Rick Mills – “How China is Diminishing US Warfighting Capabilities Through Control of Technology and Minerals”

If the 12-day war between Israel and Iran could be considered a test for Israel’s Iron Dome, and interceptor missiles supplied to Israel by the US, both countries failed miserably.

US and its allies unprepared for missile barrage

The United States reportedly blew through almost a quarter of its supply of high-end, expensive THAAD (Terminal High Altitude Area Defense) missile interceptors, “thwarting attacks at a rate that vastly outpaced production,” according to a July 28 report by CNN.

The US has seven THAAD systems spread out around the world; it used two of them in the recent missile-exchange with Iran. Experts cited by CNN believe the US fired at least 80 THAAD interceptors. At $12.7 million a pop, that works out to just over $1 billion spent during the 12-day conflict.

But the US procured only 11 new interceptors last year and is expected to receive just 12 more this year, according to the Department of Defense. Next year 23 are budgeted.

How effective was the THAAD system? While most of Iran’s drones and missiles were downed by Israeli and US air defenses, dozens still got through. The Israeli Defense Forces, or IDF, said Iran fired over 500 long-range missiles and it was able to intercept 86% of those. That left 36 Iranian missiles that struck built-up areas. Major cities like Tel Aviv suffered extensive damage, with whole apartment blocks destroyed, military sites targeted, parts of the power grid taken out and 29 people killed, states the CNN report.

Tehran’s success rate rose as the war continued, indicating Israel’s Iron Dome and the THAAD missiles began to lose their effectiveness. (Only 8% of Iranian missiles penetrated defenses in the first week of the war. That doubled to 16% in the second half of the conflict and eventually culminated at 25% on the final day of the war — CNN)

The Washington, DC-based Jewish Institute for National Security of America (JINSA) estimated that THAADs plus Israel’s Arrow-2 and Arrow-3 interceptors shot down 201 of Iran’s 574 missiles, with 57 hitting populated areas. The THAAD system accounted for almost half of the interceptions, indicating that the Israel’s Arrow stockpiles were insufficient.

A mobile system that can engage and destroy short, medium and intermediate-range ballistic missiles, each THAAD battery is operated by 95 American soldiers armed with six launchers and 48 interceptors. As mentioned, one THAAD missile, manufactured by Lockheed Martin, costs $12.7 million.

A Terminal High Altitude Area Defense (THAAD) interceptor is test- launched. Source: U.S. Department of Defense.

With 25% of US THAAD capacity used during the brief Israel-Iran encounter, an obvious question is whether the United States military is making enough of them, considering all of the other hot spots in the world that could flare up into missile-flinging events.

“What I can say without giving any numbers is I was surprised at how low some of the levels of readiness were,” one former defense official who left his post in the last year told CNN.

“Stockpiles are dropping. We need more. We need them faster than they are being built,” said the same ex-official.

“Air defense is relevant in all of the major theaters right now. And there’s not enough systems. There are not enough interceptors. There’s not enough production and there are not enough people working on it,” said Mara Karlin, former US assistant secretary of defense for strategy, plans and capabilities under Biden.

Four former senior US defense officials said the low stockpile problem is most acute in inventories of high-end interceptors that are a key part of deterrence against China, i.e., in the Indo-Pacific where the United States navy maintains a large presence to protect its allies, including Taiwan, against an encroaching Chinese navy.

The US has THAAD systems in South Korea and in Hawaii, Guam and Wake Island. Taiwan has refused to accept the interceptor missiles. The alternative is to rely on AEGIS, a very expensive system that operates at sea and therefore is not capable of fully protecting US and allied bases in the region. (Asia Times)

“From a narrowly military standpoint, the Chinese are absolutely the winners in that these last almost two years in the Middle East have seen the US expend pretty substantial amounts of capabilities that the American defense industrial base will find pretty hard to replace,” said Sidharth Kaushal, senior research fellow at Royal United Services Institute.

“God forbid there should be a conflict in the Pacific,” added a former senior Biden administration defense official.

The author of the JINSA report said that after burning through a large portion of their available interceptors, the US and Israel both face an urgent need to replenish stockpiles and sharply increase production rates. Ari Cicurel estimates it would take three to eight years to replenish them at current production rates.

Another problem is intercepting hypersonic missiles. The centerpiece of Iran’s June attack on Israel and a US airbase in Qatar was the Khorramshar-4 missile, also known as the Kheibar. One of these missiles reportedly struck Tel Aviv.

Standing 14 meters tall with a diameter of 1.5 meters, the Khorramshahr-4 weighs approximately 20,000 kilograms (20 tons) when fully loaded and is capable of speeds between Mach 8 and 16. Its operational range is 2,000 km with an 1,800 kg warhead.

The missile, said to be inspired by North Korea’s Hwasong-10 intermediate-range ballistic missile, which is also a modified version of the Soviet R-27 (SS-N-6) submarine-launched ballistic missile, is turning heads across the Middle East.

Iran’s Khorramshahr-4 hypersonic missile. Source: X

The Kheibar, like THAAD, uses kinetic energy to destroy its targets; it does not use explosives.

Along with Iran, China and Russia already have hypersonic missiles. To intercept and destroy them, THAAD would need to have longer range and speed, something that has been proposed but not yet approved, Asia Times said.

The publication also states, The US and Israeli ability to manufacture air defense missiles is inadequate against Russian, Chinese, Iranian and maybe North Korean factories’ ability to produce ballistic missiles. What is true for the defense of Israel, supplementation of Israel’s local air defenses with US assets, also is true for Europe and Asia. NATO has very limited air defenses, well below what Israel has but a need to protect a massively bigger territory…

The US, at present, would find it extremely difficult to backstop NATO against a massive attack by Russia, or to support Japan and South Korea, let alone Taiwan, with de minimis stockpiles and too few systems…

To make a long story short, the US and its allies are not well prepared against saturation missile attacks and don’t have enough coverage to protect military installations, command and control centers, airfields, naval ports or even logistic centers and factories (putting aside attacks focused on critical infrastructure, as we see on a daily basis in Ukraine).

US depends on China for military equipment inputs

Times of India asks, “Could the US actually sustain a conflict with China, or is it too entangled in its rival’s supply chains?”

A new report from data analytics firm Govini found that the United States’ defence industry remains reliant on suppliers from China, despite ongoing efforts to decouple from the very nation if might have to one day confront in battle.

The annual report titled ‘National Security Scorecard’ revealed that Chinese companies still accounted for 9.1% of Tier 1 contractors involved in the Pentagon’s major defense programs across nine critical sectors in 2024: aviation, maritime, C4I (command, control, communications, computers, and intelligence), mission support, nuclear, missiles and munitions, ground, missile defence and space. (IDN Financials)

The missile defence sector had the highest reliance on Chinese suppliers with an 11.1% share. Nuclear had the lowest at 7.8%.

Other key pieces of information provided by the report:

- Many US weapons systems — ranging from hundreds in the aviation and maritime sectors to several in the nuclear sector — remain dependent on critical minerals, the production of which is largely dominated by China.“China’s recent export bans on key minerals have exposed this vulnerability,” the report noted, referring to Beijing’s countermeasures involving export controls on rare earth elements and other critical materials amid its trade and tech war with the US.

- Govini’s April report had already stated that 80,000 US weapon components rely on antimony, gallium, germanium, tungsten or tellurium.

- Given China’s dominance in the global supply of these five minerals, nearly 78% of US weapons systems are at risk of disruption due to export restrictions.

China-US rare earths deal no help to the military

On June 11, US and Chinese officials finalized a new trade framework that includes a commitment from Beijing to resume exports of rare earth elements and magnets to the United States, following two months of severe export restrictions that disrupted key inputs for the automotive, robotics, and defense sectors.

In early April, China imposed export controls on seven rare earth elements (REEs) and related permanent magnets, citing national security concerns and in response to US tariffs. The targeted REEs included samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium.

The delay in issuing export licenses has had a significant impact on US, European and Japanese companies, particularly auto manufacturers.

According to CSIS, Ford shut down production of the Ford Explorer at its Chicago plant for a week in May due to a rare earth’s shortage; several European auto supplier plants and production lines were closed; Nissan and Suzuki Motors reported supply disruptions; and shipments of rare earth magnets to Germany fell 50% from March to April.

While Trump wrote on his Truth Social media platform, “Our deal with China is done, subject to final approval from President Xi and me,” it does not favor the United States because China has given up so little.

Reuters reported that The renewed U.S.-China trade truce struck in London left a key area of export restrictions tied to national security untouched…

Beijing has not committed to grant export clearance for some specialized rare-earth magnets that U.S. military suppliers need for fighter jets and missile systems, the people said.

Importantly, Reuters states, China has not budged on specialized rare earths, including samarium, which are needed for military applications and are outside the fast-track agreed in London, the two people said. Automakers and other manufacturers largely need other rare earth magnets, including dysprosium and terbium.

While China promised to fast-track approval of RE export applications, the applications are from non-military US manufacturers, and the licenses only have a six-month term. In other words, the United States is not getting any rare earths from China for defense purposes, and the rare earth export licenses for civilian purposes are temporary; they have to be renewed every six months.

If the US thought that imports of Chinese civilian-use rare earth magnets would continue at previous levels, they were dead wrong. The Telegraph reported on July 28 that China has restored US trade at a far slower pace than with Europe and the rest of Asia:

China exported 3,188 tonnes of rare earth magnets worldwide in June, representing a 158pc jump from May. Of that total, 353 tonnes went to the US, an almost sevenfold increase from the previous month’s low of 46 tonnes.

But the average monthly shipment to the US in the first three months of this year was 622 tonnes, suggesting trade is barely back to half the typical level.

Here’s the reality.

Despite the US-China rare earths agreement, despite what MP Materials is doing to advance a rare earth supply chain, despite what Lynas is doing, despite the Pentagon taking a 15% stake in MP, and despite handouts from the Department of Defense, China is still hamstringing the US military.

We could soon feel the effects of China’s rare earth restrictions on F-35 inventories, and on depleted US and Israeli anti-ballistic missiles. The automobile industry is shutting down production lines because it can’t get the rare earths. China makes the specialty magnets required, and it’s unwilling to share them.

Semiconductor competition

Taiwan is the world’s top contract manufacturer of semiconductor chips, which are found in most electronics, including smartphones, computers, vehicles, and weapons systems that rely on artificial intelligence.

Advanced chipmaking is among the most complex manufacturing processes ever devised. Fabricating chips takes three to four months and over a thousand manufacturing processes. It must be done in a pristine environment (no dust) and requires precision equipment that manipulates particles on sub-atomic levels.

Taiwan Semiconductor Manufacturing Company is the world’s largest contract chip maker and the top supplier for Apple and other US companies. It is one of only two companies in the world (the other is Samsung) that has the technological know-how to make the smallest, most advanced chips, and it manufactures more than 90% of them.

The BBC describes a TSMC facility built in the Arizona desert to avoid US tariffs as “the cleanest environment on Earth”:

Inside the “Gowning Building”, workers dress in protective clothing before crossing a bridge that is supposed to create the cleanest environment on Earth, in order to protect the production of these extraordinary microscopic transistors that create the microchips underpinning everything.

Konstantinos Ninios, an engineer, shows me some of the very first productions from TSMC Arizona: a silicon wafer with what is known as “4 nanometre chips”.

“This is the most advanced wafer in the US right now,” he explains. “[It] contains about 10 to 14 trillion transistors… The whole process is 3,000 to 4,000 steps.”

Driving the advancement of the technology is the miniaturisation of the smallest feature on chips. Their size is measured these days in billionths of a metre or nanometres. This progress has enabled mobile phones to become smartphone and is now setting the pace for the mass deployment of artificial intelligence.

It requires incredible complexity and expense through the use of “extreme ultraviolet (UV) light”. This is used to etch the intricate building blocks of our modern existence in a process called “lithography”.

The world’s dependence on TSMC is built on highly specialised bus-sized machines, which are in turn sourced almost entirely from a Dutch company called ASML, including in Arizona.

These machines shoot UV light tens of thousands of times through drops of molten tin, which creates a plasma, and is then refracted through a series of specialised mirrors.

The almost entirely automated process for each wafer of silicon is repeated thousands of times in layers over months, before the $1m LP-sized wafer of 4nm silicon chips is formed.

Recognizing the extent to which the United States relies on one company for critical chips, Biden pushed to strengthen the US chip industry; in 2022, Congress passed a sweeping $280 billion bill to do so.

China also relies on Taiwanese chips, though not as much as the United States does. Beijing is working to boost its own industry, especially as Washington has pushed TSMC to stop selling to Chinese companies, including Huawei, a Chinese telecommunications giant that Washington claims Beijing uses for espionage. (Council for Foreign Relations, ‘Why China-Taiwan Relations Are So Tense’, Aug 3, 2022)

In late 2024 the Biden administration curbed the sale of chips made by US and foreign companies to China — the goal being to slow China’s development of advanced semiconductors that may help its military.

In fact, China is playing catch-up in a global competition to produce the most advanced semiconductors used for the highest-tech applications, especially artificial intelligence.

According to the Centre for International Governance Innovation (CIGI), China has lagged two or three generations behind global leaders such as Taiwan and South Korea.

Before the Biden administration-imposed export controls on advanced chips in 2022-23, Chinese companies had been able to purchase or manufacture overseas high-end chips for data center and cloud computing, artificial intelligence model training and other uses, explains CIGI. Huawei’s powerful Ascend 910 chip series, released in 2019, was fabricated by TMSC, for example, using the cutting-edge “7nm process node” system.

But, while advanced chips for cloud computing and mobile phones can be mass-produced using 7nm chips, 3 nm chips or the even smaller 2nm versions can put many more transistors on each chip to achieve greater speed and computing power.

“The chip ban changed the game fundamentally,” writes CIGI. It cut off China’s access to advanced chips it required for large language models and other AI foundation models.

“The sanctions were introduced just a month before the release of ChatGPT by OpenAI. Effectively, that launched a generative AI arms race between the United States and China. This battle between the world’s two superpowers is now well under way.”

The Trump administration had already banned the sale of EUV lithography machines from being sold to China in 2019. When Biden came along, he went further and banned electronic design automation software in chip design.

Thanks to the CHIPS Act, US chip manufacturing capacity is projected to triple by 2032. (Yahoo Finance)

Because of Chinese shortages of key equipment and components, the technology gap has widened. The most advanced chips such as Nvidia’s H100 are manufactured with the 4nm process, while Nvidia’s latest B100 and B200 semiconductors used TMSC’s 3nm process.

By contrast, China’s 7nm process requires more manufacturing steps using its less advanced deep ultraviolet (DUV) lithography machine to place as many transistors as possible on each chip. This explains why the production costs are so high and the yield rate — the percentage of working chips on a wafer — is so low.

On April 1, 2025, TSMC introduced the world’s most advanced microchip, the 2nm. Mass production is expected in the second half of the year.

Asia Times reports that, compared to the previous version 3nm chips, 2nm technology delivers a 10-15% increase in computing speed at the same power level, or a 20-30% reduction in power usage at the same speed. Transistor density in the 2nm version is 15% higher, which should enable devices using them to operate faster, consumer less energy and manage more complex tasks.

The publication adds that the efficiency and speed of 2nm chips have the potential to enhance AI-based applications such as voice assistants, real-time language translation and autonomous computer systems (those designed to work with minimal to no human input).

Data centers could experience reduced energy consumption and improved processing capabilities, contributing to environmental sustainability goals.

Sectors like autonomous vehicles and robotics could benefit from the increased processing speed and reliability of the new chips, making these technologies safer and more practical for widespread adoption.

However, despite striking a USD$100 billion deal to build five new US factories, TSMC cannot make 2nm chips outside of Taiwan. The announcement was made last November by the country’s minister of economic affairs, citing technology protection rules.

Taiwanese law limits domestic chipmakers to producing chips abroad that are at least one generation less advanced than their fabs at home, states Taipei Times.

Military uses of chips

As for the use of the latest-generation microchips for military applications, the concern may be premature, states one source, GeopoliticsUnplugged Substack, in ‘Tiny Chips, Big Myths: How Military Systems Actually Use Semiconductors’.

The blog says the “chip war” isn’t primarily about military systems relying on cutting-edge, sub-5nm chips. It notes most military applications use larger, proven node sizes (45nm-250nm) that are more durable, reliable and radiation-resistant:

While smaller chips are emerging in niche areas like AI-driven systems, the race for advanced semiconductors is more about future defense use and current geopolitical control and economic influence than immediate defense needs.

Among the military applications using larger node chip are avionics, secure communications, and radiation-hardened aerospace technologies. The blog says legacy avionics in fighter jets like older F-16 variants or early F-35 systems typically use around 90nm chips.

There are occasions for modern military systems to utilize smaller nodes, such as 28nm or 14nm. These would be for applications requiring higher computational power or energy efficiency, such as advanced radar processing, AI applications or next-generation avionics.

Other key points from GeopoliticsUnplugged:

- Radiation-hardened electronics for spacecraft and ICBM guidance systems are even higher nm nodes than 90nm. Satellites such as the US GPS III system use 250nm node chips.

- In advanced systems like 5th and 6th-generation fighter jets, missile defense systems, and AI-based tools, newer nodes like 14nm, 10nm, or even smaller may be used for specific subsystems requiring significant processing power.

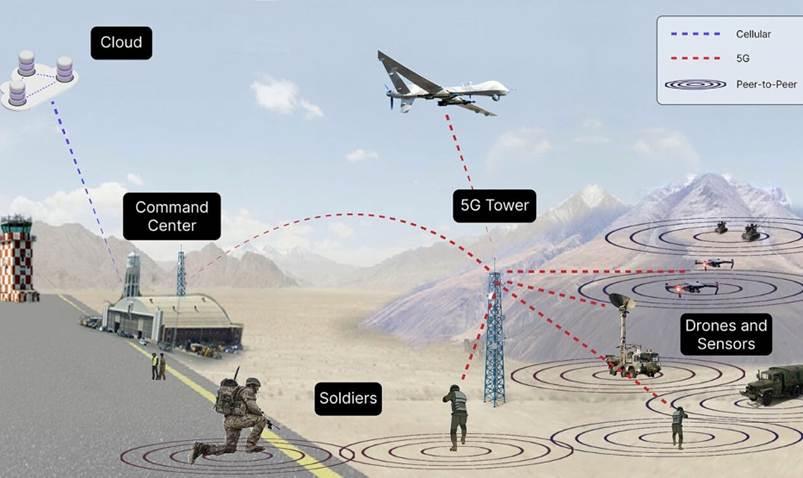

- The integration of artificial intelligence (AI) into military operations is becoming increasingly significant, with semiconductor technology playing a critical role in enhancing AI performance. Chips smaller than 5nm offer unprecedented computational power, which is vital for sophisticated AI applications in defense. Smaller node chips enable faster processing for AI algorithms, critical for real-time decision-making and autonomous operations. These sub 5nm chips allow AI systems to operate with less power, vital for field-deployable units or long-endurance missions. Smaller chips can lead to more compact AI hardware, which is advantageous for integration into various military platforms. The ability to deploy AI systems with such advanced chips could lead to superiority in information warfare, autonomous systems, and cyber operations.

- Lower node chips and AI can significantly enhance Intelligence, Surveillance, and Reconnaissance (ISR) operations in the military and national security sectors in the many ways. Lower node chips (like 5nm and below) provide higher computational speeds and efficiency, allowing for real-time analysis of vast amounts of data collected from ISR assets. This rapid processing is crucial for timely decision-making in dynamic battle environments. These lower node chips consume less power, which is vital for extending the operational life of unmanned systems or for mobile command centers where energy resources are limited.

Source: GeopoliticsUnplugged Substack

- AI algorithms running on advanced chips can identify patterns, anomalies, or threats in imagery or signals intelligence (SIGINT) faster than human analysts. For instance, AI can detect changes in terrain or infrastructure that might indicate enemy activity.

- Lower node chips enable more sophisticated AI algorithms to be embedded in unmanned aerial vehicles (UAVs), allowing for autonomous or semi-autonomous flight paths, target acquisition, and threat response, thus reducing human operator workload. With AI processing at the edge (on the device rather than relying solely on cloud computing), decisions can be made faster in environments where communication back to a central command might be compromised or delayed.

- Smaller node chips with AI can analyze and react to complex electronic signatures in real-time, aiding in jamming, spoofing, or countering enemy electronic systems.

- AI and low-node chips can power advanced wearable devices for soldiers, providing them with real-time ISR insights directly to their field of vision or personal communication devices.

China aims to lead in AI

One of the points above bears repeating: The integration of artificial intelligence (AI) into military operations is becoming increasingly significant, with semiconductor technology playing a critical role in enhancing AI performance.

In other words, sub-5nm chips may not be the norm now for most military equipment, but they’re coming. The future of military procurement will be based not so much on hard assets — like tanks, planes and ships, though such equipment is obviously important — but on artificial intelligence that enhances or replaces the role of humans.

Numerous examples were presented in the bullet points above.

China clearly wants to be the leader in AI and according to a recent Bloomberg piece it is vying to unseat the US in a fight for the $4.8 trillion AI market.

One way it is doing this is by courting the Global South. At the annual World AI Conference, China urged the creation of a new group called the World AI Cooperation Organization that would have mostly developing countries cooperate on governance, with China benefiting from more favorable rules.

For many of the countries represented at the conference, Chinese firms already offer competitive solutions, even if the US dominates the supply of cutting-edge AI chips.

“The Chinese are coming to the table with a very different AI product mix that is going to be extremely appealing to lower-income countries that lack the computing and power infrastructure needed for large-scale implementation of OpenAI-like AI systems,” said Eric Olander of the China-Global South Project.

China led emerging-technology 5G through its primary telecommunications company vehicle, Huawei, which sought to win market share abroad. But the United States government balked when concerns arose around national security risks and allegations of intellectual property theft. These concerns led to bans and restrictions on Huawei’s operations within the US and its allies, impacting the company’s ability to sell products and access certain technologies.

The US has banned Huawei’s equipment from being used in government networks and has encouraged allies to do the same. In May 2022 Canada banned the use of Huawei from accessing Canada’s 5G network over concerns for national security.

The United States appeared to have taken the AI baton and run with it with OpenAI’s release of ChatGPT in November 2022. The generative AI chatbot interacts conversationally with the user. Since its release, ChatGPT has seen updates and improvements, including the introduction of more advanced models like GPT-4o and the development of features like web search integration. (AI Overview)

Chinese tech firms rushed to create their own AI-powered chatbots, coming up with DeepSeek in January 2025. According to Reuters, the company attracted attention in AI circles after writing a paper that the training of DeepSeek-V3 required less than $6 million worth of computing power from Nvidia H800 chips.

DeepSeek-R1 is 20 to 50 times cheaper to use than OpenAI o1 model, depending on the task.

Bloomberg said The AI upstart stunned the world not just by releasing AI models that are almost as capable as those of OpenAI but also made them freely available for anyone to download and customize for free…

A succession of Chinese companies has done the same, with companies from incumbent giants like Alibaba and newcomers like Moonshot releasing cutting-edge large language models that are similarly open weight. That accessibility may be especially important to developing countries who may not have the resources to gather vast datasets and train their own AI models from scratch, a process that would involve expensive chips made by companies such as Nvidia Corp.

(A clarification: Nvidia, the most valuable company in the world, designs its own chips but has them manufactured by TSMC in Taiwan.)

According to The Economist, in the six months since DeepSeek came out, China has continued to impress; in July three labs unveiled top-flight AI models, “matching and in some cases even beating America’s best.”

The Centre for International Governance Innovation reports that, despite US sanctions that have restricted China’s efforts to gain ground in almost every subsector of the chip industry, Huawei had a breakthrough in August 2023 with its Mate 60 Pro smartphone. The phone is equipped with Huawei’s own Kirin 9000 chips, fabricated by China’s most advanced foundry, SMIC, using the 7-nm process.

Huawei’s second generations Ascend 910B AI chips, using the same SMIC 7-nm process, also shocked US officials, states CIG.

The upshot is that China has continued to evolve its AI capabilities, despite not having the semiconductors designed in the United States and other countries and produced at TSMC’s foundry in Taiwan.

Indeed, as The Economist points out, chips are its Achilles heel.

Which makes a recent decision by the Trump administration rather puzzling. In April it blocked the sales of Nvidia’s h20 chips to China, then reversed the decision on July 14, saying the company was permitted to resume sales. Why? The Economist explains:

[The] decision is a grave mistake at the worst possible time.

That is because as impressive as Chinese models have been, America’s chip controls were clearly working. When Nvidia devised the h20 to comply with an earlier set of rules, it inadvertently created a chip that was hobbled for training new AI models, but perfect for running them—a process called inference. Since exports of the H20 were banned in April, even the Chinese labs that had overcome the shortage of training chips to produce world-class AI models have been unable to access enough computing capacity to offer those models to paying customers. They have had to resort to relying on outsourced hosting and making the most of the limited quantity of AI chips produced by Huawei and other Chinese hardware firms. But the trend seems clear: without H20s, Chinese companies cannot keep up with demand.

And as AI adoption increases, having enough capacity for inference will become ever more important, making export controls even more potent. America’s ban on the export of H20s, in short, has impeded China’s progress in AI. It seems perverse for America, engaged in an arms race with China, to give up this advantage.

In April China targeted one of America’s largest chipmakers, Micron Technology. According to WECB, the Chinese government announced that Micron, which specializes in hard drives and SSDs, will be subject to a security review, citing concerns over the company’s products jeopardizing national security.

Coming for the chips

Now that the United States has opened the door to China receiving Nvidia chips, Beijing appears free to continue pursuing AI innovation that could overtake the US and its allies.

But it needs the chips to do it, and the most advanced chips, the 2nm version, are manufactured by TSMC in Taiwan. It took years for Taiwan to become the focal point of the chipmaking industry — arguably the most complicated manufacturing process in the world. Two quotes are relevant, both referring to chipmaking as a defense against China’s invasion of Taiwan, ostensibly to take over TSMC’s foundries.

Taiwan’s cutting-edge chip will reshape the tech landscape while fortifying its ‘silicon shield’ against a China invasion. (Asia Times)

Taiwan’s microchip industry is closely tied to its security. It is sometimes referred to as the “silicon shield”, because its widespread economic importance incentivizes the US and allies to defend Taiwan against the possibility of Chinese invasion. (Asia Times)

Of course, if China attempts to invade Taiwan, it will have to come up with a strategy that defeats, or potentially, circumvents the US navy, which patrols the South China Sea to protect its allies including Taiwan.

I believe that China plans to blockade Taiwan, not attack it, allowing Beijing to seize the foundries without firing a shot.

First, some background on the US-Taiwan relationship.

The United States first established diplomatic relations with the People’s Republic of China (PRC) in 1979. This was the same year it severed diplomatic ties and abrograted its mutual defense treaty with Taiwan. However, the United States maintains an unofficial relationship with the island including arms sales to its military, despite Beijing urging Washington to stop selling weapons and cease contact with Taipei.

The Chinese Communist Party has not ruled out military action to achieve reunification, and the United States hasn’t said it won’t defend Taiwan in the event of an attack.

The big question is, would the US retaliate in the event of a Chinese invasion of Taiwan? I believe it’s unlikely. China has gone to great lengths to fortify the Chinese Mainland against a foreign attack. Their military has been planting deep-sea mines that sit on the bottom of the ocean and wait for an activation signal. There are likely thousands of these mines covering the South China Sea, and in all likelihood, they have set mines along the routes that American carriers would sail, en route to Taiwan’s defence.

China has planted missiles to defend its territory, which extend out to a range of about 1,200 km. They also have submarines outside the South China Sea with the capability of firing long-range missiles. If it came to a war with China, the US carrier fleet likely would not get anywhere near the Chinese Mainland to launch aircraft.

Conclusion

Taiwan depends on imported food and fuel. A fuel blockade could cripple the island’s industries; it would result in large disruptions to the energy supply and potentially halt manufacturing. Only 12% of Taiwan’s energy comes from domestically produced fuels, renewables or nuclear power. Power generation is increasingly dependent on imported LNG.

Taiwan also doesn’t produce much of its own food; its reliance on food imports is significant given its limited arable land — the country is mountainous — and small agricultural sector.

A Chinese blockade of Taiwan could literally starve the Taiwanese into submission and deprive them of electricity to cook food and keep warm. The US would watch helplessly as China breaks Taiwan’s resistance, then walks in and takes over TSMC’s chip foundries.

The Chinese haven’t been secretive about what they plan to do. For the past two years they’ve been running drills on a blockade of Taiwan. The latest exercise occurred in April.

A series of high-ranking officials have said that China will invade Taiwan by 2027. (Time Magazine)

Some will say that even if China takes over TSMC, it will have a difficult time producing the chips because the supply chain is so diverse — lithography machines come from Holland, silicon, palladium, nickel, neon and gallium from Russia, etc. Couldn’t these material sources just ban them from China? But if control of TSMC is combined with China’s increasing capabilities in AI, which the US is abetting by allowing sales of Nvidia chips to China, will China’s customers have anywhere else to go?

Think of it this way: Through acquiring, or outright confiscation of TSMC, China gets control of the industry-leading 2nm chips, which China will use for a litany of civilian and military applications. Meanwhile the rest of the world will be forced to use 3nm chips or higher because China, like Taiwan now, won’t let anybody else have them. These chips are 10-15% faster and use 20-30% less power.

Transistor density in the 2-nm version is 15% higher.

The United States has always been committed to defending Taiwan but back to the anti-aircraft missile deficiency described at the top, Taiwan is no longer protected, therefore vulnerable to attack or blockade.

Remember, the US has THAAD systems in South Korea and in Hawaii, Guam and Wake Island. Taiwan has refused to accept the interceptor missiles. The past two years in the Middle East have seen the US expend substantial amounts of capabilities that the American defense industrial base will find hard to replace. The country most likely to benefit from this is China.

Four former senior US defense officials have said the low stockpile problem is most acute in inventories of high-end interceptors that are a key part of deterrence against China, i.e., in the Indo-Pacific where the United States navy maintains a large presence to protect its allies, including Taiwan, against an encroaching Chinese navy.

Not only does the US not have the interceptor missiles to repel the 900 short-range ballistic missiles and the 400 ground-launched cruise missiles pointed at Taiwan but they don’t have the rare earths to make them without China, the world’s supplier of critical metals.

The US Defense Department just took a 15% stake in MP Materials, which has the only producing rare earths mine in Mountain Pass, California. The DoD has also promised to buy 100% of the rare earth magnets produced by a second magnet manufacturing facility, 10X.

But Mountain Pass is primarily a light rare earths deposit. To make weapons systems, you need heavy rare earths like samarium, dysprosium and terbium. Military applications need samarium-cobalt magnets and MP Materials doesn’t have the technology to make them.

MP only has the capacity to make 1,000 tonnes of neodymium magnets per year, against China’s 300,000 tpy. Neodymium magnets are the basic rare earth magnet. To be useful in defense applications that require the magnets to withstand high temperatures, dysprosium and tellurium must be added to them.

But samarium, terbium and dysprosium, the heavy rare earths required to build military-grade, temperature-resistant permanent magnets, are still not commercially available outside China.

A new report from data analytics firm Govini revealed that Chinese companies still accounted for 9.1% of Tier 1 contractors involved in the Pentagon’s major defense programs across nine critical sectors in 2024.

The missile defence sector showed the highest reliance on Chinese suppliers with an 11.1% share.

Govini’s April report stated that 80,000 US weapons components rely on antimony, gallium, germanium, tungsten or tellurium. Given China’s dominance in the global supply of these five minerals, nearly 78% of US weapons systems are at risk of disruption due to export restrictions.

China has since December banned sales to the US of germanium, gallium and antimony — which are used to harden lead bullets and projectiles, and to allow soldiers to see at night.

Aluminum and natural graphite arethe two most used materials in the defence industry and can be found in aircraft, helicopters, aircraft and helicopter carriers, amphibious assault ships, corvettes, offshore patrol vessels, frigates, submarines, tanks, infantry fighter vehicles, artillery and missiles.

The Trump administration has doubled tariffs on steel and aluminum imports to 50%. The tariffs make it more difficult for American firms to buy imported aluminum that is turned into US military equipment.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

Deficits are expected to kick in this year as new graphite mines fail to keep up with surging demand from automakers.

And this just in: According to the WSJ citing sources, the Chinese government is now refusing or delaying exports of minerals designated for military applications and has introduced measures to enforce its control by requiring exporters to submit documentation — such as product or production-line photos — as proof of their civilian end‑use.

The new restrictions, which came despite trade concessions made with the US in recent weeks, have pushed some defense manufacturers into crisis, the WSJ said.

In one case, a US drone component firm faced production delays of up to two months while seeking rare earth magnets from non-Chinese sources. Meanwhile, samarium—a rare earth used in high‑temperature magnets for jet‑fighter engines—is being offered at as much as 60 times its typical price.

In sum, China’s dominance in the mining and processing of critical minerals, i.e, rare earths, aluminum and graphite used in many defense applications, is allowing Beijing to exert massive leverage over the United States during the US-initiated trade war.

The materials either aren’t available, are delayed, or are prohibitively expensive. The higher prices could result in lower production rates, no production of weaponry requiring rare inputs like samarium, or plant shutdowns/ layoffs.

China’s deficiency in semiconductors is still an issue, but the Trump administration’s lifting of a ban on the sale of chips to China will make it less so. China has long said it wants to reunite Taiwan with the Motherland, with officials saying it’s likely to happen by 2027. The game plan, judging from military exercises in the South China Sea, is to blockade Taiwan, not invade it.

If China plays it right, it could starve Taiwan of food and energy, gaining control of Taiwan and TSMC’s foundries without firing a shot. This would give China complete dominance over artificial intelligence — civilian and military applications — using the latest 2nm chips where applicable. Beijing would obviously prohibit the sale of these chips to other countries, the same way Taiwan has done, putting its competitors, forced to use lower-quality chips, at a disadvantage.

Meanwhile, China is meddling geopolitically in Iran and Russia. Could this be a game China is playing — selling arms to Iran, keeping America occupied in Ukraine — effectively managing the depletion of America’s warfighting capabilities? I believe so.

Consider: Iran recently confirmed receiving advanced Chinese missile systems in a massive arms deal. One Youtube source said Iran has struck a deal with Beijing to receive the latest type of long-range, surface to air missiles, specifically the HQ-9B. In a deal that trades oil for weapons, the estimated cost of one regiment of HQ-9B system is approximately $1.5 billion. Neither government has confirmed the news, but it appeared in an article in Middle East Eye.

If true, according to JINSA, By resuscitating Iran’s debilitated air defenses, China could insulate Iran from future strikes and change the U.S. and Israeli cost calculus.

China is Iran’s largest trade partner and the largest market for its oil exports.

While Beijing formally stopped selling arms to Iran two decades ago, according to the JINSA article, Chinese firms supply Iran with drone and missile engines, and several Chinese weapons companies operate in Iran. Between June 14 and 19, five Chinese planes traveled through Turkmenistan towards Iran then turned off their transponders, concealing their intentions.

China also abets Iran’s terror proxies. China reportedly trained Hamas leadership on arms manufacturing, helping turn underground Gaza into a sprawling makeshift weapons factory. Houthi drones now utilize Chinese hydrogen fuel cells, tripling their range and making them harder to detect. In early July, Chinese naval officers shined lasers at German pilots in the European Union’s counter-Houthi task force. A Chinese satellite firm serves as the Houthis’ eyes in the skies. By facilitating the Houthis’ deadly strikes on innocent seafarers, China has blood on its hands.

To date, China does not appear to want Iran to acquire a nuclear-weapons capability, according to the Carnegie Endowment for International Peace.

Over the last decade, Carnegie says China and Russia have conducted joint military exercises. The former appears to have provided the latter with machine tools, semiconductors, drone engines, and other technology for its Ukraine war effort. In September 2024, the US claimed that Russia was providing China with advanced technologies in response.

Cooperation with Russia is in part defensive and aimed at preventing a defeat in the war or a change of regime in Moscow. Russia’s collapse or defeat at the hands of the West would be detrimental to China’s security, Carnegie maintains.

Ukraine has accused China of supplying troops and mercenaries to Russia to fight against Ukraine, and army officers to observe the war to learn tactical lessons. In April Ukrainian President Volodymyr Zelenskiy said China was supplying weapons and gunpowder to Russia, specifically artillery. China did not comment publicly on the allegation.

A Reuters article said Russia has benefited from military aid from Iran and North Korea.

Could this all be in pursuit of China’s goal of destabilizing the United States and depleting its weapons stockpiles? Keeping it busy in the Middle East and Ukraine while China plans to blockade Taiwan?

They say you can never be too paranoid, only not paranoid enough.

On July 14 Trump and NATO Secretary General Mark Rutte announced NATO member states will send weapons from their stockpiles to Ukraine and buy US replacements. Separately, the Trump administration announced weapons sales to Ukraine totaling $652 million under the Foreign Military Sales Foreign Military Sales (FMS) program, adding to the $310 million in FMS approved in May.

The reveal is a reversal of a July 1 White House decision to pause arms supplies to Kiev.

The US has provided about $120 billion in aid to Ukraine since February 2022, which includes around $$69B in military aid and $51B in other forms of assistance, according to the BBC.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE