Rick Mills – “Cooler Inflation Backs Case for Rate Cuts, Lower Dollar and Higher Copper, Silver and Gold Prices”

Metals skidded lower on Wednesday, in reaction to a more hawkish-than-expected US Federal Reserve decision.

At its June meeting, the Federal Open Market Committee decided for the seventh straight time to hold interest rates unchanged, but signaled that it plans to cut rates once, by 0.25%, before year’s end.

The Fed previously forecasted two rate cuts, but the central bank is proceeding more cautiously due to a pickup in inflation in early 2024.

Still, the inflation print Wednesday bolstered the view that prices moderated in the second quarter. Overall inflation was flat in May, USA Today reported, with the core consumer price index (CPI) (excluding food and energy) registering 3.4% compared to 3.6% in April.

Bloomberg said the year-over-year measure showed inflation cooling to the slowest pace in more than three years.

“May’s CPI report is encouraging — and the core PCE deflator will likely be even more so. We anticipate a string of similar reports this summer, setting the stage for the Fed to start cutting rates in September,” Bloomberg economists Anna Wong, Eliza Winger and Estelle Ou wrote.

“In recent months, there has been modest further progress toward the (Fed’s) 2 percent inflation objective,” the Fed said, but also reiterated that it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation (now running about 3% to 3.5%) is moving sustainably toward” the Fed’s 2% goal.

We’ve always said the Federal Reserve would need to see a few months of steadily lower inflation before it proceeds with rate cuts.

But the latest data bodes well for a looser monetary policy.

CNBC reported Traders seemed encourage, with the S&P 500 jumping to a record Wednesday after the statement was issued…

For the period through 2025, the committee now sees five total cuts equaling 1.25 percentage points, down from six in March. If the projections hold, it would leave the federal funds rate benchmark at 4.1% by the end of next year.

Early Wednesday the dollar dropped the most in a month, with the Bloomberg Dollar Spot Index falling 0.5%, the most since May 15, as central banks in the euro region and Canada started lowering borrowing costs. (Bloomberg, June 12, 2024)

The case for all commodities rests upon the US dollar. Once the Fed starts cutting interest rates, the dollar will weaken and the entire commodities complex will strengthen.

Investing in juniors has historically been a good way to leverage rising copper and precious metals prices.

Juniors help the majors to replace the ore that they are constantly depleting in their operating mines, thereby helping to overcome the supply shortfall that is coming for several metals.

Our three favorites are gold, silver and copper.

Copper

Copper futures extended their downturn to $4.50 per pound mark in June, the lowest in over a month and fully erasing May’s rally that took prices to a record high of $5.20.

Still, prices are 13% higher year-to-date amid speculative bets of looming shortages. (Trading Economics)

Copper is forecast at $10,000 a ton (below the $11,000/t incentive price to build new mines) by year’s end, from the current $9,918.

Source: Trading Economics

Copper is essential to the energy transition from fossil fuels to electrification and decarbonization.

Along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now added demand for copper in electric vehicles, EV charging stations, and renewable energy systems.

Copper is used in a plethora of manufacturing processes, so commodity analysts keep a close eye on economic growth and manufacturing to get an idea in which direction copper prices are headed.

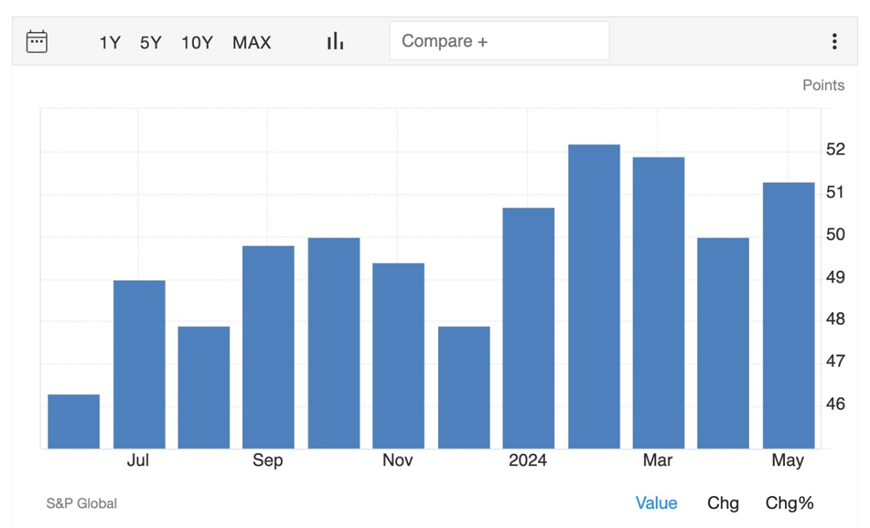

The S&P Global US Manufacturing PMI was 51.3 in May compared to 50 in April. The reading signaled a modest improvement in the health of the manufacturing sector, the fourth in the past five months, states Trading Economics.

S&P Global US Manufacturing PMI. Source: Trading Economics

Unfortunately, the manufacturing bright spot in the world’s largest economy is not matched by the number two economy. China’s official manufacturing PMI contracted in May, and trade data shows a 7.1% annual drop in imports of copper ore, as refiners use scrap copper to support output. Chinese inventories rose to their highest since 2020.

Nevertheless, in recent years, the mining sector has faced output constraints, plagued by protests, closures, water shortages and lower ore grades.

A New Copper Supercycle Is Emerging

Nearly 600,000 tonnes of copper supply didn’t come to market last year due to the Panama government’s closure of Cobre Panama, and a strike at the Las Bambas copper mine in Peru.

Anglo-American says its 2024 Chilean production will disappoint, at between 210,000 and 270,000 tonnes owing to head grade declines and logistical issues at its Los Bronces mine. (Goehring & Rozencwajg)

Chile’s copper output has been dented by a long-running drought in the country’s arid north. Codelco’s 2023 production was the lowest in 25 years.

Goldman Sachs has said it predicts a copper deficit of over half a million tonnes in 2024 due to mining disruptions. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” analysts at the bank wrote, via Oilprice.com.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

According to the International Energy Agency (IEA), to keep the world on a path to net zero carbon emissions, copper must rise from 25 million tons to 35 million tons by 2030.

In 2023, mines only produced 22Mt globally.

Kodiak Copper (TSX–V:KDK) (OTCQB:KDKCF) (Frankfurt:5DD1)

Kodiak Copper’s MPD property is surrounded by several producing and past-producing mines. The producers are Copper Mountain to the south, Highland Valley in the north, and New Afton, close to Kamloops, re-opened by New Gold in 2012.

The project lies within the southern portion of the Quesnel Terrane, British Columbia’s main copper-producing belt.

Historical drilling saw 384 holes completed since the 1960s by previous operators. Most of the drills tested mineralization from surface, with holes rarely testing below 200m depth.

Over the past four years, Kodiak Copper has completed 123 drill holes or 74,804 meters.

The company tasted success during its maiden drill program in 2019 with the discovery of the Gate Zone.

Kodiak Copper is mobilizing two drill rigs to start a 10,000-meter drill program focused on multiple drill-ready targets in the MPD North and South project areas. The goal is to locate high-grade mineralization, expanding the near-surface mineralization around known zones, and making new discoveries.

Kodiak Begins 2024 Exploration Program at its MPD Copper Gold Porphyry Project

This year’s field program is unique for Kodiak Copper in that artificial intelligence (AI) is being used to generate and confirm drill targets.

Six target areas are slated for drilling: two at MPD North (Belcarra and Blue) and four at MPD South (1516, South, Adit and Celeste). The targeting strategy involves the integration of targets developed by Kodiak’s exploration team and VRIFY AI’s predictive modeling.

VRIFY has recognized nine areas of interest, either adjacent to known copper-porphyry zones (Gamma, Zeta, Epsilon, Lambda, Omega and Sigma), or as new priority regions (Omicron, Iota and Tau) which merit follow-up.

“With Kodiak’s recently announced financing we will be fully funded for a substantial drill program as we continue to systematically prove that our district-scale MPD project has the potential to become a world-class mine,” CEO Claudia Tornquist stated in the June 12 news release. “For our 2024 program we have prioritized high-confidence targets near existing zones to expand mineralization, and new targets that present fresh discovery potential. We will continue to build critical mass and focus particularly on adding and expanding near-surface mineralization and higher-grade zones.”

Right people, right project, right location, right time

Kodiak Copper

TSXV:KDK

Cdn$0.47 2024.06.13

Shares Outstanding 63.9m

Market cap Cdn$30m

KDK website

Silver

Silver on Wednesday was below $30 an ounce and sharply lower than the 11-year high of $32 touched on May 28. Precious metals were also lowered by the People’s Bank of China halting its streak of gold-buying. (Trading Economics)

Silver is up 28% so far this year in a metal market that has traded sideways for the past three years. (Silver jumped in 2020 along with gold, on account of the pandemic.)

Source: Trading Economics

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

The Silver Institute expects demand to grow by 2% this year, led by an anticipated 20% gain in the PV market. Industrial fabrication should post another all-time high, rising by 9%. Demand for jewelry and silverware fabrication are predicted to rise by 4% and 7%, respectively.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

Who’s buying all the silver? India and silver-backed ETFs.

India in February purchased a whack of silver bullion, with silver imports surging 260%. The country bought 2,295 tonnes compared to just 637t in January — a new monthly record.

Putting that into perspective, it’s about 70 million ounces, more silver than the US Mint produced in American Silver Eagle coins over the past three years combined.

Silver North Resources (TSX–V:SNAG)

Silver North offers exposure to one of the country’s most prolific silver districts — Keno Hill. A relatively recent discovery by Snowline Gold has rekindled interest in the Yukon Territory, and Keno Hill is seeing investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Between Haldane and its Tim carbonate replacement deposit (CRD), on the BC-Yukon border, Silver North offers strong discovery and development potential against the bullish backdrop for silver.

The Keno Hill Silver District was Canada’s second largest primary silver producer and one of the richest silver-lead-zinc deposits ever mined.

Silver North’s Haldane property is 25 kilometers west of the main Keno Hill deposits, and south of Victoria Gold’s Eagle mine, which poured its first gold in 2019. The 8,164-hectare land package hosts structurally controlled silver veins containing galena, sphalerite, and tetrahedrite-tennantite in quartz-siderite gangue.

The corporate presentation shows historic small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t Ag and 59% lead, and 2.1 tons of 4,600 g/t Ag.

The property showed the potential to double the cumulative strike length of known veins, currently totalling 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

SILVER NORTH ANNOUNCES PRIVATE PLACEMENT FOR GROSS PROCEEDS OF UP TO C$1.25 MILLION

The company says the project is located adjacent to, and has the same rocks as Hecla’s high-grade Keno Hill silver mine.

In 2021 Silver North announced a new discovery at the West Fault Zone.

The goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m. This was followed by 3.14m of 1,315 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

Silver North: the next pure silver play

TSX-V:SNAG

Cdn$0.16.5 2024.06.13

Shares Outstanding 43.3m

Market cap Cdn$6.94m

SNAG website

Gold

The gold price sank to a one-month low earlier his month, after it was announced that China’s central bank did not buy any gold in May. The stoppage snapped 18 months of consecutive gold buying by Beijing, as the yellow metal set a new record-high gold price for the third month running, according to Bullion Vault.

Following the Fed’s announcement that it would likely lower interest rates only once this year instead of twice, spot gold fell to $2,321.70, as of this writing Wednesday.

Source: Trading Economics

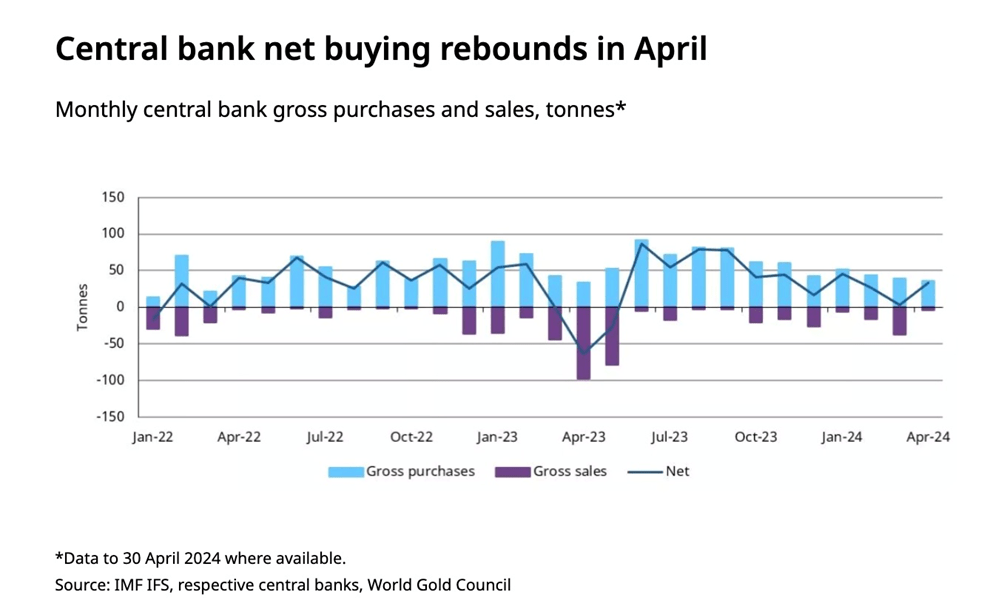

However, gold demand is still strong, driven mainly by central bank buying. According to the World Gold Council, net purchases totaled 33 tonnes in April, rebounding from a net 3 tonnes in March.

Developing nations in particular are stocking up on bullion as insurance against having their foreign currency reserves frozen like happened to Russia after it invaded Ukraine; and geopolitical instability, with wars in Ukraine and Gaza still raging and there’s China’s positioning on Taiwan causing stress. Commercial shipping in the Red Sea continues to come under attack from Houthi rebels.

Source: World Gold Council

EGR Exploration (TSX–V:EGR)

EGR Exploration is working near Detour Lake, Ontario, Canada’s largest gold operation, within a region hosting multiple multi-million-ounce deposits.

EGR’s Detour West property covers 40,255 hectares of the Abitibi Greenstone Belt, one of the most prospective regions for gold on the planet; the average gold deposit grade is higher than the global average.

Located in the northern part of the Abitibi, the Detour-Fenelon Gold Trend spans over 200 km of prospective strike length potential along the Sunday Lake and Lower Detour deformation zones. EGR’s property is located 20 km west of the Detour Lake open-pit (hence the name “Detour West”), and also directly adjoins Agnico Eagle’s holdings along the trend.

To maximize its chance of success, EGR since 2020 has increased its landholding and consolidated the entire 40,255-hectare Detour West project area, which is now 35 km long by 15 km wide.

What makes EGR’s ground so intriguing? According to respected geologist Quinton Hennigh, it’s when deformation belts like the Sunday Lake Deformation Zone become constricted, or “squeezed”.

A key task for EGR, as it goes about exploring Detour West, is testing the extension of the SLDZ, trying to prove that Detour West is on trend with Agnico-Eagle’s Detour Lake mine and its 20.7Moz of reserves.

EGR Exploration Ltd. – Permits, Corporate Update, and Plan Going Forward

An airborne magnetic survey has been flown on the property. That survey, plus historical data, a Lidar interpretation, and limited outcrop prospecting, indicate there are possible gold-bearing structures running onto Detour West.

The next step is to drill it.

This summer’s drill program envisions at least 35 reverse-circulation (RC) holes, that will target where the gold structures cross onto Detour West, including the “squeezed” deformation zone mentioned by Hennigh.

The drills will puncture an average 40 meters of glacial till before entering the bedrock. “It’s poking multiple shallow holes to find the gold dispersal train and then testing the bedrock to get a sample of what rocks we’re getting into,” CEO Daniel Rodriguez said.

If EGR can show enough gold-in-till from the fenced RC holes it can vector into the source of the mineralization.

EGR to drill Detour West as financing for juniors picks up

EGR Exploration Ltd.

TSX-V:EGR

Cdn$0.055, 2024.06.13

Shares Outstanding 40.2m

Market cap Cdn$2.2m

EGR website

Storm Exploration (TSX–V:STRM)

Storm came to my attention for the exploration agreement it recently signed with the Eabametoong First Nation regarding Miminiska, Keezhik and Attwood, which sit on their traditional territory.

It is unusual for a mining company to prioritize First Nations consultation over other activities, and I think this speaks to the progressive mindset of CEO Bruce Counts and his management team. These days, nothing happens on a mineral exploration property sitting on First Nations land without the nation’s consent.

STORM EXPLORATION AND EABAMETOONG FIRST NATION SIGN EXPLORATION AGREEMENT

Storm’s four properties are all are in the vicinity of historic Ontario gold camps, which combined have produced over 200 million ounces. The Fort Hope area is a greenstone belt with the potential to host a major gold camp.

High-grade gold has been confirmed by drilling at a number of locations on the Miminiska property. Historical assays include 5.75g/t Au over 20.84m and 13.95 g/t Au over 5.32m, with mineralization hosted in banded iron formation and associated shear zones.

Miminiska is about 12 km east to west and currently has two main targets: Frond and Miminiska. Outcrops on the shores of Lakes Frond and Miminiska were discovered in the 1940s, but so far only minor drilling has been done.

Banded iron formations account for around 60% of global iron reserves, and can be found in Australia, Brazil, Canada, the United States India, Russia, Ukraine and South Africa.

The Miminiska project bears all the hallmarks of a banded iron formation. The closest analog is Musselwhite, located ~115 km to the northwest. The deposit also has a similar geometry to the Lupin BIF mine, which produced 3.4Moz at 9.1 g/t Au before closure in 2005.

Storm plans to raise money for a drill program at Miminiska.

Ideally, between 2,000 and 2,500 meters would be drilled from six to 10 drill pads. It should be noted that the claims at Miminiska are patented claims, meaning that no drill permits are required. Normal drilling guidelines must still be followed and Storm needs the support of local first nations, which it already has.

Storm Exploration: BIF gold in Ontario

Storm Exploration Inc.

TSX-V:STRM

Cdn$0.04 2024.06.13

Shared Outstanding 41.6m

Market cap Cdn$2.6m

STRM website

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of EGR, SNAG, STRM or KDK. All 4 are paid advertisers on his site aheadoftheherd.com

This article is issued on behalf of EGR, SNAG, STRM and KDK.

MORE or "UNCATEGORIZED"

Aldebaran Announces Closing of $40 Million Bought Deal Offering

Aldebaran Resources Inc. (TSX-V: ALDE) (OTCQX: ADBRF) is please... READ MORE

Erdene Announces Closing of $25 Million Bought Deal Private Placement

Erdene Resource Development Corp. (TSX:ERD) (MSE:ERDN) (OTCQX: ER... READ MORE

NOVAGOLD Announces Closing of Upsized Bought Deal for Gross Proceeds of US$310 Million

NOVAGOLD RESOURCES INC. (NYSE: NG) (TSX: NG) is pleased to report... READ MORE

Guanajuato Silver Sees Significant Growth in Resources at Valenciana

~ Inferred Mineral Resources Increased by 630% to 20.3M AgEq Ounc... READ MORE

Copper Quest Increases and Closes Unit Offering for Total Gross Proceeds of $2,099,890

Copper Quest Exploration Inc. (CSE: CQX) (OTCQB: IMIMF) (FRA: 3MX... READ MORE