Power Nickel Hole 78 Delivers over 29.5 Metres Wide Polymetallic Zone with Grades ranging from 2.3% – 11% CuEq

Power Nickel Inc. (TSX-V: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) is pleased to announce the return of the first 2 holes of the fall campaign. Hole PN-24-076 reported no material results. Hole PN-24-078 results are outlined in Highlights and Table 1 Below.

Highlights:

PN-24-078 returned:

29.40 m of 0.53 g/t Au, 11.95 g/t Ag, 1.15 % Cu, 1.08 g/t Pd, 0.36 g/t Pt and 0.06% Ni

Including:

11.55 m of 0.44 g/t Au, 11.55 g/t Ag, 0.59 % Cu, 1.25 g/t Pd, 0.76 g/t Pt and 0.02% Ni

which includes:

2.00 m of 0.64 g/t Au, 14.85 g/t Ag, 0.49 % Cu, 2.71 g/t Pd, 2.32 g/t Pt and 0.02% Ni,

and

4.65 m of 0.59 g/t Au, 15.83 g/t Ag, 0.97 % Cu, 1.25 g/t Pd, 0.50 g/t Pt and 0.04% Ni

And Including :

13.35 m of 0.77 g/t Au, 15.86 g/t Ag, 1.98 % Cu, 1.29 g/t Pd, 0.14 g/t Pt and 0.12% Ni

Which includes :

2.90 m of 3.16 g/t Au, 21.62 g/t Ag, 5.84 % Cu, 4.72 g/t Pd, 0.44 g/t Pt and 0.48% Ni,

and

4.00 m of 0.23 g/t Au, 35.78 g/t Ag, 2.30 % Cu, 0.73 g/t Pd, 0.11 g/t Pt and 0.03% Ni

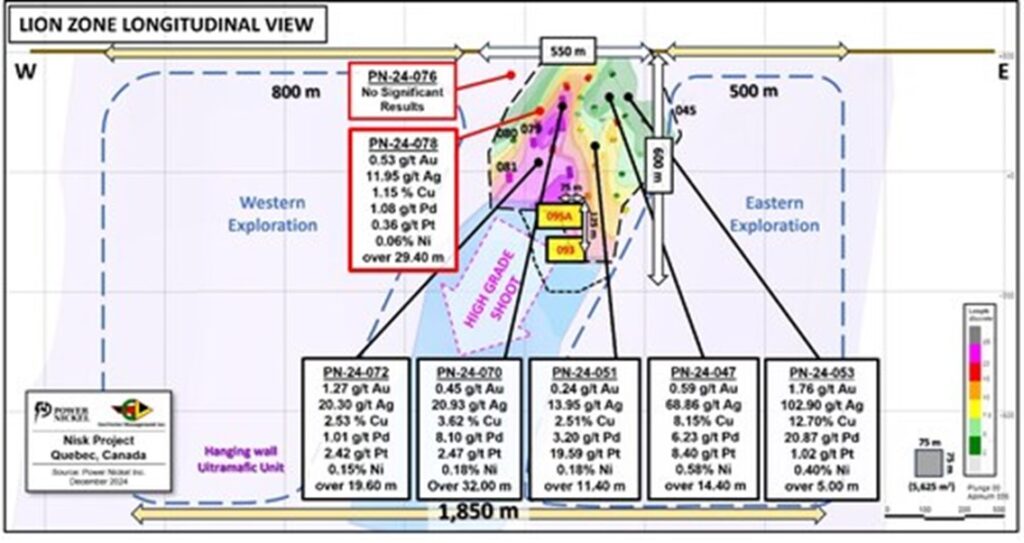

Figure 1 below is a vertical longitudinal section, presenting the location of the recent holes drilled at the Lion Zone discovery. The highlight is put on the location of the two holes for which assay results are presented in this current release. It also highlights the position of the last two holes of the current campaign, that are to date the deepest intersections of the Lion Zone, suggesting that it remains open at depth.

Terry Lynch, CEO of the Company, commented, “We had some material in for assays for metallurgical and research purposes and two early holes 76 and 78 were included in this run. 76 was a miss possibly due to the angle of attack and will be revisited in another hole. But 78 was a very good hole. Its not in the core of the ore body but imagine those results, awesome by any other review, and that’s not your A material. The Lion Zone is exceptional! We are all excited to review the next batch of holes which should include 79-82 and our success to the West which will demonstrate that we have locked on a working strategy”.

Table 1 below presents the significant results of previously released holes, and the current assays. The complete set of results obtained demonstrates an enviable success rate, which contributes to a continuously increasing level of confidence about the continuity of the zone.

Table 1: Significant recent assay results obtained at the Lion Discovery zone

| Hole | From | To | Length | Au | Ag | Cu | Pd | Pt | Ni | CuEq Rec* |

| (m) | (m) | (m) | (g/t) | (g/t) | ( %) | (g/t) | (g/t) | ( %) | ( %) | |

| PN-24-063 | 428.00 | 433.00 | 5.00 | 0.48 | 24.82 | 4.41 | 0.21 | 6.15 | 0.47 | 5.93 |

| Including | 429.00 | 432.00 | 3.00 | 0.73 | 37.90 | 7.10 | 0.30 | 9.26 | 0.50 | 9.30 |

| PN-24-064 | 452.00 | 454.15 | 2.15 | 0.21 | 2.98 | 0.49 | 0.68 | 0.24 | 0.10 | 0.87 |

| Including | 452.00 | 453.00 | 1.00 | 0.27 | 3.90 | 0.85 | 1.03 | 0.31 | 0.19 | 1.35 |

| PN-24-065 | 466.00 | 475.00 | 9.00 | NO SIGIFICANT VALUE | N/A | |||||

| PN-24-066 | 401.95 | 414.00 | 12.05 | 0.09 | 4.53 | 0.65 | 6.39 | 0.30 | 0.06 | 2.97 |

| Including | 411.00 | 414.00 | 3.00 | 0.20 | 12.50 | 1.95 | 2.26 | 0.62 | 0.12 | 2.78 |

| With | 413.00 | 414.00 | 1.00 | 0.28 | 32.40 | 5.08 | 4.44 | 0.44 | 0.16 | 6.22 |

| PN-24-067 | 430.75 | 442.90 | 12.15 | 0.12 | 8.54 | 1.75 | 1.99 | 0.36 | 0.14 | 2.36 |

| Including | 430.75 | 433.40 | 2.65 | 0.16 | 8.47 | 1.27 | 1.01 | 0.84 | 0.11 | 1.80 |

| With | 431.85 | 432.35 | 0.50 | 0.77 | 43.10 | 6.38 | 1.46 | 4.24 | 0.38 | 7.74 |

| and Including | 440.55 | 442.90 | 2.35 | 0.31 | 32.77 | 7.41 | 8.59 | 0.64 | 0.32 | 9.64 |

| With | 442.15 | 442.90 | 0.75 | 0.34 | 70.00 | 15.70 | 12.70 | 0.49 | 0.41 | 18.01 |

| PN-24-068 | 474.60 | 476.30 | 1.70 | 0.28 | 10.96 | 2.74 | 3.47 | 1.54 | 0.10 | 4.15 |

| Including | 474.60 | 475.10 | 0.50 | 0.94 | 36.30 | 8.55 | 11.40 | 5.19 | 0.28 | 13.34 |

| PN-24-069 | 100.00 | 117.00 | 17.00 | 0.28 | 9.52 | 0.93 | 7.19 | 1.66 | 0.05 | 4.05 |

| Including | 100.00 | 106.00 | 6.00 | 0.42 | 19.33 | 0.96 | 11.68 | 3.69 | 0.04 | 6.43 |

| With | 100.00 | 102.00 | 2.00 | 0.66 | 47.30 | 2.15 | 19.35 | 2.87 | 0.08 | 10.26 |

| and Including | 112.00 | 117.00 | 5.00 | 0.35 | 7.80 | 1.78 | 9.69 | 0.74 | 0.09 | 5.38 |

| With | 114.00 | 115.00 | 1.00 | 0.57 | 12.90 | 6.09 | 33.80 | 0.85 | 0.36 | 18.39 |

| PN-24-070 | 118.00 | 150.00 | 32.00 | 0.45 | 20.93 | 3.62 | 8.10 | 2.47 | 0.18 | 6.97 |

| Including | 120.00 | 130.00 | 10.00 | 0.50 | 12.94 | 1.76 | 10.82 | 5.98 | 0.08 | 7.44 |

| With | 120.00 | 122.00 | 2.00 | 0.53 | 28.20 | 5.77 | 7.61 | 1.86 | 0.25 | 8.45 |

| and Including | 138.60 | 150.00 | 11.40 | 0.60 | 44.51 | 8.39 | 11.52 | 1.24 | 0.42 | 11.94 |

| With | 141.40 | 147.40 | 6.00 | 0.79 | 60.98 | 12.90 | 15.21 | 1.60 | 0.51 | 17.22 |

| PN-24-071 | 157.00 | 196.60 | 39.60 | 0.38 | 19.57 | 2.62 | 3.37 | 0.80 | 0.13 | 4.19 |

| Including | 157.00 | 160.00 | 3.00 | 0.25 | 8.93 | 0.68 | 6.20 | 0.04 | 0.02 | 3.04 |

| and Including | 185.00 | 196.60 | 11.60 | 0.88 | 49.90 | 8.25 | 9.57 | 2.64 | 0.34 | 12.46 |

| With | 193.00 | 196.60 | 3.60 | 1.56 | 63.03 | 10.39 | 11.42 | 7.90 | 0.32 | 16.89 |

| PN-24-072 | 294.00 | 345.00 | 51.00 | 0.54 | 9.10 | 1.01 | 0.06 | 1.14 | 0.53 | 1.94 |

| including | 294.00 | 299.20 | 5.20 | 0.18 | 3.67 | 0.02 | 0.00 | 1.19 | 0.89 | 0.86 |

| and including | 307.85 | 309.75 | 1.90 | 0.45 | 4.43 | 0.11 | 0.00 | 0.99 | 0.71 | 0.99 |

| and including | 321.00 | 323.00 | 2.00 | 0.15 | 3.45 | 0.32 | 0.03 | 1.18 | 0.51 | 1.00 |

| and including | 325.40 | 332.50 | 7.10 | 0.68 | 18.14 | 0.66 | 0.08 | 0.73 | 0.15 | 1.61 |

| and including | 332.50 | 345.00 | 12.50 | 0.31 | 16.22 | 3.01 | 0.17 | 3.14 | 1.49 | 4.63 |

| With | 332.50 | 337.00 | 4.50 | 0.53 | 32.71 | 6.40 | 0.35 | 5.73 | 3.74 | 9.59 |

| PN-24-073 | 354.65 | 383.75 | 29.10 | 0.25 | 4.97 | 0.51 | 1.52 | 0.70 | 0.06 | 1.49 |

| Including | 366.85 | 368.95 | 2.10 | 0.21 | 20.67 | 3.53 | 4.05 | 0.10 | 0.27 | 5.14 |

| and Including | 376.25 | 379.25 | 3.00 | 1.67 | 14.93 | 0.89 | 10.36 | 5.71 | 0.04 | 7.41 |

| PN-24-074 | 290.00 | 313.55 | 23.55 | 0.15 | 3.06 | 0.60 | 0.11 | 0.13 | 0.02 | 0.89 |

| including | 294.80 | 295.80 | 1.00 | 0.09 | 7.20 | 0.50 | 0.02 | 0.93 | 0.02 | 0.90 |

| and including | 311.05 | 313.55 | 2.50 | 1.27 | 18.57 | 5.10 | 0.52 | 0.78 | 0.13 | 6.46 |

| PN-24-075 | 321.50 | 340.70 | 19.20 | 0.14 | 5.45 | 1.04 | 0.05 | 1.22 | 0.53 | 1.65 |

| including | 321.50 | 324.90 | 3.40 | 0.60 | 13.02 | 0.24 | 0.01 | 3.38 | 3.60 | 2.97 |

| and including | 330.25 | 331.00 | 0.75 | 0.27 | 15.40 | 1.94 | 0.06 | 0.52 | 0.00 | 2.16 |

| and including | 337.65 | 340.70 | 3.05 | 0.23 | 15.29 | 5.31 | 0.23 | 4.36 | 0.27 | 6.62 |

| PN-24-076 | 57.70 | 72.10 | 14.40 | NO SIGIFICANT VALUE | N/A | |||||

| PN-24-078 | 157.60 | 187.00 | 29.40 | 0.53 | 11.95 | 1.15 | 1.08 | 0.36 | 0.06 | 2.34 |

| Including | 157.60 | 169.15 | 11.55 | 0.44 | 11.55 | 0.59 | 1.25 | 0.76 | 0.02 | 1.92 |

| With | 158.60 | 160.60 | 2.00 | 0.64 | 14.85 | 0.49 | 2.71 | 2.32 | 0.02 | 3.24 |

| And With | 163.50 | 168.15 | 4.65 | 0.59 | 15.83 | 0.97 | 1.25 | 0.50 | 0.04 | 2.38 |

| and Including | 173.65 | 187.00 | 13.35 | 0.77 | 15.86 | 1.98 | 1.29 | 0.14 | 0.12 | 3.43 |

| With | 173.65 | 176.55 | 2.90 | 3.16 | 21.62 | 5.84 | 4.72 | 0.44 | 0.48 | 11.03 |

| And With | 183.00 | 187.00 | 4.00 | 0.23 | 35.78 | 2.30 | 0.73 | 0.11 | 0.03 | 3.23 |

| Note: Length is presented as downhole distance; true width corresponds to 60-80% of such downhole distance in function of the orientation of the hole. | ||||||||||

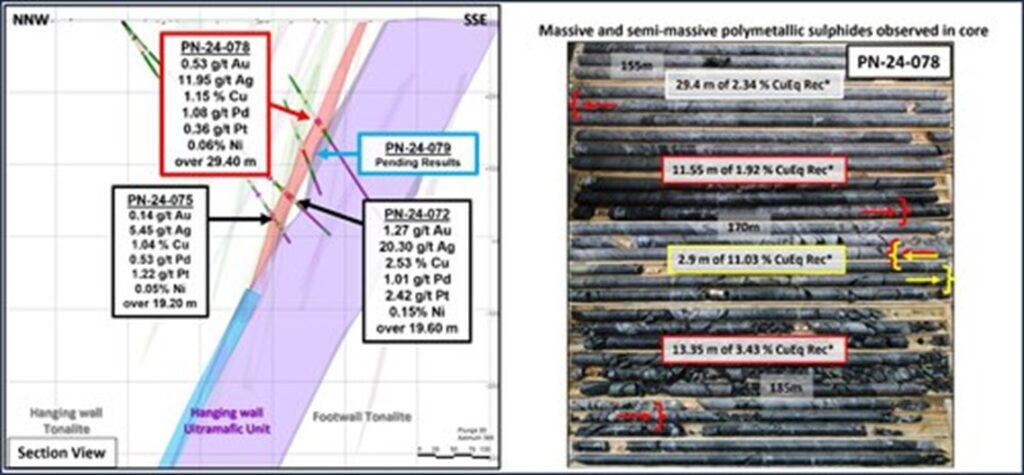

Figure 2 below is vertical cross-section along hole PN-24-078, presenting the location of the intersection with respect to other holes on the same section. It is notable how the overall thickness of the zone is preserved. The figure also presents a mosaic picture of the reported interval. Remarkably, as it is the case with most of the thick intersections, the zone appears to be consisting of two distinct mineralized sub-zones. Observations suggest that these two sub-zones slightly differ in terms of mineralogy; the upper one being on the PGE side, the lower one on the Copper side, where very high CuEq* grades can usually be observed over smaller intervals.

The Lion Zone has been producing a continuous stream of excellent intersections and grades building a substantial mineralized area of extremely high-grade copper, gold, silver, and platinum group metals.

“Once again Lion Zone is delivering what is expected be coming out of it… I mean, our level of understanding of the Zone, in all perspectives, is increasing at light speed with all new information being incorporate in the mix in almost real time. This is becoming more and more exciting. We are preparing the up-coming winter program, with much more flexibility given the frozen ground conditions. 2025 will also be a great year for Power Nickel!” – commented Ken Williamson, VP of Exploration.

Copper Equivalent Calculation

CuEq Rec represents CuEq calculated based on the following metal prices (USD) : 2,360.15 $/oz Au, 27.98 $/oz Ag, 1,215.00 $/oz Pd, 1000.00 $/oz Pt, 4.00 $/lb Cu, 10.00 $/lb Ni and 22.50 $/lb Co., and a recovery grade of 80% for all commodities, consistent with comparable peers.

QAQC and Sampling

GeoVector Management Inc is the Consulting company retained to perform the actual drilling program, which includes core logging and sampling of the drill core.

All samples were submitted to and analyzed at Activation Laboratories Ltd, an independent commercial laboratory for both the sample preparation and assaying. Actlabs is a commercial laboratory independent of Power Nickel with no interest in the Project. Actlabs is an ISO 9001 and 17025 certified and accredited laboratories. Samples submitted through Actlabs are run through standard preparation methods and analysed using RX-1 (Dry, crush (< 7 kg) up to 80% passing 2 mm, riffle split (250 g) and pulverize (mild steel) to 95% passing 105 μm) preparation methods, and using 1F2 (ICP-OES) and 1C-OES – 4-Acid near total digestion + Gold-Platinum-Palladium analysis and 8-Peroxide ICP-OES, for regular and over detection limit analysis. Pegmatite samples are analyzed using UT7 – Li up to 5%, Rb up to 2% method. Actlabs also undertake their own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

GeoVector’s QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

The results presented in the current Press Release are complete within the mineralized intervals, but results are still pending for the top portion of both holes reported. QAQC and data validation was performed on these portions of the holes where assays are fully integrated, and no material error were observed.

Qualified Person

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian exploration company focusing on developing the High-Grade Nickel Copper PGM, Gold and Silver Nisk project into Canada’s next poly metallic mine.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV).

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the high-grade nickel-copper PGM, Gold and Silver mineralization with a series of drill programs designed to evaluate the initial Nisk discovery zone, the Lion discovery zone and to explore the land package for adjacent potential poly metallic deposits.

In addition to the Nisk project, Power Nickel owns significant land packages in British Colombia and Chile. Power Nickel is expected to reorganize these assets in a related public vehicle through a plan of arrangement.

Figure 1: Longitudinal view across the Lion Zone Area, presenting the location of Lion Zone against the ultramafic extent. Location of PN-24-076 and -078 is highlighted in red; selected holes are also presented, illustrating the continuity of both grade and thickness within the core the Lion Zone. (CNW Group/Power Nickel Inc.)

Figure 2: Section view presenting the location of holes PN-24-076 and PN-24-078, along with core pictures of the intercepted mineralization in hole 078. (CNW Group/Power Nickel Inc.)

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE