Richard Mills “Kootenay Covers Precious Metal Investor Bases”

As a general rule, the most successful man in life is the man who has the best information

In 2014 estimated uses for silver were:

- electrical and electronics, 42%

- coins and medals, 35%

- photography, 13%

- jewelry and silverware, 7%

- other, 3%

“Silver is a unique metal that wins whether the economy is going well or is in bad shape. In the latter, the investor buys it as a hedge against the downturn in the economy and the markets. And if the economy improves, then the industrial demand increases.” Chintan Parikh, CPM Group commodity analyst

“The major monetary metal in history is silver, not gold.” Milton Friedman, Nobel Laureate

Gold/Silver Ratio

The crustal ratio of silver to gold is 17.5:1, interestingly in Roman times the price ratio was set at 12 or 12.5 to 1 – one ounce of gold was worth 12 or 12.5 ounces of silver. The U.S., in 1792, fixed the gold/silver price ratio at 15:1. France enacted a ratio of 15.5:1 in 1803.

The average price ratio during the 20th century was 47 silver oz’s to one gold oz.

Today, at the time of writing this article, the silver:gold ratio stands at 74.25:1 (Gold $1,156.20 oz/silver $15.57 oz = 74.25).

To get the gold/silver numbers back in sync with 20th century numbers of 45:1, silver will have to rise to $25.69.

To get back to the historical average ratio of 15:1, silver would have to rise to $77.08 an oz.

Gold could drop more in price, but since silver tracks gold (with much more volatility) silver would drop as well. The end result would still be a silver/gold ratio out of sync with historical and 20th century norms.

Silver is currently undervalued and much cheaper than historic norms.

Dow/Gold Ratio

The number of ounces of gold it takes to buy one share of the Dow is the Dow/Gold Ratio. For example, at the time of writing this article, the Dow is at 17,835 while gold is US$1,156.20. It requires a record high 15.42 ounces of gold to buy one share of the Dow, so the ratio is 15.42:1.

The National Inflation Association (NIA) reports that the median Dow/gold ratio over the past 100 plus years is 5.83.

The NIA expects a return to the median Dow/gold ratio in 2015. At the time of their report the Dow was at its new all-time nominal high of 17,138. Making gold’s fair value, based on their long term median Dow/gold ratio of 5.83, almost $3,000.00 oz.

If the NIA is correct in its gold price prediction silver would have to rise to US$66.66 to get in line with 20th century gold/silver ratio norms (45:1) and US$200.00 an oz to match the historical 15:1 gold/silver ratio.

Kootenay Silver TSX.V – KTN

Sonora, Mexico – It has been a very busy and fruitful work season in NW Mexico for Kootenay Silver Inc. President and CEO James McDonald, P.Geo and crew.

Late last year, Kootenay Silver (TSX: KTN.V) announced a Phase I drill program (25 HQ diameter core holes with 3173.5 meters of drilling) on its emerging La Negra Diatreme silver prospect in Sonora, Mexico. This hugely successful program returned a series of outstanding high-grade silver intercepts (LN 21-14 Containing from surface and bottomed in mineralization 156.47 gpt Ag over 200 meters including 420.34 gpt Ag over 50 meters from 150 to 200 meters including 1337.66 gpt Ag over 6 meters and 492.30 gpt Ag over 17 meters at the bottom of the hole excluding the 6 meters of 1337 gpt Ag interval) and widespread silver mineralization extending from surface to depth, resulting in a new high-grade silver discovery.

On February 23 of this year, the Company announced it has commenced a follow up 30-hole, 3,000 meter Phase II drill program on the new discovery that if successful, has potential to position La Negra as one of the richest, near-surface, pure silver plays witnessed in NW Mexico over the past decade.

Further fueling the excitement, because the silver mineralization extends from surface to depth, the new discovery is amenable to low-cost open-pit mining.

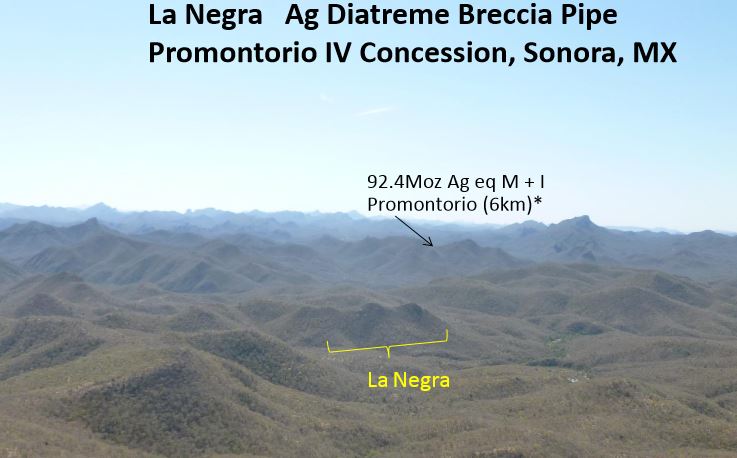

The Promontorio La Negra prospect is situated 6.5 km’s south of Kootenay’s established M&I 92M oz. silver Eqv. Promontorio resource and is contained within a 5 km x 15 km mineralized corridor known as the ‘Promontorio Mineral Belt’.

La Negra’s silver mineralization is believed to be hosted within a Diatreme breccia pipe, a system type known to contain high-grades and large deposits.

Based on its unique characteristics and the multiple high-grade intercepts observed from Phase I drilling, La Negra is already drawing comparisons to other prolific Diatreme discoveries, such as Silver Standard’s rich Pitarrilla mine in Mexico (15M ounces silver in annual production) and AngloGold Ashanti’s, Cripple Creek deposit in Colorado. (200K+ ounces gold in annual production, Diatreme’s can be either gold or silver).

Prior to its inaugural Phase I drill program, Kootenay conducted an extensive rock sampling and hand-trenching program on the grassroots prospect that returned robust and consistent grades of widespread silver mineralization across its surface, averaging 65 gpt silver within the entire 100 by 400 meter core of the La Negra Diatreme Breccia. Phase I drilling turned out to be a major revelation, showing silver grades increasing dramatically from surface to depth, leading to the discovery.

Highlights from the Phase I drill program included multiple high-grade intercepts such as hole 21, which returned 156 gpt silver over 200 meters from surface, bottoming in 50 meters grading 420 gpt silver, which included a spectacular interval grading 1337 gpt silver over 6 meters. These results were supported by a host of additional drill intercepts that returned similarly impressive silver grades.

Finding new major precious metal discoveries in Sonora, Mexico is nothing new for Kootenay President and CEO James McDonald, P.Geo. McDonald rose to prominence in early 2000 as a former founder and driving force behind National Gold and its rich Mulatos Gold deposit in Sonora, Mexico. In 2003, National Gold went on to merge to form Alamos Gold, (TSX:AGI) which is now a successful mid-tier mining company producing in excess of 140,000 ounces of gold annually.

As a former Director and Technical Committee Member of Alamos, McDonald played a key role in Mulatos’s transition from an early exploration play to full-scale gold production.

When reached at the recent PDAC Mining Conference in Toronto, Ontario, McDonald pointed out it is very rare to find an entirely new, high-grade, near surface silver discovery in today’s mining industry. He credits his technical team led by V.P. of Exploration, Dr. Tom Richards, P.Geo, for the key determination that La Negra’s mineralization is contained within a Diatreme Breccia system.

When queried about the potential size and scope of the new discovery, McDonald says, although the current Phase II drill program will help provide the ultimate answer, he remains confident that La Negra’s intrinsic qualities, combined with surface exploration and drill results to date, will lead to one of the region’s most important grassroots silver discoveries in recent years.

As the current Phase II drill program revs up and gains momentum on La Negra, it would appear McDonald and team have good reason to be optimistic that upcoming Phase II drill results will parlay the success of its inaugural drill program.

Importantly, the high-grade silver mineralization returned at depth from the Phase I drill program was remarkably consistent, mirroring the extensive zone of silver mineralization established on surface. Moreover, based on the prospect’s geometry and the continuity of the silver mineralization, Phase II drilling is expected to be a basic continuation of the Phase I program, and will aim at systematically drilling off of the known silver intercepts to depth, guided by La Negra’s large and well-defined mineralized footprint established on surface.

Not surprisingly, the mining and investment industry has been quick to embrace the La Negra prospect and its emerging status. In February of this year, the Company announced a $1.5 million, oversubscribed, private placement financing that will be used in part to fund the current drill program through to fruition. Previous to the La Negra discovery, in April 2013, renowned global miner, Agnico-Eagle took a $4.75M stake in the Company, representing a 9.9% interest in Kootenay’s issued and outstanding shares at the time.

The strategic development of the La Negra silver prospect has been four years in the making. In a market starved for important new discoveries, Kootenay’s technical and management team is holding to the belief they have found the answer at La Negra. One thing that is for certain, if Phase II drill assays return similar results to the Phase I drill campaign on La Negra, the program stands to be a game changer for Kootenay and its shareholders.

Granted, there are never any guarantees. It has been said the drill bit is mining’s version of a lie detector test, and clearly, as in all drill campaigns, results will lead the way. Most intriguing, is within the next 3 months and one round of drill results, we are about to find out the true size and extent of La Negra’s contained silver.

Expect to see some buoyant action in the Kootenay Silver Inc. (TSX: KTN.V) market over the coming weeks and months as momentum builds in anticipation of ongoing drill results from the Phase II program.

It should be noted: The Company recently set new incentive stock options and Kootenay’s key management and insiders took a sizable portion of the last two private placement financings over the past eight months – this can be considered a further testimony to management’s confidence in the project.

Conclusion

Silver acts as a hedge against an economic downturn by giving investors leverage to a rising silver price. Also, because it’s a monetary metal it offers a safe haven in times of political strife and turmoil. Of course if the economy improves, then industrial demand increases.

Kootenay Silver offers one of the best ways to play the silver, gold and Dow ratio reversion to the mean, and also to play the growing trend in merger and acquisitions (M&A) within the precious metal space.

Of course the greatest leverage to a rising silver price is to own the shares of a very well run silver focused junior with immense already existing resources, discovery upside and buyout potential.

This author firmly believes:

- That the current global economic and geo-political concerns warrant EVERYBODY owning some gold and silver in bullion form.

- That investors need exposure to the leverage of share ownership in precious metal focused juniors.

- That Kootenay Silver TSX.V – KTN truly covers all the bases for precious metal investors.

Is Kootenay on your radar screen?

If not, it should be.

Richard (Rick) Mills

Richard lives with his family on a 160 acre ranch in northern British Columbia. He invests in the resource and biotechnology/pharmaceutical sectors and is the owner of Aheadoftheherd.com. His articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Please visit www.aheadoftheherd.com – We’re telling you things everyone else doesn’t already know.

Moderated investor friendly forums – Ahead of the Herd is powered by Community Intelligence.

Free highly acclaimed newsletter featuring today’s investable junior resource companies.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard does not own shares in Kootenay Silver TSX.V – KTN

Kootenay Silver is a paid sponsor of Richards site aheadoftheherd.com

This article is not paid for content

MORE or "INDUSTRY ANALYSTS"

Mickey Fulp - Mercenary Alert: Is Zinc Still a Four-Letter Word?

Read the Report Here Mercenary Alert: Is Zinc Still a Four-Letter Word? ... READ MORE

Top 10 Financings of May 2017

May saw 125 financings close in the Canadian financial markets for C$366.5 million including 64 fina... READ MORE

ORENINC INDEX jumps as gold gets political again

ORENINC INDEX – Monday, June 12, 2017 North America’s leading junior mining finance data provide... READ MORE

The Week of June 5th to June 11th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday June 5th with... READ MORE

The Week of May 29th to June 4th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday, May 29th wit... READ MORE