Rick Mills – Copper Market in Crisis: Supply Squeeze Highlights Importance of Owning Juniors With Metal in the Ground

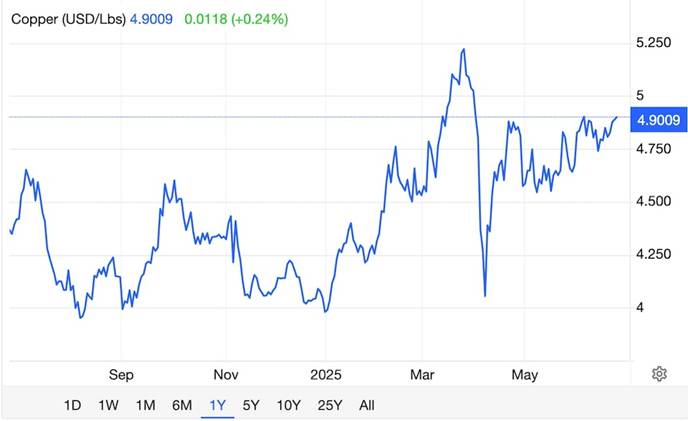

The copper market is in the grips of a systemic supply crunch, with backwardation signaling a paradigm shift.

Traders are reacting to rapidly falling inventories, potential US tariffs, and a pricing crisis at smelters.

Backwardation is when a commodity’s spot price trades higher than longer-dated contracts; it is an indication of tightening supply.

On Monday, June 23, spot copper traded at a $345 per tonne premium to three-month futures on the London Metal Exchange, the highest level since 2021.

Backwardation now extends to June 2026 futures, signaling a market pricing in significant supply shortages. Six months ago, short-term contracts traded at a discount, showing comfortable supply.

Inventories on the LME have plummeted about 80% this year and are down to less than a day of global usage. The depletion has been fueled by a global race to move copper to the United States ahead of anticipated import levies, and gap of as much as $1,000 a tonne between US and LME copper prices.

Refined copper imports to the US topped 200,000 tonnes in April, the highest in over a decade.

Source: Trading Economics

Chinese metal shortages

Despite exporting 120,000 tons in the second quarter, Chinese smelters face margin compression as copper concentrate treatment charges (TCs) fell to $20/ton — a 67% drop year-over-year. This has forced smelters into net short positions concentrated in near-month contracts, amplifying backwardation pressures. (AIinvest.com)

Chinese copper smelters are so desperate for raw materials that they are paying miners to convert their concentrates into refined metal; spot treatment entered negative territory for the first time ever.

According to Mining.com, In a bid to cover short positions on the London Metal Exchange some Chinese smelters are rapidly ramping up exports.

At least 30,000 tonnes of copper from smelters including Jiangxi Copper and Tongling Nonferrous Metals Group are poised to be delivered to LME warehouses in Asia in the coming weeks, anonymous sources told Bloomberg on Wednesday…

Reuters, also quoting unnamed persons with knowledge of the matter, reports nearly 10 Chinese smelters were preparing to deliver 40,000–50,000 tonnes to LME inventories.

Exports at these levels would bring renewed pressure and could potentially tip the Chinese market into backwardation as well.

Potential US tariffs

In February, President Trump directed the US Commerce Department to investigate the need for copper tariffs, with a report due within 270 days. If implemented, the Section 232 tariff investigation could raise US prices by 20%.

Demand-supply mismatch

AIinvest reports global copper consumption grew 8.2% year-over-year in the first quarter, fueled by renewable energy infrastructure and EV production. On the other hand, mining output faces headwinds, including power outages in China and Glencore’s Altonorte refinery shutdowns, which reduces 2025 supply by 350,000 tons.

No more copper surpluses — Richard Mills

Demand

Global copper consumption has increased steadily in recent years and currently sits at around 26 million tonnes. 2023’s 26.5 million tonnes broke a record going back to 2010, according to Statista. From 2010 to 2023, refined copper usage increased by 7 million tonnes.

Wall Street commodities investment firm Goehring & Rozencwajg quoted data from the World Bureau of Metal Statistics confirming that global copper demand remains robust, outpacing supply.

The shift to renewable energy and electric transportation, accelerated by AI and decarbonization policies, is fueling a massive surge in global copper demand, states a 2024 report by Sprott.

Increasing investments in clean technologies like electric vehicles, renewable energy and battery storage should cause copper demand to climb steadily, and challenge global supply chains to meet this demand. Artificial Intelligence, data centers, 5G, global infrastructure build out and a global effort to rearm the world’s militaries all contribute to increased copper usage. And than there’s an expected copper demand push to achieve “use parity per capita” by the vast majority of the world’s population.

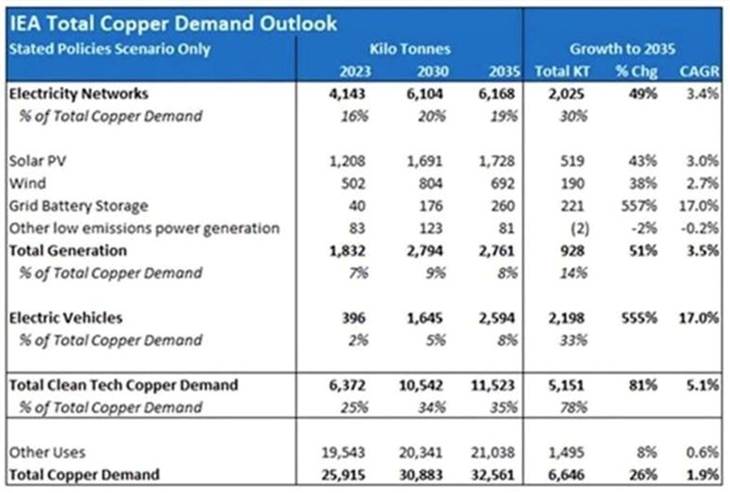

The report cites figures from the International Energy Agency (IEA), such as global copper consumption growing from 25.9 million tonnes in 2023 to 32.6Mt by 2035, a 26% increase. Clean tech copper usage is expected to rise by 81%, from 6.4Mt in 2023 to 11.5Mt in 2035.

Source: International Energy Agency (IEA)

The IEA expects the copper needs from electricity networks to grow from 4.1Mt in 2023 to 6.2Mt by 2035, an increase of 49%. Copper demand for solar panels is expected to rise by 43% and for wind power by 38% over the same period.

The fastest-growing area, though, is grid battery storage, where copper demand is expected to surge by 557% to 2035 as the need for energy storage increases, Sprott writes.

Copper demand for EVs is a close second, with a projected rise of 555% from 396,000 tonnes in 2023 to 2.6Mt by 2035, with EVs accounting for 8% of global copper consumption by that year.

BHP foresees global copper demand increasing by 70% to reach 50 million tonnes annually by 2050.

Supply

On the supply side, BHP points to the average copper mine grade decreasing by around 40% since 1991. The next decade should see between one-third and one-half of the global copper supply facing grade decline and aging mine challenges. Existing mines will produce around 15% less copper in 2035 than in 2024, states the company.

“Most of the high-grade stuff’s already been mined,” says Mike McKibben, an associate professor emeritus of geology at University of California, Riverside, quoted recently by NPR. “So, we have to go after increasingly lower grade material” that costs more to mine and process, he says.

Shon Hiatt, a business professor at the University of Southern California, said, “It’s projected that in the next 20 years, we will need as much copper as all the copper that has ever been produced up to this date.”

Mining Technology reports that global copper production in 2024 was poised to reach a new high of 22.9Mt, a 3.2% increase from 2023. A confirmation is provided by the US Geological Survey, which showed mine production in 2024 of 23Mt, 600,000 tonnes more than 2023.

The supply increase is being driven by expansions at key mining operations in several countries including Chile — the top producer — the DRC, Russia, Zambia and China.

Mining Technology notes Chile was set to see a substantial bump in 2024 output thanks to the expansion of Teck Resources’ Quebrada Blanca mine — 252,200 tonnes compared to just 62,700t in 2023, a 303% increase.

GlobalData forecasts a CAGR of 4.2% for global copper production, reaching 29.3Mt by 2030. Note from above, however, the IEA predicts global copper consumption reaching 32.6Mt by 2035, creating a potential shortfall of 3.3Mt.

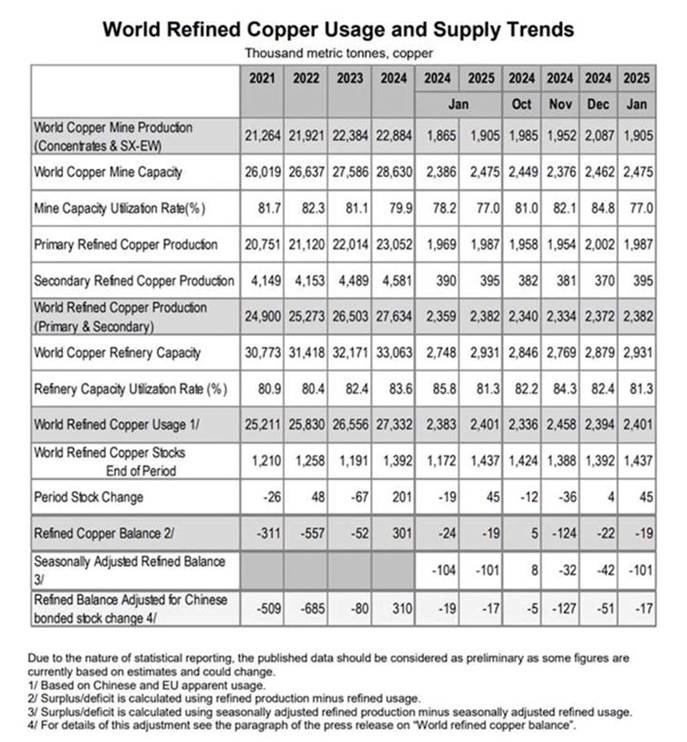

Source: World Copper Factbook 2024

Deficit

Full-year 2024 copper supply figures are available from the International Copper Study Group. In its January report, the ICSG shows a slight increase in world copper mine production, 22.884 million tonnes in 2024 versus 22.384Mt in 2023.

Last year saw a surplus of refined copper production, 301,000 tonnes, determined by subtracting world refined copper usage of 27.332Mt from world refined copper production of 27.634Mt.

Source: International Copper Study Group

However, that could change as early as this year.

According to Swiss bank UBS, via EV Magazine, the current copper surplus will swing to a deficit exceeding 200,000 tonnes in 2025.

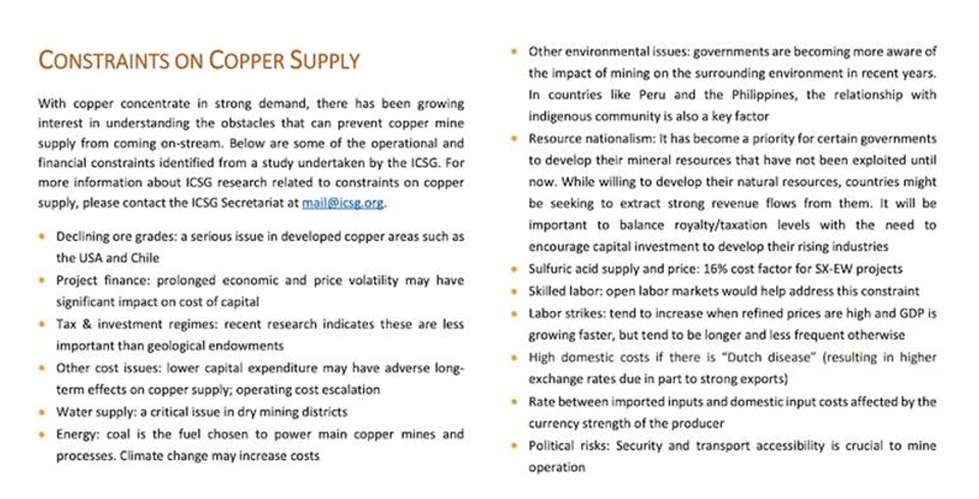

What could cause the copper market to fall into a large deficit hole from which it would be very difficult to climb out of? There are several factors.

Last year S&P Global commissioned a report that blamed the shortfall on underinvestment in new exploration and mines due to the industry’s focus on short-term returns (NPR)

It noted the copper industry faces pressures from the need to decarbonize itself; political instability in many countries which mines are located; and reputational damage from its history of safety and environmental failures. The latter means the industry is now under greater scrutiny from regulators and community groups.

The firm predicts copper supply will be unable to keep up with demand from as early as 2025; demand could double to 50Mt by 2035.

In a piece by the International Energy Forum (IEF), Goldman Sachs found that regulatory approvals for new mines are on a downward trend, having fallen to the lowest level in 15 years, which is particularly disturbing since it can take 10 to 20 years to approve and develop a mine in North America.

Another factor behind depleting copper supply is a lack of new discoveries.

According to Crux Investor, citing S&P Global Commodity Insights, despite a 12% increase in exploration budgets in 2023, the industry has seen only four major discoveries in the past five years (2019-2023), totaling a mere 4.2 million metric tons (MMt) of copper. This marks a significant downturn in the frequency and size of major discoveries compared to previous decades.

What’s behind this trend? Crux says companies are increasingly focused on brownfield (past-producing) assets rather than engaging in greenfield exploration that could yield new, large-scale discoveries.

Early-stage exploration budgets have dropped to a record low of 28%, compared to the 50-60% allocation that was typical in the 1990s and early 2000s.

Crux says the copper market is heading towards a significant supply-demand imbalance, making the following supporting points:

- A refined copper deficit is projected to begin in 2027.

- The concentrate market is currently in deficit and expected to remain so for the next five years.

- Mine supply is forecast to peak in 2029.

A potential concentrate deficit of 2.2Mt is expected by 2032.

In this tightening copper market environment, we want to position ourselves to capitalize on the rising copper price. In particular, we want junior resource companies with large stores of copper “in the ground”. Below are four companies which fit that description.

Kodiak Copper (TSX-V:KDK) (OTCQB:KDKCF) (Frankfurt:5DD1)

Kodiak’s MPD project is a 344-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt. MPD is between the towns of Merritt and Princeton, with year-round accessibility and excellent infrastructure nearby.

4 reasons I like KDK to leverage booming copper price

PTX Metals (TSX-V:PTX) (OTCQB:PANXF)

W2 is PTX Metals’ PGE-nickel-copper-cobalt project located in Ontario’s Ring of Fire. On W2’s central part there are two resource areas: the AP Zone named after Aurora Platinum; and the CA Zone which has two areas, CA1 and CA2.

Under the Spotlight – Greg Ferron, CEO PTX Metals

Silver47 Exploration Corp. (TSX-V:AGA)

Silver47 has ample copper mineralization in its Red Mountain project.

Red Mountain is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

Silver47 and Summa Silver merge into high-grade US silver explorer

Max Resource Corp (TSX-V:MAX) (OTC:MXROF) (Frankfurt:M1D2)

Max has spent much of the last five years building one of the most intriguing grassroots copper-silver exploration plays in the world.

After two years of regional prospecting in the Cesar Basin of northern Colombia, Max proved the presence of a new sedimentary basin while recording over 1,000 copper-silver occurrences over which Max filed, and acquired, a remarkable land position covering over 1,300 sq km and including 20 mining concessions and dozens more applications.

Deciphering Max Resources’ plan to Maximize Shareholder Value

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE