Rick Mills – “Exceptional Deposit, Unprecedented Financial and Political Support: G1 Working on Feasibility Study 75% Paid for by DoD”

Graphite One’s (TSX–V:GPH) (OTCQX:GPHOF) CEO Anthony Huston recently traveled to Washington, DC to meet with President Joe Biden. The meeting was between the President and a select group of executives invited to the White House to discuss investment and job creation.

Hours before the event, Biden signed an executive order establishing a 25% tariff on Chinese imports, including graphite.

The White House tariff statement noted that “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk.”

“I was honored to represent everyone at Graphite One in the meeting with President Biden,” Huston said in the May 15 news release. “We appreciate his support for the renewable energy transition and G1 is excited to continue pushing forward to create a secure 100% U.S.-based supply chain for natural and synthetic graphite. The White House meeting underscores that projects like Graphite One’s are important in so many ways — from industrial investment and job creation to the renewable energy transition, technology development and national security.”

Graphite and Critical Mineral Mining Boosted by $72B Fund

Click here for a link to the public broadcast, and here for the White House tariff statement.

Graphite has been elevated to the status of rare earths. Grouping graphite with the rare earths – both sectors dominated by China – the White House announced that “The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026.”

Graphite One has received strong support from the US government for developing its “made in America” graphite supply chain anchored by Graphite Creek, the largest graphite deposit in the country and one of the biggest in the world. Two Department of Defense grants have already been awarded, one for $37.5 million, the other for $4.7 million.

G1’s feasibility study is now 75% funded by the DoD.

In addition, G1 qualifies for federal loan guarantees from the $72 billion federal loan fund to support innovative energy and supply chain initiatives.

Graphite One’s importance to the US government is exemplified through CEO Anthony Huston’s appearance at a recent White House event.

China, meanwhile, has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is at the forefront of this trend. The company has significant financial backing from the Department of Defense, and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation, which has already made a $2 million investment with an option to invest a further $8.4 million.

The project isn’t near a salmon fishery and it has the backing of local communities such as Nome with its US$600 million port expansion. Nome has a long history of resource extraction.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce synthetic graphite and other graphite products. The ability for the company to execute on its plan to create a U.S.-based advanced graphite supply chain, anchored by the Graphite Creek deposit, is dependent on access to capital, government and community support.

Graphite One could supply a significant portion of the graphite demanded by the United States.

Consider: In 2023, the US imported 83,000 tonnes of natural graphite, of which 89% was flake and high-purity, suitable for electric vehicles. Based on G1’s prefeasibility study, not the feasibility study which is expected this fall, the Graphite Creek mine is anticipated to produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

Graphite dependence

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the economy and national security.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain. The United States currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

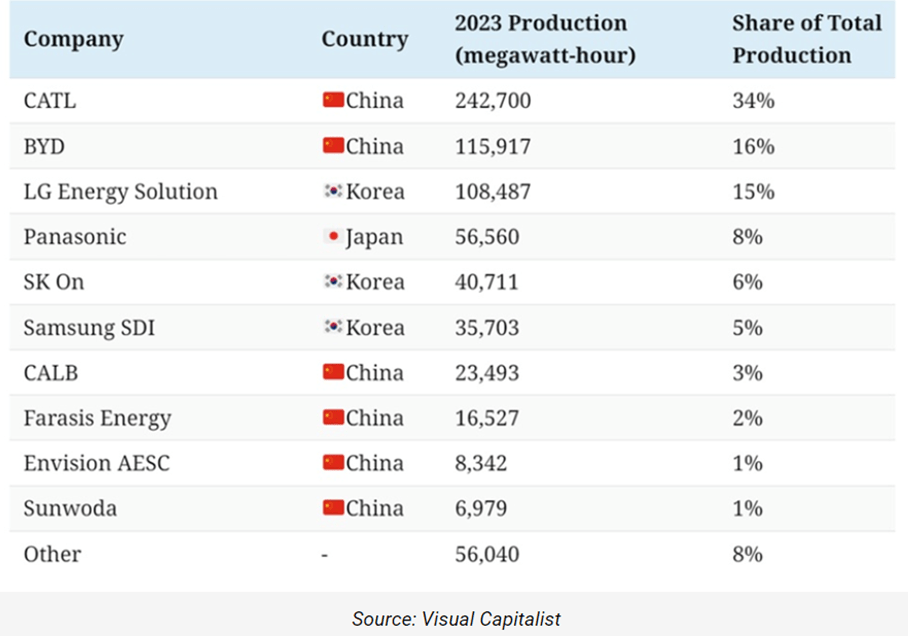

China holds a dominant position in the EV supply chain, with over three-quarters of the world’s battery production capacity. The country houses more than half the world’s processing and refining capacity for graphite, lithium and cobalt. It boasts 70% of the global production capacity for cathodes and 85% for anodes.

Washington has finally begun to recognize this vulnerability. In 2022, President Biden issued a Presidential Determination under the 1950 Defense Production Act (DPA), declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

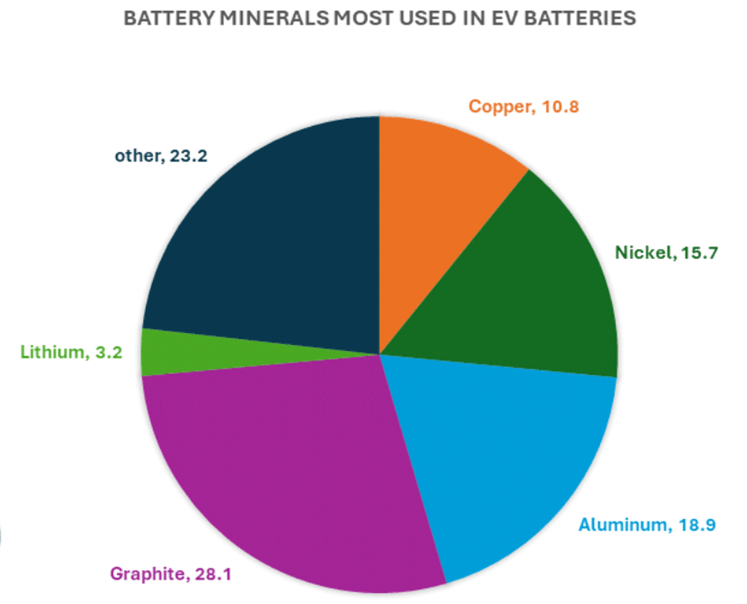

Graphite is the largest ingredient in lithium-ion batteries by weight, making it a highly-sought-after raw material by battery-makers.

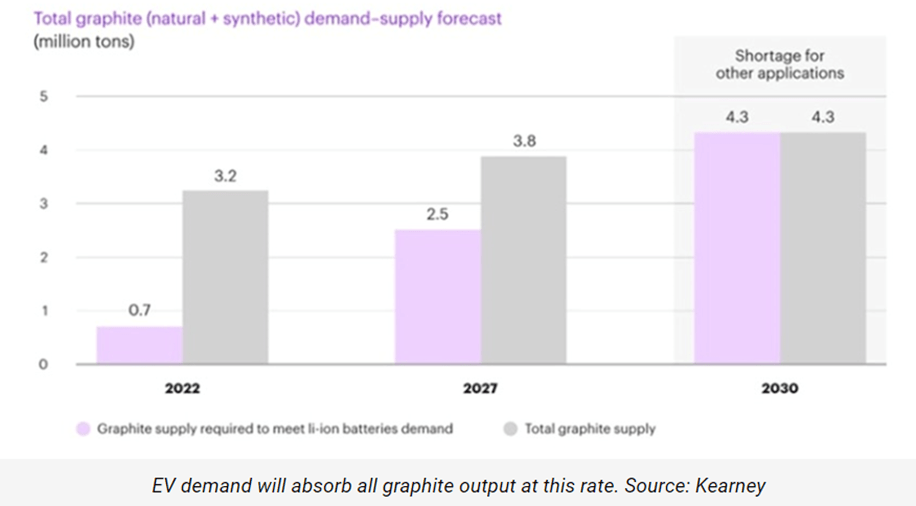

The U.S. Energy Department forecasts that global graphite demand could be more than eight times current production by 2035.

The mine

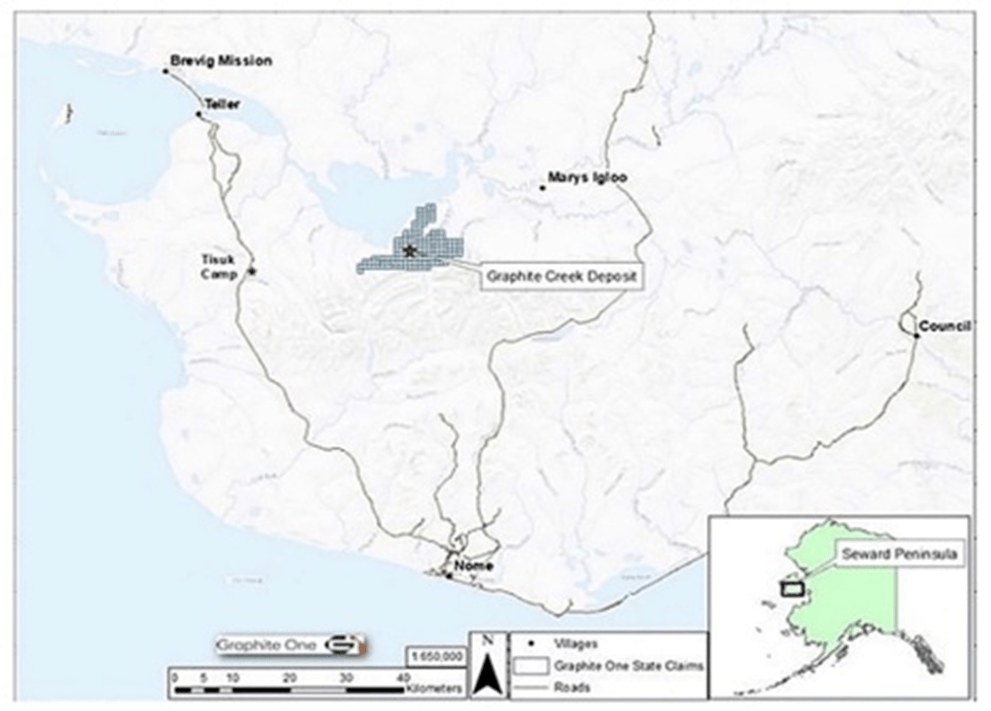

America’s largest graphite resource, and one of the biggest in the world, says the US Geological Survey, is the Graphite Creek deposit in Alaska being developed by Graphite One.

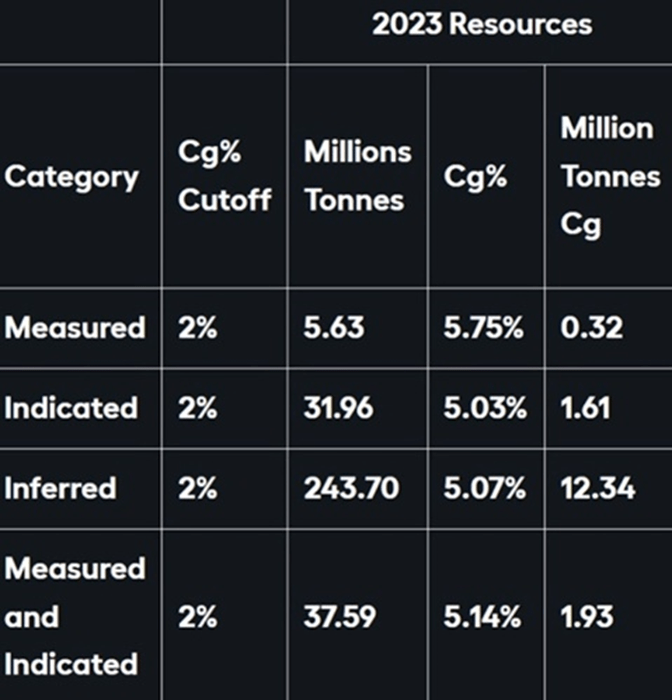

On March 13, 2023, Graphite One updated its resource estimate, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite.

2022 Drilling Program Results Increase Graphite One Measured and Indicated Resource by 15.5%

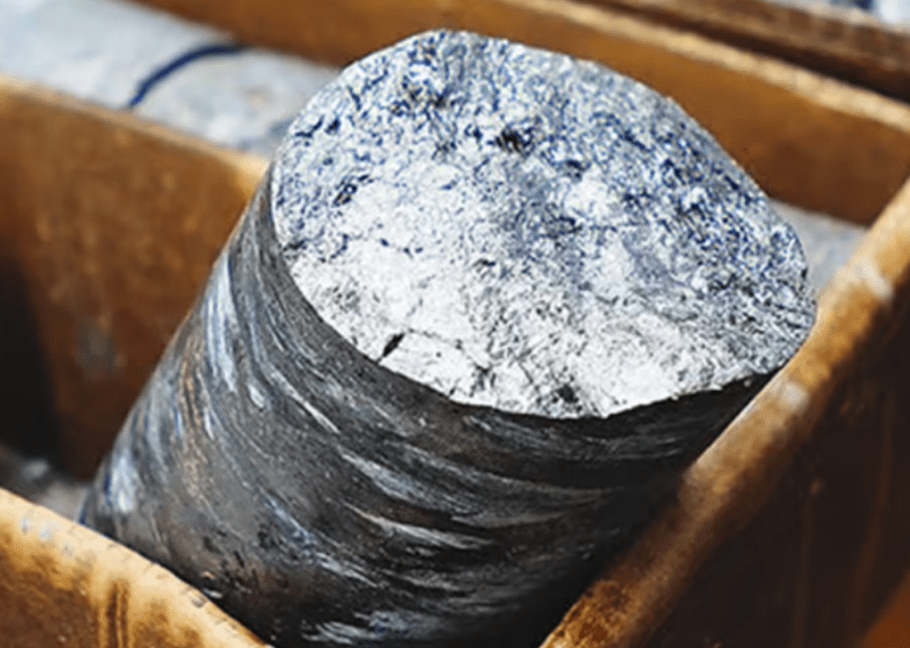

The site hosts 32.5 million tonnes of graphite (measured and indicated) grading 5.25% Cg for 1.7 million tonnes, and 254 million tonnes inferred at 5.11 Cg for 13 million tonnes. In total, 14.7Mt contained graphite. The estimate used a cutoff grade of 2% Cg.

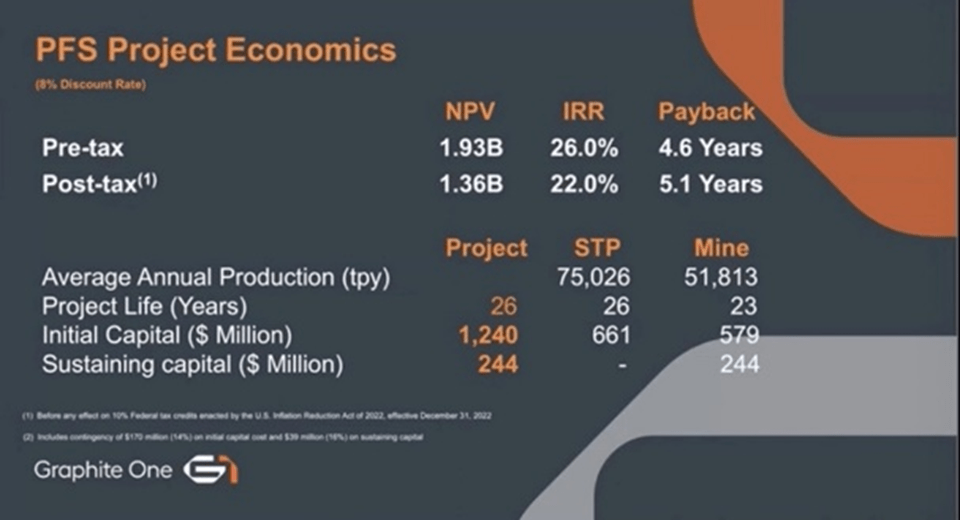

A 2022 prefeasibility study (PFS) portrays the project as highly profitable. The initial capex is $1.1 billion, with production costs of $3,590 per tonne and an after-tax present value, discounted 8%, of $1.4 billion. The internal rate of return is 22%.

Once running, the mine would produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life.

The PFS was based on the exploration of only one square kilometer of the 16-km deposit, meaning that G1 could potentially increase production by a factor several times the proposed run rate of 2,860 tonnes per day.

“The continued expansion of our Graphite Creek resource will support our plan to quadruple the annual production from our PFS study,” said Graphite One Senior Vice President of Mining Mike Schaffner.

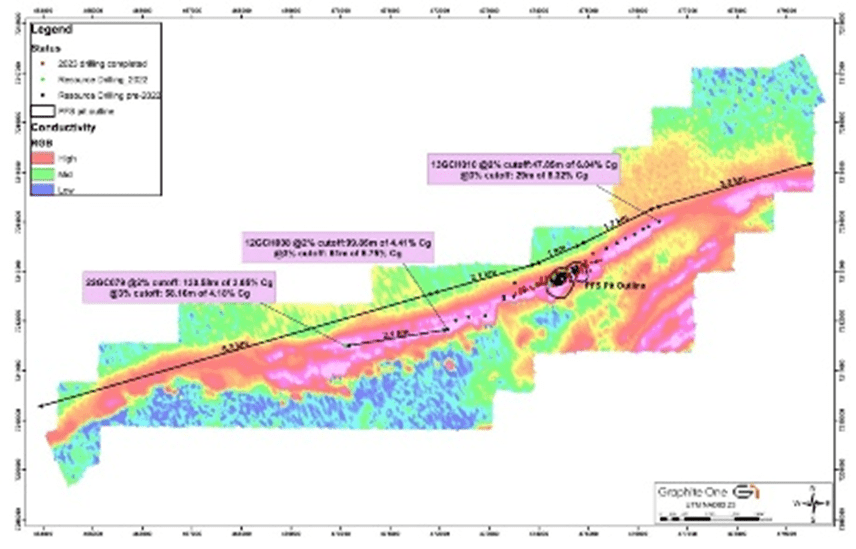

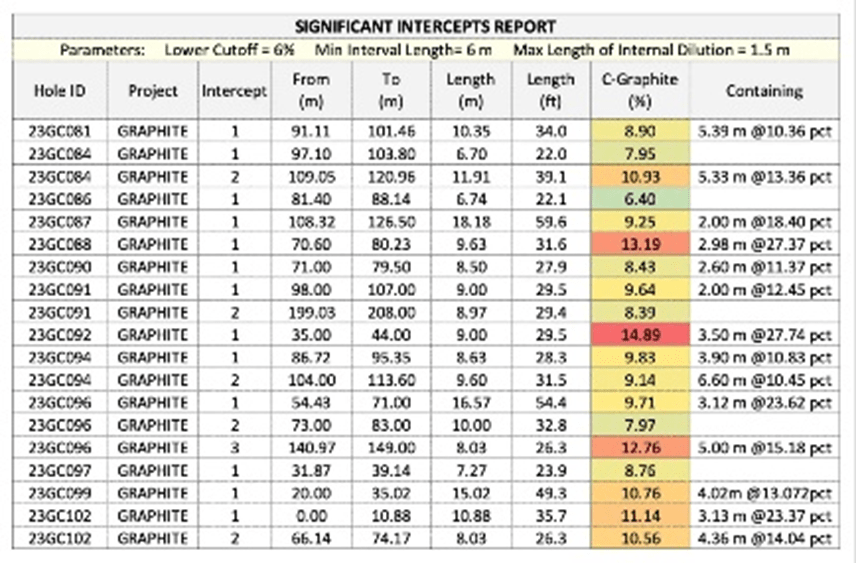

Last year, an 8,736-meter drill program focused on upgrading and expanding the deposit, and collecting data for the feasibility study, saw 52 holes drilled. Highlights included:

- 9.63 meters averaging 13.19% graphitic carbon in hole 23GC088

- 9.0 meters averaging 14.89% graphitic carbon in hole 23GC092

- 15.02 meters averaging 10.75% graphitic carbon in hole 23GC099

- 10.88 meters averaging 11.14% graphitic carbon in hole 23GC102

The company said the results demonstrated exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.

“The results – 52 graphite intercepts over 52 holes – confirm our confidence that Graphite Creek is truly a generational resource of strategic value to the United States, and we wish to thank the Alaskan Government, our funding partners, local stakeholders, and communities for their continued support in advancing this critical asset,” Huston said in the Oct. 23, 2023 news release.

The feasibility study detailing a larger mine at Graphite Creek and a processing plant in Ohio, is expected to be out by year’s end.

Only about 10% of the mineralized trend has been drilled so far.

Graphite Creek geophysical anomaly with resource drilling to date

Summary of 2023 drill results

In its May 2024 project review session with the DoD project team overseeing Graphite One’s $37.5 million Defense Production Act Title III grant, Graphite One senior management outlined plans for the 2024 field season at Graphite Creek. Work remains on schedule to complete the feasibility study as planned by December 2024, subject to financing.

“As we near completion of the feasibility study, we can now say that DoD’s support has cut about two years off of our initial feasibility study timeline,” said Huston.

Moreover, the Department of Defense is now paying a greater percentage of the feasibility study costs than previously announced. In a management and discussion analysis (MD&A) for the first quarter 2024, G1 announced: the Company entered into a revised cost-share agreement with the Department of Defense (“DoD”) to adjust the DoD’s share of expenditures associated with the feasibility study from 50% to 75% based on a revised contract value of $49.8 million. The DoD’s maximum share of the expenditures is now $37.3 million.

In other words, the DoD will still pay $37 million, but with significant savings achieved on the feasibility study, enough to lower the cost from $75m to $50m, DoD’s cost share increases from 50% to 75% — great news for Graphite One and its shareholders.

Graphite One’s 2024 field program has just been announced. It will gather the remaining data required to complete the feasibility study. The company says three drill rigs are currently operating to glean geotechnical information needed to engineer the pit walls and foundations for the process facility, tailings/waste rock facility and other infrastructure.

Twenty-two summer job positions have been filled by local residents from the communities of Teller, Brevig Mission and Nome.

Along with the drill program, site visits and field work by the engineering team and environmental specialists are also underway to continue baseline studies on: surface water quality; ground water quality; hydrogeologic investigations; bathymetric and water quality characterization of the Imuruk Basin; fish and other aquatic species surveys; raptor nesting; and cultural heritage/archeological investigations.

The infrastructure

Graphite One’s development of the Graphite Creek deposit, coincides with a major push by the United States government to upgrade the area’s infrastructure, especially its port facilities.

The increased commercial interest in Alaska both from a shipping and a resource development perspective — the area is rich in minerals — has policymakers and maritime experts concerned about the area’s lack of a deep-water port.

A U.S. Coast Guard patrol board encountered seven Chinese and Russian naval vessels cooperating in a 2023 exercise about 86 miles north of Alaska’s Kiska Island, Military Times said, adding that in 2021, Coast Guard vessels spotted Chinese ships 50 miles north of the island.

To answer such concerns, the U.S. Military is building up resources in Alaska, placing fighter jets at bases in Anchorage and Fairbanks, establishing a new Army airborne division, training soldiers for cold-weather conflicts, and ensuring missile defense capabilities.

The Military has nine bases in Alaska, the largest being the Joint Base Elmendorf Richardson camp, but none have deep water port facilities. The Navy and the Marine Corps currently have no presence in Alaska.

Beyond strategic/ military concerns, there are obvious economic reasons for building a deepwater port in Alaska, occasioned by a warming planet.

Earlier this year, Military Times wrote that, as the Arctic Sea ice retreats, shipping lanes are opening up and more tourists are venturing into Nome, Alaska, a town best known for the Iditarod Sled Dog Race and its 1898 gold rush.

As far back as 2013, the U.S. Army Corps of Engineers (USACE) and Alaska’s Department of Transportation pared down a list of 14 potential sites in northwestern Alaska that could serve as the future location of a deep-water port to two: Nome and Port Clarence.

Both communities are within a mile of areas with depths of 45 feet, deep enough to handle most ships.

However, to AOTH at least, it is readily apparent that Nome is farther ahead as a deepwater port destination, including receiving hundreds of millions of dollars in government funding.

In June of last year, The Associated Press reported that Nome, population 3,500, is slated to become the country’s first deepwater Arctic port, thanks to a $600 million expansion that would see the new facility operational by 2030.

The first part of the project is funded by $250 million in federal infrastructure money, with another $175M from the Alaska state legislature, AP said, noting field work should start this year. The expanded dock will accommodate seven to 10 ships at the same time, compared to three currently.

Rendering of the $600M port expansion. Source: City of Nome

The support

The U.S. Department of Defense, the government of Alaska and Bering Straits Native Corporation have all committed to moving Graphite One’s vision of a US advanced graphite materials supply chain forward.

Last August, the DoD awarded Graphite One with a technology investment grant of $37.5 million under Title III of the Defense Production Act. The funds are to be put towards the feasibility study.

The company subsequently announced it had entered into a one-year $5 million loan agreement with Taiga Mining Company, its largest shareholder.

In September, Graphite One closed a $2 million strategic investment by way of a private placement from Bering Straits Native Corporation, with an option to invest a further $8.4 million in the company.

Regarding the initial $2 million invested in Graphite One by the BSNC, interim president and CEO Dan Graham said:

“This is not just an investment in Graphite One, it is a long-term investment in our region. We at BSNC have watched for years as Graphite One has worked to advance the Graphite Creek project and become a friendly neighbor in the region. Graphite One has told us of its intent to develop an environmentally responsible project and provide an exciting economic opportunity for the region that hopefully will play a crucial role in the nation’s transition to a clean energy future. This is at the heart of our Board’s unanimous support of the project.”

Also in September, Graphite One was awarded a $4.7 million contract from the Defense Logistics Agency (part of the DoD), to develop a graphite and graphene-based foam fire suppressant as an alternative to PFAS fire-suppressant materials, as required by US law.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

G1’s project continues to receive strong support from Alaska politicians, including Senators Lisa Murkowski and Dan Sullivan and Congresswoman Mary Peltola, as well as Alaska Governor Mike Dunleavy. In July 2023, Senator Murkowski took the Senate floor to express support for Graphite One and its development of the Graphite Creek deposit near Nome.

In her address, Sen. Murkowski stated, “I’ve always supported Graphite One and what they’re doing in Alaska, but after my site visit there on Saturday, I’m convinced that this is a project that every one of us, those of us here in the Congress, the Biden Administration, all of us needs to support. Graphite One’s vision is to build a complete domestic supply chain for natural graphite. Their project would be anchored by responsible mining of the Graphite Creek deposit producing tens of thousands of metric tons a year, but it would also extend to a battery anode manufacturing facility in [Ohio] which would be co-located with a battery recycling plant, which is why their CEO Anthony Huston often describes Graphite One as a technology company that mines graphite. This, Mr. President, is a major opportunity for us.”

Conclusion

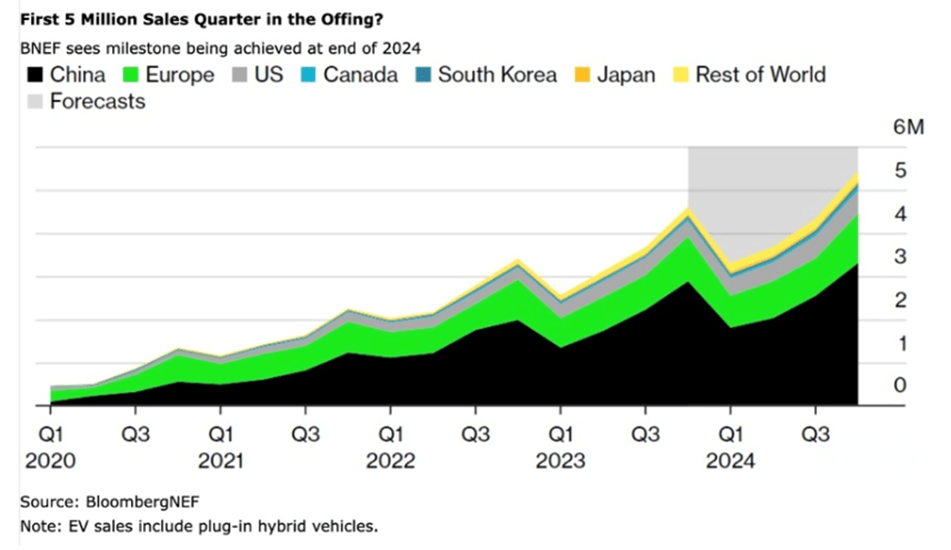

The world needs more graphite, a key ingredient in EV batteries and energy storage systems that we have no substitutes for.

The U.S. Energy Department forecasts that global graphite demand could be more than eight times current production by 2035.

But graphite supply is highly concentrated in the hands of one producer — China — which outputs 80% of global supply and controls almost 100% of graphite processing. The US currently produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

Washington has finally begun to recognize this vulnerability, in 2022 declaring graphite and four other key battery minerals at risk of supply disruptions, as “essential to the national defense.”

Graphite’s war-fighting capabilities

Graphite One’s Graphite Creek deposit in Alaska is the largest in the United States and among the biggest in the world, making it the obvious solution for making the country less graphite dependent.

Based on anticipated production of 51,813 tonnes of graphite concentrate per year, Graphite Creek represents nearly two-thirds (62%) of the US’s current 83,000 tonnes of imported graphite. Remember, Graphite One plans to quadruple that in the feasibility study. If the figure comes to fruition, Graphite Creek would not only satisfy US needs for graphite but also create opportunities for export.

The mine is indeed world-class. It currently hosts just under 15 million tonnes of contained graphite, and that’s without extensive exploration.

Only about 10% of the mineralized trend has been drilled so far. The results of a 52-hole drill program in 2023 demonstrated what G1 described as “exceptional consistency of a shallow, high-grade graphite deposit that remains open both to the east and west of the existing mineral resource estimate.”

The feasibility study, which is three-quarters paid for by the Department of Defense, detailing a larger mine at Graphite Creek and a processing plant in Ohio, is expected to be out by year’s end.

It is highly unusual for the government to bankroll a junior’s feasibility study, let alone to be invited to the White House to meet with the US President — indicating that this is no ordinary mine development.

Clearly, it is the exceptional quality of the asset which has attracted tens of millions in financial support from the Defense Department and the Bering Straits Native Corporation, and political support from the highest levels of the US government, including the president, Alaska senators, and the Governor of Alaska.

Tacking on the scheduled port infrastructure improvements, it seems to me that an unhindered path to production is shaping up for Graphite One at Graphite Creek.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.06.26 share price: Cdn$0.69

Shares Outstanding: 137.8m

Market cap: Cdn$95M

GPH website

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH

is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE