Premier American Uranium and American Future Fuel Announce Updated Mineral Resource Estimate for the Cebolleta Project, Setting the Stage for Planned Expansion Drilling

Premier American Uranium Inc. (TSX-V: PUR) (OTCQB: PAUIF) and American Future Fuel Corporation (CSE: AMPS) (OTCQB: AFFCF) (FWB: K14, WKN: A3DQFB) are pleased to announce a current mineral resource estimate and the filing of a Technical Report for the 100% owned Cebolleta Uranium Project located in Cibola County, New Mexico, US prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Technical Report is being filed under both PUR and AMPS’ respective profiles on SEDAR+ at www.sedarplus.ca, in connection with the previously announced Plan of Arrangement involving the companies which is expected to close later this week. The Technical Report, prepared by SLR International Corporation with an effective date of April 30, 2024, includes a current Mineral Resource Estimate for the Project and in line with recommendations, lays the foundation for future exploration to support a planned Preliminary Economic Assessment.

Highlights of the Technical Report

- The MRE is based on a commodity price of US$80.00 per pound of U3O8 using an underground mining cut-off grade of 0.072% eU3O8 and an open pit mining cut-off grade of 0.024% eU3O8, reported as an:

- Indicated Mineral Resource totaling 18.6 million pounds of eU3O8 (6.6 million short tons at an average grade of 0.14% eU3O8).

- Inferred Mineral Resource totaling 4.9 million pounds eU3O8 (2.6 million short tons at an average grade of 0.10% eU3O8).

- The MRE underscores the Project’s extensive exploration and operating history, incorporating reliable historical data and previously unaccounted areas such as the St. Anthony North pit, while factoring in depletion from past production (Figure 1).

- The current MRE exceeds the historical Inferred Mineral Resource that was prepared for Uranium Resources, Inc. (AMPS’ predecessor) in 2014, upgrading approximately 80% of previous Inferred Mineral Resource to the Indicated Mineral Resource category.

- Key recommendations outlined in the Technical Report include:

- Exploration to expand the deposit footprint with potentially positive implications to a mining scenario.

- Collection of additional bulk density and chemical assays in future drilling to confirm historical reported density and radiometric equilibrium results.

- Updating the MRE with additional drill hole data and completing a PEA.

- Strong exploration potential remains at the Project with potential to increase total mineral resources through exploration and expansion drilling in previously untested areas where the mineralized horizons of the Jackpile sandstone are open ended beyond the currently drilled area. Further work to de-risk the Project is expected to include infill drilling to upgrade Inferred Mineral Resource to Indicated Mineral Resource along currently mapped uranium mineralization. The Willie P area, which is not included in the MRE but was the site of previous underground mine operations, is believed to have resource potential which may be augmented by integrating additional historic radiometric logs and grade information into the resource model.

Colin Healey, CEO of PUR, commented, “We are extremely pleased to announce the updated Technical Report on Cebolleta. This asset was identified by our seasoned technical team as “highly attractive” for its resource potential, grade and favourable location on private lands in New Mexico. The new Technical Report represents a significant step forward for PUR and the Project, delivering a current MRE for the first time in a decade, and ahead of plan. The Mineral Resource estimate now exceeds the 2014 historical Inferred Mineral Resource estimate, confirming 18.6Mlb U3O8 in Indicated and 4.9Mlb U3O8 in Inferred (~80% ‘Indicated’, ~20% ‘Inferred’) and our exploration strategy can now transition from confirmation drilling to extension and expansion drilling as we work toward completing a Preliminary Economic Assessment (PEA), as recommended in the Technical Report. We believe that prioritizing our budget around these higher-impact initiatives should deliver enhanced value to shareholders with the potential to add resource pounds in new areas as we build out a mining concept. We thank all the technical staff and contractors for their contribution in achieving this major milestone and we are excited for the next phase of work at Cebolleta.”

Table 1: Summary of Mineral Resources – Effective Date of April 30, 2024

| Classification | Zone | Grade Cut-off (% eU308) |

Tonnage (Million st) |

Grade (% eU308) |

Contained Metal (Million lb eU308) |

AMPS Basis (%) |

Recovery U308 (%) |

| Underground | |||||||

| Indicated | Area I | 0.072 | 0.8 | 0.168 | 2.6 | 100 | 95 |

| Area II | 0.072 | 2.3 | 0.193 | 8.7 | 100 | 95 | |

| Area III | 0.072 | 0.7 | 0.192 | 2.7 | 100 | 95 | |

| Area IV | 0.072 | 0.0 | – | 0.0 | 100 | 95 | |

| Area V | 0.072 | 0.4 | 0.208 | 1.6 | 100 | 95 | |

| Subtotal Indicated | 4.1 | 0.189 | 15.6 | 100 | 95 | ||

| Depletion JJ#1 | -0.9 | 0.123 | -2.2 | ||||

| Total Indicated | 3.2 | 0.208 | 13.4 | ||||

| Inferred | Area I | 0.072 | 0.2 | 0.118 | 0.4 | 100 | 95 |

| Area II | 0.072 | 0.3 | 0.131 | 0.8 | 100 | 95 | |

| Area III | 0.072 | 0.2 | 0.156 | 0.6 | 100 | 95 | |

| Area IV | 0.072 | 0.1 | 0.105 | 0.3 | 100 | 95 | |

| Area V | 0.072 | 0.2 | 0.161 | 0.5 | 100 | 95 | |

| Total Inferred | 1.0 | 0.135 | 2.6 | 100 | 95 | ||

| Open Pit | |||||||

| Indicated | St. Anthony North Pit | 0.024 | 3.3 | 0.081 | 5.4 | 100 | 95 |

| 0.024 | 0.1 | 0.084 | 0.2 | 100 | 95 | ||

| Subtotal Indicated | 3.4 | 0.081 | 5.5 | 100 | 95 | ||

| Depletion Climax M6 |

-0.1 | 0.205 | -0.3 | ||||

| Total Indicated | 3.3 | 0.078 | 5.2 | ||||

| Inferred | St. Anthony North Pit | 0.024 | 1.3 | 0.070 | 1.8 | 100 | 95 |

| 0.024 | 0.3 | 0.078 | 0.5 | 100 | 95 | ||

| Total Inferred | 1.6 | 0.072 | 2.3 | 100 | 95 | ||

Notes:

1. CIM (2014) definitions were followed for Mineral Resources.

2. Mineral Resources are estimated at a cut-off grade of 0.072% eU3O8 for underground based on Deswik MSO stope

shapes and 0.024% eU3O8 for open pit using Whittle pit optimization.

3. Mineral Resources are estimated using a long-term uranium price of US$80/lb U3O8.

4. Mineral Resources have been depleted based on past reported production numbers from the underground JJ#1 and

Climax M6 mines.

5. A minimum mining width of two feet was used.

6. Tonnage Factor is 16 ft3/st (Density is 0.625 st/ft3 or 2.00 t/m3).

7. Numbers may not add due to rounding.

Mineral Resources are not Mineral Reserves, and do not have demonstrated economic viability. The authors of the Technical Report were not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MRE.

Technical Report

Mineral Resources have been classified in accordance with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM (2014) definitions).

The MRE was completed using a conventional block modelling approach. The general workflow used by SLR included the construction of a geological or stratigraphic model representing the Jurassic Morrison Formation in Seequent’s Leapfrog Geo (Leapfrog Geo) from mapping, drill hole logging, and sampling data, which was used to define discrete domain and surfaces representing the upper and lower contact of the Jackpile Sandstone Member. The geologic models were then used to constrain resource estimation completed using Seequent’s Leapfrog Edge (Leapfrog Edge) software. The MRE used a regularized, unrotated whole block approach, inverse distance cubed (ID3) interpolation methodology, and one-foot uncapped composites to estimate the eU3O8 grades in a three-pass search approach. Hard boundaries were used with ellipsoidal search ranges, and search ellipse orientation was informed by geology and mineralization wireframing. Density values were assigned based on historical bulk density records.

Estimates were validated using standard industry techniques including statistical comparisons with composite samples and parallel inverse distance squared (ID2), ordinary kriging (OK) and nearest neighbor (NN) estimates, swath plots, and visual reviews in cross section and plan. A visual review comparing blocks to drill holes was completed after the block modelling work was performed to ensure general lithologic and analytical conformance and was peer reviewed prior to finalization.

Rotary and diamond drilling (core) on the property was the principal method of exploration and delineation of uranium mineralization. From 1951 to 2014 and 2023, AMPS and its predecessors completed a reported total of 3,644 drill holes, of which 3,594 drill holes totaling 1,868,457 ft of drilling are contained in the drilling database provided to SLR. Of the 3,594 drill holes, 2,713 drill holes totaling 1,380,041 ft of drilling were used in the MRE. Historic surface holes missing collar information, lithology information, or corresponding radiometric logs, i.e., assay data, were excluded. A summary of the available data used in the modeling of mineralization is presented in Table 2.

Table 2: Summary of Drill Hole Data used in Mineral Resource Estimation

| Area | No. Holes | Total Depth (ft) |

Avg Depth (ft) |

Number of Records | ||

| Survey | Lithology | Probe | ||||

| Area I | 296 | 115,364 | 390 | 1,337 | 361 | 292,349 |

| Area II | 380 | 243,232 | 640 | 1,205 | 415 | 478,456 |

| Area III | 234 | 116,021 | 496 | 447 | 1,439 | 207,699 |

| Area IV | 125 | 81,464 | 652 | 247 | 112,191 | |

| Area V | 223 | 139,712 | 627 | 1,720 | 250,023 | |

| Area Sohio_1 | 23 | 9,486 | 412 | 23 | 9,459 | |

| Area Sohio_2 | 16 | 8,354 | 522 | 16 | 8,252 | |

| St. Anthony North Pit |

1,198 | 550,854 | 460 | 1,298 | 98 | 5,737 |

| St. Anthony South Pit |

215 | 113,679 | 529 | 216 | 40 | 367 |

| Exploratory | 3 | 1,875 | 625 | 3 | 2,692 | |

| Grand Total | 2,713 | 1,380,041 | 509 | 6,512 | 1,953 | 1,367,225 |

The Cebolleta Uranium Project

The Project is located in the northeastern corner of Cibola County, approximately 40 miles west of the city of Albuquerque, NM, and approximately 10 miles north of the town of Laguna, NM. The property encompasses 6,717 acres (2,718 hectares) of privately held mineral rights (fee or deeded) and approximately 5,700 acres (2,307 hectares) of surface rights owned in fee by La Merced del Pueblo de Cebolleta. The Project is in a region that has a lengthy history of uranium exploration and mining activity dating to the 1950’s and is close to necessary infrastructure and resources.

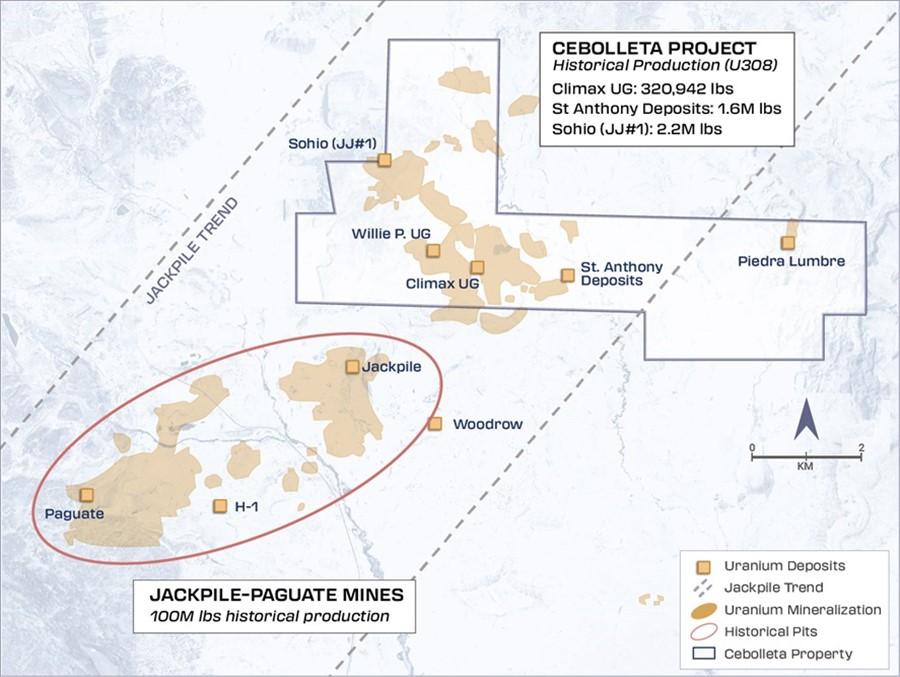

Figure 1: Plan View Map of the Cebolleta Uranium Project and Uranium Deposits

As described below and depicted above in Figure 1, the deposits that comprise the Project are classified as sandstone hosted uranium deposits with eight deposits occurring as a series of tabular bodies within the Jackpile Sandstone Member of the Upper Jurassic Morrison Formation within the boundaries of property.

These deposits are part of a broad and extensive area of uranium mineralization, including the Jackpile-Paguate deposit, located adjacent to the southern boundary of the property, which was one of the largest concentrations of uranium mineralization in the United States (Moran and Daviess, 2014). The L-Bar occurrence area contains five distinct deposits, including Areas I, II, III, IV, and V. The historical JJ#1 Mine is situated in the northwest corner of the Area II Deposit area. In addition to the L-Bar deposits, three distinct deposits occur in the St. Anthony area of the property.

The production history of the Project is as follows:

- Climax M6 Mine (1956 to 1960): 78,722 short tons (71,415 tonnes) that averaged 0.20% uranium oxide (U3O8) and contained 320,942 pounds of U3O8.

- St. Anthony Mine Complex (1975 to 1979): 1.6 million pounds of U3O8.

- Sohio JJ#1 Mine (1976-1981): 898,600 short tons averaging 0.123% U3O8 and yielding 2,218,800 pounds of U3O8.

Significant exploration potential is believed to remain on the Project. The mineralized horizons of the Jackpile sandstone are open ended and potentially trend beyond the external limits of the drill hole grid. Potential exists to extend mineralization into previously untested areas of the Project, where this mineralized zone is present but not drill tested in a comprehensive manner.

Qualified Person

The scientific and technical information contained in this news release was reviewed and approved by Mark Mathisen, CPG, SLR International Corporation, Denver, CO, an independent geological consultant to the Company, who is a “Qualified Person” (as defined in National Instrument 43- 101 – Standards of Disclosure for Mineral Projects).

Technical Report

A Technical Report prepared in accordance with NI 43-101 for the Project is being filed under PUR and AMPS’ respective profiles on SEDAR+ at www.sedarplus.ca. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

About Premier American Uranium

Premier American Uranium Inc. is focused on the consolidation, exploration, and development of uranium projects in the United States. One of PUR’s key strengths is the extensive land holdings in two prominent uranium-producing regions in the United States: the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado. With a rich history of past production and historic uranium mineral resources, PUR has work programs underway to advance its portfolio.

Backed by Sachem Cove Partners, IsoEnergy and additional institutional investors, and an unparalleled team with U.S. uranium experience, PUR’s entry into the market comes at a well-timed opportunity, as uranium fundamentals are currently the strongest they have been in a decade.

About American Future Fuel

American Future Fuel Corporation is a Canadian-based resource company focused on the strategic acquisition, exploration, and development of alternative energy projects. AMPS holds a 100% interest in the Cebolleta Uranium Project, located in Cibola County, New Mexico, USA, and situated within the Grants Mineral Belt, a prolific mineral belt responsible for approximately 37% of all uranium produced in the United States of America.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE