Rick Mills – “Graphite Essential to Green Transformation”

Despite the plethora of electronic gadgets we have at our fingertips, most people don’t make the connection between the materials that go into them, and the magic of the devices we use.

As for the electrification of the global transportation system, it doesn’t happen without graphite. That’s because the lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smart phones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

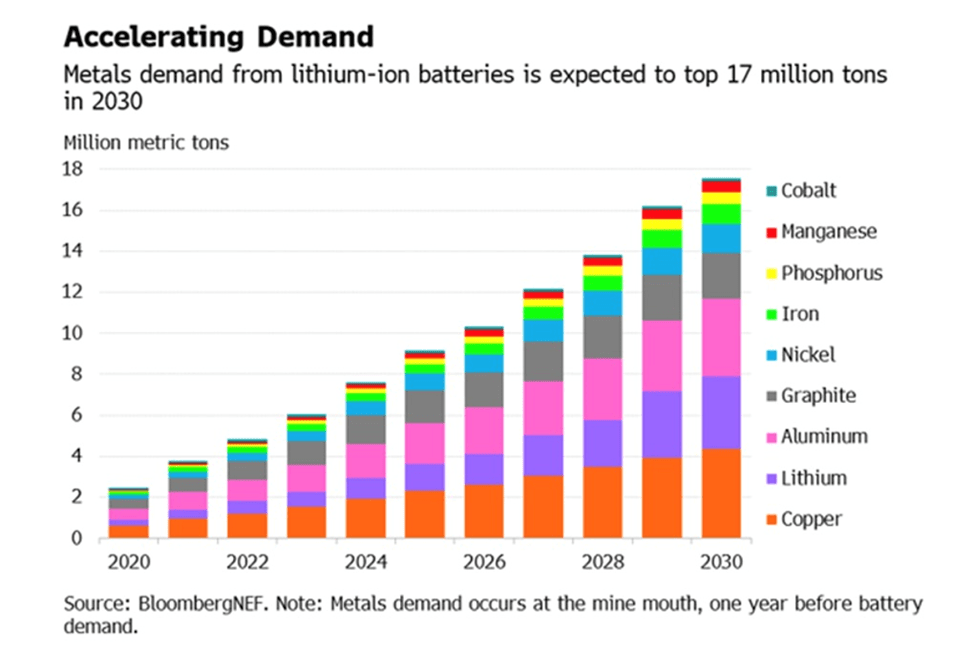

Needless to say, graphite is indispensable to the EV supply chain. Bloomberg New Energy Finance expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Graphite crisis

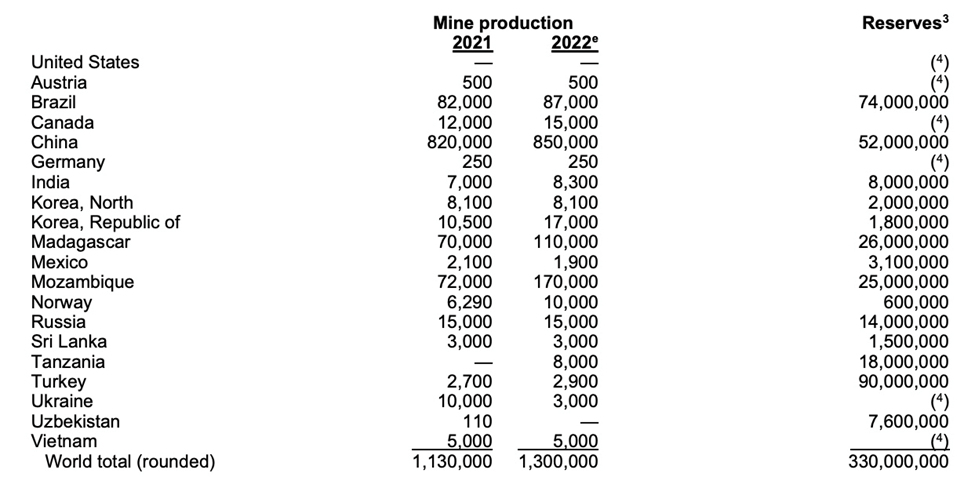

The question then becomes whether we have enough graphite to sustain the demand pressures of the EV revolution. To answer it, consider the slide below:

The United States currently imports 100% of its graphite. Another way of saying this is the US has zero production. With 70% of the world’s graphite supply coming from China, how will the United States compete in these new technologies that are shaping our world? Are we going to own what we need here or buy it from other countries? Current events are teaching us how dangerous it is to rely on foreign sources of supply, in a world where adversaries can use access to materials as an economic weapon.

American manufacturing including equipping the US military with the most advanced weapons systems in the world is untenable without domestic production of graphite and other critical minerals. 95% of the typical battery anode is composed of graphite, none of which the United States currently mines. The World Bank projects that the market for graphite will grow by nearly 500% by 2050; President Biden in his 100-day report said the number is 2,400% by 2040.

In the past, the industrial minerals sector has mostly overlooked any potential problems in securing graphite for EV batteries.

After all, graphite is plentiful, with a well-developed supply chain due to longstanding demand from industries such as steelmaking and electronics. It’s also cheaper, with the raw material priced at roughly one-tenth that of lithium. In 2022, graphite made up just 2% of the battery cost, according to consultants at Kearney.

However, what many are forgetting are two important trends concerning graphite: 1. Demand is accelerating at a rate never seen before; and 2. The industry is shifting towards natural graphite.

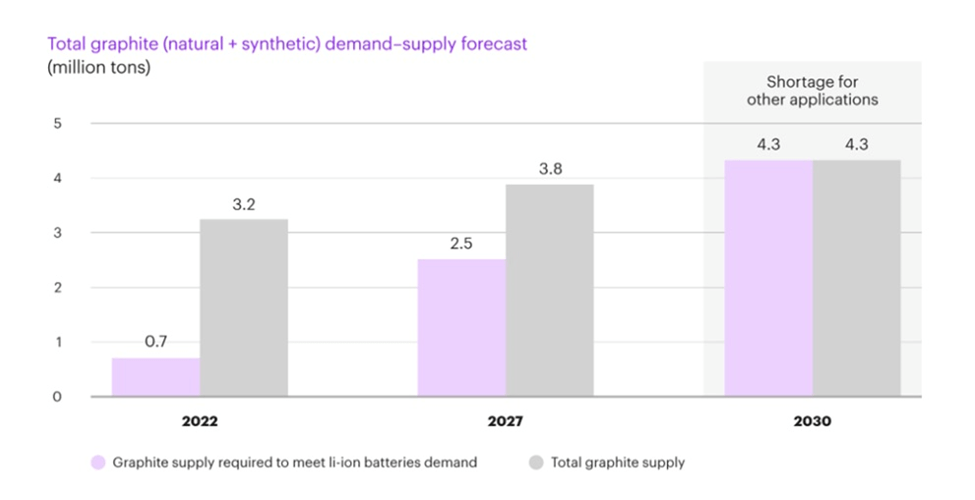

An analysis of expected demand by Benchmark Mineral Intelligence suggests that graphite has the largest future gap between supply and demand — even more than that of lithium. Graphite demand is likely to grow by a factor of eight by 2030 over 2020 levels (4.2 metric tons over a supply of 3.0), and 25 times by 2040, said Benchmark. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium (2.4 over 2.1), 26% for nickel (1.5 over 1.1), and 6% for cobalt (0.32 over 0.30).

EV demand will absorb all graphite output at this rate. Source: Kearney

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

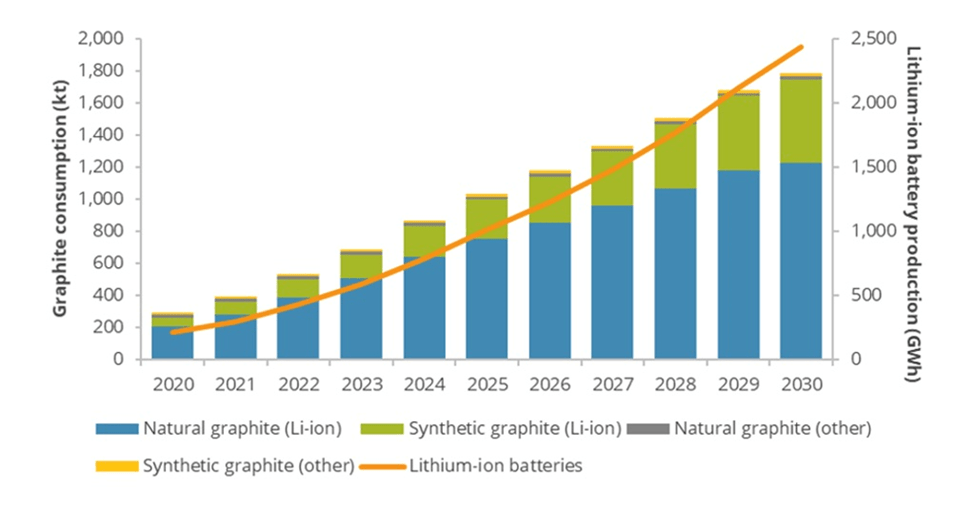

Then there’s the problem with the type of graphite used. For ages, synthetic graphite has held the lion’s share of the battery market (57% of the anode market in 2022, according to BMI), because it performs better in electrolyte compatibility and has fast-charge turnaround and battery longevity. But compared to the natural version, it costs nearly double and has a lower capacity.

Importantly, synthetic graphite is very energy-intensive. BMI estimates that anode production using synthetic graphite can be over four times more carbon-intensive than with natural graphite. Not to mention the pollutants, which make synthetic graphite counterproductive to climate goals.

For these reasons, EV manufacturers are beginning to show a preference for natural graphite, especially as processors have improved the purity. It’s widely expected that the world’s natural graphite production is likely to outpace synthetic yields by 2030 (see below).

Natural & synthetic graphite consumption outlook. Source: Roskill

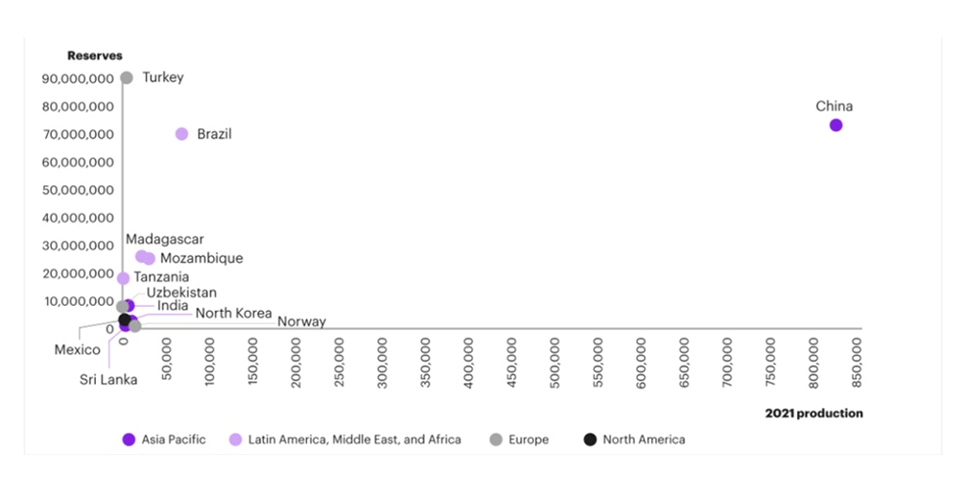

Flake graphite, as the name implies, has a distinctly flaky or platy morphology. Only flake graphite upgraded to 99.95% purity can be used in batteries. Herein lies a bigger problem: natural flake graphite is difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

Complicating matters is that not all mined material has the required purity for EV battery consumption.

China is currently by far the biggest producer with nearly three-quarters of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as the dominant force in every stage of the supply chain.

US import dependence

As much as the United States wants to keep pace with China in the global EV race, it can’t do so without a reliable graphite supply. As mentioned, the US does not mine any graphite, so it is solely reliant on imports.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

Heavy reliance on Chinese graphite mine supply. Source: Kearney

This is why graphite is firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions. The other four — lithium, nickel, cobalt and manganese — typically form the cathode that decides the capacity and therefore tend to get more attention. But graphite, as the anode material, is probably the most crucial one since it’s far superior to current alternatives.

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It’s thought that battery demand could gobble up well over 1.6 million tonnes of natural flake graphite per year.

For context, 2022 mine supply was about 1.3 million tonnes, which means we’re very close to entering, if not already, a period of deficits. Benchmark Mineral Intelligence projects natural graphite will have the largest supply shortfalls of all battery materials by 2030, with demand outstripping expected supplies by about 1.2 million tonnes.

Source: USGS

And this is just counting EV battery use; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, which at first may seem doable but considering the number of graphite projects worldwide and the time it takes to develop them into mines, we’re really up against it.

Support from government

Thankfully, the US. government has begun to appreciate the current crisis in graphite and other critical minerals it is import-dependent on.

In 2022 the Biden administration invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies.

The trillion-dollar infrastructure bill allocates $7 billion to advance domestic projects and renewable energy, supply chains and critical minerals with specific focus on EV batteries.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE