Rick Mills – “Harvest Gold Cashed Up and Going to Drill

On Dec. 19, 2023, Harvest Gold entered into an option agreement with EGR Exploration (TSX-V:EGR) to acquire 100% of the Urban Barry property in the Eeyou Istchee James Bay/Abitibi region of Quebec.

Urban Barry is situated on the southwestern edge of the Urban Barry Greenstone Belt and has a strike length of approximately 19 kilometers.

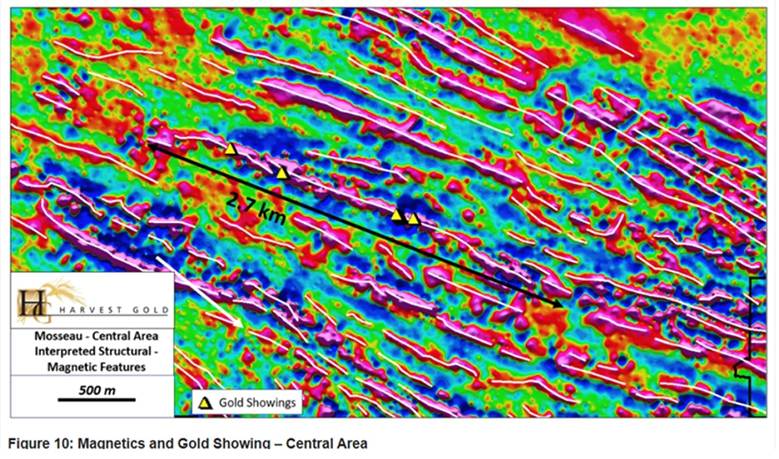

From November 2019 to March 2020, EGR flew an airborne drone magnetic geophysical survey over the property. The results confirmed the northwest extension of rock units and fault structures hosting the nearby Windfall gold deposit.

A little bit of history: Gold Fields (NYSE:GFI) was expanding out of South Africa; they took over Osisko Mining and the Windfall deposit and all their properties.

Gold Fields now effectively owns almost the entire Urban Barry Greenstone Belt.

On March 12, 2024, Harvest Gold acquired, through staking, a continuous block of 60 mining claims southeast of its Mosseau project. The La Belle property overlays the same geological contact as Mosseau and Urban Barry and covers an area of 3,394 hectares.

This recent staking brings Harvest Gold’s total land position in the Urban Barry region to 329 claims covering 17,539 ha in three projects.

In April of this year Harvest raised $150,000 through a private placement led by Crescat Capital. By taking down about 40% of the private placement, Crescat became a 14.19% owner in Harvest Gold.

The world-famous Abitibi region is a geological formation now dominated by Gold Fields. Harvest Gold controls three large prospective land packages (Urban Barry, Mosseau and La Belle) all overlaying the same geological contact within the Urban Barry Greenstone Belt.

The Mosseau is where Harvest Gold is going to focus their drilling; it has a north, central and southern area, where La Belle is connected onto it; it’s their flagship project.

According to Crescat’s geologic & technical advisor Quinton Hennigh, the Mosseau in the western part of the Urban Barry belt is a mirror image, early-stage version prospective version of the Windfall deposit.

Urban Barry to the northeast hasn’t had much work at all, an La Belle to the southeast is unexplored. HVG has finalized drill targets in the north and central Mosseau areas.

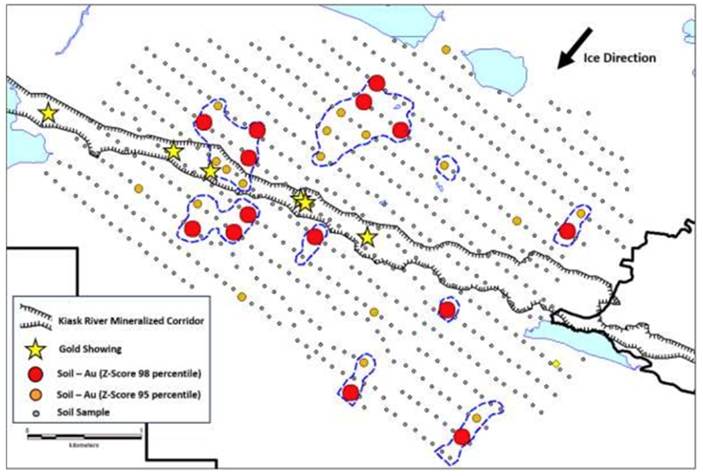

In June they had a news release where they put out the soil geochemical surveys on a mineralized corridor in central Mosseau called the Kiask River Fault Corridor, the KMRC. The important thing about this area and why they did this geochemical survey was the fault.

All three properties are close to each other and all of them are in contact with the granite of the Wilson pluton. For non-geologists this doesn’t mean a lot but understand that these contacts are where the big deposits lie. And here the contact is between the granites and the volcanics, and then you’ve got cross-cutting structures that go through that contact, which can act as a trap for gold.

This is why I’m so excited about the central area. If you look at the map of Mosseau you’ll see a large structure running right through the middle, and that’s where they did all the work on the KMRC last summer and they’ve finally got the results.

These results from the soil geochemical program highlight distinctive gold targets. HVG had a greater than 98th percentile gold Z score; the extremely high values are clearly defining eight zones in and parallel to the KRMC.

When Harvest Gold looked at these results from the Kiask River mineralized corridor in the center of Mosseau they confirmed three gold trains that were already known mineralization; another five are brand new. And they’re also associated with magnetic highs and geologically you see the diorite and the gabbros there, so to me that’s an excellent target.

On July 24 HVG announced they have identified 23 priority drill targets in the central and north parts of Mosseau. They’re probably not going to get to drill all 23, but the excitement is in that’s a lot of gold targets.

Drilling is expected to begin in early August, with 5,000 meters planned in a first phase. The company also wants to do some groundwork at its other two properties, including a high-resolution magnetic survey over La Belle, and a property-wide till sampling survey over Urban Barry.

Conclusion

As for reasons to invest in Harvest Gold, it’s important for readers to understand the mining industry is capital-intensive; miners always need money, and the reason the juniors have been hit so bad over the last couple of years is because nobody’s had any money to advance their projects. Now that’s starting to change, and things are getting better.

A Golden Rule of junior resource investing is to buy stocks when they’re cheap and to sell them when they get expensive.

When I began talking about Harvest Gold it was 2.5 cents a share and it’s $0.095 now. It had a ridiculously low market cap of $2 million; it’s now $8.3 million. That has been a home run over the last two months but here’s what’s important: They have 17 million warrants at $0.07 that are in the money, so as time goes by people will be selling shares to exercise their warrants and that’s a good thing for both investors and potential investors. It will keep the price from running away and it will bring money to the company.

Now in addition to that, there’s another 25 million warrants at $0.05 that will be exercisable in August. So, all the warrants are in the money, 17 million of them can be exercised now, another 25 million will be exercisable in August, so the companies in good shape for money and now all they have to do is deliver some results.

My calculator says that money is over $2.4 million and that is a nice pot to have sitting there. Good results from the drill bit will propel the share price higher, and those warrants will get exercised, putting $2.4 million into the kitty, funding the company and saving more dilution.

It seems to me that HVG is certainly in motion towards possibly becoming a premier exploration stock in what is the hugely underexplored Urban Barry Greenstone Belt.

Harvest Gold Corp.

(TSX-V:HVG)

Cdn$0.095 2025.07.29

Shares Outstanding: 88.1 million

Market Cap: $8.3m

HVG website

Subscribe to AOTH’s free newsletter

Richard owns shares of Harvest Gold Corp. (TSX-V:HVG). HVG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of HVG.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE