Rick Mills – Graphite Creek Project Completes FAST-41 60-day Coordinated Project Plan Process; Permitting Timeline Set at 13.5 Months

The Graphite Creek project in Alaska being developed by Graphite One (TSX-V:GPH) (OTCQX:GPHOF) has reached another milestone, with GPH on Aug. 5 announcing it has completed the 60-day Coordinated Project Plan (CPP) process under the US government’s “FAST-41 Permitting Dashboard”.

The Coordinated Project Plan brings all participating federal agencies and the company together to identify and publicly post all project reviews, authorizations and timelines.

The CPP establishes Graphite Creek’s permitting timeline at 13.5 months.

Graphite Creek is the first Alaskan mining project to be listed on the dashboard. The resulting plan for reviews, authorizations and timeline posted on the FAST-41 Federal Dashboard can be accessed here.

“The ability to coordinate with all participating federal agencies involved in our permitting, develop a transparent plan for the process and post that plan publicly is a testament to the FAST-41 process and the predictability and transparency it provides,” said Graphite One’s CEO Anthony Huston in the Aug. 5 news release. “With President Trump’s Critical Mineral and Alaska Executive Orders, Graphite One is positioned at the leading edge of a domestic Critical Mineral renaissance that will power transformational applications from energy and transportation to AI infrastructure and national defense.”

FAST-41 streamlines the permitting process by providing improved timeliness and predictability by establishing publicly posted timelines and procedures for federal agencies, reducing unpredictability in the permitting process. FAST-41 also provides issue resolution mechanisms, while the federal permitting dashboard allows all project stakeholders and the general public to track a project’s progress, including periods for public comment.

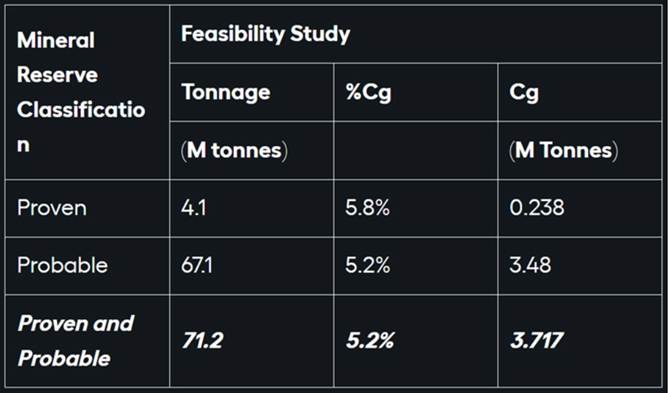

Graphite Creek’s FAST-41 status follows publication of Graphite One’s Feasibility Study (FS) filed on April 23, which, with the support of the Department of Defense Production Act award ($37.5 million), was completed 15 months ahead of schedule. The annual graphite concentrate capacity of the Graphite Creek mine in the FS was increased from that in the 2022 Pre-Feasibility Study (PFS) – from 53,000 tpy to 175,000 tpy while maintaining a 20-year mine life. Measured plus Indicated Resources increased to 322% of the PFS resource. The FS projects a post-tax internal rate of return of 27%, using an 8% discount rate, with a net present value of $5.03 billion and a payback period of 7.5 years.

Thanks to the FS, the Graphite Creek project has entered the permitting phase with a production rate triple that projected two years ago.

Domestic graphite supply chain

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek in Alaska, the largest graphite deposit in the country and one of the biggest in the world.

The strategy involves mining, manufacturing and recycling, all done domestically — a US first.

Subject to financing, the company plans to invest $435 million to build a graphite product manufacturing plant in Warren, Ohio, between Cleveland and Pittsburgh. The plant would produce Active Anode Materials, first using synthetic graphite, and then, once the Graphite Creek mine is in production, using natural flake graphite concentrate.

Two Department of Defense grants have been awarded to Graphite One, one for $37.5 million – paying 75% of the cost of the Feasibility Study, the other for $4.7 million — the latter to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite sourced from Graphite Creek.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

G1 has also received a $325 million non-binding Letter of Interest from the EXIM Bank for the construction of the company’s Ohio-based anode manufacturing plant. Both DPA and EXIM are among the agencies that will have expanded critical mineral authorities under President Trump’s March 20 executive order, titled “Immediate Measures to Increase American Mineral Production.”

FAST-41 CPP

The CPP is a concise plan for coordinating public and agency participation in, and completion of, any required federal environmental reviews and authorizations for the project.

The CPP contains:

- A list of, and roles and responsibilities for, all entities with environmental review or authorization responsibilities for the Project.

- A permitting timetable that includes intermediate and final completion dates for action by each agency on any federal environmental review or authorization required for the project, and to the maximum extent practicable, the dates by which state permits, reviews and approvals must be made.

- A discussion of potential avoidance, minimization, and mitigation strategies, if required by applicable law and known.

- Plans and a schedule for public and tribal outreach and coordination, to the extent required by applicable law.

Permitting Council

Established in 2015 by Title 41 of the Fixing America’s Surface Transportation Act (FAST-41), the Permitting Council is a federal agency charged with improving the transparency and predictability of the federal environmental review and authorization process for certain critical infrastructure projects. The council coordinates federal environmental reviews and authorizations for projects that seek and qualify for FAST-41 coverage.

Political backing

The filing of the FAST-41 CPP received support from the following federal officials:

“As Alaska’s first Critical Mineral mining project on the FAST-41 Dashboard, Graphite One is blazing the trail for projects that contribute not only to the American economy but to our national security,” said Alaska Governor Mike Dunleavy. “In the 21st Century, the wealth of nations – their ability to provide opportunities for their people, their ability to remain safe in a dangerous world – depends on access to the resources that power our technologies. For our nation, the message is clear: There is no path forward to American Energy Dominance without the minerals, metals and natural gas resources Alaska has in abundance.”

“I thank the Permitting Council for recognizing the strategic importance of the Graphite One project and for moving quickly to add it to the FAST-41 dashboard—the first Alaskan mining project on the dashboard,” said Alaska Senator Lisa Murkowski. “As China continues to restrict the United States’ supply of critical minerals, it is crucial for Graphite One to advance without delay. This is North America’s largest deposit of natural graphite, foundational to any effort to rebuild our domestic supply chains, and we now have a concrete timeline of 13.5 months for federal agencies to bring it through the permitting process.”

“FAST-41 is designed to provide speed, transparency, and accountability for all groups involved in permitting and approving projects like those offered by Graphite One, and it’s encouraging to see G1 complete this process within the allotted 60-day window,” said Nick Begich, congressman for All Alaska. “Domestic supply chains for critical minerals are cornerstone requirements for domestic production and national security. G1 is blazing a trail for additional efforts of this kind – demonstrating how we can work across governmental jurisdictions to unlock the full potential of Alaska for the benefit of all Americans.”

“Graphite Creek is critical to achieving President Trump’s energy dominance agenda and is exactly the kind of project that can benefit from the transparency and accountability that comes with FAST-41,” said Emily Domenech, executive director, Federal Permitting Improvement Steering Council (FPISC). “Our team worked with federal agencies to develop an efficient and responsible permitting timetable, and we are ready to partner with Graphite One to get this project to construction.”

Military uses of graphite

America is facing a crisis regarding its lack of graphite production. Graphite is a necessary component of lithium-ion batteries; it’s used in the anode.

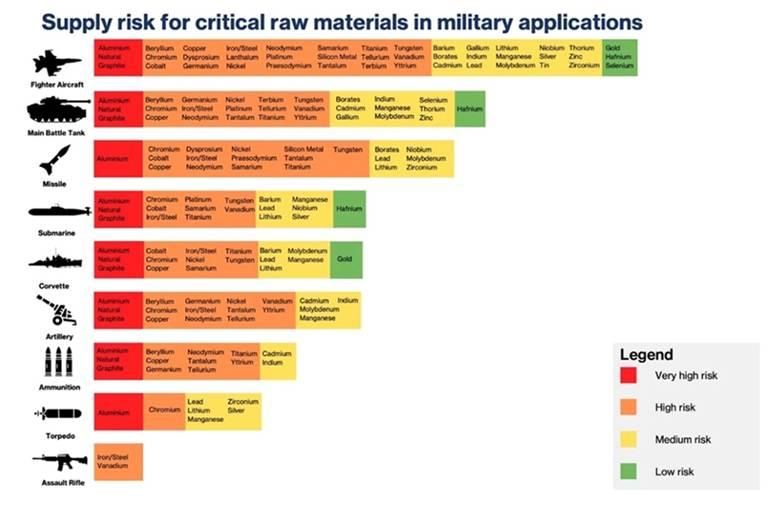

A report from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

The report assessed the degree of criticality for each of 40 materials deemed critical or soon to be critical. Natural graphite was rated “very high-risk” for air applications, and “high-risk” for sea applications.

In the table below, natural graphite is rated red, very high risk, for its use in fighter aircraft, main battle tanks, submarines, corvettes, artillery and ammunition. Aluminum, used in fighters, tanks, missiles, submarines, corvettes, artillery, ammunition and torpedo’s, was also rated a very high-risk material.

Source: Hague Centre for Strategic Studies

The report says aluminum and natural graphite are the two most used materials in the defence industry and can be found in aircrafts (fighter, transport, maritime patrol, and unmanned), helicopters (combat and multi-role), aircraft and helicopter carriers, amphibious assault ships, corvettes, offshore patrol vessels, frigates, submarines, tanks, infantry fighter vehicles, artillery, and missiles. These materials are used in components such as airframe and propulsion systems of helicopters and aircrafts as well as onboard electronics of aircraft carriers, corvettes, submarines, tanks, and infantry fighter vehicles. The impact of supply security disruption would hence be very significant, given the multiplicity of aluminum and natural graphite’s applications.

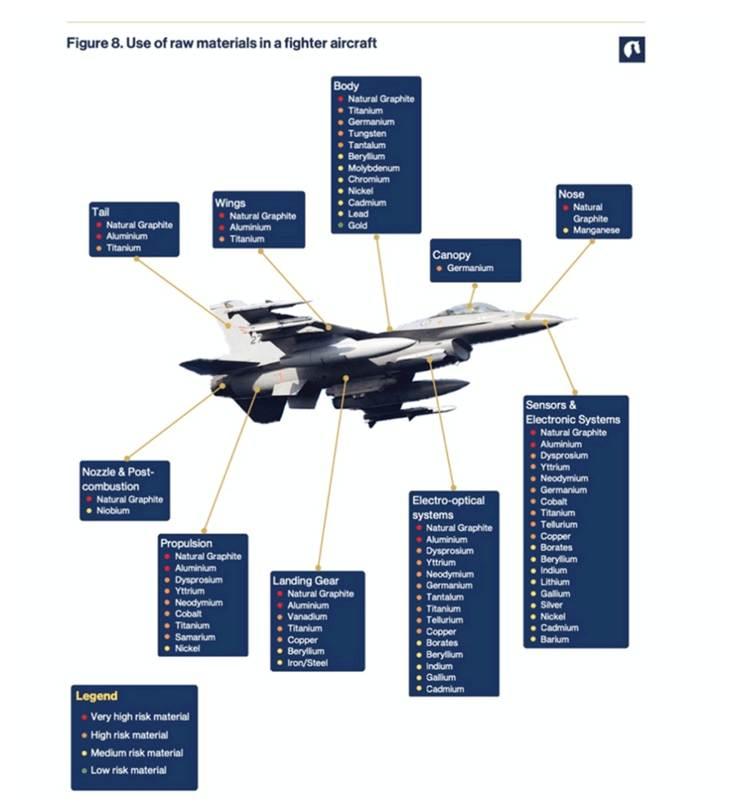

In the fighter plane graphic below, notice the use of natural graphite (red dots) in almost every part of the plane, including the body, wings, tail, nose, nozzle, propulsion system, landing gear, electro-optical systems, and sensors and electronic systems.

According to the report, the most used of the 40 materials across the air domain are aluminum, natural graphite, copper and titanium:

These materials have several applications in aeronautics. In aircrafts (fighter, transport, maritime patrol, and unmanned) and helicopters (combat and multi-role), aluminium, natural graphite, and titanium find their main application in the airframe, where they are used in the body, wings, tail, nose, and axis of the aircraft. They are also employed in the production of propulsion systems’ components such as combustors, nozzle, drive shaft, and propellers, as well as in landing gears, connectors, and electronic systems.

Source: Hague Centre for Strategic Studies

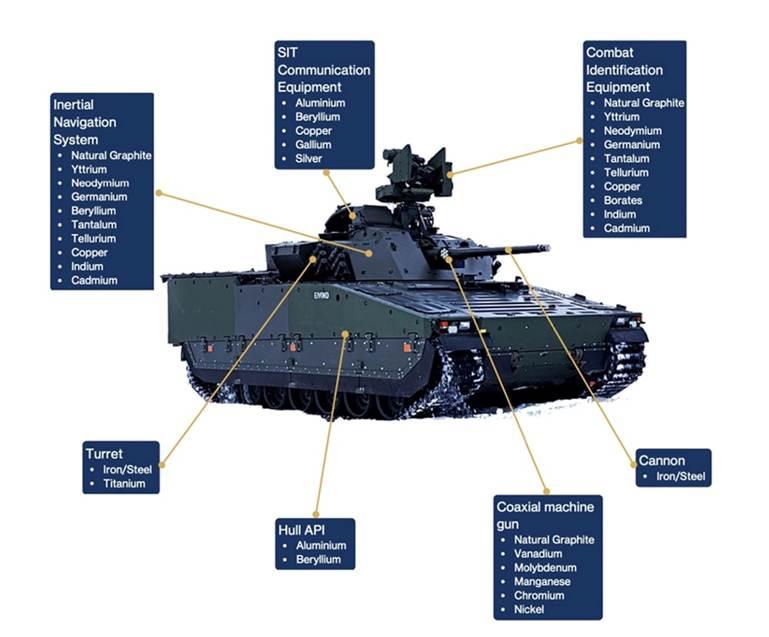

A second graphic of a tank shows natural graphite in the inertial navigation system, combat identification equipment, and coaxial machine gun.

According to the report, For the construction of tank guns, Howitzer machine guns in infantry fighter vehicles, and GPS/SAL guidance systems in ammunition, natural graphite is found in combination with other materials to construct these components.

Source: Hague Centre for Strategic Studies

Graphite’s superior thermal management and electrical conductivity are crucial for missile guidance systems, ensuring precise and accurate targeting.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

Deficits are expected to kick in this year as new graphite mines fail to keep up with surging demand from automakers. According to Benchmark Mineral Intelligence, as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, a figure impossible to achieve.

The US is heavily reliant on imports for graphite. In 2024, the US imported 60,000 tonnes of natural graphite, with 87.7% being flake and high purity.

The US military could not function without graphite, and the US currently does not produce any graphite from domestic mines.

Conclusion

Thanks to Graphite One, the US could soon have security of supply for a critical mineral that they are currently almost 100% reliant on China for.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

China accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

China has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Up to now, the US has had no security of supply for graphite. The country has reached a point where much more graphite needs to be discovered and mined in the US.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite product manufacturing plant in Voltage Valley, Ohio.

Graphite Creek is the first Alaskan mining project to be listed on the US government’s FAST-41 Permitting Dashboard. The Coordinated Project Plan establishes Graphite Creek’s permitting timeline at 13.5 months — considerably shorter than the time it normally takes to permit a mine in the United States.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.08.06 Share Price: Cdn$0.96

Shares Outstanding: 140.1m

Market Cap: Cdn$140.4m

GPH website

Subscribe to AOTH’s free newsletter

Richard owns shares of Graphite One Inc. (TSX-V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of GPH.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE