Precious Metals Commentary by James Anderson

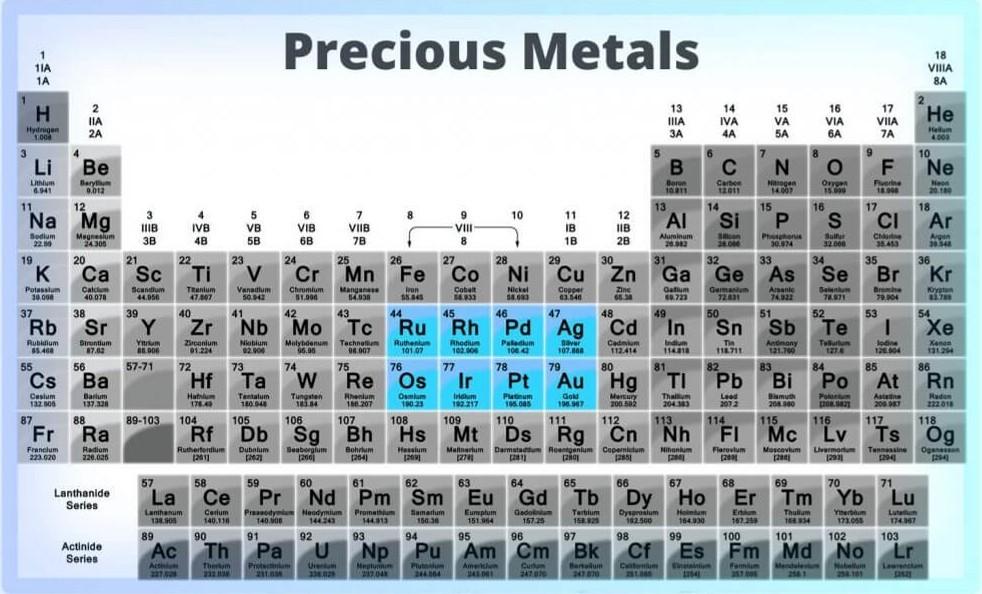

The recent move in the price of platinum foreshadows what could be just ahead of us for silver. Before I begin, I am going to wade into the debate of what actually constitutes a “precious metal”. If you do a quick internet search, you will see that eight metals are listed as “precious” – gold, silver, platinum, palladium, rhodium, ruthenium, iridium, and osmium. And there are always people trying to tack on more metals to this list.

My view is that only gold, silver and platinum are precious metals and that the rest are just “expensive metals”. No one in human history ever used iridium as a store of wealth; only gold and silver have been used this way. Even silver is often classified as a “semi-precious” metal, and is at times categorized as either a base metal OR a precious metal. I am often asked – “So James, which one is it?”

My view for many years has been simple – when the silver price is rising, then it is both a precious metal and an industrial metal; when the silver price is dropping, it is neither.

The recent move seen in the platinum price is worthy of examination (see the 5-year chart below). Platinum is up over 25% in less than a month! Why? Because reality is slipping into the narrative. For years, market commentary from a wide array of sources have been projecting scarcity and substantial supply/demand deficits. In the case of platinum, as the nursery rhyme suggests, Old Mother Hubbard went to the cupboard, and she found it was indeed quite bare of platinum. Years of supply deficits were ultimately ignored; and since 80% of supply comes from either South Africa – where rolling electrical blackouts are now the norm – or from Russia – where war and economic turmoil are now the norm – adding supply quickly, or at all, becomes an impossibility.

I’m confident that we are on the cusp of seeing the same supply crunch for silver; and I am predicting we will then see a similar dramatic reaction in the silver price. A 25% move in silver would take us past the mid $45 range and push us towards the holy grail of all silver prices – $50. Regardless of how we get there, I believe the move will be very reminiscent of the price action we have just seen in platinum – breathtaking!

This all reminds me of the uranium market in the mid-2000s. After enjoying a steady rise in 2004, the uranium price crossed the $20 mark in January 2005. At this point, the supply/demand argument became apparent to the general market and the result was a parabolic and sustained run over a 36-month period all the way to $136 per pound. Silver has also appreciated well over the past year and is now poised to cross the threshold where there will be little technical chart resistance for spot silver until prices are considerably higher.

As I recently stated, it is a great time to be looking at silver as a stand alone investment class – and an even better time to be producing it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE