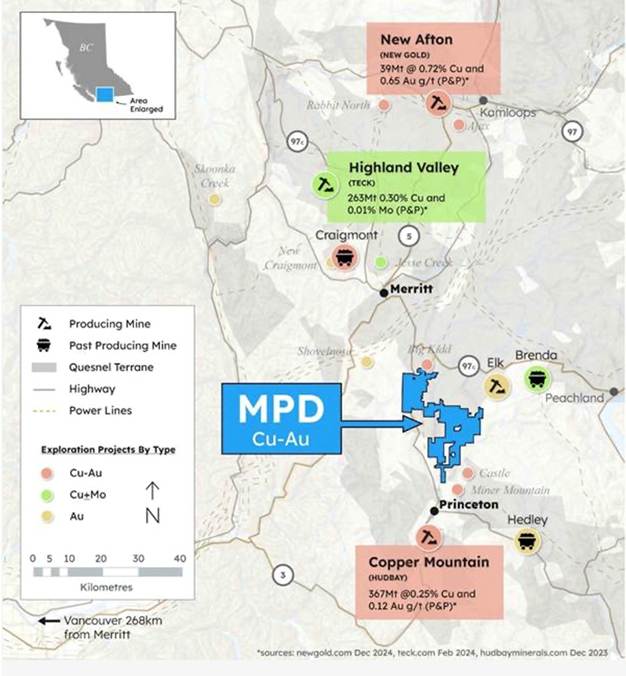

- Location, location, location

The MPD project is a 344-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt. MPD is between the towns of Merritt and Princeton, with year-round accessibility and excellent infrastructure nearby.

The Nicola Belt geology has similar characteristics to the neighboring alkalic porphyry systems at Hudbay’s Copper Mountain mine to the south and New Gold’s New Afton mine to the north.

- Maiden resource

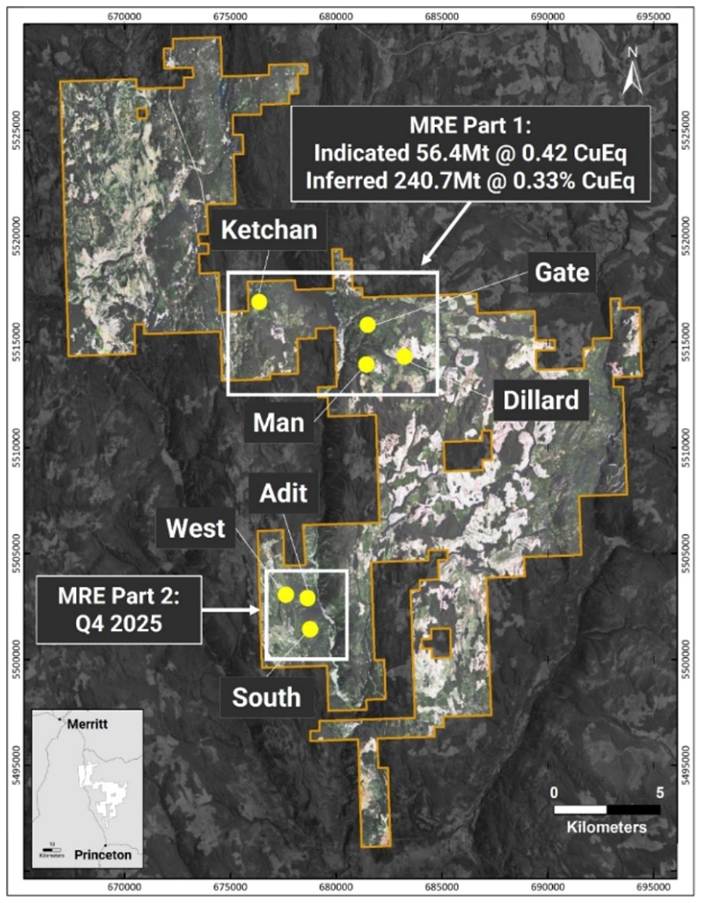

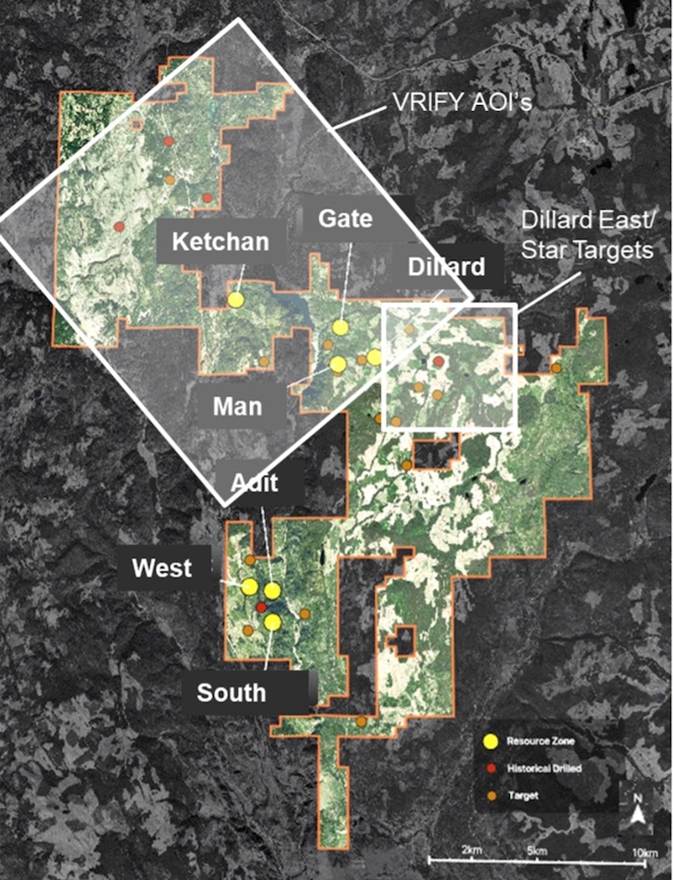

Kodiak announced on Jan. 16 that it started work on a National Instrument 43-101-compliant resource estimate that will include seven mineralized zones: Gate/Prime, Man, Dillard, Ketchan, West, Adit and South/Mid.

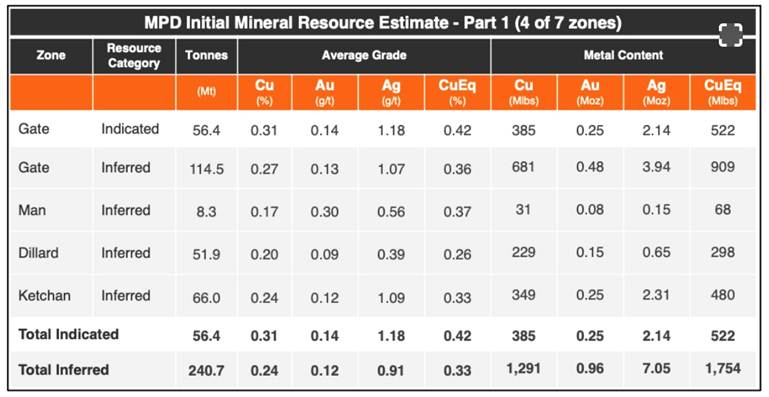

On June 24 Kodiak reported the first part of the maiden resource comprising four of the seven zones: Gate, Man, Dillard and Ketchan.

The highlight is an indicated resource of 56.4 million tonnes grading 0.42% copper-equivalent (CuEq) containing 385 million pounds of copper and 0.25 million ounces of gold.

In the inferred category, the four zones comprise 240.7Mt grading 0.33% CuEq, containing 1.291 billion pounds of copper and 0.96Moz of gold.

According to KDK, the mineral resource estimate (MRE) is defined using open-pit design shells to constrain the resource models and a cut-off grade of 0.2% CuEq.

Mineralization remains open for expansion within and beyond the pit shells, in multiple directions and at depth.

The full MRE for MPD is planned for completion in Q4 with the addition of three further mineralized zones — West, Adit and South — where confirmation and infill drilling is currently underway as part of the company’s 2025 exploration program.

The higher-grade, near surface mineralization identified at these three zones has the potential to make an important contribution to the full MRE, KDK states.

Initial mineral resource estimate — 4 of 7 zones

- Serious upside

Another important aspect of the MPD story is its potential upside.

While the company has identified multiple zones, it remains committing to continued exploration to further grow the project, both through zone expansion and the testing of new targets.

Drilling

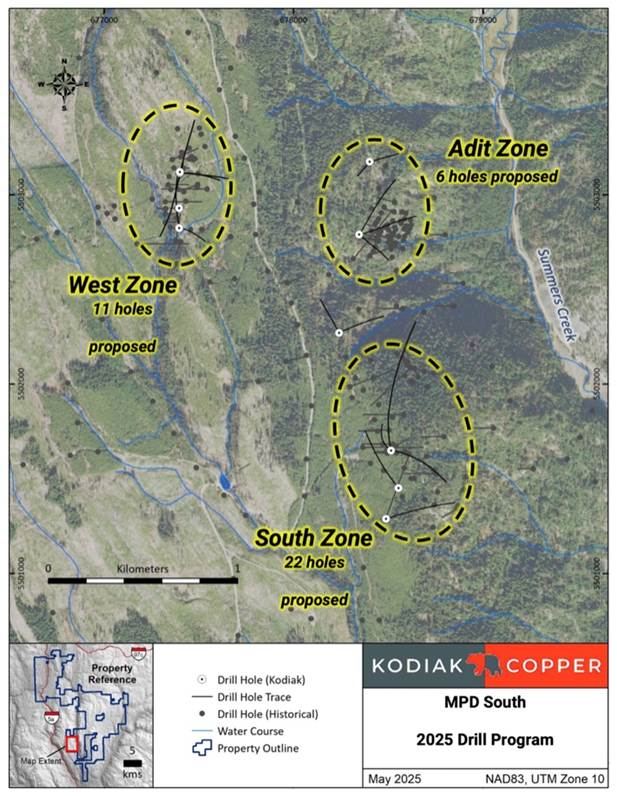

On June 18 Kodiak announced its fully-funded 2025 exploration program at MPD will involve drilling approximately 5,500 meters at West, Adit and South. A total of 39 drill holes are proposed.

Drilling is designed to support the resource estimation on these three mineralized zones, which will be completed in the fall, following receipt of assay results. Together with the resource estimate for the first four mineralized zones (Gate, Ketchan, Man and Dillard), this will complete the initial resource estimate for the MPD project.

Drilling will be conducted using one diamond drill rig and one reverse circulation rig and will include the twinning of select historical drill holes as well as improving coverage in areas with lower drill density.

The 2025 program also includes geologic mapping and prospecting around the resource zones to prioritize areas for further infill and step-out drilling and support modeling.

Fieldwork will also evaluate select new target areas, including new VRIFY Areas of Interest and priority targets generated by Kodiak’s 2024 exploration program.

2025 resource drilling map

Project areas and exploration targets

Conclusion

At 64 cents a share, Kodiak Copper in my opinion is undervalued.

Its MPD project is a huge land package in British Columbia’s primary copper and gold-producing belt.

The company has just published an initial resource estimate that comprises four of the seven mineralized zones: Gate, Ketchan, Man and Dillard. Between the indicated and inferred categories, the maiden resource amounts to 1.676 billion pounds of copper and 1.21 million ounces of gold.

The 2025 drill program of 5,500 meters in 39 drill holes is designed to support the resource estimation on the remaining three zones — West, Adit and South. This is expected to be completed in the fall, following receipt of assay results.

Given the positive copper market fundamentals, and how many times copper has been in the news lately, I think there will be a rerating of Kodiak’s market cap based on: the amount of copper in the ground right now; the fact that there are three additional zones that will be drilled; and that there is more drilling planned on the significant extensions of the zones that have, and will have, initial resources.

Kodiak Copper’s MPD project has all the hallmarks of a major copper/gold porphyry system with the potential, in my opinion, to become a world-class mine. The company is fully cashed up for 2025’s drill program (in March KDK closed an oversubscribed private placement of $5.5 million) and that means there will be a lot of news flow to keep investors interested.

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.64 2025.07.30

Shares Outstanding 85.8m

Market Cap Cdn$54.8m

KDK website

Subscribe to AOTH’s free newsletter

Richard does not own shares of Kodiak Copper (TSX-V:KDK). KDK is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE