Premier American Uranium Announces Preliminary Economic Assessment and Mineral Resource Update for the Cebolleta Uranium Project, Outlining Project Economics and Framework for Enhancement

PEA outlines base case production averaging 1.4 Mlb U₃O₈ annually over a 13-year mine life for total output of 18.1 Mlb with an after-tax NPV (8%) of US$83.9M, with strong leverage to higher uranium prices and increased recovery

Premier American Uranium Inc. (TSX-V: PUR) (OTCQB: PAUIF) is pleased to announce the results of its Preliminary Economic Assessment for the Cebolleta Uranium Project in New Mexico. The PEA highlights the potential for a large-scale, long-life, low-capex uranium project with leverage to rising uranium prices. The PEA contemplates a heap leach strategy that produces a uranium-loaded resin that would be suitable for off-site processing at multiple under-utilized licensed domestic in-Situ Recovery (ISR) central processing plants, enabling potential development without reliance on legacy conventional mills. Preliminary economics are believed to have strong potential to be enhanced near-term with advanced metallurgical testing and process optimization.

The updated Mineral Resource Estimate for Cebolleta increases Indicated Mineral Resources by 1.7 Mlb eU3O8 (+9%) to 20.3 Mlb eU3O8 and increases Inferred Mineral Resources by 2.2 Mlb eU3O8 (+45%) to 7.0 Mlb eU3O8, compared to the previous technical report on the Project released in April 2024. The updated MRE positions Cebolleta as one of the largest undeveloped uranium deposits in the western United States. The PEA and MRE are included in a Technical Report prepared in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects by SLR International Corporation an independent consulting firm with extensive experience in mining and mineral processing, including uranium operations in the United States.

The PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized.

Highlights

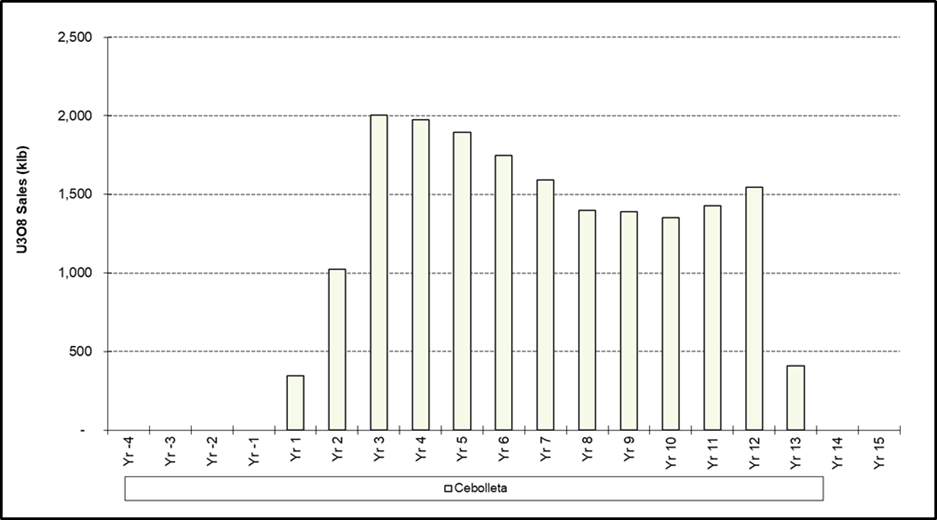

- Base case mining concept shows Cebolleta average production of 1.4 Mlb U₃O₈ annually (peak of 2.0 Mlb) for a total of 18.1 Mlb over its 13-year mine life.

- After-tax net present value (8%) of US$83.9M (US$106M pre-tax)

- After-tax IRR of 17.7%

- Pre-production costs:

- Direct CAPEX of US$64.2M

- Indirect (EPCM / Owners cost / Indirect) of US$19.3M

- 35% contingency of US$29.2M

- Life of Mine (“LOM”) after-tax free cash flow of US$287M

- LOM operating cashflow of US$496M

- Average operating cost of US$41.60 per lb U3O8 recovered

- Relatively low operating costs are underpinned by very competitive heap leach processing costs of US$16.72 per short ton

-

- Base case uranium price assumption of US$90/lb U₃O₈

- Strong leverage to uranium prices, with higher prices expected to potentially further enhance project economics and cash flow generation. Uranium price sensitivity analysis shows after-tax NPV (8%) could reach:

- US$154M at US$100/lb U₃O₈

- US$325M at US$125/lb U₃O₈

- US$488M at US$150/lb U₃O₈

- Upside potential with improved metallurgical recoveries – Sensitivity analysis indicates that base-case after-tax NPV (8%) of US$84M, increases by approximately 90% to US$159M using a 90% metallurgical recovery assumption.

- Updated MRE significantly increases total Project mineral resources:

- Indicated resource: 20.3 Mlb eU3O8 (8.3 Mst grading 0.12% eU3O8), up 1.7 Mlb eU3O8 or 9% vs. 2024 Technical Report

- Inferred resource: 7.0 Mlb eU3O8 (3.6 Mst grading 0.10% eU3O8), up 2.1 Mlb eU3O8 or 43% vs. 2024 Technical Report

Colin Healey, CEO and Director of Premier American Uranium, commented, “The PEA highlights that Cebolleta has the potential to be a cornerstone U.S. uranium project with a long mine life, low upfront capital, and strong leverage to higher uranium prices. Alongside the PEA, the updated MRE significantly increases project-wide resources, reflecting another successful deliverable for our team. With a clear pathway to optimizing embedded process assumptions through additional metallurgical studies, and exploration upside potential, we see an opportunity to rapidly de-risk and increase project value, as we advance Cebolleta toward potential development. We believe these next steps have the potential to position Cebolleta as a critical contributor to U.S. energy independence.”

Table 1: Summary of Key Economic Parameters – Base Case

| Description | US$ million |

| Realized Market Prices | |

| U3O8 ($/lb) | $90 |

| Payable Metal | |

| U3O8 (klb) | 18,101 |

| Total Gross Revenue | $1,629 |

| Mining Cost | $(705) |

| Mill Feed Transport Cost | $(1) |

| Process Cost | $(175) |

| G & A Cost | $(76) |

| Royalties | $(98) |

| Severance Tax | $(29) |

| Total Operating Costs | $(1,085) |

| Operating Margin (EBITDA) | $545 |

| Operating Margin % | 33% |

| Corporate Income Tax | $(48) |

| Working Capital* | $0 |

| Operating Cash Flow | $496 |

| Development Capital | $(113) |

| Sustaining Capital | $(81) |

| Closure/Reclamation | $(16) |

| Total Capital | $(209) |

| Pre-tax Free Cash Flow | $335.4 |

| Pre-tax NPV @ 5% | $166.8 |

| Pre-tax NPV @ 8% | $106.3 |

| Pre-tax NPV @ 12% | $53.3 |

| Pre-tax IRR | 19.8% |

| Pre-tax Undiscounted Payback from Start of Commercial Production (Years) | 4.3 |

| After-tax Free Cash Flow | $286.9 |

| After-tax NPV @ 5% | $137.3 |

| After-tax NPV @ 8% | $83.9 |

| After-tax NPV @ 12% | $37.3 |

| After-tax IRR | 17.7% |

| After-tax Undiscounted Payback from Start of Commercial Production (Years) | 4.9 |

Sensitivity Analysis

Sensitivity analysis of the Cebolleta PEA indicates strong leverage to uranium price, where a 11% increase to the base case assumption (US$90/lb U3O8) to US$100/lb, increases after-tax NPV (8%) by 83%, to US$154M. Given the current market growth expectations for the uranium sector and recent (2024 peak UxC Spot uranium price: US$107/lb U3O8) and leading uranium price indicators, (UxC 5-year price: US$94/lb U3O8), sensitivity at higher prices was also examined. At US$125/lb U3O8, the after-tax project NPV (8%) increases to US$325M (39% increase in uranium price increases post-tax NPV (8%) by 288%).

Also notable, is the leverage to metallurgical recovery assumption, where a 2.5% increase from 80% recovery to 82%, increases post-tax NPV (8%) by 19%, to US$99.6M. Increasing recovery by 12% (from 80% recovery to 90%) increases after-tax NPV (8%) by 90%, to US$159M. Standard uranium project sensitivities to various inputs are tabled below.

Table 2: After-Tax Sensitivity Analyses (deviation from base-case)

| Variance | Metal Prices (US$/lb U3O8) |

NPV at 8% (US$000) |

||

| 78% | $70 | ($57,384) | ||

| 89% | $80 | $14,410 | ||

| 100% | $90 | $83,857 | ||

| 111% | $100 | $153,718 | ||

| 122% | $110 | $222,911 | ||

| 139% | $125 | $325,391 | ||

| 167% | $150 | $487,514 | ||

| Variance | Recovery (%) |

NPV at 8% (US$000) |

||

| 95% | 64% | ($41,713) | ||

| 98% | 72% | $21,288 | ||

| 100% | 80% | $83,857 | ||

| 103% | 82% | $99,590 | ||

| 112% | 90% | $159,261 | ||

| Variance | LOM Total Operating Costs (US$/ton cumulative) |

NPV at 8% (US$000) |

||

| 85% | $804,491 | $145,076 | ||

| 93% | $875,476 | $114,522 | ||

| 100% | $946,460 | $83,857 | ||

| 118% | $1,112,091 | $12,696 | ||

| 135% | $1,277,721 | ($61,750) | ||

| Variance | LOM Total Capital Costs (US$000) |

NPV at 8% (US$000) |

||

| 85% | $190,546 | $105,766 | ||

| 93% | $207,359 | $94,812 | ||

| 100% | $224,172 | $83,857 | ||

| 118% | $263,402 | $58,297 | ||

| 135% | $302,633 | $32,736 | ||

Mineral Resource Estimate

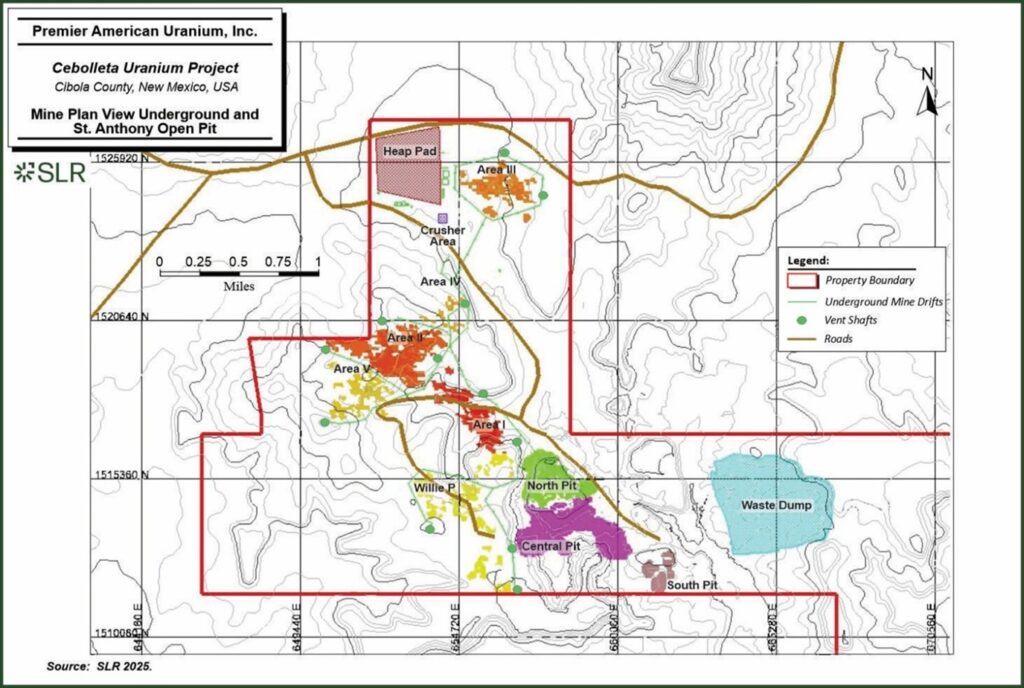

The Cebolleta Uranium Project is underlain by Upper Jurassic Morrison Formation units, particularly the Jackpile Sandstone Member, which hosts the majority of uranium mineralization. The mineralization is primarily stratabound and tabular, hosted within medium- to coarse-grained, humate-rich fluvial sandstones of the Jackpile Sandstone. Mineralization is primarily hosted in the relatively flat laying Jackpile Sandstone at depths below the surface of 0 ft to 500 ft. The Project is composed of the St. Anthony, Willie P, and Areas I, II, III, IV, and V mining areas.

Historical exploration, including over 4,000 drill holes and multiple mining operations (Willie P, Climax M-6, St. Anthony, and Sohio JJ#1), has established a robust geologic and mineralization framework for the Project.

A modern confirmation drilling program conducted in 2023 validated historical drilling data, confirming stratigraphy, mineralization thickness, and grades. Results support the use of legacy data in current resource estimation.

The MRE incorporates over 3,300 validated drill holes totaling greater than 1.7 million feet and is summarized below.

SLR is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MRE.

Table 3: Mineral Resource Estimate – Cebolleta Uranium Project – Effective May 14, 2025

| Classification | Grade Cut-off (% eU3O8) |

Tonnage (Mst) |

Grade (% eU3O8) |

Contained Metal (Mlb eU3O8) |

| Indicated | ||||

| Underground | 0.00 | 5.89 | 0.15 | 18.14 |

| Open Pit | 0.02 | 3.81 | 0.07 | 5.61 |

| Subtotal Indicated | 9.70 | 0.12 | 23.75 | |

| Depletion | -1.40 | 0.12 | -3.44 | |

| Total Indicated less Depletion | 8.30 | 0.12 | 20.31 | |

| Inferred | ||||

| Underground | 0.00 | 1.79 | 0.12 | 4.42 |

| Open Pit | 0.02 | 1.81 | 0.07 | 2.62 |

| Total Inferred | 3.60 | 0.10 | 7.04 | |

Notes:

|

||||

Mine Plan Overview and Mineable Resources

The PEA contemplates a two-year underground pre-production period and a 13-year active mine life comprised of underground and open pit mining across seven mining zones (St. Anthony, Willie P, and Areas I, II, III, IV, and V). The primary mining methods expected to be employed at Cebolleta will be open pit (St. Anthony Area) and room and pillar (Areas I, II, III, IV, V and Willie P, St. Anthony North and South Zones).

The mine plan, which is based on Indicated and Inferred Mineral Resources, includes a total of 8.30 million short tons (Mst) at 0.12% eU₃O₈ containing 20.31 million pounds (Mlb) eU₃O₈ Indicated and 3.60 Mst at 0.10% eU₃O₈ containing 7.04 Mlb eU₃O₈ Inferred.

The underground mining areas will be accessed by a 3,500-ft long adit decline starting near the heap pad location for Area III, with a 2,500-ft long extension of this decline to access Area II. There will be a second access to the underground mining at Area I and Willie P, which will be a 930-ft long adit starting at a location in the northwest corner of the St. Anthony open pit. These two underground accesses will be connected by a 3,800-ft long drift. A minimum mining thickness of six feet was applied to two-foot-thick mining blocks. An underground 85% mining recovery was applied to the Mineral Resource Estimate reporting panels with underground panel dilution expected to be 21%. PUR is acutely aware of the need to keep dilution low, given the high cost of mining and treatment.

Over the LOM, mining is expected to supply total process feed of 10.46 Mst with an average head grade of 0.11% eU3O8. Mining rates are anticipated to be 1,079 short tons per day from underground and 1,982 stpd from open pit operations.

It is envisioned that Cebolleta will supply approximately 1.1 million short tons of mineralized material per year to PUR’s heap leach pad located on the Cebolleta property.

Figure 1: Mine Plan View – Cebolleta Uranium Project Open Pit and Underground

Processing Overview

Mineralized material will be crushed via mobile crusher in 2-stages to a 2-inch crush size and stacked in lifts on an HLP and irrigated with dilute sulfuric acid solution for uranium leaching. The LOM average head grade is 0.11% U3O8, and the process design U3O8 head grade is 0.140% with the nominal leach recovery assumed at 80%.

Leached uranium is collected as a pregnant leach solution and processed via ion exchange columns containing resin. The uranium in the PLS will load onto the resin with the resultant barren solution recycled back to the heap leach for additional leaching cycles. Loaded resin columns will be removed from service and shipped offsite for further processing.

Total expected LOM uranium recovered is 18.28 Mlb eU3O8 over the 13-year operating life for an annual average production rate of 1.4 Mlb eU3O8 (assumed to be 99% payable).

The key planned design criteria are summarized below.

Table 4: Cebolleta Process Design Criteria

| Parameter | Units | Design | Source |

| Daily throughput | stpd | 2,300 | Assumed |

| Annual throughput | stpa | 839,500 | Calculated |

| U3O8head grade, design | % | 0.140 | Calculated |

| U3O8head grade, LOM | % | 0.110 | Calculated |

| Heap leach recovery | % | 80 | Assumed |

| U3O8production – Stacked Short Tons per Day | stpa | 2,290 | Calculated |

| U3O8production – Average Annual Recovered Metal | Mlb/annum | 1.4 | Calculated |

| U3O8production – Average Daily Recovered Metal | lb/day | 3,800 | Calculated |

| ROM moisture | % | 3 | Assumed |

| Mineralized material specific gravity | 3 | Assumed | |

| Mineralized Heap Leach bulk density | lb/ft3 | 99.88 | Assumed |

| Crushing | 2 stage mobile crusher | Assumed | |

| Crusher P80 | in | 2 | Assumed |

| Heap leach stacking time | hours/day | 10 | Assumed |

| Heap leach pad dimensions | |||

| Pad height | ft | 26.2 | Assumed |

| Irrigation rate | gpm/ft2 | 0.004 | Assumed |

| Heap Leach Time | Days | 90 | Assumed |

| Overall heap leach pad mass | st | 299,000 | Calculated |

| Heap leach pad application mass | st | 207,000 | Calculated |

| Heap leach pad area | ft2 | 228,164 | Calculated |

| Heap leach application area | ft2 | 157,960 | Calculated |

| Acid Concentration | % | 98 | Assumed |

| Leach solution H2SO4Concentration | lb/gal | 0.05 | Assumed |

| Pregnant solution flowrate | gpm | 646 | Calculated |

| Evaporation | % | 7% | Assumed |

| Uranium pregnant solution concentration | mg/L | 664 | Calculated |

| Ion exchange column volume | ft3 | 530 | Assumed |

| Resin bed depth, height | ft | 10.8 | Calculated |

| Column diameter | ft | 8.3 | Calculated |

| Number of columns | 4 (2 online, 2 standby) | Calculated | |

| Bed volumes per hour | BV/hr | 10 | Calculated |

| Uranium loading capacity | g U3O8per litre resin | 30 | Assumed |

| Loaded resin volume per day | st | 11 | Calculated |

| Number of columns taken out of service per day | Columns/d | 1.0 | Calculated |

| Number of columns inventory | 21 | Assumed | |

| Loading pH | 1.5 – 2.5 | Assumed | |

| Operating temperature | Ambient | Ambient (20 – 40C) | Assumed |

| Pressure drop across column | bar | 0.5 – 1 | Assumed |

Figure 2: Payable eU3O8 LOM Production Schedule

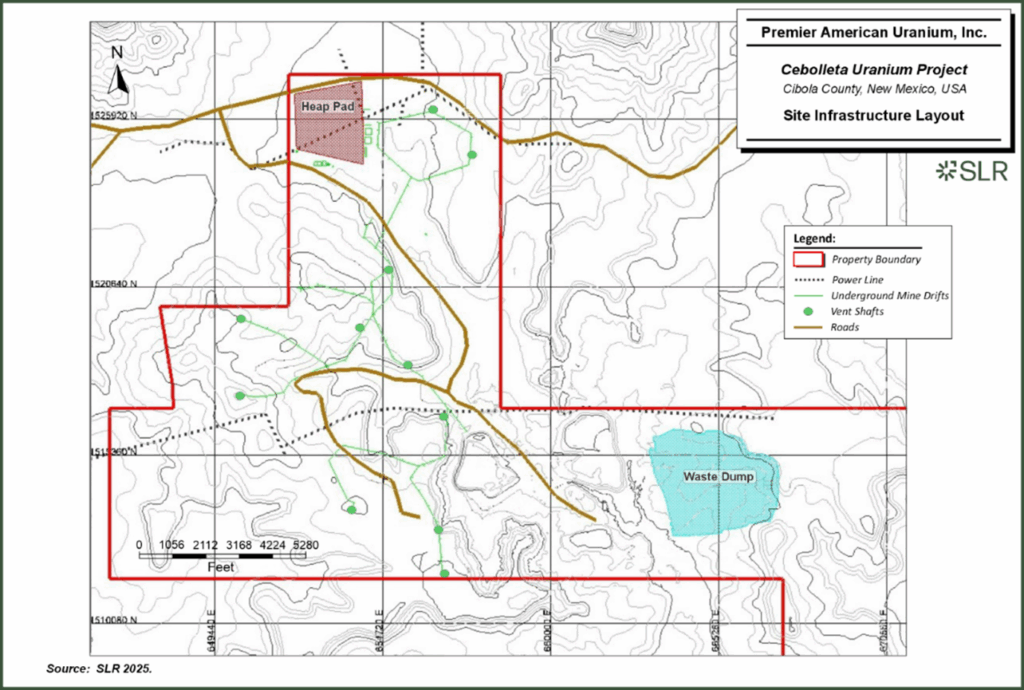

Project Infrastructure Overview

Current Project access is considered very good and the PEA includes upgrading for commercial operations. The Project will require an HLP, a resin-in-column processing plant, and standard surface facilities to support mining and processing operations.

The HLP and associated pond will be synthetically lined so that the solution is contained within a closed system, with the only net solution loss being to evaporation (designed as a zero-discharge facility). An appropriate location on site has been identified that meets the capacity requirements and other constraints, as shown below. The HLP construction is staged throughout the Project life to reduce up-front capital costs.

The Project will have line power and diesel-generated backup electric power for the processing plant, underground operation, ventilation fans, and surface infrastructure.

The general site layout, including placement of the heap leach pad, waste dump, power lines, roads, underground drifts and vent shafts are depicted below.

Figure 3: Site Infrastructure Layout

Key Recommendations of the PEA

Given the favourable technical and economic results of the PEA, the independent technical consultants preparing the PEA and Technical Report have recommended a multi-phase plan to further de-risk and refine project scope and economics, including advanced metallurgical test work to investigate and enhance leach recovery assumptions and assess other opportunities for optimization identified within the PEA. Recommendations also include drilling of core holes for confirmation and to provide sample material for leach tests, among a broader scope of work, ultimately supporting a recommendation to pursue a PEA update or Preliminary Feasibility Study.

Technical Report

The effective date of the PEA and the MRE is May 15, 2025, and the Technical Report will be filed on the Company’s website and under its SEDAR+ profile within 45 days of this news release.

When available, readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA and mineral resource model. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

About the Cebolleta Uranium Project and Mineral Resources

Located in New Mexico, the Cebolleta Uranium Project is a past-producing property with extensive historical work and infrastructure. Its location in one of the premier uranium districts in the US provides strategic advantages, including proximity to utilities and existing processing facilities.

Qualified Person

The scientific and technical information contained in this news release relating to the PEA and MRE was reviewed and approved by Mr. Mark B. Mathisen, C.P.G., Stuart Collins, P.E., Jeffrey L. Woods, MMSA QP, Lee (Pat) Gochnour, MMSA QP and Matthew Behling, P.E., for SLR International Corporation, the authors of the Current Technical Report, each of whom is a “Qualified Person” (as defined in NI 43-101).

Mr. Mathisen has verified the exploration, sampling, analytical, and test data supporting the Technical Report through review and audit of historical and recent databases, comparison with original geophysical logs and assay records, and inspection of drill hole collar, interval, and grade data for completeness and accuracy. Verification included a site visit on September 12, 2023, review of drilling and downhole logging procedures, and evaluation of the 2023 twin-hole and 2025 Willie P database audits, which confirmed strong correlation with historical results and overall data reliability. Although no historical core or quality assurance/quality control reference materials are available and most legacy holes lack deviation surveys, no limitations were placed upon the QP during the verification process, and the QP considers the verification methods and resulting database adequate for Mineral Resource estimation and compliant with NI 43-101 requirements.

Additional scientific and technical information in this news release not specific to the PEA and MRE has been reviewed and approved by Dean T. Wilton, PG, CPG, MAIG, a consultant of Premier American Uranium Inc. , who is a “Qualified Person” (as defined in NI 43-101).

About Premier American Uranium Inc.

Premier American Uranium is focused on consolidating, exploring, and developing uranium projects across the United States to strengthen domestic energy security and advance the transition to clean energy. The Company’s extensive land position spans five of the nation’s top uranium districts, with active work programs underway in New Mexico’s Grants Mineral Belt and Wyoming’s Great Divide and Powder River Basins.

Backed by strategic partners including Sachem Cove Partners, IsoEnergy Ltd., Mega Uranium Ltd., and other leading institutional investors, PUR is advancing a portfolio supported by defined resources and high-priority exploration and development targets. Led by a distinguished team with deep expertise in uranium exploration, development, permitting, operations, and uranium-focused M&A, the Company is well positioned as a key player in advancing the U.S. uranium sector.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE