Rick Mills – “Here Be Dragons, The Complexity Of Everything – a Bob Moriarty Exclusive Interview #3”

Rick Mills, Editor/ Publisher, Ahead of the Herd:

What are your sentiment indicators saying to you?

Bob Moriarty, Founder, 321gold: Well I’ll tell you something interesting, you’ve known me long enough. I’m a contrarian and in my books I literally argue that you don’t have to know anything about investing if you can measure sentiment accurately.

Right now is interesting because of what’s happened this week and I will give you a clue. Gold went up three days running, $100/oz, how much do you think that effected the DSI [Daily Sentiment Indicator]?

RM: I’ve got a feeling it’s fairly major.

BM: Actually it’s not very much at all. A week ago the DSI for gold was 86 and then with the three days where gold went up $100, it went 86, 79, 82, 87 which is the highest it’s been, and with the small decline yesterday it’s down to 80. Now I can tell you categorically it has not topped out at 87 when it gets up to 95 or 96 that will be a major top but we are nowhere near a major top.

There’s a lot of voodoo to his sentiment, it’s not an arbitrary number that he comes up with, he’s doing the mathematical calculation on commodities but it’s exceptionally accurate and for the DSI to go down to 80 when you’ve got $3,300 gold that’s just absolutely remarkable to me.

RM: It doesn’t make sense does it?

BM: Well here’s the key, it’s not supposed to make sense. It is exactly what it is, it is a measure of sentiment and nothing more and all these clowns in the industry say oh, if the Dow Jones goes up the price of gold goes down, if the price of gold goes up the S&P goes down, and they’re trying to connect things that are not necessarily connectable all the time.

Sentiment is sentiment. When we have an all-time high it will show it and I think if you go back to April 25th of 2011 I think the sentiment on silver was higher than it was in January of 1980.

RM: You’re trading on emotions and they are fear and greed, that’s what sentiment is and if you can somehow measure that accurately and put it into a number that’s Bernstein’s system.

BM: Well he’s onto something, I’ve known for many years how important sentiment is, but trying to buy the best sentiment gauge was really difficult.

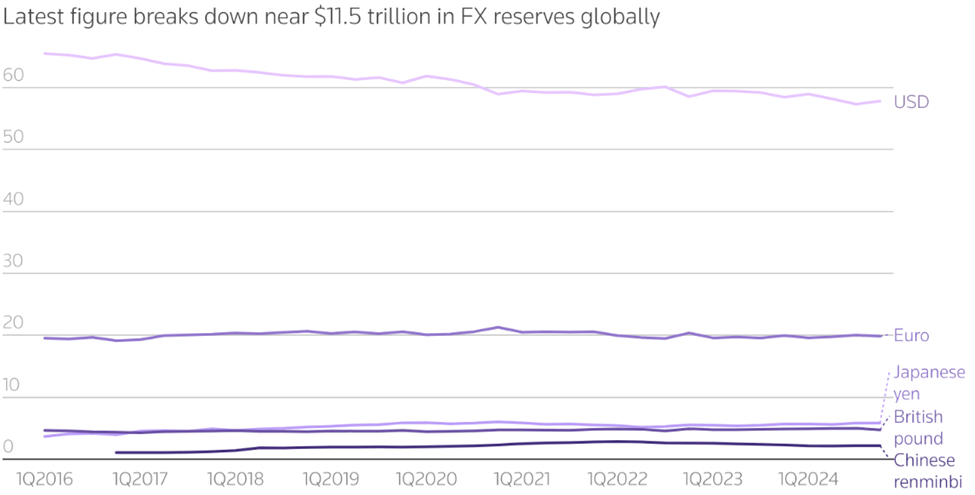

RM: The US has $9.2 trillion of debt that they have to either pay off, roll over or newly finance and a big part of it is $2 trillion deficit that is due this year. We know that the Treasury sales have been going quite well, so no talk of debt monetization yet, as a matter of fact there was a massive Treasury auction in February and I mean everybody was buying, it was the euro area, UK, Taiwan I mean even the BRICS were buying, China and India and even Brazil.

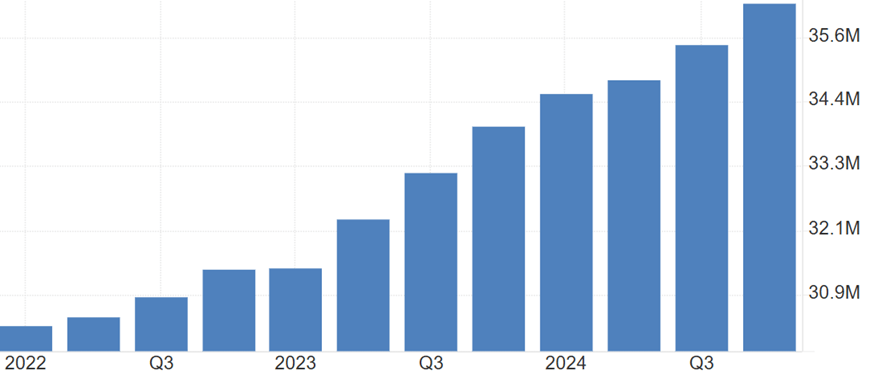

United States – Federal Debt: Total Public Debt

United States Gross Federal Debt to GDP

There was the biggest increase in buying from foreigners since ‘21 and they all bought most of it in long-term debt, the short term just wasn’t attractive at all, and they were buying long-term debt at an average of 4.28%.

We know that the Trump administration really wants to get lower interest rates because what’s happening now of course is they’re trying to get their agenda together, trying to keep the tax cuts going and everything, and I think that when people start to realize one important fact, and this is really going resonate with a lot of people, is that the military budget for the US is $1 trillion.

In reality it’s a lot higher than that because they don’t include nuclear weapons, that’s under Energy, they don’t include Special Forces and they don’t include Veterans’ admin the VA, so your biggest line item on your federal government accounting ledger right now is the military.

Well that’s gone now, with this big roll over and the buying of the debt with such a high yield, and the reason they’re buying the US debt the long term it’s 10, 20, 30-year stuff, is because there’s only one other place that’s higher and that’s the UK. Everybody else their bonds are like half, their 10-year bonds around 1.6% maybe 2.1%m they’re getting really good yield on longer-term US debt, but what they’re doing is driving up the interest payment cost to over a trillion dollars.

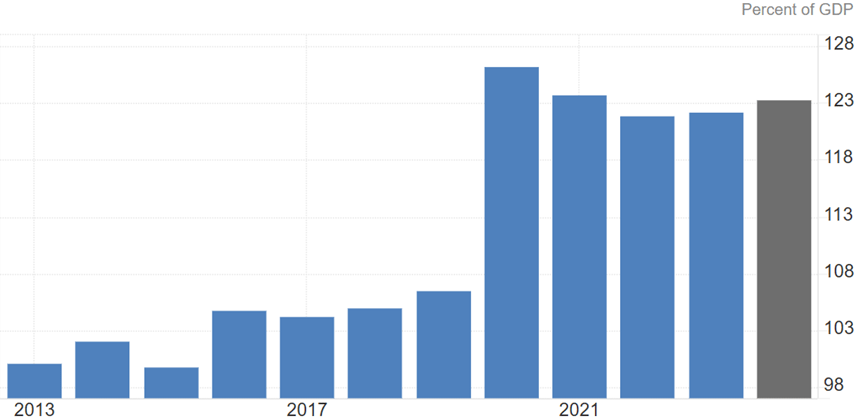

US Government Interest Payments

Now your biggest line item in a government accounting ledger per year is going to be interest payments on the debt. That to me just shows something totally out of control, what’s your feelings on that?

BM: Strangely enough you used most accurate term you could possibly use. When Elon Musk said Social Security is a Ponzi scheme he was rich enough incredible enough that he can say something that everybody knows, ok? Social Security is a Ponzi scheme and we know how Ponzi schemes end, and I’ve been saying this for years, this is a a conflict between the BRICS system which is resource-based on the debt-based system of the West.

We’ve gone being a manufacturing county to being a country where 32% of the economy is shuffling pieces of paper. It’s a crisis but it’s a crisis that can only be solved by crashing and starting all over again. Now my fear is Donald Trump’s walked into a China shop and he’s swinging a baseball bat as hard as he can. He wants to make enemies of our biggest trading partner, I just don’t see any way that that’s going succeed.

I think it’s not Donald Trump and the tariffs all by themselves, the blown-up basis trade is far more important than the tariffs believe it or not. There is a crisis going on right now a liquidity crisis is going on behind the scenes and the world’s financial system it’s about to blow sky high, there is no solution other than a default and it scares me because I see Trump choosing the path of going to war, believing that’s a way out of a Depression I think there’s an excellent chance we’re going go to war and do it very soon.

RM: Did you notice that Citi [bank] has said that the US stock market is no longer a buy and they’ve downgraded US stocks to neutral from overweight. They also said that investors should begin diversifying away from the US.

Deutsche Bank said that the market is reassessing the US dollar’s structural underpinnings as the world’s reserve currency, because of the geopolitical and geostrategic shift, de-dollarization and the BRICS.

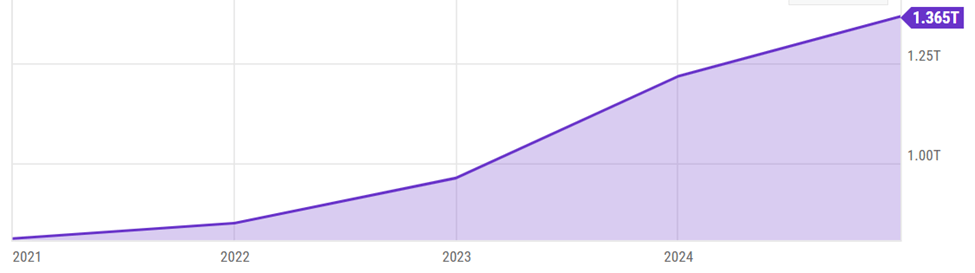

Reuters

The greenback share of global reserves declined to 58% in ’24, 20 years ago it was over 70%. There are new payment systems that aren’t involving US banks, and commodity transactions are increasingly priced in non-US dollar currencies.

The bottom line here is bonds, dollars and equities are all selling off in sync. And there are structural problems in the bond market and people are reassessing the US dollars position.

BM: Well there’s structural problems in the world’s financial system, it’s not just the bond market, it’s the entire system and Donald Trump just threw a hand grenade into a crowded theater. You can’t go into a biker bar and go up to the biggest biker and start swinging punches without expecting to get your ass kicked and Trump’s tariff-on, tariff-off there’s no consistency to what he’s doing and there is a lot of people who still support him because some of the stuff that he supports I think is brilliant.

This concept of a 6’ 3” male competing in women’s swimming is just obscene ok? And how people thought that was acceptable is totally beyond me. The UK court system said your sex is not what you’re wearing. When you’re born ok it doesn’t change just because you feel differently. So we’re in an interesting turning point in the world’s history, it’s going be interesting see what happens, I think there’s an excellent chance we’re going to go to war.

RM: We talked about this in our last interview where we both agreed the Middle East might be the start.

Are you concerned about the massive unfunded debt the US has?

BM: No, we talk about the funded debt as if it’s important, it’s not important at all. There’s a concept that very few people understand and pretty much nobody but me actually recognizes. All debt gets paid, it gets paid either by the borrower or it gets paid by the lender. And the key is not how much debt the US is accumulating, the key is how much the US is spending because it’s got to be paid, you could pay it in taxes, you could pay it in inflation or you could pay it in default and I don’t see any way out of the debt crisis short of a total catastrophic default.

RM: Well the federal government in the US brings in a little over $5 trillion a year, the spending this year is well over $7 trillion, which means there’s $2 trillion worth of deficit debt that has to be financed. And paying interest on that unfunded debt is already the biggest expenditure the US gov’t has. That spending hampers a lot of good policy ideas.

Fed head Powell was on TV and he said something that really caught my attention and we’re not at stagflation yet but what he was saying was he’s worried the inflation rate is going to go up, unemployment is going to go up, and growth is already slowing, now that’s stagflation. That is the exact definition of stagflation. We’re not there yet, but I think the US is heading for severe stagflation do you agree?

BM: I think it’s worse. I think it’s far worse. I have predicted for 15 years that there was going to be a massive financial crisis in the United States and there would be a market crash across the board worse than 1929. I think it’s here, it’s started nobody recognizes it yet, you can’t do what Donald Trump has done with the tariffs and not create a giant problem, he’s throwing monkey wrenches into a system that’s very fragile to start off with. When you throw a monkey wrench into the gears it doesn’t run better it runs worse.

RM: The stagflation scenario is the one that is probably the best-case scenario for what’s coming.

BM: I lived through stagflation back during the Nixon and Carter administrations and it’s something that you could cope with, a lot of people lost their jobs and interest rates went up and things were bad but we made it through.

RM: But gold and silver soared, and mining equities did well in the ‘70‘s, way better than bonds and the markets. That seems to be the developing situation right now, stagflation or total collapse.

Bob you and I sit here and we look at all this stuff going on, I’ve got a lot of time too. I research a lot and I’m online a lot and I just shake my head with what’s going on, it’s kind of nice to not be involved in day-to-day stuff. I mean I’ve been retired 20 years and we retired the wife early and the two of us sit here and we run our business, the TV’s are on and we’re listening to the world and we’re watching what’s going on. Every now and then we just have shut it off the nonsense and walk away because of the absolute stupidity of what people are saying and just what they’re doing. It makes absolutely no sense.

BM: Let me give me a good example. I’m in France of course and Macron is talking about sending French troops to Ukraine. Starmer in the UK is talking about doing the same thing. You could take the entire British Army and fit them into Wembley Stadium and still have seats to spare. There are 75,000 British Army troops, they need 72,000 for ceremonial duty, so they’re talking about sending 3,000 people to Ukraine.

Ukraine is the dumbest war in history. It was a civil war that was started by the United States and NATO to attack Russia, and it’s been a total absolute catastrophic failure for NATO, for Germany, for the EU, for the United States and nobody’s got the guts to say you know we kind of screwed this up. Why don’t we pull the plug ok? Anything worth doing is worth doing right and anything not worth doing is not worth doing.

That was a dumb fucking war and there is no way to win it and Russia quite frankly is not the enemy of the EU, and it’s not the enemy of the US. All this nonsense about Russian’s going invade the EU is bullshit, they made it up. France is not any risk from Russia, France is at risk from the United States.

When the United States blew up Nordstream [pipeline] and as an intelligence officer and a combat officer I tell you the US blew up Nordstream it could not possibly have been anybody else, they just destroyed the economic foundation of the EU. So why is Macron worried about Russia? Why is Starmer worried about Russia? They need to be worried about the United States, the United States is their enemy not Russia.

RM: The US seems to be acting in an extremely unfriendly way to a lot of people.

BM: Well we live in interesting times and it makes me very glad that I’m old. Now we’re speaking on Good Friday, do you know what my single biggest concern is today?

RM: The price of an Easter egg hunt?

BM: No. Our entire society is on the verge of a catastrophic collapse because of the complexity of everything and then you’ve got the Trump administration throwing hand grenades into crowded theaters.

RM: “The complexity of everything.” That’s pretty good Bob nails it.

Bob I sent you something on this Basel III. Basically I think for us it might come down to a battle between allocated gold and not allocated and what the US is going to do, it’s interesting that they said that they were going re-adjust some values in assets they hold and then DOGE went and wanted to audit the gold in Fort Knox.

What’s your impression on The Basel III and the Endgame in the US? Do you think it’s going to make retail thinking they want more gold? I mean central banks are buying gold a lot, you could make an argument it’s because of this and a possible global reset to a new currency system. What are your thoughts on the Basel III?

BM: It’s part of an ongoing issue that’s very interesting and basically the Basel III requirements are that banks have to hold more solid reserves and gold being one. I try to address the things nobody else talks about. I’m going ask some questions and you give me your best answers.

RM: Sure.

BM: Don’t give me a number, but in relative terms how big is the silver market?

RM: Tiny.

BM: Tiny. Miniscule. And in relative terms how big is the gold market?

RM: Not much bigger, maybe it’s little bit bigger but not much, it’s miniscule as well.

BM: Thank you. Ok, everybody tries to make things too complicated. In 2007 I wrote about the GFC [Global Financial Crisis] and I said that everybody believes that when the music stops they can get a chair. But what if there are no chairs?

And I think the same thing is true of gold and especially of silver. When the music stops I think everybody’s going be shocked there are no chairs, ok?

Now what’s going to happen when gold goes up 500 bucks a day and you can’t buy it? What if that’s true and there are four or five demands for each ounce of gold? And the answer is you’re going see chaos like you’ve never seen before. By and large I don’t sell silver or gold, ok? Those my insurance policy against financial chaos.

The relative value of gold and silver shares compared to the price of gold and silver is the lowest it’s been in 45 years ok? I look at gold going up 3% in one day. A 3% move in gold in one day is a big damn move. We had three of them last week.

I expect my gold shares to be up 10 or 15% because they should command a premium over the rise of the price of gold. People are so skeptical about gold that it’s a gimme, ok, if you want to make money.

There’s a lot of purposes for owning gold. The primary purpose of owning gold is as an insurance policy against financial chaos. Now we have financial chaos and I’m quite happy because I’m insured.

But there’s also the investment angle and I am always looking for what’s the best investment I can make right now. Now I’m going to tell you there’s lot of gold stocks out there and silver stocks, they’re going to go up 50- or 100-fold. People are going be shocked.

RM: Well they shouldn’t be because between me and you, we know that historically your best leverage to a rising gold and silver price has been owning quality junior resource companies searching for and developing deposits of gold and silver. I mean that’s not even arguable it’s just a freaking fact.

BM: No you’re wrong, doesn’t even have to be quality. There was a company that I went to visit in Tanzania back to 2007, 2008 and to say the management was crooked and deceitful and incompetent would be a nice thing to say because it was actually worse than that. And they totally ran out of money and they did a placement at five cents, ok? Now there’s a lot of 5-cent stocks right now but there weren’t very many 5-cent stocks back then.

They did a placement at 5 cents, and then they drilled off the project that they had had for years and they came up with some great intercepts and the stock went to 5 bucks. Now I’ve already warned you that the incompetence and the deceitfulness and the lying and cheating and stealing of management what do you suppose happened to the company?

RM: Probably collapsed, probably fell apart.

BM: Thank you, so people are going be surprised there are some companies out there run by idiots who are crooks that are going go up 100-fold and it’s happened already.

The strange thing is and I talk about this in the two books I’ve written about finances, the reason sentiment is so important, the very best book on people ever written was ‘Extraordianary Popular Delusions and the Madness of Crowds’. When you read that you realize people are dumber than bricks. All you have to do is figure out what everybody’s doing and do the opposite ok?

You know that three or four months ago I was calling for a top in the stock market and a top in the cryptocurrencies. Everybody thought I was some blithering idiot and I was wrong.

RM: You were following the sentiment index?

BM: Of course. That’s why I wrote those two finance books in the first place. They’re very simple books and they’re books anybody can read in two hours and the fact is people are going be reading those books 50 years from now because I say a lot of things that are so simple you can’t get confused,

If you buy an investment to make money and that’s your goal you sell it when you’ve made money.

RM: There’s two things about this conversation. First off, about your books, your advice about selling is timeless. Good advice like that is good advice today, tomorrow and next week.

Second, when I sell, I sell because I’m uncomfortable holding it, that’s what makes me sell. It isn’t where it’s going to go, it isn’t where it’s come from, it’s not what it’s going do tomorrow, it’s not on somebody’s recommendation to hold or sell.

When I sell it’s because I’m freaking uncomfortable with holding it anymore, I’m scared I’m going lose my profit. So I sell when I’m uncomfortable with the amount of money I’ve made if that makes any sense.

BM: Yeah it makes all the sense in the world, if you go back to ‘Extraordianary Popular Delusions and the Madness of Crowds’ people sometimes are offended by me saying that people are dumber than bricks. Well the reason I say people are dumber than bricks is because they are dumber than bricks.

People get the most bullish at absolute tops and they get the most bearish at absolute bottoms, there’s a lot of stocks in the resource area two-three months ago you couldn’t give away, ok? And I look at it and say it’s time for me to clean up.

I’m still buying some stocks at 2 or 3 cents a share because yeah they can go zero, they can go to 20 or 30 cents too, we’re going to go into an area that 99% of investors have never been in. Have you ever seen any of the ancient maps from the 15th, 16th century? Where they didn’t know where things were?

RM: Here be dragons.

BM: Ok and that’s exactly what the situation is. Here be dragons. So buy when things are cheap and sell when things are dear.

RM: The gold-silver ratio when we had our first talk it was 102 and it’s back to 102, gold’s $3,300 silver’s $32.50. I was just playing around and I did an AI search. I wanted to know what the average gold-silver ratio was going back 20 years, and the answer I got was 60 to 1, which would mean $55 silver today.

So, I know gold’s a buy, silver’s a better buy imo and we’ve talked about a lot of things today, why gold, silver and that I firmly believe that your best leverage to a rising PM price is a quality junior, but I see a disconnect here, like a huge disconnect in the gold-silver ratio and I want to talk about a silver stock here in a few minutes. But you want to talk about New Found Gold NVG a little bit more? What do you want to say?

BM: Ok, one of the things that investors should understand is that they’re the ones that make the money and they’re the ones who lose the money, so instead of looking for gurus, do you know why people want to listen to gurus? It’s simple but it’s counter-intuitive why are gurus so popular?

RM: I do top-down bottom-up, a macro-micro approach to everything and then I go from there. I don’t listen to the gurus, I don’t know why anyone would listen to one.

BM: Well the reason people listen to gurus, and people do listen to gurus, go back to ‘Extraordianary Popular Delusions’ people are dumber than bricks, is they’ve got someone to blame when they make a mistake.

I’ve got some extraordinary stories I can tell you for hours about stocks that had everything going for them and somebody made one or two bad decisions and it blew up.

So I’ve got a pretty good sense but people want to listen to gurus because they’ve got somebody to blame, let’s go back to New Found Gold.

You have seen the assay results and there have been hundreds of ultra-high grade intercepts of gold. Now the one mistake that the two young guys made that were running the company is how they come out with the resource, they were using a shotgun approach and they wanted to test the entire project and it’s a very big project, and they came up with extraordinary results, but by trying to test what was a couple of dozen kilometers of strike they made the mistake of the hole spacing was way too far apart.

They had a lot of good gold intercepts, when a QP, Qualified Person does a 43-101 there’s two things he’s got to take into account. He’s got to take in the spacing between holes and basically no matter what the grade is, ok the bigger the space between the holes the lower the amount of gold that you say is there because you don’t know what’s in the area you haven’t drilled.

And another thing that’s very important that virtually nobody knows about is capping ultra-high grade ok? If you’ve got 75 grams intercept of gold you have sliced half of the core. Is the other half of the core gonna have 75 grams? And the answer is not necessarily, it could have 150 grams but it could have 5g so if you’ve got an intercept of say 7 meters of 75g gold you cap it. You say we don’t think it’s 75 grams across the whole thing, we think it’s 10 grams.

RM: What I, and a lot of other people want to know is do you think NFG has more gold than 2 million ounces?

BM: Now I don’t come out and ever use the word guarantee however I will tell you right now the chances of 2,000,000 ounces of gold reflecting an accurate measure of the 43-101, the chance of that being accurate is zero.

It is so absurdly conservative that the next 43-101 is going to have a lot more gold, that is a Fosterville deposit ok? Fosterville took Kirkland Lake from being a $3 billion company to an $18 billion company.

The guys who were buying New Found Gold for the last month are going make out like bandits, it’s an extraordinary project, it’s not a flawed project.

There were some decisions made that in hindsight were wrong but if we’d had a real booming market which we didn’t have, maybe they weren’t wrong at all they were just wrong for now but you’re going see a lot more gold than 2 million ounces.

Two serious geologists, two people I know that I discussed New Found Gold’s 43-101 with have both used the same term, and that is the 43-101 is bullshit.

RM: Well I was I was extremely shocked to see such a low resource.

BM: The gold’s there, Fosterville was deep, New Found Gold is not deep it’s shallow so it’s a lot more gold. I mean the next 43-101 is going be interesting.

And of course the management’s gonna look like absolute heroes but the price of the stock was taken down by Labrador Gold selling their shares and a exceptionally conservative 43-101.

RM: I’m going to talk about a nice silver play that I have as an advertiser. I really like CEO Jason Weber he’s a smart guy, I like what he’s doing with Silver North. The symbol is SNAG, they have a property that’s under option to Coeur [Mining] and Coeur’s got a CRD up on the border with the Yukon.

Silver North’s Tim property is optioned to Coeur. Coeur’s been coming over and working on it. The confidence level is extremely high that there’s a carbonate replacement system on the property that is a look-alike to what Coeur’s working on their property. That’s an interesting project but like I said it’s optioned off and Coeur’s doing their earn-in.

The property that I’m going to talk about today is Silver North’s Haldane property and it’s up in the Yukon’s Keno Silver District, which is one of the highest-grade silver districts in the world. There’s been 200 million ounces of silver mined so far out of the district and the mines up there are primary silver mines with by-products zinc and lead.

SNAG’s Haldane project is right beside Hecla [Mining], who started mining in 2023 with proven and probable reserves of close to 50 million ounces @ 700 grams per tonne. And the mineralisation in their project, what they’re mining, is similar to the Haldane project.

The average silver mine in the Keno district is 30 million ounces ok, and historical production grade sits in right around 1,100 grams per tonne silver, and again they are considered primary silver mines so they’re not really going with silver-equivalent this is a primary mine.

Silver North does have a plan, they do have a focus and they’re executing. They just raised $1.35 million and this is the hard dollar precursor to an upcoming charity financing of up to $4 million and when you’re doing these charity finances it’s nice to have a good comfortable runway of hard money first.

They want to see that and they did do a charity financing last year so I expect that it will be a successful raise and they want to raise up to $4 million and as I said the focus is to drill 2,000 to 5,000 meters, depending on the size of the raise, in their most recent discovery the Main Fault.

Now they’ve done three small drill programs and each of the drill programs has made discoveries, but this Main Fault is special, it’s a very large chunk of mineralization and there’s three layers to it which is which is interesting. And they think drilling this year is going to, at the very least, achieve clear visibility towards, if not outright, attaining a 30-million-oz normal Keno deposit.

So with their share price what it is today they could do a 17 and a half-cent financing and by the time you figure it all out and everything with the full warrant they’d have 138 million shares outstanding fully diluted. There’s also $1.5 million in warrants at 15 [cents] that hopefully could get exercised.

Now, I’ll do a little bit of valuation here, there’s 12 kilometers of vein potential on the property; there’s other discoveries already including the high-grade West Fault. And I think that if you’re starting to look at this one with it’s current market cap it’s not unreasonable to think that you could get multiples on that with a successful drill program.

I like this project because it’s got standalone potential, or it could be a plug into Hecla’s existing operation. Remember, they’ve got 49.7 million ounces of proven and probable mining reserves, you’re next door, you’re 2 kilometers away from Hecla’s mill. If you can show that you’ve got 30, 40, 50 million ounces of silver, I’m thinking you’re going be looked at pretty hard by Hecla.

BM: I have not followed this but while you were speaking I did some research and again this is one of those projects that’s so cheap that if you believe in silver. There was a lot of silver that came out of there, so the Yukon is going be very hot this year.

RM: I like their chances of building a Keno primary silver deposit.

BM: Yeah, but if you like silver you’ve got to like the leverage that you get from a good pure silver play. And being right next to Hecla is a big deal.

RM: It is huge, Hecla’s a very friendly company to juniors, they’re very junior-compatible or friendly I’m not sure that’s the right word but they’re not hard to get along with at all.

BM: The timing is near perfect and I congratulate them on raising enough money for a serious drill program.

RM: Was there any was there anything else you wanted to talk about today Bob?

BM: There’s stuff we can cover in the future.

RM: Alright, I appreciate you spending your time with us.

BM: Super, ok.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE