Rick Mills – “Graphite One to Build Graphite Anode Manufacturing Plant in Ohio, On Site Previously Used to Stockpile Critical Minerals

Graphite One (TSX–V:GPH) (OTCQX:GPHOF) plans to invest $435 million to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

Through its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based company has selected Ohio’s Voltage Valley as the site, entering into a 50-year land-lease agreement on 85 acres. The deal also contains an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

Graphite One plans to start construction within the next three years at the Site, as part of the company’s strategy to become the first vertically integrated producer to serve the US EV battery market. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically.

The Ohio facility represents the second link in Graphite One’s advanced graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, currently working toward completion of its Feasibility Study in 4Q 2024, on an accelerated timetable, with a $37.5 million Defense Production Act grant from the Department of Defense provided in July 2023.

Subject to financing, the plant will manufacture synthetic graphite until a source of natural graphite becomes available from the Company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20th news release.

Until the government abandoned the Ohio property, the 160-acre site was used to store 26 types of materials including chrome ore, lead, tin, copper, zinc, nickel, rubber, mercury and graphite.

“It’s great to come full circle, this site also known as the old Warren Depot included graphite in the National Defense Stockpile more than 30 years ago, the last time the U.S. actually mined graphite,” said Graphite One’s President and CEO, Anthony Huston. “Ohio is the perfect home for the second link in our strategy to build a 100% U.S.-based advanced graphite supply chain — from mining to refining to recycling. The U.S., simply cannot maintain a 21st Century tech-driven economy without Critical Minerals like graphite.”

The company says it will produce 25,000 tons per year of battery-ready anode material, and plans to ramp up production to 100,000 tpa.

EV hub

According to Graphite One, the “Voltage Valley” Site is in the heart of the automobile industry, with ample low-cost electricity produced from renewable energy sources. It is accessible by road and rail, with nearby barging facilities.

The state of Ohio is actively seeking EV-related industry to diversify its economy. “With manufacturing being one of Ohio’s largest economic drivers, I am proud to see this new U.S.-based advanced graphite supply chain in Niles,” said Republican Congressman Dave Joyce. “This new project will bring over 160 jobs and spur even more economic growth in the area. I look forward to seeing the success of this project right here in [district] OH-14.”

Among the announced projects coming to Ohio, South Korean-based LG Energy Solution has partnered with General Motors in Ultium Cells LLC, which is building a $2.3 billion electric-vehicle manufacturing plant in Lordstown, Ohio; Honda and LG Energy Solution will construct a new EV battery plant in Fayette County; and Honda also announced $700 million to retool three of its existing factories in Union, Logan, and Shelby counties for EV production.

National Defense Stockpile à Critical Minerals List

In the years before World War II, the United States created the National Defense Stockpile to acquire and store critical strategic materials for national defense purposes. The Defense Logistics Agency Strategic Materials oversees operations of the NDS and their primary mission is to “protect the nation against a dangerous and costly dependence upon foreign sources of supply for critical materials in times of national emergency.”

How governments can accelerate the mining of critical minerals, and the obstacles in the way

Despite this, in 1992 Congress directed that the bulk of the strategic and critical materials the US had accumulated in the National Defense Stockpile be sold.

The primary purpose of the National Defense Stockpile was to decrease the risk of dependence on foreign or single suppliers of strategic and critical materials used in defense, essential civilian, and essential industrial applications.

While much of the rest of the world was scrambling to tie up control of strategic minerals, America deliberately hamstrung itself.

Things began to change under former President Trump, and it had to — at the time the US was 100% reliant on imports of 13 critical minerals, including graphite.

In 2017 Trump signed an executive order to encourage the exploration and development of new US sources of these metals.

In December 2017, the U.S. Geological Survey released its Professional Paper 1802 titled “Critical Mineral Resources of the United States— Economic and Environmental Geology and Prospects for Future Supply”.

The report represented the US Government’s most comprehensive assessment of the nation’s mineral resource profile and potential, serving to inform federal mineral policy. The report lists 23 metals and minerals that are critical to “the national economy and national security of the United States.”

In 2018, the US Government’s Critical Minerals List was published. By 2020, the Critical Minerals List was codified into federal law, with a mandate for it to be updated every three years. As of 2024, the Critical Minerals List has grown to 50 elements.

“The United States needs resilient, diverse, and secure supply chains to ensure our economic prosperity and national security. Pandemics and other biological threats, cyber-attacks, climate shocks and extreme weather events, terrorist attacks, geopolitical and economic competition, and other conditions can reduce critical manufacturing capacity and the availability and integrity of critical goods, products, and services.”

The EO identifies three technology sectors as critical supply chains:

- Advanced semiconductors

- High-capacity batteries, including electric vehicle (EV) batteries

- Pharmaceuticals

The EO also identifies “critical minerals and other… strategic materials” as a fourth supply chain, essential to technology manufacturing and the defense industrial base.

Improving US dependence on graphite imports

One of the battery metals the world needs more of is graphite, a key ingredient in EV batteries and energy storage systems for which there are no substitutes.

Analysts estimate that by 2030, it will take at least 5 million tonnes of graphite per year to fill battery demand. This is roughly four times the 1.3 million tonnes mined globally, according to the USGS’s Mineral Commodities Summaries 2023.

This is why the US Department of Energy ranked graphite near the top of its list of minerals critical to America’s energy future. In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals that are at risk of supply disruptions, as “essential to the national defense.” That DPA authority provided Graphite One the $37.5 million grant to accelerate its Feasibility Study.

Graphite One could represent a significant portion of the amount of graphite demanded by the United States, currently.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles.

Based on the prefeasibility study, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

If all goes according to plan, the feasibility study — ahead of schedule by one year — would move Graphite One’s Graphite Creek deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance. (In fact, the FS contemplates a tripling of production, from 50,000 tonnes of graphite concentrate per year as estimated in the PFS to more than 150,000 tonnes.)

Graphite Creek mine

The only way to alleviate import dependence is for the United States to find its own source of graphite production, and at AOTH we believe a project like Graphite One’s Graphite Creek deposit ticks all the boxes.

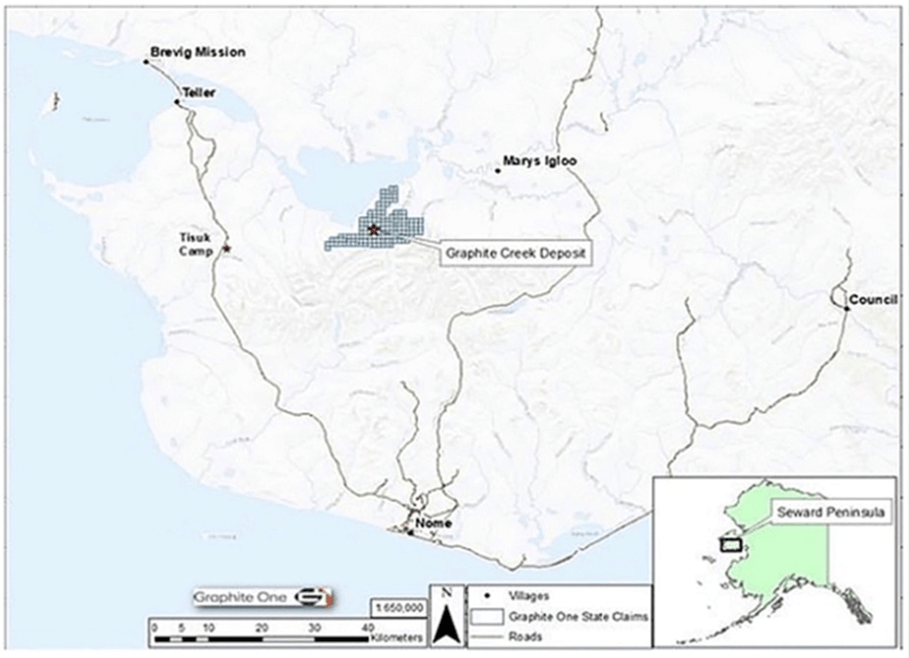

According to the US Geological Survey, Graphite Creek is America’s largest known flake graphite resource, and is among the largest in the world.

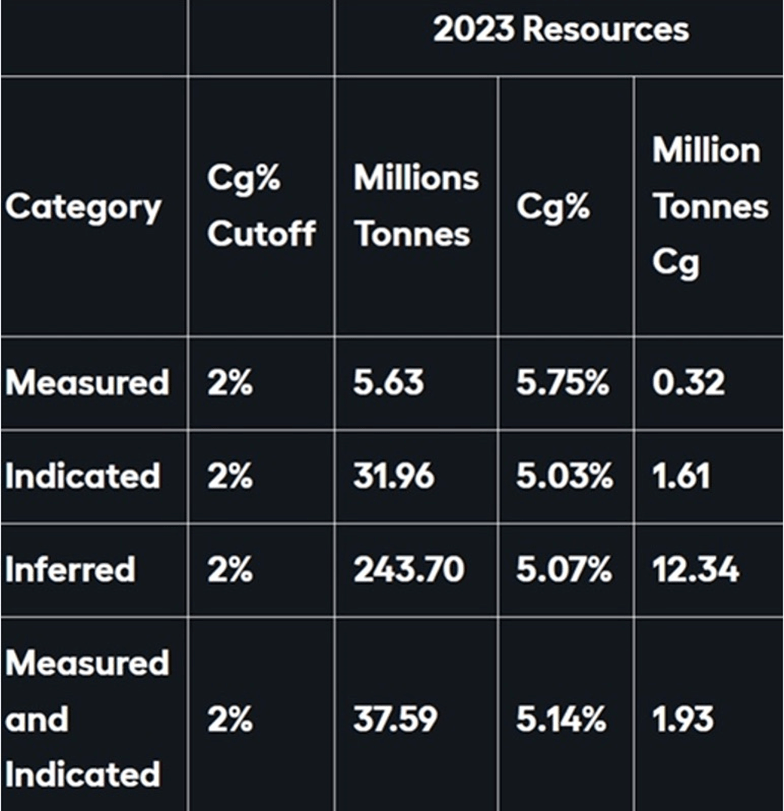

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite, with an inferred resource of 243.7 million tonnes at 5.07% graphite.

According to the PFS, the mine is expected to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life. The company itself is anticipated to produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

In October, Graphite One announced the completion of the 2023 drill program along with a selection of assay results. With the infusion of DoD funds, G1’s program quadrupled the scope of 2022’s, with 57 holes completed for a total of 8,736 meters — the largest drill program in Graphite One’s history. Of the 57 holes, 5 holes were geotechnical and the remaining 52 resource holes all intersected visual graphite mineralization and continued to demonstrate exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

More broadly speaking, Graphite One’s activities should be considered a bolt-on to what is already happening in northwestern Alaska with respect to the building of the first deepwater port in the US Arctic region.

The U.S. Army Corps of Engineers and Alaska’s Department of Transportation have chosen two sites for a deepwater port facility: Nome and Port Clarence. Nome has received $600 million in government grants and appears to be well on its way to doubling the size of its existing port to accommodate the world’s largest commercial and military vessels. Work is expected to start this year.

Port Clarence is only about 25 miles from Graphite One’s Graphite Creek deposit, meaning G1 could become an anchor customer for a port on BSNC land at Point Spenser. At AOTH, we are agnostic as to which deepwater port site gets built — both Port Clarence and Nome are within a short distance of Graphite Creek and could easily be connected by road.

While the development of Graphite Creek is in feasibility study stage, the project has been given a leg up by the federal government, which in 2021 gave the project High-Priority Infrastructure Project status. This ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The project isn’t near a salmon fishery and it has the backing of local communities such as Nome, which has a long history of resource extraction.

The company has help from the highest political offices in Alaska — the governor, both senators and Alaska’s single House member. They clearly see an investment to increase domestic capabilities for graphite as money well spent.

The Bering Straits Native Corporation has pledged its support for the project including an up-front US$2 million investment with an option to increase its investment up to US$10.4 million.

As a matter of national security, the United States must build port infrastructure and start developing this region if it wants to maintain Arctic sovereignty, and we see Graphite One’s Graphite Creek project as fitting in perfectly with these strategic plans.

We also see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it, either through Nome or Port Clarence, to its planned graphite anode manufacturing plant in Voltage Valley, Ohio.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.03.21 share price: Cdn$0.93

Shares Outstanding: 129.0m

Market cap: Cdn$123M

GPH website

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does own shares of Graphite One Inc. (TSXV:GPH) GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of Graphite One

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE