Prime Intersects 9.4 gpt Gold Equivalent over 10.5 metres at Tahonitas in the Z-T Trend

Continuity of Very High Gold and Silver Grades May Support Underground Mining Potential

Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) (Frankfurt: 04V3) is reporting expansion drilling results from the Company’s Los Reyes Project, located in Sinaloa State, Mexico. These results are from 2024 drilling at the Z-T Trend and are not included in the Company’s May 2, 2023, Mineral Resource Estimate.

Expansion Drilling Highlights at Z-T

The Company is reporting 11 core holes at Tahonitas in the Z-T Trend with the following highlights:

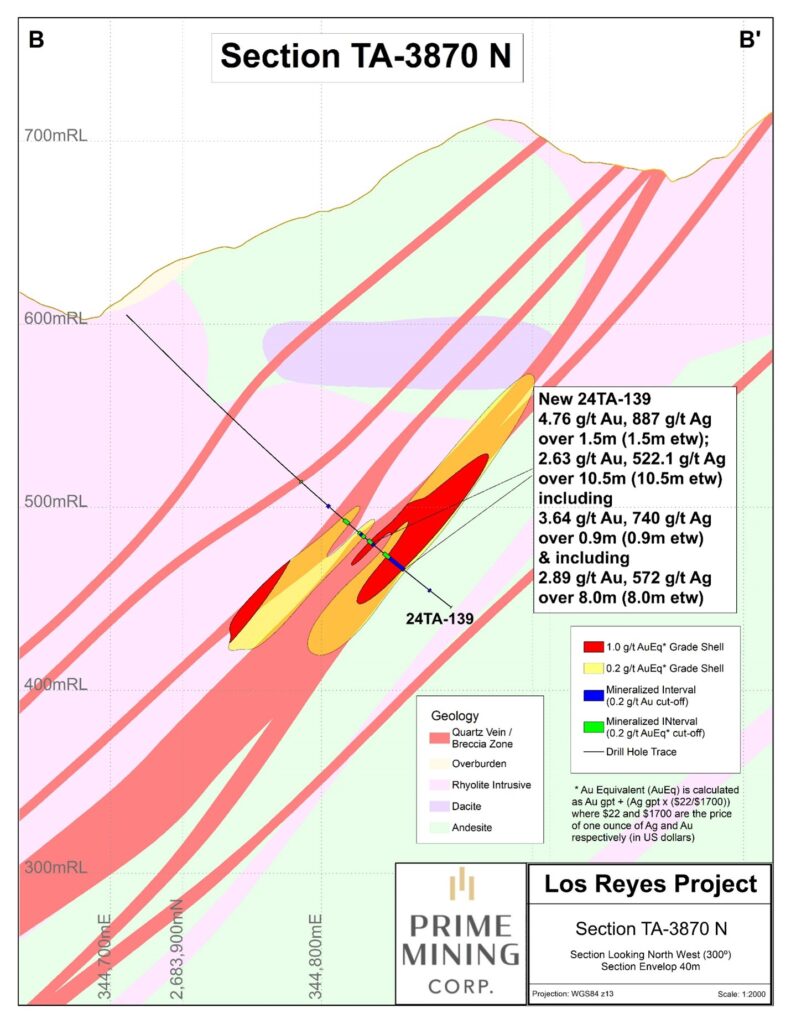

- 9.39 grams per tonne gold-equivalent (2.63 gpt Au and 522.1 gpt Ag) over 10.5 metres estimated true width in hole 24TA-139, including:

- 10.29 gpt AuEq (2.89 gpt Au and 572.0 gpt Ag) over 8.0 m etw,

- 4.55 gpt AuEq (2.87 gpt Au and 130.0 gpt Ag) over 4.1 m etw in hole 24TA-138, including:

- 8.06 gpt AuEq (5.23 gpt Au and 218.3 gpt Ag) over 2.1 m etw, and,

- 3.56 gpt AuEq (2.92 gpt Au and 49.2 gpt Ag) over 4.6 m etw in hole 24TA-138, including:

- 5.57 gpt AuEq (4.84 gpt Au and 56.8 gpt Ag) over 2.7 m etw,

- 2.95 gpt AuEq (2.88 gpt Au and 5.5 gpt Ag) over 4.1 m etw in hole 24TA-135, including:

- 13.21 gpt AuEq (12.95 gpt Au and 20.3 gpt Ag) over 0.7 m etw, and,

- 4.24 gpt AuEq (4.08 gpt Au and 12.2 gpt Ag) over 2.3 m etw in hole 24TA-135, including:

- 13.92 gpt AuEq (13.40 gpt Au and 40.4 gpt Ag) over 0.6 m etw.

Prime Mining Corp. Chief Executive Officer Scott Hicks commented, “Expansion drilling results at Tahonitas in the Z-T trend have been excellent, demonstrating continuity of very high gold and silver grades down dip and within previous drilling gaps. This can be seen in the highlighted holes, including 24TA-139 where high-grade extensions are supportive of underground potential.”

Scott Smith, Executive Vice President of Exploration, added, “The holes released today include some of the southeastern-most holes we have drilled to date, collared at over 550m along strike from the southeast Z-T pit crest. These holes intersected mineralization at elevations between 370m to over 450m (above sea level). We know that the areas where mineralization occurs in this structure also extend above and below these elevations, which in turn provides great targets to continue to expand Z-T in this direction.”

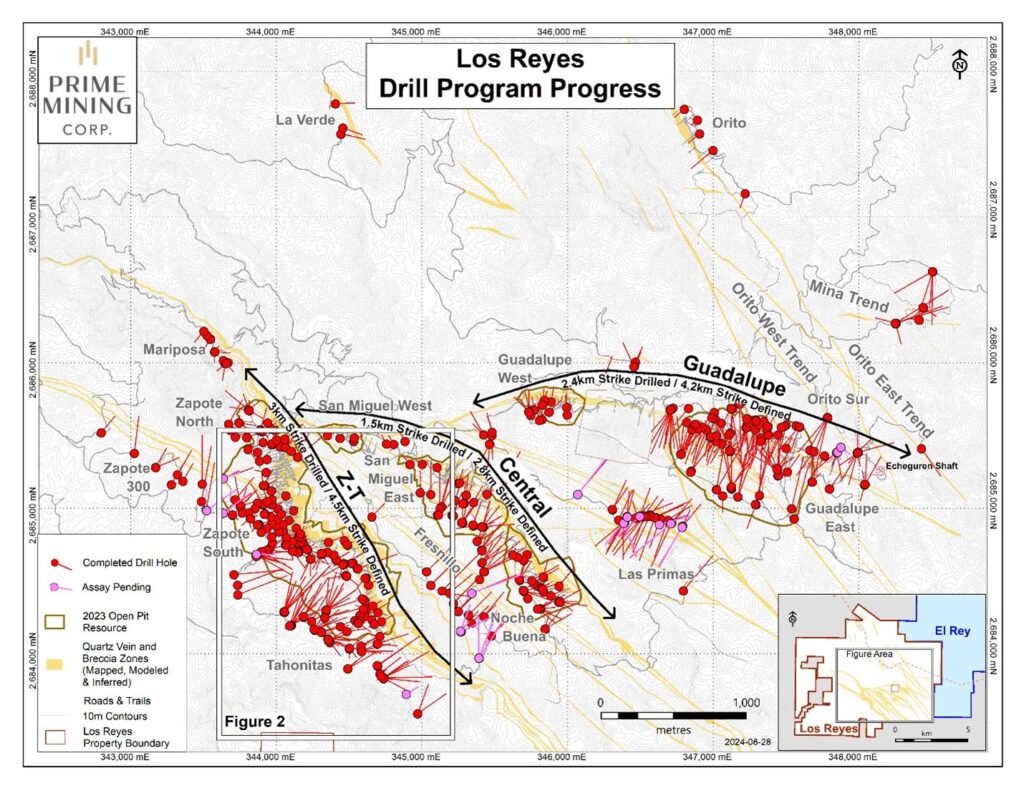

Figure 1: Expansion drilling update

Tahonitas Drill Hole Highlights1

| Hole ID | From (m) | To (m) | Interval (m) | ETW (m)2 | Au (gpt) | Ag (gpt) | AuEq3 | Au Cut-off4 |

| 24TA-132 | 137.0 | 139.0 | 2.0 | 2.0 | 1.43 | 3.3 | 1.47 | 0.2 |

| 24TA-135 | 272.2 | 278.6 | 6.4 | 4.1 | 2.88 | 5.5 | 2.95 | 0.2 |

| including | 274.5 | 276.0 | 1.5 | 1.0 | 1.20 | 1.4 | 1.22 | 1.0 |

| & including | 276.4 | 277.5 | 1.1 | 0.7 | 12.95 | 20.3 | 13.21 | 1.0 |

| 24TA-135 | 306.6 | 310.1 | 3.5 | 2.3 | 4.08 | 12.2 | 4.24 | 0.2 |

| including | 306.6 | 307.5 | 1.0 | 0.6 | 13.40 | 40.4 | 13.92 | 1.0 |

| 24TA-135 | 377.4 | 379.5 | 2.1 | 1.4 | 1.51 | 135.4 | 3.26 | 0.2 |

| including | 377.4 | 378.4 | 1.0 | 0.7 | 2.71 | 280.0 | 6.33 | 1.0 |

| 24TA-137 | 384.80 | 391.30 | 6.50 | 4.60 | 0.78 | 33.85 | 1.22 | 0.2 |

| 24TA-138 | 404.5 | 410.2 | 5.7 | 4.1 | 2.87 | 130.0 | 4.55 | 0.2 |

| including | 405.9 | 408.8 | 2.9 | 2.1 | 5.23 | 218.3 | 8.06 | 1.0 |

| 24TA-138 | 413.9 | 420.3 | 6.4 | 4.6 | 2.92 | 49.2 | 3.56 | 0.2 |

| including | 413.9 | 417.7 | 3.8 | 2.7 | 4.84 | 56.8 | 5.57 | 1.0 |

| 24TA-139 | 194.3 | 195.8 | 1.5 | 1.5 | 4.76 | 887.0 | 16.24 | 1.0 |

| 24TA-139 | 206.7 | 217.2 | 10.5 | 10.5 | 2.63 | 522.1 | 9.39 | 0.2 |

| including | 207.4 | 208.3 | 0.9 | 0.9 | 3.64 | 740.0 | 13.22 | 1.0 |

| including | 208.1 | 216.0 | 8.0 | 8.0 | 2.89 | 572.0 | 10.29 | 1.0 |

Notes:

- A complete table of assay results from all deposits and all secondary zones intersected utilizing a 0.20 gpt Au cut-off is on the Company’s website.

- Estimated True Widths (ETW) are estimated based on drill hole geology or comparisons with other on-section drill holes.

- Au Equivalent (AuEq) is calculated as Au gpt + (Ag gpt x ($22/$1700)) where $22 and $1700 are the price of one ounce of Ag and Au respectively (in US dollars).

- Composite assay grades presented in summary tables are calculated using a Au grade minimum average of 0.20 gpt or 1.0 gpt as indicated in “Au Cut-off” column of Summary Tables. Maximum internal waste included in any reported composite interval is 3.00 m. The 1.00 gpt Au cut-off is used to define higher-grade “cores” within the lower-grade halo.

INTERPRETATION

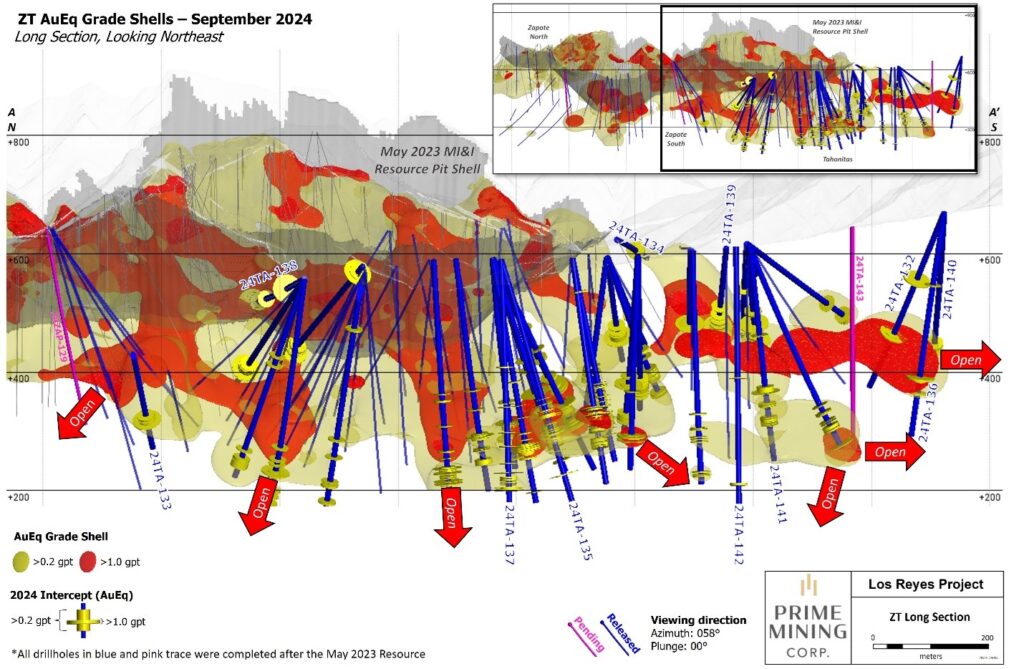

Tahonitas:

24TA-138: (1) returned higher Au and Ag grades than estimated in the 2023 MRE block model, (2) was drilled at a more favourable intercept angle than historical drilling in the area and (3) is within the existing MI&I pit shell. As a result, we anticipate that this drillhole will have a positive impact on future Resource estimates at Z-T by improving both the grade and Resource classification in this area.

24TA-139 is the best intercept to-date in the newly identified high-grade shoot developing at the southern end of the Z-T trend, returning exceptionally high Au and Ag grades over significant thickness. Further, 24TA-132 and 24TA-136 confirm the existence of this shoot at a distance of more than 500m from the south-east pit crest, demonstrating the continuity of mineralization along the Z-T structure along strike to the south. The high-grade mineralization defined by 24TA-132, 24TA-136, and 24TA-139 remains open along strike and at depth and will continue to be a focus for future drilling at Z-T.

24TA-137 returned one of our deepest intercepts to-date at 200m above sea level, grading 1.22 gpt AuEq over 4.6m etw. This hole demonstrates that the productive zone remains open at depth and open to the southeast along strike.

The ongoing discovery of mineralization hosted along strike and at depth continues to suggest the following:

- The Z-T structure continues to be mineralized for more than 500m along strike from the current south-east pit crest.

- The potential exists to discover more high-grade plunging shoots with continued drilling below the current resource pit bottom and within the new south-east strike extension. These high-grade shoots have the potential to support underground resource estimation.

- Several high-grade plunging shoots identified to-date remain open at depth and along strike in multiple areas along the Trend.

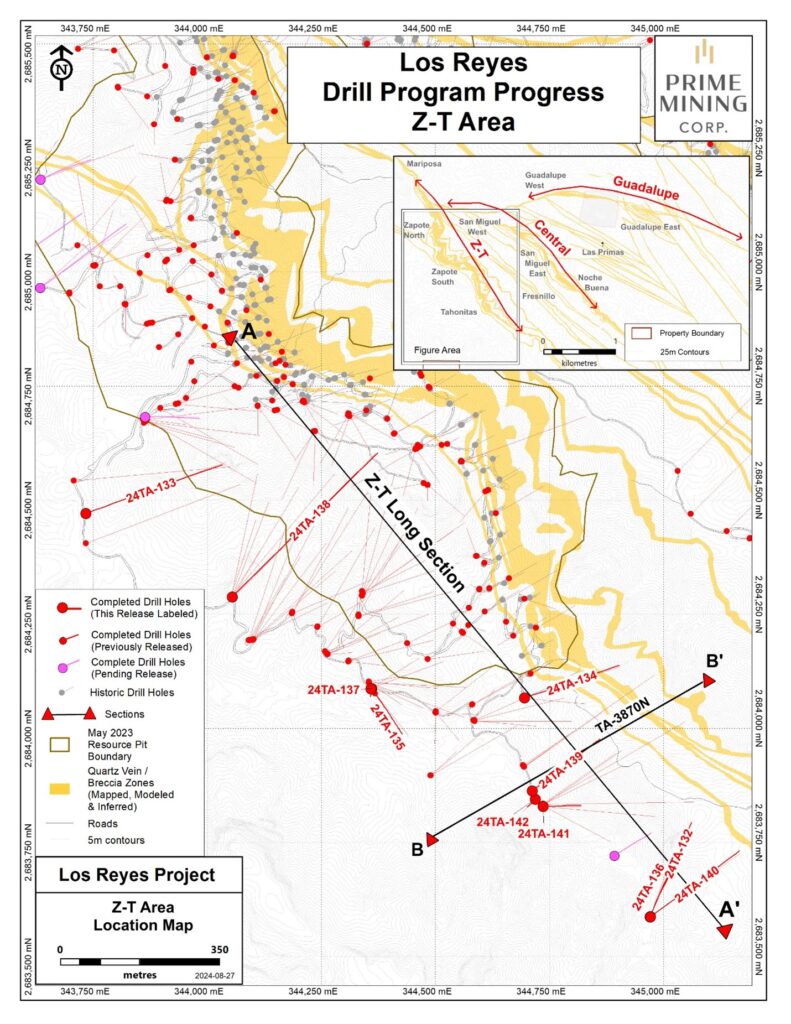

Figure 2: Z-T Trend drilling update

Figure 3: Z-T Trend long section with drill holes highlighted (A-A’)

Figure 4: Z-T Trend (Tahonitas) cross section B-B’

2024 Outlook

Given the results from Prime’s success-based drilling program at mid-year, the Company approved the expansion of its fiscal 2024 program to 50,000m from 40,000m. The drill program will continue to be evaluated according to this success-based approach. This evaluation will also include prioritization of targets based on probability of resource development and generative area discovery potential.

Four drill rigs are currently active on site at Los Reyes, with 2024 exploration focused on:

- Extending the high-grade Z-T Area shoots that remain open at depth, as well as along strike, both north and south.

- Expanding the known high-grade mineralization at Guadalupe East.

- Increasing the Central Area resource through additions at Noche Buena and its connection to San Miguel East.

- Generative target drilling of high-grade intercepts at Las Primas, Mariposa, Fresnillo, Mina and others to further develop the resource potential at Los Reyes.

Links to Figures:

- Figure 1 – Expansion drilling update

- Figure 2 – Z-T Area drilling update

- Figure 3 – Z-T Area long section with drill holes highlighted (A-A’)

- Figure 4 – Z-T Area (Tahonitas) cross section (B-B’)

Links to Tables:

About the Los Reyes Gold and Silver Project

Los Reyes is a rapidly evolving high-grade, low sulphidation epithermal gold-silver project located in Sinaloa State, Mexico. Since acquiring Los Reyes in 2019, Prime has spent approximately CAD$55 million on direct exploration activities and has completed over 198,500 metres of drilling.

On May 2, 2023, Prime announced an updated multi-million-ounce high-grade open pit constrained resource (see the May 2, 2023, press release for more details).

May 2, 2023 Resource Statement

| Assurance Category |

Ore Tonnes Mt |

Average Gold Grade (g/t) |

Contained Gold (k ozs) |

Average Silver Grade (g/t) |

Contained Silver (k ozs) |

Average AuEq Grade (g/t) |

Contained AuEq (k ozs) |

| Measured (M) | – | – | – | – | – | – | – |

| Indicated (I) | 27.2 | 1.16 | 1,013 | 40.40 | 35,263 | 1.68 | 1,470 |

| M+I | 27.2 | 1.16 | 1,013 | 40.40 | 35,263 | 1.68 | 1,470 |

| Inferred | 18.1 | 0.85 | 497 | 31.52 | 18,334 | 1.26 | 734 |

Drilling is on-going and suggests that the three known main deposit areas (Guadalupe, Central and Z-T) are larger than previously reported. Potential also exists for new discoveries where mineralized trends have been identified outside of the currently defined resource areas.

Historic operating results indicate that an estimated 1 million ounces of gold and 60 million ounces of silver were recovered from five separate operations at Los Reyes between 1770 and 1990. Prior to Prime’s acquisition, recent operators of Los Reyes had spent approximately US$20 million on exploration, engineering, and prefeasibility studies.

QA/QC Protocols and Sampling Procedures

Drill core at the Los Reyes project is drilled in predominately HQ size (63.5 millimetre “mm”), reducing to NQ (47.6 mm) when required. Drill core samples are generally 1.50 m long along the core axis with allowance for shorter or longer intervals if required to suit geological constraints. After logging intervals are identified to be sampled, the core is cut and one half is submitted for assay. RC drilling returns rock chips and fines from a 133.35 mm diameter tricone bit. The returns are homogenized and split into 2 halves, with one half submitted for analysis and the other half stored.

Sample QA/QC measures include unmarked certified reference materials, blanks, and field duplicates as well as preparation duplicates are inserted into the sample sequence and make up approximately 8% of the samples submitted to the laboratory for each drill hole.

Samples are picked up from the Project by the laboratory personnel and transported to their facilities in Durango or Hermosillo Mexico, for sample preparation. Sample analysis is carried out by Bureau Veritas and ALS Labs, with fire assay, including over limits fire assay re-analysis, completed at their respective Hermosillo, Mexico laboratories and multi-element analysis completed in North Vancouver, Canada. Drill core sample preparation includes fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250-gram split to at least 85% passing 75 microns.

Gold in diamond drill core is analyzed by fire assay and atomic absorption spectroscopy of a 30 g sample (code FA430 or Au-AA23). Multi-element chemistry is analyzed by 4-Acid digestion of a 0.25-gram sample split (code MA300 or ME-ICP61) with detection by inductively coupled plasma emission spectrometer for a full suite of elements.

Gold assay techniques FA430 and Au-AA23 have an upper detection limit of 10 ppm. Any sample that produces an over-limit gold value via the initial assay technique is sent for gravimetric finish via method FA-530 or Au-GRA21. Silver analyses by MA300 and ME-ICP61 have an upper limit of 200 ppm and 100 ppm, respectively. Samples with over-limit silver values are re-analyzed by fire assay with gravimetric finish FA530 or Au-GRA21.

Both Bureau Veritas and ALS Labs are ISO/IEC accredited assay laboratories.

Additional Notes

Metres is represented by “m”; “etw” is Estimated True Width and is based on drill hole geometry or comparisons with other on-section drill holes; “Au” refers to gold, and “Ag” refers to silver; “gpt” is grams per metric tonne; some figures may not sum due to rounding; Composite assay grades presented in summary tables are calculated using a Au grade minimum average of 0.20 gpt or 1.0 gpt as indicated in “Au Cut-off” column of Summary Tables. Maximum internal waste included in any reported composite interval is 3.00 m. The 1.00 gpt Au cut-off is used to define higher-grade “cores” within the lower-grade halo.

Gold equivalent grades are calculated based on an assumed gold price of US$1,700 per ounce and silver price of $22 per ounce, based on the formula AuEq grade (gpt) = Au grade + (Ag grade x ($22 / $1,700)). Metallurgical recoveries are not considered in the in-situ grade estimate but are estimated to be 93% and 83% for gold and silver, respectively, when processed in a mill, and 72% and 25% respectively when heap-leached. See the June 12, 2023, Los Reyes Technical Report for additional details.

Qualified Person

Scott Smith, P.Geo., Executive Vice President of Exploration, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Prime Mining

Prime is managed by an ideal mix of successful mining executives, strong capital markets personnel and experienced local operators all focused on unlocking the full potential of the Los Reyes Project. The Company has a well-planned capital structure with a strong management team and insider ownership. Prime is targeting a material resource expansion at Los Reyes through a combination of new generative area discoveries and growth, while also building on technical de-risking activities to support eventual project development.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE