Power Nickel Discovers a New High Grade Cu-Pd-Pt-Au-Ag Zone 5km Northeast of its Main Nisk Deposit

1 Oz/Tonne Combined Platinum and Palladium over 7.75 Metres

New Discovery

- 1.47% Cu, 13.1 g/t Ag, 0.28 g/t Au, 5.71 g/t Palladium, 20.76 g/t Platinum over 7.75m in Hole PN-23-031A, including 3.90% Cu, 25 g/t Ag, 0.52g/t Au, 19.97g/t Palladium, 90.60g/t Platinum over 1.75m.

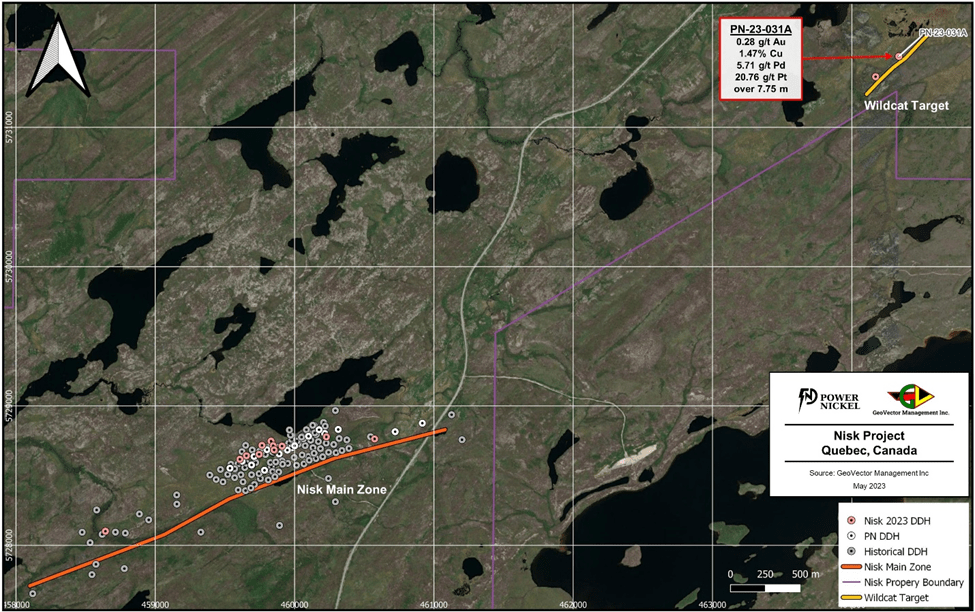

Power Nickel Inc. (TSX-V:PNPN) (OTCQB:PNPNF) (Frankfurt:IVVI) is pleased to announce the discovery of a new high-grade Cu-PGE mineralized zone approximately 5km northeast of the main Nisk deposit. The target area was never previously drilled and was identified as “Wildcat.” It is characterized by a strong magnetic anomaly from an ultramafic unit previously mapped in the surface outcrop. Ultramafic rocks consistent with the main Nisk deposit were intersected in hole PN-23-031A, but the high-grade mineralization is hosted in amphibolite and tonalite, which lie on top of the ultramafic sequence.

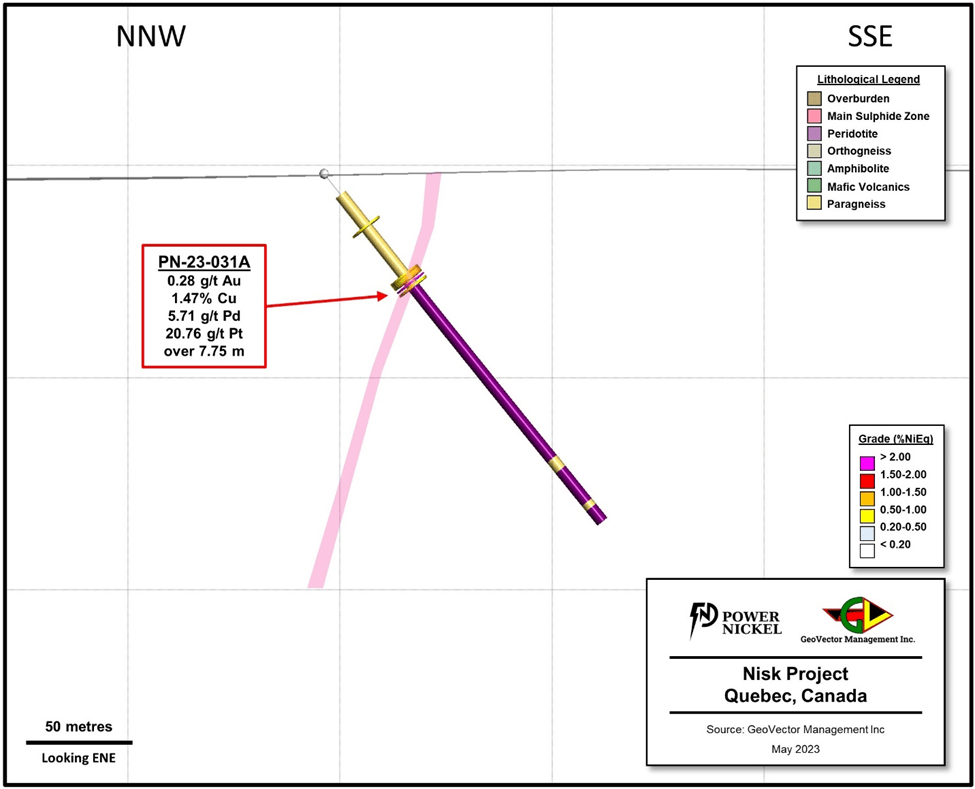

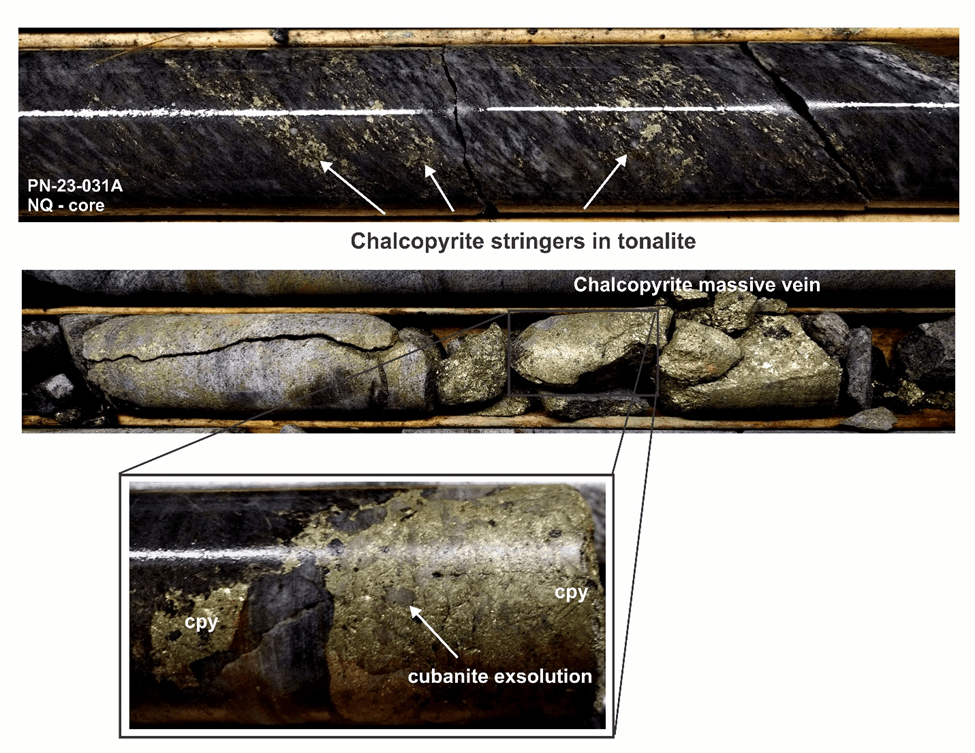

Hole PN-23-031A (Figure 1) intersected multiple chalcopyrite stringers and veinlets almost continuously in the first sixty (60) metres of the drill hole. The thickness and density of these stringers increased from 60.50 to 68.25 m down the hole. The main mineralization is characterized by a high density of chalcopyrite veinlets with local massive chalcopyrite (Figure 2). The veins are greatly enriched in platinum and palladium with significant accessory gold and silver (Table 1). The samples are rich in platinum, and palladium will be re-analyzed to include the complete Platinum Group Elements (PGE), such as osmium, iridium, rhodium, and ruthenium.

Figure 1 – Cross-section of DDH PN-23-031A

Figure 2 – Stringers and massive chalcopyrite in DDH PN-23-031A

Table 1: Significant results from the wildcat zone.

| Hole ID | UTM E 1 | UTM N 1 | Length (m) | Azimuth (°) | Dip (°) | From (m) | To (m) | Interval Length 2 (m) | Au (g/t) | Ag g/t) | Cu (%) | Pd (g/t) | Pt (g/t) |

| PN-23-031A | 464338 | 5731510 | 210 | 163 | -60 | 31.50 | 32.50 | 1.00 | 0.34 | 10.0 | 1.10 | 0.02 | NSR |

| PN-23-031A | 464338 | 5731510 | 210 | 163 | -60 | 60.50 | 68.25 | 7.75 | 0.28 | 13.1 | 1.47 | 5.71 | 20.76 |

| Including | 464338 | 5731510 | 210 | 163 | -60 | 64.35 | 66.10 | 1.75 | 0.52 | 25.0 | 3.90 | 19.97 | 90.60 |

- UTM NAD83, Zone 18N.

- True widths are estimated to be 70% of the Interval Length.

The Wildcat area represents an entirely new target to explore and is wide open laterally along strike and at depth (Figure 3). This new discovery is very significant with high-grade platinum and palladium associated with copper. It is probable that the high-grade platinum and palladium originated in the underlying ultramafic unit and remobilized to the tonalite unit where the mineralization occurs. As the mineralization is remobilized, there is potential for discovery in a broader target area in the vicinity of the ultramafic source rocks. Follow-up drilling will consider all other lithological units in addition to identifying the source mineralization in the ultramafic unit.

Figure 3 – Location of the Wildcat Target relative to the main Nisk deposit.

“Wow, what a hole! Hats off to the team for identifying the outcrop and selling me on testing it. We did not go too deep, only 200 metres, as we will be conducting the Ambient Noise Tomography (see January 31. 2022 news release 1) over this area, looking for similar signatures that we have on our main Nisk mineralized zone. It is entirely possible that the massive sulfides containing the nickel sequence are below this unit deeper in the Ultramafic. It’s not unheard of for nickel deposits to have a lot of high-grade PGM’s but this hole is special. Obviously, we will be following this sector up in our next round of drilling. This certainly has the potential to contribute greatly to the project’s economics,” commented Power Nickel CEO Terry Lynch.

“This was a great surprise following up on continued good news from the exploration program. Recently we conducted an Airborne EM survey over our mapped 5.5 Kilometre Ultramafic section, and preliminary data review identified several encouraging signals that will require follow-up exploration and eventually drilling in our fully funded Q3/Q4 2023 campaigns that will commence sometime around late July” Lynch advised.

About the Nisk Project

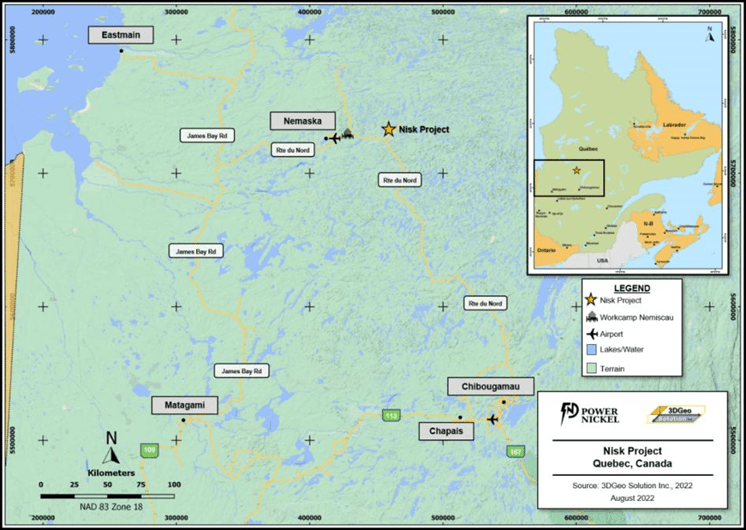

The Nisk Project is located in the southern portion of the Eeyo Istchee James Bay territory, Québec, the site of a number of mining projects improving infrastructure (Figure 4).

Figure 4 – Location of the Nisk Project with respect to the current infrastructure available in the area .

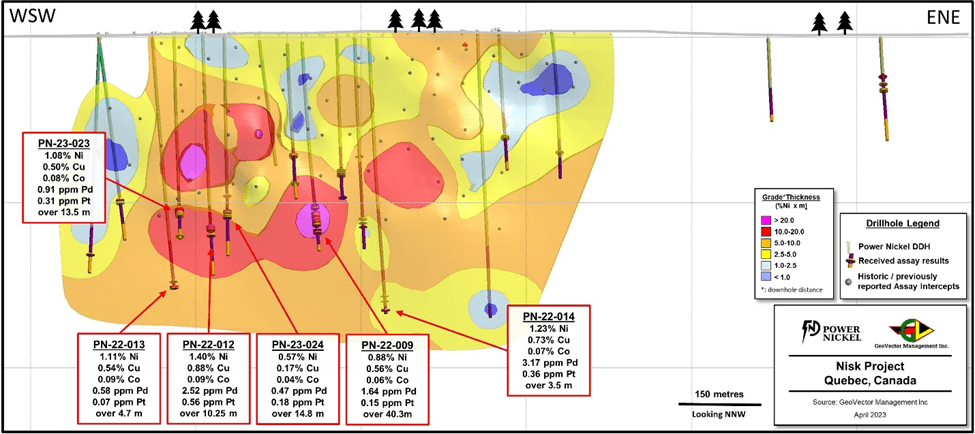

Power Nickel completed the acquisition of its option to acquire up to 80% of the Nisk Project from Critical Elements Lithium Corp. (TSX-V:CRE). The Nisk Project comprises a large land position (20 kilometres of strike length) with numerous high-grade Nickel intercepts. Figure 5 below illustrates highlights from previously released assays from the current drill program.

Figure 5 – Long section highlighting mineralized intercepts of the Main Nisk Deposit.

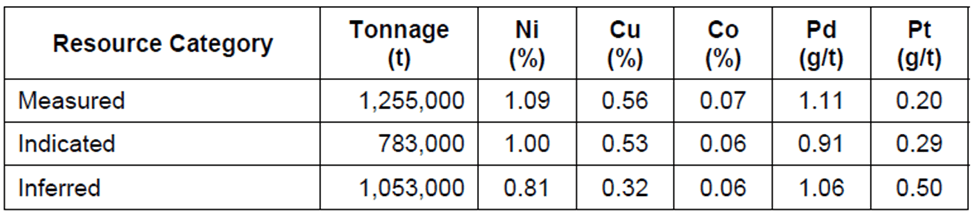

The existing resource estimates at the Nisk project are of historic nature, and the Company’s geology team has not completed sufficient work to confirm a NI 43-101 compliant mineral resource. Therefore, caution is appropriate since these historic estimates cannot and should not be relied on. For merely informational purposes, see Table 2.

Table ‑2: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled “Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec” dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

Power Nickel expects to take the results from the historical drilling programs, its initial program in late 2021, the current drill program, and a new metallurgical study and prepare a new 43-101, which we would expect to deliver in Q3 2023.

Power Nickel posts its drilling information and azimuths on www.PowerNickel.com to enable independent modeling of the ore body.

QAQC and SAMPLING

GeoVector Management Inc is the Consulting Company retained to oversee the drilling program, which includes core logging and sampling of the drill core.

All samples were submitted to and analyzed at ALS Global, an independent commercial laboratory located in Val-d’Or, Québec, for both the sample preparation and assaying. ALS is a commercial laboratory independent of Power Nickel with no interest in the Nisk Project. ALS is an ISO 9001 and 17025 certified and accredited laboratory. Samples submitted through ALS are run through standard preparation methods and analyzed using ME-ICP61a (33 element Suite; 0.4g sample; Intermediate Level Four Acid Digestion) and PGM-ICP27 (Pt, Pd, and Au; 30g fire assay and ICP-AES Finish) methods. ALS also undertakes its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

GeoVector’s QAQC program includes the regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results.

The results presented in the current Press Release are complete. QAQC and data validation was performed on these holes, and no material errors were observed.

Qualified Person

Eric Hébert, Géo, Ph.D. from GeoVector Management Inc and consultant to Power Nickel, is the independent qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX-V:CRE)

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits. 2

Power Nickel announced on June 8 th, 2021, that an agreement had been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 130 million ounces of gold, 800 million ounces of silver, and 40 billion pounds of copper (Resource World). This property hosts two known mineral showings (gold ore and Magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold and plus/minus copper.

Power Nickel is also 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit that was sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3 million at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s first region.

MORE or "UNCATEGORIZED"

Terra Balcanica Drills 636 g/t Ag Eq. Over 4.3 m At Cumavici Ridge in Bosnia and Herzegovina

Terra Balcanica Resources Corp. (CSE:TERA) (FRA:UB1) (OTC:TEBAF) ... READ MORE

Koryx Copper Announces Further Significant Drill Results at the Haib Copper Project, Southern Namibia

Highlights Assay results reported for a further 13 drill holes ... READ MORE

NorthWest Reports Significant Ore Sorting Results at Kwanika

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce posit... READ MORE

Hudbay Delivers Record Fourth Quarter and Full Year 2025 Results; Achieves 2025 Consolidated Copper and Gold Production and Cost Guidance

Hudbay Minerals Inc. (TSX:HBM) (NYSE: HBM) released its fourth ... READ MORE

Argo to Acquire the Hurdman Silver-Zinc Project

Argo Gold Inc. (CSE: ARQ) (OTC: ARBTF) entered into an agreement ... READ MORE