Rick Mills – “Graphite One Signs Key Technology Agreements With Leading AAM Manufacturer; Receives LI for $325 million in EXIM Financing”

Graphite One (TSX-V:GPH) (OTCQX:GPHOF) has taken two giant leaps forward in its strategy of becoming the first vertically integrated producer of active anode materials (AAM) to serve the upstart US EV battery market.

Earlier this month, G1 said it had received a Letter of Interest (LI) for up to $325 million in debt financing from the Export-Import Bank of the United States (EXIM), to go towards construction of its AAM manufacturing facility in Ohio.

The plant would first accommodate synthetic graphite, then add natural graphite from Graphite One’s Graphite Creek mine in Alaska, for use in electric-vehicle battery anodes. Two, at least, other product possibilities are silicon-blend graphite, where silicon is embedded within a graphite matrix in the anode; and hard carbon, which improves ionic flow and provides higher power densities in batteries.

And more recently, Graphite One signed a technology license and a consulting agreement with Hunan Chenyu Fuji New Energy Technology Co. Ltd. (Chenyu), an Anode Active Material (“AAM”) manufacturer headquartered in Changsha City, China that currently supplies qualified AAM to lithium-ion battery producers.

Leading AAM manufacturer Hunan Chenyu Fuji New Energy Technology Co. Ltd. is capable of, and has extensive experience, manufacturing synthetic graphite for anodes and silicon-blend graphite. Chenyu would grant G1 an exclusive license to certain AAM technologies in return for the payment of royalties; offer advice and guidance in designing, constructing, commissioning and operating the Ohio AAM plant in return for the payment by G1 of milestone fees; agree to offer G1 advanced AAM technology prior to offering it to other AAM manufacturers in North America; and agree to offer G1 the right to license Chenyu’s AAM technology in Europe, the United Kingdom and, surprise, the Kingdom of Saudi Arabia before offering it to other AAM manufacturers.

This is in addition to Graphite One working towards a Feasibility Study of its Graphite Creek Mine in Alaska, now expected in Q1 2025.

Let’s dig into this remarkable ‘Security of Supply’ effort by Graphite One’s team.

Voltage Valley plant

Graphite One plans to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

The Vancouver-based company has selected Ohio’s Voltage Valley as the site, entering into a 50-year land-lease agreement on 85 acres. The deal also contains an option to purchase the property once known as the Warren Depot, part of the National Defense Stockpile infrastructure, until the brownfield site was processed through the Ohio EPA Voluntary Action program a decade ago, certifying that the land does not need further cleanup.

According to Graphite One, the Voltage Valley site is in the heart of the automobile industry (the ‘Rust Belt’ is being transformed into the ‘Battery Belt”), with ample low-cost electricity produced from renewable energy sources. It is accessible by road and rail, with nearby barging facilities. Existing power lines are sufficient for Graphite One’s Phase 1 production target of 25,000 tonnes per year of battery-ready anode material. Land is available for follow-on phases to ramp up to 100,000 tpy of production.

Graphite One plans to start construction within the next three years as part of the company’s strategy to become the first vertically integrated producer to serve the US EV battery market. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically.

As Graphite One builds its anode active materials (AAM) production plant, first to accommodate synthetic graphite, then add natural graphite from the Graphite Creek mine, the company has the opportunity to make other graphite products. Two possibilities are silicon-blend graphite, where silicon is embedded within a graphite matrix in the anode; and hard carbon, which improves ionic flow and provides higher power densities in batteries.

The Ohio facility represents the second link in Graphite One’s graphite materials supply chain; the first link is Graphite One’s Graphite Creek mine in Alaska, currently working toward completion of its Feasibility Study in Q1 2025, mostly funded by a $37.5 million Defense Production Act grant from the Department of Defense in July 2023.

G1’s Voltage Valley AAM manufacturing facility will produce it’s own synthetic graphite to produce synthetic anode active materials and in the future add natural graphite anode active materials as graphite becomes available from the company’s Graphite Creek mine, located near Nome, Alaska, according to the March 20th news release.

The plan also includes a recycling facility to reclaim graphite and other battery materials, to be co-located at the Ohio site, which is the third link in Graphite One’s circular economy strategy.

Unlike metals that go into the battery cathode, there is no substitute for graphite in the anode. Anode technology such as that being proposed by Graphite One is essential for developing a domestic “mine to battery” supply chain.

G1 CEO meets President Biden

Anthony Huston, the CEO of Graphite One, was at the White House in May 2024 with other industry leaders when President Joe Biden imposed tariffs on Chinese imports including natural graphite.

“I was honored to represent everyone at Graphite One in the meeting with President Biden,” Huston said in the May 15 news release. “We appreciate his support for the renewable energy transition and G1 is excited to continue pushing forward to create a secure 100% U.S.-based supply chain for natural and synthetic graphite.”

To help make graphite mined and processed in the US competitive with China, the tariff will rise from 0% to 25% by 2026. The tariff on EVs from China will quadruple from 25% to 100%.

The substantial tariff increases are part of a larger government policy of shielding American businesses from unfair Chinese trade practices.

“To encourage China to eliminate its unfair trade practices regarding technology transfer, intellectual property, and innovation, the President is directing increases in tariffs across strategic sectors such as steel and aluminum, semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products,” the White House said in a statement.

The statement noted that “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

“Projects like Graphite One’s are important in so many ways — from job creation and the renewable energy transition to technology development and national security,” Huston said in response to Biden.

Huston’s inclusion in an audience with Biden at the Rose Garden is highly unusual for the CEO of a junior resource company; it also underscores the importance of graphite to the federal government.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Washington has finally begun to recognize this vulnerability. In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

Mining projects focused on critical minerals like graphite, lithium, and cobalt are eligible for federal loan guarantees worth $72 billion.

The need for the United States to start building its own domestic graphite to EV battery anodes industry became especially apparent when China in late 2023 restricted the export of certain graphite materials used to make anodes.

Washington responded by increasing the tariff on natural graphite and rare earth magnets.

The White House announced that “The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026.” To my knowledge, this is the first time the US government has grouped graphite with, or equated graphite’s importance to rare earths, and is thus hugely important to Graphite One, which is developing the first “mine to battery” supply chain in the United States, anchored by its Graphite Creek project in Alaska.

Active anode materials market

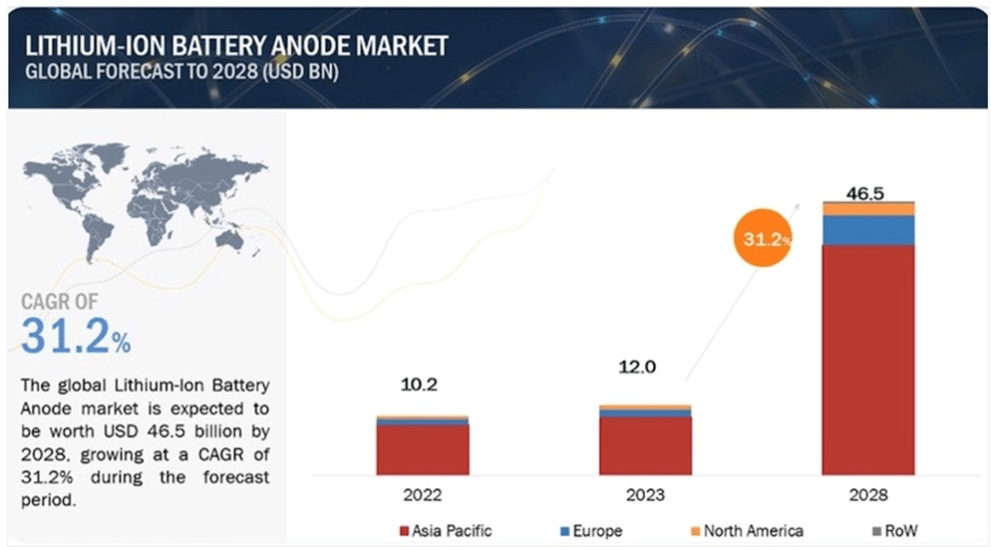

A report by Polaris Research valued the global anode market at $11.5 billion in 2023. By 2032, revenues should reach $123.7B, with the industry growing at a CAGR of 30.9%.

The main reason for such a high growth rate is increasing EV adoption.

“The lithium-ion battery anode market is experiencing notable growth due to electric vehicle acquisition. The growing approval of plug-in hybrids and EVs instantly translates into growing demand for lithium-ion batteries,” states Polaris Market Research via PR Newswire.

Another report by Markets&Markets projects anodes will grow from a $12 billion industry in 2023 to $46.5 billion in 2028.

The report concurs with Polaris Research’s observation that electric vehicles are the key demand driver, but adds that industrial applications are increasingly adopting lithium-ion batteries for their efficiency and clean-energy benefits.

Growth will be fueled by the rising need for energy storage solutions, the shift toward sustainable energy sources, and government initiatives promoting clean energy adoption, according to the report.

The growth of the anode market will be impacted by factors including technology, the level of demand for electric vehicles, renewable energy integration, and the development of consumer electronics.

EV adoption includes EVs and plug-in hybrids, a key component of which is the anode. Energy storage devices are increasingly used in hybrid automobiles and renewable energy. Lithium-ion batteries have proven to be suitable for large-capacity energy storage systems.

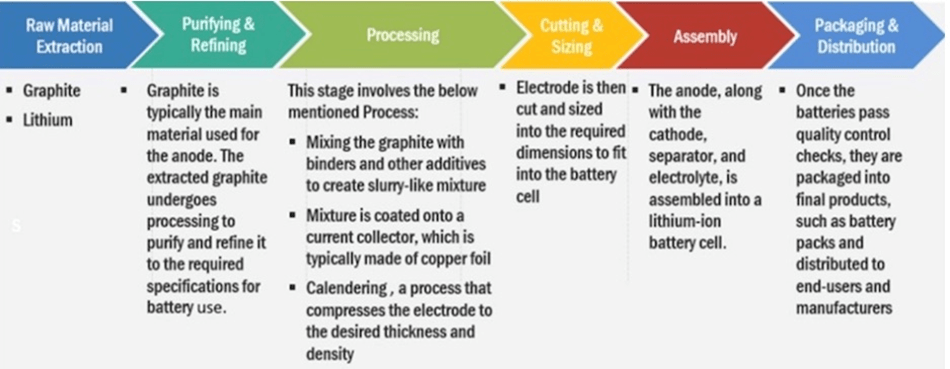

The anode, also known as the negative electrode, is typically made up of graphite powder baked onto copper foil.

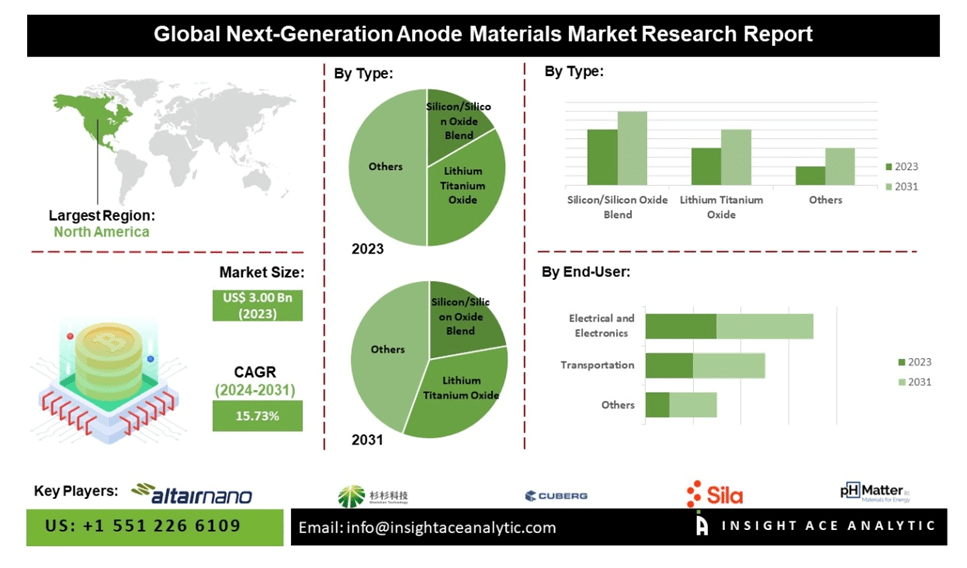

Active anode materials (AAM) is a term referring to materials that are being developed for use in various energy storage and convergence technologies; the primary focus is on improving battery performance.

To be suitable for lithium-ion battery manufacturing, anode materials should meet the following requirements:

- Excellent porosity and conductivity

- Good durability and light weight

- Low cost

- Voltage match with preferred cathode

According toInsight Ace Analytic Pvt. Ltd., the AAM market was valued at USD$3 billion in 2023 and is predicted to triple by 2031 to $9.57B.

Technological advancements are resulting in the development of novel anode materials with higher energy densities, faster charging rates, and longer lives. This is propelling the use of next-generation anode materials in a variety of applications, including consumer electronics, energy storage, and electric vehicles.

Synthetic graphite market and supply chain

Synthetic, or artificial graphite, and natural graphite are both used in battery anode applications, but synthetic dominates the market.

China controls 80% of synthetic graphite production.

Total synthetic graphite consumption is pegged at 3.04Mt this year, compared to 1.68Mt for natural graphite.

Despite its higher cost compared to natural graphite from graphite mines, “its well-defined structure facilitates smoother lithium-ion movement, enabling faster charging and higher reliability,” states Markets&Markets. An additional advantage of synthetic graphite is its longer lifespan compared to natural.

According to Benchmark Mineral Intelligence, synthetic graphite could account for nearly two-thirds of the EV battery anode market by 2025.

Source: Markets&Markets

Given Chinese export restrictions, and the vast potential of the synthetic graphite market, Graphite One is forging ahead with it’s plans to build America’s first synthetic graphite production plant.

The important thing here is security of supply. There is currently no commercial US production of synthetic graphite; to get it, a company would have to buy it from overseas companies such as China’s BTR New Energy Materials and Kuntian New Energy Technology. Other possibilities are Resonac Holdings (Japan) and Norway’s Vianode.

Graphite One intends to produce synthetic graphite from scratch, then make bespoke anode materials for their customers. G1 is the first link of a homegrown synthetic and natural graphite supply chain for EV batteries.

Lucid supply agreement

The importance of graphite to vehicle electrification is highlighted by the fact that EV manufacturers are signing deals directly with graphite miners such as Graphite One.

Graphite One and EV maker Lucid sign historic Supply Agreement — Richard Mills

On July 25, G1 announced it had entered into a non-binding Supply Agreement with Lucid Group, Inc. (NASDAQ: LCID), a California-based electric vehicle manufacturer, for anode active materials (AAM) used in EV batteries.

“This is a historic moment for Graphite One, Lucid and North America: the first synthetic graphite Supply Agreement between a U.S. graphite developer and U.S. EV company,” said Huston, adding:

“G1 is excited to continue pushing forward developing our 100% U.S. domestic supply chain. We appreciate the support from our investors and the grant from the Department of Defense. Subject to project financing required to build the AAM facility, the Supply Agreement with Lucid puts G1 on the path to produce revenue in 2027, and that’s just the beginning for Graphite One as work to meet market demands and create a secure 100% U.S.-based supply chain for natural and synthetic graphite for U.S. industry and national security.”

Lucid’s flagship vehicle is the Lucid Air, which has been recognized with a number of awards, including MotorTrend 2022 Car of the Year, World Luxury Car of the Year, and Car and Driver 10 Best. Lucid is preparing a factory in Arizona to begin production of the Lucid Gravity SUV.

The five-year, non-binding Supply Agreement provides for 5,000 tpa of synthetic graphite. Sales are based on an agreed price formula linked to future market pricing, as well as satisfying base-case pricing agreeable to both parties.

CNBC reported in August that Lucid Group’s largest shareholder, Saudi Arabia’s Public Investment Fund (PIF), will provide a $1.5 billion cash injection to be used to provide new models to its product line.

The deal comes ahead of Lucid’s plan to launch its Gravity SUV later this year and keeps the EV maker funded until the fourth quarter of 2025.

An affiliate of PIF, Avar Third Investment has agreed to buy $750 million worth of convertible preferred stock and provide a similar amount as a credit line, CNBC said.

Lucid’s new manufacturing plant is in Saudi Arabia and in March of this year Saudi Arabia’s PIF announced it has agreed to a joint venture with Hyundai Motor Co. to establish another new factory in Saudi Arabia. The PIF, which owns 70% of the venture, aims to build 50,000 vehicles annually after the more than $500 million plant opens in 2026.

$325M EXIM financing

Graphite One showed remarkable progress this month when it announced receipt of a non-binding Letter of Interest from the Export-Import Bank of the United States (EXIM) for potential debt financing of up to $325 million through EXIM’s “Make More in America” and “China and Transformational Exports Program” (CTEP) initiatives.

The EXIM Bank is the official export credit agency of the United States. Our mission is to support American job creation, prosperity and security through exporting. We accomplish this by unlocking financing solutions for U.S. companies competing around the globe. We help level the playing field and fill gaps in private sector financing.

Borrowers must:

- Export US goods and/or services

- Be domiciled in the US; Ownership by foreign nationals or entities is acceptable.

- Have a positive net worth and an operating history of at least one year.

Graphite One appears to meet all of these criteria.

Specific programs and initiatives include:

- China and Transformational Exports Program (CTEP), established in the 2019 reauthorization, which aims to: (1) counter export subsidies and finance provided by the People’s Republic of China or other designated countries; or (2) advance U.S. comparative leadership with respect to the PRC, or support US innovation, employment, or technological standards in statutory “transformational” export areas (e.g. artificial intelligence, 5G, renewable energy, semiconductors).

- Make More in America (MMIA), approved by the Board in 2022, which provides financing for “export-oriented” domestic manufacturing projects that also meet other criteria, as part of the Biden Administration’s efforts to strengthen US supply chains.

For FY2023, the Bank authorized $8.8 billion (see Figure 1), to support some $10.6 billion of U.S. exports. As a share of total authorizations, small business comprised 23.0% by dollar amount and 87.2% by number; and renewable energy comprised 10.4% and CTEP comprised 27.8%, both by dollar amount. — Congressional Research Service, Jan, 19, 2024

The EXIM Bank was established in 1994 to increase support for exports of environmentally beneficial goods and services. It has grown from 10 transactions in FY ’94, to a high of 68 in FY ’07. Its total portfolio new exceeds $3 billion.

Key priorities are Small Business, Clean & Renewable Energy, Sub-Saharan Africa, Competing with China, Underserved Communities and Frontiers of Technology.

The Letter of Interest states: “We are pleased to extend this Letter of Interest in support of the proposed capital funding plan by Graphite One (Alaska) Inc. for the AAM Manufacturing Facility. Based on the preliminary information submitted regarding expected U.S. exports and U.S. jobs supported by this project, EXIM may be able to consider potential financing of up to $325 million of the project’s costs with a repayment tenor of 15 years under EXIM’s Make More in America initiative.”

“EXIM’s potential financing, following on G1’s two Department of Defense grants under the Defense Production Act and from the Defense Logistics Agency, underscores the urgent need to bring U.S. graphite supply into production, and end the nation’s 100% foreign dependency,” said Graphite One’s Anthony Huston.

EXIM’s funding commitment is conditional upon completing the application, due diligence and underwriting process and receiving all required approvals.

G1 expects to submit a formal application to EXIM in 2025. Upon receipt of an application for financing, EXIM will conduct all requisite due diligence necessary to determine if a Final Commitment may be issued for this transaction. Any Final Commitment will be dependent on meeting EXIM’s underwriting criteria, authorization process, finalization and satisfaction of terms and conditions. All Final Commitments must comply with EXIM policies as well as program, legal and eligibility requirements.

The company intends to make a production decision on the Graphite One Project upon completion of its Feasibility Study, expected in the first quarter of 2025.

Chenyu’s AAM technology

Graphite One has one of the largest highest grade graphite mines in the world, recently secured a site for synthetic graphite production, and already has an offtake agreement with EV manufacturer Lucid.

The next step is getting the technology to make synthetic graphite, know-how which currently does not exist in the United States.

The latest news on Graphite One concerns a pair of agreements that provides G1 with exclusive access to leading anode manufacturing technology.

According to the Oct. 21 news release, “Execution of the Graphite One-Chenyu Agreements marks key step in providing the knowledge base for U.S. Anode Active Material (“AAM”) manufacturing at G1’s planned Ohio AAM facility.” And “Leading AAM manufacturer grants exclusive license to the North American market.”

The release explains how Graphite One Products Inc., a wholly owned subsidiary of Graphite One, has signed a technology license agreement and a consulting agreement with Hunan Chenyu Fuji New Energy Technology Co. Ltd.

Chenyu is a Chinese AAM manufacturer that currently supplies AAM to lithium-ion battery producers.

Founded in 2019, Chenyu is a high-tech company specializing in R&D, production, sales and professional services of lithium-ion battery materials including artificial graphite anode, natural graphite anode, silicon carbon anode materials and waste battery recycling. The company currently has five production facilities and an R&D center.

Dr. Zhou Xiangyang, a professor at Central South University in Changsha, China will guide Chenyu’s project team providing work under the agreements. He is a member of several professional organizations in the United States and a recognized expert in battery materials’ science. Dr. Xiangyang has published more than 100 professional papers and obtained more than 100 patents. He has successfully developed products for global battery companies and will advise Graphite One’s commercial program.

The agreements are an important milestone for G1 in

bringing leading technology in AAM manufacturing to the US domestic supply chain for battery materials.

“The United States has zero commercialization of synthetic anode battery materials. The execution of these Agreements represents a critical step in creating domestic supply for the lithium-ion battery materials,” said Anthony Huston, CEO of Graphite One. ”Supplying proven products to the North American battery material supply chain will give G1 a competitive edge by allowing rapid entry into a market where technology is developing quickly.”

The agreements give G1 access to critical AAM technology from an experienced AAM supplier to major battery manufacturers. AAM technology is evolving rapidly as battery makers require fast charging, high density, and long-life battery specifications and G1 expects to keep pace with this advancement.

The agreements are strictly fee-for-services arrangements, and provide no direct or indirect equity in G1, no representation in the management or Boards of Directors of G1 or any of its affiliates, and no direct or indirect rights to control the projects of G1 or any of its affiliates.

Technical license agreements have been used for EV battery development by such companies as General Motors and Ford.

The Chenyu Agreements include:

- Technology License Agreement: Chenyu grants an exclusive license to certain AAM technologies in return for the payment of royalties applied to net revenues received by G1 from the sale in each calendar quarter of AAM products manufactured using the technology;

- Consulting Agreement: Chenyu will provide:

- Advice and guidance in designing, constructing, commissioning and operating the Ohio AAM plant in return for the payment by G1 of milestone fees which track events progressing from the commencement of work on the plant by hiring an engineering, procurement and construction management firm, through to G1 successfully qualifying licensed products manufactured at the plant with a US customer.

- Consulting and advisory services as requested based on individual statements of work for agreed-upon fees.

- Other contractual provisions:

- Right of First Negotiation for Next Generation Products: Chenyu agrees to offer G1 advanced, next-generation AAM technology prior to offering it to other AAM manufacturers in North America; and

- Right of First Negotiation for Additional Markets: Chenyu agrees to offer G1 the right to license Chenyu’s AAM technology in Europe, the United Kingdom and the Kingdom of Saudi Arabia before offering it to other AAM manufacturers.

Conclusion

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Graphite is therefore indispensable to the EV supply chain.

Automakers and defense companies have been raising alarm bells over the fact that the United States hasn’t mined any graphite since the 1950s, and even if it had, it would need to be shipped to China for processing. G1 intends to play a large part in correcting this.

The company has already received two major grants from the US Department of Defense, including a $37.5 million Defense Production Act grant in July 2023 to go towards the mine’s Feasibility Study.

But mine production, despite being fast-tracked, is a few years away. Graphite One’s plan to build an AAM plant in Ohio is an important interim step before mining begins.

Phase 1 production targets 25,000 tonnes per year of battery-ready anode material. Land is available for follow-on phases to ramp up to 100,000 tpy of production.

Graphite One has a non-binding LOI for up to $325 million in debt financing from the EXIM Bank, to be paid back over 15 years. The company appears to meet all of EXIM’s criteria.

Graphite One has the opportunity to become the first synthetic graphite producer in the United States, ending decades of import dependence. Graphite One would produce its own synthetic graphite, it would not buy it from other overseas companies, before manufacturing it into active anode materials for its customers.

The opportunity here is huge.

A report by Polaris Research valued the global anode market at $11.5 billion in 2023. By 2032, revenues should reach $123.7B, with the industry growing at a CAGR of 30.9%.

The active anode materials (AAM) market was valued at USD$3 billion in 2023 and is predicted to triple by 2031 to $9.57B.

Through its licensing agreements with Chenyu, Graphite One would have Chenyu’s technology before any other AAM manufacturer in North America. Graphite One also has the right to license the technology to Europe, the UK and Saudi Arabia. The latter has some major skin in the game ($1.5 billion) with Lucid.

Graphite One’s importance to the US government is exemplified through CEO Anthony Huston’s appearance at a White House event.

China, meanwhile, has imposed restrictions on graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is a ‘first mover’ at the forefront of this trend. The company has significant financial backing from the Department of Defense, and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation, which has already made a $2 million investment with an option to invest a further $8.4 million.

Graphite, whether synthetic or natural, plays a vital, irreplaceable part in the move away from fossil fuels to the electrification of the US and global economies.

Paramount to a successful energy transition is ‘Security of Supply.” With the upcoming release of a feasibility Study on G1’s Graphite Creek Project, a technology licensing agreement, and a consulting agreement with Hunan Chenyu Fuji New Energy Technology Co., a Letter of Interest (LI) for up to $325 million in debt financing from the Export-Import Bank of the United States, plans for a AAM manufacturing plant in Ohio’s Voltage Valley with a re-cycling facility attached it would seem G1 has positioned itself to play a leading role.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.10.22 share price: Cdn$0.88

Shares Outstanding: 137.8m

Market cap: Cdn$121.9M

GPH website

Subscribe to AOTH’s free newsletter

Richard owns shares of Graphite One Inc. GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE