Rick Mills “Diamonds Thrill Again In Saskatchewan”

As a general rule, the most successful man in life is the man who has the best information

De Beers shaped today’s diamond market. They started in the U.S. back in the late 1930s.

De Beers wanted to expand its market (at the time De Beers controlled 90% of the global diamond market). Diamonds, the larger diamonds, had always symbolized wealth and status but how could De Beers market the smaller diamonds to the masses?

In 1938, De Beers hired Philadelphia ad agency N.W. Ayer. The agency set an ambitious goal, they set out to: “create a situation where almost every person pledging marriage feels compelled to acquire a diamond engagement ring.”

A U.S. promotional campaign was planned and it focused on telling every guy (and maybe even more important every girl) that he absolutely needed to give his special her a diamond ring (and diamond jewelry) to express his true love and lasting commitment, because, just like his love and commitment, ‘a diamond is forever.’

“The agency wanted to make it look like diamonds were everywhere, and they started by using celebrities in the media. “The big ones sell the little ones,” said Dorthy Digham, a publicist for De Beers at N.W. Ayer.”

How Diamonds Became Forever,The New York Times

The “A Diamond is Forever” campaign was so successful the U.S. became, and still is at $9 billion a year, the world’s largest diamond jewelry market.

The same campaign was also a huge success in Japan with diamonds replacing pearls in the 1950s. Today China and India’s 2.6 billion people are targeted – because only diamonds can show her how you truly feel.

“If you look back 20 years, there was no diamond acquisition culture in China. But today in Beijing, Shanghai, and Guangzhou, there is an obvious launch pad. 40% of brides in those cities are getting diamond engagement rings. It was zero 15 years ago.” Gareth Penny, CEO DeBeers

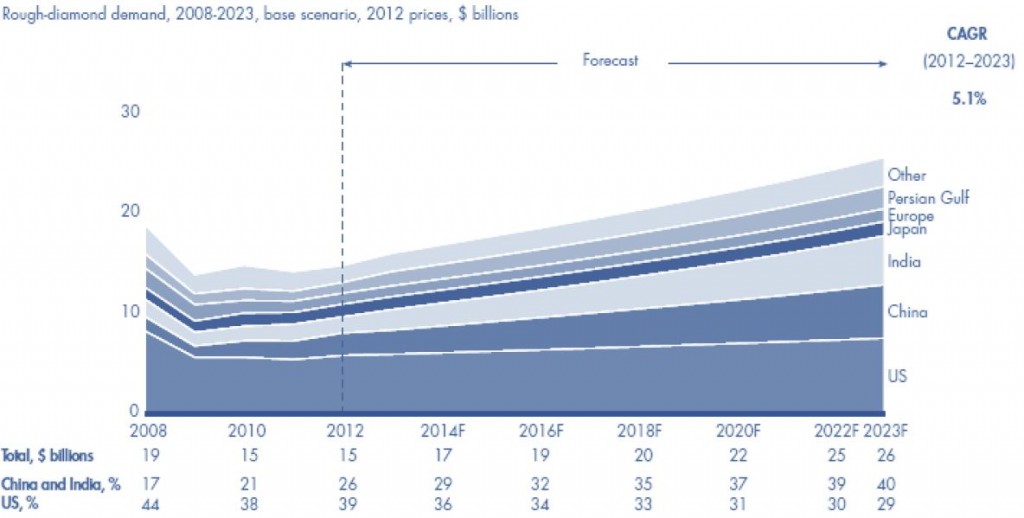

The decade to come will be the years of the diamond. According to a Bain & Company report global rough-diamond demand in value terms should increase at a compound annual rate of 5.1%, to $26 billion by 2023.

“The appetite for high-quality diamonds in China and India is growing,” notes Gerhard Prinsloo, the author of the report.” In terms of market share, India and China will represent 30% by 2020, equal to that of the United States. Supply should only increase by 2.8% per year, leading to a structural shortage.”

Diamond demand, over the next decade or so, will be particularly driven by India and China due to a doubling of the middle class in these countries (of the two China has the fastest growing demand, jumping to a share of about 15 percent of the world’s diamond market from less than three percent in 2003).

There’s no shortage of future markets – it won’t be long before one out of every four people on the planet is going to be an African. They don’t know it yet but there’s diamond jewelry in most of their futures.

Dundee Capital Markets

Current diamond demand is 175 million carats, by 2020 demand is expected to reach 247 million carats.

Two new diamond mines are expected to start production in Canada over the next few years – Gahcho Kué and Renard.

Dominion Diamond’s Ekati mine will increase production by starting to mine the Misery pipe.

Globally there are three large mines scheduled to start operations within the next four years: Lace, Botuobinskaya and Bunder.The last major mine discovery came a decade ago in India, at Rio Tinto’s yet to be completed Bunder project.

LUKoil’s Grib mine started production this earlier this year and Alrosa’s Karpinskogo mine started production in October.

Some of the largest and most important mines in the world are running out of diamonds to mine – Orapa and Jwaneng (Botswana) have less than 15 years of production left at current parameters. Orapa and Jwaneng are the largest diamond mines in terms of total dollar value produced.

The alluvial Marange diamond fields (Zimbabwe – 13% of global rough supply in 2013) are expected to produce eight million carats of diamonds in 2014. Mining is transitioning from easily accessible loose surface gravel to hard conglomerate rock. Most miners are not willing to make the necessary investment at current rough diamond prices. Conglomerate rock grades are 0.4-0.5 carats per tonne while surface grades were 3.75 cpt

Marange is the largest producing project in the world in terms of total carats produced. It is third in terms of total dollar value after Botwana’s Orapa and Jwaneng mines.

Pikoo Kimberlite Field

Let’s take a look at what might well be the world’s newest emerging diamond district.

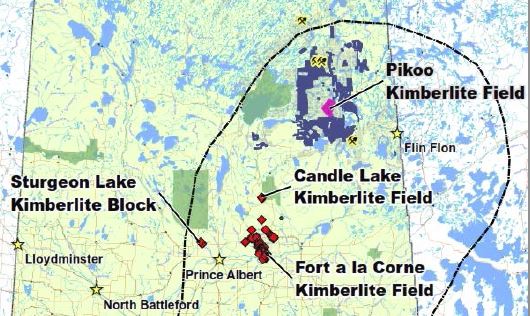

Stornoway Diamond Corp.’s (TSX – SWY) regional exploration programs were intended to test the diamond potential of the Sask craton in north-central Saskatchewan.

Assortment of kimberlitic indicator minerals including purple pyrope, red, orange and pink pyrope garnets, chromian diopside, picroilmenite and chromite.

Exploration work included KIM sampling programs, an airborne geophysical survey (to detect magnetic differences on the ground), prospecting and geophysical anomaly checking – ground truthing of targets.

Kimberlite indicator mineral (KIM) sampling consists of digging a hole and taking up to 20 kg of glacial till – dirt – and sending it to a laboratory for the recovery and analysis of indicator minerals – if any

Indicator minerals such as pyrope garnets, chromites, and ilmenites are used as kimberlite tracers because these KIMs are found in the same place diamonds form, deep beneath the earth’s surface in the diamond stability field.

Kimberlite magma comes up from below the diamond stability field and takes indicator minerals, and hopefully diamonds, all the way to the Earth’s surface…

“Kimberlite, a variety of ultramafic volcanic and sub-volcanic rock, is the dominant source of diamonds worldwide. It is widely accepted that the majority of diamonds are not formed within the kimberlite and much evidence points towards an ancient origin for most diamond in the

deep lithospheric keels of Archaean cratons. The kimberlites, therefore, are transporting agents that ‘‘sample’’ deep, occasionally diamond-bearing, mantle material and rapidly convey it to surface.” DIAMONDS AND ASSOCIATED HEAVY MINERALS IN KIMBERLITE: A REVIEW OF KEY CONCEPTS AND APPLICATIONS TOM E. NOWICKI, RORY O. MOORE, JOHN J. GURNEY AND MIKE C. BAUMGARTNER

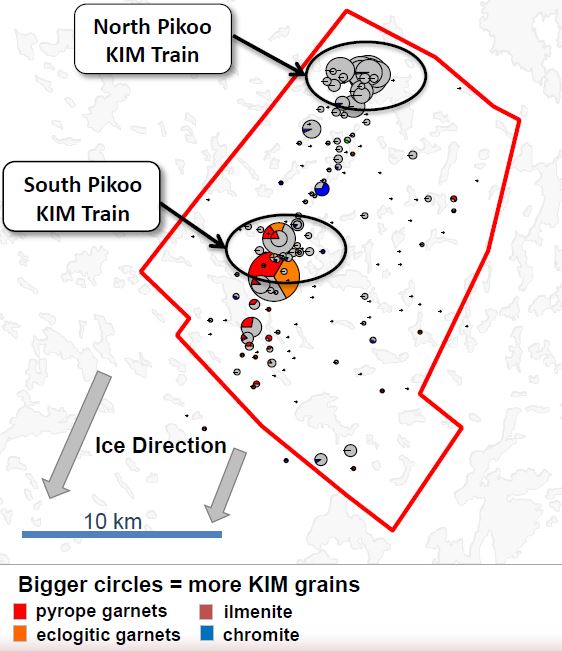

Glaciers smear the visually distinctive, dense and resistant to weathering indicator minerals across the surface in a fan shaped pattern called the indicator train. The train narrows back to a source (>).

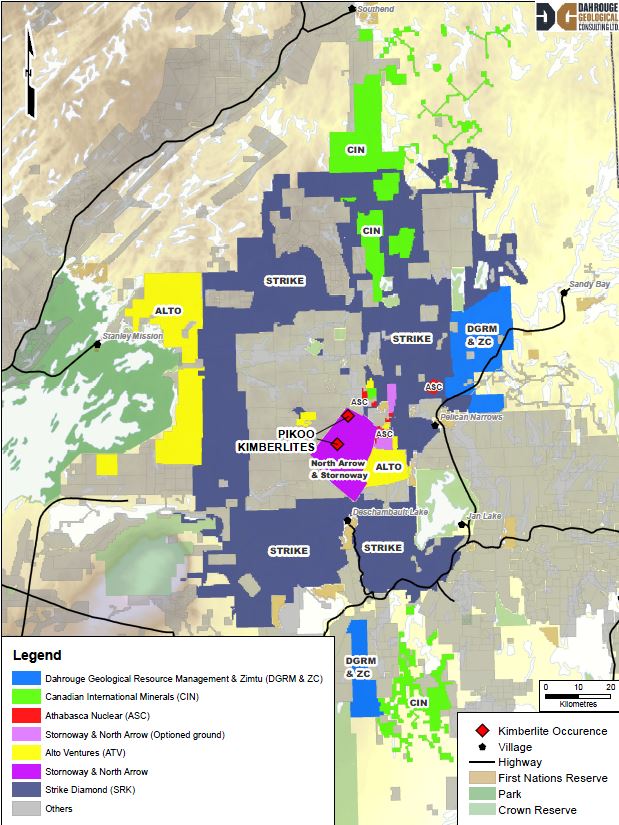

The terms up ice or down ice simply refers to where you are in relation to a kimberlite source. Take a look at the next map, find Pelican Narrows and Deschambault Lake. The glaciers came in from the north east heading south west. Ice direction would be from Pelican Narrows towards Deschambault Lake. If you found a kimberlite in the middle of the two villages Pelican Lake would be up ice, Deschambauly Lake down ice.

The Pikoo claims were staked by Stornoway, in February and March of 2011, based on their regional test results.

The black outline is the North Sask Craton boundary

The Pikoo claim block was optioned to North Arrow Minerals TSX.V – NAR.

North Arrow focused on much tighter spaced till sampling than what Stornoway had done with their regional sampling. Two distinct indicator trains, the North Pikoo train and the South Pikoo train were found.

Both the North and South Pikoo trains were drill-tested in July of 2013. The 2,000 meter program resulted in the discovery of a new diamondiferous kimberlite field.

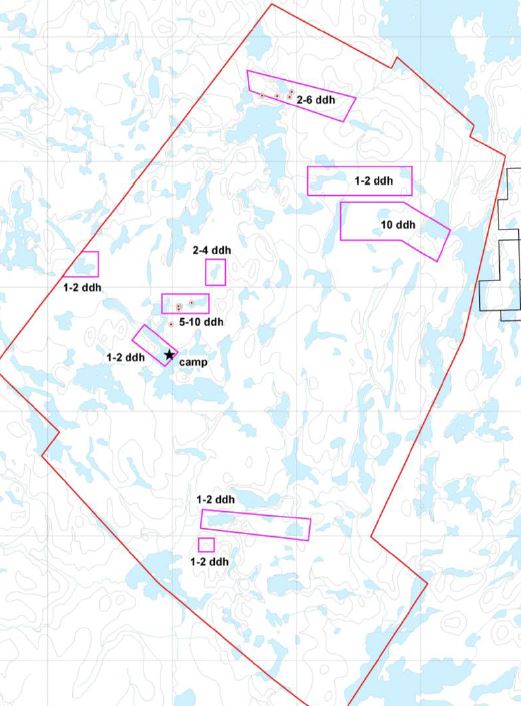

In the North Pikoo area, five drill holes tested an east-west trending target over a 1.1 km strike length. The drill holes encountered between one and six individual kimberlite dykes ranging from 3 cm to 59 cm in width, interpreted to be vertical to steeply south dipping. Surface anomalies suggest the dyke system extends over a significantly greater strike length than tested by the five hole drill program.

The most significant discovery might of been in the South Pikoo area.

The PK150 kimberlite dyke is a roughly 15 meter wide almost vertical body intersected over a 75 m strike length (3 holes spaced 35 m apart) and is currently open to depth and along strike. Since the indicator mineral trains are a couple of kilometers wide a longer strike length might be established.

According to John Kaiser of The Bottom Fishing Report:

“The kimberlite is comprised of dark grey hypabyssal kimberlite containing abundant olivine as well as common ilmenite and orange to purple garnets and less common chrome diopside.

The kimberlite is also riddled with mantle nodules up to 10 cm in diameter suggesting that the kimberlite magma may have entrained a good payload from the diamond stability field… the micro diamond results are well distributed through the 3-4 sample batches processed for each of the three holes, ruling out the risk of a “nugget effect” from the lucky presence of a particularly rich mantle nodule.”

A 209.7 kg sample of drill core from the kimberlite returned 745 diamonds larger than the 0.106 mm sieve size, including 23 diamonds larger than the 0.85 mm sieve size – considered the cut-off for commercial stones.

The total weight of the +0.85 mm diamonds recovered from the sample was 0.2815 carats, for a total recovery sample grade of 1.34 carats per tonne for stones over +0.85 mm.

Recovered diamonds have similar, high quality characteristics across all size fractions. Over 95% of the diamonds are described as intact, white octahedrons and aggregates.

The large project area hosts additional kimberlite targets and numerous anomalous KIM samples outside of the initial areas of interest (North Pikoo and South Pikoo trains). These areas were more densely till sampled in June and September 2014.

Preliminary results have been received from approximately half of the program samples and have defined new kimberlite indicator mineral (KIM) trains within the property. These KIM trains are separate and discrete from the North and South Pikoo KIM trains.

A winter drill program commencing in February 2015 is being planned to test as many as nine new targets at the heads of these trains as well as some of the untested lake bound and land based targets related to the North and South Pikoo trains. An application was submitted to the Saskatchewan Environment on June 9, 2014 to drill up to 30 drill holes.

NAR and SWY

The Pikoo Diamond Project is a joint venture (JV) between North Arrow Minerals (80%) and and Stornoway Diamond Corp. (20%).

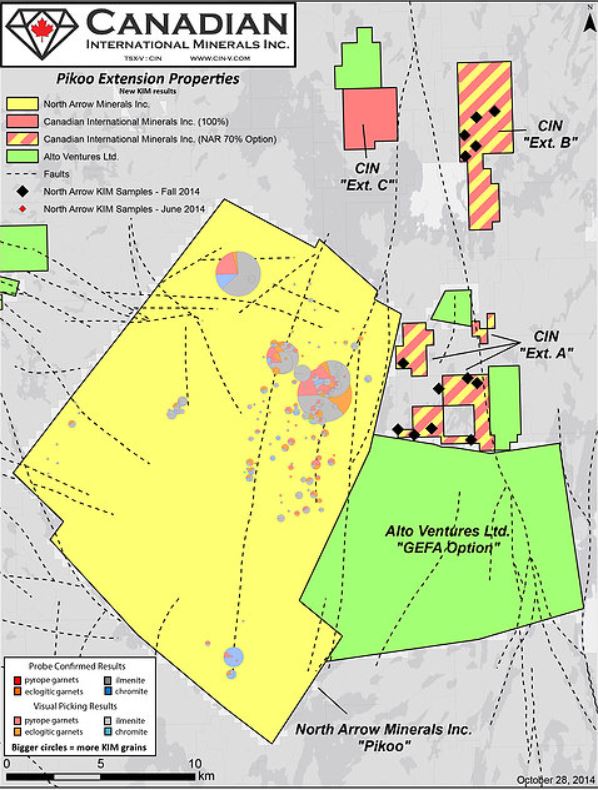

Stornoway has exercised its right to participate in the Pikoo East option agreement between North Arrow (70%) and Canadian International Minerals TSX.V – CIN (30%). The Pikoo East properties comprise 5 claims totaling 3,447 hectares.

The A group directly adjoins North Arrow/Stornoway’s Pikoo property, and the B group lies approximately 7 km northeast of Pikoo’s northern boundary.

Till samples (black blocks on above left map) have been collected on the Pikoo East properties under the option agreement. The samples have been submitted for kimberlite indicator mineral (KIM) processing. Results are expected in early 2015.

Stornoway has also exercised its right to participate in the Orchid property agreement between North Arrow (70%) and Eagle Plains Resources TSX.V – EPL (30%).

Staking Rush

In June of 2013, North Arrow announced they drilled kimberlite at Pikoo.

In November, NAR made headlines by announcing it had high microdiamond counts from the PK 150 kimberlite dyke. The high diamond counts demonstrated the potential for a coarse diamond size distribution (larger diamonds might be found) andestablished Pikoo, and the northern Sask Craton, as Canada’s new diamond district.

Of course a junior resource company staking rush ensued. Click on the map for a larger image.

We know what North Arrow and Stornoway are up to. A few other companies have been quietly working away or entering the play via land acquisitions.

Alto Ventures TSX.V – ATV collected 325 till samples on its 60% owned contiguous to Pikoo properties. Results are expected in December.

Athabasca Nuclear Corp. TSX.V – ASC has just acquired the right to earn an 80% interest in the Prongua Lake diamond project. The Project encompasses 16 mineral claims totaling in excess of 9,270 acres and is located up ice to the north, east, and northeast of North Arrow and Stornoway’s Pikoo project. A number of early-stage geophysical targets have been identified.

Copper Reef Mining TSX.V – CZC completed a small ground magnetic survey and collected an unknown number of till samples on its properties.

Gem Oil Inc., a private company, has done an enormous amount of work. A report is expected sometime in the new year.

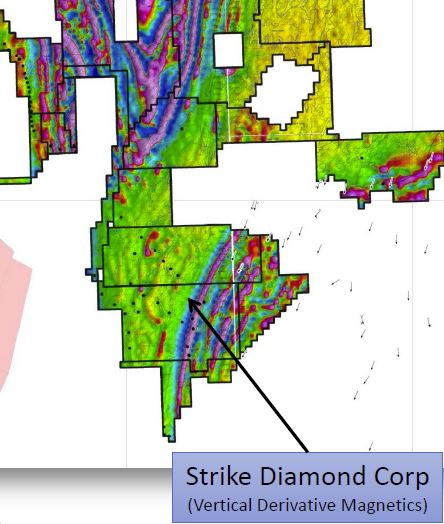

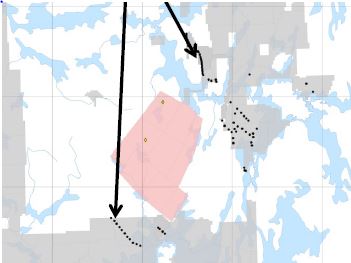

Strike Diamond collected 118 till samples (the majority up ice from Pikoo) on its 80% owned properties. Results from SRK’s property are expected in December/January.

Above, to the left, you can see the arrow pointing to several small subtle circular magnetic lows and highs. These are kimberlite targets. To the left of these kimberlite targets is the western border, in pink, of North Arrows Pikoo claim blocks.

On the map to the right the arrows point to black dots representing where Strike Diamonds took till samples for indicator mineral processing.

Conclusion

Demand for diamonds is not going to fade away, diamonds are a part of our western cultural heritage, and an established and growing eastern one as well. De Beers created value. They packaged it in an acceptable way and delivered it to customers. Diamonds – currently a $72 billion a year industry thanks largely to a De Beers marketing campaign that started in the late ‘30s – are a girl’s best friend.

They may also be a BFF to investors looking for a safe haven from market storms.

Mined diamond supply is not going to be able to keep up with increasing demand – production growth will be limited as older mines become exhausted and production is scaled back, new production is not expected to fill the gap.

There’s close to 800 till samples from Canada’s newest diamond play in the lab for indicator mineral processing.

It just might be a very Merry Christmas and extremely happy New Year for a few diamond focused resource juniors, and their shareholders, in the North Sask Craton Diamond Play.

Saskatchewan diamonds might thrill again and they should be on every investors radar screens. Are they on yours?

If not, maybe they should be.

Richard lives with his family on a 160 acre ranch in northern British Columbia. He invests in the resource and biotechnology/pharmaceutical sectors and is the owner of Aheadoftheherd.com. His articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Please visit www.aheadoftheherd.com

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares in Strike Diamond TSX.V – SRK and Canadian International Minerals TSX.V – CIN.

Athabasca Nuclear Corp. TSX.V – ASC and Strike Diamond TSX.V – SRK are advertisers on Richard’s site aheadoftheherd.com.

This article is not paid for content.

MORE or "INDUSTRY ANALYSTS"

Mickey Fulp - Mercenary Alert: Is Zinc Still a Four-Letter Word?

Read the Report Here Mercenary Alert: Is Zinc Still a Four-Letter Word? ... READ MORE

Top 10 Financings of May 2017

May saw 125 financings close in the Canadian financial markets for C$366.5 million including 64 fina... READ MORE

ORENINC INDEX jumps as gold gets political again

ORENINC INDEX – Monday, June 12, 2017 North America’s leading junior mining finance data provide... READ MORE

The Week of June 5th to June 11th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday June 5th with... READ MORE

The Week of May 29th to June 4th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday, May 29th wit... READ MORE