Rick Mills – “Brigadier Gold Hits at Picachos”

Brigadier Gold (TSX-V:BRG) (USA:BGADF) (FSE:B7LM) has released results from the first three holes of the 2020 drill program at the company’s Picachos high-grade gold-silver project in Sinaloa state, Mexico.

The junior market is always edgy this time of year and the drop in the gold price – about $150 over the past month — has investors even more nervous. A lot is riding on these results for Brigadier, as the company aims to prove the potential for multiple veins; the depth, strike length and continuity of the veins; and to understand the source of the vein-hosted mineralization, along with its potential relationship to copper-porphyry mineralization identified on the property.

The veins are open at depth and have never been diamond drill-tested – until now – making San Agustín the primary focus of the current drill program.

In October, the company announced the first diamond drill (BRG-001) intersected the San Agustín vein, 65 meters below historic gold workings at the San Agustín mine, where about 665 meters of underground development has been completed. Historic workings range from shallow pits a few meters across, to tunnels hundreds of meters long, driven at several levels on some of the larger vein systems.

Underground channel sampling by a previous operator returned an average 81.22 g/t Au and 73.36 Ag across 1.2m. Values from the bottom of a 45-meter-deep production shaft were 185 g/t Au. In 2014, Vane Minerals test-mined three rounds from the south face. Average assay values were 15.8 g/t Au and 63 g/t Ag across a width of 2.5m.

In November, diamond drill results from Picachos were released to the market for the first time. According to Brigadier Gold, All three holes intercepted the mineralized fault, in particular the contact between thickly laminated graphitic and pyritic argillite in the hanging wall and intermediate pyroclastic rocks correlated to the Tarahumara Formation in the footwall. Mineralized portions of the fault are brecciated, and higher precious metal grades are evident in cockade quartz breccias and crustiform quartz veinlets that occur both in argillite and in the volcanic rocks.

The objective of this fence of holes was to tightly constrain the orientation of the structure for exploration along strike and down-dip outside the immediate mine area. Collectively, the drill holes tested up to 170 meters below surface.

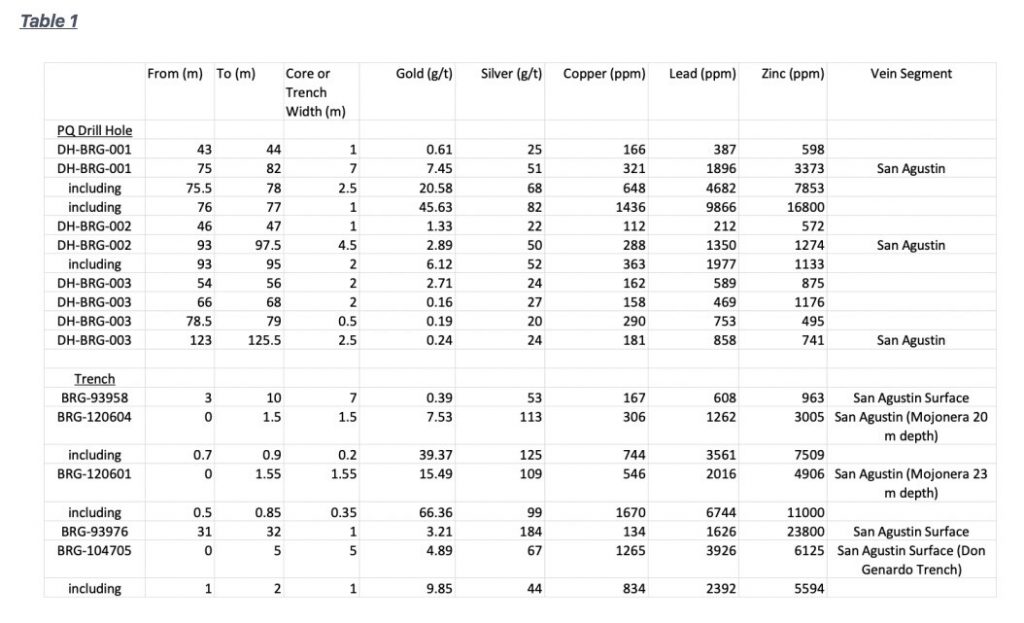

The highlight was hole BRG-001, which returned 7 meters of 7.45 g/t gold and 51 g/t silver, including 2.5m of 20.58 g/t Au + 68 g/t Ag, and 1m of 45.63 g/t Au + 82 g/t Ag. The identified core was shallow — around 75m below ground. Trench highlights include 0.39 g/t Au and 53 g/t Ag across 7 meters for trench BRG-93958, which according to Brigadier, clearly implies the presence of a major structure below surface.

Regarding hole BRG-001, Brigadier’s head geologist Michelle Robinson admits in the news release that the drill appears to have cut through old underground workings reducing the potential reported overall width of mineralized material.

In other words, it encountered older, mined-out areas that reduced the width of the intersection.

However, hole BRG-001 still managed to hit a significant intercept.

Let’s take a closer look at this intercept:

In underground mining, the grades and the value of the rock are important, but what is even more important, are the widths of the intersections. This is especially the case in Mexico, famous for its high-grade, but narrow veins.

Narrow veins are an important source of metals throughout the world, but they are technically challenging to mine. Like a human artery, they swell in some places and pinch in others, and the grades are never uniform throughout.

Logistics of mobilizing trackless equipment underground to mine a narrow vein requires a minimum 3m – 4m drift width. Tracked equipment requires 2m (but its tight), I’ve heard of it being done at 1.5 meters but you need to have cut-outs in the side of the tunnel so workers can step off to safety when a train passes.

Luckily dilution happens only on drift development costs. Miners match drift width to type of mining, drive the drift under the vein dropping ore out of the stope above and Long-Hole techniques can be mined upwards of 20 feet or more.

Brigader Gold’s hole BRG-001:

The one meter of 45.63g/t gold and 82g/t silver is significant but so is the 2.5m of 20.58g/t gold and 68g/t silver. It’s because if you read the table closely the 1m is within the 2.5 meters.

That one meter of rock’s insitu value is over US$2,700.00t, the 2.5 meters is worth, in the ground, US$1,268.78t. Whichever mining methods are used – racked, trackless, long-hole or short hole – both intercepts are significant interceptions.

Hole BRG-002 and Hole BRG-003 both continuity of the vein. I wouldn’t want to try and build a mine out of continuing numbers like that, but once you have your mine you would definitely include them in your mining plan.

The main point is, just three holes into the drill program, Brigadier has already established that the widths it is hitting at the San Agustín vein are, imo, comfortably mineable, both economically and logistically. Also consider that hole BRG-001 unintentionally drilled through an adit (ie. A mined-out area) If the adit hadn’t been there, the widths could potentially have been better. (Brigadier estimates the true width of BRG-001 at 5.3m, which is fine for underground mining)

Having only just acquired (by option agreement) the Picachos gold-silver property, Brigadier Gold has made excellent progress.

“Since commencing exploration and diamond drilling activities at Picachos in August, we’ve identified several high priority targets for follow up work and have gained a significant understanding of the mineralized gold- silver vein, and copper-molybdenum porphyry systems traversing the property,” President and CEO Ranjeet Sundher stated in a Dec. 9 exploration update. “As we await further assays from the ongoing 40-hole, 5,000-meter drill program, targeting veins below and surrounding the historic San Agustín gold mine, we are excited to move into 2021 with a solid blueprint to advance Picachos.”

Milestones completed so far include:

- Diamond drill testing of the southwestern portion of the Cocolmeca vein system, mainly down dip of the historic San Agustín gold mine.

- Discovery of several new veins by trenching under historic soil geochemical anomalies in the central part of the property.

According to the company, hole BRG-001 supports the thesis that San Agustín is a gold-bearing structure of significant width that merits further exploration to develop its commercial gold potential.

Other exploration highlights:

- A sample returning 4.89 g/t Au and and 67 g/t Ag, with a true width of 5 meters, was cut across a surface outcrop of the San Agustín vein;

- 10m of 1.85 g/t Au and 4 g/t Ag, was trenched across the Tejones prospect pits, which are on the same structure along strike from San Agustín;

- About 1.2 km north-northeast of the mine, Brigadier trenched 16m @ 1.1 g/t Au, 6 g/t Ag and 0.2% Pb, across the northeast-trending Rogue vein, including 2m of 8.84 g/t Au, 36 g/t Ag and 1.6% Pb;

- Sampling of the porphyry copper-molybdenum occurrence returned values of 0.32 g/t Au, 48 g/t Ag, 0.53% Cu, 15 ppm Mo, 16 ppm tungsten (W) and 140 ppm bismuth across 12 meters.

Conclusion

Unfortunately, the nature of gold vein exploration is inconsistency. Chasing underground veins can be rewarded with high-grade assays, but sometimes, the grade doesn’t carry. The main objective is to build ounces within mineable widths. And in that respect, Brigadier Gold has done well, just three holes into its 40-hole, 5,000-meter program. While the grades at hole BRG-001 aren’t spectacular, they clearly show the San Agustín vein is mineralized, @ decent grades and widths.

The fact that gold prices have temporarily fallen of late, due to news of three covid-19 vaccines that appear to be effective, has made it tougher to get drill results onto the radar of resource investors. Especially during tax-loss season.

However, none of that changes our expectations of big things to come from Brigadier Gold at Picachos. The project features over 150 historic mines and underground workings, high-grade veins open at depth, and it is road accessible, with drill permits and agreements with the local community already in place.

The coming deluge of fiat (paper money) printing by the world’s central banks to finance black top/electrification/5G infrastructure projects to lead the world out of the covid-19 induced economic disaster, is leading us into a highly inflationary environment. The US, owner of the world’s reserve currency, is going to print trillions and trillions more dollars.

High inflation leading to possible hyperinflation, minus interest rates that have to be held close to zero because of unbelievable global debt levels means real interest rates soar. That is an environment wherein precious metals do very well.

At AOTH we believe patience in gold, silver and Brigadier Gold’s continuing Picachos drill program, will be rewarded.

Brigadier Gold

TSXV:BRG, USA:BGADF, FSE:B7LM

Cdn$0.26, 2020.12.11

Shares Outstanding 58,544,348m

Market cap Cdn$14.9m

BRG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Brigadier Gold (TSX.V:BRG). BRG is a paid advertiser on his site aheadoftheherd.com

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE