Rick Mills – “Is the US Dollar Done?”

Donald Trump has boldly imposed a new era of US economic policy dominated by tariffs, trade wars, and threats to the sovereignty of nations it has long considered allies (Canada, Denmark, Panama), as the second-term president aims to rewrite the rules of international trade mostly by disregarding them as he pursues an America-first agenda.

The cost to the United States of Trump’s trade war and “country takeover” rhetoric has already cost America its reputation. After the Trump administration imposed tariffs on Canada — despite having renegotiated the NAFTA free trade agreement with Canada and Mexico in his first term — erroneously on the basis of Canada being “subsidized” by hundreds of billions of US dollars every year, Prime Minister-elect Mark Carney said that Canada’s old relationship with the United States, “based on deepening integration of our economies and tight security and military cooperation, is over.” (The Guardian).

Is the US dollar and its status as the world’s most important reserve currency also about to be tossed into the rubbish bin of world history? A de-dollarization movement that started a few years ago appears to be gathering pace. What’s going on with the dollar and if it recedes or, God forbid, collapses, what are the alternatives? This article aims to find out.

De-dollarization

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. His point was well taken.

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China and Iran.

As the target of US economic sanctions (for annexing Crimea, interfering in its election, and invading Ukraine), Russia sees diversification from the dollar and into gold and other currencies as a way of skirting sanctions.

After Russia’s full-scale Ukraine invasion, the US and its allies froze Russian foreign exchange reserves in their jurisdictions. By late July 2023, the amount of frozen Russian assets held in these countries was estimated at $335 billion.

Many countries including the BRICS saw what happened to Russia and have been purchasing gold bullion to store in their central bank vaults instead of dollars, lest they get on the wrong side of Washington.

A few years ago, China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF.

Most Russia-China trade is now conducted in Chinese yuan or Russian rubles, with the US dollar almost completely bypassed.

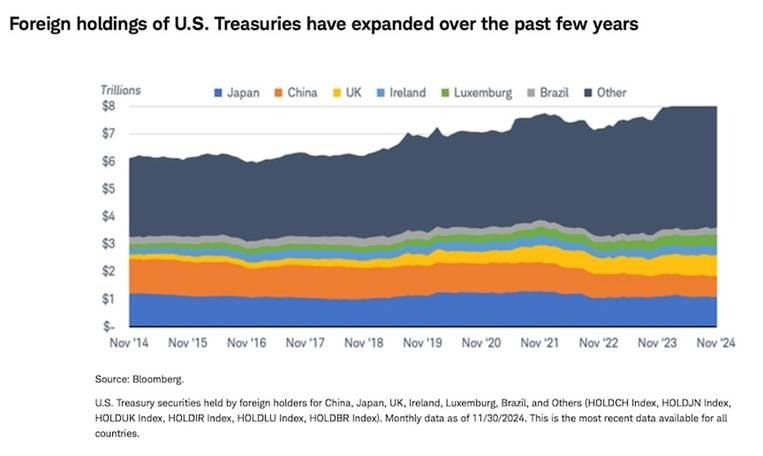

Before Trump’s electoral victory last November, Japanese investors sold a record $61.9 billion US Treasuries in the three months ended Sept. 30, data from the US Department of the Treasury showed. Funds in China offloaded $51.3 billion during the same period, the second biggest sum on record. (BNN Bloomberg)

China reportedly reduced its official holdings of US Treasuries by more than 27% from January to December 2024 — much faster than the 17% it dropped in seven years from 2015 to 2022 (The Financial Times). Beijing has two fears: one, that Washington could freeze its holdings of US government debt like it did to Russia; and two, that the US government could default on its debt.

(The latter fear is well-founded. “Secretary of the Treasury Scott Bessent has been talking about extending Treasury maturities and lowering coupons on Treasuries held abroad. The United States has $37 trillion of debt in funded liabilities and over $200 trillion in unfunded liabilities and let me be absolutely clear: the United States is bankrupt. It’s not my opinion. Anybody that can work the math out realizes it. For all of Trump’s talk about lowering the cost of the United States government, he’s actually increasing the cost, he’s increasing the deficit, he’s increasing the total debt. When the Secretary of the Treasury starts talking about extending maturities and lowering interest rates what he is talking about is a default. Rest assured, we’re very close. That will destroy the US dollar. And we’ve certainly seen about a 20% change in the value of the dollar against other currencies literally in the last few months.” — Bob Moriarty, 321gold)

US Dollar Index DXY, year to date. Source: MarketWatch

In mid-April, when Trump announced so-called “reciprocal tariffs” on dozens of countries including a monstrous 145% tariff on China, another round of Treasury selling ensued.

This was evidenced by the yield on the benchmark 10-year Treasury soaring to nearly 5%, the highest since February, and the 30-year bond notching is highest level since November 2023. Bond sales knock bond prices down and cause yields to rise.

The phenomenon was unusual, since Treasuries are considered a safe haven and foreign investors normally flock to them (and gold) during periods of economic turmoil. US government bonds were no longer being seen as a safe-haven asset.

The culprits according to CNBC were China and Japan. The two Asian behemoths are by far the largest foreign holders of US Treasury securities, with Japan owning $1.1 trillion worth and China hanging onto bonds worth $759 billion. China reportedly sold Treasuries and converted the proceeds into euros or German “bunds”.

The situation in Japan was a bit more complicated. One source said it was actually Japanese life insurers not the central bank offloading US bonds. Japan’s Ministry of Finance recently reported that domestic investors were net sellers of foreign bonds for six consecutive weeks from early March to mid-April. (Schwab.com)

The selling could also have been fueled by a combination of European and Japanese pension accounts selling long-dated Treasuries to purchase European fixed income, CNBC hypothesized.

Whatever the reason(s), it’s not what Trump expected or campaigned on. Many will recall that when Trump was running for president in 2024, he promised to punish any country that sought alternatives to the US dollar. At a campaign rally he vowed, “You leave the dollar, you’re not doing business with the United States, because we’re going to put 100% tariff on your goods.”

Since Trump has returned for a second term, though, his tariffs and trade war has accelerated the decline of the dominance of the dollar, not slowed it. (Geopolitical Economy)

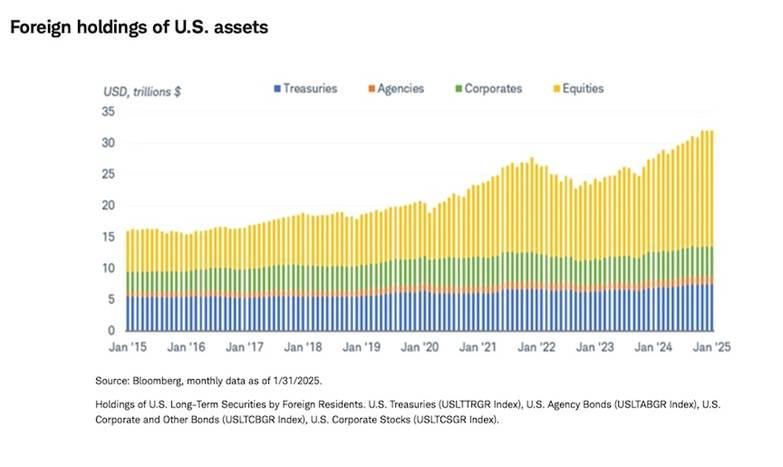

GE says it’s not only governments that are seeking alternatives to the US dollar but also major financial institutions and investors.

The Financial Times of Britain published an analysis from the global head of FX research at Deutsche Bank, who warned, “We are witnessing a simultaneous collapse in the price of all US assets including equities, the dollar versus alternative reserve FX and the bond market. We are entering unchartered territory in the global financial system.”

The Deutsche Bank analyst wrote:

The market is rapidly de-dollarizing. It is remarkable that international dollar funding markets and cross-currency basis remains well behaved. In a typical crisis environment, the market would be hoarding dollar liquidity to secure funding for its underlying US asset base. This dollar imbalance is what ultimately results in a triggering of the Fed swap lines. Dynamics here seem to be very different: the market has lost faith in US assets, so that instead of closing the asset-liability mismatch by hoarding dollar liquidity it is actively selling down the US assets themselves. We wrote a few weeks ago that US administration policy is encouraging a trend towards de-dollarization to safeguard international investors from a weaponization of dollar liquidity. We are now seeing this play out in real-time at a faster pace than even we would have anticipated.

Let’s dive a little deeper into this de-dollarization theme. Certain countries are diversifying away from the dollar, buying gold and other reserve currencies like the euro instead, or conducting trade in one another’s currencies, like yuan and rubles.

But to what extent could this dethrone the dollar? The answers to this question are mixed.

King Dollar

There are two reasons why the dollar is the number one reserve currency. The first and most obvious relates to oil. The so-called petro-dollar was set up in the early 1970s as an agreement between the US and its ally in the Middle East, Saudi Arabia. In exchange for military protection, the Saudis agreed to sell all their oil in dollars. Eventually other OPEC members joined the pact, creating an endless demand for dollars in an economy that ran, and continues to run on oil.

The second reason is more practical. When countries trade, it’s awkward for them to use their own currencies to buy and sell goods and services. It’s easier to use an intermediary like the dollar. For example, when a Brazilian farmer sells soybeans to a Japanese condiment company, he converts the needed yen into dollars, and then the condiments company converts the dollars they receive into yen.

According to Federal Reserve estimates, between 1999 and 2019, the dollar accounted for 96% of in of international trade transactions in the Americas, 74% in Asia and 79% elsewhere. Globally, banks used dollars for about 60% of their non-domestic deposits and loans. And in the foreign exchange market, the dollar is on one side of about 90% of all transactions. (U.S. News)

Signs of weakness

These arguments speak to the strength of the dollar, but its resilience is up for debate.

JP Morgan points to two scenarios that could erode the dollar’s status. The first includes adverse events that undermine the perceived safety and stability of the greenback. “Bad actors” like Donald Trump seem to fit this description perfectly. The second factor involves positive developments outside the US that boost the credibility of alternative currencies — economic and political reforms in China, for example.

The influential bank notes that signs of de-dollarization are evident in the commodities space, where energy transactions are increasingly priced in non-US dollar currencies. India, China and Turkey are all either using or seeking alternatives to the greenback, while emerging market central banks are increasing their gold holdings in a bid to diversify away from a USD-centric financial system.

As mentioned above, new payments systems are facilitating cross-border transactions without the involvement of US banks, which could undermine the dollar’s clout.

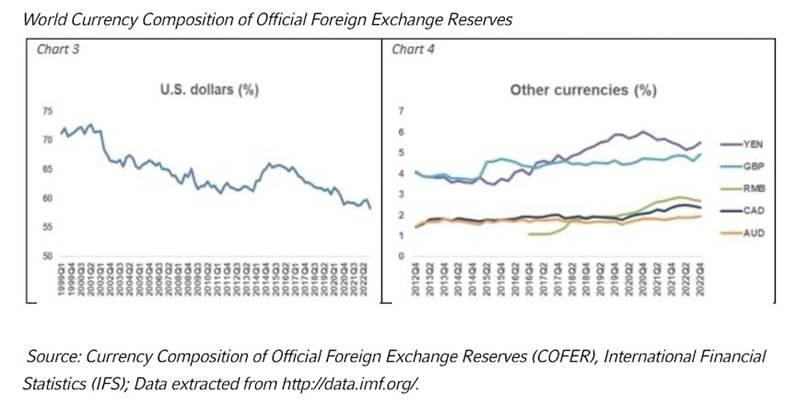

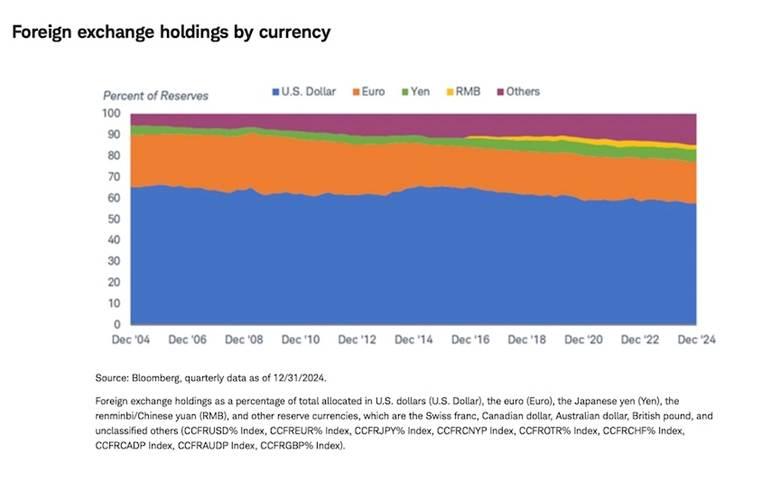

Finally, the US dollar’s share of foreign-exchange reserves has decreased, mostly in emerging markets.

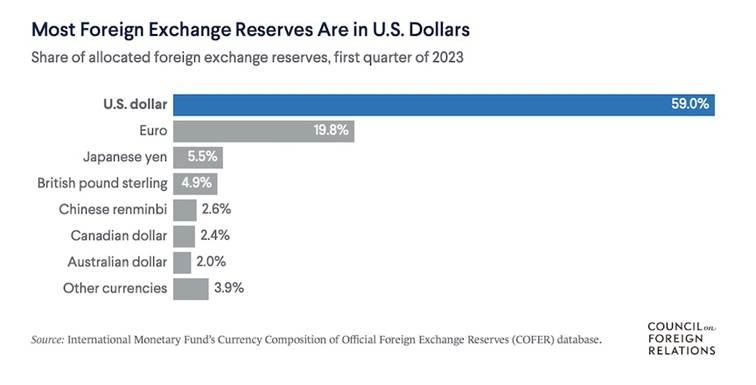

According to IMF data, at the end of 2024, the dollar accounted for 58% of global foreign exchange reserves, while 10 years earlier that share was 65%.

Source: Council on Foreign Relations

Equally, the share of the US Treasury market owned by foreigners has also fallen sharply, from 50% in 2014 to around a third today.

JP Morgan’s thinks the impact of de-dollarization would shift the balance of power among countries, and this could, in turn, reshape the global economy and markets. The impact would be most acutely felt in the U.S., where de-dollarization would likely lead to a broad depreciation and underperformance of U.S. financial assets versus the rest of the world…

While a structurally depressed dollar could raise U.S. competitiveness, it could also directly lower foreign investment in the U.S. economy. In addition, a weakening dollar could in principle create inflationary pressure in the U.S. by raising the cost of imported goods and services, though benchmark estimates suggest these effects may be relatively small.

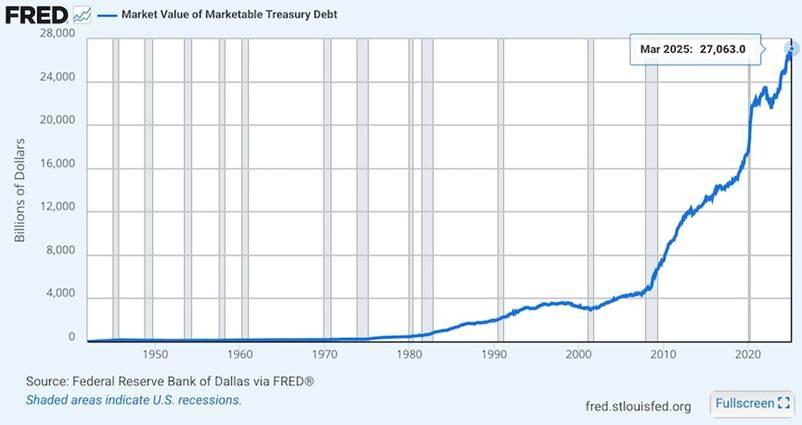

One thing that is not small is the size of the US national debt. At $36 trillion and counting, interest payments on the debt now surpass the entire US defense budget. Many countries are questioning the fiscal strength of the US economy and whether holding Treasuries is worth hitching their wagon to an economy that is so deep in the red.

Source: FRED

More burden than blessing

In Donald Trump’s first term he railed against a high dollar, claiming it was making imports cheap (though exports expensive) and exacerbating trade deficits. It was a big part of why he launched a trade war against China, which he felt was taking advantage of the US by dumping cheap Chinese goods into the US and creating a monster US-China trade deficit, where imports greatly exceeded exports.

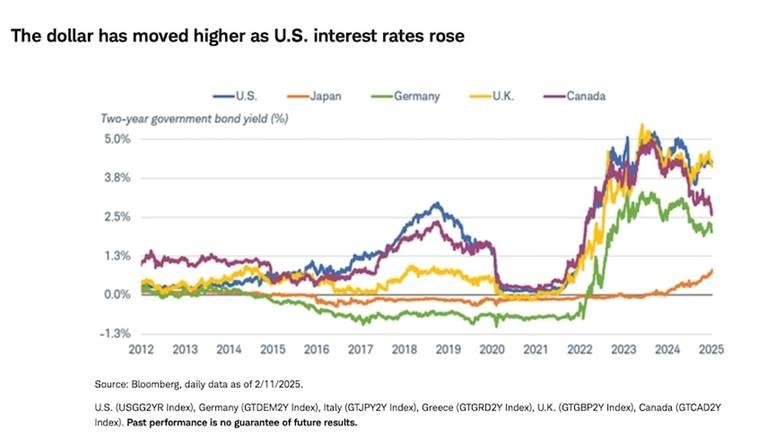

Trump frequently clashed with the Federal Reserve Chairman for not lowering interest rates fast enough.

Fast forward to the second term. To most observers the dollar is falling this time due to the likelihood of a recession caused by the tariffs, which imply a sharp fall in growth. This repels capital inflows and currency depreciation is the result.

However according to Chatham House there may be a deeper cause of the dollar’s decline, rooted in the view of some within the Trump administration that the reserve currency status of the dollar is more of a burden to the US economy than a blessing.

Their remedy is to erode the dollar’s status in the international monetary system as part of an effort to weaken it permanently against other currencies, hoping that a more depreciated dollar might reduce the trade deficit and attract manufacturers to the US.

Adherents of this view include Vice President JD Vance and Steve Miran, the chairman of President Trump’s Council of Economic Advisers.

Vance in 2023 questioned the validity of the dollar as the reserve currency by employing a variant of “Dutch Disease” — when a country’s one big commodity export leads to an appreciation of the currency that renders the rest of the economy, and especially its manufacturing sector, uncompetitive. He argued that the importance of coal to Appalachia led to a hollowing out of the region’s industry.

By analogy, some in the Trump administration argue that the dollar’s attractions as an international monetary haven have created so much demand for it that the exchange rate has become structurally overvalued and subsequently caused a loss of competitiveness. For them, this is a key factor in explaining why the share of workers involved in US manufacturing has fallen from 24 percent in 1974 to just 8 percent in 2024.

Of course at AOTH, we understand the United States can’t have its cake and eat it too. Having the world’s reserve currency means demand for dollars will always be strong, therefore a weak currency is impossible — maybe temporarily, due to factors like tariffs, but not forever.

The cost of having this privileged status is the country that has it must run a trade deficit with the rest of the world. It can’t have the strongest currency and also keep the currency low to increase exports.

This is what’s known as the Triffin Dilemma.

Five alternatives

Supporters of a strong US dollar are comforted by the fact that there are few, if any, replacements for it as the world’s reserve currency.

U.S. News notes that for awhile, at the turn of the century, it looked like the euro could fulfill this role. However, the 2008 financial crisis and various political and economic shocks in Europe have since diminished the standing of a central European currency as a world standard. Japan has its own issues with a stagnant economy and shrinking population. China is unlikely to become a reserve currency anytime soon given the extreme capital controls that its government places on the use of the yuan.

All other potential candidates are likely too small to be a reserve currency. The Swiss franc, for example, is known as a stable and well-regarded currency, but Switzerland’s economy is tiny and can’t support the huge capital flows required of an international reserve currency.

The International Monetary Fund recognizes eight major reserve currencies: the Australian dollar, the British pound sterling, the Canadian dollar, the Chinese renminbi, the euro, the Japanese yen, the Swiss franc, and the US dollar. As mentioned the dollar is the most commonly held, making up 59% of global foreign exchange reserves.

As of July 2023, China has by far the most reported foreign currency reserves of any country, with more than $3 trillion. Japan, in second place, has around $1.1 trillion. India, Russia, Saudi Arabia, Switzerland, and Taiwan also have large reserve holdings. The United States currently holds roughly $244 billion worth of assets in its pool of reserves, including $36 billion worth of foreign currencies. (Council on Foreign Relations)

The five most commonly suggested alternatives to the dollar are listed below; however, each comes with its own problems.

- BRICS currency. The leaders of the BRICS countries have for years discussed a shared currency that would protect against devaluation when the dollar rises. The problem is the BRICS have several structural challenges including a lack of robust central banks and monetary policies.

- Euro. The euro would appear to be a viable challenger to the dollar. It is the second most used reserve currency and the European Union rivals the United States in market size. Plus it has a strong central bank and financial markets. The problem with the euro is it lacks a common treasury, and the lack of a unified bond market limits its attractiveness as a reserve currency.

- Yuan. Also known as the renminbi, the Chinese government has been trying to boost the role of the yuan since the late 2000s. Beijing is increasingly pushing for its use in bilateral trade especially since the Ukraine war started in 2022. The problem is that China has imposed strict capital controls on the flow of its money outside China, limiting the renminbi’s growth.

- Special Drawing Rights (SDR). COFR reminds its readers that during the Bretton Woods talks, British economist John Maynard Keynes proposed creating an international currency called the “bancor”. While the plan never materialized, there have been calls to use the IMF’s Special Drawing Rights as a global reserve currency. SDR is based on five currencies: the euro, pound sterling, renminbi, USD and yen. Proponents argue it would be more stable than one national currency.But for SDR to be adopted widely, economists say it would need to function more like an actual currency, accepted in private transactions with a market for SDR-denominated debt. The IMF would also need to be empowered to control the supply of SDR, which, given the United States’ de facto veto power within the organization’s voting structure, would be a tall order.

- Cryptocurrencies. Crypto backers dream of a world where bitcoin replaces fiat currencies, freeing countries from the whims of others’ monetary policies. Critics counter that using cryptocurrencies as legal tender constrains a government’s policy options during a crisis, and that its volatility reduces its viability as a means of exchange. Few economists see private forms of money such as bitcoin replacing the US dollar.

A sixth possibility is rather than the dollar being replaced, it loses importance as other currencies become more common. The World Economic Forum notes that China has established around 40 bilateral currency swap lines with developing countries. These efforts are part of a long-term strategy to reduce dependence on the dollar. China’s share of trade invoiced in renminbi has gone from 20% a decade ago to 56% today.

Many experts agree that the dollar will not be overtaken by another currency anytime soon. More likely is a future in which it slowly comes to share influence with other currencies (Council on Foreign Relations).

Dollar dominance retained

Still, there are those who maintain that the US dollar isn’t going anywhere anytime soon and that its dominance over other currencies will prevail well into the future.

De-dollarization proponents like to base their argument on the ascendancy of the yuan versus the dollar. What they don’t usually say is that, although the renminbi’s share of global FX may continue to increase, its current 2.7% is a small fraction of the USD’s 58% share of global FX reserves.

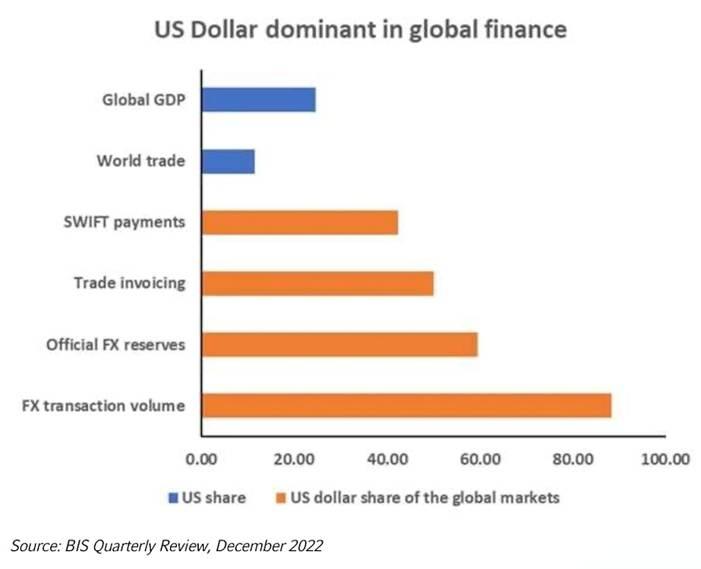

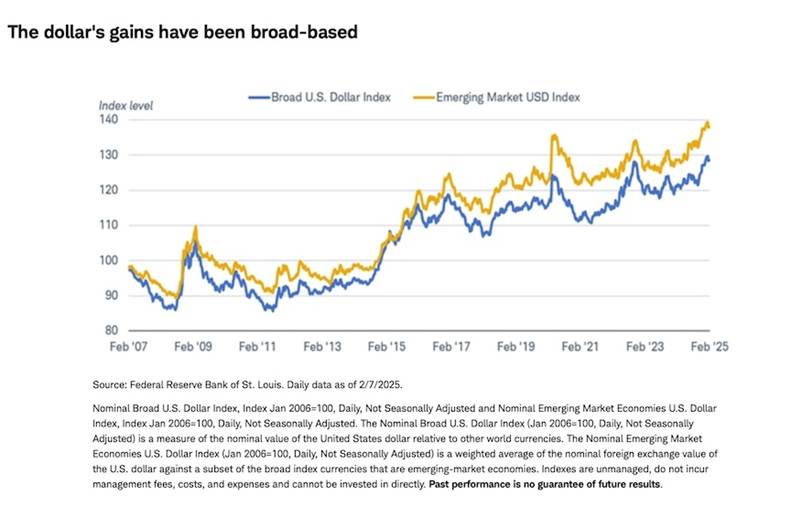

Despite the decline in the dollar’s share of official FX reserves, it remains central to international finance. Chart 5 shows that the USD punches above its weight. Although it represents about 25% of global GDP and 12% of global trade, the USD’s share of global markets is significantly more. For instance, the USD is involved in almost 90% of FX transaction volumes, 50% of trade invoicing, and 42% of SWIFT payments. Despite a gradually declining share of global FX reserves, it will likely remain the primary medium for international commerce. (Russell Investments)

The continued dominance of the US dollar is reflected in the six charts below by Charles Schwab. The brokerage firm concludes there is no obvious replacement for the dollar as a reserve currency. The U.S. has the largest and most liquid bond market in the world. Most global financial transactions are conducted in U.S. dollars, creating underlying demand for central banks to hold them.

Moreover, as emphasized by COFR, no other country has a market for its debt akin to the United States’, which totals roughly $27 trillion.

Source: FRED

Gold’s role

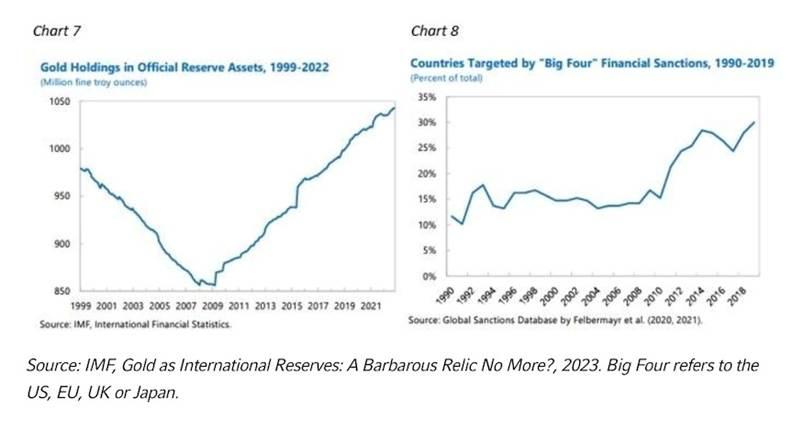

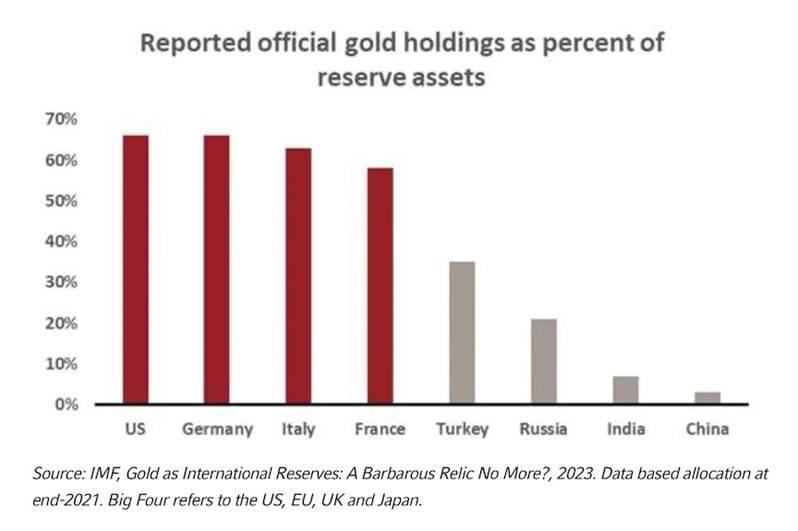

Even though gold is no longer a currency in the traditional context (the gold standard), gold holdings in official reserve assets have risen considerably since the financial crisis of 2008-09 (chart 7 below taken from an IMF working paper). Moreover, Russell Investments notes that countries targeted by “Big Four” sanctions (US, EU, UK, Japan) have been increasing their share of gold as a reserve asset since 2010. Russia and China have contributed most to this increase along with India and Turkey. (chart 8)

Since Trump 2.0 assumed power in January, gold has been on a tear — attracting billions of dollars from scared investors looking for a safe haven to park their liquidated cash.

Spot gold price. Source: Kitco

Monetary reset

To the question of why the United States delayed Basel III until this year. There is no obvious answer but two theories are plausible.

First, the US understands that the sooner Basel III goes into effect, the sooner the dollar will lose its standing as the world’s reserve currency. This is obviously something the US government fears and wants to avoid at all costs. If Basel III forces banks to treat gold as a Tier 1 asset — the same as cash and Treasuries — it could disrupt a dollar-denominated world where confidence is based on debt, derivatives and fiat-backed assets. “The US has a lot to lose as gold’s role expands because it threatens dollar supremacy,” states a video on the topic.

The other theory is that the US is buying time to get a “Plan B” in place. Many are pointing to a recent comment by US Treasury Secretary Scott Bessent, who said “within the next 12 months we’re going to monetize the asset side of the US balance sheet”. Could Bessent have been referring to anything other than gold?

Regardless of the cause of the US delay, one thing is for sure: the rest of the world is moving forward towards gold especially BRICS nations; they are preparing for the transition.

Conclusion

Central banks are buying gold because of protection against currency instability, as global debt reaches unsustainable levels. When trust in fiat currencies is shattered it is gold that will act as a true hedge against inflation and a safeguard against devaluation.

The second reason they are purchasing gold is because there is a global shift toward a multi-polar currency or neutral settlement currency as China, Russia and the BRICS-alliance countries work together to move away from the dollar, which the United States has weaponized against them. Gold is neutral, it is not affiliated with any country, it transcends politics and acts as universal true money.

Most importantly, central banks are buying gold because they are preparing for a new gold-backed monetary system once reasons one and two come to fruition. As ITM Trading reminds us, “When the fiat system that we know today collapses, these banks are going to be leaning on their hard assets. They’re going to need gold as a way to set themselves up in the new system because every major monetary shift in history has had gold at the heart of it and this time will be no different.”

As for what this means for retail investors, the answer is simple — buy gold because demand will surely exceed the supply and move the price even higher than it is now. Also, having gold will be the most effective form of wealth protection when paper money becomes worthless.

For now, the dollar is the most important reserve currency, but the power of the mighty buck is receding as countries see more of a future in conducting trade in local currencies, like China, Russia and the other BRICS nations.

In early 2024, BRICS expanded its membership to include Egypt, Ethiopia, Iran, and the United Arab Emirates. January 2025, Indonesia joined, becoming the first Southeast Asian member.

America’s $36 trillion debt is dragging the country down like an anchor and countries that hold a large amount of US dollars in reserve as Treasuries are getting twitchy. They don’t want to be rats on a sinking ship in the event of a US debt default. Japan, Russia and China have been selling their US bonds in the wake of Trump’s aggressive actions. This should make America’s politicians very nervous, for without foreigners buying its debt the US cannot afford to pay for its out-of-control spending. Roughly $10 trillion of the debt is set to roll over within a year, at much higher interest rates than it was purchased at. The US government will have to figure out a way to pay the interest it owes its bondholders. Remember, the annual interest on the debt now exceeds the entire budget of the US military.

In a recent report Sprott states:

In a multipolar world, traditional reliance on a single dominant reserve currency like the U.S. dollar is becoming less viable. The dollar, while still the largest reserve currency, is facing challenges, and its dominance is decreasing. This decline is partly due to strategic decisions by various countries to reduce their dependency on the currency, driven by concerns over monetary policy volatility and geopolitical risks.

We must remember that the arc of history is long. The concept of a reserve currency has been around for centuries, and the dollar’s turn has been relatively short — just 81 years. Consider that previous countries holding the crown include Portugal (1450-1580), Spain (1530-1640), Netherlands (1640-1720), France (1720-1815), and Great Britain (1815-1944). In 1944, the Bretton Woods Agreement established the US dollar as the world’s reserve currency and it was backed by gold.

The gold standard was officially ended by President Richard Nixon in 1971 and since then currencies have been allowed to float freely — some pegged to the US dollar — without a hard asset backstop.

The result has been a constantly depreciating US dollar as America spends and borrows its way deeper into debt.

We end with this quote from The Globe and Mail:

Since [1971], the US dollar has remained the dominant global reserve currency, however that dominance is declining. The volatile US economic environment, political instability, soaring debt levels, low interest rates and weaponization of the currency have led other countries to think of alternatives to the US dollar. But what could replace it?

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE